Management accounting in pricing decisions for real estate of real estate firms in Vietnam

Abstract

In Real Estate Firms (REEs), managers always have to make decisions while running their

business in various forms. Among the manager’s decisions on real estate business, the

pricing decision for real estate is one of the difficult decisions for managers in the REEs.

Pricing decisions for real estate are often strategic decisions, which play an important role

for the existence and development of REEs. Thus, enterprise managers often consider this

to be the most important task for its historical mission and decisive factor of other tasks.

This paper focuses on analyzing and evaluating the actual situation of Vietnam’s REEs in

making pricing decisions for real estate, then proposing some recommendations for

improving the information system and pricing decisions for real estate making process for

creating the highest economic efficiency for the REEs in the current market conditions.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Tóm tắt nội dung tài liệu: Management accounting in pricing decisions for real estate of real estate firms in Vietnam

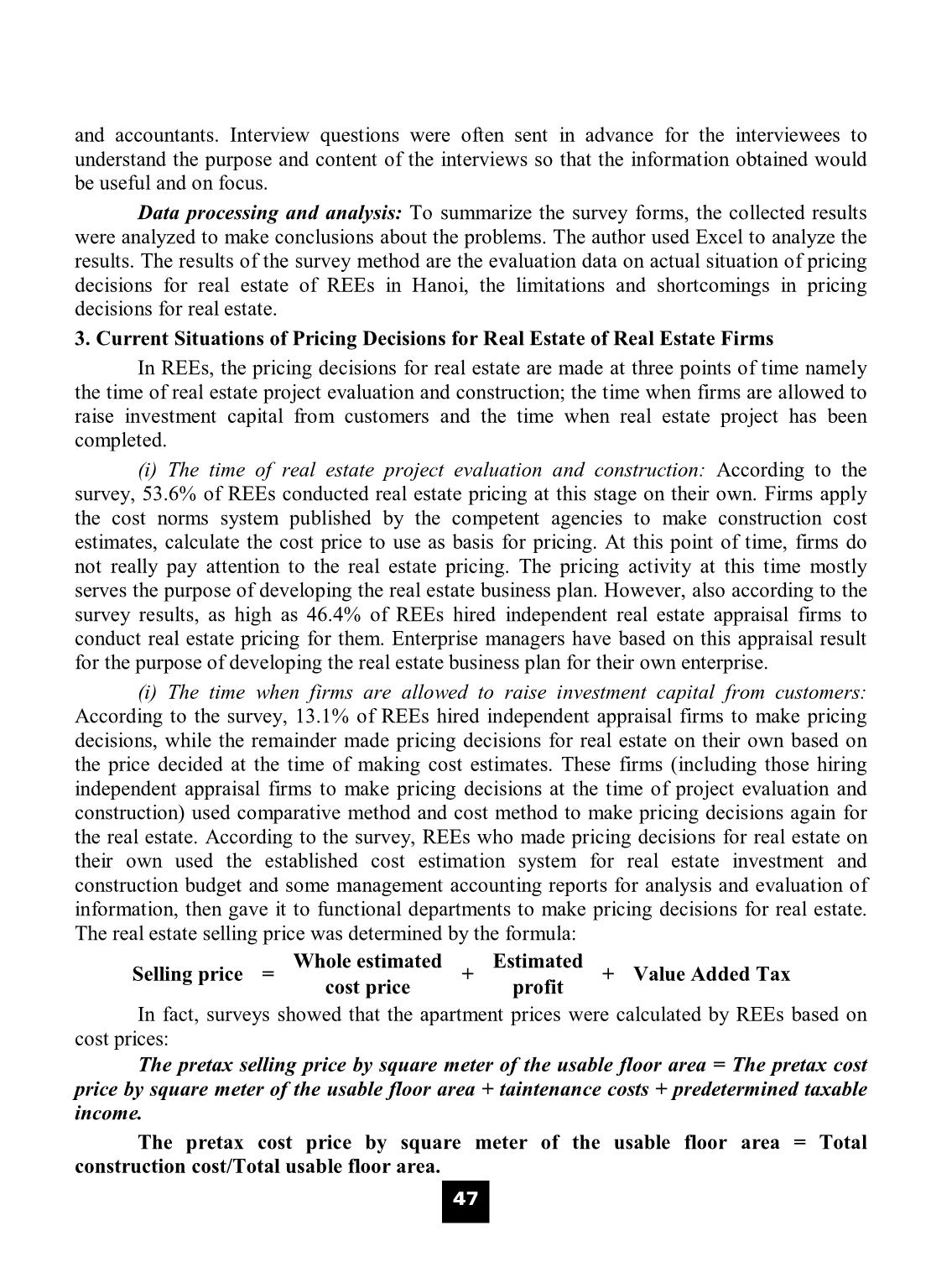

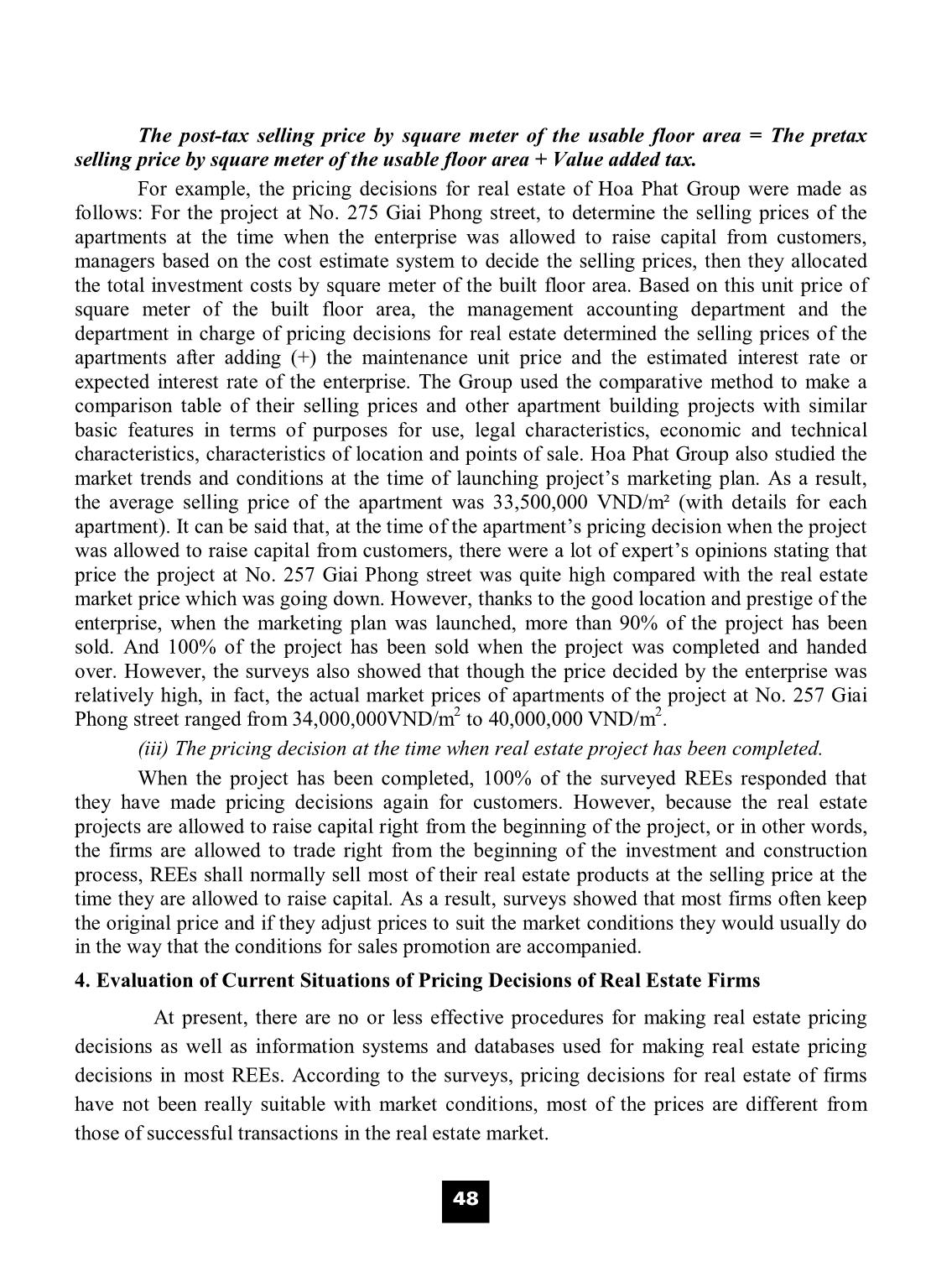

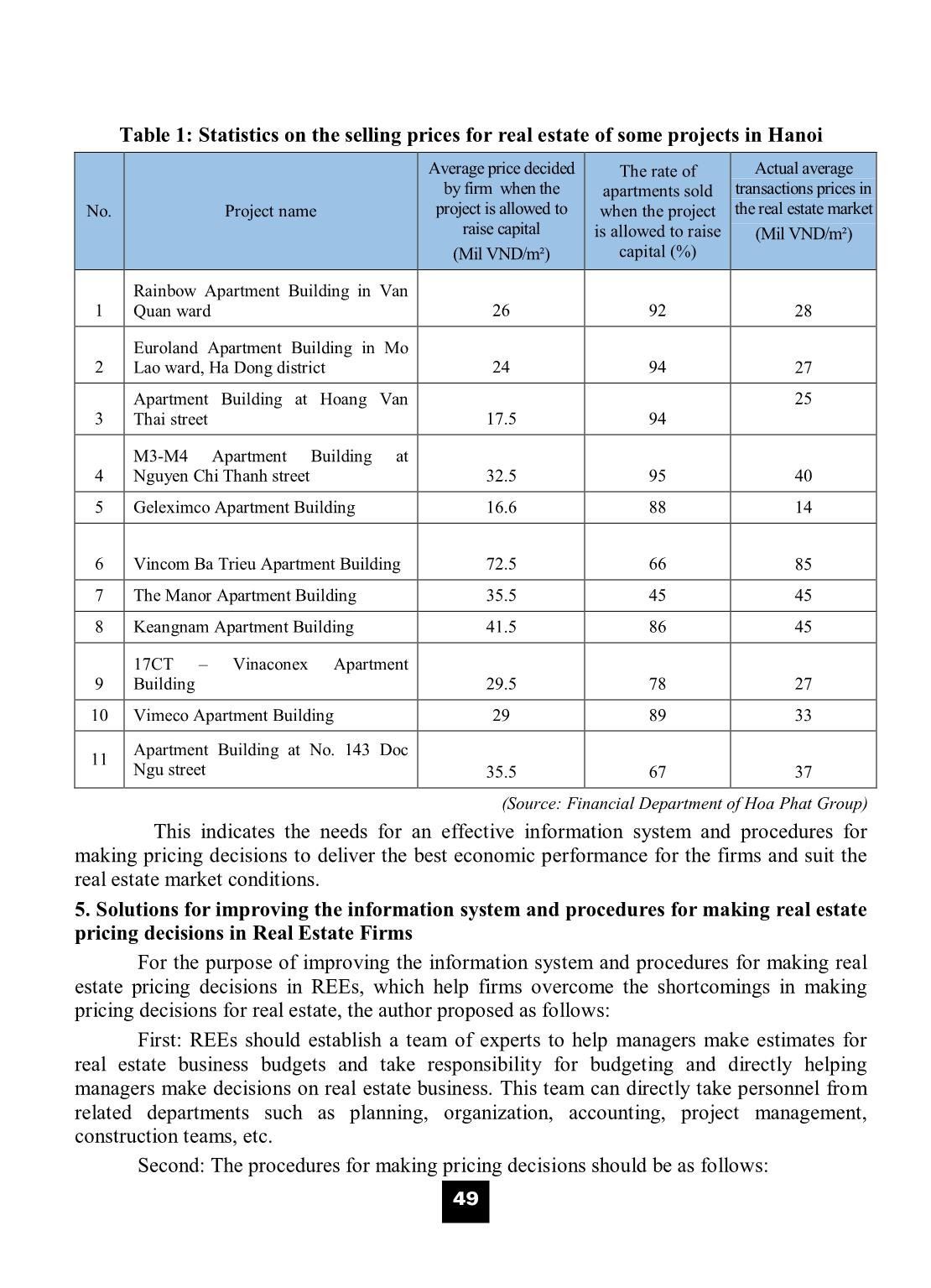

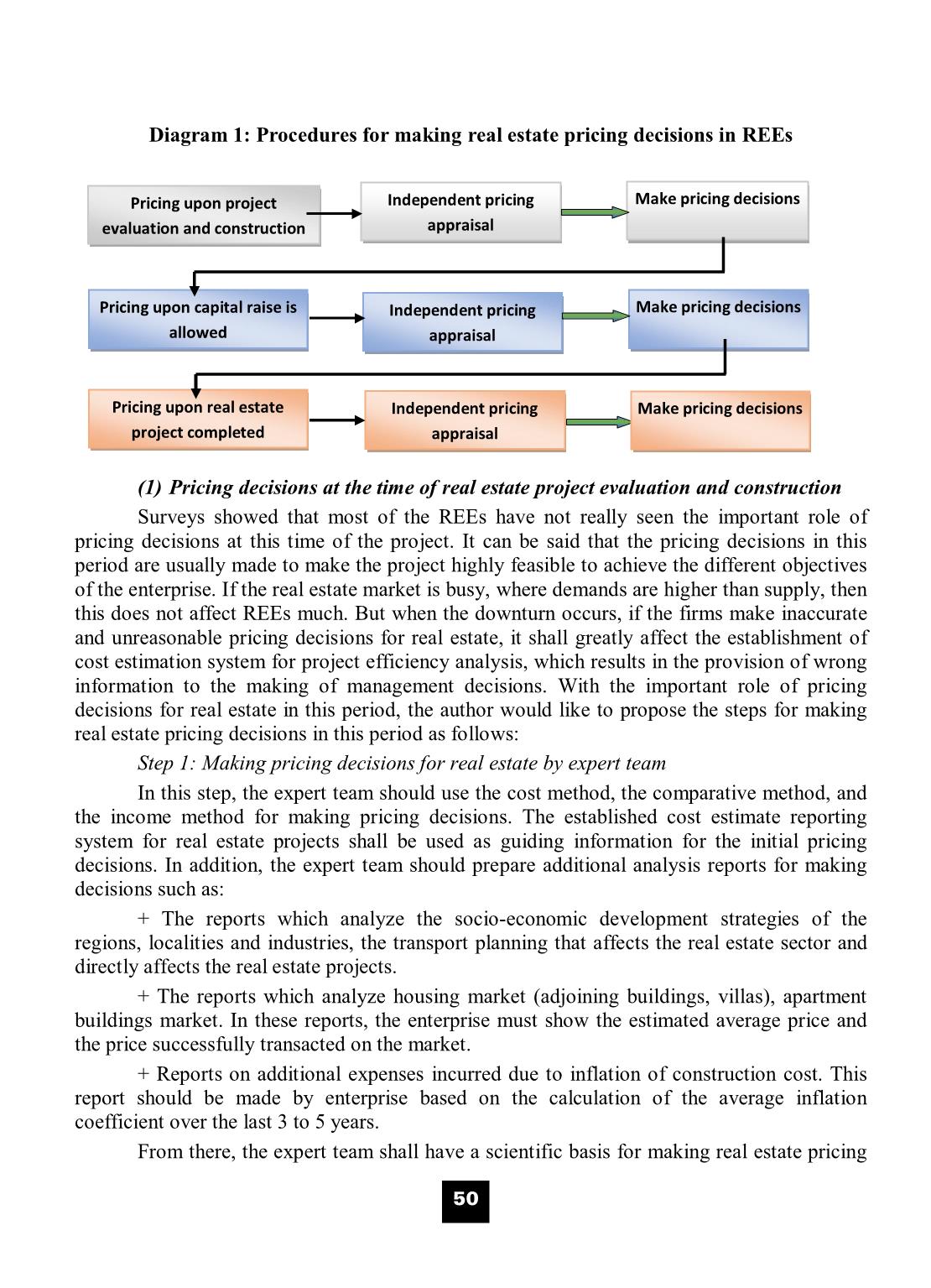

At present, there are no or less effective procedures for making real estate pricing decisions as well as information systems and databases used for making real estate pricing decisions in most REEs. According to the surveys, pricing decisions for real estate of firms have not been really suitable with market conditions, most of the prices are different from those of successful transactions in the real estate market. n trÞ - Kinh nghiÖm quèc tÕ vµ thùc tr¹ng ë ViÖt Nam 49 Table 1: Statistics on the selling prices for real estate of some projects in Hanoi No. Project name Average price decided by firm when the project is allowed to raise capital (Mil VND/m²) The rate of apartments sold when the project is allowed to raise capital (%) Actual average transactions prices in the real estate market (Mil VND/m²) 1 Rainbow Apartment Building in Van Quan ward 26 92 28 2 Euroland Apartment Building in Mo Lao ward, Ha Dong district 24 94 