Political ties and performance of multinational corporations in Vietnamese emerging market

Local governments play a key role in attracting foreign investment and the operations of multinational

corporations (MNCs) in Vietnam, yet limited research has focused on the emerging issues in this

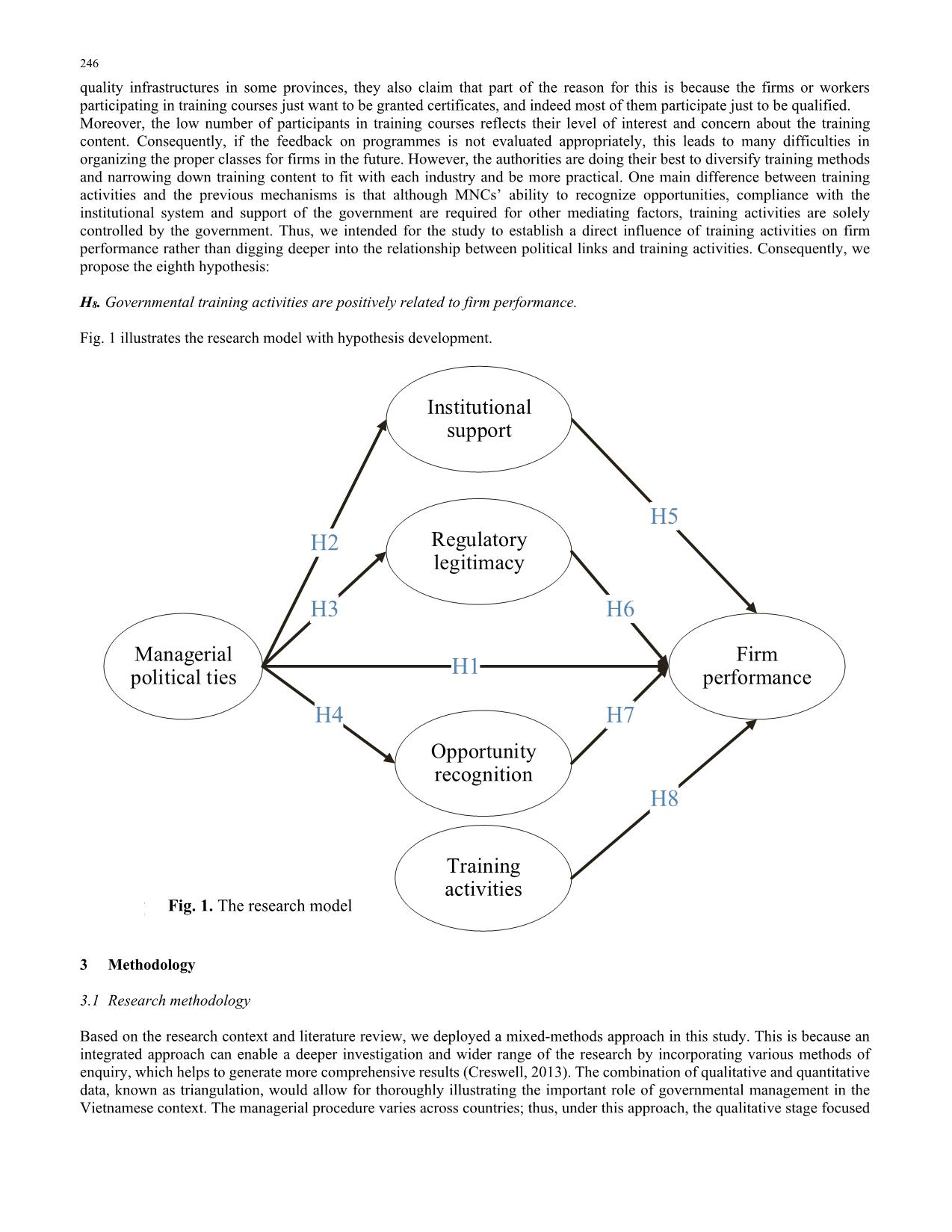

context. This study adopted a mixed-methods approach. Representatives of MNCs in Ho Chi Minh

City and four provinces participated in this research. Partial least squares structural equation modelling

was used to analyze the data and test the model. The results reveal both direct and indirect relationships

between political ties, institutional support, opportunity recognition and firm performance.

