The effect of factors on degree of disclosing accounting information: Evidence from food industry

Today, the stock market has increasingly proven its important role and become a focus of many

participants with different purposes and positions. In the stock market, the information is like a blood

vessel and energy source which feed the market especially financial information. The securities market

of a country that wants to be active and attracts many investors, the transparency of information is

considered as an important factor. This paper studies the extent of factors influencing the disclosure

in the financial statement of listed food industry companies on the Vietnam’s stock market. Based on

the information of 60 companies that belong to food industry listed on the Vietnam’s stock market,

the disclosure indexes and regression model are employed to measure the disclosure by SPSS 22.0.

The results demonstrate that, the extent of disclosure is significantly influenced by efficient use of

assets, liquidity, independent audit, size, the percentage of board members not participating in

management and the number of board members

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Tóm tắt nội dung tài liệu: The effect of factors on degree of disclosing accounting information: Evidence from food industry

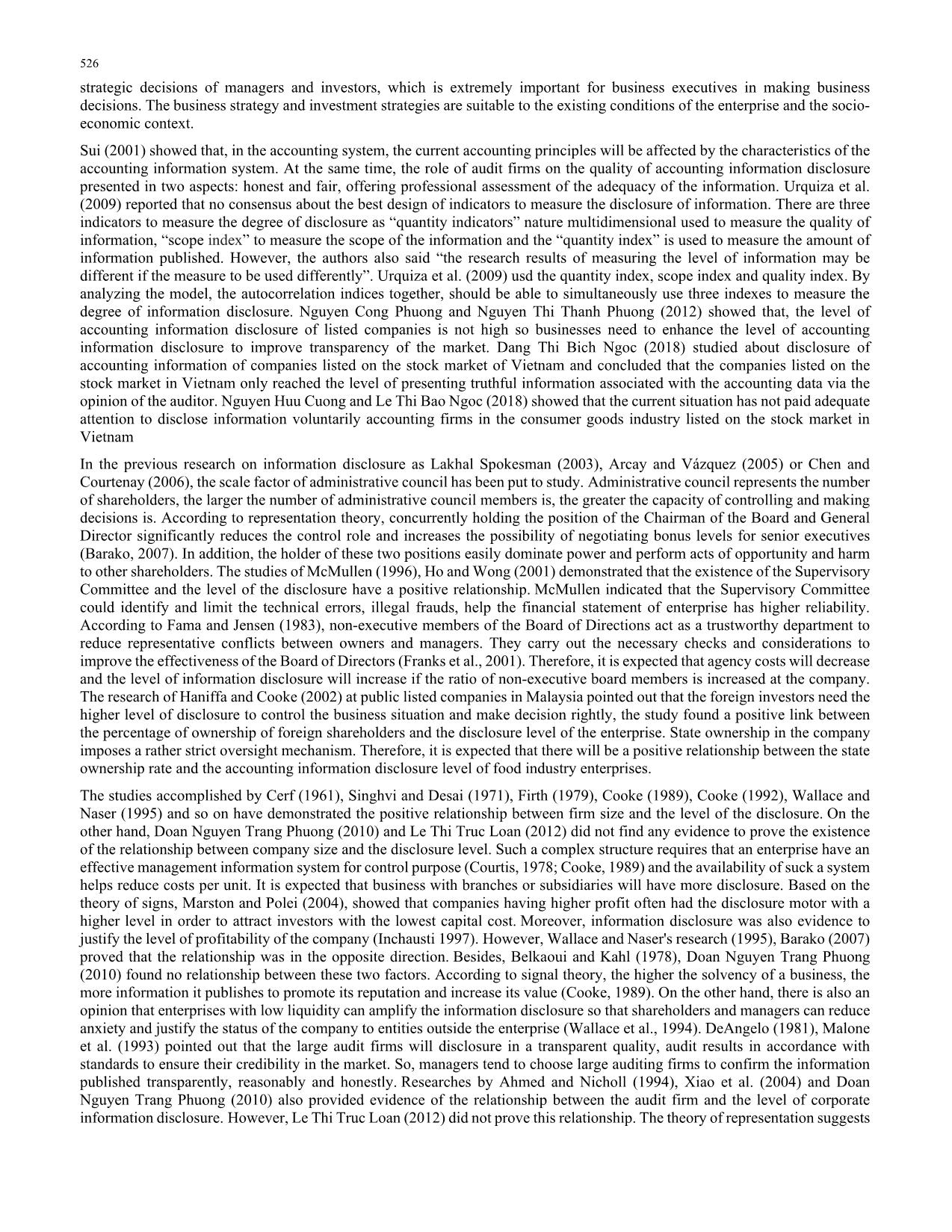

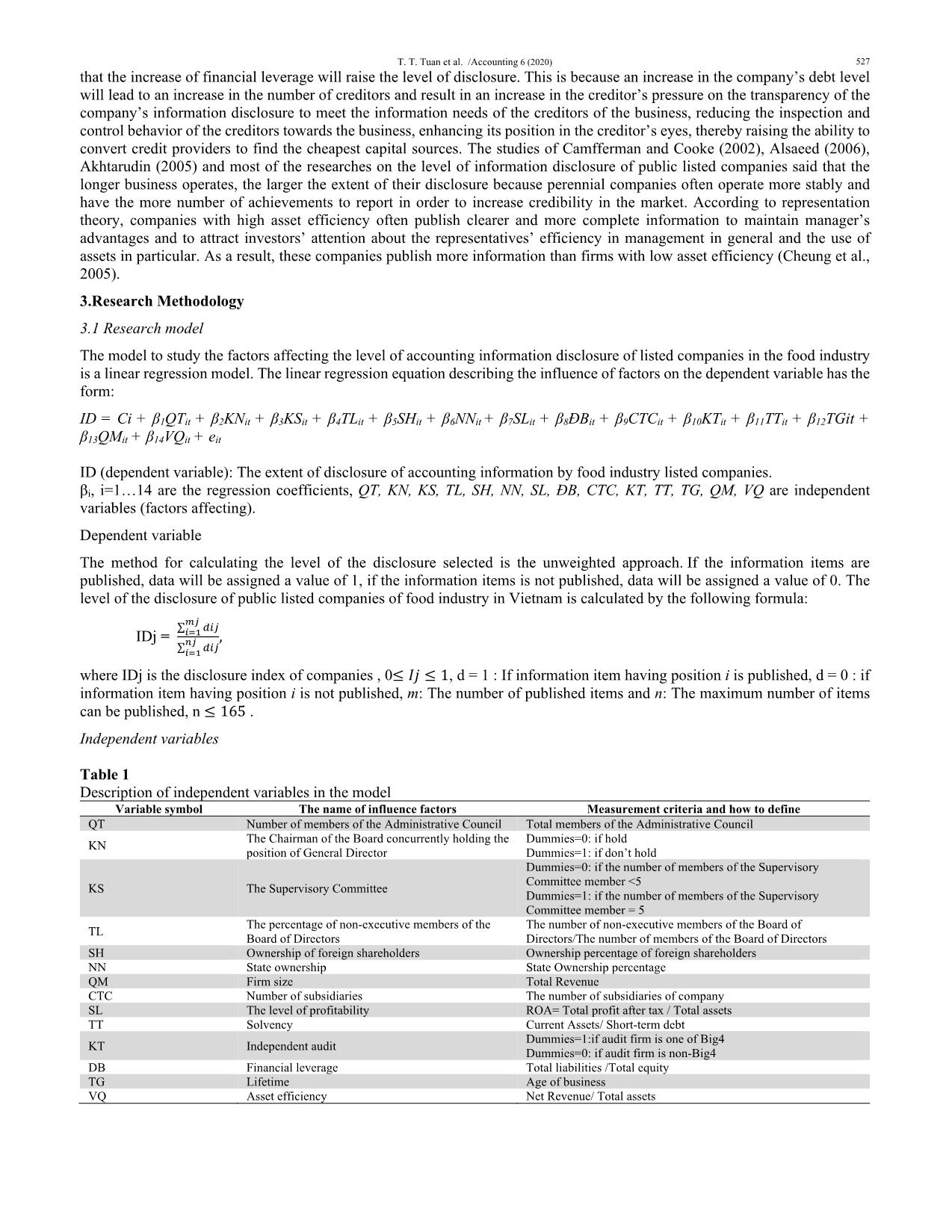

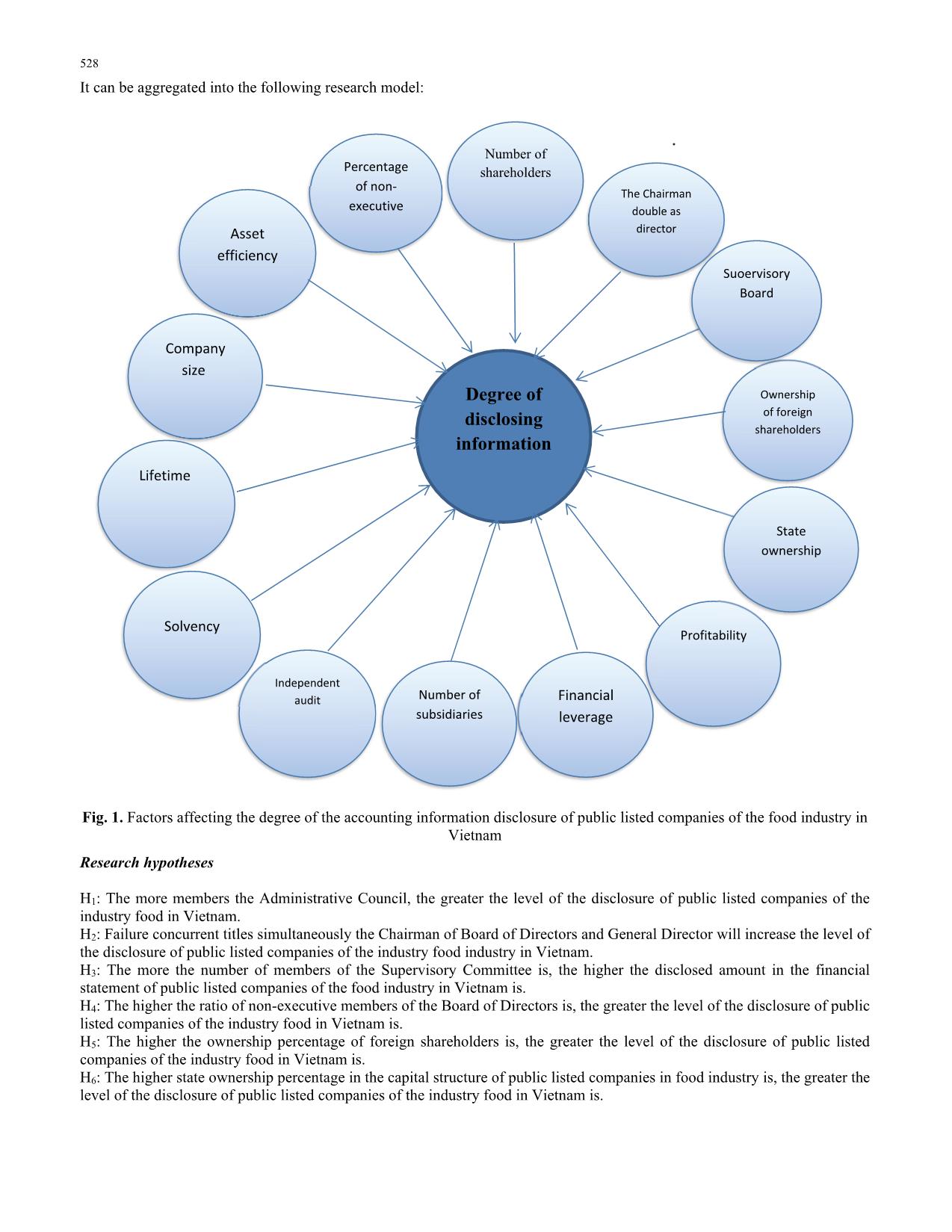

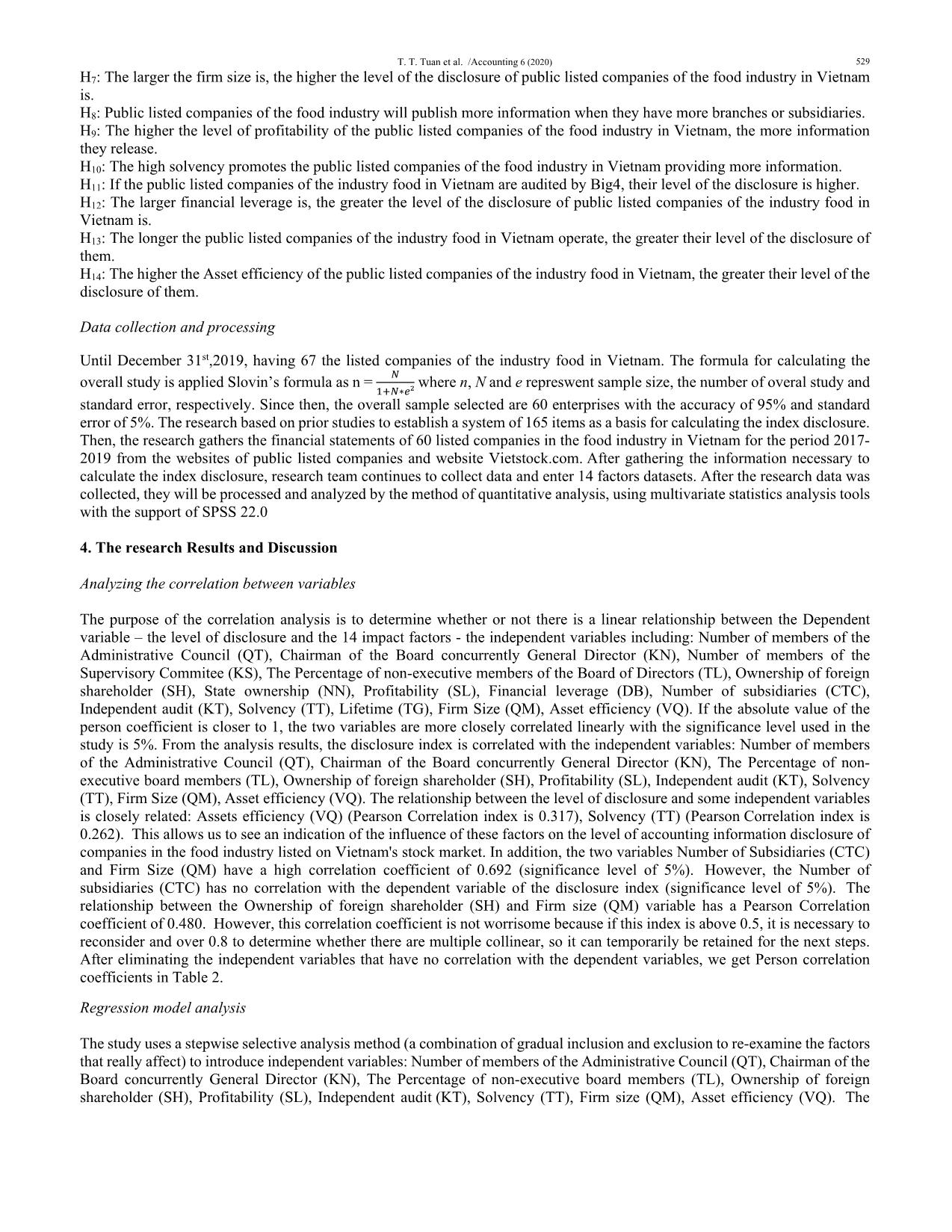

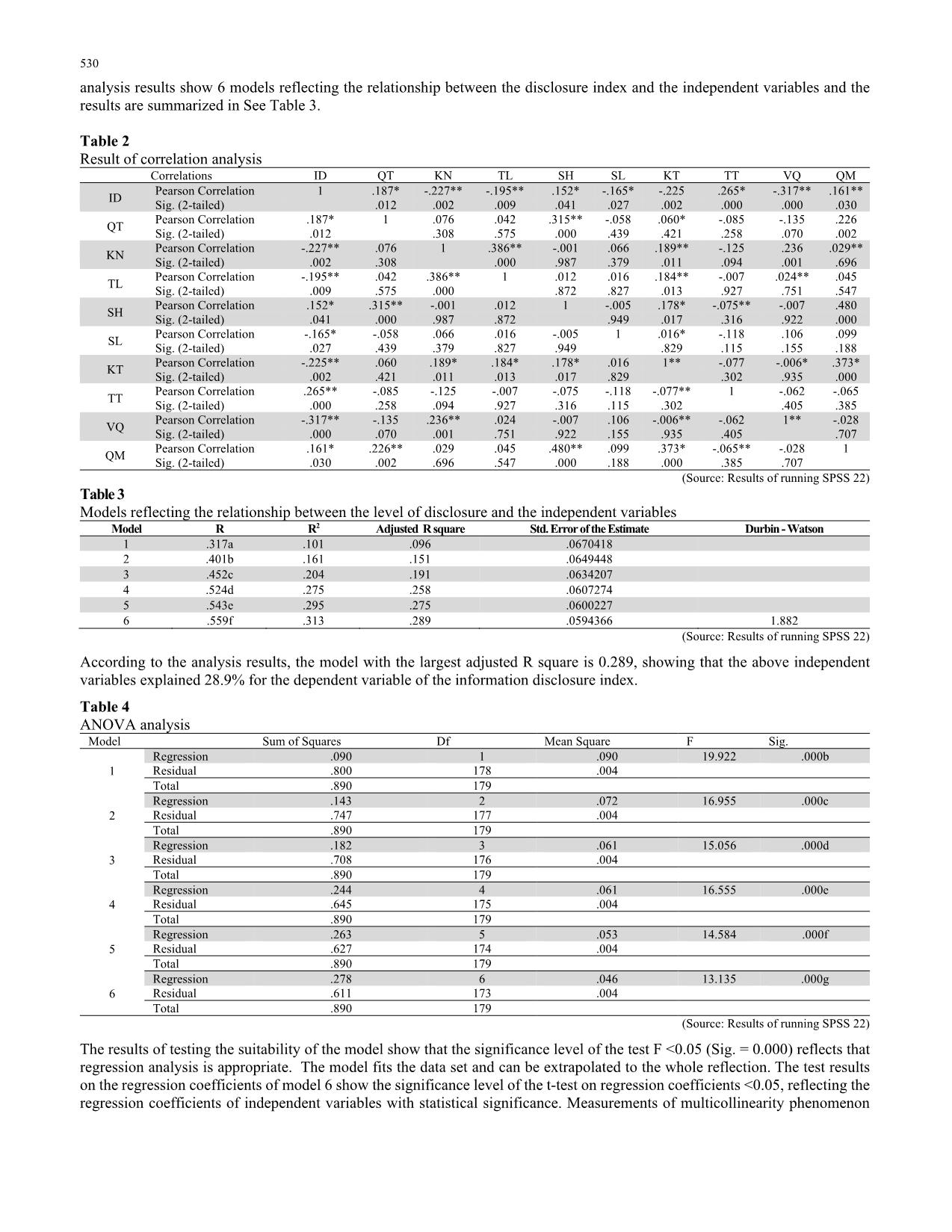

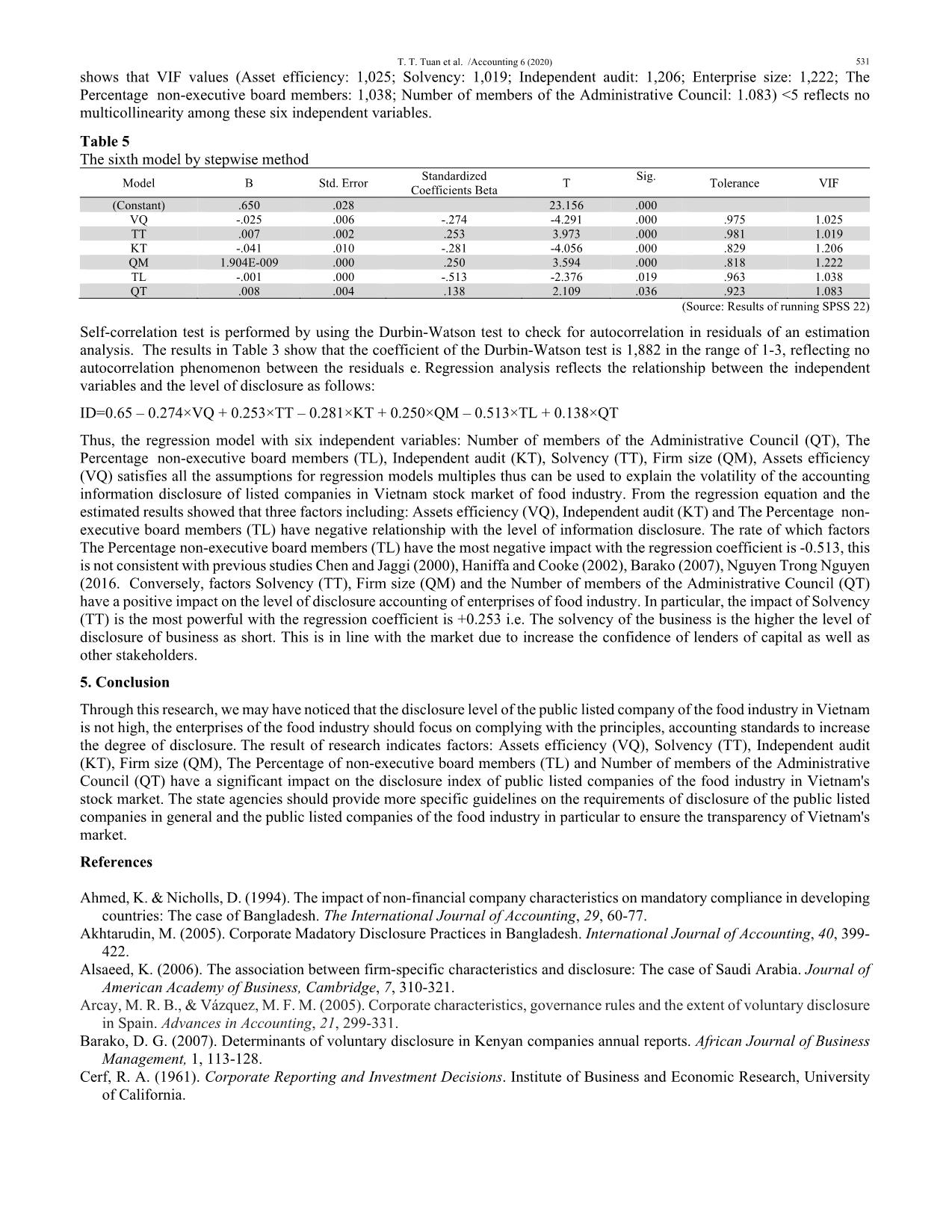

dependent audit (KT), Solvency (TT), Firm Size (QM), Asset efficiency (VQ). The relationship between the level of disclosure and some independent variables is closely related: Assets efficiency (VQ) (Pearson Correlation index is 0.317), Solvency (TT) (Pearson Correlation index is 0.262). This allows us to see an indication of the influence of these factors on the level of accounting information disclosure of companies in the food