Determinants influencing audit delay: The case of Vietnam

This research is conducted to investigate determinants that affect delays in the signing of audit reports

in Vietnam. The audit delay is measured as a function of the number of days that elapse from the

accounting period until the date when the audit report is signed. This study employs a sample of 142

foreign direct investment (FDI) firms in Vietnam in 2019. We use Linear regression analysis,

modelling audit delay as a function of the following explanatory variables: firm size, audit firm type,

sign of income, audit opinion, and leverage. The findings indicate that the firms that report net income,

that have standard audit opinion, and that have bigger size release their audited financial statements

earlier. Variables such as auditor firm and leverage show no significant relationship with audit delay.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Tóm tắt nội dung tài liệu: Determinants influencing audit delay: The case of Vietnam

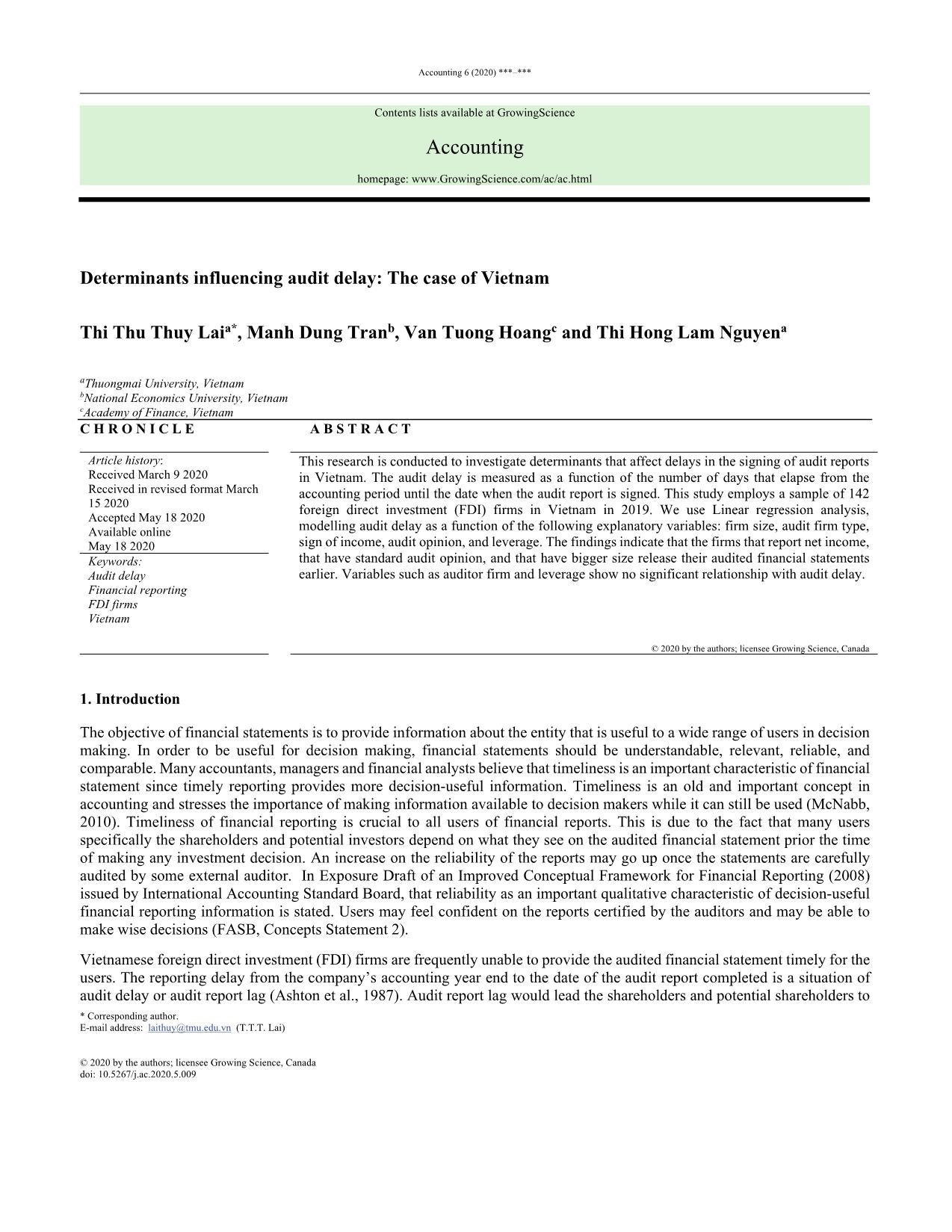

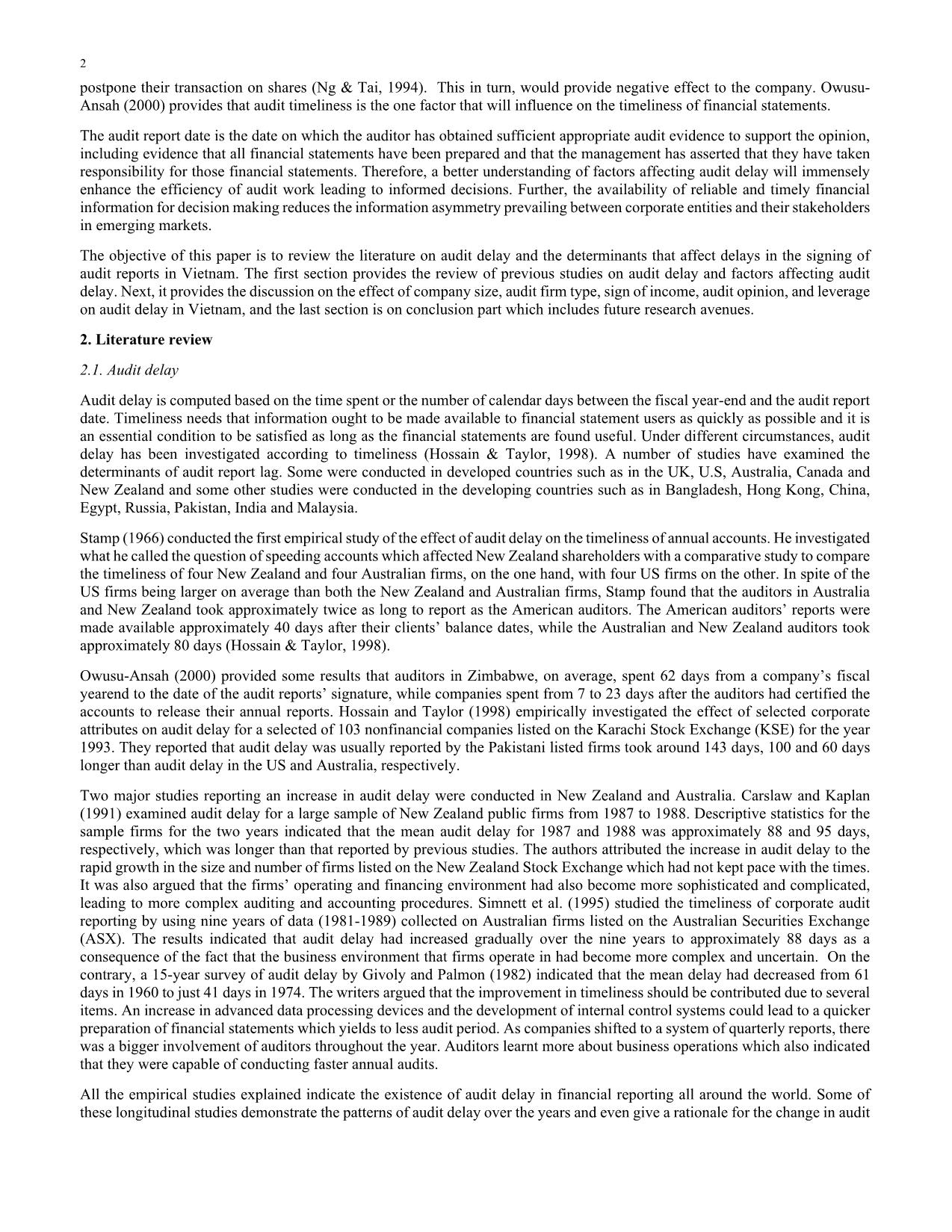

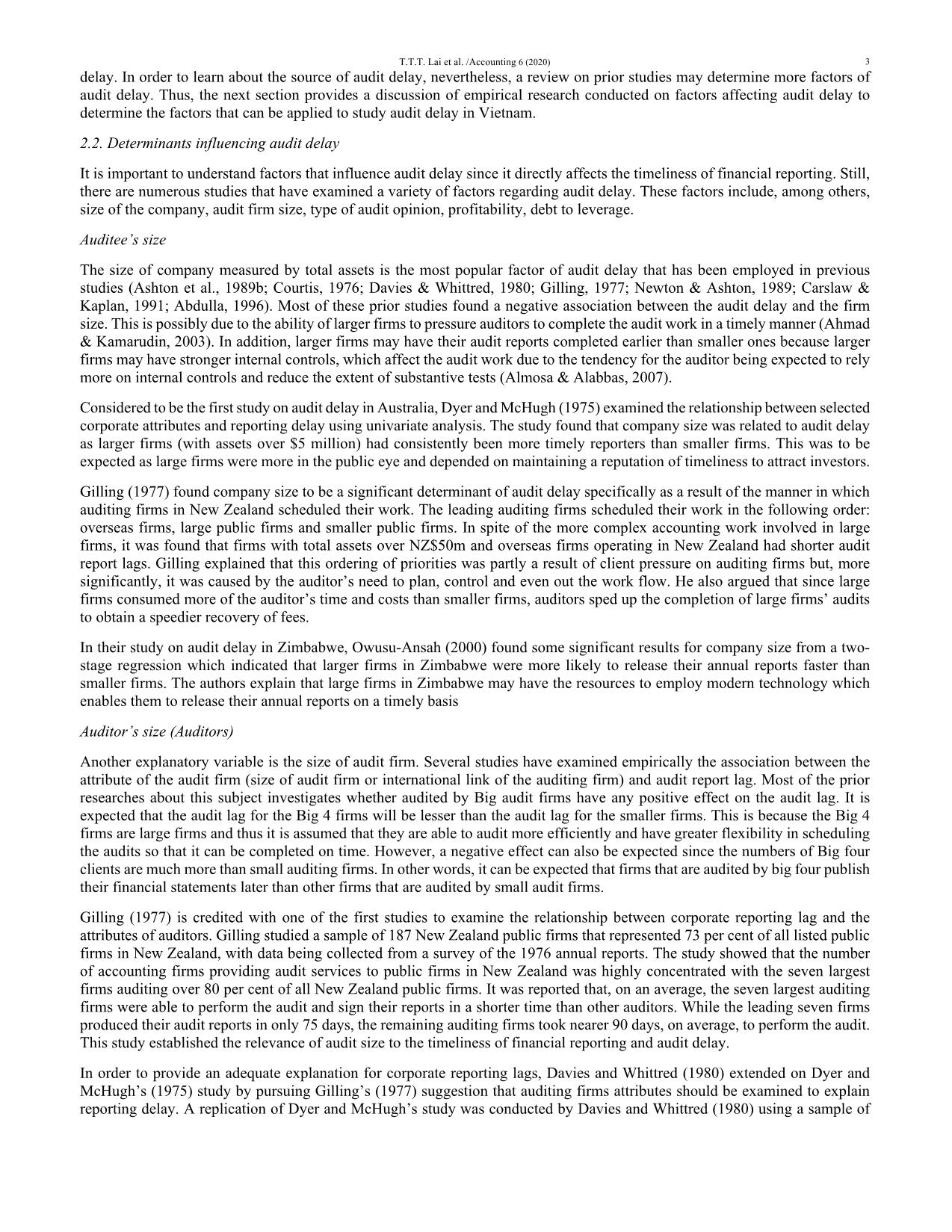

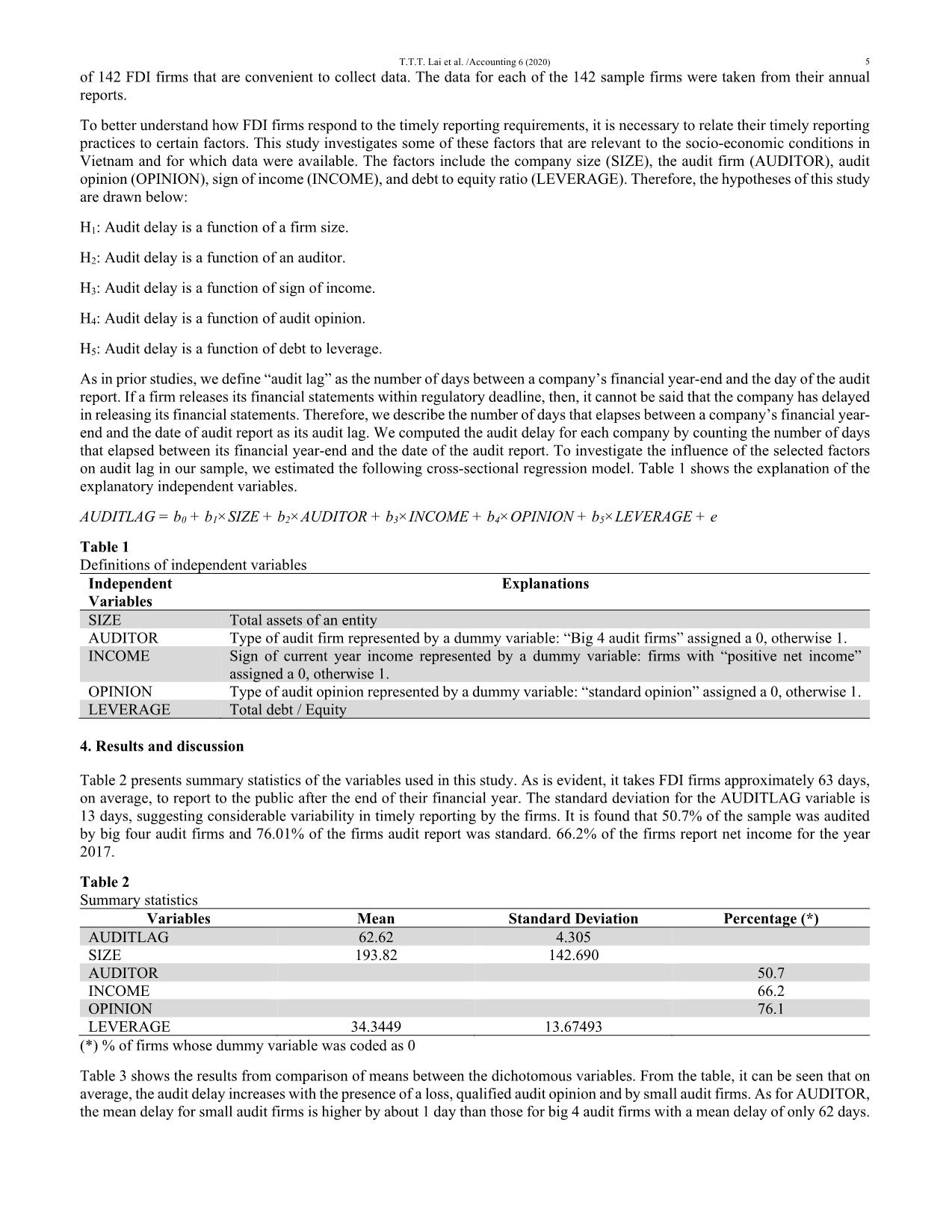

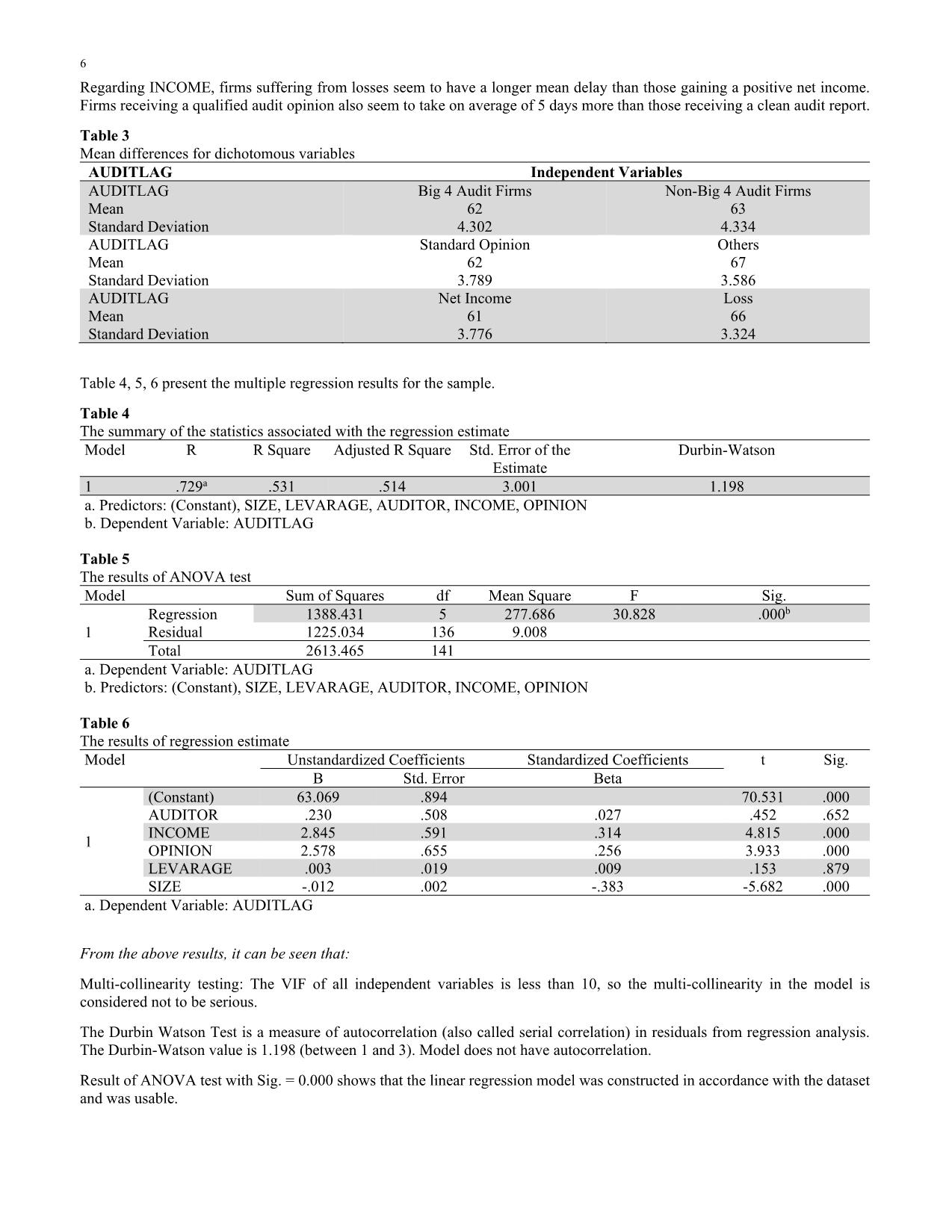

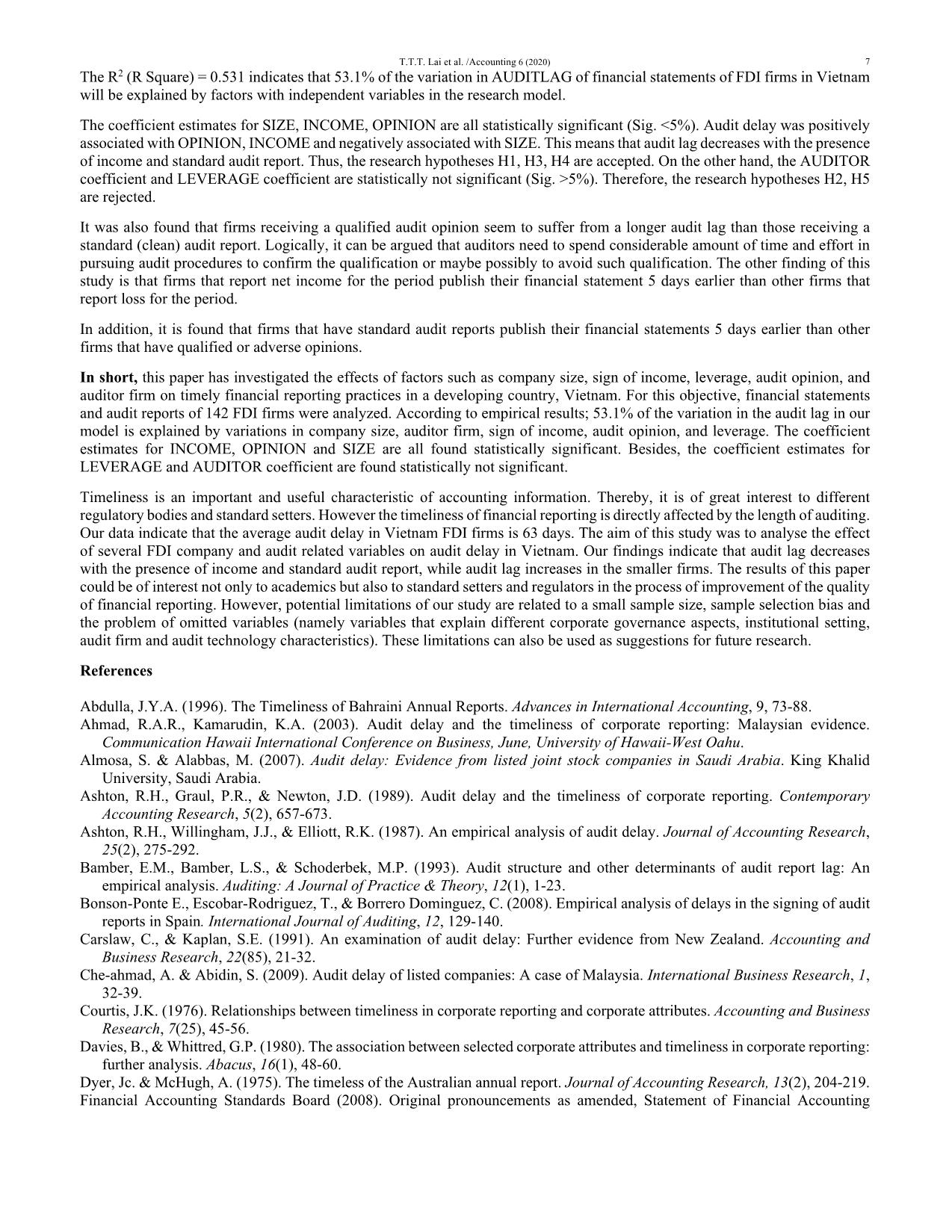

in income before interest and taxes (EBIT). According to Mckinnie (2016), leverage ratio is the company's ability to meet its liability. If the company has a high leverage ratio, the risk of loss will increase. Therefore, to gain confidence in the company's financial statements, the auditor will increase his prudence so that the audit report lag span will be longer. Besides, it has been argued that increasing the amount of debt a firm uses, will put pressure on the firm to provide its creditors with audited financial reports more quickly (Abdulla, 1996). 