Impact of disclosure of environmental accounting information on financial performance: Negative or positive?

Abstract: This research was undertaken for improving financial performance of mining

companies in Vietnam securities market by promoting the disclosure of environmental

accounting information. Data were collected from 57 mining companies listed on the Vietnam

stock market for five consecutive years from 2013 to 2017. Based on quantitative research

method, this study assessed the impact of the disclosure level of environmental accounting

information on financial performance. The resultsindicatethat the disclosure level of

environmental accounting information affects the financial performance of the current year

as well as financial performance in the future. Some suggestions are pointed out for

improving the disclosure levels of environmental accounting information to improve

corporate financial performance.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Tóm tắt nội dung tài liệu: Impact of disclosure of environmental accounting information on financial performance: Negative or positive?

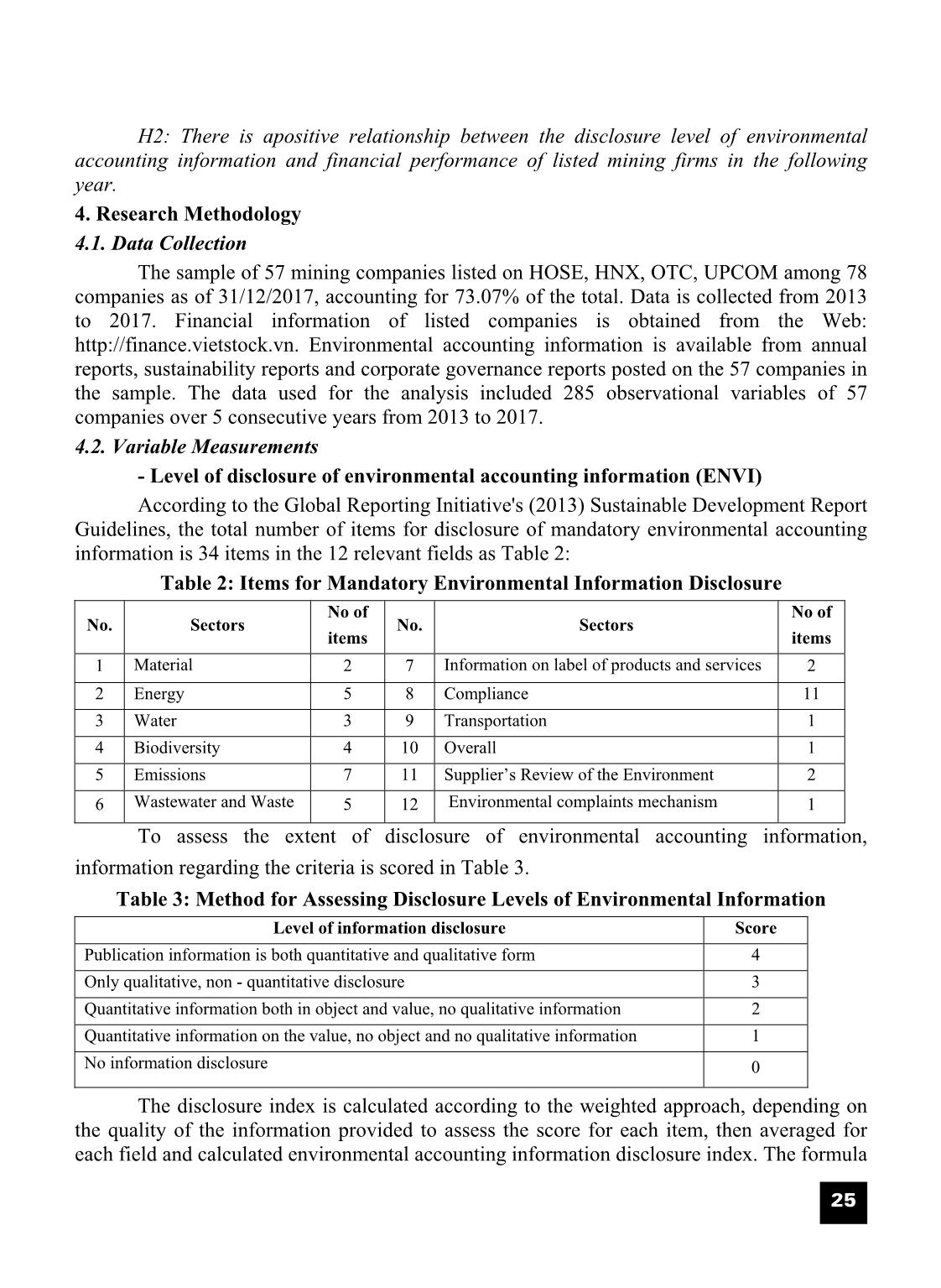

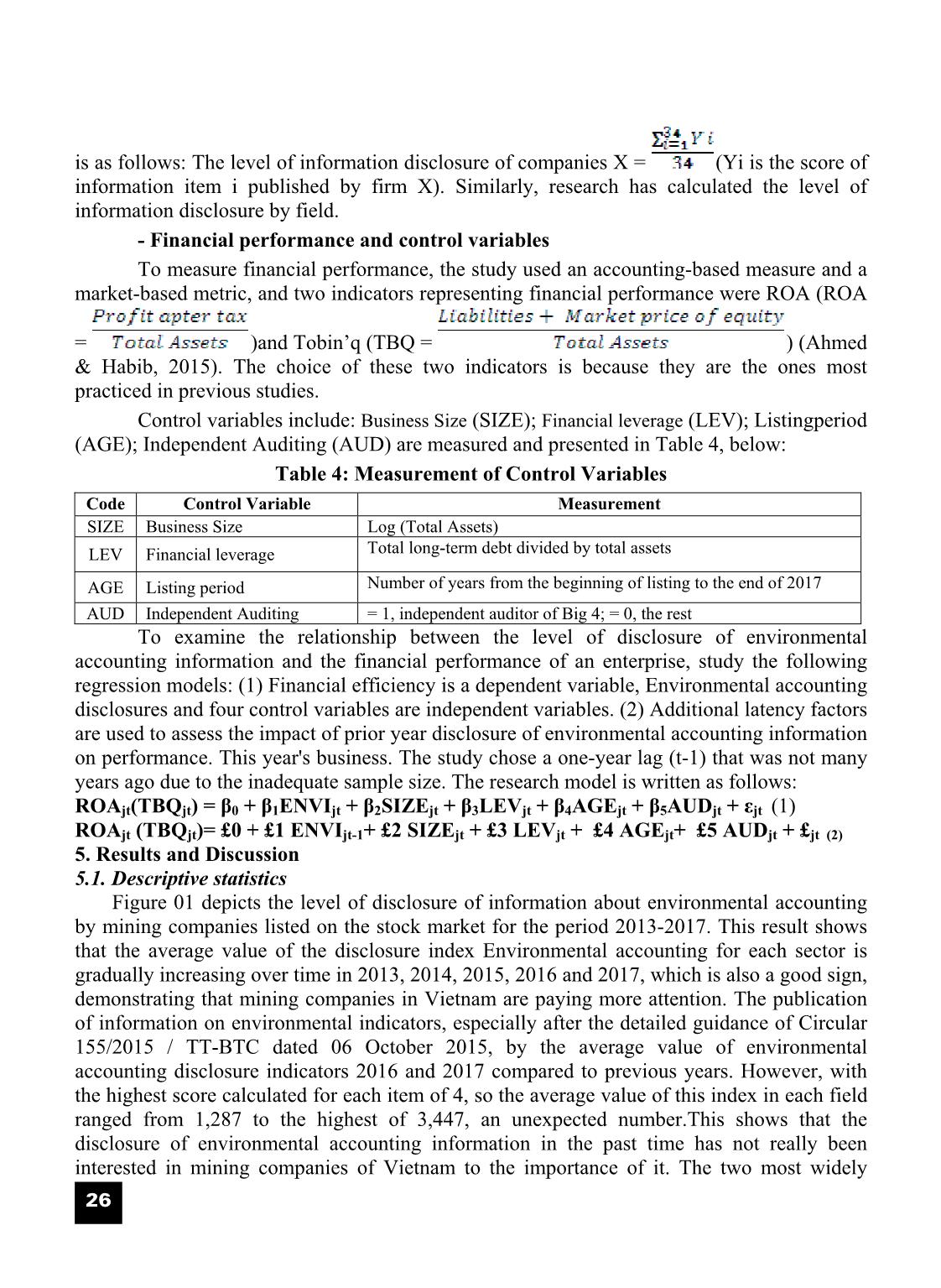

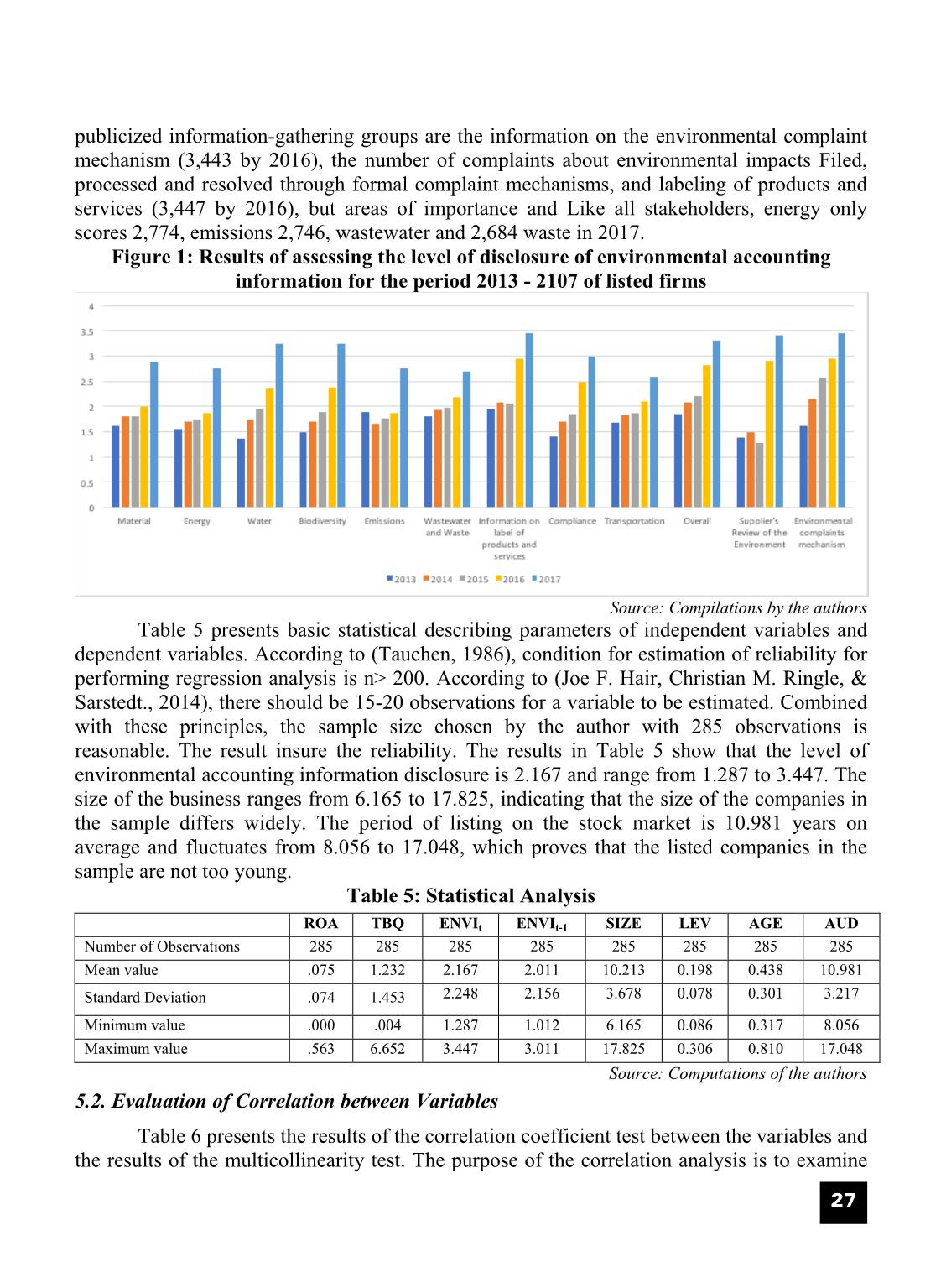

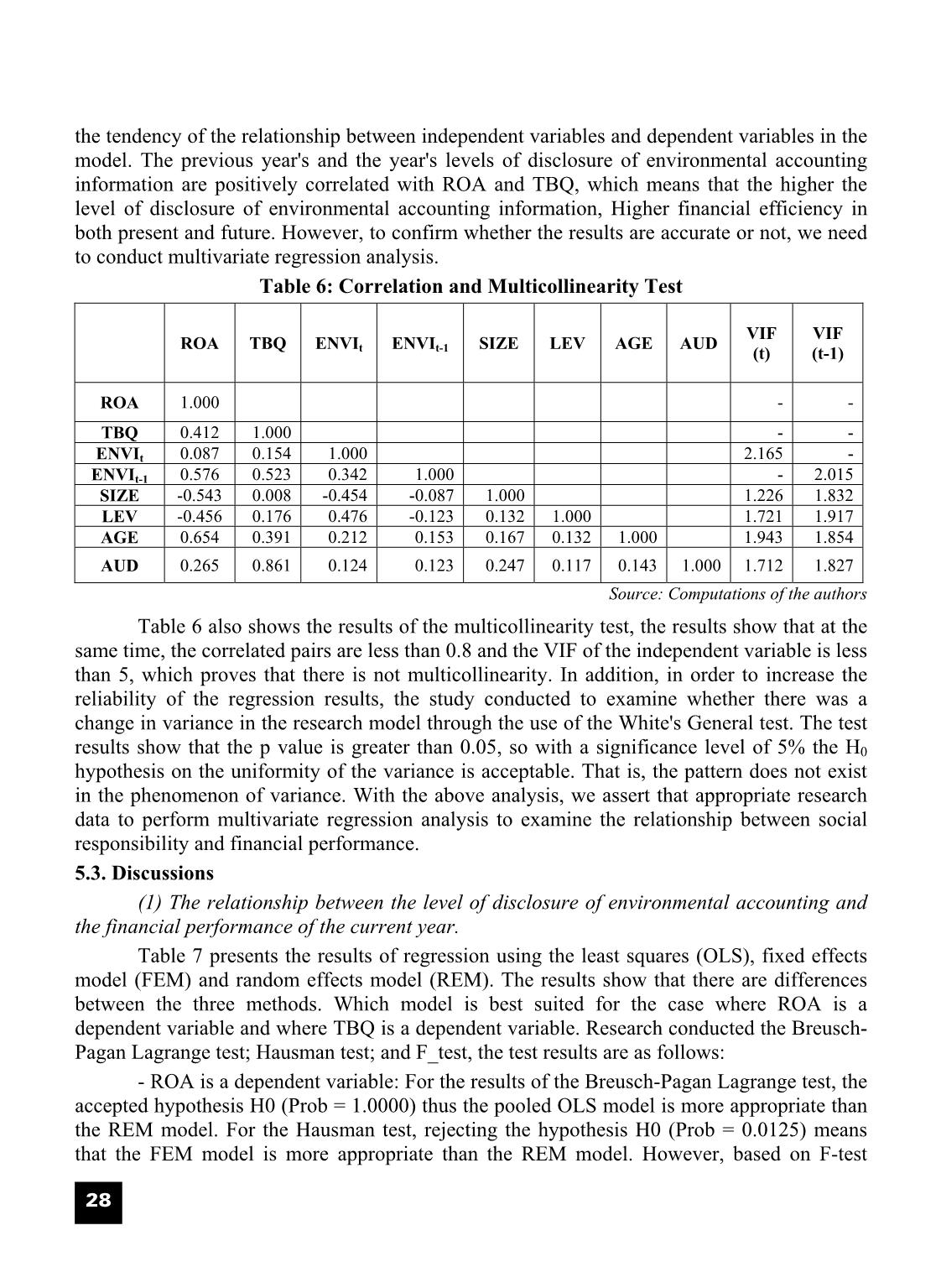

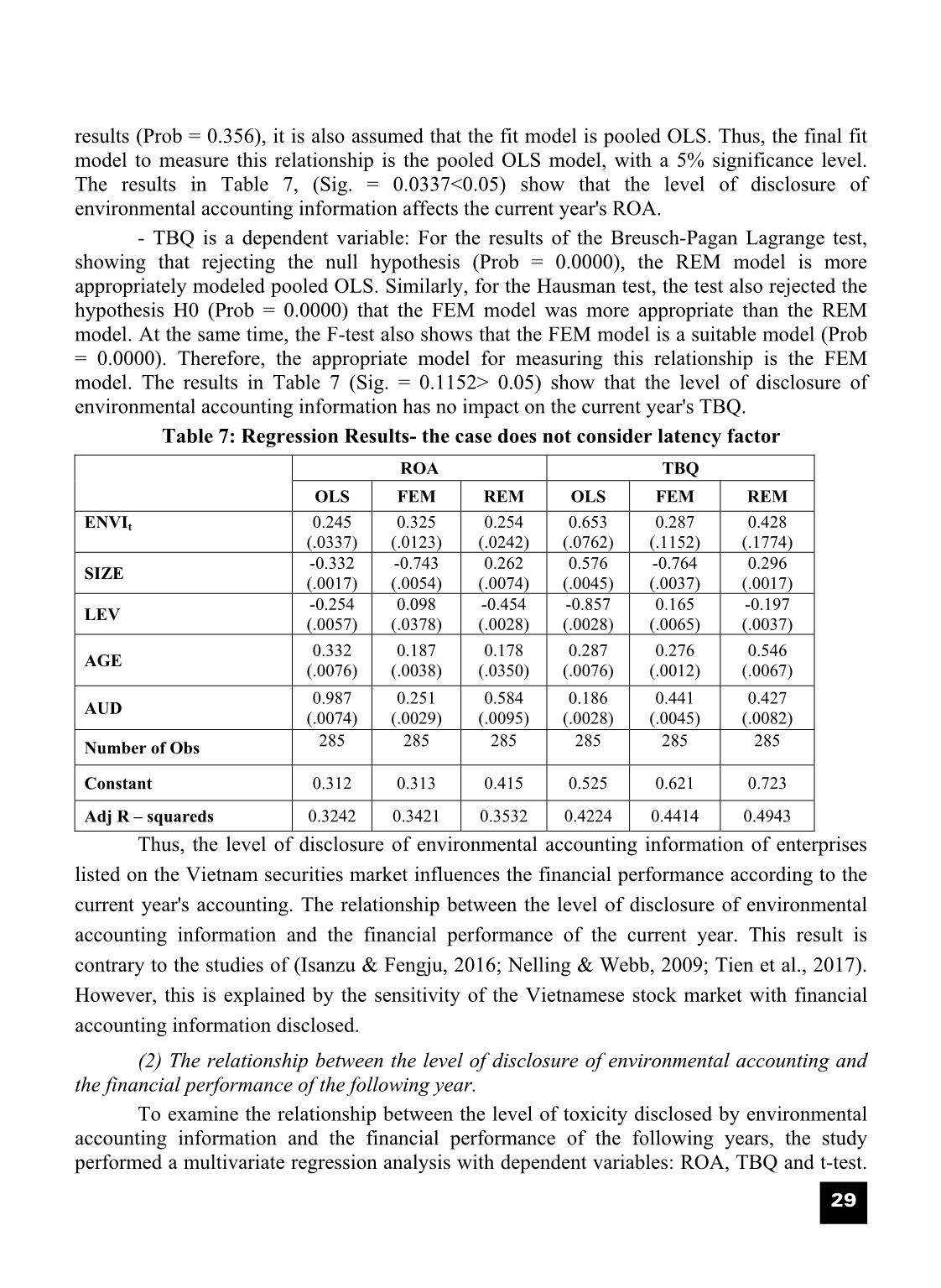

research model through the use of the White's General test. The test results show that the p value is greater than 0.05, so with a significance level of 5% the H0 hypothesis on the uniformity of the variance is acceptable. That is, the pattern does not exist in the phenomenon of variance. With the above analysis, we assert that appropriate research data to perform multivariate regression analysis to examine the relationship between social responsibility and financial performance. 