industry listed on Vietnam's stock market. In addition, the two variables Number of Subsidiaries (CTC) and Firm Size (QM) have a high correlation coefficient of 0.692 (significance level of 5%). However, the Number of subsidiaries (CTC) has no correlation with the dependent variable of the disclosure index (significance level of 5%). The relationship between the Ownership of foreign shareholder (SH) and Firm size (QM) variable has a Pearson Correlation coefficient of 0.480. However, this correlation coefficient is not worrisome because if this index is above 0.5, it is necessary to reconsider and over 0.8 to determine whether there are multiple collinear, so it can temporarily be retained for the next steps. After eliminating the independent variables that have no correlation with the dependent variables, we get Person correlation coefficients in Table 2. Regression model analysis The study uses a stepwise selective analysis method (a combination of gradual inclusion and exclusion to re-examine the factors that really affect) to introduce independent variables: Number of members of the Administrative Council (QT), Chairman of the Board concurrently General Director (KN), The Percentage of non-executive board members (TL), Ownership of foreign shareholder (SH), Profitability (SL), Independent audit (KT), Solvency (TT), Firm size (QM), Asset efficiency (VQ). The 530 analysis results show 6 models reflecting the relationship between the disclosure index and the independent variables and the results are summarized in See Table 3. Table 2 Result of correlation analysis Correlations ID QT KN TL SH SL KT TT VQ QM ID Pearson Correlation 1 .187* -.227** -.195** .152* -.165* -.225 .265* -.317** .161** Sig. (2-tailed) .012 .002 .009 .041 .027 .002 .000 .000 .030 QT Pearson Correlation .187* 1 .076 .042 .315** -.058 .060* -.085 -.135 .226 Sig. (2-tailed) .012 .308 .575 .000 .439 .421 .258 .070 .002 KN Pearson Correlation -.227** .076 1 .386** -.001 .066 .189** -.125 .236 .029** Sig. (2-tailed) .002 .308 .000 .987 .379 .011 .094 .001 .696 TL Pearson Correlation -.195** .042 .386** 1 .012 .016 .184** -.007 .024** .045 Sig. (2-tailed) .009 .575 .000 .872 .827 .013 .927 .751 .547 SH Pearson Correlation .152* .315** -.001 .012 1 -.005 .178* -.075** -.007 .480 Sig. (2-tailed) .041 .000 .987 .872 .949 .017 .316 .922 .000 SL Pearson Correlation -.165* -.058 .066 .016 -.005 1 .016* -.118 .106 .099 Sig. (2-tailed) .027 .439 .379 .827 .949 .829 .115 .155 .188 KT Pearson Correlation -.225** .060 .189* .184* .178* .016 1** -.077 -.006* .373* Sig. (2-tailed) .002 .421 .011 .013 .017 .829 .302 .935 .000 TT Pearson Correlation .265** -.085 -.125 -.007 -.075 -.118 -.077** 1 -.062 -.065 Sig. (2-tailed) .000 .258 .094 .927 .316 .115 .302 .405 .385 VQ Pearson Correlation -.317** -.135 .236** .024 -.007 .106 -.006** -.062 1** -.028 Sig. (2-tailed) .000 .070 .001 .751 .922 .155 .935 .405 .707 QM Pearson Correlation .161* .226** .029 .045 .480** .099 .373* -.065** -.028 1 Sig. (2-tailed) .030 .002 .696 .547 .000 .188 .000 .385 .707 (Source: Results of running SPSS 22) Table 3 Models reflecting the relationship between the level of disclosure and the independent variables Model R R2 Adjusted R square Std. Error of the Estimate Durbin - Watson 1 .317a .101 .096 .0670418 2 .401b .161 .151 .0649448 3 .452c .204 .191 .0634207 4 .524d .275 .258 .0607274 5 .543e .295 .275 .0600227 6 .559f .313 .289 .0594366 1.882 (Source: Results of running SPSS 22) According to the analysis results, the model with the largest adjusted R square is 0.289, showing that the above independent variables explained 28.9% for the dependent variable of the information disclosure index. Table 4 ANOVA analysis Model Sum of Squares Df Mean Square F Sig. 1 Regression .090 1 .090 19.922 .000b Residual .800 178 .004 Total .890 179 2 Regression .143 2 .072 16.955 .000c Residual .747 177 .004 Total .890 179 3 Regression .182 3 .061 15.056 .000d Residual .708 176 .004 Total .890 179 4 Regression .244 4 .061 16.555 .000e Residual .645 175 .004 Total .890 