3. Research methodology The aim of this research is to investigate the effects of firm size, sign of income, leverage, audit opinion, and auditor firm on audit delay for FDI firms in Vietnam. Based on Hair et al. (2006), the sample size is at least 100. We chose our sample consists T.T.T. Lai et al. /Accounting 6 (2020) 5 of 142 FDI firms that are convenient to collect data. The data for each of the 142 sample firms were taken from their annual reports. To better understand how FDI firms respond to the timely reporting requirements, it is necessary to relate their timely reporting practices to certain factors. This study investigates some of these factors that are relevant to the socio-economic conditions in Vietnam and for which data were available. The factors include the company size (SIZE), the audit firm (AUDITOR), audit opinion (OPINION), sign of income (INCOME), and debt to equity ratio (LEVERAGE). Therefore, the hypotheses of this study are drawn below: H1: Audit delay is a function of a firm size. H2: Audit delay is a function of an auditor. H3: Audit delay is a function of sign of income. H4: Audit delay is a function of audit opinion. H5: Audit delay is a function of debt to leverage. As in prior studies, we define “audit lag” as the number of days between a company’s financial year-end and the day of the audit report. If a firm releases its financial statements within regulatory deadline, then, it cannot be said that the company has delayed in releasing its financial statements. Therefore, we describe the number of days that elapses between a company’s financial year- end and the date of audit report as its audit lag. We computed the audit delay for each company by counting the number of days that elapsed between its financial year-end and the date of the audit report. To investigate the influence of the selected factors on audit lag in our sample, we estimated the following cross-sectional regression model. Table 1 shows the explanation of the explanatory independent variables. AUDITLAG = b0 + b1×SIZE + b2×AUDITOR + b3×INCOME + b4×OPINION + b5×LEVERAGE + e Table 1 Definitions