The relationship between level of environmental financial accounting practices and financial performance in Vietnam

This research is conducted for assessing the relationship between the level of environmental financial

accounting practices (EFAP) and financial performance (FP) of listed firms. Data were collected from

listed firms on Vietnam Stock Exchange for the period from 2013 to 2017, including the firms

disclosed and not disclose EFAP. Ordinary least square (OLS), fixed effect model (FEM), and random

effect model were employed for processing the data. The results reveal that there is a close relationship

between the EFAP and financial performance. In addition, there is a difference in financial

performance between the group of firms disclosed and not disclosed EFAP. Based on the findings,

some recommendations are given for motivating EFAP in the listed firms for improving financial

performance.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tóm tắt nội dung tài liệu: The relationship between level of environmental financial accounting practices and financial performance in Vietnam

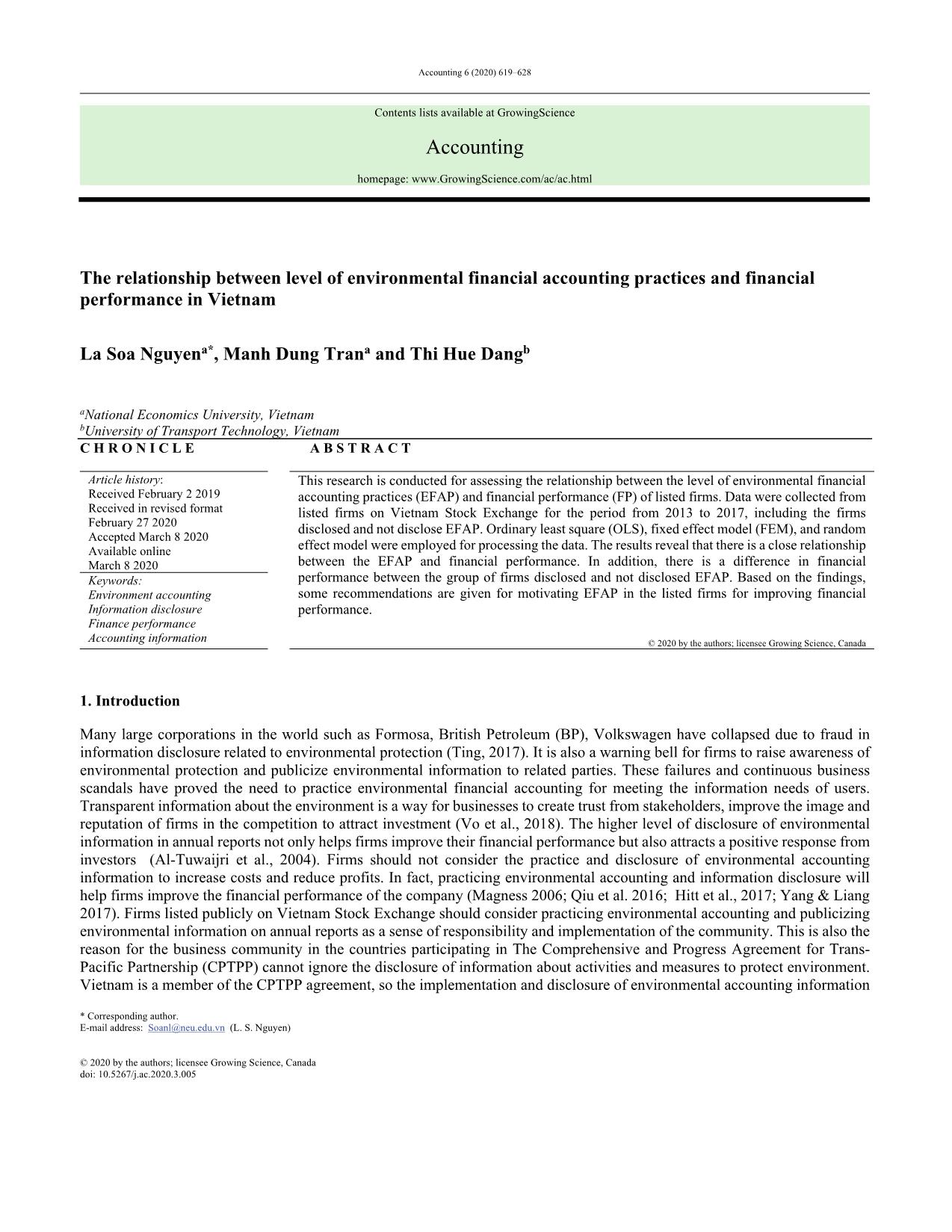

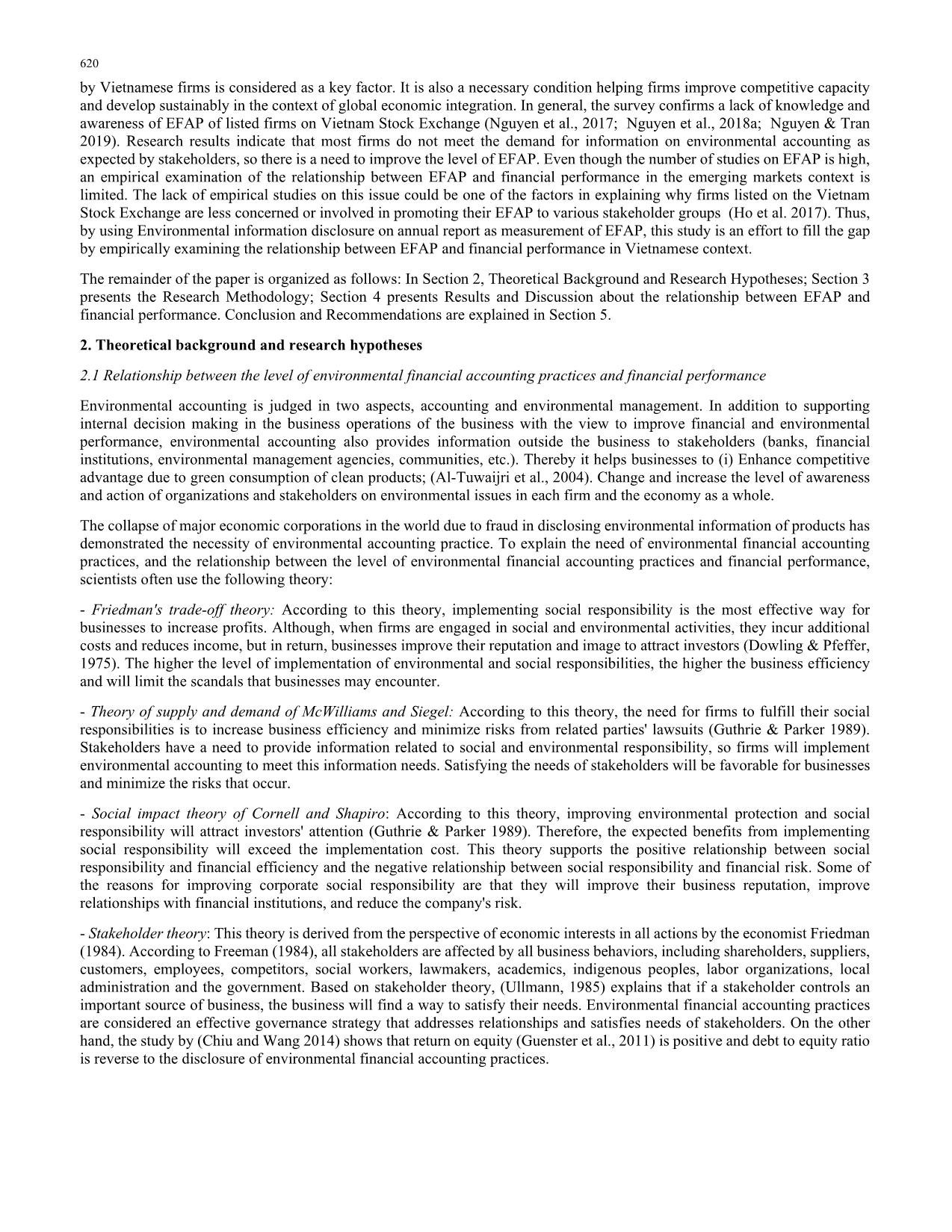

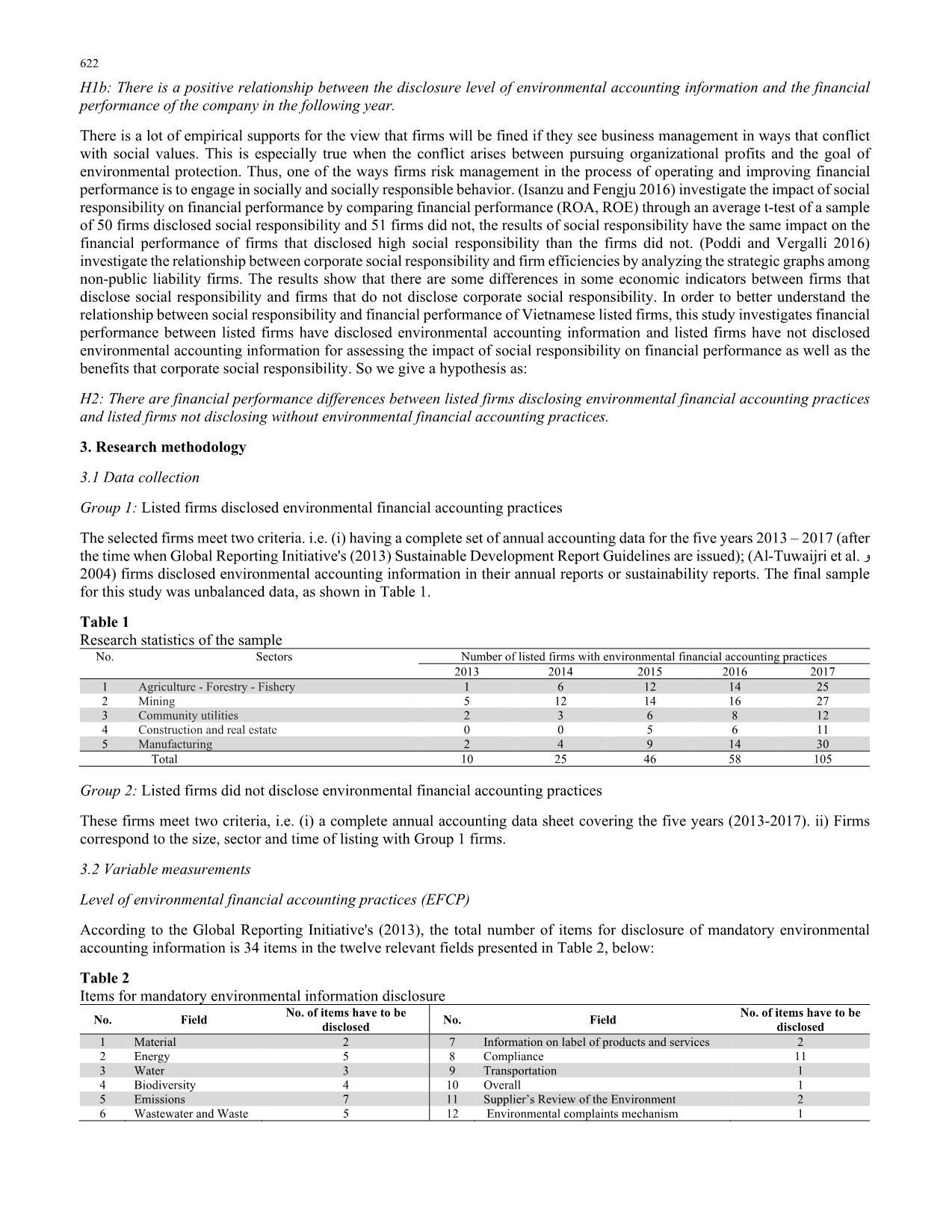

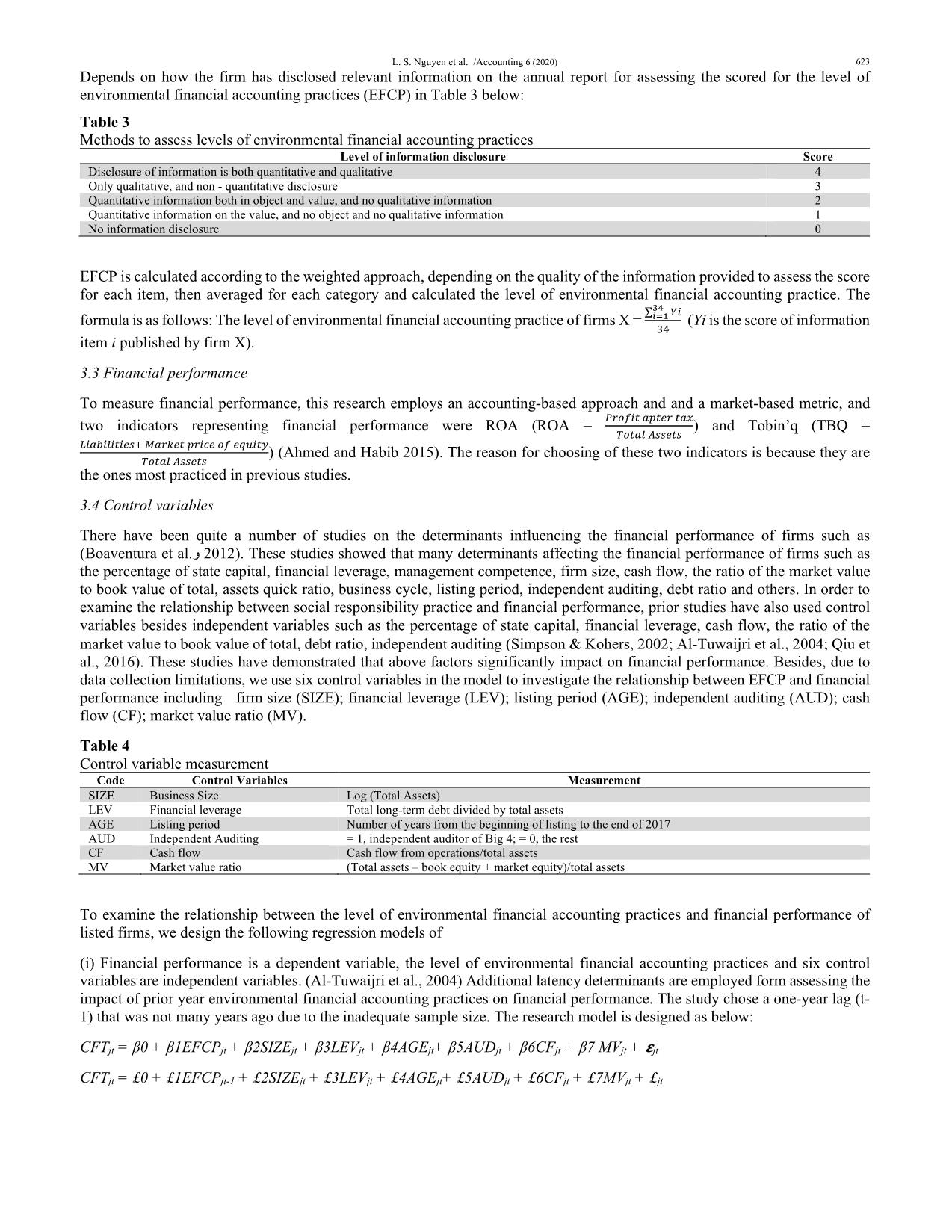

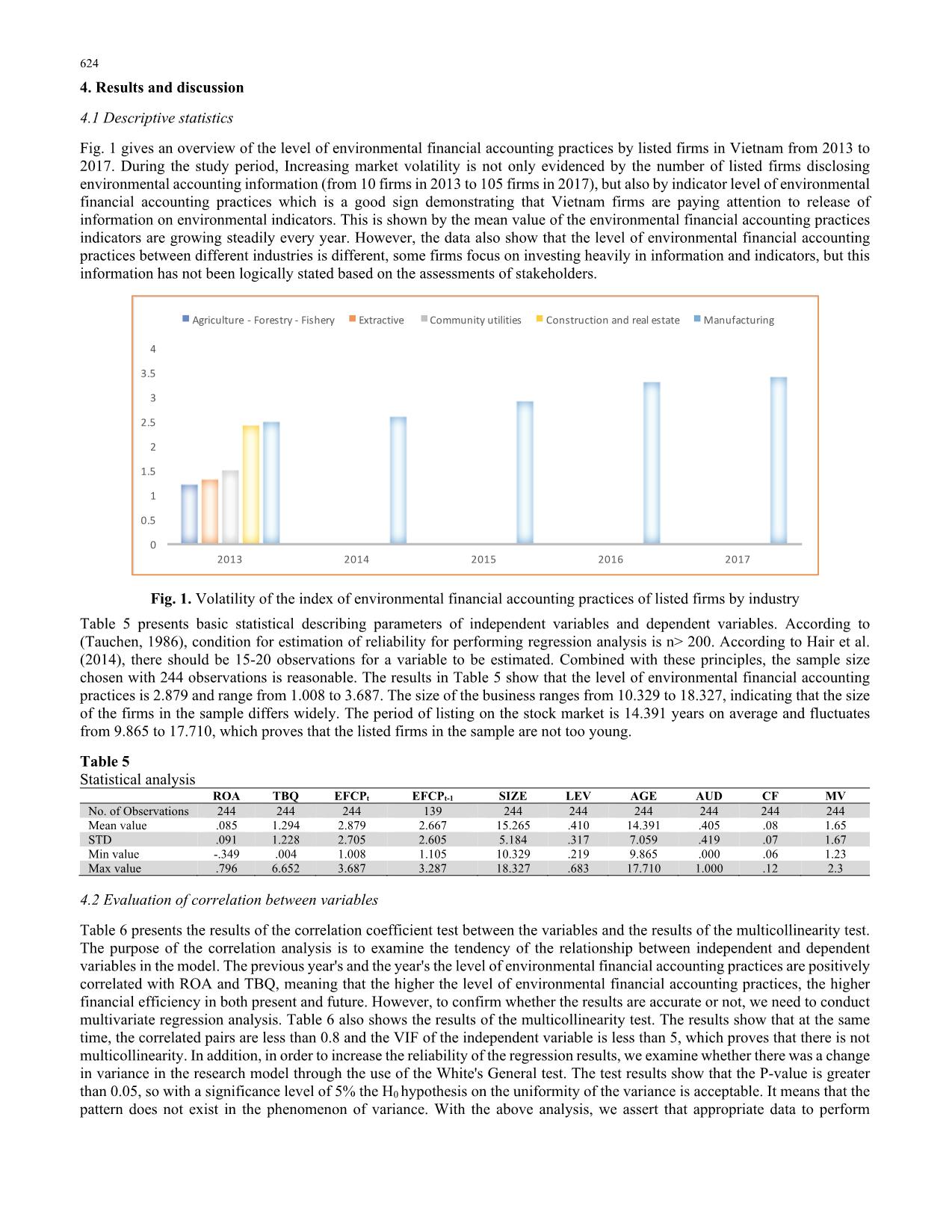

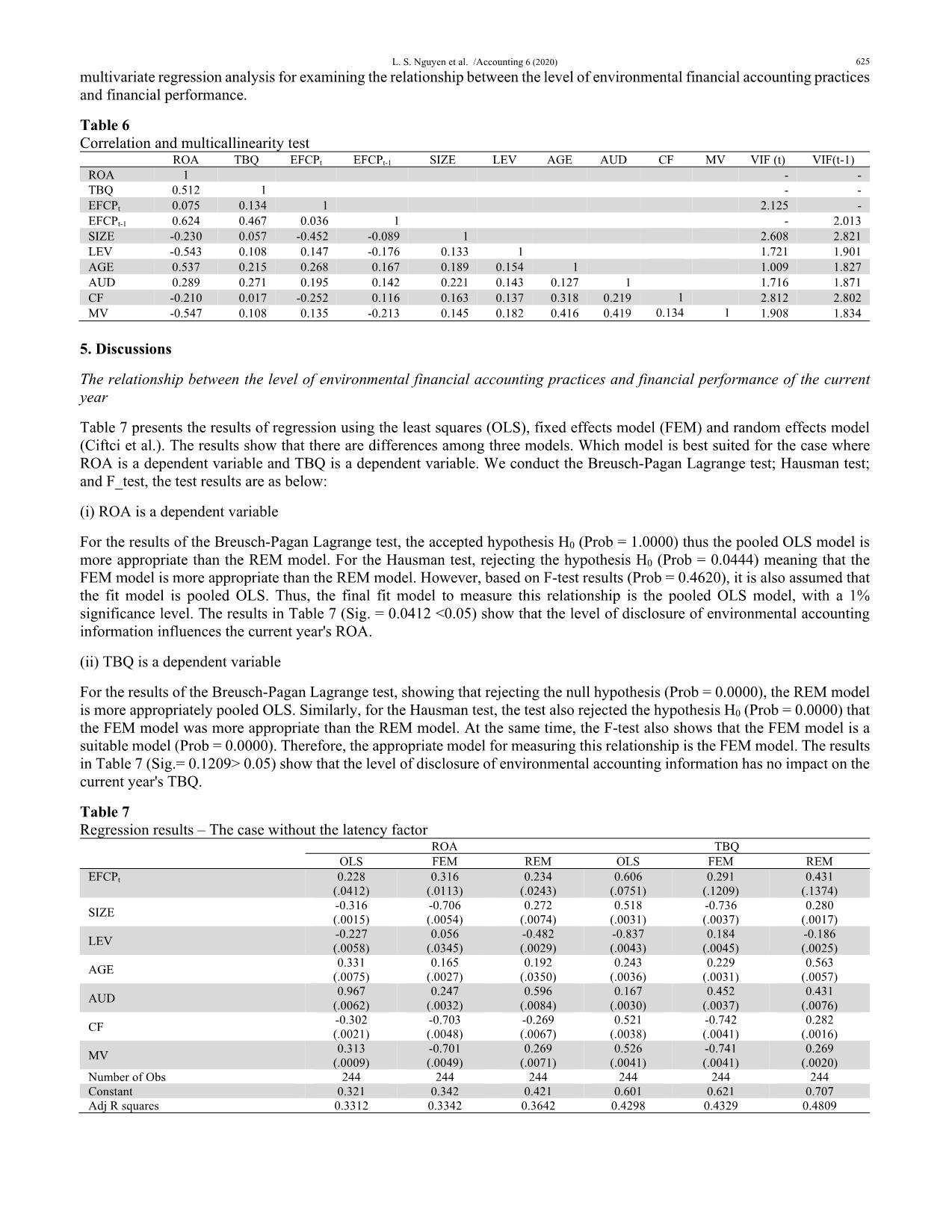

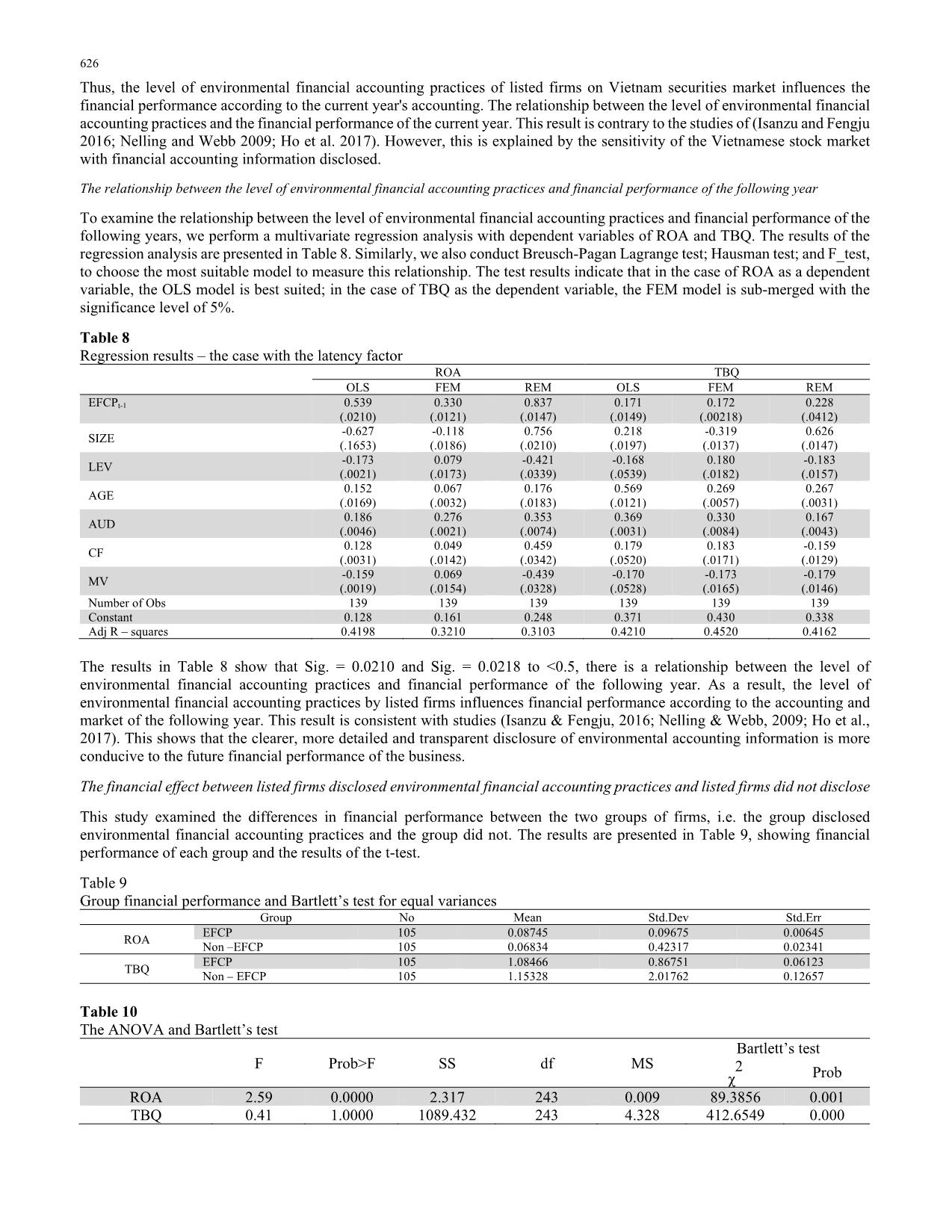

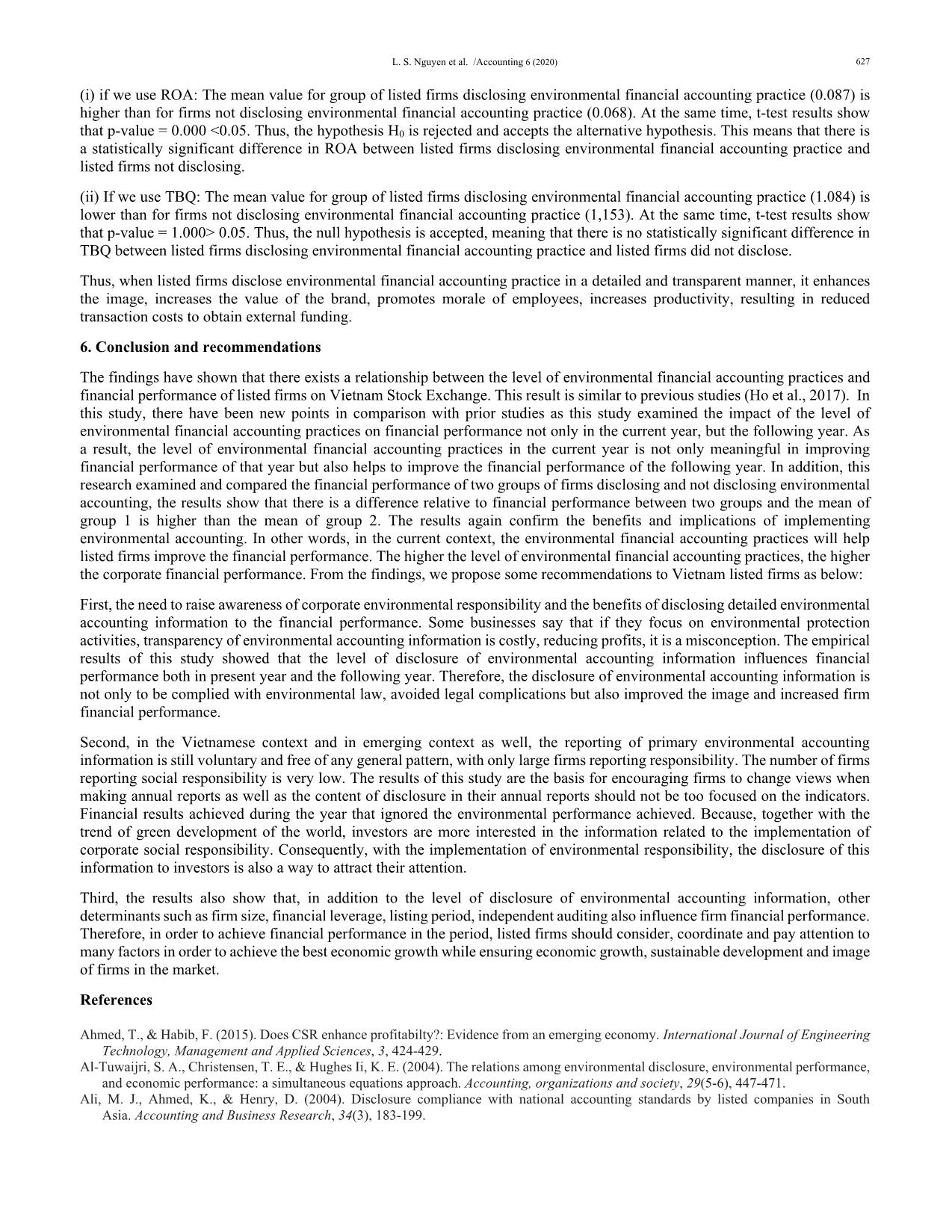

ncial accounting information disclosed. The relationship between the level of environmental financial accounting practices and financial performance of the following year To examine the relationship between the level of environmental financial accounting practices and financial performance of the following years, we perform a multivariate regression analysis with dependent variables of ROA and TBQ. The results of the regression analysis are presented in Table 8. Similarly, we also conduct Breusch-Pagan Lagrange test; Hausman test; and