179 5 Regression .263 5 .053 14.584 .000f Residual .627 174 .004 Total .890 179 6 Regression .278 6 .046 13.135 .000g Residual .611 173 .004 Total .890 179 (Source: Results of running SPSS 22) The results of testing the suitability of the model show that the significance level of the test F <0.05 (Sig. = 0.000) reflects that regression analysis is appropriate. The model fits the data set and can be extrapolated to the whole reflection. The test results on the regression coefficients of model 6 show the significance level of the t-test on regression coefficients <0.05, reflecting the regression coefficients of independent variables with statistical significance. Measurements of multicollinearity phenomenon T. T. Tuan et al. /Accounting 6 (2020) 531 shows that VIF values (Asset efficiency: 1,025; Solvency: 1,019; Independent audit: 1,206; Enterprise size: 1,222; The Percentage non-executive board members: 1,038; Number of members of the Administrative Council: 1.083) <5 reflects no multicollinearity among these six independent variables. Table 5 The sixth model by stepwise method Model B Std. Error Standardized Coefficients Beta T Sig. Tolerance VIF (Constant) .650 .028 23.156 .000 VQ -.025 .006 -.274 -4.291 .000 .975 1.025 TT .007 .002 .253 3.973 .000 .981 1.019 KT -.041 .010 -.281 -4.056 .000 .829 1.206 QM 1.904E-009 .000 .250 3.594 .000 .818 1.222 TL -.001 .000 -.513 -2.376 .019 .963 1.038 QT .008 .004 .138 2.109 .036 .923 1.083 (Source: Results of running SPSS 22) Self-correlation test is performed by using the Durbin-Watson test to check for autocorrelation in residuals of an estimation analysis. The results in Table 3 show that the coefficient of the Durbin-Watson test is 1,882 in the range of 1-3, reflecting no autocorrelation phenomenon between the residuals e. Regression analysis reflects the relationship between the independent variables and the level of disclosure as follows: ID=0.65 – 0.274×VQ + 0.253×TT – 0.281×KT + 0.250×QM – 0.513×TL + 0.138×QT Thus, the regression model with six