Does bank capital affect profitability and risk in Vietnam?

In this paper, we attempt to answer the question of whether or not bank capital affects profitability and

risk. The paper forms an unbalanced panel with 354 observations using both data of 35 banks over the

period 2007-2018. Two-step GMM is used to estimate the impacts of bank capital on profitability and

risk in order to eliminate endogeneity and serial correlation issues. As a proxy of bank capital, the

bank equity ratio, and equity level are used. Return on assets (ROA), return on equities (ROE), and

net interest margin (NIM) are used to measure bank profitability, whereas nonperforming loan ratio

and loan loss reserve ratio are used to measure bank risk. Bank capital displays significant impacts on

profitability, which is measured by ROA and ROE, whereas capital shows no impact on bank NIM.

When the loan loss reserve ratio is considered as proxy of bank risk, bank capital does not affect bank

risk. The equity ratio, the proxy of bank capital, displays significant negative impacts on risk, whereas

the equity level, the other proxy of bank capital, shows positive impacts on bank risk.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Tóm tắt nội dung tài liệu: Does bank capital affect profitability and risk in Vietnam?

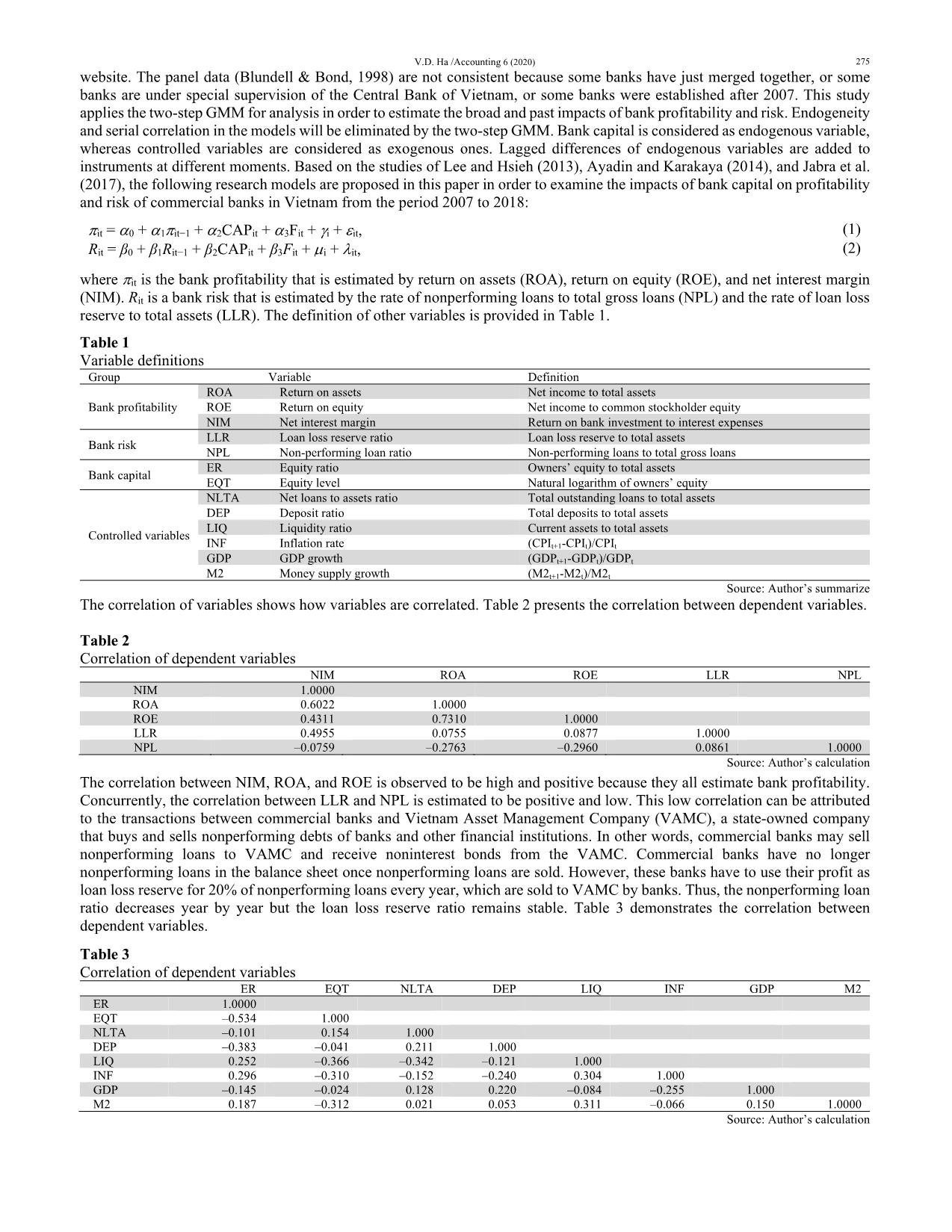

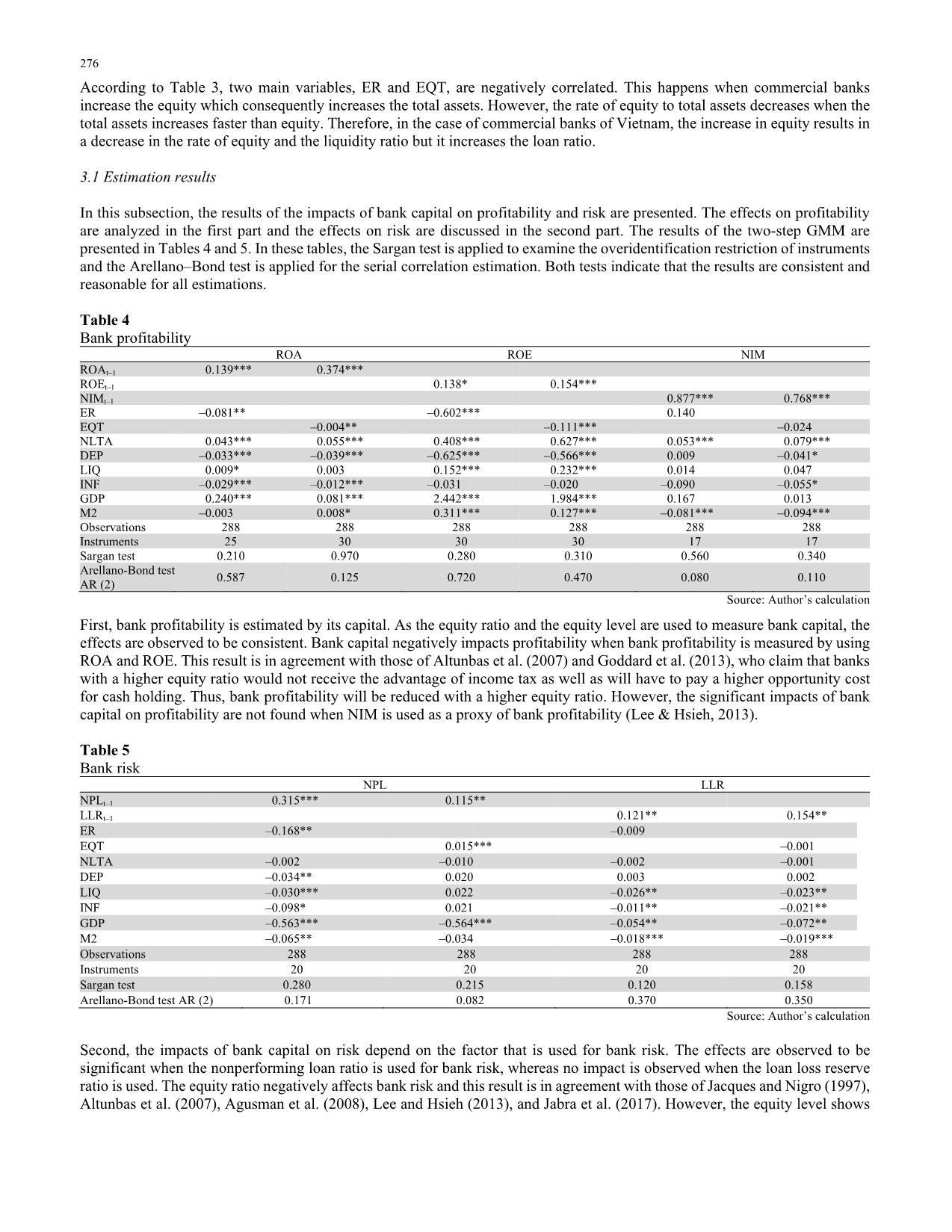

es. Table 2 Correlation of dependent variables NIM ROA ROE LLR NPL NIM 1.0000 ROA 0.6022 1.0000 ROE 0.4311 0.7310 1.0000 LLR 0.4955 0.0755 0.0877 1.0000 NPL –0.0759 –0.2763 –0.2960 0.0861 1.0000 Source: Author’s calculation The correlation between NIM, ROA, and ROE is observed to be high and positive because they all estimate bank profitability. Concurrently, the correlation between LLR and NPL is estimated to be positive and low. This low correlation can be attributed to the transactions between commercial banks and Vietnam Asset Management Company (VAMC), a state-owned company that buys and sells nonperforming debts of banks and other financial institutions. In other words, commercial banks may sell nonperforming loans to VAMC and receive noninterest bonds from the VAMC. Commercial banks have no longer nonperforming loans in the balance sheet once nonperforming loans are sold. However, these banks have to use their profit as loan loss reserve for 20% of nonperforming loans every year, which are sold to VAMC by banks. Thus, the nonperforming loan ratio decreases year by year but the loan loss reserve ratio remains stable. Table 3 demonstrates the correlation between dependent variables. Table 3 Correlation of dependent variables ER EQT NLTA DEP LIQ INF GDP M2 ER 1.0000 EQT –0.534 1.000 NLTA –0.101 0.154 1.000 DEP –0.383 –0.041 0.211 1.000 LIQ 0.252 –0.366 –0.342 –0.121 1.000 INF 0.296 –0.310 –0.152 –0.240 0.304 1.000 GDP –0.145 –0.024 0.128 0.220 –0.084 –0.255 1.000 M2 0.187 –0.312 0.021 0.053 0.311 –0.066 0.150 1.0000 Source: Author’s calculation 276 According to Table 3, two main variables, ER and EQT, are negatively correlated. This happens when commercial banks increase the equity which consequently increases the total assets. However, the rate of equity to total assets decreases when the total assets increases faster than equity. Therefore, in the case of commercial banks of Vietnam, the increase in equity results in a decrease in the rate of equity and the liquidity ratio but it increases the loan ratio. 