Recommendations for the local governments are discussed in detail.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

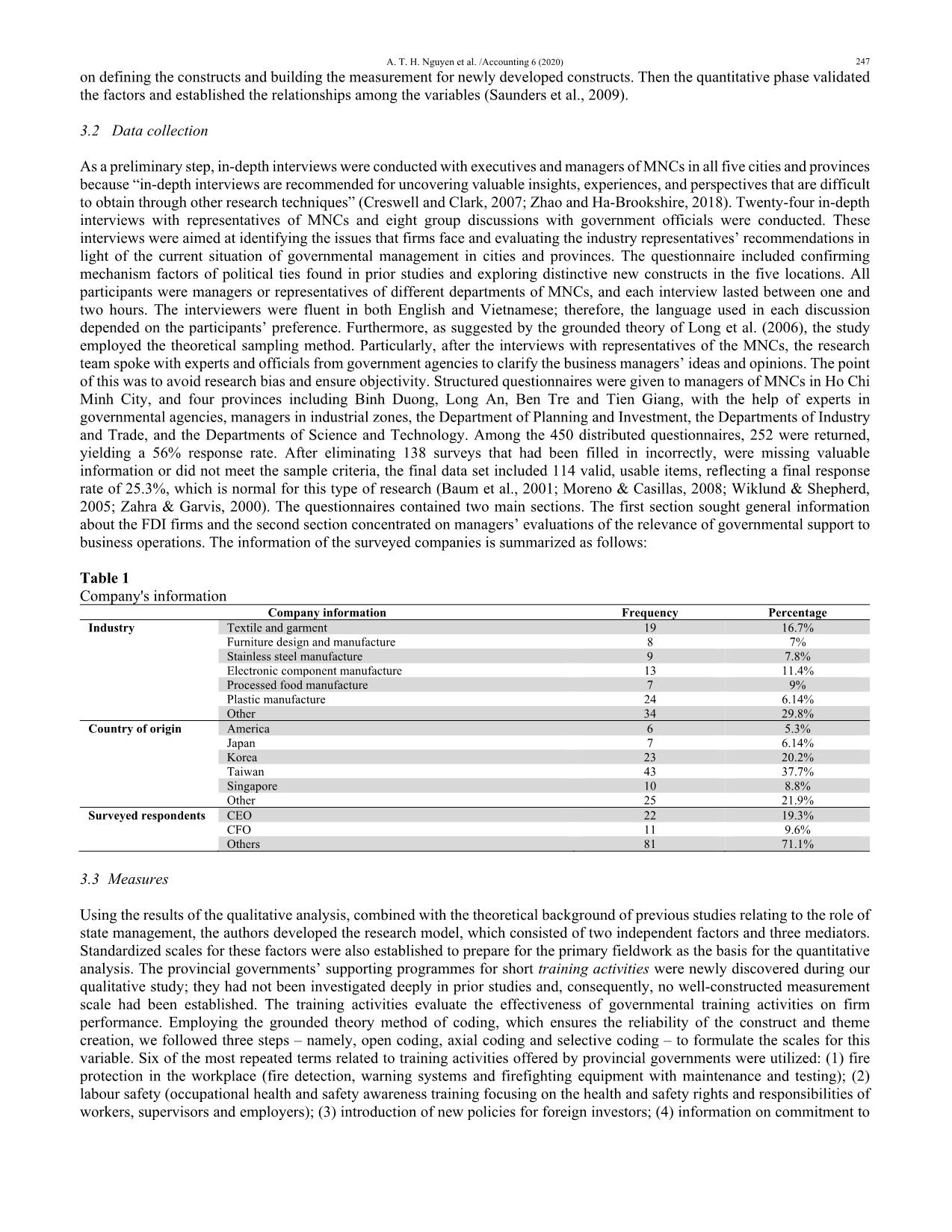

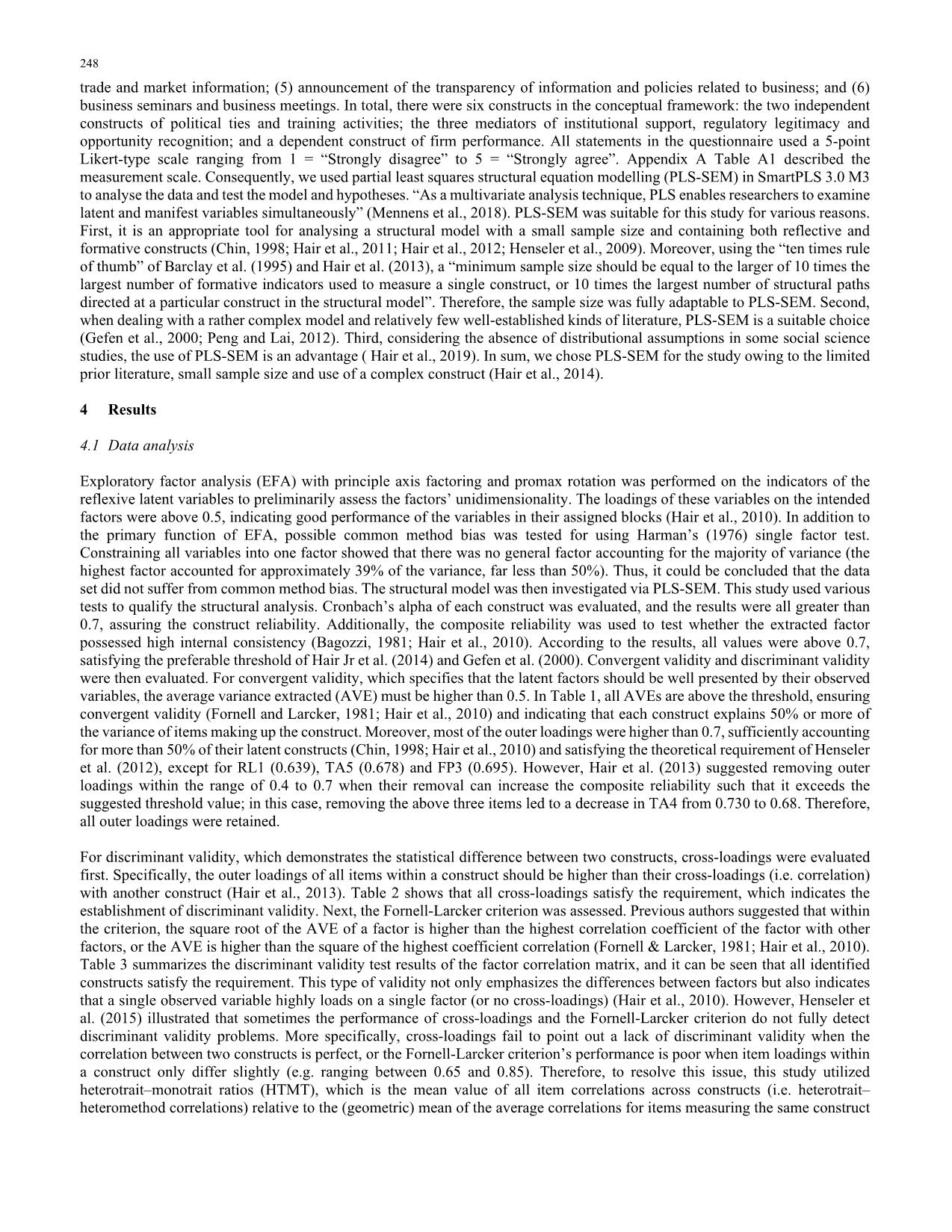

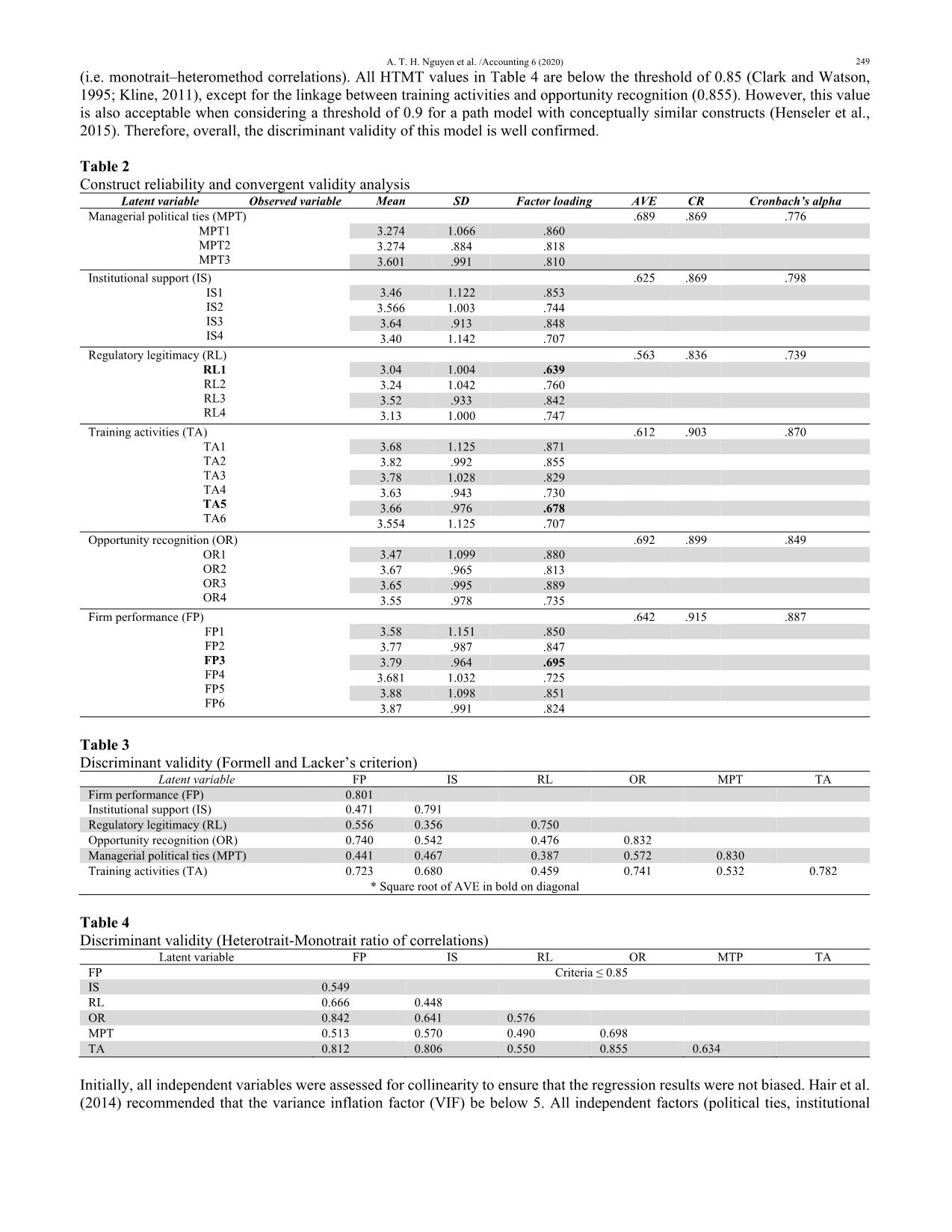

Tóm tắt nội dung tài liệu: Political ties and performance of multinational corporations in Vietnamese emerging market