27 3 Apartment Building at Hoang Van Thai street 17.5 94 25 4 M3-M4 Apartment Building at Nguyen Chi Thanh street 32.5 95 40 5 Geleximco Apartment Building 16.6 88 14 6 Vincom Ba Trieu Apartment Building 72.5 66 85 7 The Manor Apartment Building 35.5 45 45 8 Keangnam Apartment Building 41.5 86 45 9 17CT – Vinaconex Apartment Building 29.5 78 27 10 Vimeco Apartment Building 29 89 33 11 Apartment Building at No. 143 Doc Ngu street 35.5 67 37 (Source: Financial Department of Hoa Phat Group) This indicates the needs for an effective information system and procedures for making pricing decisions to deliver the best economic performance for the firms and suit the real estate market conditions. 5. Solutions for improving the information system and procedures for making real estate pricing decisions in Real Estate Firms For the purpose of improving the information system and procedures for making real estate pricing decisions in REEs, which help firms overcome the shortcomings in making pricing decisions for real estate, the author proposed as follows: First: REEs should establish a team of experts to help managers make estimates for real estate business budgets and take responsibility for budgeting and directly helping managers make decisions on real estate business. This team can directly take personnel from related departments such as planning, organization, accounting, project management, construction teams, etc. Second: The procedures for making pricing decisions should be as follows: n trÞ - Kinh nghiÖm quèc tÕ vµ thùc tr¹ng ë ViÖt Nam 50 Diagram 1: Procedures for making real estate pricing decisions in REEs (1) Pricing decisions at the time of real estate project evaluation and construction Surveys showed that most of the REEs have not really seen the important role of pricing decisions at this time of the project. It can be said that the pricing decisions in this period are usually made to make the project highly feasible to achieve the different objectives of the enterprise. If the real estate market is busy, where demands are higher than supply, then this does not affect REEs much. But when the downturn occurs, if the firms make inaccurate and unreasonable pricing decisions for real estate, it shall greatly affect the establishment of cost