The effects of organization size and manager’s educational background on responsibility accounting: Evidences from Vietnamese cement enterprises

Responsibility accounting is important content of management accounting. This is an accounting

system provides the flexible information, timely and accurately that to assess efficiency of managers

and improve performance of firms. The paper aims to identify effects of organization size and level of

manager education on responsibility accounting in Vietnamese cement enterprises. In this paper, SPSS

22 was used to collect and analysis data by distributing 103 questionnaires on managers and head of

departments from Vietnamese cement manufacturers. The Results of research have shown that there

are significant relationships between organization size, and level of manager education and

responsibility accounting in the Vietnamese cement enterprises

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Tóm tắt nội dung tài liệu: The effects of organization size and manager’s educational background on responsibility accounting: Evidences from Vietnamese cement enterprises

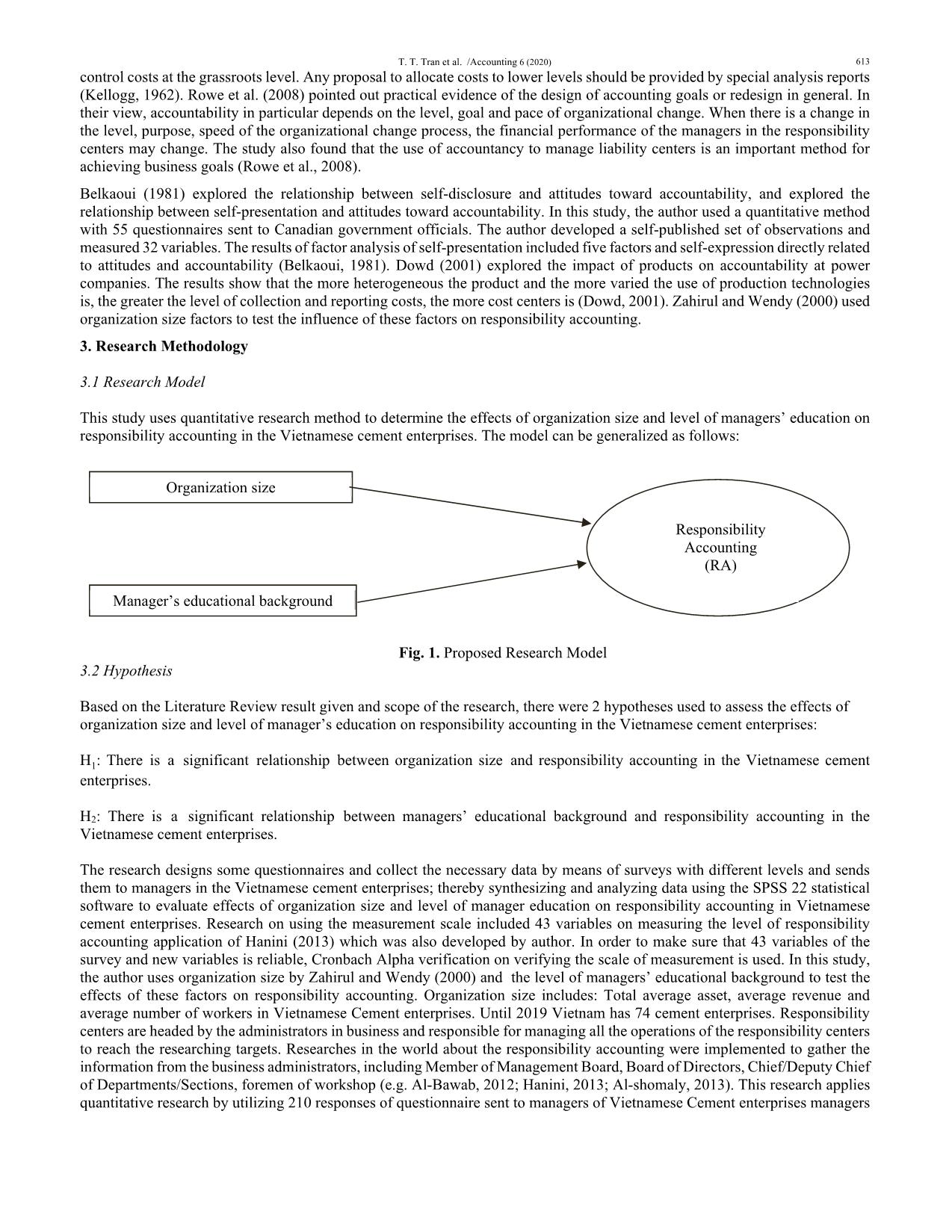

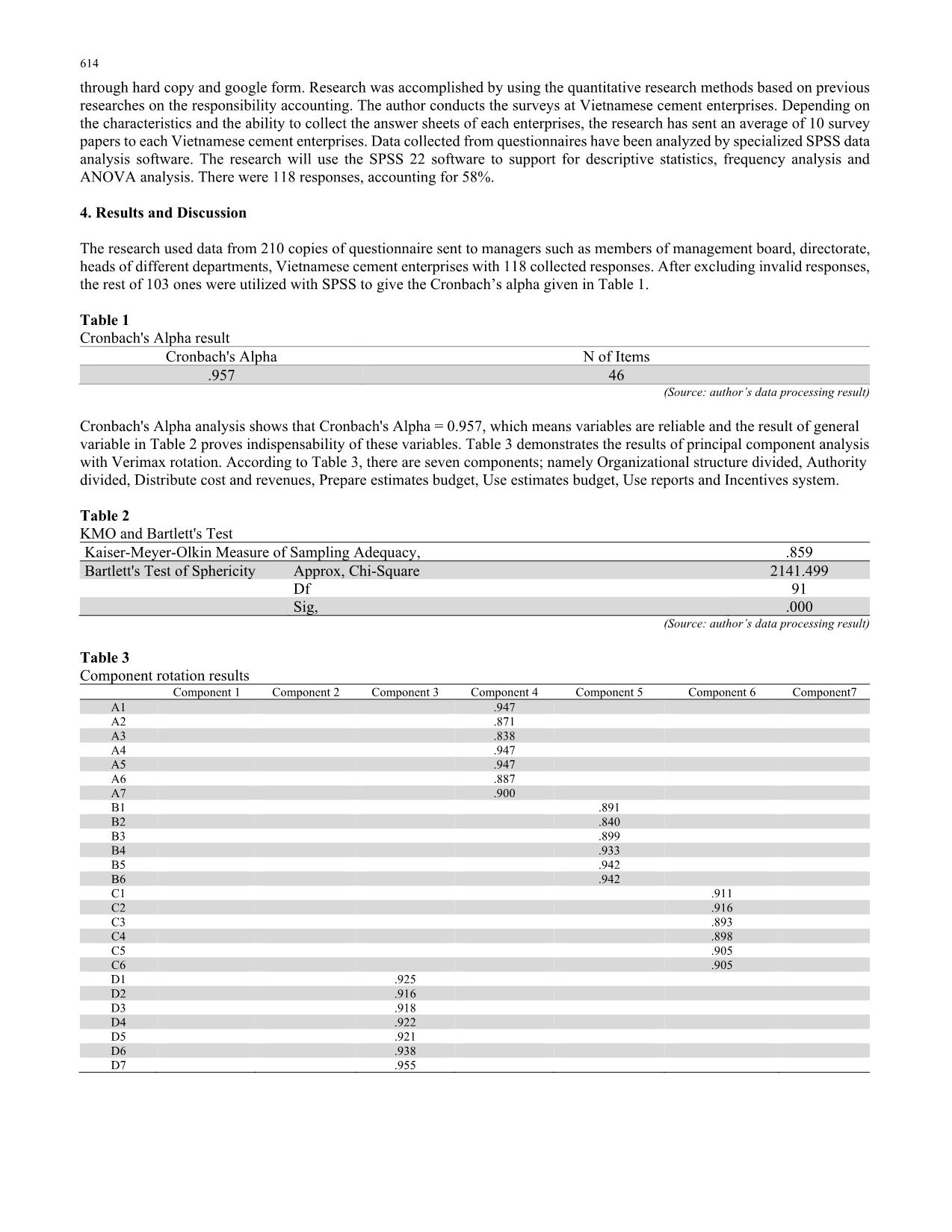

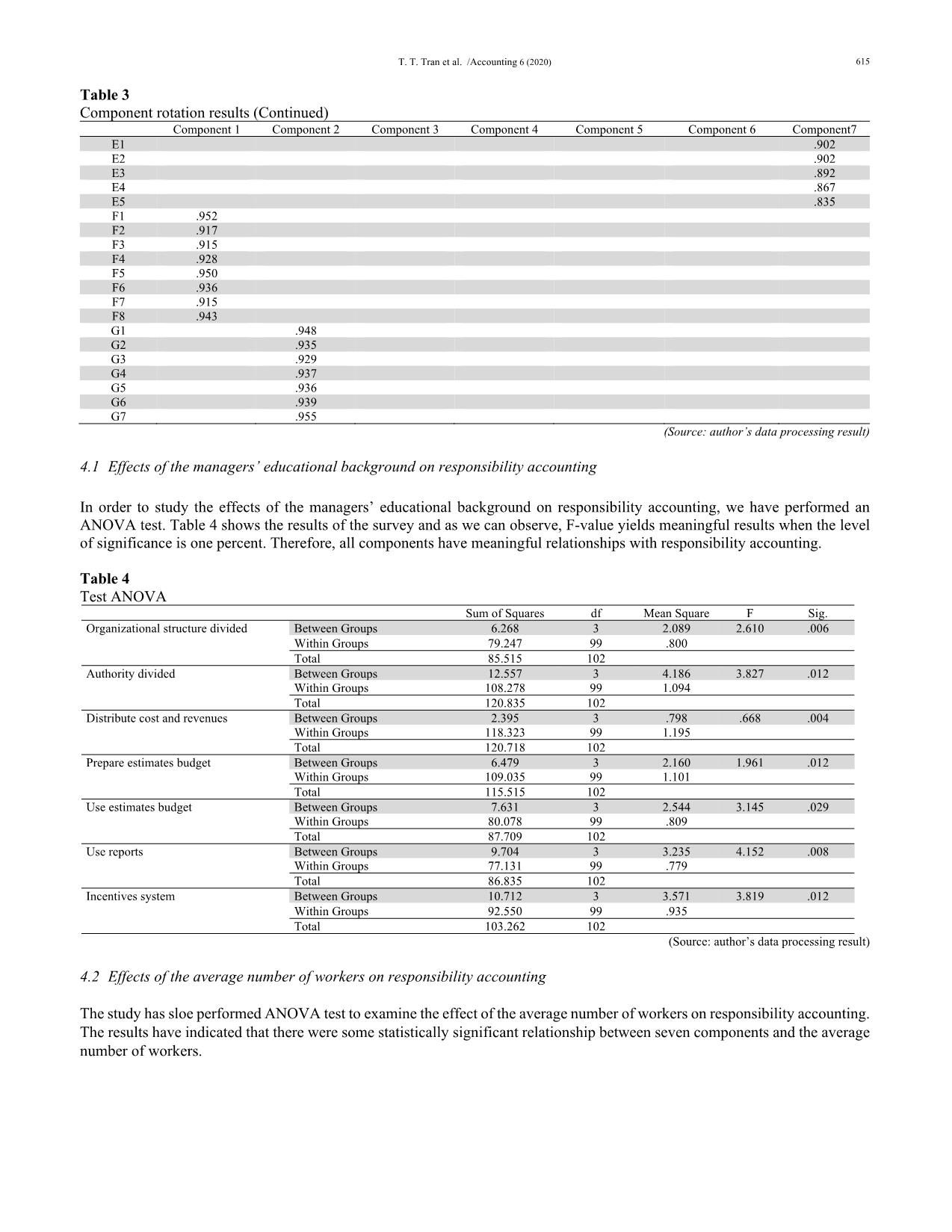

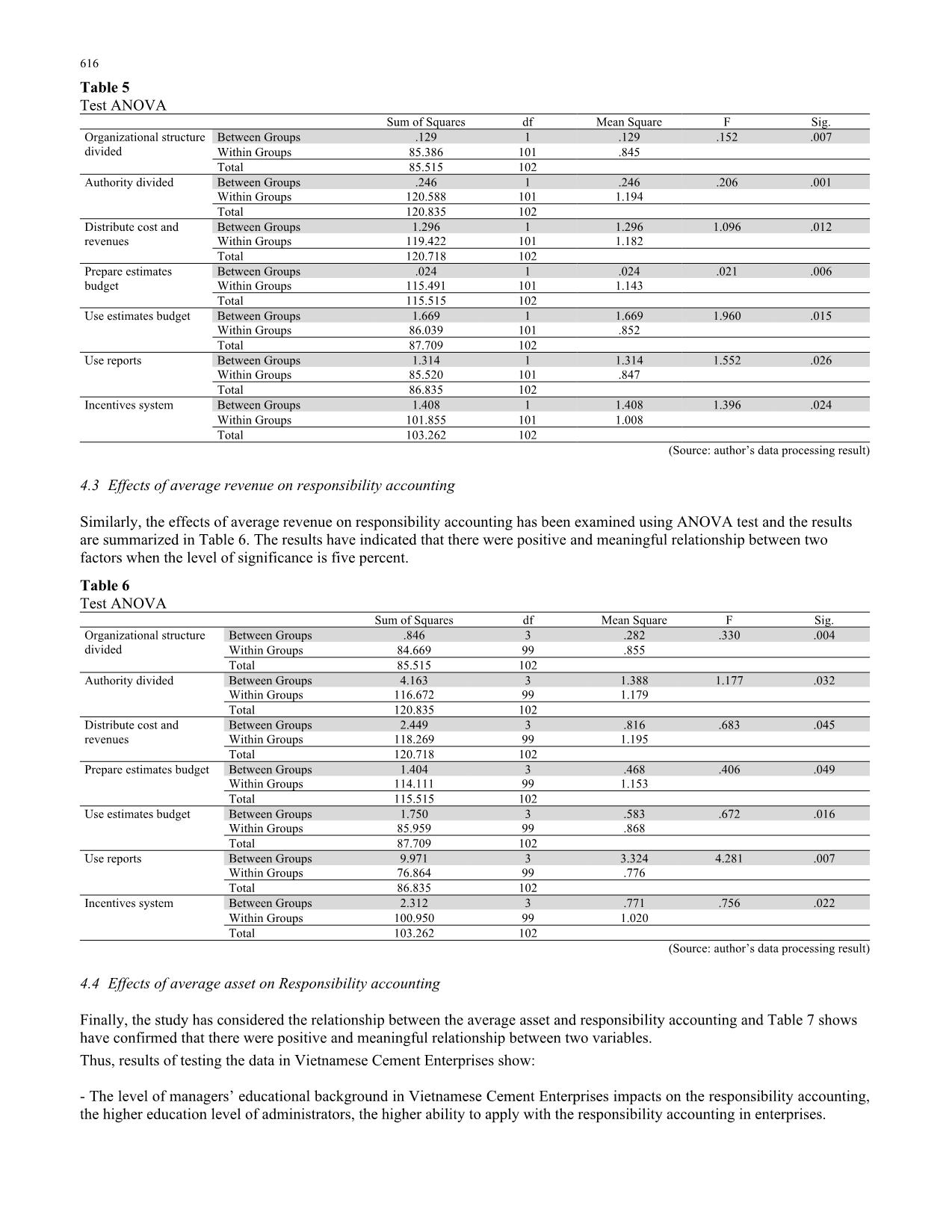

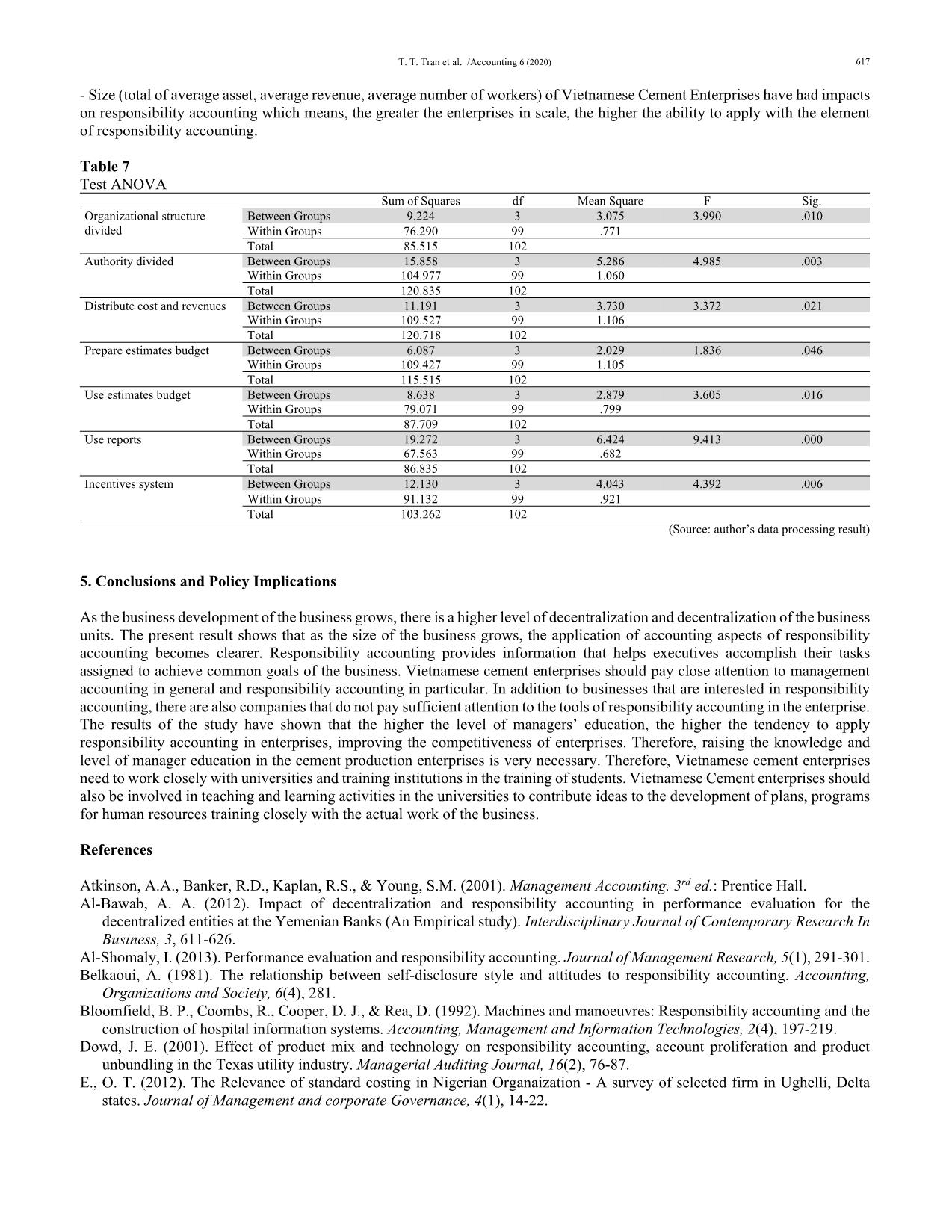

st the effects of these factors on responsibility accounting. Organization size includes: Total average asset, average revenue and average number of workers in Vietnamese Cement enterprises. Until 2019 Vietnam has 74 cement enterprises. Responsibility centers are headed by the administrators in business and responsible for managing all the operations of the responsibility centers to reach the researching targets. Researches in the world about the responsibility accounting were implemented to gather the information from the business administrators, including Member of Management Board, Board of Directors, Chief/Deputy Chief