The effects of attitude, trust and switching cost on loyalty in commercial banks in Ho Minh City

This paper focuses on identifying the effects of attitude, trust, switching cost on loyalty of individual customers in commercial banks in Ho Chi Minh City. Based on a sample of 282 customers, the paper employs Frequencies, Cronbach's Alpha test, Exploratory Factor Analysis (EFA), Affirmative Factor Analysis (CFA) and Structural Equation Model (SEM) for analysis. The results show that the Attitude had a positive impact on Trust, Loyalty; Trust and Switching cost positively affects Loyalty

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Bạn đang xem tài liệu "The effects of attitude, trust and switching cost on loyalty in commercial banks in Ho Minh City", để tải tài liệu gốc về máy hãy click vào nút Download ở trên

Tóm tắt nội dung tài liệu: The effects of attitude, trust and switching cost on loyalty in commercial banks in Ho Minh City

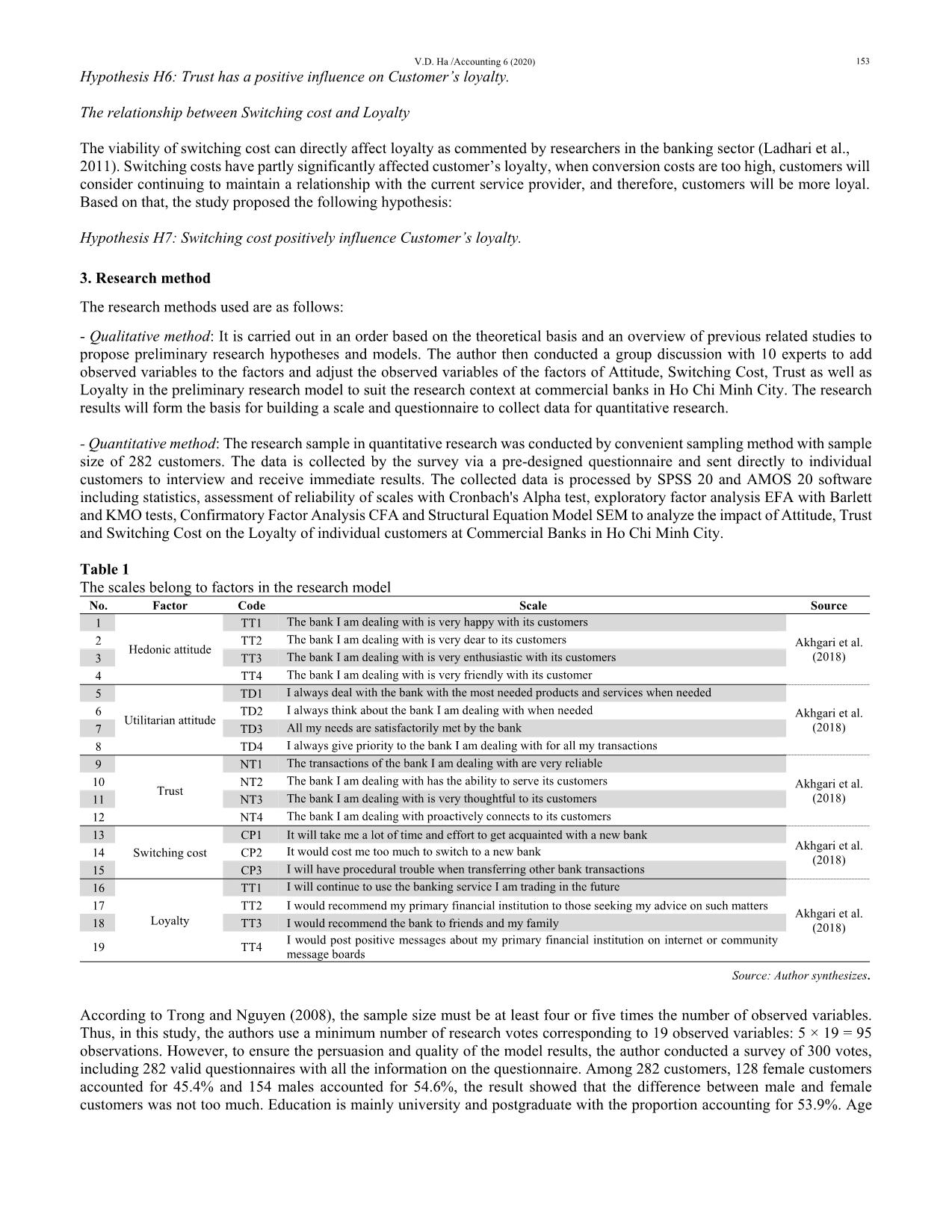

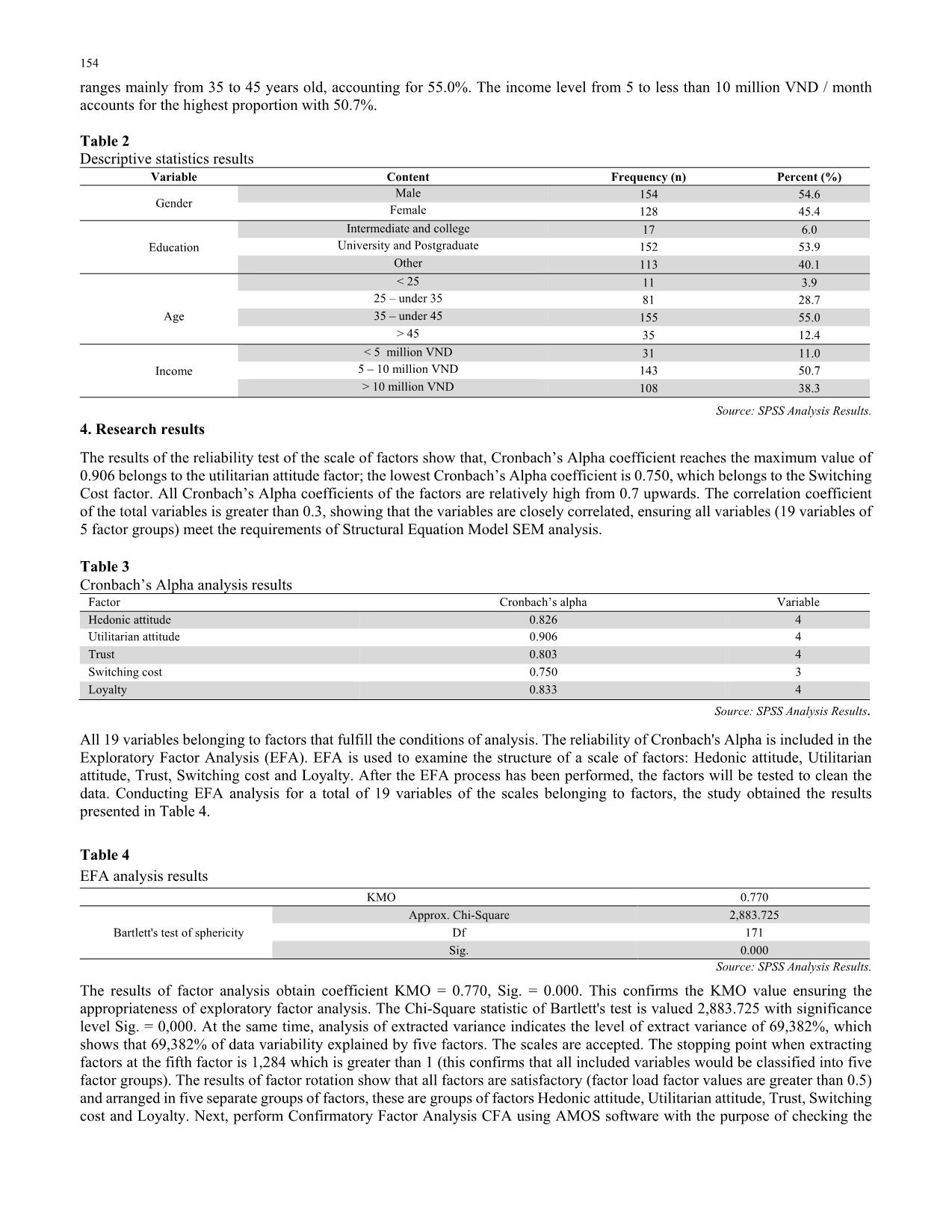

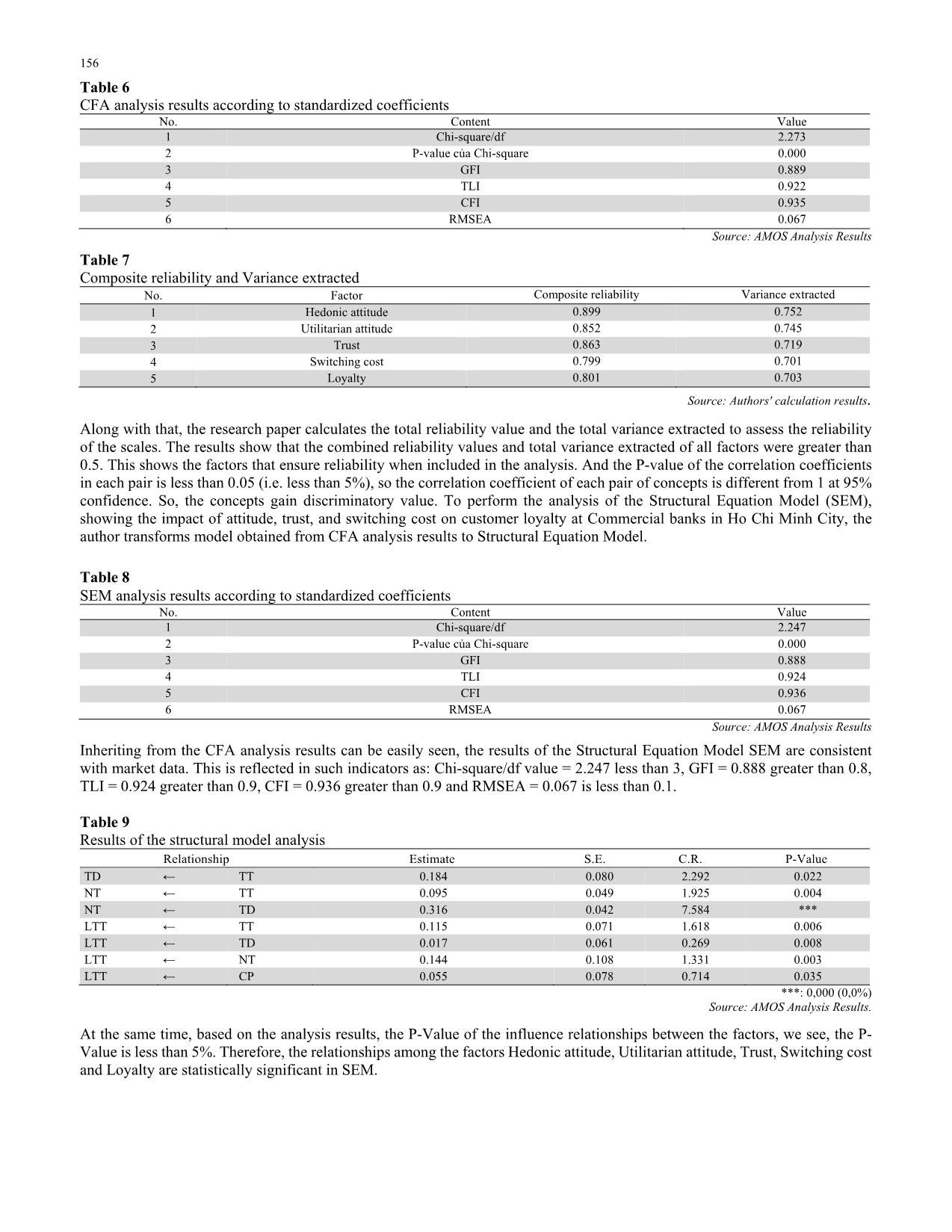

g cost and Loyalty. The results indicate that the value of Chi-square/df = 2.273 is less than 3, GFI = 0.889 is greater than 0.8, TLI = 0.922 is greater than 0.9, CFI = 0.935 is greater than 0.9 and RMSEA = 0.067 is less than 0.1; Therefore, it can be said that the model is suitable for market data. At the same time, the standardized weights are greater than 0.5. That is statistically significant, so the concepts achieve convergent value. Thus, with CFA analysis results, the main factors are included in the analysis, which are: Hedonic attitude, Utilitarian attitude, Trust, Switching cost and Loyalty. Table 5 Rotated Component Matrix Component 1 2 3 4 5 TD1 0.992 TD4 0.986 TD2 0.746 TD3 0.688 LTT3 0.896 LTT2 0.834 LTT4 0.800 LTT1 0.743 NT3 0.835 NT2 0.832 NT4 0.728 NT1 0.705 TT3 0.882 TT2 0.833 TT4 0.796 TT1 0.728 CP2 0.869 CP1 0.846 CP3 0.727 Eigenvalue = 1,284 Cumulaive % 23.763 39.811 53.241 62.624 69.382 Source: SPSS Analysis Results. Fig. 1. CFA analysis results according to standardized coefficients TT (Hedonic attitude), TD (Utilitarian attitude), NT (Trust), CP (Switching cost), LTT (Loyalty) Source: AMOS Analysis Results 156 Table 6 CFA analysis results according to standardized coefficients No. Content Value 1 Chi-square/df 2.273 2 P-value của Chi-square 0.000 3 GFI 0.889 4 TLI 0.922 5 CFI 0.935 6 RMSEA 0.067 Source: AMOS Analysis Results Table 7 Composite reliability and Variance extracted No. Factor Composite reliability Variance extracted 1 Hedonic attitude 0.899 0.752 2 Utilitarian attitude 