estimation system for project efficiency analysis, which results in the provision of wrong information to the making of management decisions. With the important role of pricing decisions for real estate in this period, the author would like to propose the steps for making real estate pricing decisions in this period as follows: Step 1: Making pricing decisions for real estate by expert team In this step, the expert team should use the cost method, the comparative method, and the income method for making pricing decisions. The established cost estimate reporting system for real estate projects shall be used as guiding information for the initial pricing decisions. In addition, the expert team should prepare additional analysis reports for making decisions such as: + The reports which analyze the socio-economic development strategies of the regions, localities and industries, the transport planning that affects the real estate sector and directly affects the real estate projects. + The reports which analyze housing market (adjoining buildings, villas), apartment buildings market. In these reports, the enterprise must show the estimated average price and the price successfully transacted on the market. + Reports on additional expenses incurred due to inflation of construction cost. This report should be made by enterprise based on the calculation of the average inflation coefficient over the last 3 to 5 years. From there, the expert team shall have a scientific basis for making real estate pricing Pricing upon project evaluation and construction Independent pricing appraisal Make pricing decisions Pricing upon capital raise is allowed Independent pricing appraisal Make pricing decisions Pricing upon real estate project completed Independent pricing appraisal Make pricing decisions n trÞ - Kinh nghiÖm quèc tÕ vµ thùc tr¹ng ë ViÖt Nam 51 decisions and prepare reports on estimates of revenue, profit and loss and reports on the effectiveness of the project. Step 2: Independent appraisal firm Depending on the conditions of each enterprise, the independent appraisal of the price made by the expert team can be done by the enterprise on their own or by another independent appraisal firm. Then, based on the results of the independent appraisal, the expert team