Human capital, capital structure choice and firm profitability in developing countries: An empirical study in Vietnam

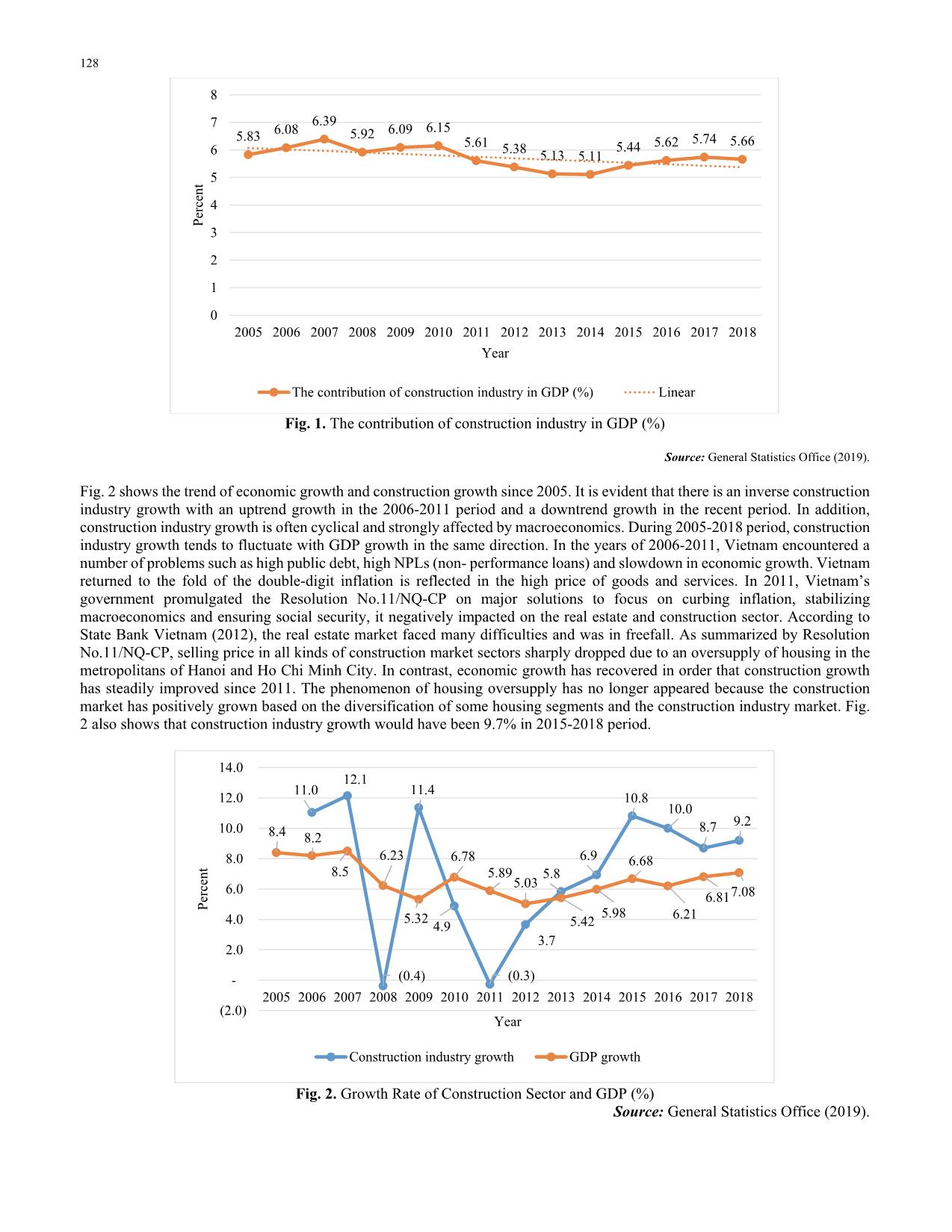

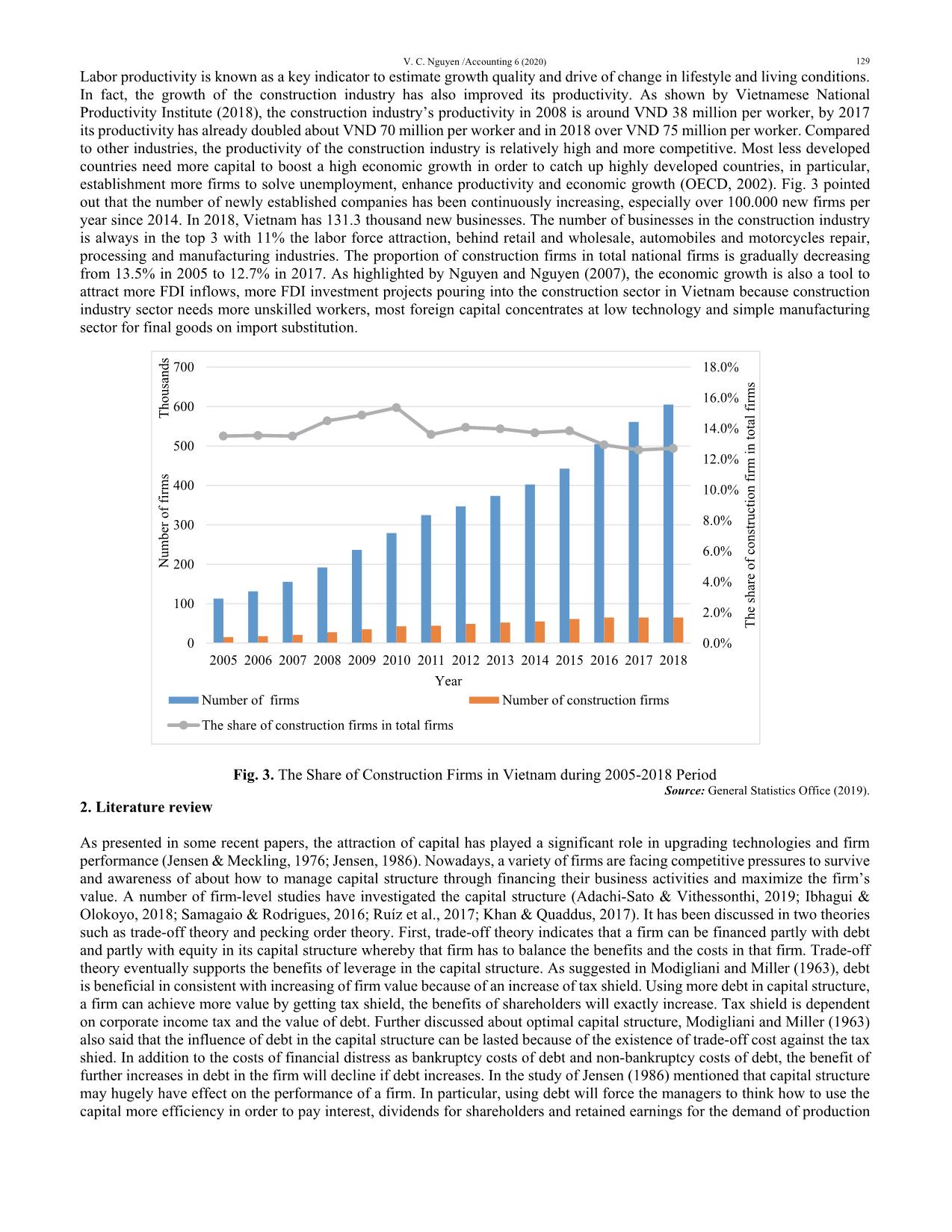

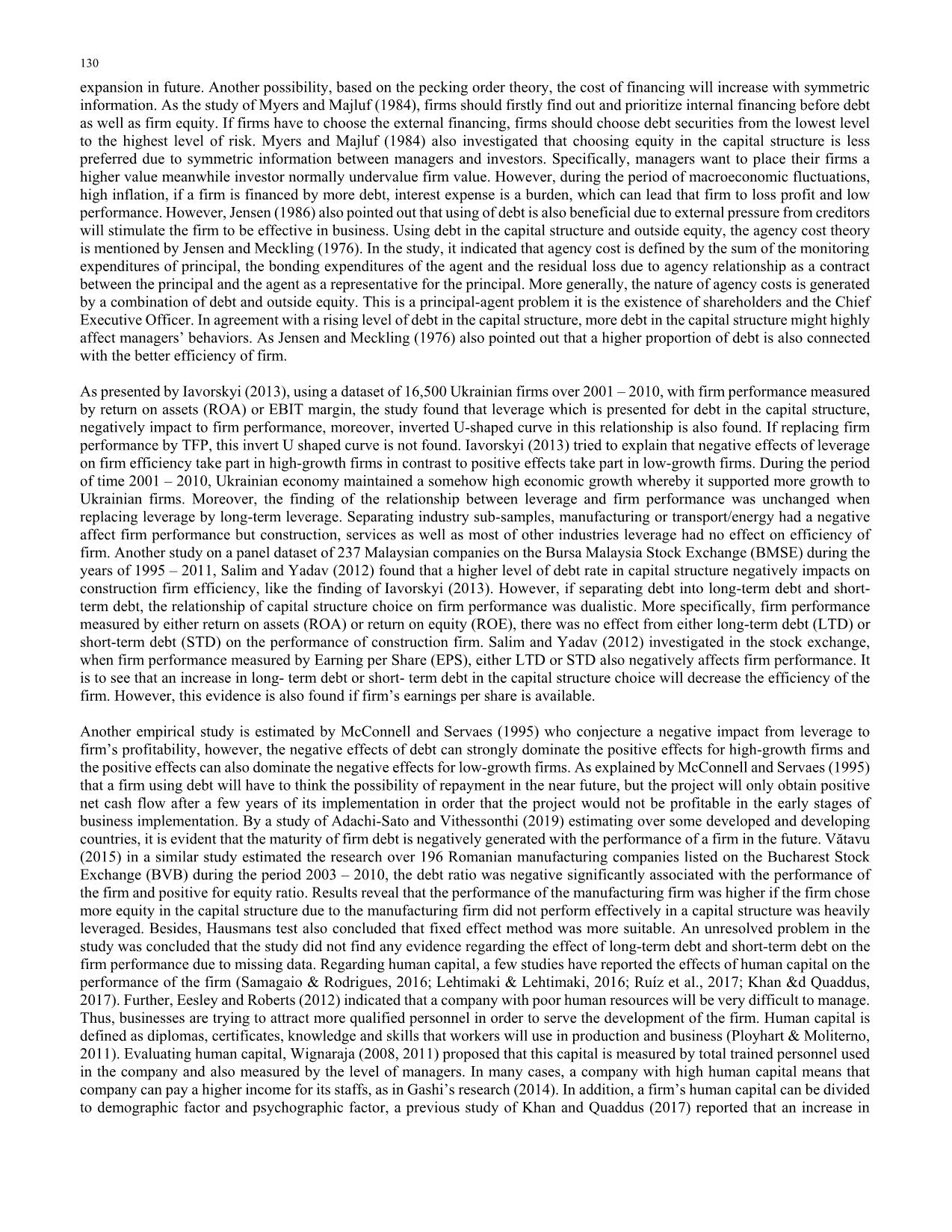

The paper aims to examine the impact of human capital, capital structure choice and firm profitability of 48,673 Vietnamese construction firms in 2016. Measuring firm profitability by return on assets (ROA) or return on equity (ROE), the results demonstrated that using more debt in capital structure would positively increase the performance of the firm but this positive effect was increasingly declining. Moreover, evidence showed that human capital had a positive impact on the result of business activities. A larger size of a firm could positively boost firm performance. Regarding firm location, a firm locating in the metropolitan of Ho Chi Minh City had a higher level of performance than a firm locating in the metropolitan of Hanoi capital. Finally, operating status of the firm as well as the establishment of industrial park had insignificant impacts on firm profitability

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tóm tắt nội dung tài liệu: Human capital, capital structure choice and firm profitability in developing countries: An empirical study in Vietnam