5.3. Discussions (1) The relationship between the level of disclosure of environmental accounting and the financial performance of the current year. Table 7 presents the results of regression using the least squares (OLS), fixed effects model (FEM) and random effects model (REM). The results show that there are differences between the three methods. Which model is best suited for the case where ROA is a dependent variable and where TBQ is a dependent variable. Research conducted the Breusch- Pagan Lagrange test; Hausman test; and F_test, the test results are as follows: - ROA is a dependent variable: For the results of the Breusch-Pagan Lagrange test, the accepted hypothesis H0 (Prob = 1.0000) thus the pooled OLS model is more appropriate than the REM model. For the Hausman test, rejecting the hypothesis H0 (Prob = 0.0125) means that the FEM model is more appropriate than the REM model. However, based on F-test n trÞ - Kinh nghiÖm quèc tÕ vµ thùc tr¹ng ë ViÖt Nam 29 results (Prob = 0.356), it is also assumed that the fit model is pooled OLS. Thus, the final fit model to measure this relationship is the pooled OLS model, with a 5% significance level. The results in Table 7, (Sig. = 0.0337<0.05) show that the level of disclosure of environmental accounting information affects the current year's ROA. - TBQ is a dependent variable: For the results of the Breusch-Pagan Lagrange test, showing that rejecting the null hypothesis (Prob = 0.0000), the REM model is more appropriately modeled pooled OLS. Similarly, for the Hausman test, the test also rejected the hypothesis H0 (Prob = 0.0000) that the FEM model was more appropriate than the REM model. At the same time, the F-test also shows that the FEM model is a suitable model (Prob = 0.0000). Therefore, the appropriate model for measuring this relationship is the FEM model. The results in Table 7 (Sig. = 0.1152> 0.05) show that the level of disclosure of environmental accounting information has no impact on the current year's TBQ. Table 7: Regression Results- the case does not consider latency factor ROA TBQ OLS FEM REM OLS FEM REM ENVIt 0.245 (.0337) 0.325 (.0123) 0.254 (.0242) 