and the independent appraisal firm shall produce a report analyzing the pricing results, the increase and decrease and the causes for that and submit to the management board to make the final pricing decision. Step 3: Making pricing decisions In this step, the management board of the enterprise shall base on the pricing results analysis report of the two appraisal organizations to make the final pricing decision. This is the decision that shall influence the calculation of the project efficiency, product identification of the real estate project and customer group of the real estate project. (2) Pricing decisions at the time when capital raise is allowed This can be considered as the most important pricing time of a real estate project, or in other words, a pricing decision at this time is one of the most important management decisions of the REEs. This pricing decision will directly response to the market acceptance of the project’s products and will be almost critical to the success of the real estate project. Step 1: Making pricing decisions for real estate by expert team The basis for pricing decisions at this time is the pricing decisions made when the enterprise evaluated and developed the real estate project. However, due to the different times of making pricing decisions, the expert team should re-execute the analytical reports which have been made for the pricing process to obtain accurate information up to the present time. In addition, the price which was determined by the enterprise or an independent appraisal firm at the time of the project evaluation and development is the average price per square meter for real estate projects, such as the average prices per square meter for apartments, villas, and adjoining buildings. In fact, the cost prices per square meter of built real estate is the same, but due to the tastes for real estate of customers, due to the differences of real estate, such as the different directions of two apartments on the same floor, the customer’s decisions to buy are affected. Therefore, in order to meet the market conditions and the needs of customers, in this period REEs need to make detailed pricing decisions for real estate of each apartment, villa or adjoining building on the basis of adjusting the average