Application of incoterms in the international sale of goods contract

In recent years, along with the development of international trade, sale of goods contracts have

become more and more popular and there are more and more disputes related to this type of

contract. Incoterms (International Commercial Terms) are increasingly used by contracting parties

for the convenience and clarity of terms related to risk transfer, task division of the parties. This

article analyzes the necessity of applying Incoterms 2010 in international commodity trading

contracts. At the same time, the article also compares the application of Incoterms 2010 in goods

trading contracts in some countries around the world and in Vietnam.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Bạn đang xem tài liệu "Application of incoterms in the international sale of goods contract", để tải tài liệu gốc về máy hãy click vào nút Download ở trên

Tóm tắt nội dung tài liệu: Application of incoterms in the international sale of goods contract

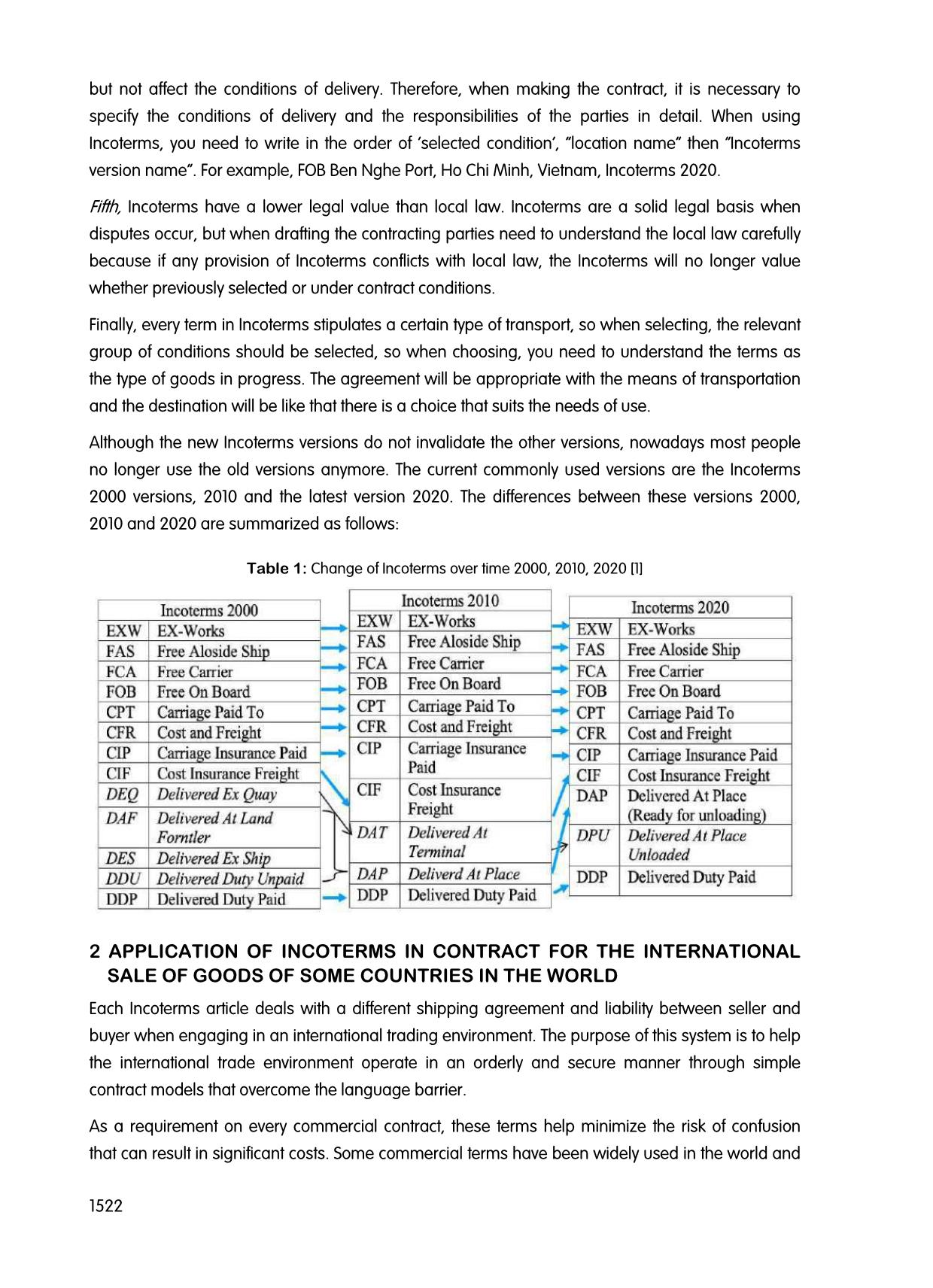

nsibilities of the signing parties. Incoterms has 11 rules detailing the time points of different responsibilities. Fourth, a query about liability when the dispute is arising. Incoterms is an internationally recognized provision that takes effect when selected by contracting parties. So when problems related to terms in Incoterms arise. Incoterms can completely become a legal document to resolve disputes. Incoterms are terms of international trade so the Incoterms contract must be an international goods purchase and sale contract. In addition, Incoterms only apply to tangible goods, goods not belonging to the field of intellectual property or service provision. For example, technology software, copyright, public services, etc. cannot apply Incoterms. When learning about Incoterms, understanding the role and concepts of Incoterms helps people apply the rules easily and accurately. However, if you ignore the Incoterms during the agreement process, sometimes there will be unnecessary errors. There are six things to keep in mind when applying Incoterms: Firstly, Incoterms are not mandatory. Incoterms are not a law, but an international custom of commerce should be considered as a common voice of contracting parties to help accelerate the negotiation process. Incoterms are not compulsory but when selected for use in international contracts of sale of goods, which the parties need to specify in the contract terms, the seller and the buyer will have the obligations and responsibilities for this clause. Secondly, the validity of the Incoterms versions. The first Incoterms were issued in 1936 and have undergone many revisions and improvements, but the new versions of Incoterms do not lose the validity and validity of the previous versions. Depending on the habit, the parties may choose the appropriate Incoterms version, but when using, the name of the version must be clearly stated when the agreement is entered into in the contract to avoid causing unnecessary disputes. Thirdly, Incoterms stipulate the issues of places of transfer of responsibilities, costs, risks from sellers to buyer during the import and export of goods. The remaining issues as a result of breach of contract or the time of transfer of ownership are not specified in Incoterms, so Incoterms cannot be applied to solve them but instead need a clear agreement in other terms of the contract. Fourth, conditions of delivery facilities can not be changed. It is necessary to clearly distinguish between practical responsibilities and delivery bases. Because, depending on the advantages of business, the parties may increase or decrease their responsibilities according to the agreement 1522 but not affect the conditions of delivery. Therefore, when making the contract, it is necessary to specify the conditions of delivery and the responsibilities of the parties in detail. When using Incoterms, you