The effect of non-Performing loans on profitability of commercial banks: Case of Vietnam

Profit always be the top priority of banking operation over the years. Commercial banks maximize the net interest margin by charging more interests to the borrowers and offering lower interests to the depositors. Their aggressive lending strategies can sometimes result in credit risk, moral hazard and non-Performing loans. Some studies found that non-performing loans have negative impact on the bank’s profitability; some argued otherwise. This paper aims at investigating the impact of non-performing loans on the ability to make profit of Vietnamese commercial banks in the period of 2008 to 2017 and draws a conclusion as well as recommendations to mitigate the risk

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Tóm tắt nội dung tài liệu: The effect of non-Performing loans on profitability of commercial banks: Case of Vietnam

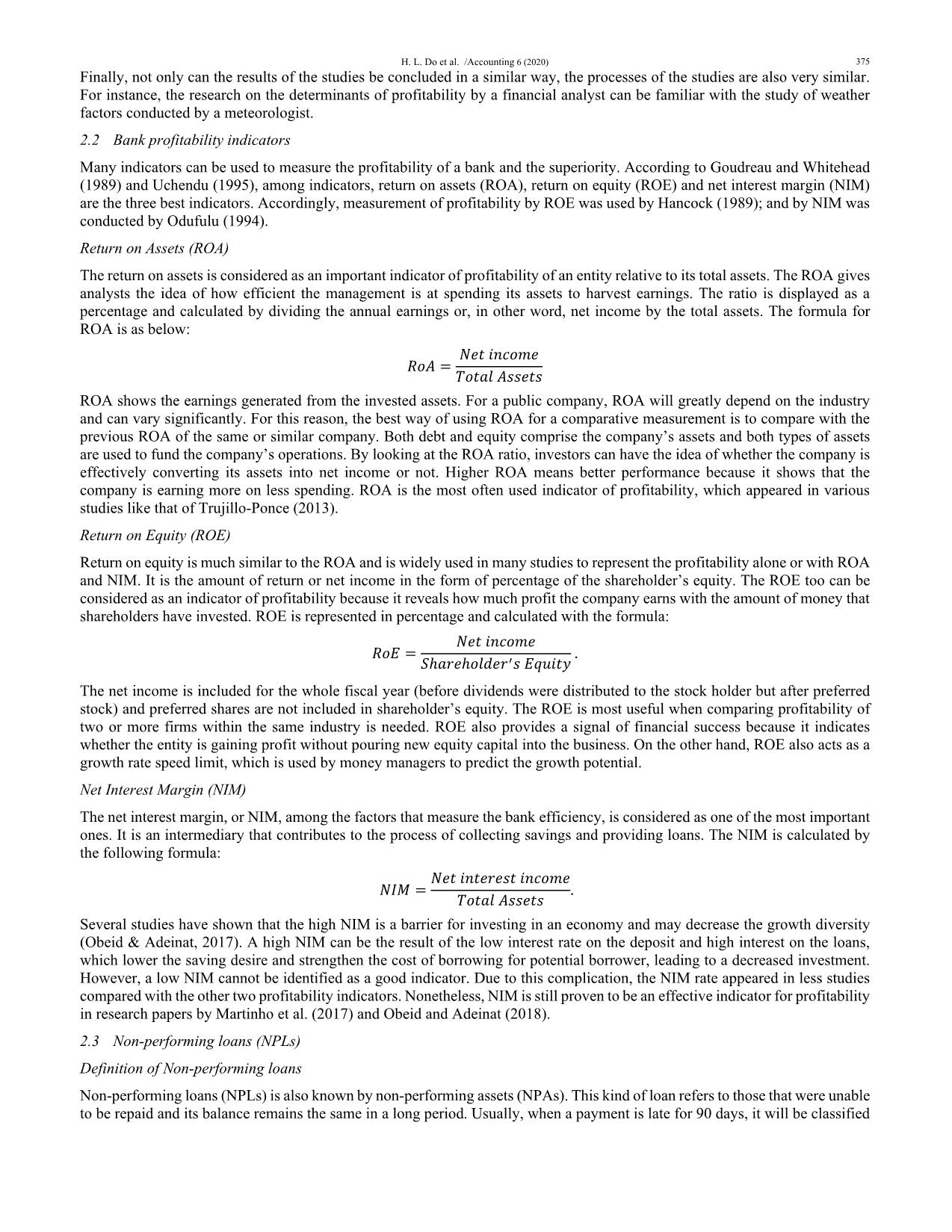

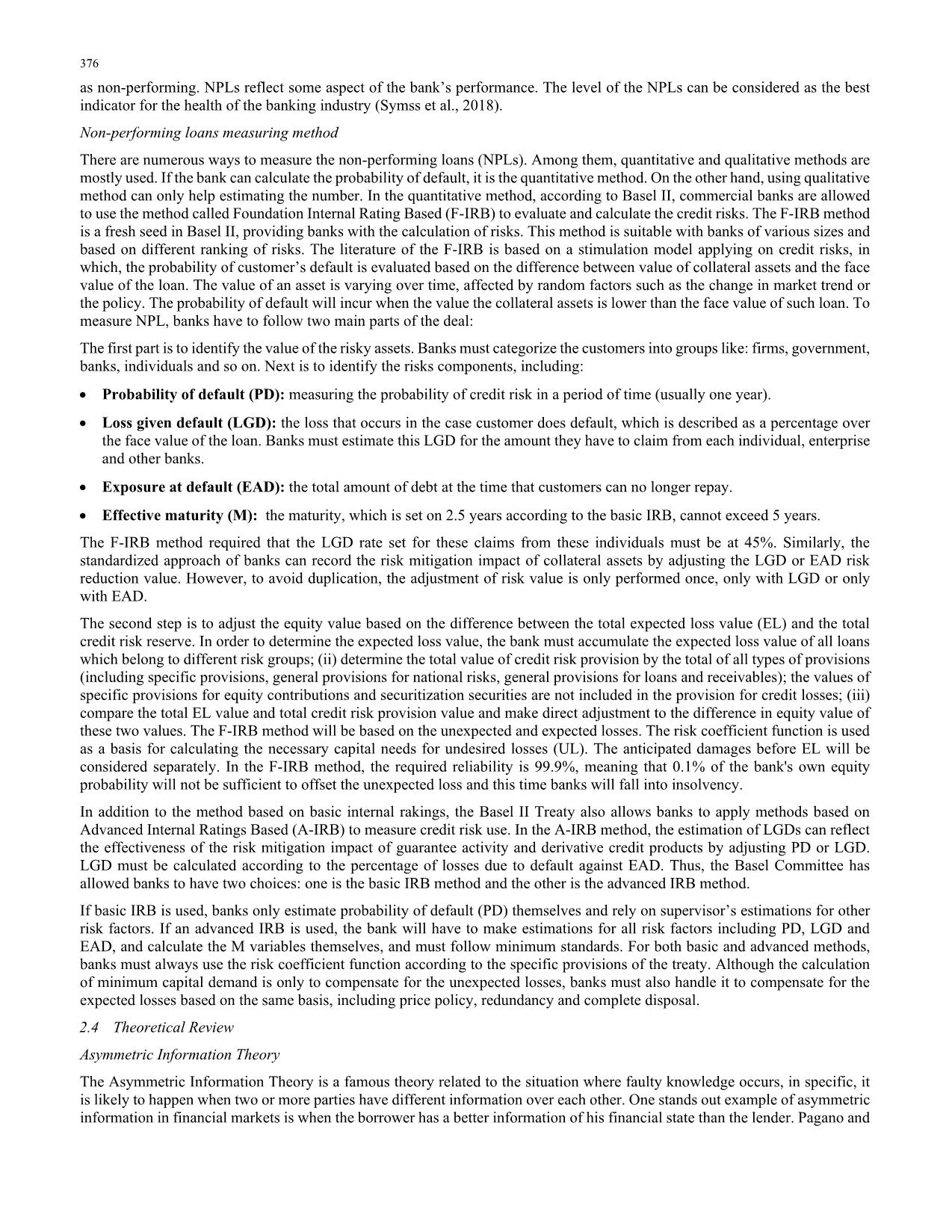

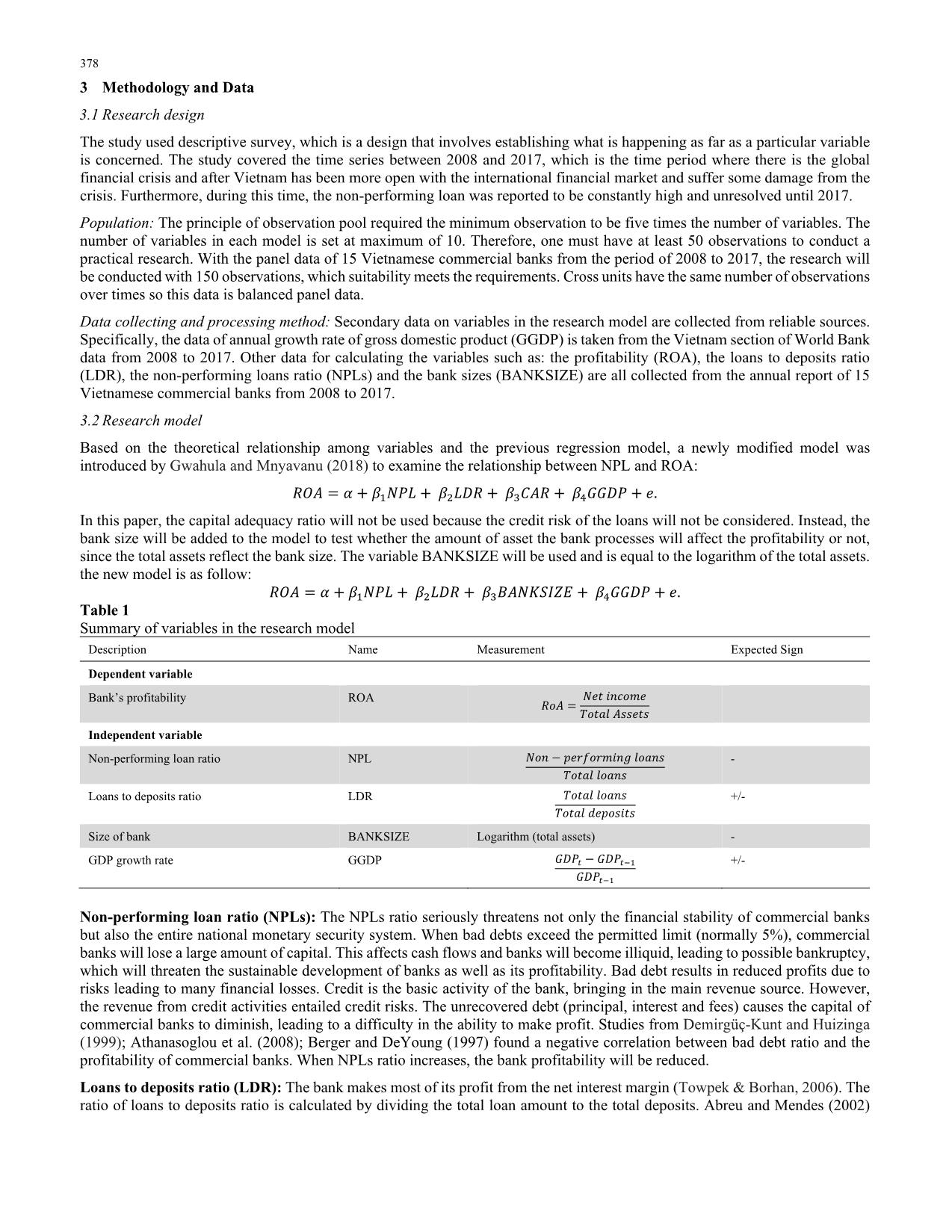

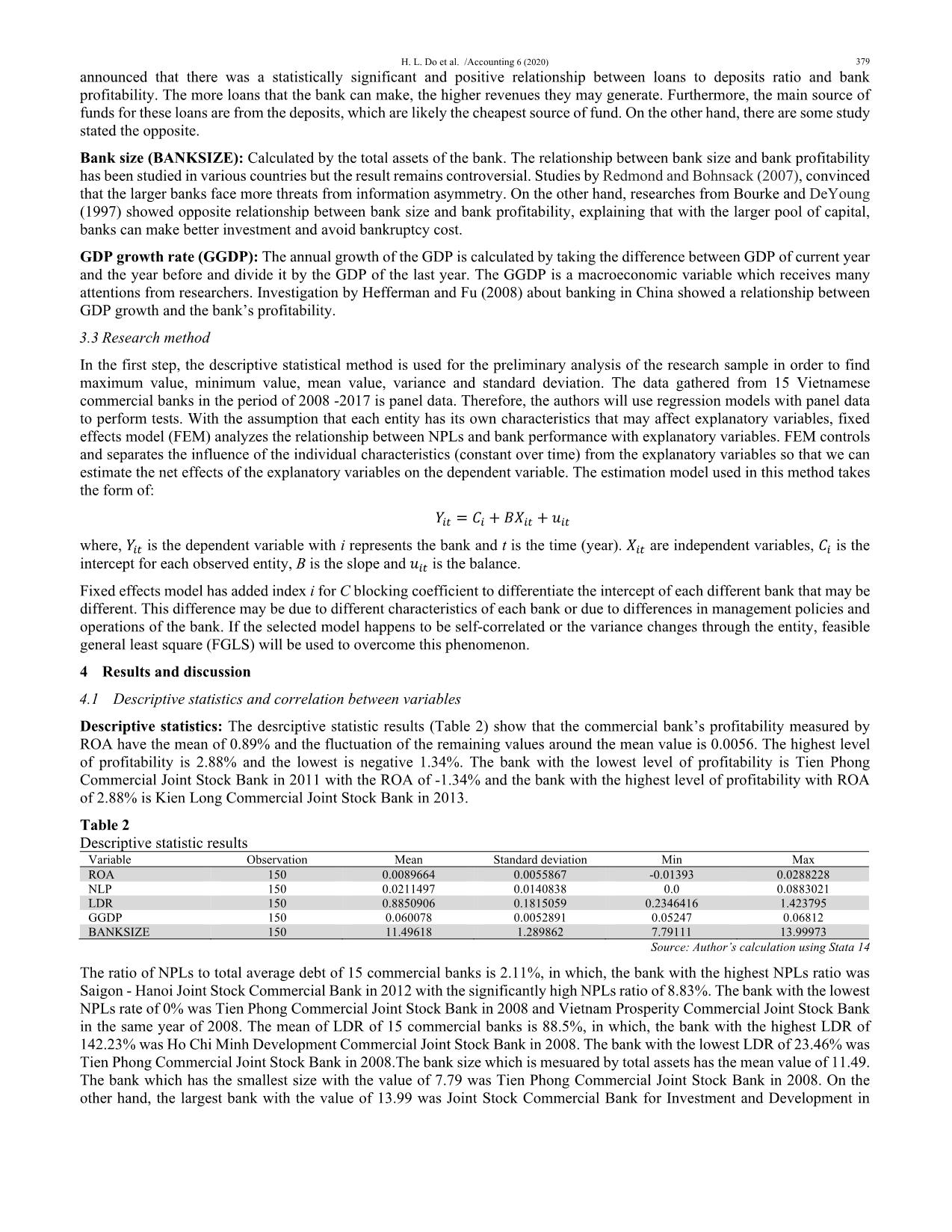

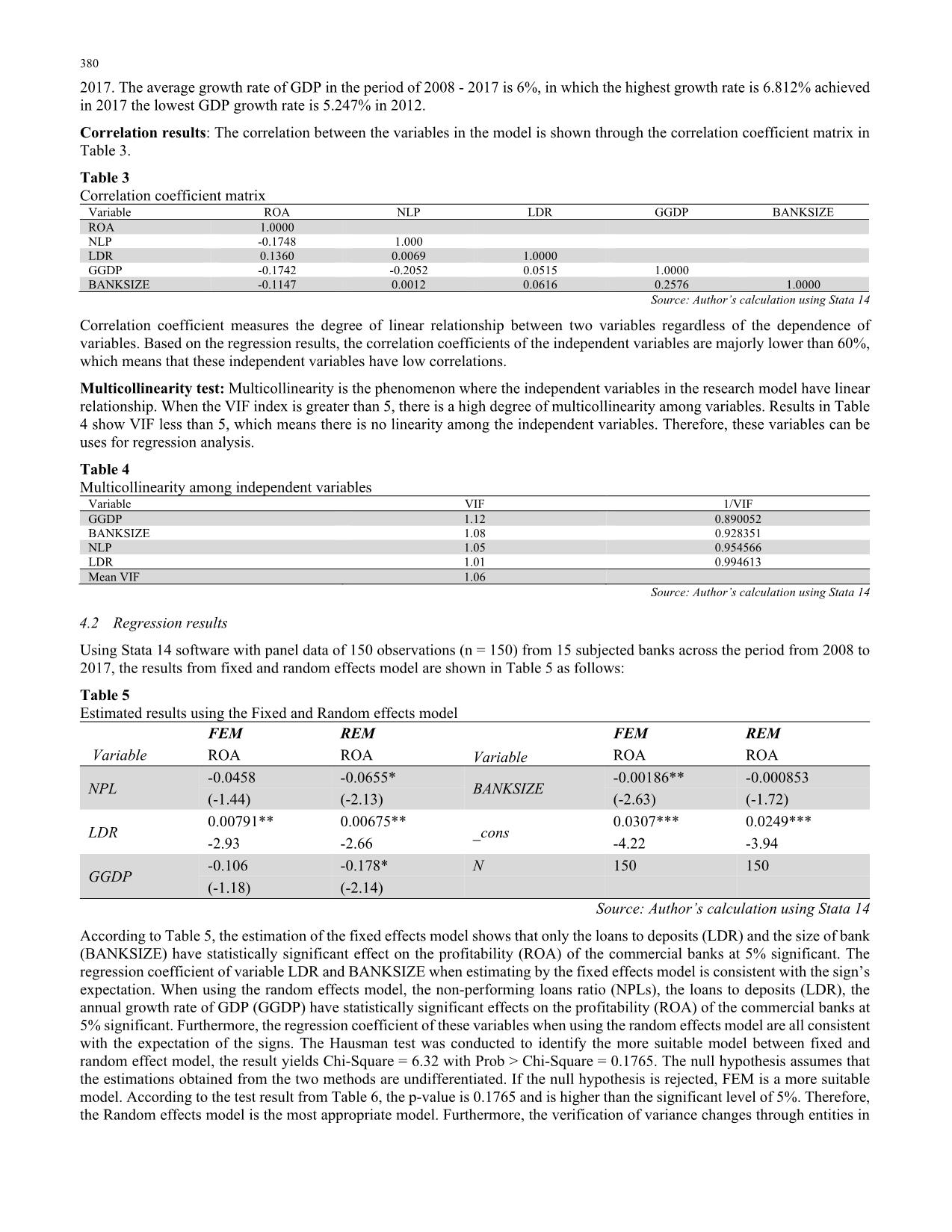

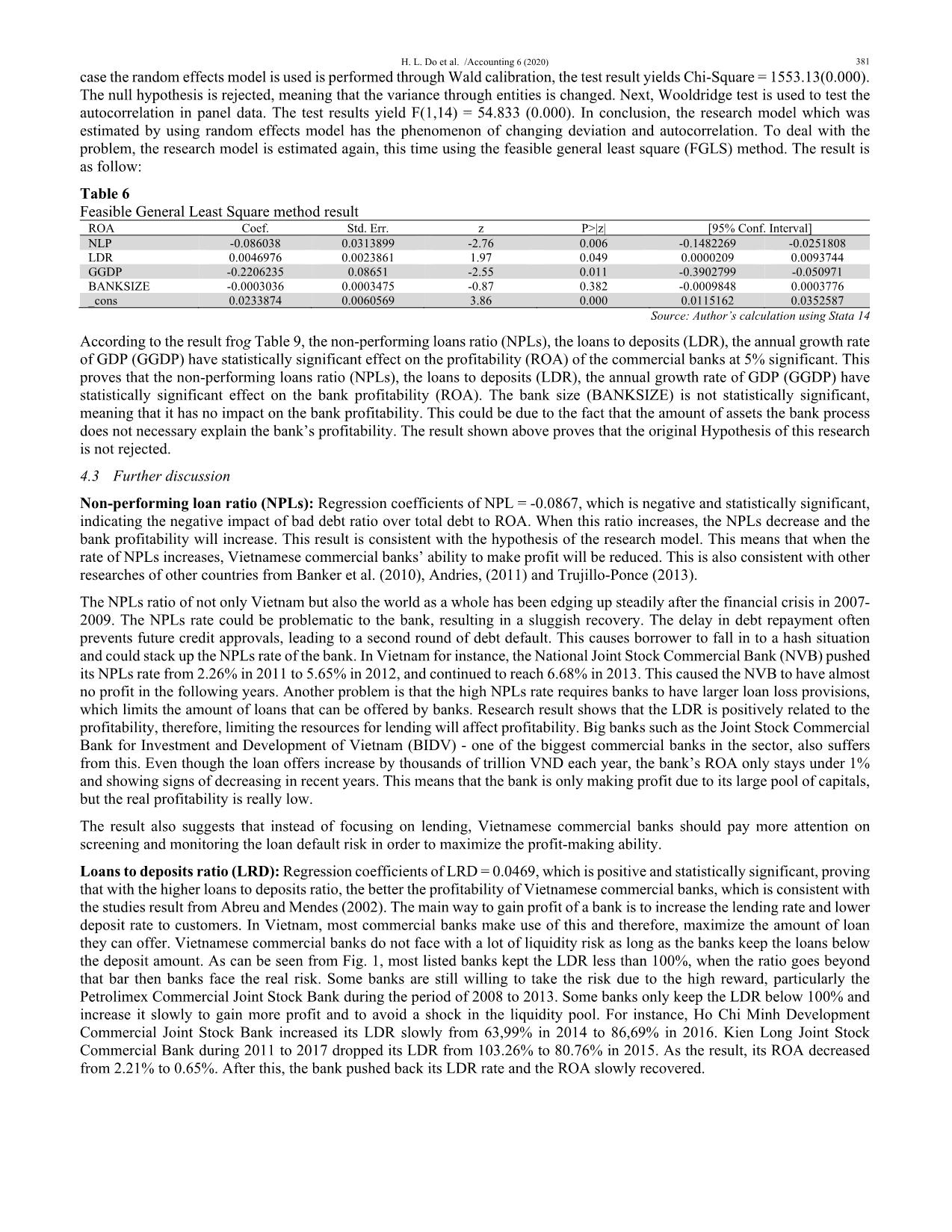

al Joint Stock Bank during the period of 2008 to 2013. Some banks only keep the LDR below 100% and increase it slowly to gain more profit and to avoid a shock in the liquidity pool. For instance, Ho Chi Minh Development Commercial Joint Stock Bank increased its LDR slowly from 63,99% in 2014 to 86,69% in 2016. Kien Long Joint Stock Commercial Bank during 2011 to 2017 dropped its LDR from 103.26% to 80.76% in 2015. As the result, its ROA decreased from 2.21% to 0.65%. After this, the bank pushed back its LDR rate and the ROA slowly recovered. 