0.653 (.0762) 0.287 (.1152) 0.428 (.1774) SIZE -0.332 (.0017) -0.743 (.0054) 0.262 (.0074) 0.576 (.0045) -0.764 (.0037) 0.296 (.0017) LEV -0.254 (.0057) 0.098 (.0378) -0.454 (.0028) -0.857 (.0028) 0.165 (.0065) -0.197 (.0037) AGE 0.332 (.0076) 0.187 (.0038) 0.178 (.0350) 0.287 (.0076) 0.276 (.0012) 0.546 (.0067) AUD 0.987 (.0074) 0.251 (.0029) 0.584 (.0095) 0.186 (.0028) 0.441 (.0045) 0.427 (.0082) Number of Obs 285 285 285 285 285 285 Constant 0.312 0.313 0.415 0.525 0.621 0.723 Adj R – squareds 0.3242 0.3421 0.3532 0.4224 0.4414 0.4943 Thus, the level of disclosure of environmental accounting information of enterprises listed on the Vietnam securities market influences the financial performance according to the current year's accounting. The relationship between the level of disclosure of environmental accounting information and the financial performance of the current year. This result is contrary to the studies of (Isanzu & Fengju, 2016; Nelling & Webb, 2009; Tien et al., 2017). However, this is explained by the sensitivity of the Vietnamese stock market with financial accounting information disclosed. (2) The relationship between the level of disclosure of environmental accounting and the financial performance of the following year. To examine the relationship between the level of toxicity disclosed by environmental accounting information and the financial performance of the following years, the study performed a multivariate regression analysis with dependent variables: ROA, TBQ and t-test. n trÞ - Kinh nghiÖm quèc tÕ vµ thùc tr¹ng ë ViÖt Nam 30 The results of the regression analysis are presented in Table 8. Similarly, the study also conducted Breusch-Pagan Lagrange test; Hausman test; and F_test, to choose the most suitable model to measure this relationship. The test results indicate that, in the case of ROA as a dependent variable, the OLS model is best suited, in the case of TBQ as the dependent variable, the FEM model is sub-merged with the