independent variables: Number of members of the Administrative Council (QT), The Percentage non-executive board members (TL), Independent audit (KT), Solvency (TT), Firm size (QM), Assets efficiency (VQ) satisfies all the assumptions for regression models multiples thus can be used to explain the volatility of the accounting information disclosure of listed companies in Vietnam stock market of food industry. From the regression equation and the estimated results showed that three factors including: Assets efficiency (VQ), Independent audit (KT) and The Percentage non- executive board members (TL) have negative relationship with the level of information disclosure. The rate of which factors The Percentage non-executive board members (TL) have the most negative impact with the regression coefficient is -0.513, this is not consistent with previous studies Chen and Jaggi (2000), Haniffa and Cooke (2002), Barako (2007), Nguyen Trong Nguyen (2016. Conversely, factors Solvency (TT), Firm size (QM) and the Number of members of the Administrative Council (QT) have a positive impact on the level of disclosure accounting of enterprises of food industry. In particular, the impact of Solvency (TT) is the most powerful with the regression coefficient is +0.253 i.e. The solvency of the business is the higher the level of disclosure of business as short. This is in line with the market due to increase the confidence of lenders of capital as well as other stakeholders. 5. Conclusion Through this research, we may have noticed that the disclosure level of the public listed company of the food industry in Vietnam is not high, the enterprises of the food industry should focus on complying with the principles, accounting standards to increase the degree of disclosure. The result of research indicates factors: Assets efficiency (VQ), Solvency (TT), Independent audit (KT), Firm size (QM), The Percentage of non-executive board members (TL) and Number of members of the Administrative Council (QT) have a significant