382 Fig. 1. Histogram of LDR frequency Annual GDP growth rate (GGDP): Regression coefficients of GGDP = -0.0867 is statistically significant. This means that the GDP growth of Vietnam has negative impact on the bank’s performance. Therefore, it can be concluded that with in the growing economy, the banks of Vietnam are more likely to perform worse. Fig. 2. GDP growth and average bank's ROA from 2008 to 2017 Source: Author’s compilation The high GDP growth indicates that the economic is stable and well developing. With the developing economy, demand for credit would rise as the needs to expand investment and productivity also rise. Such economies will let banks offer deals more confidently, at the same, time trigger the liquidity risk. If the lending activities are made, so are the default risk and the profitability. The moral hazard can cause banks to make riskier trades; risk management can be loosened. As can be seen in Fig. 2, at the beginning of the crisis that happened in 2008, the GDP fell from 5.662% to 5.398% in 2009. At the same time the ROA of commercial banks slightly increased from 1.16% to 1.21% in 2009. This could come from the demand for fund during the downfall of the economic; risky assets are retreated from commercial banks and more secure loans were made. The same pattern applied up to 2017. The period from 2012 to 2015 was when Vietnam’s economy has recovered and begin to develop again, which is shown by the rapid increase in GDP from 5.247% in 2012 to 6.68% in 2015 and followed by the fall in average ROA of commercial banks. 5. Conclusion and recommendation On the basis of inheriting the results of previous studies, the author uses the fixed and random effects model, as well as the feasible general least square method to construct the test with panel data. The test results have shown that when the rate of non- performing loans increases, the bank’s ROA will decrease, meaning that the bank profitability will be lowered. Furthermore, the research results have pointed out that in the case of Vietnam, the loans to deposits rate and the growth of GDP both have an 0 10 20 30 40 Fr eq ue nc y 0.0000 0.5000 1.0000 1.5000 LDR 5.662% 5.398% 6.423% 6.240% 5.247% 