of Departments/Sections, foremen of workshop (e.g. Al-Bawab, 2012; Hanini, 2013; Al-shomaly, 2013). This research applies quantitative research by utilizing 210 responses of questionnaire sent to managers of Vietnamese Cement enterprises managers Responsibility Accounting (RA) Organization size Manager’s educational background 614 through hard copy and google form. Research was accomplished by using the quantitative research methods based on previous researches on the responsibility accounting. The author conducts the surveys at Vietnamese cement enterprises. Depending on the characteristics and the ability to collect the answer sheets of each enterprises, the research has sent an average of 10 survey papers to each Vietnamese cement enterprises. Data collected from questionnaires have been analyzed by specialized SPSS data analysis software. The research will use the SPSS 22 software to support for descriptive statistics, frequency analysis and ANOVA analysis. There were 118 responses, accounting for 58%. 4. Results and Discussion The research used data from 210 copies of questionnaire sent to managers such as members of management board, directorate, heads of different departments, Vietnamese cement enterprises with 118 collected responses. After excluding invalid responses, the rest of 103 ones were utilized with SPSS to give the Cronbach’s alpha given in Table 1. Table 1 Cronbach's Alpha result Cronbach's Alpha N of Items .957 46 (Source: author’s data processing result) Cronbach's Alpha analysis shows that Cronbach's Alpha = 0.957, which means variables are reliable and the result of general variable in Table 2 proves indispensability of these variables. Table 3 demonstrates the results of principal component analysis with Verimax rotation. According to Table 3, there are seven components; namely Organizational structure divided, Authority divided, Distribute cost and revenues, Prepare estimates budget, Use estimates budget, Use