The effect of enterprise risk management on firm value: Evidence from Vietnam industry listed enterprises

This study considers 77 Vietnam industry listed enterprises from 2012 to 2018 as research samples to

establish indicators for evaluating the relationship between Enterprise risk management (ERM) and

firm value among industry enterprises in Vietnam. International economic integration not only opens

up many business opportunities for businesses but also brings many challenges for Vietnamese

businesses. One of the challenges is that the financial risks to businesses are increasingly diverse in

type and sophistication. Our results show that the implementation of ERM in the previous year has

strong positive relationship with firm value. These findings support the recent pressure on businesses

to adopt more comprehensive risk management systems.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Tóm tắt nội dung tài liệu: The effect of enterprise risk management on firm value: Evidence from Vietnam industry listed enterprises

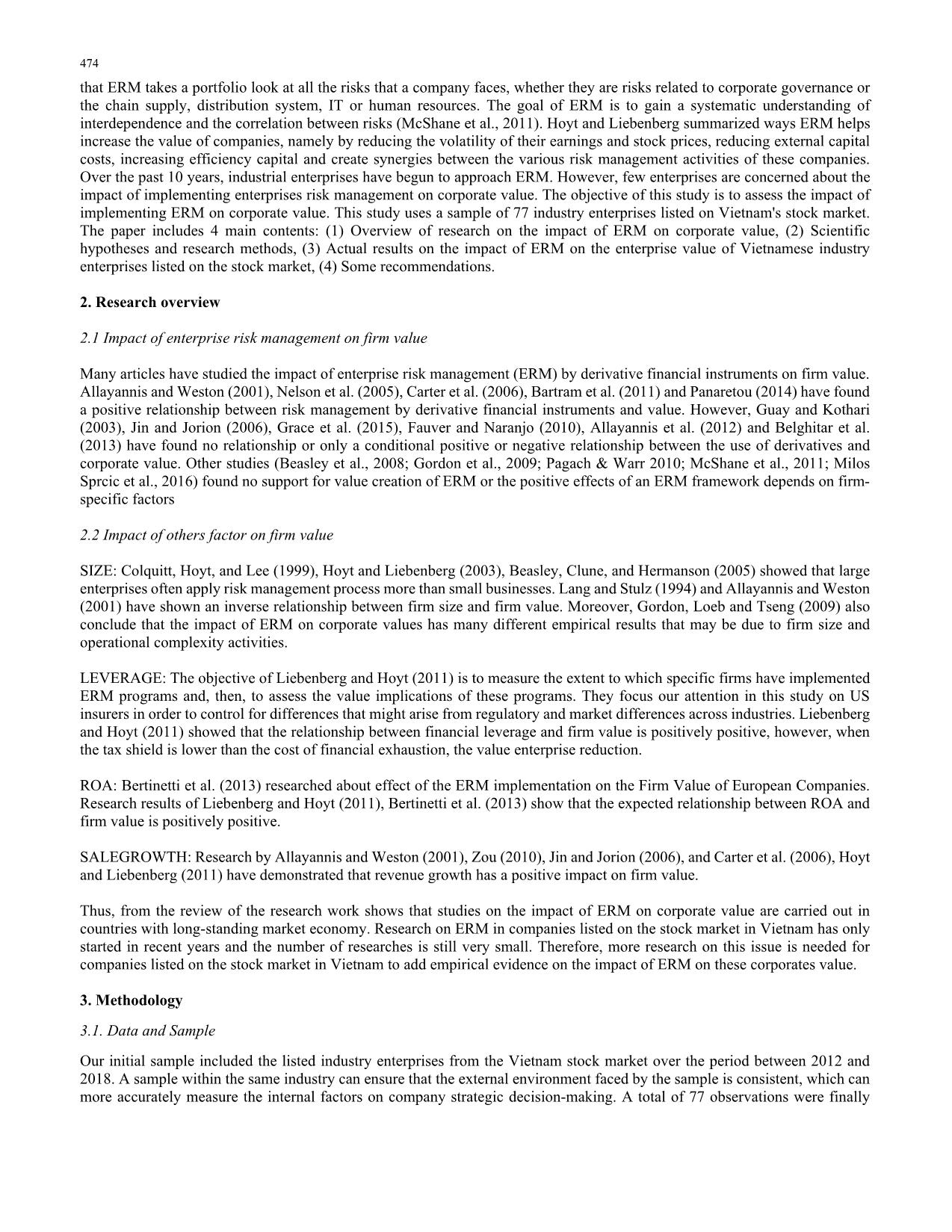

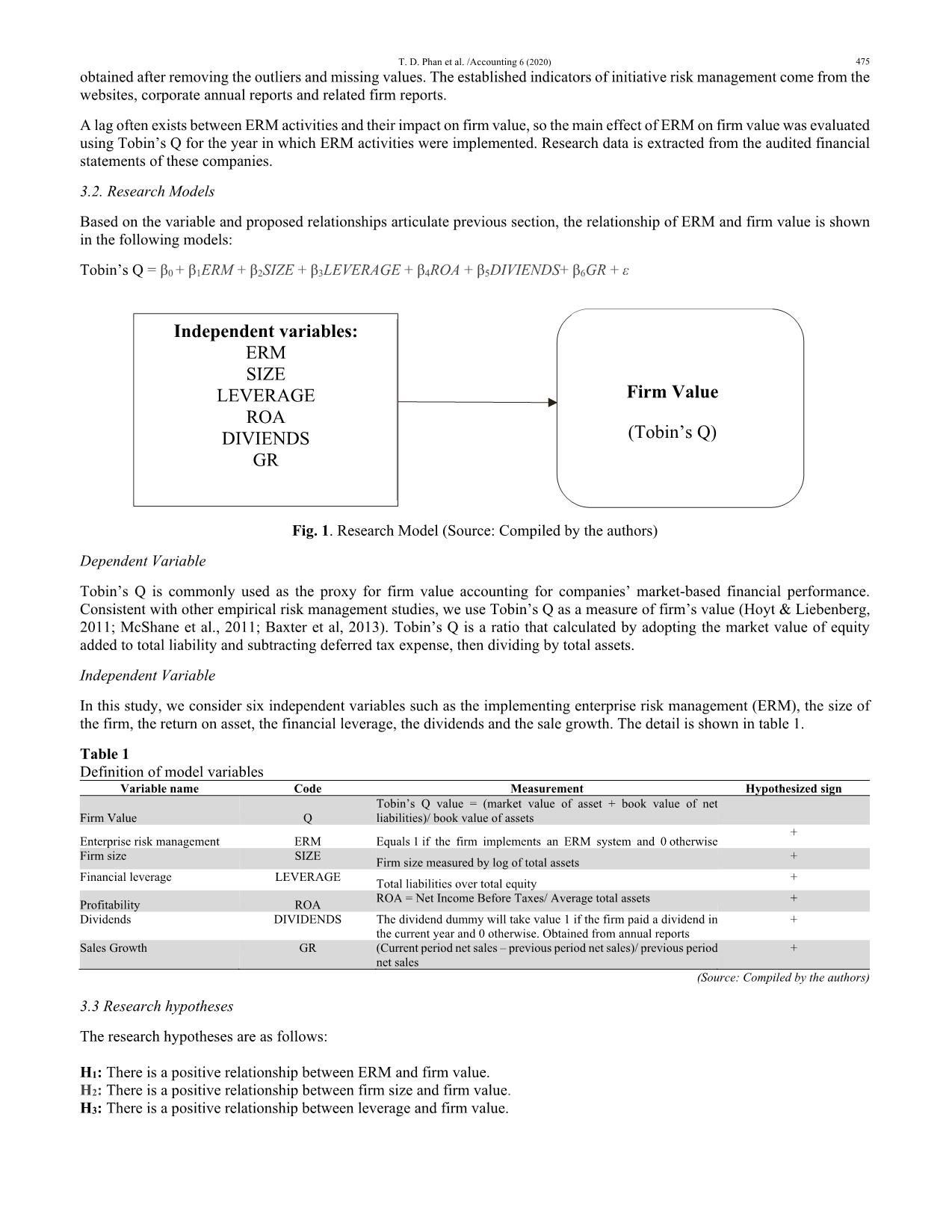

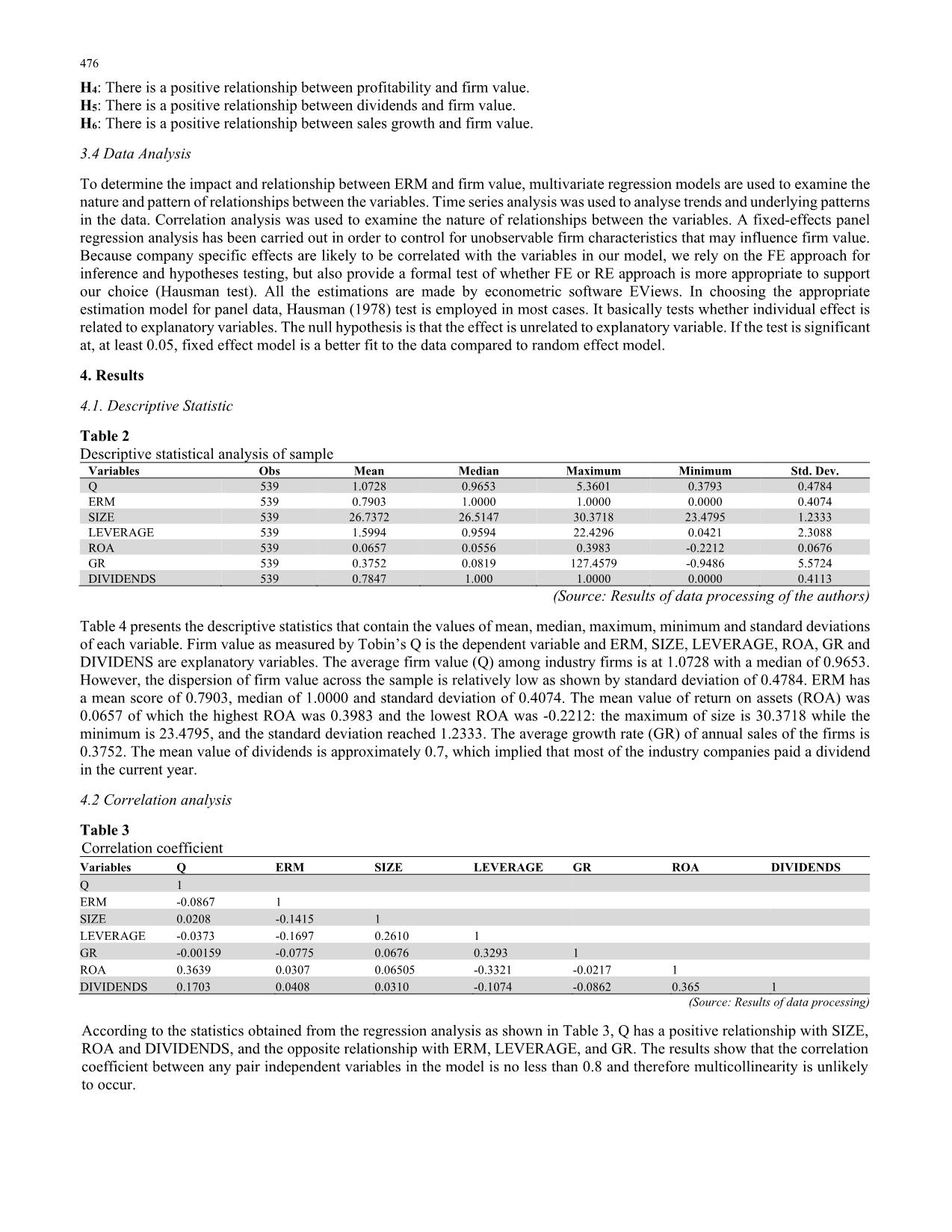

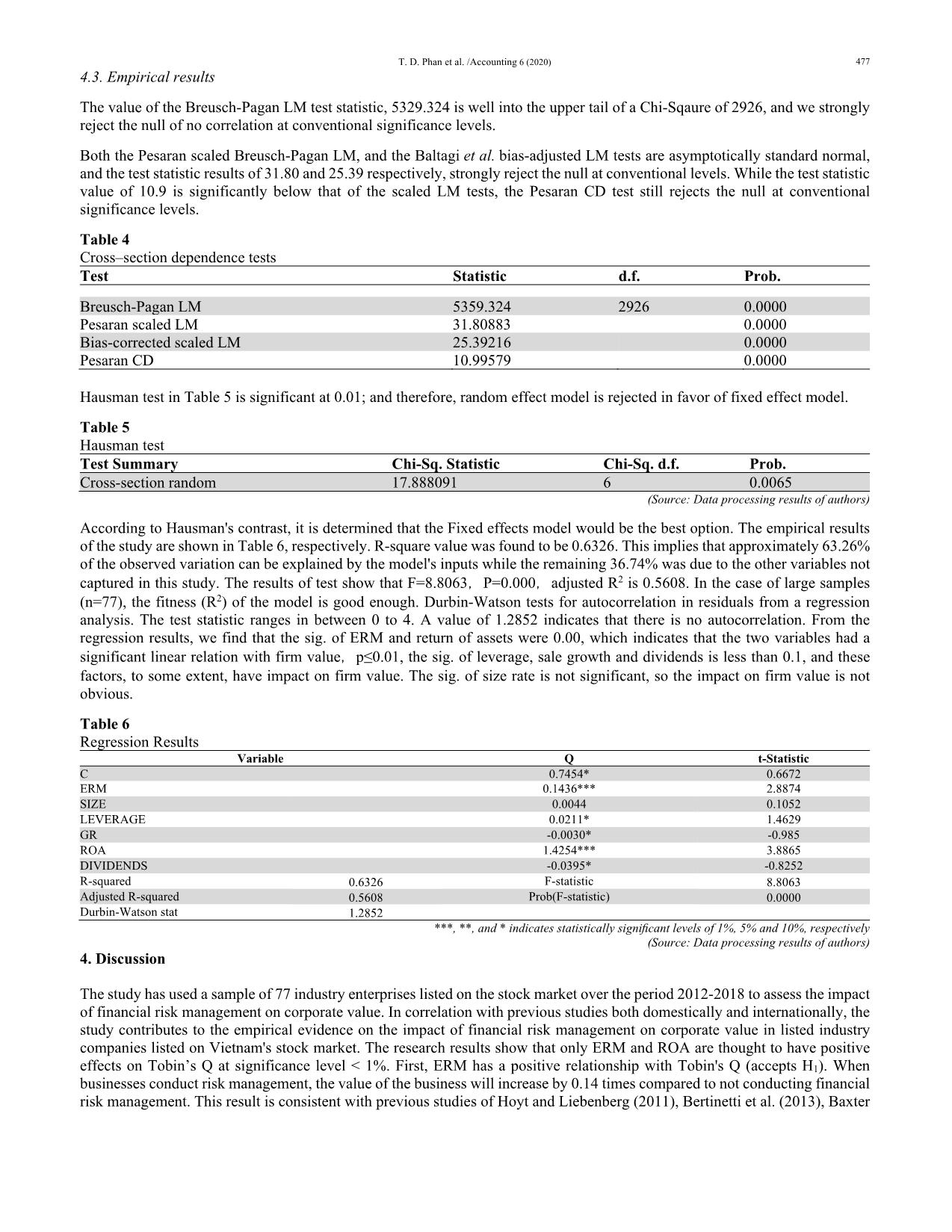

ERM -0.0867 1 SIZE 0.0208 -0.1415 1 LEVERAGE -0.0373 -0.1697 0.2610 1 GR -0.00159 -0.0775 0.0676 0.3293 1 ROA 0.3639 0.0307 0.06505 -0.3321 -0.0217 1 DIVIDENDS 0.1703 0.0408 0.0310 -0.1074 -0.0862 0.365 1 (Source: Results of data processing) According to the statistics obtained from the regression analysis as shown in Table 3, Q has a positive relationship with SIZE, ROA and DIVIDENDS, and the opposite relationship with ERM, LEVERAGE, and GR. The results show that the correlation coefficient between any pair independent variables in the model is no less than 0.8 and therefore multicollinearity is unlikely to occur. T. D. Phan et al. /Accounting 6 (2020) 477 4.3. Empirical results The value of the Breusch-Pagan LM test statistic, 5329.324 is well into the upper tail of a Chi-Sqaure of 2926, and we strongly reject the null of no correlation at conventional significance levels. Both the Pesaran scaled Breusch-Pagan LM, and the Baltagi et al. bias-adjusted LM tests are asymptotically standard normal, and the test statistic results of 