of independent variables Independent Variables Explanations SIZE Total assets of an entity AUDITOR Type of audit firm represented by a dummy variable: “Big 4 audit firms” assigned a 0, otherwise 1. INCOME Sign of current year income represented by a dummy variable: firms with “positive net income” assigned a 0, otherwise 1. OPINION Type of audit opinion represented by a dummy variable: “standard opinion” assigned a 0, otherwise 1. LEVERAGE Total debt / Equity 4. Results and discussion Table 2 presents summary statistics of the variables used in this study. As is evident, it takes FDI firms approximately 63 days, on average, to report to the public after the end of their financial year. The standard deviation for the AUDITLAG variable is 13 days, suggesting considerable variability in timely reporting by the firms. It is found that 50.7% of the sample was audited by big four audit firms and 76.01% of the firms audit report was standard. 66.2% of the firms report net income for the year 2017. Table 2 Summary statistics Variables Mean Standard Deviation Percentage (*) AUDITLAG 62.62 4.305 SIZE 193.82 142.690 AUDITOR 50.7 INCOME 66.2 OPINION 76.1 LEVERAGE 34.3449 13.67493 (*) % of firms whose dummy variable was coded as 0 Table 3 shows the results from comparison of means between the dichotomous variables. From the table, it can be seen that on average, the audit delay increases with the presence of a loss, qualified audit opinion and by small audit firms. As for AUDITOR, the mean delay for small audit firms is higher by about 1 day than those for big 4 audit firms with a mean delay of only 62 days. 6 Regarding INCOME, firms suffering from losses seem to have a longer mean delay than those gaining a positive net income. Firms receiving a qualified audit opinion also seem to take on average of 5 days more than those receiving a clean audit report. Table 3 Mean differences for dichotomous variables AUDITLAG Independent Variables AUDITLAG Mean