significance level of 5%. Table 8: Regression Results – The case considers the latency factor ROA TBQ OLS FEM REM OLS FEM REM ENVIt-1 0.516 (.0121) 0.312 (.0113) 0.845 (.0154) 0.165 (.0154) 0.117 (.0119) 0.224 (.0423) SIZE -0.643 (.1645) -0.154 (.0138) 0.887 (.0143) 0.129 (.0197) -0.185 (.0165) 0.654 (.0187) LEV -0.186 (.0011) 0.086 (.0187) -0.413 (.0342) -0.175 (.0543) 0.178 (.0197) -0.197 (.0165) AGE 0.148 (.0198) 0.087 (.0023) 0.186 (.0190) 0.581 (.0123) 0.276 (.0087) 0.286 (.0017) AUD 0.197 (.0065) 0.286 (.0017) 0.325 (.0086) 0.372 (.0026) 0.327 (.0098) 0.154 (.0036) Number of Obs 228 228 228 228 228 228 Constant 0.134 0.165 0.253 0.367 0.434 0.354 Adj R – squareds 0.4234 0.3268 0.3136 0.4134 0.4654 0.4035 The results in Table 8 show that Sig. = 0.0121 and Sig. = 0.0119 to <0.5, there is a relationship between the level of disclosure of previous year's accounting information and the financial performance of the following year. As a result, the level of disclosure of environmental accounting information by enterprises listed on the Vietnamese securities market affects the financial performance according to the accounting and market of the following year. This result is consistent with studies(Isanzu & Fengju, 2016; Nelling & Webb, 2009; Tien et al., 2017). This shows that the clearer, more detailed and transparent disclosure of environmental accounting information is more conducive to the future financial performance of the business. 6. Conclusion and Recommendations The results show that the mining sector in Vietnam has made positive changes in the awareness of social responsibility and disclosure of accounting information related to the environment. It has been proven that mining companies with high economic efficiency are often among the top companies that are well-regarded for their environmental responsibility, as demonstrated by full and detailed disclosure information related to the environment. Disclosure of environmental accounting information