reports and Incentives system. Table 2 KMO and Bartlett's Test Kaiser-Meyer-Olkin Measure of Sampling Adequacy, .859 Bartlett's Test of Sphericity Approx, Chi-Square 2141.499 Df 91 Sig, .000 (Source: author’s data processing result) Table 3 Component rotation results Component 1 Component 2 Component 3 Component 4 Component 5 Component 6 Component7 A1 .947 A2 .871 A3 .838 A4 .947 A5 .947 A6 .887 A7 .900 B1 .891 B2 .840 B3 .899 B4 .933 B5 .942 B6 .942 C1 .911 C2 .916 C3 .893 C4 .898 C5 .905 C6 .905 D1 .925 D2 .916 D3 .918 D4 .922 D5 .921 D6 .938 D7 .955 T. T. Tran et al. /Accounting 6 (2020) 615 Table 3 Component rotation results (Continued) Component 1 Component 2 Component 3 Component 4 Component 5 Component 6 Component7 E1 .902 E2 .902 E3 .892 E4 .867 E5 .835 F1 .952 F2 .917 F3 .915 F4 .928 F5 .950 F6 .936 F7 .915 F8 .943 G1 .948 G2 .935 G3 .929 G4 .937 G5 .936 G6 .939 G7 .955 (Source: author’s data processing result) 4.1 Effects of the managers’ educational background on responsibility accounting In order to study the effects of the managers’ educational background on responsibility accounting, we have performed an ANOVA test. Table 4 shows the results of the survey and as we can observe, F-value yields meaningful results when the level of significance is one percent. Therefore, all components have meaningful relationships with responsibility accounting. Table 4 Test ANOVA Sum of Squares df Mean Square F Sig. Organizational structure divided Between Groups 6.268 3 2.089 2.610 .006 Within Groups 79.247 99 .800 Total 85.515 102 Authority divided Between Groups 12.557 3 4.186 3.827 .012 Within Groups 108.278 99 1.094 Total 120.835 102 Distribute cost and revenues Between Groups 2.395 3 .798 .668 .004 Within Groups 118.323 99 1.195 Total 120.718 102 Prepare estimates budget Between Groups 6.479 3 2.160 1.961 .012 Within Groups 109.035 99 1.101 Total 115.515 102 Use estimates budget Between Groups 7.631 3 2.544 3.145 .029 Within Groups 