5.422% 5.984%6.679% 6.211% 6.812% 1.162% 1.218%1.107%1.111%0.927%0.816%0.684%0.598%0.609% 0.734% 0.000% 1.000% 2.000% 3.000% 4.000% 5.000% 6.000% 7.000% 8.000% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 GDP Average ROA H. L. Do et al. /Accounting 6 (2020) 383 impact on the bank’s performance; while the bank size does not matter. Therefore, the authors suggest the following actions in order to prevent the impact of NPLs on bank’s profitability: Raising equity: Raising equity contributes to the ability of a bank responding to liquidity crisis and to cover for the bad debt, which is what the Modern Portfolio Theory recommended. Improving financial capacity such as capital and asset quality will provide the bank with back up for the unrecovered loans. However, this action needs to be proceeded with caution to avoid further volatility. In order to increase equity, banks need to develop a balanced policy in the distribution of profit for dividend payments and retain earnings. Banks need to retain some profits in addition to shareholders’ equity to increase the scale of capital for future investment. Increasing equity often leads to dilution of the shareholdings. Therefore, bank owners need to accept this situation in order to expand pool of shareholders, thereby increasing equity to reduce the risk and increase stability. In addition, diluting the shareholding rate and limiting the concentration of large capital ownership in a small group of shareholders also promote the development of corporate governance, avoiding bank manipulation and acquisition by dominating group of shareholders. This unfortunate circumstance can cause great losses to other shareholders and distort the financial situation of banks. Appropriate risk managing system: Commercial banks need to complete the Basel II credit risk management framework. A good credit risk management system must be placed in an appropriate risk environment. The risk management strategy