Standard Deviation Big 4 Audit Firms 62 4.302 Non-Big 4 Audit Firms 63 4.334 AUDITLAG Mean Standard Deviation Standard Opinion 62 3.789 Others 67 3.586 AUDITLAG Mean Standard Deviation Net Income 61 3.776 Loss 66 3.324 Table 4, 5, 6 present the multiple regression results for the sample. Table 4 The summary of the statistics associated with the regression estimate Model R R Square Adjusted R Square Std. Error of the Estimate Durbin-Watson 1 .729a .531 .514 3.001 1.198 a. Predictors: (Constant), SIZE, LEVARAGE, AUDITOR, INCOME, OPINION b. Dependent Variable: AUDITLAG Table 5 The results of ANOVA test Model Sum of Squares df Mean Square F Sig. 1 Regression 1388.431 5 277.686 30.828 .000b Residual 1225.034 136 9.008 Total 2613.465 141 a. Dependent Variable: AUDITLAG b. Predictors: (Constant), SIZE, LEVARAGE, AUDITOR, INCOME, OPINION Table 6 The results of regression estimate Model Unstandardized Coefficients Standardized Coefficients t Sig. B Std. Error Beta 1 (Constant) 63.069 .894 70.531 .000 AUDITOR .230 .508 .027 .452 .652 INCOME 2.845 .591 .314 4.815 .000 OPINION 2.578 .655 .256 3.933 .000 LEVARAGE .003 .019 .009 .153 .879 SIZE -.012 .002 -.383 -5.682 .000 a. Dependent Variable: AUDITLAG From the above results, it can be seen that: Multi-collinearity testing: The VIF of all independent variables is less than 10, so the multi-collinearity in the model is considered not to be serious. The Durbin Watson Test is a measure of autocorrelation (also called serial correlation) in residuals from regression analysis. The Durbin-Watson value is 1.198 (between 1 and 3). Model does not have autocorrelation. Result of ANOVA test with Sig. = 0.000 shows that the linear regression model was constructed in accordance with the dataset and was usable. T.T.T. Lai et al. /Accounting 6 (2020) 7 The R2 (R Square) = 0.531 indicates that 53.1% of the variation in AUDITLAG of financial statements of FDI firms in Vietnam will be explained by factors with independent variables