Using net present value method in economic efficiency analysis for forest plantation: Problems and solutions

This paper discussed limitations in perception and application of Net Present Value (NPV) method in economic and financial analysis for forest plantation. Starting point of the discussion is a common fact in forest plantation that, while financial efficiency assessments based on NPV criterion of the forest plantation projects are satisfactory, most of the forestry state owned enterprises and other forestry units are facing huge financial difficulties. The author pointed out that, the reasons for that contradiction are significant errors in NPV method’s application. They are: Ad hoc selection of forest planting rotations; ignorance of risk premium; irrelevant treatment of inflation; and overuse of NPV per hectare. Consequently, NPV method has been failed to give a correct criterion for economic and financial assessment in forest plantation. Since the errors are right placed in teaching materials and legal documents, negative impacts caused by misusing of the method are long lasted and exaggerated. Based on the problems analysis, the author proposed the solutions for each issue: simultaneously solving problems of planted forest rotation period and NPV identification; including of risk premium in discount rate; consistently handling of inflation factor and price’s type in NPV calculation; and using of an appropriate set of criteria in economic and financial assessment. In the author point of view, the proposed solutions are rather simple and ready to use, the most concern is laid in a full awareness towards the existence of the problems and an immediate responses by people engaged in related academic and practical fields

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Tóm tắt nội dung tài liệu: Using net present value method in economic efficiency analysis for forest plantation: Problems and solutions

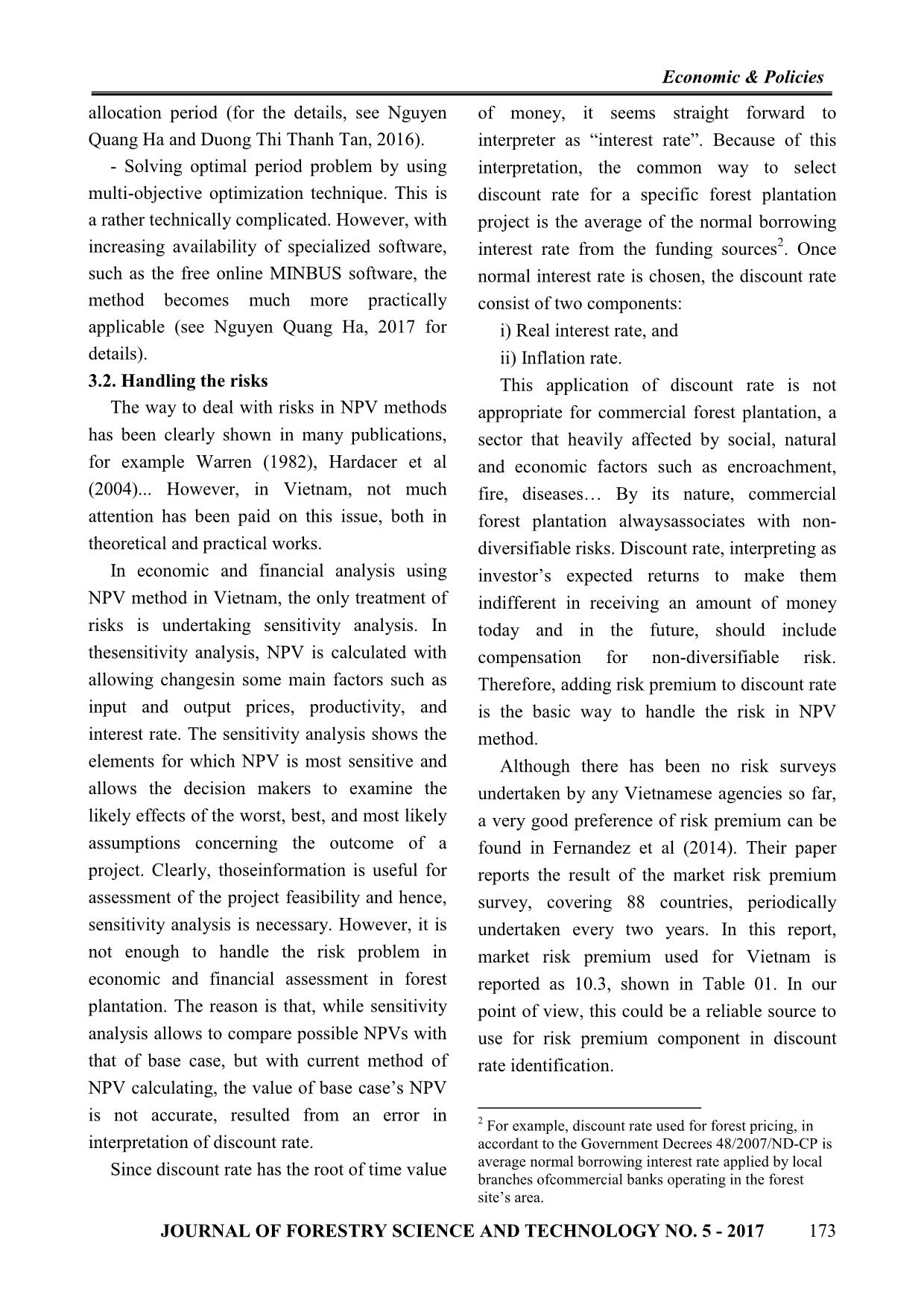

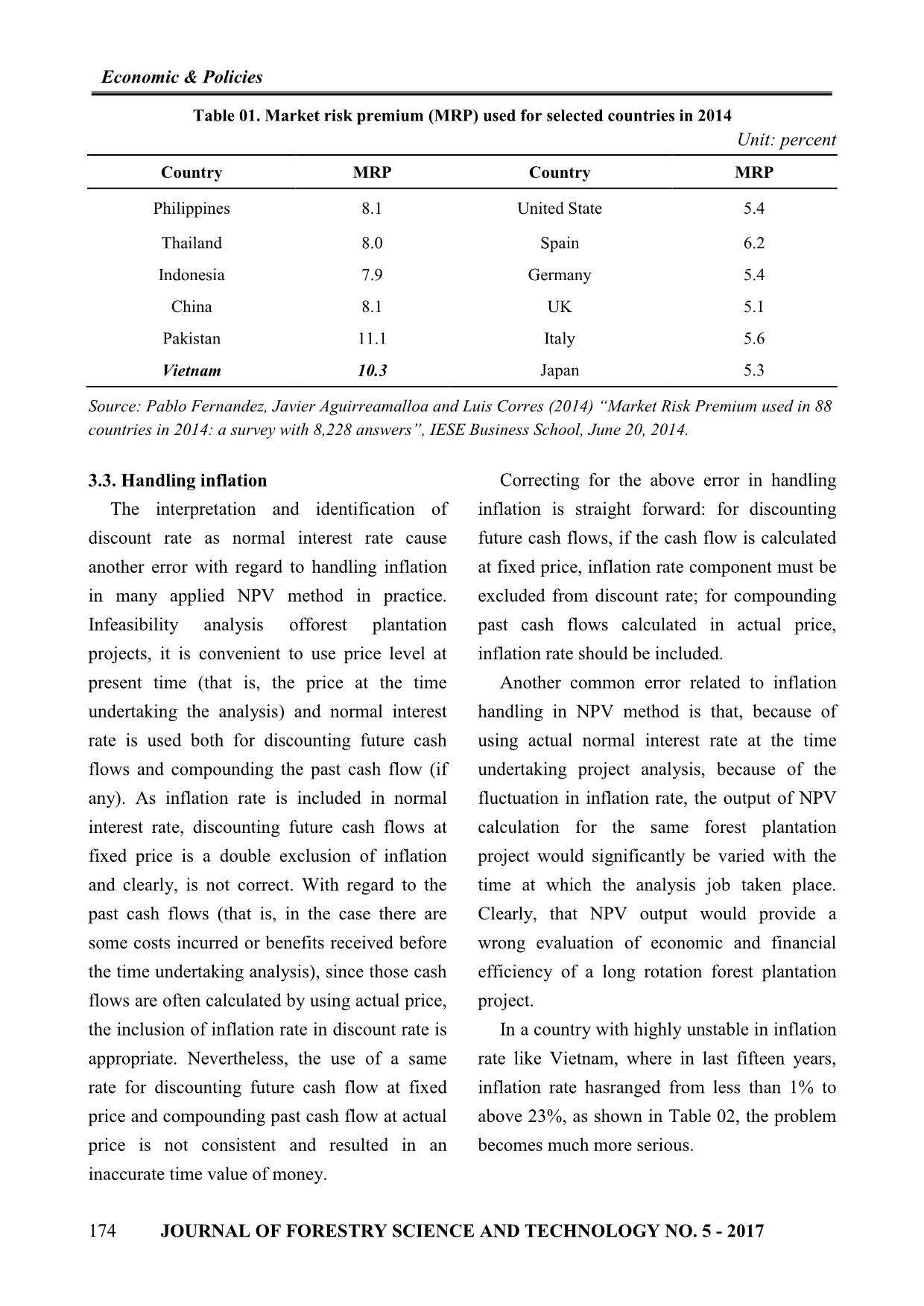

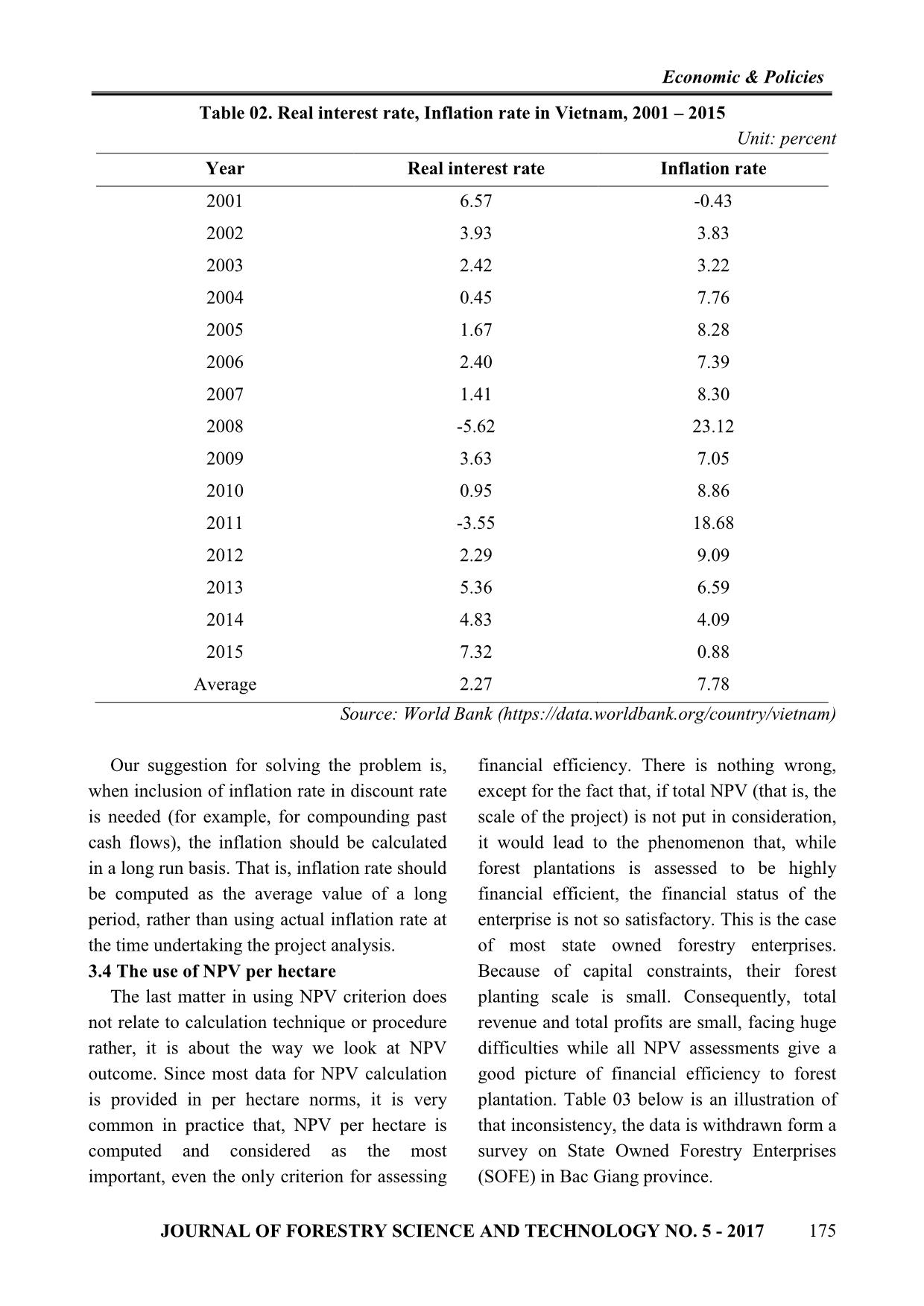