F_test, to choose the most suitable model to measure this relationship. The test results indicate that in the case of ROA as a dependent variable, the OLS model is best suited; in the case of TBQ as the dependent variable, the FEM model is sub-merged with the significance level of 5%. Table 8 Regression results – the case with the latency factor ROA TBQ OLS FEM REM OLS FEM REM EFCPt-1 0.539 (.0210) 0.330 (.0121) 0.837 (.0147) 0.171 (.0149) 0.172 (.00218) 0.228 (.0412) SIZE -0.627 (.1653) -0.118 (.0186) 0.756 (.0210) 0.218 (.0197) -0.319 (.0137) 0.626 (.0147) LEV -0.173 (.0021) 0.079 (.0173) -0.421 (.0339) -0.168 (.0539) 0.180 (.0182) -0.183 (.0157) AGE 0.152 (.0169) 0.067 (.0032) 0.176 (.0183) 0.569 (.0121) 0.269 (.0057) 0.267 (.0031) AUD 0.186 (.0046) 0.276 (.0021) 0.353 (.0074) 0.369 (.0031) 0.330 (.0084) 0.167 (.0043) CF 0.128 (.0031) 0.049 (.0142) 0.459 (.0342) 0.179 (.0520) 0.183 (.0171) -0.159 (.0129) MV -0.159 (.0019) 0.069 (.0154) -0.439 (.0328) -0.170 (.0528) -0.173 (.0165) -0.179 (.0146) Number of Obs 139 139 139 139 139 139 Constant 0.128 0.161 0.248 0.371 0.430 0.338 Adj R – squares 0.4198 0.3210 0.3103 0.4210 0.4520 0.4162 The results in Table 8 show that Sig. = 0.0210 and Sig. = 0.0218 to <0.5, there is a relationship between the level of environmental financial accounting practices and financial performance of the following year. As a result, the level of environmental financial accounting practices by listed firms influences financial performance according to the accounting and market of the following year. This result is consistent with studies (Isanzu & Fengju, 2016; Nelling & Webb, 2009; Ho et al., 2017). This shows that the clearer, more detailed and transparent disclosure of environmental accounting information is more conducive to the future financial performance of the business. The financial effect between listed firms disclosed environmental financial accounting practices and listed firms did not disclose This study examined the differences