impact on the disclosure index of public listed companies of the food industry in Vietnam's stock market. The state agencies should provide more specific guidelines on the requirements of disclosure of the public listed companies in general and the public listed companies of the food industry in particular to ensure the transparency of Vietnam's market. References Ahmed, K. & Nicholls, D. (1994). The impact of non-financial company characteristics on mandatory compliance in developing countries: The case of Bangladesh. The International Journal of Accounting, 29, 60-77. Akhtarudin, M. (2005). Corporate Madatory Disclosure Practices in Bangladesh. International Journal of Accounting, 40, 399- 422. Alsaeed, K. (2006). The association between firm-specific characteristics and disclosure: The case of Saudi Arabia. Journal of American Academy of Business, Cambridge, 7, 310-321. Arcay, M. R. B., & Vázquez, M. F. M. (2005). Corporate characteristics, governance rules and the extent of voluntary disclosure in Spain. Advances in Accounting, 21, 299-331. Barako, D. G. (2007). Determinants of voluntary disclosure in Kenyan companies annual reports. African Journal of Business Management, 1, 113-128. Cerf, R. A. (1961). Corporate Reporting and Investment Decisions. Institute of Business and Economic Research, University of California. 532 Chen, C., & Courtenay, M. (2006). Board composition, regulatory regime and voluntary disclosure. The International Journal of Accounting, 41, 262-289. Cheung, S. Y. L., Connelly, J. T., & Limpaphayom, P. (2007). Determinants of corporate disclosure and transparency: Evidence from Hong Kong and Thailand. International Corporate Responsibility Series, 3, 313-342. Cooke, T. E. (1989). Disclosure in the corporate annual report of Swedish companies, Accounting and Business Research, 19, 113. Cooke, T. E. (1992). The impact of size, Stock Market Listing and Industry Type on Disclosure in the Annual Reports of Japanese Listed Corporations. Accounting and Business Research, 