should clearly identify the level of general risk and the level of credit risk tolerance to be the guideline for the risk management operation. The bank's credit risk strategy must be developed based on comprehensive assessments, thoroughly understanding of the bank's business situation and macroeconomic situation. The Board of Directors should be responsible for the final approval of the credit risk strategy. Credit risk management procedures must also be appropriate. In order to obtain a reasonable credit risk management process, the bank needs to establish reasonable credit risk criteria, appropriate authority hierarchy, and risk appetite of the bank. In addition, credit risk management policies coupled with credit growth, high-risk lending such as securities investments, and real estates need to be regularly reviewed to ensure the compliance with risk management strategies during each period. Furthermore, the system has to be carefully monitored and frequently evaluated to ensure the effectiveness and to avoid asymmetric information. This work is required to be carried out regularly by risk management departments and other independent monitoring departments. Acknowledgement This paper has been supported by National Economics University. References Abreu, M., & Mendes, V. (2002). Commercial Bank Interest Margins and Profitability. Andries, A. M. (2011). The determinants of bank efficiency and productivity growth in the Central and Eastern European banking systems. Eastern European Economics, 49(6), 38-59. Athanasoglou, P. P., Brissimis, S. N., & Delis, M. D. (2008). Bank-specific, industry-specific and macroeconomic determinants of bank profitability. Journal of international financial Markets, Institutions and Money, 18(2), 121-136. Atemkeng, T., & Nzongang, J. (2006). Market structure and profitability performance in the banking industry of CFA countries: The case of commercial banks in Cameroon. Journal of Sustainable Development in