Investments in subsidiaries, joint ventures, affiliates and firm growth: Evidence from Vietnam

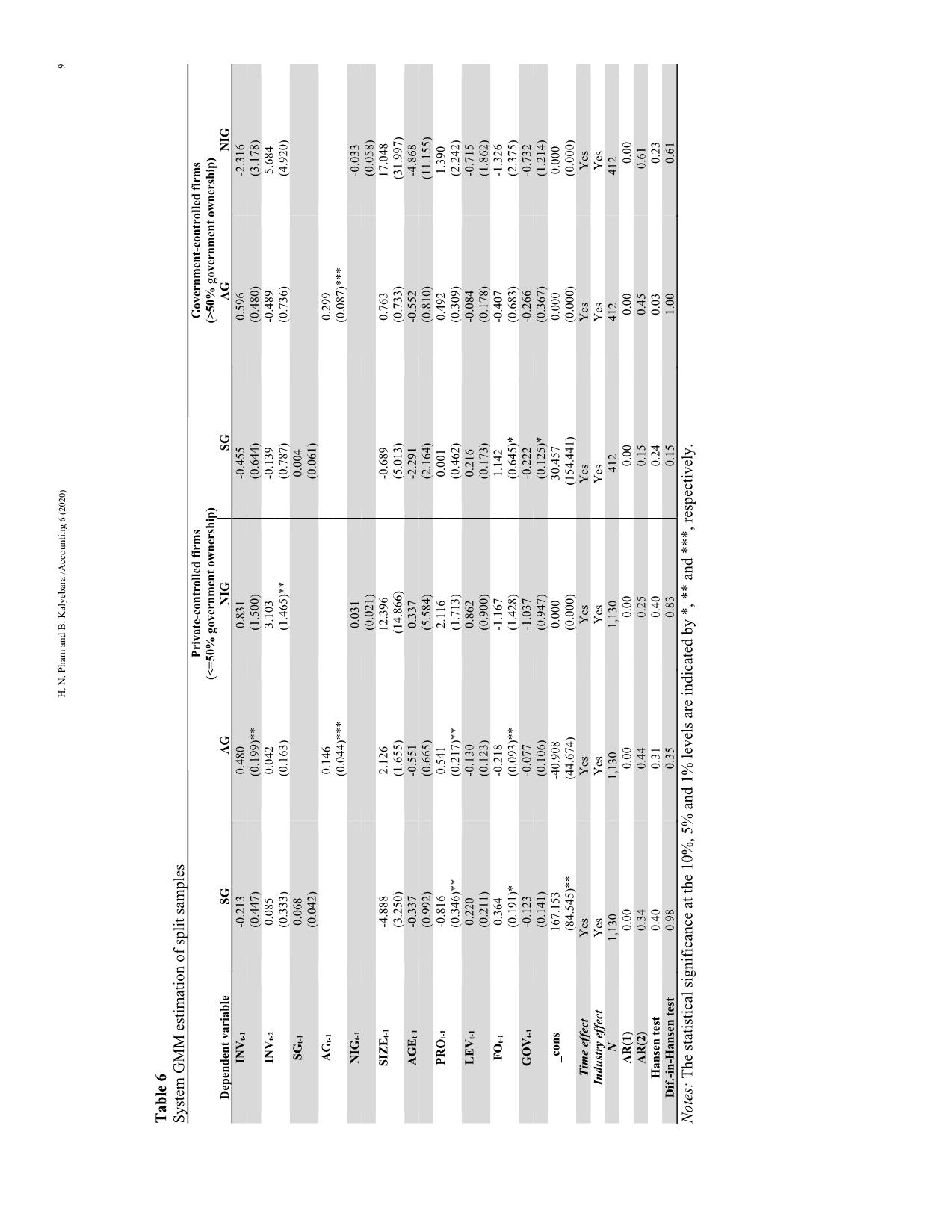

This paper investigates the effect of investments in subsidiaries, joint ventures and affiliates (affiliate

investment) on firm growth. Using both static and dynamic panel data models with a sample dataset of