much more practically consist of two components: applicable (see Nguyen Quang Ha, 2017 for i) Real interest rate, and details). ii) Inflation rate. 3.2. Handling the risks This application of discount rate is not The way to deal with risks in NPV methods appropriate for commercial forest plantation, a has been clearly shown in many publications, sector that heavily affected by social, natural for example Warren (1982), Hardacer et al and economic factors such as encroachment, (2004)... However, in Vietnam, not much fire, diseases By its nature, commercial attention has been paid on this issue, both in forest plantation alwaysassociates with non- theoretical and practical works. diversifiable risks. Discount rate, interpreting as In economic and financial analysis using investor’s expected returns to make them NPV method in Vietnam, the only treatment of indifferent in receiving an amount of money risks is undertaking sensitivity analysis. In today and in the future, should include thesensitivity analysis, NPV is calculated with compensation for non-diversifiable risk. allowing changesin some main factors such as Therefore, adding risk premium to discount rate input and output prices, productivity, and is the basic way to handle the risk in NPV interest rate. The sensitivity analysis shows the method. elements for which NPV is most sensitive and Although there has been no risk surveys allows the decision makers to examine the undertaken by any Vietnamese agencies so far, likely effects of the worst, best, and most likely a very good preference of risk premium can be assumptions concerning the outcome of a found in Fernandez et al (2014). Their paper project. Clearly, thoseinformation is useful for reports the result of the market risk premium assessment of the project feasibility and hence, survey, covering 88 countries, periodically sensitivity analysis is necessary. However, it is undertaken every two years. In this report, not enough to handle the risk problem in market risk premium used for Vietnam is economic and financial assessment in forest reported as 10.3, shown in Table 01. In our plantation. The reason is that, while sensitivity point of view, this could be a reliable source to analysis allows to compare possible NPVs with use for risk premium component in discount that of base case, but with current method of rate identification. NPV calculating, the value of base case’s NPV is not accurate, resulted from an error in 2 For example, discount rate used for forest pricing, in interpretation of discount rate. accordant to the Government Decrees 48/2007/ND-CP is Since discount rate has the root of time value average normal borrowing interest rate