31.80 and 25.39 respectively, strongly reject the null at conventional levels. While the test statistic value of 10.9 is significantly below that of the scaled LM tests, the Pesaran CD test still rejects the null at conventional significance levels. Table 4 Cross–section dependence tests Test Statistic d.f. Prob. Breusch-Pagan LM 5359.324 2926 0.0000 Pesaran scaled LM 31.80883 0.0000 Bias-corrected scaled LM 25.39216 0.0000 Pesaran CD 10.99579 0.0000 Hausman test in Table 5 is significant at 0.01; and therefore, random effect model is rejected in favor of fixed effect model. Table 5 Hausman test Test Summary Chi-Sq. Statistic Chi-Sq. d.f. Prob. Cross-section random 17.888091 6 0.0065 (Source: Data processing results of authors) According to Hausman's contrast, it is determined that the Fixed effects model would be the best option. The empirical results of the study are shown in Table 6, respectively. R-square value was found to be 0.6326. This implies that approximately 63.26% of the observed variation can be explained by the model's inputs while the remaining 36.74% was due to the other variables not captured in this study. The results of test show that F=8.8063,P=0.000,adjusted R2 is 0.5608. In the case of large samples (n=77), the fitness (R2) of the model is good enough. Durbin-Watson tests for autocorrelation in residuals from a regression analysis. The test statistic ranges in between 0 to 4. A value of 1.2852 indicates that there is no autocorrelation. From the regression results, we find that the sig. of ERM and return of assets were 0.00, which indicates that the two variables had a significant linear relation with firm value,p≤0.01, the sig. of leverage, sale growth and dividends is less than 0.1, and these factors, to some extent, have impact on firm value. The sig. of size rate is not significant, so the impact on firm value is not obvious. Table 6 Regression Results Variable Q t-Statistic C 0.7454* 0.6672 ERM 0.1436*** 2.8874 SIZE 0.0044 0.1052 LEVERAGE 0.0211* 1.4629 GR -0.0030* -0.985 ROA 1.4254*** 3.8865 DIVIDENDS -0.0395* -0.8252 R-squared 0.6326 F-statistic 8.8063 Adjusted R-squared 0.5608 Prob(F-statistic) 0.0000 Durbin-Watson stat 1.2852 ***, **, and * indicates statistically significant levels of 1%, 5% and 