need to write in the order of 'selected condition', ‚location name‛ then ‚Incoterms version name‛. For example, FOB Ben Nghe Port, Ho Chi Minh, Vietnam, Incoterms 2020. Fifth, Incoterms have a lower legal value than local law. Incoterms are a solid legal basis when disputes occur, but when drafting the contracting parties need to understand the local law carefully because if any provision of Incoterms conflicts with local law, the Incoterms will no longer value whether previously selected or under contract conditions. Finally, every term in Incoterms stipulates a certain type of transport, so when selecting, the relevant group of conditions should be selected, so when choosing, you need to understand the terms as the type of goods in progress. The agreement will be appropriate with the means of transportation and the destination will be like that there is a choice that suits the needs of use. Although the new Incoterms versions do not invalidate the other versions, nowadays most people no longer use the old versions anymore. The current commonly used versions are the Incoterms 2000 versions, 2010 and the latest version 2020. The differences between these versions 2000, 2010 and 2020 are summarized as follows: Table 1: Change of Incoterms over time 2000, 2010, 2020 [1] 2 APPLICATION OF INCOTERMS IN CONTRACT FOR THE INTERNATIONAL SALE OF GOODS OF SOME COUNTRIES IN THE WORLD Each Incoterms article deals with a different shipping agreement and liability between seller and buyer when engaging in an international trading environment. The purpose of this system is to help the international trade environment operate in an orderly and secure manner through simple contract models that overcome the language barrier. As a requirement on every commercial contract, these terms help minimize the risk of confusion that can result in significant costs. Some commercial terms have been widely used in the world and 1523 EXW is the most commonly used commercial terms. EXW - EX Works - ex-factory price, the seller must place the goods at the disposal of the buyer within the time-limit and at the place determined by the contract, so that the buyer can load the goods onto his means of transport. The buyer must accept the goods at the seller's location (warehouse, workshop, etc.) together with the costs and risks of delivering the goods to the designated location. In fact, the buyer arranges the freight collection at the designated location and is responsible for customs clearance of goods through the Customs. The buyer is also responsible for completing all export documents, although sellers are obligated to obtain information and documents required by buyer. In the UK, when importing goods by this method, it is quite simple to clearly state your responsibilities as an importer. The buyer is responsible for all costs, arrangement of export documents and liability from collecting the goods from the supplier's factory to the buyer until the goods are delivered in the UK. EXW also has similar benefits and is used quite a lot when importing goods in the US, China, It can be seen that EXW's transportation methods are a little different from the rest of them: All costs and risks during the entire process from loading at the warehouse to unloading at the final point are due to The buyer is responsible (except for the storage at the original warehouse or packaging, if any), and the seller is only responsible for ensuring that the buyer receives the goods. It is most commonly used because almost all costs and risks are the responsibility for the buyer during the entire shipping process (the seller is almost only in packaging), which means set maximum obligations to buyer and minimum obligations to seller. Therefore, it is not suitable for small lots, less cargo. In order to the agreements to be made explicitly and to avoid problems that may occur in the process of working, as well as protect their legitimate rights, when using