80.078 99 .809 Total 87.709 102 Use reports Between Groups 9.704 3 3.235 4.152 .008 Within Groups 77.131 99 .779 Total 86.835 102 Incentives system Between Groups 10.712 3 3.571 3.819 .012 Within Groups 92.550 99 .935 Total 103.262 102 (Source: author’s data processing result) 4.2 Effects of the average number of workers on responsibility accounting The study has sloe performed ANOVA test to examine the effect of the average number of workers on responsibility accounting. The results have indicated that there were some statistically significant relationship between seven components and the average number of workers. 616 Table 5 Test ANOVA Sum of Squares df Mean Square F Sig. Organizational structure divided Between Groups .129 1 .129 .152 .007 Within Groups 85.386 101 .845 Total 85.515 102 Authority divided Between Groups .246 1 .246 .206 .001 Within Groups 120.588 101 1.194 Total 120.835 102 Distribute cost and revenues Between Groups 1.296 1 1.296 1.096 .012 Within Groups 119.422 101 1.182 Total 120.718 102 Prepare estimates budget Between Groups .024 1 .024 .021 .006 Within Groups 115.491 101 1.143 Total 115.515 102 Use estimates budget Between Groups 1.669 1 1.669 1.960 .015 Within Groups 86.039 101 .852 Total 87.709 102 Use reports Between Groups 1.314 1 1.314 1.552 .026 Within Groups 85.520 101 .847 Total 86.835 102 Incentives system Between Groups 1.408 1 1.408 1.396 .024 Within Groups 101.855 101 1.008 Total 103.262 102 (Source: author’s data processing result) 4.3 Effects of average revenue on responsibility accounting Similarly, the effects of average revenue on responsibility accounting has been examined using ANOVA test and the results are summarized in Table 6. The results have indicated that there were positive and meaningful relationship between two factors when the level of significance is five percent. Table 6 Test ANOVA Sum of Squares df Mean Square F Sig. Organizational structure divided Between Groups .846 3 .282 .330 .004 Within Groups 84.669 99 .855 Total 85.515 102 Authority divided Between Groups 4.163 3 1.388 1.177 .032 Within Groups 116.672 99 1.179 Total 120.835 102 Distribute cost and revenues Between Groups 2.449 3 .816 .683 .045 Within Groups 118.269 99 1.195 Total 120.718 102 Prepare estimates budget Between Groups 1.404 3 .468 .406 .049 Within Groups 114.111 99 1.153 Total 115.515 102 Use estimates budget Between Groups 1.750 3 .583 .672 .016 Within Groups 85.959 99 .868 Total 87.709 102 Use reports Between Groups 9.971 3 3.324 4.281 .007 Within Groups 76.864 99 .776 Total 86.835 102 Incentives system Between Groups 2.312 3 .771 .756 .022 Within Groups 100.950 99 1.020 Total 103.262 102 (Source: author’s data processing result) 4.4 Effects of average asset on Responsibility accounting Finally, the study has considered the relationship between the average asset and responsibility accounting and Table 7 shows have confirmed that there were positive and meaningful relationship between two variables. Thus, results of testing the data in Vietnamese Cement Enterprises show: - The level of managers’ educational background in Vietnamese Cement Enterprises impacts on the responsibility accounting, the higher education level of administrators, the higher ability to apply with the responsibility accounting in enterprises. T. T. Tran et al. /Accounting 6 (2020) 617 - Size (total of average asset, average revenue, average number of workers) of Vietnamese Cement Enterprises have had impacts on responsibility accounting which means, the greater the enterprises in scale, the higher the ability to apply with the element of responsibility accounting. Table 7 Test ANOVA Sum of Squares df Mean Square F Sig. Organizational structure divided Between Groups 9.224 3 3.075 3.990 .010 Within Groups 76.290 99 .771 Total 85.515 102 Authority divided Between Groups 15.858 3 5.286 4.985 .003 Within Groups 104.977 99 1.060 Total 120.835 102 Distribute cost and revenues