3.1 Estimation results In this subsection, the results of the impacts of bank capital on profitability and risk are presented. The effects on profitability are analyzed in the first part and the effects on risk are discussed in the second part. The results of the two-step GMM are presented in Tables 4 and 5. In these tables, the Sargan test is applied to examine the overidentification restriction of instruments and the Arellano–Bond test is applied for the serial correlation estimation. Both tests indicate that the results are consistent and reasonable for all estimations. Table 4 Bank profitability ROA ROE NIM ROAt–1 0.139*** 0.374*** ROEt–1 0.138* 0.154*** NIMt–1 0.877*** 0.768*** ER –0.081** –0.602*** 0.140 EQT –0.004** –0.111*** –0.024 NLTA 0.043*** 0.055*** 0.408*** 0.627*** 0.053*** 0.079*** DEP –0.033*** –0.039*** –0.625*** –0.566*** 0.009 –0.041* LIQ 0.009* 0.003 0.152*** 0.232*** 0.014 0.047 INF –0.029*** –0.012*** –0.031 –0.020 –0.090 –0.055* GDP 0.240*** 0.081*** 2.442*** 1.984*** 0.167 0.013 M2 –0.003 0.008* 0.311*** 0.127*** –0.081*** –0.094*** Observations 288 288 288 288 288 288 Instruments 25 30 30 30 17 17 Sargan test 0.210 0.970 0.280 0.310 0.560 0.340 Arellano-Bond test AR (2) 0.587 0.125 0.720 0.470 0.080 0.110 Source: Author’s calculation First, bank profitability is estimated by its capital. As the equity ratio and the equity level are used to measure bank capital, the effects are observed to be consistent. Bank capital negatively impacts profitability when bank profitability is measured by using ROA and ROE. This result is in agreement with those of Altunbas et al. (2007) and Goddard et al. (2013), who claim that banks with a higher equity ratio would not receive the advantage of income tax as well as will have to pay a higher opportunity cost for cash holding. Thus, bank profitability will be reduced with a higher equity ratio. However, the significant impacts of bank capital on profitability are not found when NIM is used as a proxy of bank profitability (Lee & Hsieh, 2013). Table 5 Bank risk NPL LLR NPLt–1 0.315*** 0.115 ** LLRt–1 0.121** 0.154** ER –0.168** –0.009 EQT 0.015 *** –0.001 NLTA –0.002 –0.010 –0.002 –0.001 DEP –0.034** 0.020 0.003 0.002 LIQ –0.030*** 0.022 –0.026** –0.023** INF –0.098* 0.021 –0.011** –0.021** GDP –0.563*** –0.564 *** –0.054** –0.072** M2 –0.065** –0.034 –0.018*** –0.019*** Observations 288 288 288 288 Instruments 20 20 20 20 Sargan test 0.280 0.215 0.120 0.158 Arellano-Bond test AR (2) 0.171 0.082 0.370 0.350 Source: Author’s calculation Second, the impacts of bank capital on risk depend on the factor that is used for bank risk. The effects are observed to be significant when the nonperforming loan ratio is used for bank risk, whereas no impact is observed when the loan loss reserve ratio is used. The equity ratio negatively affects bank risk and this result is in agreement with those of Jacques and Nigro (1997), Altunbas et