in the research model. The coefficient estimates for SIZE, INCOME, OPINION are all statistically significant (Sig. <5%). Audit delay was positively associated with OPINION, INCOME and negatively associated with SIZE. This means that audit lag decreases with the presence of income and standard audit report. Thus, the research hypotheses H1, H3, H4 are accepted. On the other hand, the AUDITOR coefficient and LEVERAGE coefficient are statistically not significant (Sig. >5%). Therefore, the research hypotheses H2, H5 are rejected. It was also found that firms receiving a qualified audit opinion seem to suffer from a longer audit lag than those receiving a standard (clean) audit report. Logically, it can be argued that auditors need to spend considerable amount of time and effort in pursuing audit procedures to confirm the qualification or maybe possibly to avoid such qualification. The other finding of this study is that firms that report net income for the period publish their financial statement 5 days earlier than other firms that report loss for the period. In addition, it is found that firms that have standard audit reports publish their financial statements 5 days earlier than other firms that have qualified or adverse opinions. In short, this paper has investigated the effects of factors such as company size, sign of income, leverage, audit opinion, and auditor firm on timely financial reporting practices in a developing country, Vietnam. For this objective, financial statements and audit reports of 142 FDI firms were analyzed. According to empirical results; 53.1% of the variation in the audit lag in our model is explained by variations in company size, auditor firm, sign of income, audit opinion, and leverage. The coefficient estimates for INCOME, OPINION and SIZE are all found statistically significant. Besides, the coefficient estimates for LEVERAGE and AUDITOR coefficient are found statistically not significant. Timeliness is an