2,056 firm-year observations on Vietnam’s stock market from 2008-2015, the study finds that

increasing affiliate investment in prior periods had a significantly positive impact on asset growth and

net income growth (but not sales growth) of the firms in subsequent periods. In addition, the study

finds new empirical evidence that private-controlled firms are more efficient than governmentcontrolled firms in terms of affiliate investment. It is also found that profitability, government

ownership and foreign ownership are significant dynamics for firm growth. This research sheds light

on the role of affiliate investment as a corporate diversification strategy to boost firm growth, including

growth rates of multinational corporations. It also provides important implications about the

determinants of different dimensions of firm growth in the context of an Asian emerging economy.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Tóm tắt nội dung tài liệu: Investments in subsidiaries, joint ventures, affiliates and firm growth: Evidence from Vietnam

ms should not rely on external sources of funding to boost the expansion in both sales and assets, particularly for accelerating net income growth. Foreign ownership: Foreign ownership shows a significantly positive impact on sales growth, and this finding is consistent in all estimation methods, including static and dynamic models. Interestingly, while foreign ownership appears to improve sales growth, it is found to have a negative impact on asset growth, particularly in private-controlled firms. Precisely, foreign ownership is estimated to be significantly negatively related to the asset growth rate of private firms at the 5% significance level. An increase of 1% in foreign ownership is associated with a drop of more than 0.2% in asset growth. The sign of the coefficient on foreign ownership is also negative for net income growth, but this effect is not statistically significant. In the context of an emerging stock market like Vietnam, the increase of foreign shareholdings in the listed firms can be a positive signal to the market in terms of improved credit rating and long-term growth, resulting in attracting more business partners, gaining larger market shares and hence raising sales volume. At the same time, it is likely that the presence of foreign shareholders strengthens the monitoring role of shareholders while restraining the firms’ discretion to expand assets through investing in risky projects. 5.3. Robustness Checks Two further tests are conducted to check for the robustness of the research methods used and the reliability of results as reported above. First, firm size is conventionally a variable of interest in investigating the determinants of firm growth, in particular for testing Gibrat’s law. Therefore, another proxy of firm size (SIZE2) is employed in this research to check for the robustness of the results reported above. SIZE2 is measured as the natural logarithm of the market capitalization of the firm. Second, firm age (AGE) is removed from both Model 1 and Model 2. Under such new treatments of variables, estimated results are entirely consistent. 6. Conclusion Several main results of this research are summarized as follows. First, we have shown that investment in subsidiaries, joint ventures and affiliates (affiliate investment) did matter with regards to firm growth since the former had significantly positive dynamic effects on relevant measures of the latter. Second, there was strong evidence that the positive impact of affiliate investment was valid for private-controlled firms instead of government-controlled firms. Furthermore, this study has found that profitability, government ownership and foreign ownership were significant dynamics for firm growth in the context of a transitional and emerging market. This study makes a theoretical contribution to the literature by shedding light upon the relationship between affiliate investment and firm growth as well as the impact of corporate investment behaviors on firm H. N. Pham and B. Kalyebara /Accounting 6 (2020) 11 growth in general. It indicates that long-term financial investment in the form of affiliate investment in the previous years plays a significantly positive role in accelerating firm growth in the current year. However, it depends on whether ownership concentration at the firm is in the hands of private shareholders or government shareholders. Methodologically, by focusing on affiliate investment in relation to three different dimensions of firm growth (i.e. sales growth, asset growth, net income growth), this study implies that any claims on the determinants of firm growth depend on how firm growth is measured. It shows that affiliate investment can be adopted as a good channel to boost some dimensions of firm growth but not all. Empirically, this study provides new evidence that private-controlled firms are more efficient than government-controlled firms in terms of affiliate investment, and corporate investment decisions by private investors are more value-enhancing than that of government shareholders. While