0.852 0.745 3 Trust 0.863 0.719 4 Switching cost 0.799 0.701 5 Loyalty 0.801 0.703 Source: Authors' calculation results. Along with that, the research paper calculates the total reliability value and the total variance extracted to assess the reliability of the scales. The results show that the combined reliability values and total variance extracted of all factors were greater than 0.5. This shows the factors that ensure reliability when included in the analysis. And the P-value of the correlation coefficients in each pair is less than 0.05 (i.e. less than 5%), so the correlation coefficient of each pair of concepts is different from 1 at 95% confidence. So, the concepts gain discriminatory value. To perform the analysis of the Structural Equation Model (SEM), showing the impact of attitude, trust, and switching cost on customer loyalty at Commercial banks in Ho Chi Minh City, the author transforms model obtained from CFA analysis results to Structural Equation Model. Table 8 SEM analysis results according to standardized coefficients No. Content Value 1 Chi-square/df 2.247 2 P-value của Chi-square 0.000 3 GFI 0.888 4 TLI 0.924 5 CFI 0.936 6 RMSEA 0.067 Source: AMOS Analysis Results Inheriting from the CFA analysis results can be easily seen, the results of the Structural Equation Model SEM are consistent with market data. This is reflected in such indicators as: Chi-square/df value = 2.247 less than 3, GFI = 0.888 greater than 0.8, TLI = 0.924 greater than 0.9, CFI = 0.936 greater than 0.9 and RMSEA = 0.067 is less than 0.1. Table 9 Results of the structural model analysis Relationship Estimate S.E. C.R. P-Value TD ← TT 0.184 0.080 2.292 0.022 NT ← TT 0.095 0.049 1.925 0.004 NT ← TD 0.316 0.042 7.584 *** LTT ← TT 0.115 0.071 1.618 0.006 LTT ← TD 0.017 0.061 0.269 0.008 LTT ← NT 0.144 0.108 1.331 0.003 LTT ← CP 0.055 0.078 0.714 0.035 ***: 0,000 (0,0%) Source: AMOS Analysis Results. At the same time, based on the analysis results, the P-Value of the influence relationships between the factors, we see, the P- Value is less than 5%. Therefore, the relationships among the factors Hedonic attitude, Utilitarian attitude, Trust, Switching cost and Loyalty are statistically significant in SEM. V.D. Ha /Accounting 6 (2020) 157 Table 10 Results of the structural model analysis according to standardized coefficients Relationship Standardized estimate Standardized estimate according to the diagram TD ← TT 0.148 0.15 NT ← TT 0.125 0.13 NT ← TD 0.517 0.52 LTT ← TT 0.117 0.12 LTT ← TD 0.021 0.02 LTT ← NT 0.111 0.11 LTT ← CP 0.052 0.05 Source: AMOS Analysis Results. Fig. 