applied by local branches ofcommercial banks operating in the forest site’s area. JOURNAL OF FORESTRY SCIENCE AND TECHNOLOGY NO. 5 - 2017 173 Economic & Policies Table 01. Market risk premium (MRP) used for selected countries in 2014 Unit: percent Country MRP Country MRP Philippines 8.1 United State 5.4 Thailand 8.0 Spain 6.2 Indonesia 7.9 Germany 5.4 China 8.1 UK 5.1 Pakistan 11.1 Italy 5.6 Vietnam 10.3 Japan 5.3 Source: Pablo Fernandez, Javier Aguirreamalloa and Luis Corres (2014) “Market Risk Premium used in 88 countries in 2014: a survey with 8,228 answers”, IESE Business School, June 20, 2014. 3.3. Handling inflation Correcting for the above error in handling The interpretation and identification of inflation is straight forward: for discounting discount rate as normal interest rate cause future cash flows, if the cash flow is calculated another error with regard to handling inflation at fixed price, inflation rate component must be in many applied NPV method in practice. excluded from discount rate; for compounding Infeasibility analysis offorest plantation past cash flows calculated in actual price, projects, it is convenient to use price level at inflation rate should be included. present time (that is, the price at the time Another common error related to inflation undertaking the analysis) and normal interest handling in NPV method is that, because of rate is used both for discounting future cash using actual normal interest rate at the time flows and compounding the past cash flow (if undertaking project analysis, because of the any). As inflation rate is included in normal fluctuation in inflation rate, the output of NPV interest rate, discounting future cash flows at calculation for the same forest plantation fixed price is a double exclusion of inflation project would significantly be varied with the and clearly, is not correct. With regard to the time at which the analysis job taken place. past cash flows (that is, in the case there are Clearly, that NPV output would provide a some costs incurred or benefits received before wrong evaluation of economic and financial the time undertaking analysis), since those cash efficiency of a long rotation forest plantation flows are often calculated by using actual price, project. the inclusion of inflation rate in discount rate is In a country with highly unstable in inflation appropriate. Nevertheless, the