, & Pomfret, R. (2011). Technology spillovers from foreign direct investment in Vietnam: Horizontal or vertical spillovers? Journal of the Asia Pacific Economy, 16(2), 183–201. https://doi.org/10.1080/13547860.2011.564746 Lester, R. H., Hillman, A., Zardkoohi, A., & Cannella, A. A. (2008). Former government officials as outside directors: The role A. T. H. Nguyen et al. /Accounting 6 (2020) 255 of human and social capital. Academy of Management Journal, 51(5), 999–1013. https://doi.org/10.5465/AMJ.2008.34789675 Li, Haiyang, & Atuahene-Gima, K. (2001). Product innovation strategy and the performance of new technology ventures in China. Academy of Management Journal, 44(6), 1123–1134. https://doi.org/10.2307/3069392 Li, Haiyang, & Zhang, V. (2007). The role of managers’ political networking and functional experience in new venture performance: Evidence from China’s transition economy. Strategic Management Journal, 28(8), 791–804. https://doi.org/10.1002/smj.605 Li, Hongbin, Meng, L., Wang, Q., & Zhou, L. A. (2008). Political connections, financing and firm performance: Evidence from Chinese private firms. Journal of Development Economics, 87(2), 283–299. https://doi.org/10.1016/j.jdeveco.2007.03.001 Li, J. J. (2005). The formation of managerial networks of foreign firms in China: The effects of strategic orientations. Asia Pacific Journal of Management, 22(4), 423–443. https://doi.org/10.1007/s10490-005-4118-8 Li, J. J., Zheng, K., & Shao, A. T. (2009). Competitive position , managerial ties , and profitability of foreign firms in China : an interactive perspective. Journal of International Business Studies, 40(2), 339–352. https://doi.org/10.1057/jibs.2008.76 Li, J. J., & Zhou, K. Z. (2010). How foreign firms achieve competitive advantage in the Chinese emerging economy: Managerial ties and market orientation. Journal of Business Research, 63(8), 856–862. https://doi.org/10.1016/j.jbusres.2009.06.011 Long, D. R., Strauss, A., & Corbin, J. (2006). Basics of Qualitative Research: Grounded Theory Procedures and Techniques. Sage Publications. Newbury Park, CA. https://doi.org/10.2307/328955 Luo, Y. (2003). Industrial dynamics and managerial networking in an emerging market: the case of China. Strategic Management Journal, 24(13), 1315–1327. https://doi.org/10.1002/smj.363 Manolova, T. S., Manev, I. M., & Gyoshev, B. S. (2014). Friends with money? Owner’s financial network and new venture internationalization in a transition economy. International Small Business Journal: Researching Entrepreneurship, 32(8), 944–966. https://doi.org/10.1177/0266242613482482 McMillan, J., & Woodruff, C. (1999). Interfirm relationships and informal credit in Vietnam. Quarterly Journal of Economics, 114(4), 1285–1320. https://doi.org/10.1162/003355399556278 McWilliams, A., Van Fleet, D. D., & Cory, K. D. (2002). Raising rivals’ costs through political strategy: An extension of resource-based theory. Journal of Management Studies, 39(5), 707–724. https://doi.org/10.1111/1467-6486.00308 Mennens, K., Van Gils, A., Odekerken-Schröder, G., & Letterie, W. (2018). Exploring antecedents of service innovation performance in manufacturing SMEs. International Small Business Journal: Researching Entrepreneurship, 36(5), 500– 520. https://doi.org/10.1177/0266242617749687 Mesquita, L. F., Lazzarini, S. G., & Cronin, P. (2007). Determinants of firm competitiveness in Latin American emerging economies: Evidence from Brazil’s auto-parts industry. International Journal of Operations and Production Management, 27(5), 501–523. https://doi.org/10.1108/01443570710742384 Moreno, A. M., & Casillas, J. C. (2008). Entrepreneurial orientation