important and useful characteristic of accounting information. Thereby, it is of great interest to different regulatory bodies and standard setters. However the timeliness of financial reporting is directly affected by the length of auditing. Our data indicate that the average audit delay in Vietnam FDI firms is 63 days. The aim of this study was to analyse the effect of several FDI company and audit related variables on audit delay in Vietnam. Our findings indicate that audit lag decreases with the presence of income and standard audit report, while audit lag increases in the smaller firms. The results of this paper could be of interest not only to academics but also to standard setters and regulators in the process of improvement of the quality of financial reporting. However, potential limitations of our study are related to a small sample size, sample selection bias and the problem of omitted variables (namely variables that explain different corporate governance aspects, institutional setting, audit firm and audit technology characteristics). These limitations can also be used as suggestions for future research. References Abdulla, J.Y.A. (1996). The Timeliness of Bahraini Annual Reports. Advances in International Accounting, 9, 73-88. Ahmad, R.A.R., Kamarudin, K.A. (2003). Audit delay and the timeliness of corporate reporting: Malaysian evidence. Communication Hawaii International Conference on Business, June, University of Hawaii-West Oahu. Almosa, S. & Alabbas, M. (2007). Audit delay: Evidence from listed joint stock companies in Saudi Arabia. King Khalid University, Saudi Arabia. Ashton, R.H., Graul, P.R., & Newton, J.D. (1989). Audit delay and the timeliness of corporate reporting. Contemporary Accounting Research, 5(2), 657-673. Ashton, R.H., Willingham, J.J., & Elliott, R.K. (1987). An empirical analysis of audit delay. Journal of Accounting Research, 25(2), 275-292. Bamber, E.M., Bamber, L.S., & Schoderbek, M.P. (1993). Audit structure