Africa, 8(2), 1-14. Auronen, L. (2003, May). Asymmetric information: theory and applications. In Seminar of Strategy and International Business as Helsinki University of Technology. Banker, R. D., Chang, H., & Lee, S. Y. (2010). Differential impact of Korean banking system reforms on bank productivity. Journal of Banking & Finance, 34(7), 1450-1460. Berger, A. N., & DeYoung, R. (1997). Problem loans and cost efficiency in commercial banks. Journal of Banking & Finance, 21(6), 849-870. Berger, A. N., & Humphrey, D. B. (1992). Measurement and efficiency issues in commercial banking. In Output measurement in the service sectors (pp. 245-300). University of Chicago Press. Bofondi, M., & Gobbi, G. (2004). Bad loans and entry into local credit markets (Vol. 509). Banca d'Italia. Demirgüç-Kunt, A., & Huizinga, H. (1999). Determinants of commercial bank interest margins and profitability: some international evidence. The World Bank Economic Review, 13(2), 379-408. Goudreau, R. E., & Whitehead, D. D. (1989). FYI Commercial Bank Profitability: Improved In 1988. Economic Review-Federal Reserve Bank of Atlanta, 74(4), 34. Gwahula, R., & Mnyavanu, W. (2018). Determinants of dividend payout of Commercial Banks Listed at Dar Es Salaam Stock Exchange (DSE). Account and Financial Management Journal, 3(06), 1571-1580. Hancock, D. (1989). Bank profitability, deregulation, and the production of financial services (No. 89-16). Hefferman, S., & Fu, M. (2008). The Determinants of Bank- Performance in China. Ema Working Paper Series No. 032008. 384 Karim, M. Z. A., Chan, S. G., & Hassan, S. (2010). Bank efficiency and non-performing loans: Evidence from Malaysia and Singapore. Prague Economic Papers, 2(1), 118-132. Krakah, A. K., & Ameyaw, A. (2010). Determinants of Bank’s Profitability in Ghana. The Case of Merchant Bank Ghana Limited (MBG) and Ghana Commercial Bank (GCB), A master‟ s thesis in business administration. Kwan, S. H., & Eisenbeis, R. A. (1995). An