2. Results of the structural model analysis show effects of attitude, trust, switching cost to loyalty at commercial banks in Ho Chi Minh city TT (Hedonic attitude), TD (Utilitarian attitude), NT (Trust), CP (Switching cost), LTT (Loyalty) Source: AMOS Analysis Results. When considering the value of regression coefficients among factors, it shows that the regression coefficient values are all greater than zero, which means that there is a positive influence among the factors, specifically as follows: The Hedonic attitude factor positively affects Customer’s Utilitarian attitude, Trust and Loyalty with regression coefficient of 0.15; 0.13 and 0.12. This means that, when the Hedonic attitude factor is better, Customers’ Utilitarian attitude, Trust and Loyalty will increase (with a one-time increase in the Hedonic attitude, Customer’s Utilitarian attitude, Trust and Loyalty will increase by 0.15 times; 0.13 times and 0.12 times). Fig. 3. Results of the structural model analysis show effects of attitude, trust, switching cost to loyalty at commercial banks in Ho Chi Minh city Source: Author’s analytical results, 2019. Hedonic attitude Utilitarian attitude Switching cost Trust Loyalty + 0.15 + 0.13 + 0.52 + 0.11 + 0.02 + 0.05+ 0.12 158 Similarly, the Utilitarian attitude factor positively affects Customers' Trust and Loyalty with regression coefficients of 0.52 and 0.02. This means that, when the Utilitarian attitude factor is better, Customers' Trust and Loyalty will increase (with a one-time increase in the Utilitarian attitude, Customers' Trust and Loyalty will increase by 0.52 times and 0.02 times). When the Trust and Switching Cost factor is better, Customer Loyalty will increase (with a one-time increase in Trust and Switching Cost, Customer Loyalty will increase by 0.11 times and 0.05 times). Thus, after analyzing the Structural Equation Model SEM, the study showed the relationship between Attitude, Trust, Switching Cost and Loyalty of individual customers, in which the Attitude factor positively affects the Trust and Loyalty; Trust and Switching Cost factors positively affect Loyalty. 5. Conclusion and management implications 5.1 Conclusion Based on the theories related to Attitudes, Trust, Switching Cost and Loyalty, previous studies related to the topic of the research, the authors built a scale and proposed research model with 5 main factors including: (1) Hedonic attitude; (2) Utilitarian attitude; (3) Trust; (4) Switching Cost and (5) Loyalty. Next, the authors conducted qualitative research to correct and supplement errors if any, then conducted a survey