is a way for mining enterprises to raise their image and prestige with related parties. However, data on the level of disclosure of environmental accounting information by mining enterprises from 2013 to 2017 show that this level has not really met the information needs of the stakeholders. Therefore, in the coming time, businesses need to strengthen the solution to complete environmental n trÞ - Kinh nghiÖm quèc tÕ vµ thùc tr¹ng ë ViÖt Nam 31 accounting to support the disclosure of information related to the environment is really necessary. From the research results, the research team proposed some recommendations as follows: First, the need to raise awareness of corporate environmental responsibility and the benefits of disclosing detailed environmental accounting information to the financial performance of the business. Some businesses say that if they focus on environmental protection activities, transparency of environmental accounting information is costly, reducing profits, it is a misconception. The empirical results of the study have shown that the level of disclosure of environmental accounting information affects the economic efficiency of enterprises both now and in the future. Therefore, the disclosure of environmental accounting information is not only to comply with environmental law, avoid legal complications but also to improve the image and increase the financial efficiency of the business. Second, in the Vietnamese context, the reporting of primary environmental accounting information is still voluntary and free of any general pattern, with only large companies reporting responsibility. The number of companies reporting social responsibility is very low. Research results are the basis for encouraging organizations to change views when making annual reports as well as the content of disclosure in their annual report should not be too focused on the indicators. Financial results achieved during the year that ignored the environmental