use of a same rate like Vietnam, where in last fifteen years, rate for discounting future cash flow at fixed inflation rate hasranged from less than 1% to price and compounding past cash flow at actual above 23%, as shown in Table 02, the problem price is not consistent and resulted in an becomes much more serious. inaccurate time value of money. 174 JOURNAL OF FORESTRY SCIENCE AND TECHNOLOGY NO. 5 - 2017 Economic & Policies Table 02. Real interest rate, Inflation rate in Vietnam, 2001 – 2015 Unit: percent Year Real interest rate Inflation rate 2001 6.57 -0.43 2002 3.93 3.83 2003 2.42 3.22 2004 0.45 7.76 2005 1.67 8.28 2006 2.40 7.39 2007 1.41 8.30 2008 -5.62 23.12 2009 3.63 7.05 2010 0.95 8.86 2011 -3.55 18.68 2012 2.29 9.09 2013 5.36 6.59 2014 4.83 4.09 2015 7.32 0.88 Average 2.27 7.78 Source: World Bank (https://data.worldbank.org/country/vietnam) Our suggestion for solving the problem is, financial efficiency. There is nothing wrong, when inclusion of inflation rate in discount rate except for the fact that, if total NPV (that is, the is needed (for example, for compounding past scale of the project) is not put in consideration, cash flows), the inflation should be calculated it would lead to the phenomenon that, while in a long run basis. That is, inflation rate should forest plantations is assessed to be highly be computed as the average value of a long financial efficient, the financial status of the period, rather than using actual inflation rate at enterprise is not so satisfactory. This is the case the time undertaking the project analysis. of most state owned forestry enterprises. 3.4 The use of NPV per hectare Because of capital constraints, their forest The last matter in using NPV criterion does planting scale is small. Consequently, total not relate to calculation technique or procedure revenue and total profits are small, facing huge rather, it is about the way we look at NPV difficulties while all NPV assessments give a outcome. Since most data for NPV calculation good picture of financial efficiency to forest is provided in per hectare norms, it is very plantation. Table 03 below is an illustration of common in practice that, NPV per hectare is that inconsistency, the data is withdrawn form a computed and considered as the most survey on State Owned Forestry Enterprises important, even the only criterion for assessing (SOFE) in Bac Giang province. JOURNAL OF FORESTRY SCIENCE AND TECHNOLOGY NO. 5 - 2017 175 Economic & Policies Table 03. Performance of four SOFEs in Bac Giang provice, the year 2015 Unit: thousand VND No Items Luc Nam Luc Ngan Yen The Mai Son Avarage 1 Total revenue 3,546.76 8,266.06 14,792.30 2,487.41 7,273.13 2 Revenue from forest plantation 2,982.46 8,138.24 14,578.93 2,044.75 6,936.10 3 Total costs 3,380.62 7,496.60 14,410.34 2,427.43 6,928.75 4 Before tax profits 166.14 769.46 381.96 59.98 344.39 5 After tax profits 157.33 662.91 313.81 47.29 295.34 6 Total Assets (capital) 27,156.10 10,763.27 10,433.69 11,347.17 14,925.06 Of which: Ower’s assets (Equity) 3,275.54 6,906.21 2,368.57 1,901.97 3,613.07 7 Planted Forest area 2,610.33 2,949.20 1,997.27 809.40 2,091.55 8 Profits/Revenue percentage (%) 4.44 8.02 2.12 1.90 4.06 9 Return on Asset –ROA (%) 0.58 6.16 3.01 0.42 1.98 10 Return on Equity – ROE (%) 4.80 9.60 13.25 2.49 8.17 11 Revenue per hectare 1.14 2.76 7.30 2.53 3.32 12 NPV per hectare (at r = 11%) 2,138.00 17,450.00 14,365.00 n/a 11,317.67 Source: Pham Thanh Le et al (2016) It is clear from Table 03 that, while NPV per should be put on total project NPV, rather than hectare is positive and relatively big magnitude, only NPV per hectare. Also, for the case of indicating a good financially feasibility of production unit like enterprises, for which forest plantation, all other criteria show a very commercial forest plantation is the main weak financial status of the enterprises. sources of annual income, the annual revenue Apart from small scale, the conflict pictures and profits is equally important, not only of financial efficiency in forestry state owned discounted value of a specific project, in enterprises measured by NPV per hectare and financial feasibility analysis. total annual profits are caused also by another IV. CONCLUSION factor: not all management costs are fully NPV can be considered as of the most accounted in NPV calculation sheet, whereas popular criterion used in economic and those costs are of significant amount. financial analysis for forest plantation. Management costs in enterprises are relatively However, its terminology and methodology has big, because of large and complex forest been misinterpreted both in academic and planting sites and complexities in production practical context. Adhoc selection of forest