and conducted a formal survey to collect the opinions of individual customers at Commercial banks in Ho Chi Minh City. With the collected database, the author conducted SPSS 20, AMOS 20 software for analysis; the study has achieved certain results as follows: - Show the most basic concepts and scales to measure Attitude, Trust, Switching Cost and Loyalty factors; the previous research results showed the relationship as well as the influence of attitude, trust, and switching cost on Loyalty as the scientific basis for subsequent studies. - Perform preliminary statistics on the objects of the survey such as: gender, education level, age and income. - Assess the reliability of the scale by using Cronbach's alpha analysis technique showed that with 19 variables (including variables of the factors) all meet the evaluation requirements; Cronbach's alpha coefficients are from 0.7 or more and the correlation coefficient of the total variables is greater than 0.3. - The results of the exploratory factor analysis EFA show that all variables belonging to the factors meet the analytical requirements (factor load factor values are greater than 0.5); with a total of 19 variables and sorted by 5 groups of factors, which: Hedonic attitude, Utilitarian attitude, Trust, Switching cost and Loyalty. - Confirmatory Factor Analysis shows that the model is suitable for market data, the scales ensure reliability and concepts to achieve discriminatory value. - Structural Equation Model shows that: (1) Attitude positively affects Trust, Loyalty; (2) Trust and Switching Cost positively affect Loyalty. 5.2 Administration implications Based on the results from the model, in order to increase the Loyalty of individual customers at commercial banks in Ho Chi Minh City, the study proposes some governance implications as follows: - Enhancing the training on sales and communication skills for employees to meet customer service needs and improve customer service quality. - Collecting and receiving customers' suggestions to promptly correct the mistakes if any when dealing with customers, in order to improve the positive attitude of customers with the bank. - Regularly monitoring and actively contacting customers to notify customers of transactions, which showing the interest from the bank for customers and helps customers appreciate the bank trust. - Showing to customers the specific benefits that customers have when dealing with banks and the trade-offs of costs and time that customers encounter when switching transactions to other banks through seminars, product introduction sessions for