10%, respectively (Source: Data processing results of authors) 4. Discussion The study has used a sample of 77 industry enterprises listed on the stock market over the period 2012-2018 to assess the impact of financial risk management on corporate value. In correlation with previous studies both domestically and internationally, the study contributes to the empirical evidence on the impact of financial risk management on corporate value in listed industry companies listed on Vietnam's stock market. The research results show that only ERM and ROA are thought to have positive effects on Tobin’s Q at significance level < 1%. First, ERM has a positive relationship with Tobin's Q (accepts H1). When businesses conduct risk management, the value of the business will increase by 0.14 times compared to not conducting financial risk management. This result is consistent with previous studies of Hoyt and Liebenberg (2011), Bertinetti et al. (2013), Baxter 478 et al. (2013), Eckles et al. (2014), and Farrell and Gallagher (2015). If businesses conduct financial risk management, it will contribute to good control of financial risk. This has a positive impact on the performance of the business and its value. Second, there is no indirect effect of firm size on the firm value of industry firms, so the hypothesis H2 is rejected. A big asset value of a firm does not guarantee that investor’s impression towards the firm will increase. Investors do not think of firm size as a base of investment decision. The study done by Nwamaka and Ezeabasili (2017) showed that the firms with big assets do not always share profit to the shareholder. Firm which retains the profit rather than share it as dividend might affect the stock price and its firm value. The results of this study are in line with the finding of Setiadharma and Machali (2017), but in contrast to the study result of Liebenberg and Hoyt (2003), and Allayannis and Weston (2001). Third, there is no correlation between debt and firm value (H3 is not acceptable). This result is inconsistent with previous studies. Liebenberg and Hoyt (2011) showed that the relationship between financial leverage and firm value is positive, however, when the tax shield is lower than the cost of financial exhaustion, the