affiliate investment can be utilised as a channel for corporate diversification into new business lines as already mentioned, this strategy should be adopted by private firms only for firm growth. Hence, this finding is also beneficial to the literature on corporate diversification. Besides, the finding for the effect of foreign ownership suggests that multinational corporations may encounter contradicting scenarios of financial growth rates in a host country. As mentioned earlier, foreign ownership is found to be positively associated with sales growth, but it has a negative impact on asset growth in the context of an Asian emerging economy like Vietnam. This paper has some limitations. First, under the equity method in accounting, affiliate investment appears in the balance sheet as a part of the firm’s total assets. Thus, there is a limitation in finding an alternative proxy of affiliate investment that covers all forms of long-term financial investment into subsidiaries, joint ventures and affiliates. Second, due to the focus of research, this study has not discussed the links between affiliate investment and corporate risk-taking behaviors. Further research examine the relationships among affiliate investment, corporate risk management and firm growth. References Adams, M., Andersson, L. F., Hardwick, P., & Lindmark, M. (2014). Firm size and growth in Sweden's life insurance market between 1855 and 1947: A test of Gibrat's law. Business History, 56(6), 956-974. Aktas, N., Croci, E., & Petmezas, D. (2015). Is working capital management value-enhancing? Evidence from firm performance and investments. Journal of Corporate Finance, 30, 98-113. Alperovych, Y., Hübner, G., & Lobet, F. (2015). How does governmental versus private venture capital backing affect a firm's efficiency? Evidence from Belgium. Journal of Business Venturing, 30(4), 508-525. Arellano, M., & Bond, S. (1991). Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. The Review of Economic Studies, 58(2), 277-297. Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(1), 29-51. Audretsch, D. B., Klomp, L., Santarelli, E., & Thurik, A. R. (2004). Gibrat's Law: Are the Services Different? Review of Industrial Organization, 24(3), 301-324. Blandina, O., & Adelino, F. (2005). The Dynamics of the Growth of Firms: Evidence from the Services Sector. In: GEMF - Faculdade de Economia, Universidade de Coimbra. Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115-143. Calvo, J. L. (2006). Testing Gibrat's Law for Small, Young and Innovating Firms, 117. Cameron, A. C., & Trivedi, P. K. (2010). Microeconometrics using Stata (Rev. ed.): College Station, Tex. : Stata Press. Capasso, M., Treibich, T., & Verspagen, B. (2015). The medium-term effect of R&D on firm growth. Small Business Economics, 45(1), 39- 62. Chadha, S., & Sharma, A. K. (2015). Capital Structure and Firm Performance: Empirical Evidence from India. Vision, 19(4), 295-302. Chen, T.-J., & Ku, Y.-H. (2000). The effect of foreign direct investment on firm growth: the case of Taiwan’s manufacturers. Japan and the World Economy, 12(2), 153-172. Chih-Ping, Y. (2016). Size and growth of mobile phone firms in Mainland China, Hong Kong, and Taiwan. Chinese Economy, 49(4), 277- 286. Cleary, S. (1999). The relationship between firm investment and financial status. The Journal of Finance, 54(2), 673-692. Coad, A. (2009). The growth of firms: A survey of theories and empirical evidence: Edward Elgar Publishing. Coad, A., & Rao, R. (2010). Firm growth and R&D expenditure. Economics of Innovation and New Technology, 19(2), 127-145. Coad, A., Segarra, A., & Teruel, M. (2016). Innovation and firm growth: Does firm age play a role? Research policy, 45(2), 387-400. Copeland, T. E., Weston, J. F., & Shastri, K. (2005). Financial theory and corporate policy: Boston, MA : Addison-Wesley, 4th ed. Cumming, D. J., Grilli, L., & Murtinu, S. (2017). Governmental and independent venture capital investments in Europe: A firm-level performance analysis. Journal of Corporate Finance, 42, 439-459. Daily, C. M., & Thompson, S. S. (1994). Ownership structure, strategic posture, and firm growth: An empirical examination. Family Business Review, 7(3), 237-249. Daunfeldt, S.-O., & Elert, N. (2013). When is Gibrat’s law a law? Small Business Economics, 41(1), 133-147. Dimelis, S. P. (2005). Spillovers from foreign direct investment and firm growth: Technological, financial and market structure effects. International Journal of the Economics of Business, 12(1), 85-104. Djankov, S., & Murrell, P. (2002). Enterprise restructuring in transition: A quantitative survey. Journal of economic literature, 40(3), 739- 792. Douma, S., George, R., & Kabir, R. (2006). Foreign and Domestic Ownership, Business Groups, and Firm Performance: Evidence from a Large Emerging Market. Strategic Management Journal, 27(7), 637-657. doi:10.1002/smj.535 12 Dushnitsky, G., & Lenox, M. J. (2006). When does corporate venture capital investment create firm value? Journal of Business Venturing, 21(6), 753-772. Engel, D., & Keilbach, M. (2007). Firm-level implications of early stage venture capital investment—An empirical investigation. Journal of Empirical Finance, 14(2), 150-167. Federico, J., & Capelleras, J.