and other determinants of audit report lag: An empirical analysis. Auditing: A Journal of Practice & Theory, 12(1), 1-23. Bonson-Ponte E., Escobar-Rodriguez, T., & Borrero Dominguez, C. (2008). Empirical analysis of delays in the signing of audit reports in Spain. International Journal of Auditing, 12, 129-140. Carslaw, C., & Kaplan, S.E. (1991). An examination of audit delay: Further evidence from New Zealand. Accounting and Business Research, 22(85), 21-32. Che-ahmad, A. & Abidin, S. (2009). Audit delay of listed companies: A case of Malaysia. International Business Research, 1, 32-39. Courtis, J.K. (1976). Relationships between timeliness in corporate reporting and corporate attributes. Accounting and Business Research, 7(25), 45-56. Davies, B., & Whittred, G.P. (1980). The association between selected corporate attributes and timeliness in corporate reporting: further analysis. Abacus, 16(1), 48-60. Dyer, Jc. & McHugh, A. (1975). The timeless of the Australian annual report. Journal of Accounting Research, 13(2), 204-219. Financial Accounting Standards Board (2008). Original pronouncements as amended, Statement of Financial Accounting 8 Concepts No. 2 Qualitative Characteristics of Accounting Information. Gilling, D.M. (1977). Timeliness in corporate reporting: Some further comment. Accounting and Business Research, 8, 35-50. Givoly, D., & Palmon, D. (1982). Timeliness of annual earnings announcements: Some empirical evidence. Accounting Review, 57(3), 486-508. Hair, J.F., Black, W.C., Babin, B.J., & Anderson, R.E. (2006). Multivariate Data Analysis. New Jersey: Pearson International Edition. Hossain, M. & Taylor, P. (1998). An examination of audit delay: Evidence from Pakistan. Working Paper, University of Manchester. IASB (2008). Exposure Draft of An Improved Conceptual Framework for Financial Reporting: Chapter 1: The Objectives of Financial Reporting, Chapter 2: Qualitative Characteristics and Constraints of Decision-useful Financial