al. (2007), Agusman et al. (2008), Lee and Hsieh (2013), and Jabra et al. (2017). However, the equity level shows V.D. Ha /Accounting 6 (2020) 277 positive impacts on bank risk. In Vietnam, banks have to promote their sale and investment when they increase their capital levels, which may lead to higher nonperforming loans. In reality, in order to fulfill the commitment of capital level, commercial banks increase their capital during the period 2008–2010 and as a result, the nonperforming loan ratio sharply increased in the next period of 2011–2013, peaking 4% in 2012. The impacts of controlled variables on bank profitability and risk are estimated to be relatively consistent with other studies. The net loans to assets ratio demonstrates a positive impact on bank profitability (Iannotta et al., 2007; Lee & Hsieh, 2013; Ayaydin & Karakaya, 2014; Menicucci & Paolucci, 2015; Jabra et al., 2017) because until now offering loans is the primary source of bank income in Vietnam, like most developing economies. According to this study, NLTA does not show a significant impact on bank risk and this result is partly in agreement with those of Lee and Hsieh (2013) and Jabra et al. (2017). The deposit ratio shows significant negative impacts on both bank profitability and risk. A higher deposit ratio creates more pressure on banks to use deposits effectively. Similarly, a rapid increase in deposit may result in a higher level of interest paid, which will reduce profitability. On the other hand, an increase in the deposit ratio may ensure low reserve from banks or may increase bank liquidity, which in turn may reduce the operational risk. In general, the liquidity ratio shows positive impacts on profitability and negative impacts on risk. For short-term sale, such as interbank loans, short-term loans, etc., high liquid assets may be used. Hence, these short-term sales can make banks more effective. Macroindicators are positively related to bank profitability and risk. Inflation shows negative impacts on bank profitability (Naceur & Kandil, 2009; Lee and Hsieh, 2013). Similarly, unexpected inflation can make banks inactive by adjusting their interest rates, which may reduce the net interest margin of banks. In this period, inflation was under control in Vietnam, indicating that moderate inflation is a favorable condition for economic development, which in turn reduces bank risk. A higher rate of GDP growth can lead to higher bank profitability and lower bank risk. The improvement in the economy will generate more demand in the capital market which will have positive impacts on bank operation or bank profitability. Flamini et al. (2009), Lee and Hsieh (2013), and Jabra et al. (2017) show similar results. Finally, money supply (M2) shows positive impacts on ROA and ROE of banks, whereas M2 negatively affects the NIM of banks. An expansionary monetary policy not only improves ROA and ROE of banks but also increases the cost of the marginal interest rate. In addition, the expansion of loans can create higher cost of reserve, which reduces the net interest margin of banks. 