organization. planting rotations, ignorance of risk premium, The recommended solution with regard to irrelevant treatment of inflation, and overuse of this problem is that, a better data should be NPV per hectare are found to be not trivial. In collected for NPV calculation, in particular, our point of view, with those problems in its indirect costs need to be fully projected. In application, the method have been failed to financial feasibility analysis, more attention provide sound norms for decision making. The 176 JOURNAL OF FORESTRY SCIENCE AND TECHNOLOGY NO. 5 - 2017 Economic & Policies negative impacts of misusing the method is https://data.worldbank.org/country/vietnam long lasted and exaggerated as the errors are in 5. Lofgren, K.G (1983), The Fraustmann – Ohlin theorem: a history note, History of Political Economy 15 place in teaching materials and legal (2) pp 261-264 documents. Correction for those errors, 6. NASC – National Assembly Standing Committee therefore, is really needed. Our solutions for (2015). “Monitoring report on implementation of land each problem are not complicated, and ready to use policies in state owned agriculture and forestry use. We strongly recommend a full awareness enterprises in the 2004-2014 period”. Report 958/BC- UBTVQH13 dated 16/10/2015. towards the existence of the problems and an 7. Nguyen Quang Ha (2017) “Applying Multi- immediate correction. objective optimization problem in identification of forest REFERENCES optimal rotation period”. Vietnam Journal of Agriculture 1. Fernandez,P.et al. (2014). Market Risk Premium and Rural Development, No 315-2017, pp104-112 used in 88 countries in 2014: a survey with 8,228 answer. 8. Nguyen Quang Ha and Duong Thi Thanh Tan Working Paper, IESE Business School, University of (2016). “Identification of the forest optimal rotation Nevarra, Spain. period”. Journal ofEconomic Studies, Vietnam Academy 2. Government of Vietnam (2007). “Decree on the of Social Science, No 7, pp 41-47. principles and methods for forest pricing”. Decree 9. Pham Thanh Le (2016). “Research on the 48/2007-NĐ-CP dated 28/3/2007. performance of State Owned Forest Enterprises in Bac 3. Hardacer,J.B.et al (2004). Coping with Risk in Giang Province”. Final Report, Bac Giang Agriculture Agriculture. CABI Publishing, pp 234-244. and Forestry University. 