performance achieved. Because, together with the trend of green development of the world, investors are more interested in the information related to the implementation of corporate social responsibility. Consequently, with the implementation of environmental responsibility, the disclosure of this information to investors is also a way to attract their attention. Basing on the quantitative and qualitative research methodology, the team assessed the impact of the level of disclosure of environmental accounting information on the financial performance of listed mining companies in Vietnam securities market. The results indicate that the level of disclosure of environmental accounting information affects the financial performance of businesses both now and in the future. From the research results, the team has made several recommendations to promote the level of disclosure of environmental accounting information in the future. The article has enriched the sources of research on environmental accounting as well as contributed to the disclosure of environmental accounting information in the future. However, research is limited to two financial measures and four control variables, while still using other indicators to test this relationship, further limiting the sample also makes sense. Dependency of affected results. Nevertheless, we consider these to be suggestive for further research in the future. ----------------------- References Ahmed, T., & Habib, F. (2015). Does CSR Enhance Profitabilty? : Evidence from an EmergingEconomy. International Journal of Engineering Technology, Management and Applied Sciences. Al-Tuwaijri, S. A., Christensen, T. E., & II, K. E. H. (2004). The relations among environmental disclosure, environmental performance, and economic performance: a simultaneous equations approach. Accounting, Organizations and Society, 29(5-6). doi:https://doi.org/10.1016/S0361-3682(03)00032-1 n trÞ - Kinh nghiÖm quèc tÕ vµ thùc tr¹ng ë ViÖt Nam 32 