4. Conclusion In this paper, the impacts of bank capital on profitability and risk in Vietnam were empirically investigated from the period 2007 to 2018. The equity ratio and the equity level were considered as bank capital. ROA, ROE, and NIM were used to measure bank profitability, whereas the loan loss reserve ratio and the nonperforming loan ratio were used to measure the proxy of bank risk. In this paper, data of 35 commercial banks were merged into an unbalanced panel sample by collecting bank data from the audited balance sheet. In addition, inflation, GDP growth, and M2 were also used as controlled variables in the model. The two- step GMM, which controls endogeneity and serial correlation, was used to estimate the impacts. Bank capital, in both equity ratio and equity level, has shown significant negative impacts on bank profitability (ROA and ROE), whereas it showed no impacts on NIM. Moreover, the impacts of bank capital on risk also depend on how capital and risk are measured. Bank capital was found to have no impact on risk if the loan loss reserve ratio was considered bank risk. If the nonperforming loan ratio is used to measure risk, the equity ratio shows significant negative impacts on risk whereas the equity level shows positive impacts on risk. The impacts of bank capital on profitability and risk may propose some implications. First, it depends on what banks need, high profitability, and high risk or vice versa, in the case of commercial banks. Banks can reduce the equity ratio or the equity level if commercial banks want to raise their profit. Moreover, banks can buy their stocks for reserve or can increase deposits in order to decrease the equity ratio. However, a decrease in the equity ratio may lead to higher bank risk. Banks can reduce the deposit ratio or increase the capital level if banks want to reduce their risk. Banks require performing well in investment risk management in order to lower their risk. In order to obtain the targeted capital ratio, banks also increase deposits nowadays when they increase their equity. Second, the nonperforming loan ratio may increase sharply, as happened in the past, if the policymakers instruct banks to increase their capital in a short time. Therefore, policymakers should instruct every bank to outline their own procedure for managing risk management and gradually fulfilling the global requirements. In addition, policymakers should also draw a roadmap for banks in order to increase their bank capital. Simultaneously, banks should also develop their risk management system in order to strengthen their ability to control the increasing risk. References Agusman, A., Monroe, G. S., Gasbarro, D., & Zumwalt, J. K. (2008). Accounting and capital market measures of risk: Evidence from Asian banks during 1998–2003. Journal of Banking and Finance, 32(4), 480–488. Alper, D., & Anba, A. (2011). Bank specific and macroeconomic determinants of comercial bank profitability: Empirical evidence from Turkey. Journal of Business and Economics Research, 2(2), 139 – 152. Altunbas, Y. S., Carbo, E., Gardener, P. M., & Molyneux, P. (2007). Examining the relationships between capital, risk, and efficiency in European banking. European Financial Management, 13(1), 49–70. Arellano, M., & Bover, O. (1995). Another look at the instrumental-variable estimation of errorcomponents. Journal of Econometrics, 68(1), 29–52. 