price. Making detailed real estate pricing decisions for each property in the project is a complex task, which reflects the sensitivity of the pricing team with the real estate market, directly affecting the sales of the real estate firms. Firms can apply price adjustment method by coefficient. For example, the method of adjusting prices for apartments is as follows: Identify factors that affect the real estate prices such as: location of the building, floor, apartment direction, usable area, private car park, etc. Identify the adjustment coefficient for each affecting factor In this step, the REEs have to choose the coefficients for the factors affecting real n trÞ - Kinh nghiÖm quèc tÕ vµ thùc tr¹ng ë ViÖt Nam 52 estate prices based on actual experience and business sensitivity. Normally, for each factor the most typical type is selected and coefficient of 1 is taken, the other types shall be adjusted by the coefficient in increasing or decreasing orders. For example, in the real estate project there are 3 buildings, the building which has the best and most convenient location shall have the highest adjustment coefficient. The apartments on the best floors according to Asian concepts such as 8, 9, 10, etc. shall have higher coefficients than the apartments on other floors. The enterprise can determine the coefficient of apartment position on each floor by criteria such as the number of openings (apartment in corner or at center), landscape in the balcony view, door direction to the East or the South or directions of stairs, garbage door, etc.) Determining selling price for real estate. Using the above results, REEs can determine the selling price for real estate by the formula: Real estate selling price = Average real estate valuation price * Apartment selling price coefficient The apartment selling price coefficient is the adjustment rate of the apartment unit price compared with the average unit price of the project. The apartment selling price coefficient is defined as the multiply of the adjusted coefficients. Step 2: Independent appraisal firm According to the author’s recommendations, with the important role of pricing decisions in this period, after the pricing team has determined the real estate price, the enterprise should hire an