in financial performance between the two groups of firms, i.e. the group disclosed environmental financial accounting practices and the group did not. The results are presented in Table 9, showing financial performance of each group and the results of the t-test. Table 9 Group financial performance and Bartlett’s test for equal variances Group No Mean Std.Dev Std.Err ROA EFCP 105 0.08745 0.09675 0.00645 Non –EFCP 105 0.06834 0.42317 0.02341 TBQ EFCP 105 1.08466 0.86751 0.06123 Non – EFCP 105 1.15328 2.01762 0.12657 Table 10 The ANOVA and Bartlett’s test F Prob>F SS df MS Bartlett’s test χ2 Prob ROA 2.59 0.0000 2.317 243 0.009 89.3856 0.001 TBQ 0.41 1.0000 1089.432 243 4.328 412.6549 0.000 L. S. Nguyen et al. /Accounting 6 (2020) 627 (i) if we use ROA: The mean value for group of listed firms disclosing environmental financial accounting practice (0.087) is higher than for firms not disclosing environmental financial accounting practice (0.068). At the same time, t-test results show that p-value = 0.000 <0.05. Thus, the hypothesis H0 is rejected and accepts the alternative hypothesis. This means that there is a statistically significant difference in ROA between listed firms disclosing environmental financial accounting practice and listed firms not disclosing. (ii) If we use TBQ: The mean value for group of listed firms disclosing environmental financial accounting practice (1.084) is lower than for firms not disclosing environmental financial accounting practice (1,153). At the same time, t-test results show that p-value = 1.000> 0.05. Thus, the null hypothesis is accepted, meaning that there is no statistically significant difference in TBQ between listed firms disclosing environmental financial accounting practice and listed firms did not disclose. Thus, when listed firms disclose environmental financial accounting practice in a detailed and transparent manner, it enhances the image, increases the value of the brand, promotes morale of employees, increases productivity, resulting in reduced transaction costs to obtain external funding. 