278 Athanasoglou, P. P., Delis, M. D., & Staikouras, C. K. (2006). Determinants of bank profitability in the South Eastern European Region. Bank of Greece, Working paper No. 25. Ayaydin, H., & Karakaya, A. (2014). The effect of bank capital on profitability and risk in Turkish banking. International Journal of Business and Social Science, 5(1), 252–271. Berger, A. N. (1995). The relationship between capital and earnings in banking. Journal of Money, Credit and Banking, 27(2), 432–456. Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87, 115–143. Dimitrios, P. L., Angelos, T. V., & Vasilios, L. M. (2010). Macroeconomic and bank specific determinates of nonperforming loans in Greece’s. Bank of Greece. Working paper No. 118. Doytch, N., & Uctum, M. (2011). Does the worldwide shift of FDI from manufacturing to services accelerate economic growth? A GMM estimation study. Journal of International Money and Finance, 30(3), 410–427. Flamini, V., McDonald, C., & Schumacher, L. (2009). The determinants of commercial bank profitability in Sub Saharan Africa. International Monetary Fund, Working paper, No 9. Goddard, J., Molyneux, P., Wilson, J. O. S., & Liu, H. (2013). Do bank profits converge? European Financial Management, 19(2), 345–365. Iannotta, G., Nocera, G., & Sironi, A. (2007). Ownership structure, risk, and performance in the European banking industry. Journal of Banking and Finance, 31(7), 2127–2149. Jabra, W. B., Mighri, Z., Mansouri, F. (2017). Bank capital, profitability and risk in BRICS banking industry. Global Business and Economics Review, 19(1), 89-119. Jacques, K. T., & Nigro, P. (1997). Risk-Based Capital, Portfolio Risk and Bank Capital: A Simultaneous Equations Approach. Journal of Economics and Business, 49, 533-547. Jafari, M. K. A., & Alchami, M. (2014). Determinants of bank profitability: Evidence from Syria. Journal of Applied Finance & Banking, 4(1), 17-45. Lee, C. C., & Hsieh, M. F. (2013). The impact of bank capital on profitability and risk in Asian Banking. Journal of International Money and Finance, 32, 251–281. Menicucci, E., & Paolucci, G. (2016). The determinants of bank profitability: empirical evidence from European banking sector. Journal of Financial Reporting and Accounting, 14(1), 86-115. Muda, M., Shaharuddin, A., & Embaya, A. (2013). Comparative analysis of profitability determinants of Domestic and Foreign Islamic banks in Malaysia. International Journal of Economics and Financial Issues, 2(2), 559-569. Naceur, S B. & Kandil, M. (2009). The impacts of capital requirements on banks’ cost of intermediation and performance: The case of Egypt. Journal of Economics and Business, 61(1), 70-89. Nguyen, T. H. V., & Le, P. T. D. T. (2016). Effects of Bank Capital on Profitability and Credit Risk: The Case of Vietnam’s Commercial Banks. Journal of Economic Development, 23(4), 117-137. © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

does_bank_capital_affect_profitability_and_risk_in_vietnam.pdf

does_bank_capital_affect_profitability_and_risk_in_vietnam.pdf