22, 229. Courtis, J. K. (1978). Annual report disclosure in New Zealand: Analysis of selected corporate attribute. Deangelo, L. E. (1981). Auditor Independence “Low Balling” an Disclosure Regulation. Journal of Accounting and Economics, 3, 111-179. Dang Thi Bich Ngoc. (2018). Research published accounting information of companies listed on Vietnam's stock market. Doctoral thesis. Financial institutions. Doan nguyen trang phuong (2010). Factors affecting the level of information disclosure of companies listed on Vietnam's stock market. 35 years of development and integration of the University of Economics, University of Danang. Da Nang University of Economics. Fama, E. F. & Jensen, M. C. (1983). Agency Problems and Residual Claims. Journal of Law and Economics, 26, 327-349. Firth, M. (1979). Impact of size, stock market listing and auditors on voluntary disclosure in corporate annual reports. Accounting and Business Research, 9, 273-280. Sui, F. W. (2001). Accounting System and Information Disclosure. KPMG, Shanghai. Franks, J., Mayer, C., & Renneboog, L. (2001). Who disciplines management in poorly performing companies?. Journal of Financial Intermediation, 10(3-4), 209-248. Haniffa, R. M., & Cooke, T. E. (2002). Culture, corporate governance and disclosure in Malaysian corporations. Abacus, 38(3), 317-349. Lakhal, F. (2005). Voluntary earnings disclosures and corporate governance: Evidence from France. Review of Accounting and Finance, 4, 64-85. Le Thi My Hanh (2015). Transparent financial information of the Company listed on the stock market of Vietnam. Doctoral thesis. University of Economics Ho Chi Minh City. Le Thi Truc Loan (2012). The study of the level of risk disclosure in the annual report of the petroleum enterprises listed on the Hochiminh City Stock Exchange. Da Nang University of Economics. Malone, D., Fries, C. & Jones, T. (1993). An empirical investigation of the extent of corporate financial disclosure in the oil and gas industry. Journal of Accounting, Auditing & Finance, 