customers. Acknowledgement The authors would like to thank the anonymous referees for constructive comments on earlier version of this paper. V.D. Ha /Accounting 6 (2020) 159 References Afsar, B., Rehman, Z. U., & Shahjehan, A. (2010). Determinants of customer loyalty in the banking sector: The case of Pakistan. African Journal of Business Management, 4(6), 1040-1047. Akhgari, M., Bruning, E. R., Finlay, J., & Bruning, N. S. (2018). Image, performance, attitudes, trust, and loyalty in financial services. International Journal of Bank Marketing, 36(4), 744-763. Batra, R., & Homer, P. M. (2004). The situational impact of brand image beliefs. Journal of consumer psychology, 14(3), 318- 330. Bravo, R., Montaner, T., & Pina, J. M. (2009). The role of bank image for customers versus non-customers. International Journal of Bank Marketing, 27(4), 315-334. Chaudhuri, A., & Holbrook, M. B. (2001). The chain of effects from brand trust and brand affect to brand performance: the role of brand loyalty. Journal of marketing, 65(2), 81-93. Chitturi, R., Raghunathan, R., & Mahajan, V. (2008). Delight by design: The role of hedonic versus utilitarian benefits. Journal of marketing, 72(3), 48-63. Hasan, H., Kiong, T. P., & Ainuddin, R. A. (2014). Effects of perceived value and trust on customer loyalty towards foreign banks in Sabah, Malaysia. Global Journal of Emerging Trends in e-Business, Marketing and Consumer Psychology, 1(2), 137-154. He, H., Li, Y., & Harris, L. (2012). Social identity perspective on brand loyalty. Journal of Business Research, 65(5), 648-657. Homer, P. M. (2008). Perceived quality and image: When all is not “rosy”. Journal of Business Research, 61(7), 715-723. Hoq, M. Z., Sultana, N., & Amin, M. (2010). The effect of trust, customer satisfaction and image on customers' loyalty in islamic banking sector. South Asian Journal of Management, 17(1), 70. Keisidou, E., Sarigiannidis, L., Maditinos, D. I., & Thalassinos, E. I. (2013). Customer satisfaction, loyalty and financial performance: A holistic approach of the Greek banking sector. International Journal of Bank Marketing, 31(4), 259-288. Ladhari, R., Souiden, N., & Ladhari, I. (2011). Determinants of loyalty and recommendation: The role of perceived service quality, emotional satisfaction and image. Journal of Financial Services Marketing, 16(2), 111-124. Lam, S. Y., Shankar, V., Erramilli, M. K., & Murthy, B. (2004). Customer value, satisfaction, loyalty, and switching costs: an illustration from a business-to-business service context. Journal of the Academy of Marketing Science, 32(3), 293-311. Leninkumar, V. (2017). The