independent appraisal firm to revalue the price determined by the expert team. The purpose of this step is to avoid the subjectivity of the enterprise itself and to give the enterprise the pricing decisions which ensure the market acceptance and achieve the profit goals of the enterprise. Step 3: Making pricing decisions In this step, like the same step at the time of project evaluation and construction, the enterprise management board shall base on the pricing results analysis report of the two appraisal organizations to make the final pricing decision. This is the decision that will affect the success of the real estate project. (3) Pricing decisions at the time when the project has been completed The pricing at the time when the project has been completed also includes three steps similar to the pricing at the two points of time above. However, the pricing at this time is based on the reporting system of performance results, fluctuations and causes of fluctuations for real estate business. In the surveyed REEs the real estate projects are normally divided into two cases. Case 1: The real estate project has sold most of the properties since its launch. Then the pricing at the time of project completion shall not be paid attention by REEs. Normally in this case the REEs do not change or if so they often increase the selling price of the real estate. Case 2: The real estate project still has many real estate products left. This case occurs n trÞ - Kinh nghiÖm quèc tÕ vµ thùc tr¹ng ë ViÖt Nam 53 when the enterprise make real estate pricing decisions which are inappropriate with the market. In this case, the enterprise’s expert team should conduct a revaluation in full steps to revaluate the selling price to suit the actual cost as well as the market fluctuations and trends to meet the goals of the enterprise. In short, The pricing decision for real estate is one of the difficult decisions for the managers of the REEs. Pricing decisions in the REEs are often strategic decisions, which play an important role for the existence and development of REEs. Thus, enterprise managers often consider this to be the most important task for its historical mission and decisive factor of other tasks. ----------------------------- References 1. Bodie Z., Merton R(2000), Finance, Prentice Hall, 2000. 