firm value reduction. This can be explained by the structure of debt of industrial enterprises in the state of imbalance, current debt is mainly short-term debt, long -term debt ratio is still very low. Fourth, ROA has a positive relationship with Tobin’s Q (accepting H4). When the ROA is increased by one unit, firm value increases by 1.42 times under the condition of other factors unchanged. This result is consistent with the studies of Bertinetti et al. (2013). Good business profitability is an important factor that positively influences firm value. Fifth, this analysis shows that leverage mostly does not have any significant relationship with examined variables (H5 is not acceptable). The result is in agreement with Tas and Ede (2018) and Modigliani and Miller (1958) findings that leverage is unrelated to firm value; and Millers (1977) hypothesis which states that the capital structure of a firm does not impact on its market value. For further study, we need to compare leverage of our industry firms and global peers. Also, we may extend our data since it is limited with only 7 years in this study. Sixth, there is no correlation between sale growth and firm value (H6 is rejected). Jang and Pack (2011) implied that profit creates growth but growth impedes profitability. This conclusion is consistent with the results of Anton (2018), Jang and Pack (2011), but in contrast to the study result of Allayannis and Weston (2001), Zou (2010), Jin and Jorion (2006), and Carter et al. (2006). 5. Conclusion This study has attempted to examine the impact of ERM implementation on firm value, measured by the Tobin’s Q. The study has employed fixed effect dynamic panel data to examine the valuation effect of ERM. Our findings have supported our prediction that ERM implementation is likely to affect firm performance adversely. The result can help industry businesses explain the impact of financial risk management on corporate value, thereby helping corporate executives to make financial decisions, production and business projects accordingly to maximize the value of the business. Industry enterprises need to pay special attention to the management of financial risks in enterprises. Industrial enterprises listed on the stock market of