Ali, M. J., Ahmed, K., & Henry, D. (2004). Disclosure compliance with national accounting standards by listed companies in South Asia. Accounting and Business Research(3). doi:https://doi.org/10.1080/00014788.2004.9729963 Barakat, F. S. Q., Pérez, M. V. L., & Ariza, L. R. (2015). Corporate social responsibility disclosure (CSRD) determinants of listed companies in Palestine (PXE) and Jordan (ASE). Review of Managerial Science, 9. doi:https://doi.org/10.1007/s11846-014-0133-9 Boaventura, J. o. M. c. G., Silva, R. S. d., & Bandeira-de-Mello, R. (2012). Corporate Financial Performance and Corporate Social Performance: Methodological Development and the Theoretical Contribution of Empirical Studies. Paper presented at the R. Cont. Fin. – USP, São Paulo. Carroll, W. E., & Graves, S. B. (1998). The corporate social performance - financial performance link. Strategic Management Journal, 18(4), 303-319. Dowling, J., & Pfeffer, J. (1975). Organizational legitimacy: social values and organization behavior. Pacific Sociological Review, 18. doi:https://doi.org/10.2307/1388226 Hitt, M. A., Freeman, R. E., & Harrison, J. S. (2017). A Stakeholder Approach to Strategic Management. Published Online: 26 NOV 2017: The Blackwell Handbook of Strategic Management. Horváthová, E. (2012). The impact of environmental performance on firm performance: Short-term costs and long-term benefits? Ecological Economics, 84. doi:https://doi.org/10.1016/j.ecolecon.2012.10.001 Isanzu, J., & Fengju, X. (2016). Impact of Corporate Social Responsibility on Firm’s Financial Performance: The Tanzanian Perspective. Journal on Innovation and Sustainability, 7. doi: Joe F. Hair, Christian M. Ringle, & Sarstedt., M. (2014). PLS-SEM: Indeed a Silver Bullet. Journal of Marketing Theory and Practice. doi: Magness, V. (2006). Strategic posture, financial performance and environmental disclosure: An empirical test of legitimacy theory. Accounting, Auditing & Accountability Journal, 19(4). doi:https://doi.org/10.1108/09513570610679128 