EXW, a number of things are paid attention below: First of all, EXW is a more convenient terms for the seller because the buyer is responsible for the greater part. The second important thing, the parties should specify as clearly as possible the location at the place of delivery specified as the costs and risks to that point are borne by the seller. The buyer bears all costs and risks related to the receipt of goods from the prescribed point, if any, at the designated delivery place. Moreover, a buyer who buys from a seller under EXW terms for export needs to know that the seller is obliged to assist the buyer only when the buyer requests to make the export and the seller is not obliged to do customs clearance manually. Therefore, buyer should not use the EXW condition if they can not carry out export clearance procedures directly or indirectly. 3 PRACTICE OF APPLICATION INCOTERMS IN CONTRACT FOR THE INTERNATIONAL SALE OF GOODS IN VIETNAM Incoterms have come in many versions. The first is the version, which was born in 1936, has been revised, supplemented and developed in 1953, 1967, 1980 versions, etc. Because Incoterms are not considered as law, they can not be applied by default but only upon the agreement of the parties 1524 concerned and the terms of the contract. Unlike other countries in the world, when exporting by CIF term and importing by FOB term, in Vietnam, most businesses choose to export by FOB term and import by CIF term. With this option, Vietnamese businesses can avoid the risks of hiring and purchasing cargo insurance such as not being able to charter a ship, the unsuitable type of vessel or the increase in freight rates and insurance premiums because when choosing to export by FOB, the seller does not have to hire ships or buy insurance for the goods. In addition, businesses in Vietnam often have low capital, if used under this condition, it will solve the situation as there is not enough capital to prepay for charter costs and insurance. On the payment side, there is also little risk that when a high-value shipment is sold, it will be insolvent, leading to large losses. Besides, choosing to export by FOB instead of CIF will also lead to certain risks. When exporting by FOB, Vietnamese enterprises will give up the right to hire ships and buy insurance for the buying countries, which inadvertently insulates Vietnamese insurance enterprises and shipping lines economy. Opposite, When importing by CIF and having loss of goods, there will be difficulties for Vietnamese enterprises when having to negotiate directly with foreign shipping lines and insurance. Moreover, compared to import by CIF, FOB export earns a much lower amount of foreign currency. For a developing country like Vietnam, there are still many obstacles in import and export. In terms of knowledge as well as experience in insurance transport, many Vietnamese businesses do not really understand the chartering and insurance business, so choosing a reputable carrier is very difficult, especially for cargo. If cargo is in large quantities, chartering is more complicated. Vietnam's exports are mainly raw or semi-processed raw materials of low value so the rate of freight to goods is quite large. Normally, freight to transport wares is from 7% to 10% of CIF value of goods, but because Vietnam's exports are bulky, low value, this rate is often higher (up to 50% of items) [2] but capital of many businesses are not enough to pay for freight or insurance, businesses that choose to export at FOB prices do not have to worry about chartering as well as cargo insurance. Insurance companies in Vietnam have low staff quality, which leads to embarrassment in dealing with time-consuming issues. In addition, the unreasonable insurance fee calculation makes the import-export companies feel inadequate to receive compensation. The coordination between shippers, ship owners and insurers in Vietnam is still loose and unconnected, so there