Between Groups 11.191 3 3.730 3.372 .021 Within Groups 109.527 99 1.106 Total 120.718 102 Prepare estimates budget Between Groups 6.087 3 2.029 1.836 .046 Within Groups 109.427 99 1.105 Total 115.515 102 Use estimates budget Between Groups 8.638 3 2.879 3.605 .016 Within Groups 79.071 99 .799 Total 87.709 102 Use reports Between Groups 19.272 3 6.424 9.413 .000 Within Groups 67.563 99 .682 Total 86.835 102 Incentives system Between Groups 12.130 3 4.043 4.392 .006 Within Groups 91.132 99 .921 Total 103.262 102 (Source: author’s data processing result) 5. Conclusions and Policy Implications As the business development of the business grows, there is a higher level of decentralization and decentralization of the business units. The present result shows that as the size of the business grows, the application of accounting aspects of responsibility accounting becomes clearer. Responsibility accounting provides information that helps executives accomplish their tasks assigned to achieve common goals of the business. Vietnamese cement enterprises should pay close attention to management accounting in general and responsibility accounting in particular. In addition to businesses that are interested in responsibility accounting, there are also companies that do not pay sufficient attention to the tools of responsibility accounting in the enterprise. The results of the study have shown that the higher the level of managers’ education, the higher the tendency to apply responsibility accounting in enterprises, improving the competitiveness of enterprises. Therefore, raising the knowledge and level of manager education in the cement production enterprises is very necessary. Therefore, Vietnamese cement enterprises need to work closely with universities and training institutions in the training of students. Vietnamese Cement enterprises should also be involved in teaching and learning activities in the universities to contribute ideas to the development of plans, programs for human resources training closely with the actual work of the business. References Atkinson, A.A., Banker, R.D., Kaplan, R.S., & Young, S.M. (2001). Management Accounting. 