8, 249. Marston, C. & Polei, A. (2004). Corporate Reporting on The Internet by German Companies. International Journal of Accounting Information Systems, 5, 285-311. Mcmulen, D. A. (1996). Audit committee performance: an investigation of the consequences associated with audit committee. Auditing: A Journal of Practice & Theory, 15, 87-96,98,100-103. Nguyen Cong Phuong, Vo Hong Tam, Huynh Ngoc Quang & Vo Thi Thuy Trang. (2012). Research Disclosure of information in financial statements of companies listed on the Ho Chi Minh City Stock Exchange, Economics University Danang. Nguyen Huu Cuong & Le Thi Ngoc Bao. (2018). The study of factors affecting the level of disclosure of the consumer sector enterprises listed on Vietnam's stock market. Economic Research. Vietnam Institute of Economics 4/2018, No. 4 (479), 33- 41. Nguyen Thi Thanh Phuong (2012). Analysis of the factors affecting the level of disclosure of information in the financial statements of enterprises listed in the Ho Chi Minh Stock Exchange. Master thesis. The University of Danang. Nguyen Trong Nguyen (2015). The impact of corporate governance on the quality of information in the financial statements of listed companies in Vietnam. Doctoral thesis. University of Economics, Ho Chi Minh City. Singhvi, S. S., & Desai, H. B. (1971). An empirical analysis of the quality of corporate financial disclosure. The Accounting Review, 46(1), 129-138. Urquiza, F. B., Navarro, M. C. A., & Trombetta, M. (2009). Disclosure indices design: does it make a difference?. Revista de Contabilidad-Spanish Accounting Review, 12(2), 253-278. Wallace, R. S. & Naser, K. 1995. Firm specific determinants of comprehensive of mandatory disclosure in the corporate annual reports of firms listed on the stock exchange of Hong Kong. Journal of Accounting and Public Policy, 14, 311-368. © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

the_effect_of_factors_on_degree_of_disclosing_accounting_inf.pdf

the_effect_of_factors_on_degree_of_disclosing_accounting_inf.pdf