is often a situation of overcapacity but lack of ships or vice versa. Moreover, Vietnam's shipping industry has not developed strongly, foreign networks are scarce, the management system is sparse, high freight rates. Because of all that, Vietnamese businesses have chosen to export by FOB and import by CIF to suit Vietnam's economy and minimize risks. Explaining the fact that when shipping by container, FCA should be used instead of FOB because FOB requires the seller to deliver goods on the deck but most container goods are required to ‚land‛ at container yard or container at an odd warehouse before loading the goods on board. In the process of transfer between seller and buyer, if the goods (according to FOB conditions) arrive at the wharf or the odd warehouse, there are losses and damages, the dispute between the two sides will certainly occur. Therefore, the buyer and seller should specify the time and place of risk transfer, force majeure cases so that when a dispute occurs, the two sides soon find a satisfactory solution. Within Incoterms 2010, FCA 1525 conditions were adjusted to suit modern container transport modes. When the parties agree to use FCA terms, the two parties agree that the buyer shall arrange loading and loading of goods on the means of transport provided by the seller, the location of risk transfer may be the seller's premises or at a certain agreed location within the seller's inland. This will minimize the risk of the goods being transferred from seller to buyer. For any type of contract, disputes are inevitable between the parties involved but limiting those disputes is possible. When discussing the issue of applying Incoterms in international sales contracts, we have some suggestions for experience as follows: First, learn and understand about the versions and terms of Incoterms. To avoid misunderstandings about the parties' responsibilities. Second, choose the dispute settlement agency in the contract. Third, clearly defining the cases of liability waiver, the seller needs to clearly define the force majeure cases as well as the payment responsibility of the buyer when the dispute occurs. Fourth, the seller should try to reach an agreement so that the responsibility for carrying out import procedures rests with the buyer. At the same time, the buyer is also responsible for payment in the event that the law of the buyer country changes so that the goods cannot be imported but the goods are on the way of transportation to the buyer or have arrived at the buyer's port. 4 CONCLUSION Up to the present time, Vietnam's economy has developed and improved a lot more than before. Viet Nam has been backward from agriculture, experienced many periods and wars have also strongly revived and opened the door to integrate into the world. The continuous development in all fields of economy, science, technology, transportation, etc., especially in international trade, has made strong developments when Vietnamese businesses learn and apply. Incoterms’ terms of sale of international goods. This proves that Vietnamese businesses have quickly caught up with the pace of the world trend and are constantly evolving to improve as well as bring more benefits to Vietnamese businesses when participating in the deals. international trade translation. REFERENCES [1] Công ty cổ phần logistics Vinalink, 2019, Incoterms 2020 có gì mới, xem tại: https://www.vinalinklogistics.com/ban-tin/Incoterms-2020-co-gi-moi-1745.html Truy cập ngày 10/05/2020. [2] Logistics Institute, 2019, Mua bán CIF-FOB ở nước ta như thế nào?, xem tại: https://logistics- institute.vn/mua-ban-cif-fob-o-nuoc-ta-nhu-the-nao. [Truy cập ngày 10/05/2020] [3] The International Trade Administration, Know Your Incoterms, xem tại: https://www.trade.gov/know-your-Incoterms Truy cập ngày 10/05/2020

File đính kèm:

application_of_incoterms_in_the_international_sale_of_goods.pdf

application_of_incoterms_in_the_international_sale_of_goods.pdf