analysis of inefficiencies in banking. Journal of Banking & Finance, 19(3-4), 733- 734. Markowitz, H. (1952). Portfolio selection. The Journal of Finance, 7(1), 77-91. Martinho, R., Oliveria, J., & Oliveria, V. (2017). Bank profitability and Macroeconomic factors. Financial stability papers, Banco de Portugal, Lisbon, August, ISSN, 2183-4059. Norris, H. (1945). Profit: Accounting theory and economics. Economica, 12(47), 125-133. Obeid, R., & Adeinat, M. (2017). Determinants of net interest margin: An analytical study on the commercial banks operating in Jordan (2005-2015). International Journal of Economics and Financial Issues, 7(4), 515-525. Odufulu, O. (1994). Monetary Policy and Banks’ Profitability in Nigeria. First Bank of Nigeria Plc Bi-Annual Review. Pagano, M., & Jappelli, T. (1993). Information sharing in credit markets. The journal of finance, 48(5), 1693-1718. Quang, L. (2015). Determinants of banking crisis: The case of Vietnam. Journal of Science, 4, 64. Redmond, W. J., & Bohnsack, C. L. (2007). Bank size and profitability: One nation, one bank?. International Journal of Business Research, 7(1), 162-169. Symss, J., Saradhi, V. R., & Nehra, P. (2018). Determinants of Non-Performing Assets in Indian Banking Sector. The Management Accountant Journal, 53(7), 91-98. Towpek, H., & Borhan, J. T. (2006). Untung dalam sistem perbankan Islam. Islamic Banking and Finance Institute Malaysia (IBFIM). Trujillo-Ponce, A. (2013). What determines the profitability of banks? Evidence from Spain. Accounting & Finance, 53(2), 561–586. Tulsian, M. (2014). Profitability analysis: A comparative study of SAIL & TATA Steel. Journal of Economics and Finance (IOSR-JEF), 3(2), 19-22. Uchendu, O.A. (1995). Monetary policy and the performance of commercial banking in Nigeria. Monograph, Research Department, CBN. Vinh, N. T. H. (2017). The impact of non-performing loans on bank profitability and lending behavior: Evidence from Vietnam. Journal of Economic