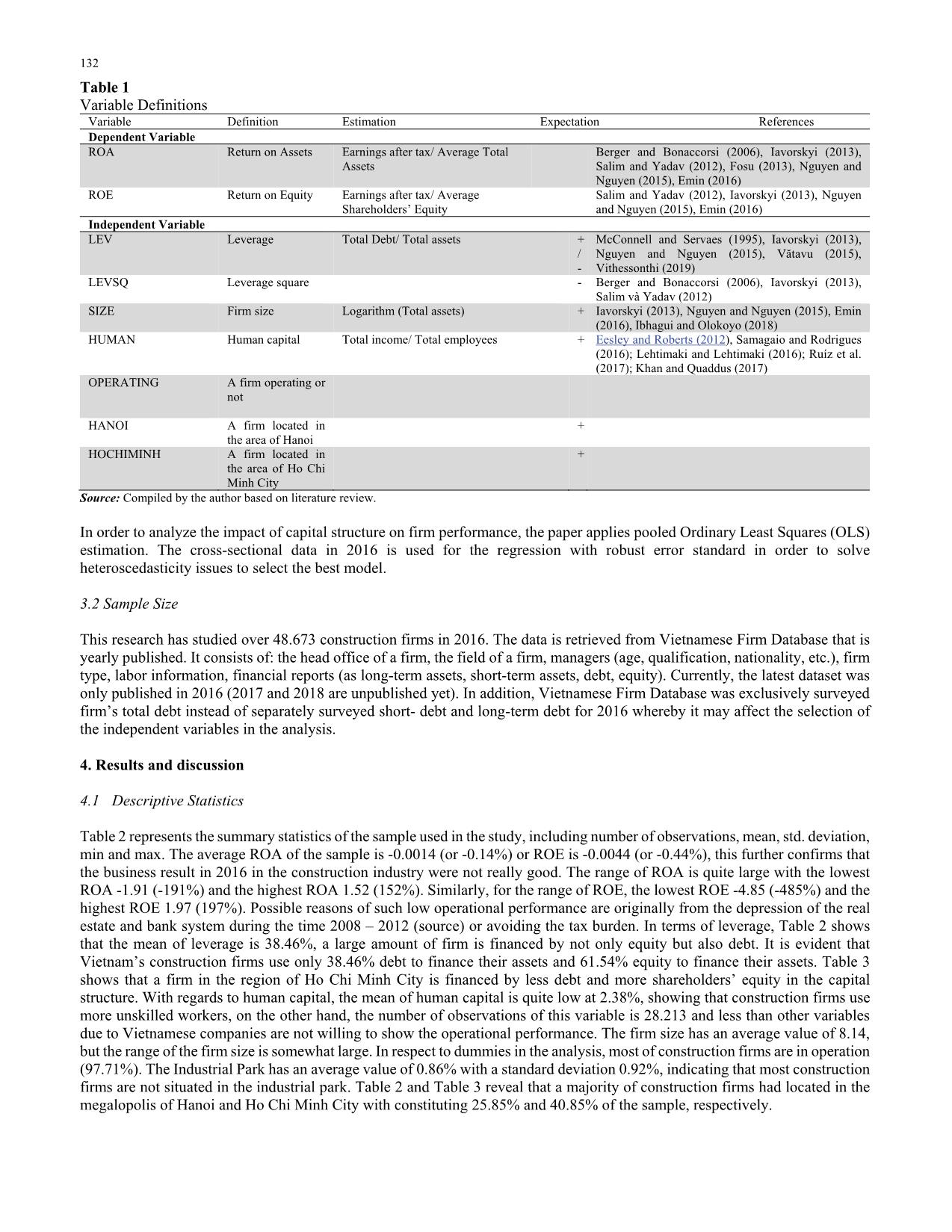

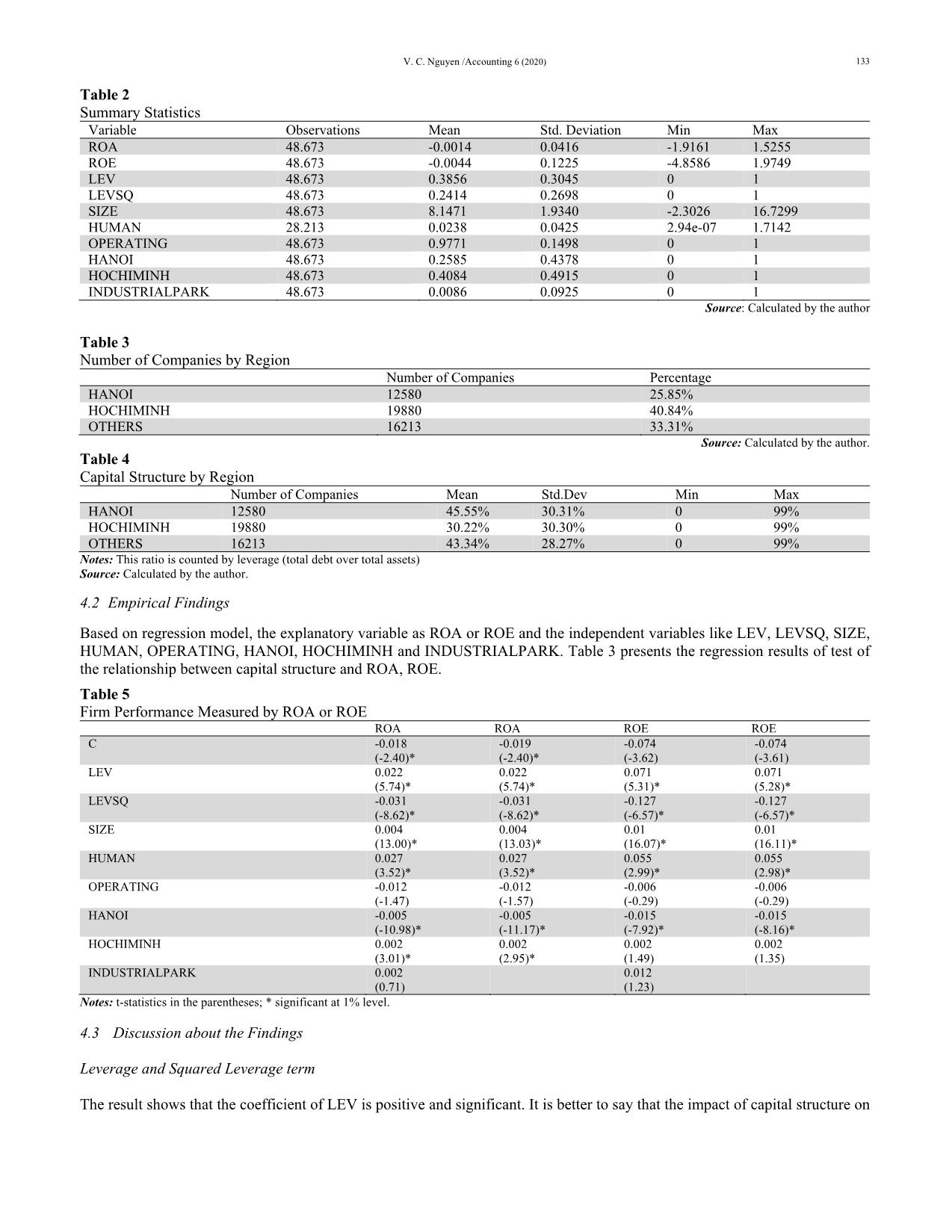

base that is yearly published. It consists of: the head office of a firm, the field of a firm, managers (age, qualification, nationality, etc.), firm type, labor information, financial reports (as long-term assets, short-term assets, debt, equity). Currently, the latest dataset was only published in 2016 (2017 and 2018 are unpublished yet). In addition, Vietnamese Firm Database was exclusively surveyed firm’s total debt instead of separately surveyed short- debt and long-term debt for 2016 whereby it may affect the selection of the independent variables in the analysis. 4. Results and discussion 4.1 Descriptive Statistics Table 2 represents the summary statistics of the sample used in the study, including number of observations, mean, std. deviation, min and max. The average ROA of the sample is -0.0014 (or -0.14%) or ROE is -0.0044 (or -0.44%), this further confirms that the business result in 2016 in the construction industry were not really good. The range of ROA is quite large with the lowest ROA -1.91 (-191%) and the highest ROA 1.52 (152%). Similarly, for the range of ROE, the lowest ROE -4.85 (-485%) and the highest ROE 1.97 (197%). Possible reasons of such low operational performance are originally from the