Reporting Information. Leventis, S., Weetman, P. & Caramanis, C. (2005). Determinants of audit report lag: Some evidence from the Athens Stock Exchange. International Journal of Auditing, 9, 45-58. Mckinnie, M. (2016). Cloud computing: TOE adoption factors by service model in manufacturing. Dissertation, Georgia State Unversity, USA. McNabb, D.E. (2010). Research Methods for Political Science: Quantitative and Qualitative Approaches, ME Sharpe Inc. Modugu, P.K, Eragbhe, E & Ikhatua, O.J. (2012). Determinants of audit delay in Nigerian companies: Empirical evidence. Research Journal of Finance and Accounting, 3(6), 46-54. Ng, P. P., & Tai, B. Y. (1994). An empirical examination of the determinants of audit delay in Hong Kong. The British Accounting Review, 26(1), 43-59. Newton, J. D., & Ashton, R. H. (1989). The association between audit technology and audit delay. Auditing-a Journal of Practice & Theory, 8, 22-37. Owusu-Ansah, S. (2000). Timeliness of corporate financial reporting in emerging capital markets: empirical evidence from the Zimbabwe Stock Exchange. Accounting & Business Research, 30, 241-254. Owusu-Ansah, S. and Leventis, S. (2006). Timeliness of Corporate Annual Financial Reporting in Greece: A Research Note. European Accounting Review, 15(2), 273-287. Simnett, R., Aitken, M, Choo, F. & Firth, M. (1995). The determinants of audit delay. Advances in Accounting, 13, 1-20. Soltani, B. (2002). Timeliness of corporate and audit reports: Some empirical evidence in the French context. The International Journal of Accounting, 37, 215-246. Stamp, E. (1982). First steps towards a British conceptual framework. Accountancy, March, 123-130. Whittred, G.P. (1980). The timeliness of the Australian Annual Report: 1972-1977. Journal of Accounting Research, 18, 623- 628. © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

determinants_influencing_audit_delay_the_case_of_vietnam.pdf

determinants_influencing_audit_delay_the_case_of_vietnam.pdf