Moore, G. (2001). Corporate Social and Financial Performance: An Investigation in the U.K. Supermarket Industry. Journal of Business Ethics, 34(3-4). Nelling, E., & Webb, E. (2009). Corporate social responsibility and financial performance: the “virtuous circle” revisited. Review of Quantitative Finance and Accounting, 32(2). doi:https://doi.org/10.1007/s11156-008-0090-y NI, T. (2017). Disclosure of the Environmental Accounting Information Research. Paper presented at the International Conference on E- commerce and Contemporary Economic Development (ECED 2017). Qiu, Y., Shaukat, A., & Tharyan, R. (2016). Environmental and social disclosures: Link with corporate financial performance. The British Accounting Review, 48(1). doi:https://doi.org/10.1016/j.bar.2014.10.007 Simpson, W. G., & Kohers, T. (2002). The Link Between Corporate Social and Financial Performance: Evidence from the Banking Industry. Journal of Business Ethics, 35(2). doi:https://doi.org/10.1023/A:1013082525900 Tauchen, G. (1986). Finite state markov-chain approximations to univariate and vector autoregressions. Economics letters, 20(2). doi:https://doi.org/10.1016/0165-1765(86)90168-0 Tien, H. V., Anh, H. T. V., & Chinh, N. T. (2017). The corporate environmental responsibility and corporate financial performance: evidences from Vietnamese listed companies. Paper presented at the Proceedings of ICUEH2017: International conference of University of Economic Ho Chi Minh City: Policies and sustainable economic development., HCMC, Vietnam, September 28, 2017. Ullmann, A. A. (1985). Data in Search of a Theory: A Critical Examination of the Relationships Among Social Performance, Social Disclosure, and Economic Performance of U.S. Companies. Academy of Management Review, 10(3). doi:10.5465/AMR.1985.4278989 -----------------------

File đính kèm:

impact_of_disclosure_of_environmental_accounting_information.pdf

impact_of_disclosure_of_environmental_accounting_information.pdf