-L. (2015). The heterogeneous dynamics between growth and profits: the case of young firms. Small Business Economics, 44(2), 231-253. doi:10.1007/s11187-014-9598-9 Gainsborough, M. (2009). Privatisation as State Advance: Private Indirect Government in Vietnam. New Political Economy, 14(2), 257-274. doi:10.1080/13563460902826013 Gedajlovic, E., & Shapiro, D. M. (2002). Ownership Structure and Firm Profitability in Japan. The Academy of Management Journal, 45(3), 565-575. Geroski, P. A., & Gugler, K. P. (2001). Corporate Growth Convergence in Europe. In: C.E.P.R. Discussion Papers. Geroski, P. A., Lazarova, S., Urga, G., & Walters, C. F. (2003). Are Differences in Firm Size Transitory or Permanent?, 47. Gibrat, R. (1931). Les inégalités économiques: Recueil Sirey. Goddard, J., Molyneux, P., & Wilson, J. O. (2004). Dynamics of growth and profitability in banking. Journal of Money, Credit and Banking, 1069-1090. GSO. (2016). The Movement and Reality of Socio-Economic Situation in Vietnam over the 5-year Period from 2011-2015 In. Hidenobu, O., & Lai Thi Phuong, N. (2012). Capital Structure and Investment Behavior of Listed Companies in Vietnam: An Estimation of the Influence of Government Ownership. International Journal of Business and Information, 7(2), 137. IFC. (2010). Corporate Governance Manual (2nd ed.). Hanoi. Jang, S., & Park, K. (2011). Inter-relationship between firm growth and profitability. International Journal of Hospitality Management, 30, 1027-1035. doi:10.1016/j.ijhm.2011.03.009 Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360. Kankaanpää, J., Oulasvirta, L., & Wacker, J. (2014). Steering and Monitoring Model of State-Owned Enterprises. International Journal of Public Administration, 37(7), 409-423. doi:10.1080/01900692.2013.858355 Kim, K.-H., & Rasheed, A. A. (2014). Board heterogeneity, corporate diversification and firm performance. Journal of Management Research, 14(2), 121. Konings, J. (1997). Firm growth and ownership in transition countries. Economics Letters, 55(3), 413-418. Lee, S. (2014). The relationship between growth and profit: evidence from firm-level panel data. Structural Change and Economic Dynamics, 28, 1-11. Megginson, W. L., Nash, R. C., & Randenborgh, M. (2012). The financial and operating performance of newly privatized firms: An international empirical analysis. The Journal of Finance, 49(2), 403-452. Nguyen, T. N. (2013). Determinants of Firm Growth in the Vietnamese Commercial-Service Sector. Journal of Economics and Development, 14(1), 57. Nguyen, T. T., & Van Dijk, M. A. (2012). Corruption, growth, and governance: Private vs. state-owned firms in Vietnam. Journal of banking & finance, 36(11), 2935-2948. Penrose, E. T. (1956). Foreign investment and the growth of the firm. The economic journal, 66(262), 220-235. Pham, C. D., & Carlin, T. M. (2008). Financial performance of privatized state-owned enterprises (SOEs) in Vietnam. Journal of International Business Research, 7(3), 105. Phung, D. N., & Mishra, A. V. (2016). Ownership Structure and Firm Performance: Evidence from Vietnamese Listed Firms. Australian Economic Papers, 55(1), 63-98. doi: Rasiah, D., Tong, D. Y. K., & Kim, P. K. (2014). Profitability and Firm Size-Growth Relationship in Construction Companies in Malaysia From 2003 to 2010. Review of Pacific Basin Financial Markets & Policies, 17(3), 1-19. doi:10.1142/S0219091514500143 Roberta, D., Ivan, P., & Emiliano, S. (2014). Size, Age and the Growth of Firms: New Evidence from Quantile Regressions. In: Fondazione Eni Enrico Mattei. Roodman, D. (2009). How to do xtabond2: An introduction to difference and system GMM in Stata. Stata Journal, 9(1), 86-136. Scott, W. R. (2015). Financial accounting theory: Don Mills, Ontario : Pearson Canada, [2015], 7th edition. Sun, Q., & Feng, F. (2004). Do government-linked companies underperform? Journal of banking & finance, 28(10), 2461-2492. Tang, A. (2015). Does Gibrat's law hold for Swedish energy firms? Empirical Economics, 49(2), 659-674. doi:10.1007/s00181-014-0883-x Truong, D. L., Lanjouw, G., & Lensink, R. (2006). The impact of privatization on firm performance in a transition economy - The case of Vietnam. ECONOMICS OF TRANSITION, 14(2), 349-389. Weill, P. (1992). The relationship between investment in information technology and firm performance: A study of the valve manufacturing sector. Information systems research, 3(4), 307-333. Xiu-fang, L., Xiao-jiao, B., & Chao, A. (2013). The Growth Model of Life Insurance Companies: Based on the Empirical Test of the Gibrat Law. Insurance Studies, 3, 010. Yang, W., & Meyer, K. E. (2018). How does ownership influence business growth? A competitive dynamics perspective. International Business Review. Zhou, H., & de Wit, G. (2009). Determinants and dimensions of firm growth. SCALES EIM Research Reports (H200903). © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

investments_in_subsidiaries_joint_ventures_affiliates_and_fi.pdf

investments_in_subsidiaries_joint_ventures_affiliates_and_fi.pdf