2. Colin Drury (2005), Management Accounting for Business Decisions, Thomson Learning Publisher. 3. Do Minh Cuong (2001), Văn hóa và triết lý kinh doanh (Business culture and philosophy), National Political Publishing House, Hanoi. 4. John B.Corgel, PH.D và Halbert C. David C.Ling, PH.D, Real Estate Perspectives - An introduction to real estate. 5. Luc Mach Hien (2014), Định giá nhà ở thương mại xây dựng mới ở các DN đầu tư, xây dựng và kinh doanh nhà ở (Pricing of newly built commercial houses in firms specialized in investing, building and trading houses), PhD thesis, National Economics University. 6. Nguyen, D.D. (2004) Scientific research project at ministerial level “Hoàn thiện mô hình tổ chức kế toán quản trị và phân tích kinh doanh trong các DN sản xuất” (Improving the model of management accounting and business analysis in manufacturing firms), Academy of Finance. 7. Nguyen, T.H.N. (2012), Pháp luật về chuyển nhượng quyền sử dụng đất trong kinh doanh bất động sản ở Việt Nam (Legislation on transfer of land use rights in the real estate business in Vietnam), PhD thesis, Hanoi Law University. 8. Ministry of Finance (2014), Circular No. 158/2014/TT-BTC promulgating Vietnamese price appraisal standards No. 01, 02, 03 and 04, on October 27, 2014. 9. Steven M.Bragg (2009), Management Accounting Best practices, John Wiley & Sons, Inc. 10. Trinh, D.D. (2014), “Chiến lược phát triển thị trường bất động sản trong tiến trình hoàn thiện thể chế kinh tế thị trường định hướng xã hội chủ nghĩa” (Development strategy of the real estate market in the process of improving the socialist-oriented market economy institution), Tạp chí cộng sản (Communist Magazine), October 2014. 11. Vu, A. (2012), Pháp luật về kinh doanh bất động sản ở Việt Nam – những vấn đề lý luận và thực tiễn (Legislation on real estate business in Vietnam - theoretical and practical issues), PhD thesis, Graduate Academy of Social Sciences. 12. Xiaosong, Z. (2012), “Management Accounting Practices in China: Current Key Problems and Solutions”, Social Research, 4 (29), 91-98. -----------------------------

File đính kèm:

management_accounting_in_pricing_decisions_for_real_estate_o.pdf

management_accounting_in_pricing_decisions_for_real_estate_o.pdf