depression of the real estate and bank system during the time 2008 – 2012 (source) or avoiding the tax burden. In terms of leverage, Table 2 shows that the mean of leverage is 38.46%, a large amount of firm is financed by not only equity but also debt. It is evident that Vietnam’s construction firms use only 38.46% debt to finance their assets and 61.54% equity to finance their assets. Table 3 shows that a firm in the region of Ho Chi Minh City is financed by less debt and more shareholders’ equity in the capital structure. With regards to human capital, the mean of human capital is quite low at 2.38%, showing that construction firms use more unskilled workers, on the other hand, the number of observations of this variable is 28.213 and less than other variables due to Vietnamese companies are not willing to show the operational performance. The firm size has an average value of 8.14, but the range of the firm size is somewhat large. In respect to dummies in the analysis, most of construction firms are in operation (97.71%). The Industrial Park has an average value of 0.86% with a standard deviation 0.92%, indicating that most construction firms are not situated in the industrial park. Table 2 and Table 3 reveal that a majority of construction firms had located in the megalopolis of Hanoi and Ho Chi Minh City with constituting 25.85% and 40.85% of the sample, respectively. V. C. Nguyen /Accounting 6 (2020) 133 Table 2 Summary Statistics Variable Observations Mean Std. Deviation Min Max ROA 48.673 -0.0014 0.0416 -1.9161 1.5255 ROE 48.673 -0.0044 0.1225 -4.8586 1.9749 LEV 48.673 0.3856 0.3045 0 1 LEVSQ 48.673 0.2414 0.2698 0 1 SIZE 48.673 8.1471 1.9340 -2.3026 16.7299 HUMAN 28.213 0.0238 0.0425 2.94e-07 1.7142 OPERATING 48.673 0.9771 0.1498 0 1 HANOI 48.673 0.2585 0.4378 0 1 HOCHIMINH 48.673 0.4084 0.4915 0 1 INDUSTRIALPARK 48.673 0.0086 0.0925 0 1 Source: Calculated by the author Table 3 Number of Companies by Region Number of Companies Percentage HANOI 12580 25.85% HOCHIMINH 19880 40.84% OTHERS 16213 33.31% Source: Calculated by the author. Table 4 Capital Structure by Region Number of Companies Mean Std.Dev Min Max HANOI 12580 45.55% 30.31% 0 99% HOCHIMINH 19880 30.22% 30.30% 0 99% OTHERS 16213 43.34% 28.27% 0 99% Notes: This ratio is counted by leverage (total debt over total assets) Source: Calculated by the author. 4.2 Empirical Findings Based on regression model, the explanatory variable as ROA or ROE and the independent variables like LEV, LEVSQ, SIZE, HUMAN, OPERATING, HANOI, HOCHIMINH and INDUSTRIALPARK. Table 3 presents the regression results of test of the relationship between capital structure