6. Conclusion and recommendations The findings have shown that there exists a relationship between the level of environmental financial accounting practices and financial performance of listed firms on Vietnam Stock Exchange. This result is similar to previous studies (Ho et al., 2017). In this study, there have been new points in comparison with prior studies as this study examined the impact of the level of environmental financial accounting practices on financial performance not only in the current year, but the following year. As a result, the level of environmental financial accounting practices in the current year is not only meaningful in improving financial performance of that year but also helps to improve the financial performance of the following year. In addition, this research examined and compared the financial performance of two groups of firms disclosing and not disclosing environmental accounting, the results show that there is a difference relative to financial performance between two groups and the mean of group 1 is higher than the mean of group 2. The results again confirm the benefits and implications of implementing environmental accounting. In other words, in the current context, the environmental financial accounting practices will help listed firms improve the financial performance. The higher the level of environmental financial accounting practices, the higher the corporate financial performance. From the findings, we propose some recommendations to Vietnam listed firms as below: First, the need to raise awareness of corporate environmental responsibility and the benefits of disclosing detailed environmental accounting information to the financial performance. Some businesses say that if they focus on environmental protection activities, transparency of environmental accounting information is costly, reducing profits, it is a misconception. The empirical results of this study showed that the level of disclosure of environmental accounting information influences financial performance both in present year and the following year. Therefore, the disclosure of environmental accounting information is not only to be complied with environmental law, avoided legal complications but also improved the image and increased firm financial performance. Second, in the Vietnamese context and in emerging context as well, the reporting of primary environmental accounting information is still voluntary and free of any general pattern, with only large firms reporting responsibility. The number of firms reporting social responsibility is very low. The results of this study are the basis for encouraging firms to change views when making annual reports as well as the content of disclosure in their annual reports should not be too focused on the indicators. Financial results achieved during the year that ignored the environmental performance achieved. Because, together with the trend of green development of the world, investors are more interested in the information related to the implementation of corporate social responsibility. Consequently, with the implementation of environmental responsibility, the disclosure of this information to investors is also a way to attract their attention. Third, the results also show that, in addition to the level of disclosure of environmental accounting information, other determinants such as firm size, financial leverage, listing period, independent auditing also influence firm financial performance. Therefore, in order to achieve financial performance in the period, listed firms should consider, coordinate and pay attention to many factors in order to achieve the best economic growth while ensuring economic growth, sustainable development and image of firms in the market. References Ahmed, T., & Habib, F. (2015). Does CSR enhance profitabilty?: Evidence from an emerging economy. International Journal of