4. Hoang Lien Son (2016). “Research on the 10. Warren, M.F. (1982). Financial Management for integration models based value chain in planted forest Farmers, the basic Techniques of “Money Farming”. products”. Final Report, Vietnamese Academy of Forest Third Edition, Stanly Thorns. Science. SỬ DỤNG NPV TRONG ĐÁNH GIÁ HIỆU QUẢ KINH TẾ TRỒNG RỪNG: MỘT SỐ BẤT CẬP VÀ HƯỚNG GIẢI QUYẾT Nguyễn Quang Hà Trường Đại học Nông Lâm Bắc Giang TÓM TẮT Bài viết này thảo luận những hạn chế trong nhận thức và ứng dụng phương pháp NPV trong phân tích hiệu quả kinh tế trồng rừng. Xuất phát điểm của bài thảo luận là một thực tế khá phổ biến: trong khi các kết quả đánh giá hiệu quả tài chính dựa trên tiêu chí NPV của các dự án trông rừng rất khả quan, thì hầu hết các doanh nghiệp lâm nghiệp nhà nước và các đơn vị trồng rừng khác lại đang lâm vào tình cảnh tài chính hết sức khó khăn. Tác giả bài báo chỉ ra rằng, lý do của mâu thuẫn đó là các sai sót đáng kể trong ứng dụng phương pháp NPV. Các sai sót đó là: lựa chọn chu kỳ trồng rừng thiếu căn cứ, bỏ qua yếu tố rủi ro, xử lý không hợp lý yếu tố lạm phát, và sử dụng quá mức chỉ tiêu NPV trên một hecta. Do những sai sót đó, phương pháp NPV đã không đưa ra được một tiêu chí đúng cho đánh giá hiệu quả kinh tế và hiệu quả tài chính của trồng rừng. Do các sai sót đó nằm ngay trong các tài liệu giảng dạy và các văn bàn pháp quy, nên các hệ lụy của việc dùng sai phương pháp là lâu dài và ngày càng nghiêm trọng. Dựa vào kết quả phân tích, tác giả đề xuất các giải pháp cho từng vấn đề: phương pháp xác định chu kỳ trồng rừng và xác định NPV một cách đồng thời, đưa phần bù đắp rủi ro vào tỷ lệ chiết khấu, xử lý thống nhất yếu tố lạm phát và loại giá cả sử dụng trong tính toán NPV, và sử dụng tổng hợp các tiêu chí trong đánh giá hiệu quả kinh tế và hiệu quả tài chính. Theo tác giả bài báo, các giải pháp đề xuất là khá đơn giản, có thể sử dụng được ngay, nên vấn đề đáng quan tâm là ở nhận thức về sự tồn tại của các vấn đề và các phản ứng khẩn trương của những người làm việc trong các lĩnh vực liên quan, cả về học thuật và thực tiễn. Từ khóa: Giá trị hiện tại ròng, hiệu quả kinh tế, trồng rừng, tỷ lệ chiết khấu. Received : 06/9/2017 Revised : 02/10/2017 Accepted : 13/10/2017 JOURNAL OF FORESTRY SCIENCE AND TECHNOLOGY NO. 5 - 2017 177

File đính kèm:

using_net_present_value_method_in_economic_efficiency_analys.pdf

using_net_present_value_method_in_economic_efficiency_analys.pdf