and ROA, ROE. Table 5 Firm Performance Measured by ROA or ROE ROA ROA ROE ROE C -0.018 (-2.40)* -0.019 (-2.40)* -0.074 (-3.62) -0.074 (-3.61) LEV 0.022 (5.74)* 0.022 (5.74)* 0.071 (5.31)* 0.071 (5.28)* LEVSQ -0.031 (-8.62)* -0.031 (-8.62)* -0.127 (-6.57)* -0.127 (-6.57)* SIZE 0.004 (13.00)* 0.004 (13.03)* 0.01 (16.07)* 0.01 (16.11)* HUMAN 0.027 (3.52)* 0.027 (3.52)* 0.055 (2.99)* 0.055 (2.98)* OPERATING -0.012 (-1.47) -0.012 (-1.57) -0.006 (-0.29) -0.006 (-0.29) HANOI -0.005 (-10.98)* -0.005 (-11.17)* -0.015 (-7.92)* -0.015 (-8.16)* HOCHIMINH 0.002 (3.01)* 0.002 (2.95)* 0.002 (1.49) 0.002 (1.35) INDUSTRIALPARK 0.002 (0.71) 0.012 (1.23) Notes: t-statistics in the parentheses; * significant at 1% level. 4.3 Discussion about the Findings Leverage and Squared Leverage term The result shows that the coefficient of LEV is positive and significant. It is better to say that the impact of capital structure on 134 firm performance is actually positive. Similarly, a higher level of debt is related to better firm performance. This finding is consistent with Jensen (1986), Berger and Bonaccora (2006), Salim and Yadav (2012). This finding is in contrast with Nguyen and Nguyen (2015) who revealed that firm performance is negatively associated with capital structure. The coefficient of LEVSQ is negative and also