3rd ed.: Prentice Hall. Al-Bawab, A. A. (2012). Impact of decentralization and responsibility accounting in performance evaluation for the decentralized entities at the Yemenian Banks (An Empirical study). Interdisciplinary Journal of Contemporary Research In Business, 3, 611-626. Al-Shomaly, I. (2013). Performance evaluation and responsibility accounting. Journal of Management Research, 5(1), 291-301. Belkaoui, A. (1981). The relationship between self-disclosure style and attitudes to responsibility accounting. Accounting, Organizations and Society, 6(4), 281. Bloomfield, B. P., Coombs, R., Cooper, D. J., & Rea, D. (1992). Machines and manoeuvres: Responsibility accounting and the construction of hospital information systems. Accounting, Management and Information Technologies, 2(4), 197-219. Dowd, J. E. (2001). Effect of product mix and technology on responsibility accounting, account proliferation and product unbundling in the Texas utility industry. Managerial Auditing Journal, 16(2), 76-87. E., O. T. (2012). The Relevance of standard costing in Nigerian Organaization - A survey of selected firm in Ughelli, Delta states. Journal of Management and corporate Governance, 4(1), 14-22. 618 Fowzia, R. (2011). Use of responsibility accounting and measure the satisfaction levels of service organizations in Bangladesh. International Review of Business Research Papers, 7(5), 53-67. Garrison, R. H., & Noreen, E. W. (2008). Managerial Accounting. New York: Mac Graw-Hill. Gharayba, F., & Debi, M. M. ’Moon, & Nasar, A.