Engineering Technology, Management and Applied Sciences, 3, 424-429. Al-Tuwaijri, S. A., Christensen, T. E., & Hughes Ii, K. E. (2004). The relations among environmental disclosure, environmental performance, and economic performance: a simultaneous equations approach. Accounting, organizations and society, 29(5-6), 447-471. Ali, M. J., Ahmed, K., & Henry, D. (2004). Disclosure compliance with national accounting standards by listed companies in South Asia. Accounting and Business Research, 34(3), 183-199. 628 Barakat, F. S., Pérez, M. V. L., & Ariza, L. R. (2015). Corporate social responsibility disclosure (CSRD) determinants of listed companies in Palestine (PXE) and Jordan (ASE). Review of Managerial Science, 9(4), 681-702. Boaventura, J. o. M. c. G., R. S. d. Silva, and R. Bandeira-de-Mello. 2012. Corporate Financial Performance and Corporate Social Performance: Methodological Development and the Theoretical Contribution of Empirical Studies. Paper read at R. Cont. Fin. – USP, São Paulo. Waddock, S. A., & Graves, S. B. (1997). The corporate social performance–financial performance link. Strategic management journal, 18(4), 303-319.. Chiu, T. K., & Wang, Y. H. (2015). Determinants of social disclosure quality in Taiwan: An application of stakeholder theory. Journal of business ethics, 129(2), 379-398. Ciftci, I., Tatoglu, E., Wood, G., Demirbag, M., & Zaim, S. (2019). Corporate governance and firm performance in emerging markets: Evidence from Turkey. International Business Review, 28(1), 90-103. Dowling, J., & Pfeffer, J. (1975). Organizational legitimacy: Social values and organizational behavior. Pacific sociological review, 18(1), 122-136. Guenster, N., Bauer, R., Derwall, J., & Koedijk, K. (2011). The economic value of corporate eco‐efficiency. European Financial Management, 17(4), 679-704. Guthrie, J., & Parker, L. D. (1989). Corporate social reporting: a rebuttal of legitimacy theory. Accounting and business research, 19(76), 343-352. Hitt, M. A., Freeman, R. E., & Harrison, J. S. (2017). A Stakeholder Approach to Strategic Management. Published Online: 26 NOV 2017: The Blackwell Handbook of Strategic Management. Ho, V. T., T. V. A. Ho, and T. C. Nguyen. 