and growth of SMEs: A causal model. Entrepreneurship: Theory and Practice, 32(3), 507–528. https://doi.org/10.1111/j.1540-6520.2008.00238.x Newman, C., Rand, J., Talbot, T., & Tarp, F. (2015). Technology transfers, foreign investment and productivity spillovers. European Economic Review, 76(May), 168–187. https://doi.org/10.1016/j.euroecorev.2015.02.005 Nguyen, N. T. K. (2017). The Long Run and Short Run Impacts of Foreign Direct Investment and Export on Economic Growth of Vietnam. Asian Economic and Financial Review, 7(5), 519–527. https://doi.org/10.18488/journal.aefr.2017.75.519.527 Nguyen, T. V. (2005). Learning to trust: A study of interfirm trust dynamics in Vietnam. Journal of World Business, 40(2), 203– 221. https://doi.org/10.1016/j.jwb.2005.02.001 Okhmatovskiy, I. (2010). Performance implications of ties to the government and SOEs: A political embeddedness perspective. Journal of Management Studies, 47(6), 1020–1047. https://doi.org/10.1111/j.1467-6486.2009.00881.x Park, S. H., & Luo, Y. (2001). Guanxi and organizational dynamics: Organizational networking in Chinese firms. Strategic Management Journal, 22(5), 455–477. https://doi.org/10.1002/smj.167 Peng, D. X., & Lai, F. (2012). Using partial least squares in operations management research: A practical guideline and summary of past research. Journal of Operations Management, 30(6), 467–480. https://doi.org/10.1016/j.jom.2012.06.002 Peng, M. W., & Heath, P. S. (1996). The growth of the firm in planned economies in transition: Institutions, organizations, and strategic choice. Academy of Management Review, 21(2), 429–528. https://doi.org/10.5465/AMR.1996.9605060220 Peng, M. W., & Luo, Y. (2000). Managerial ties and firm performance in a transition economy: The nature of a micro-macro link. Academy of Management Journal, 43(3), 486–501. https://doi.org/10.2307/1556406 Podolny, J. M., & Page, K. L. (1998). Network Forms of Organization. Annual Review of Sociology, 24(1), 57–76. https://doi.org/10.1146/annurev.soc.24.1.57 Pollack, J. M., Coy, A. E., Green, J. D., & Davis, J. L. (2015). Satisfaction, Investment, and Alternatives Predict Entrepreneurs’ Networking Group Commitment and Subsequent Revenue Generation. Entrepreneurship: Theory and Practice, 39(4), 817– 837. https://doi.org/10.1111/etap.12075 Pruthi, S., & Wright, M. (2017). Social Ties, Social Capital, and Recruiting Managers in Transnational Ventures. Journal of East-West Business, 23(2), 105–139. https://doi.org/10.1080/10669868.2016.1270247 Rao, H., Morrill, C., & Zald, M. N. (2000). Power Plays: How Social Movements and Collective Action Create New Organizational Forms. Research in Organizational Behavior, 22, 237–281. https://doi.org/10.1016/s0191-3085(00)22007-8 256 Rao, R. S., Chandy, R. K., & Prabhu, J. C. (2008). The Fruits of Legitimacy:Why Some New Ventures Gain More from Innovation Than Others. Journal of Marketing, 72(4), 58–75. https://doi.org/10.1509/jmkg.72.4.58 Robert Baum, J., Locke, E. A., & Smith, K. G. (2001). A multidimensional model of venture growth. Academy of Management Journal, 44(2), 292–303. Sami, P., Rahnavard, F., & Alavi Tabar, A. (2019). The effect of political and business ties on firm performance: The mediating role of product innovation. Management Research Review, 42(7), 778–796. https://doi.org/10.1108/MRR-12-2017-0439 Saunders, M., Lewis, P., & Thornhill, A. (2009). Research Methods for Business Students Fifth edition. In Prentice Hall, Harlow, Essex. https://doi.org/10.1017/CBO9781107415324.004 Shane, S., & Venkataraman, S. (2000). The promise of entrepreneurship as a field of research. Academy of Management Review, 25(1), 