Vietnam performing financial risk management are still heavy in formality in the financial statements, but have not really paid attention to the effectiveness of financial management, results of financial risk management in the enterprise. Therefore, the impact of financial risk management on corporate value is not high. Acknowledgment The authors would like to thank the anonymous referees for constructive comments on earlier version of this paper. References Allayannis, G., & Weston, J. P. (2001). The use of foreign currency derivatives and firm value. The Review of Financial Studies, 14, 243–276. Allayannis, G., Lel, U., & Miller, D. P. (2012). The use of foreign currency derivatives, corporate governance, and firm value around the world. Journal of International Economics, 87(1), 65–79. Anton, S. G. (2018). The impact of enterprise risk management on firm value: Empirical evidence from romanian non-financial firms. Inzinerine Ekonomika-Engineering Economics, 29(2), 151-157. Aretz, K., Bartram, S. M., & Dufey, G. (2007). Why hedge? Rationales for corporate hedging and value implications. Journal of Risk Finance, 8(5), 434–449. Bartram, S. M., Brown, G. W., & Conrad, J. (2011). The effects of derivatives on firm risk and value. Journal of Financial and Quantitative Analysis, 46(4), 967–999. Baxter, R., Bedard, J. C., Hoitash, R., & Yezegel, A. (2013). Enterprise risk management program quality: Determinants, value relevance, and the financial crisis. Contemporary Accounting Research, 30, 1264–1295. Beasley, M. S., Pagach, D., & Warr, R. (2008). Information conveyed in hiring announcements of senior executives overseeing enterprise-wide risk management processes. Journal of Accounting, Auditing and Finance, 23(3), 311–332. Belghitar, Y., Clark, E., & Salma, M. (2013). Foreign currency derivative use and shareholder value. International Review of Financial Analysis, 29, 283–293. Bertinetti, G. S., Cavezzali, E., & Gardenal, G. (2013). The Effect of the Enterprise Risk Management Implementation on the T. D. Phan et al. /Accounting 6 (2020) 479 Firm Value of European Companies. Working Paper No. 10, Università Ca' Foscari Venezia, Italy. Bessembinder, H. (1991). Forward contracts and firm value: investment incentive and contracting