relationship between customer satisfaction and customer trust on customer loyalty. International Journal of Academic Research in Business and Social Sciences, 7(4), 450-465. Ofori, K. S., Boateng, H., Okoe, A. F., & Gvozdanovic, I. (2017). Examining customers’ continuance intentions towards internet banking usage. Marketing Intelligence & Planning, 35(6), 756-773. Okada, E. M. (2005). Justification effects on consumer choice of hedonic and utilitarian goods. Journal of marketing research, 42(1), 43-53. Overby, J. W., & Lee, E. J. (2006). The effects of utilitarian and hedonic online shopping value on consumer preference and intentions. Journal of Business research, 59(10-11), 1160-1166. Palmatier, R. W., Dant, R. P., Grewal, D., & Evans, K. R. (2006). Factors influencing the effectiveness of relationship marketing: a meta-analysis. Journal of Marketing, 70(4), 136-153. Pham, M. T. (2004). The logic of feeling. Journal of Consumer Psychology, 14(4), 360-369. Ryu, K., Han, H., & Jang, S. (2010). Relationships among hedonic and utilitarian values, satisfaction and behavioral intentions in the fast-casual restaurant industry. International Journal of Contemporary Hospitality Management, 22(3), 416-432. Schoorman, F.D., Mayer, R.C. and Davis, J.H. (2007), An integrative model of organizational trust: past, present, and future, The Academy of Management Review, 32(2), 344-354. Schwarz, N. (2012), Feelings-as-information theory, in Van Lange, P.A.M., Kruglanski, A. and Higgins, E.T. (Eds), Handbook of Theories of Social Psychology, Sage, Thousand Oaks, CA, pp. 289-308. Sirdeshmukh, D., Singh, J. and Sabol, B. (2002), Consumer trust, value, and loyalty in relational exchanges, Journal of Marketing, 66(1), 15-37. Tho, N.D. (2011), Methods of scientific research in business. Social Labor Publishing. Tho, N. D., & Trang, N.T.M. (2011), Market research syllabus. Labor Publishing. Trong, H., & Nguyen, M.N.C. (2008), Textbook of Data Analysis with SPSS Episodes 1 & 2. Hong Duc Publishing, TP.HCM Tweneboah-Koduah, E., & Farley, Y.D. (2015). Relationship between customer satisfaction and customer loyalty in the retail banking sector of Ghana, International Journal of Business and Management, 11(1), 249-262. Voss, K.E., Spangenberg, E.R., & Grohmann, B. (2003). Measuring hedonic and utilitarian dimensions of consumer attitude. Journal of Marketing Research, 40(3), 310-320. 160 © 2019 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

the_effects_of_attitude_trust_and_switching_cost_on_loyalty.pdf

the_effects_of_attitude_trust_and_switching_cost_on_loyalty.pdf