2017. The corporate environmental responsibility and corporate financial performance: evidences from Vietnamese listed companies. Paper read at Proceedings of ICUEH2017: International conference of University of Economic Ho Chi Minh City: Policies and sustainable economic development., at HCMC, Vietnam, September 28, 2017. Horváthová, E. (2012). The impact of environmental performance on firm performance: Short-term costs and long-term benefits?. Ecological Economics, 84, 91-97.. Isanzu, J., & Fengju, X. (2016). Impact of Corporate Social Responsibility on Firm’s Financial Performance: The Tanzanian Perspective. Journal on Innovation and Sustainability. 7. Jamil, M., Zuriana, C., Mohamed, R., Muhammad, F., & Ali, A. (2015). Environmental management accounting practices in small medium manufacturing firms. Procedia-Social and Behavioral Sciences, 172, 619-626. Magness, V. (2006). Strategic posture, financial performance and environmental disclosure. Accounting, Auditing & Accountability Journal, 19(4). Nelling, E., & Webb, E. (2009). Corporate social responsibility and financial performance: the “virtuous circle” revisited. Review of Quantitative Finance and Accounting, 32(2), 197-209. Nguyen, L., & Tran, M. (2019). Disclosure levels of environmental accounting information and financial performance: The case of Vietnam. Management Science Letters, 9(4), 557-570. Nguyen, L. S., Tran, M. D., Nguyen, T. X. H., & Le, Q. H. (2017). Factors Affecting Disclosure Levels of Environmental Accounting Information: The Case of Vietnam. Accounting and Finance Research 6(4). Nguyen, L. S., Tran, T. H., & Nguyen, T. N. (2018a). Factors Affecting Disclosure Levels of Environmental Accounting Information: The Case of Vietnam firms doing business under of the model parent company – subsidiary