effects. Journal of Financial and Quantitative Analysis, 26, 519–532. Bromiley, P., McShane, M., Nair, A., & Rustambekov, E. (2015). Enterprise risk management: Review, critique, and research directions. Long Range Planning, 48(4), 265-276. Carter, D. A., Rogers, D. A., & Simkins, B. J. (2006). Does hedging affect firm value? Evidence from the US airline industry. Financial Management, 35, 53–86. Colquitt, L. L., Hoyt, R. E., & Lee, R. B. (1999). Integrated risk management and the role of the risk manager. Risk Management and Insurance Review, 2(3), 43-61. Eckles, D. I., Hoyt, R. E., & Miller, S. M. (2014). The impact of enterprise risk management on the marginal cost of reducing risk: Evidence from the insurance industry. Journal of Banking and Finance, 43, 247–261. Farrell, M., & Gallagher, R. (2015). The Valuation Implications of Enterprise Risk Management Maturity. Journal Risk and Insurance, 82(3), 625–657. Fauver, L., & Naranjo, A. (2010). Derivative usage and firm value: The influence of agency costs and monitoring problems. Journal of Corporate Finance, 16(5), 719–735. Gordon, L. A., Loeb, M. P., & Tseng, C. Y. (2009). Enterprise risk management and firm performance: A contingency perspective. Journal of Accounting and Public Policy, 28(4), 301–327. Grace, M. F., Leverty, J. T., Phillips, R. D., & Shimpi, P. (2015). The value of investing in enterprise risk management. The Journal of Risk and Insurance, 82(2), 289–316. Guay, W., & Kothari, S. P. (2003). How much do firms hedge with derivatives?. Journal of Financial Economics, 80, 423– 461. Hoyt, R., & Liebenberg, A. (2011). The value of enterprise risk management. Journal of Risk and Insurance, 78(4), 795– 822. Hoyt, R., & Liebenberg, A. (2015). Evidence of the value of enterprise risk management. Journal of Applied Corporate Finance, 27(1), 41–47. Jang, S. S., & Park, K. (2011). Inter-relationship between firm growth and profitability. International Journal of Hospitality Management, 30(4), 1027-1035. Jin, Y., & Jorion, P. (2006). Firm value and hedging: Evidence from U.S. oil and gas producers. The Journal of Finance, 61, 893-919. Lang, L. H., & Stulz, R. M. (1994). Tobin's q, corporate diversification, and firm performance. Journal of Political Economy, 102(6), 