Development, (JED, Vol. 24 (3)), 27-44. Wheelock, D., & Wilson, P. (1995). Explaining bank failures: Deposit insurance, regulation, and efficiency. Review of Economics and Statistics, 77, 689–700. Appendix List of banks for research data Name Code 1 Asia Commercial Joint Stock Bank ACB 2 Joint Stock Commercial Bank for Investment and Development of Vietnam BID 3 Vietnam Export Import Commercial Joint Stock Bank EIB 4 Vietnam Joint Stock Commercial Bank for Industry and Trade CTG 5 Ho Chi Minh Development Commercial Joint Stock Bank HDB 6 Kien Long Commercial Joint Stock Bank KLB 7 National Joint Stock Commercial Bank NVB 8 Joint Stock Commercial Bank of Saigon - Hanoi SHB 9 Saigon Thuong Tin Commercial Joint Stock Bank STB 10 Joint Stock Commercial Bank for Foreign Trade of Vietnam VCB 11 Military Joint Stock Commercial Bank MBB 12 Vietnam International Joint Stock Commercial Bank VIB 13 Vietnam Prosperity Commercial Joint Stock Bank VPB 14 Petrolimex Commercial Joint Stock Bank PGB 15 Tien Phong Commercial Joint Stock Bank TPB H. L. Do et al. /Accounting 6 (2020) 385 Results from fixed effects model Results from random effects model Hausman test F test that all u_i=0: F(14, 131) = 3.77 Prob > F = 0.0000 rho .36486287 (fraction of variance due to u_i) sigma_e .0047632 sigma_u .00361019 _cons .0307258 .0072862 4.22 0.000 .016312 .0451396 BANKSIZE -.0018635 .0007079 -2.63 0.009 -.0032639 -.0004631 GGDP -.1059966 .0899528 -1.18 0.241 -.2839448 .0719515 LDR .0079103 .0027028 2.93 0.004 .0025635 .013257 NPL -.0458482 .0318621 -1.44 0.153 -.1088791 .0171826 ROA Coef. Std. Err. t P>|t| [95% Conf. Interval] corr(u_i, Xb) = -0.4668 Prob > F = 0.0001 F(4,131) = 6.76 overall = 0.0540 max = 10 between = 0.0030 avg = 10.0 within = 0.1712 min = 10 R-sq: Obs per group: Group variable: Banks Number of groups = 15 Fixed-effects (within) regression Number of obs = 150 rho .21627246 (fraction of variance due to u_i) sigma_e .0047632 sigma_u .00250217 _cons .0248835 .006322 3.94 0.000 .0124927 .0372744 BANKSIZE -.0008526 .0004943 -1.72 0.085 -.0018214 .0001162 GGDP -.1781982 .0833829 -2.14 0.033 -.3416257 -.0147707 LDR .0067517 .0025401 2.66 0.008 .0017732 .0117301 NPL -.06552 .0307857 -2.13 0.033 -.1258589 -.005181 ROA Coef. Std. Err. z P>|z| [95% Conf. Interval] corr(u_i, X) = 0 (assumed) Prob > chi2 = 0.0002 Wald chi2(4) = 22.25 overall = 0.0883 max = 10 between = 0.0000 avg = 10.0 within = 0.1580 min = 10 R-sq: Obs per group: Group variable: Banks Number of groups = 15 Random-effects GLS regression Number of obs = 150 Prob>chi2 = 0.1765 = 6.32 chi2(4) = (b-B)'[(V_b-V_B)^(-1)](b-B) Test: Ho: difference in coefficients not systematic B = inconsistent under Ha, efficient under Ho; obtained from xtreg b = consistent under Ho and Ha; obtained from xtreg BANKSIZE -.0018635 -.0008526 -.0010109 .0005068 GGDP -.1059966 -.1781982 .0722016 .0337461 LDR .0079103 .0067517 .0011586 .0009236 NPL -.0458482 -.06552 .0196717 .0082117 fe re Difference S.E. (b) (B) (b-B) sqrt(diag(V_b-V_B)) Coefficients 386 Feasible General Least Square © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license ( _cons .0233874 .0060569 3.86 0.000 .0115162 .0352587 BANKSIZE -.0003036 .0003475 -0.87 0.382 -.0009848 .0003776 GGDP -.2206235 .086561 -2.55 0.011 -.3902799 -.0509671 LDR .0046976 .0023861 1.97 0.049 .0000209 .0093744 NPL -.0867038 .0313899 -2.76 0.006 -.1482269 -.0251808 ROA Coef. Std. Err. z P>|z| [95% Conf. Interval] Log likelihood = 573.9505 Prob > chi2 = 0.0017 Wald chi2(4) = 17.30 Estimated coefficients = 5 Time periods = 10 Estimated autocorrelations = 0 Number of groups = 15 Estimated covariances = 1 Number of obs = 150 Correlation: no autocorrelation Panels: homoskedastic Coefficients: generalized least squares Cross-sectional time-series FGLS regression

File đính kèm:

the_effect_of_non_performing_loans_on_profitability_of_comme.pdf

the_effect_of_non_performing_loans_on_profitability_of_comme.pdf