217–226. https://doi.org/10.1007/978-3-540-48543-8_8 Sheng, S., Zhou, K. Z., & Li, J. J. (2011). The Effects of Business and Political Ties on Firm Performance : Evidence from China. Journal of Marketing, 75(1), 1–15. https://doi.org/10.1509/jm.75.1.1 Short, J. C., Ketchen, D. J., Shook, C. L., & Ireland, R. D. (2010). The concept of “Opportunity” in entrepreneurship research: Past accomplishments and future challenges. Journal of Management, 36(1), 40–65. https://doi.org/10.1177/0149206309342746 Singh, J. V., Tucker, D. J., & House, R. J. (1986). Organizational Legitimacy and the Liability of Newness. Administrative Science Quarterly, 171–193. https://doi.org/10.2307/2392787 Suchman, M. C. (1995). Managing Legitimacy: Strategic and Institutional Approaches. Academy of Management Review, 20(3), 571–610. https://doi.org/10.5465/amr.1995.9508080331 Thang, T. T., Pham, T. S. H., & Barnes, B. R. (2016). Spatial Spillover Effects from Foreign Direct Investment in Vietnam. Journal of Development Studies, 52(10), 1431–1445. https://doi.org/10.1080/00220388.2016.1166205 Tihanyi, L., Aguilera, R. V., Heugens, P., van Essen, M., Sauerwald, S., Duran, P., & Turturea, R. (2019). State Ownership and Political Connections. Journal of Management, 45(6), 2293–2321. https://doi.org/10.1177/0149206318822113 Tornikoski, E. T., & Newbert, S. L. (2007). Exploring the determinants of organizational emergence: A legitimacy perspective. Journal of Business Venturing, 22(2), 311–335. https://doi.org/10.1016/j.jbusvent.2005.12.003 Tsang, E. W. (1998). Can guanxi be a source of sustained competitive advantage for doing business in China? Academy of Management Executive, 12(2), 64–73. Vissa, B., & Chacar, A. S. (2009). Leveraging ties: The contingent value of entrepreneurial teams’ external advice networks on Indian software venture performance. Strategic Management Journal, 30(11), 1179–1191. https://doi.org/10.1002/smj.785 Wang, G., Jiang, X., Yuan, C.-H., & Yi, Y.-Q. (2013). Managerial ties and firm performance in an emerging economy : Tests of the mediating and moderating effects. Asia Pacific Journal of Management, 30(2), 537–559. https://doi.org/10.1007/s10490-011-9254-8 Wang, K. J., & Lestari, Y. D. (2013). Firm competencies on market entry success: Evidence from a high-tech industry in an emerging market. Journal of Business Research, 66(12), 2444–2450. https://doi.org/10.1016/j.jbusres.2013.05.033 Warren, D. E., Dunfee, T. W., & Li, N. (2004). Social Exchange in China: The Double-Edged Sword of Guanxi. Journal of Business Ethics, 55(4), 353–370. https://doi.org/10.1007/s10551-004-1526-5 Wiklund, J., & Shepherd, D. (2005). Entrepreneurial orientation and small business performance: A configurational approach. Journal of Business Venturing, 20(1), 71–91. https://doi.org/10.1016/j.jbusvent.2004.01.001 Xin, K. R., & Pearce, J. L. (1996). Guanxi: Connections as substitutes for formal institutional support. The Academy of Management Journal, 39(6), 1641–1658. Yu, X., Chen, Y., Nguyen, B., & Zhang, W. (2014). Ties with government, strategic capability, and organizational ambidexterity: Evidence from China’s information communication technology industry. Information Technology and Management, 15(2), 81–98. https://doi.org/10.1007/s10799-014-0175-3 Zahra, S. A., & Garvis, D. M. (2000). International corporate entrepreneurship and firm performance: The moderating effect of international environmental hostility. Journal of Business Venturing, 15(5), 469–492. https://doi.org/10.1016/S0883- 9026(99)00036-1 Zhang, M., Qi, Y., Wang, Z., Zhao, X., & Pawar, K. S. (2019). Effects of business and political ties on product innovation