1248-1280. McShane, M., Nair, A., & Rustambekov, E. (2011). Does enterprise risk management increase firm value?. Journal of Accounting. Auditing and Finance, 26(4), 641–658. Milos Sprcic, D., Mesin Zagar, M., Sevic, Z., & Marc, M. (2016). Does enterprise risk management influence market value– A long-term perspective. Risk Management, 18(2/3), 18–65. Modigliani, F., & Miller, M. H. (1958). The cost of capital, corporation finance and the theory of investment. American Economic Review, 48(3), 261–297. Nance, D. R., Smith Jr., C. W., & Smithson, C. W. (1993). On the determinants of corporate hedging. Journal of Finance, 48, 267–284. Nelson, J., Moffitt, J. S., & Affleck-Graves, J. (2005). The impact of hedging on the market value of equity. Journal of Corporate Finance, 11, 851–881. Nocco, B., & Stulz, R. (2006). Enterprise risk management: Theory and practice. Journal of Applied Corporate Finance, 18(4), 8–20. Nwamaka, O. C., & Ezeabasili, V. (2017). Effect of dividend policies on firm value: Evidence from quoted firms in Nigeria. International Journal of Management Excellence, 8(2), 956-967. Panaretou, A. (2014). Corporate Risk Management and Firm Value: Evidence from the UK Market. The European Journal of Finance, 20(12), 1161–1186. Pagach, D. P., & Warr, R. S. (2010). The effects of enterprise risk management on firm performance. Working Paper, Social Science Research Network. Available at SSRN. Setiadharma, S., & Machali, M. (2017). The effect of asset structure and firm size on firm value with capital structure as intervening variable. Journal of Business & Financial Affairs, 6(4), 1-5. Smith, C. W., & Stulz, R. (1985). The determinants of firms' hedging policies. Journal of Financial and Quantitative Analysis, 20(14), 391–405. Tas, O., & Ede, S. (2018). The effect of capital structure on the value of firm. A study of Turkey non-metal product index. PressAcademia Procedia, 8(1), 34-37. Zou, H. (2010). Hedging affecting firm value via financing and investment: evidence from property insurance use. Financial Management, 39(3), 965-996. 480 © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

the_effect_of_enterprise_risk_management_on_firm_value_evide.pdf

the_effect_of_enterprise_risk_management_on_firm_value_evide.pdf