(2011). The extent of applying the elements of responsibility accounting in the industrial shareholding companies and its effect on the company’s profitability and operational efficiency. Administrative Sciences, 38(1), 219-234. Hanini, A. (2013). The extent of implementing responsibility accounting features in the Jordanian banks. European Journal of Business and Management, 5(1), 217-229. Hansen, D. R., & Mowen, M. M. (2005). Management Accounting: Thomson South-Western. Hermanson, R., Edwards, J. B., & Salmonson, R. F. (1987). Accounting Principles: Taxes Business Publication Inc. Higgins, J. A. (1952). Responsibility accounting (Vol. 12). Chicago, IL: The Arthur Andersen chronicle. Horngren, C. T., Foster, G., & Datar, S. (2000). Cost accounting: managerial Emphasis: Prentice Hall of India Private Limited, newdelhi. Kellogg, M. N. (1962). Fundamentals of Responsibility Accounting. National Association of Accountants. NAA Bulletin (pre- 1986), 43(8), 5. Kinney, M. F., & Raiborn, C. A. (2011). Cost accounting. South-Western, Mason, OH. Meda, I. (2003). System of responsibility accounting in the Jordanian shareholding companies: Reality and hope. Journal of university of Damascus, 19(2), 317-363. Okoye, E. I., R., E. N., & Ngozi, I. (2009). Improvement of Managerial Performance in Manufacturing Organizations - An Application of Responsibility Accounting. Journal of the Management Sciences, 9(1), 1-17. Rajbi, M. T. (2004). The Administrative Accounting (Vol. Dar Wael). Amman, Jordan. Reddy, B. V. v. R. (2008). Responsibility -Accounting - Conceptual Framework. Retrieved 15/9/, 2013 Rowe, C., Birnberg, J. G., & Shields, M. D. (2008). Effects of organizational process change on responsibility accounting and managers' revelations of private knowledge. Accounting, Organizations and Society, 33(2/3), 164-198. Zahirul, H., & Wendy, J. (2000). Linking balanced scorecard measures to size and market factors: Impact on organizational performance. Journal of Management Accounting Research, 12, 1-17. © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

the_effects_of_organization_size_and_managers_educational_ba.pdf

the_effects_of_organization_size_and_managers_educational_ba.pdf