performance: Evidence from China and India. Technovation, 80–81(February-March), 30–39. https://doi.org/10.1016/j.technovation.2018.12.002 Zhang, S., & Li, X. (2008). Managerial ties, firm resources, and performance of cluster firms. Asia Pacific Journal of Management, 25(4), 615–633. https://doi.org/10.1007/s10490-008-9090-7 Zhao, L., & Ha-brookshire, J. (2018). Importance of Guanxi in Chinese apparel new venture success : a mixed-method approach. Journal of Global Entrepreneurship Research, 8(13), 1–19. https://doi.org/10.1186/s40497-018-0099-1 Zhou, K. Z., Li, J. J., Sheng, S., & Shao, A. T. (2014). The evolving role of managerial ties and firm capabilities in an emerging economy: evidence from China. Journal of the Academy of Marketing Science, 42(6), 581–595. https://doi.org/10.1007/s11747-014-0371-z Zhu, Y. (2020). An interactive perspective of managers’ functional experience and managerial ties of new ventures in transition economies. Technology Analysis & Strategic Management, 32(3), 292–305. A. T. H. Nguyen et al. /Accounting 6 (2020) 257 Zott, C., & Huy, Q. N. (2007). How Entrepreneurs Use Symbolic Management to Acquire Resources. Administrative Science Quarterly, 52(1), 70–105. https://doi.org/10.2189/asqu.52.1.70 Appendix A Table A1 Measurement scale. Variable (Code) Item Adapted and modified from previous studies or self-developed Managerial political ties (MPT) Political leaders at various levels of the government. (MTP1) (Li & Zhou, 2010) Officials in industrial bureaus. (MTP2) Officials in regulatory and supporting organizations such as tax bureaus, state banks, commercial administration bureaus, and the like (MTP3) Institutional support (IS) The government often implements policies and programs beneficial to our operations (IS1) (Guo et al., 2014; Li & Zhou, 2010) The government provides us with much useful information. (IS2). The government often helps us obtain licenses such like an import license or a technical license (IS3) The government provides us with securing local resources such as land, electricity, and human resources (IS4). Opportunity Recognition (OR) Recognizing opportunities from the new establishment or the adjustment of industrial policies and planning (OR1) (Guo et al., 2014) Recognizing opportunities by communicating with government officials (OR2) Recognizing opportunities from new free trade agreements in Vietnam (OR3) Developed from the in- depth interviews We have well prepared to predict the outcome of the upcoming trade agreements (OR4) Regulatory Legitimacy (RL) What we do are authorized by the government (RL1) (Guo et al., 2014) What we do confirm with the policies, rules and regulations (RL2) What we do correspond to the government's thinking of possible policy adjustments (RL3) What we do often become industrial templates as recommended by the government (RL4). Training activities (TA) Training for fire protection (TA1) Developed from the in- depth interviews Training on labor safety (TA2) Informing new policies for FDI firms (ex post facto) (TA3) Providing information about the commitment of trade and market information (TA4) Informing the transparency of information and policies related to business (TA5) Organizing business seminars and business meetings (TA6) Firm performance (FP) Market share growth (FP1) (Guo et al., 2014; Jayaram & Tan, 2010) Sales growth (FP2) Profit growth (FP3) Return on assets (FP4) Product quality (FP5) Customer service level (FP6) 258 © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

political_ties_and_performance_of_multinational_corporations.pdf

political_ties_and_performance_of_multinational_corporations.pdf