company. Paper read at The 5thIBSM International Conference on Business, Management and Accounting 19-21 April 2018. , at Hanoi University of Industry, Viet Nam. Nguyen, T. H., Khuu, T. Q., & Nguyen, N. D. L. (2018b). Determinants of Firm Growth: Evidence from Vietnamese Small and Medium Sized Manufacturing Enterprises. The Journal of Economics and Development (JED) 20 (3). Ting, N. I. (2017). Disclosure of the environmental accounting information research. DEStech Transactions on Economics, Business and Management, (eced). Poddi, N. C. L., & Vergalli, S. (2016). Corporate Social Responsibility and Firms’ Performance: a Strategic Graphical Analysis. Journal of International Business and Economics, 4(1), 1-12. Qiu, Y., Shaukat, A., & Tharyan, R. (2016). Environmental and social disclosures: Link with corporate financial performance. The British Accounting Review, 48(1), 102-116. Simpson, W. G., & Kohers, T. (2002). The link between corporate social and financial performance: Evidence from the banking industry. Journal of business ethics, 35(2), 97-109. Tauchen, G. (1986). Finite state markov-chain approximations to univariate and vector autoregressions. Economics letters, 20(2), 177-181. Ullmann, A. A. (1985). Data in search of a theory: A critical examination of the relationships among social performance, social disclosure, and economic performance of US firms. Academy of management review, 10(3), 540-557. Vo, T. T. A., Ha, X. T. , & Bui, P. N. K. (2018). What Causes Financial Crisis in Asian Countries? The Journal of Economics and Development (JED) 20(3). Yang, L.-H., and X.-T. Liang. 2017. Study on the Influencing Factors of Environmental Accounting Information Disclosure. Paper read at International Conference on Economics, Management Engineering and Marketing (EMEM 2017). © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

the_relationship_between_level_of_environmental_financial_ac.pdf

the_relationship_between_level_of_environmental_financial_ac.pdf