significant. An inverted U-shaped relationship might be appeared from the influence of the leverage on firm performance. This evidence is explained that in the real life, appearing of taxes, a company can acquire benefit the tax so called tax shield (Westerfield & Jordan, 2011; Iavorskyi, 2013). In addition, the absence of bankruptcy cost, a firm with a higher level of debt in the capital structure is associated with a higher level of financial distress cost. Firm Size In respect to Firm Size, the coefficient is positive and significant. Showing that the firm size has positively significant relationship with the performance of the firm. It reveals that an increase in firm size will accelerate the performance of the firm. Besides the evidence, t-statistics is very high in consistent with a strong effect. It is correlated with the findings of Nguyen and Nguyen (2015) who conducting in 147 companies on Ho Chi Minh City Stock Exchange as well as the study of Emin (2016) who conducting in Turkey during 2006-2014. This finding is easy to explain in terms of micro-economy, a larger firm is often more efficient due to the economies of scale. Human Capital It is essential to understand human capital as a stock of technically qualified employees in employment, the level of education of the managers. In the construction industry, the finding is said that a firm with a higher level of human capital is positively associated with a higher level of performance which is in line with the findings of Gashi (2014) who indicated that human capital as assets does not follow the law of diminishing marginal utility. The evidence is also connected with the findings in the studies of Samagaio and Rodrigues (2016); Lehtimaki and Lehtimaki (2016); Ruíz et al. (2017); Khan and Quaddus (2017). Consequently, using optimal human resources, firms’ performance can strongly increase. Operating Status, Region (Hanoi, Ho Chi Minh) and Industrial Park A dummy of operating of the firm. An insignificant negative effect of operating status on firm performance is found. In addition, it is evident to conclude that a firm locating in Hanoi’s area may have a significant, negative impact on firm performance. A significant, positive relationship for a firm locating in the metropolitan of Ho Chi Minh and performance has been found. The results also indicate that firms locating in the region of Ho Chi Minh have a better performance than firms locating in the region of Hanoi. In fact, Ho Chi Minh is known as the better place to do business than Hanoi, especially for private companies like construction industry. Following is the business placement related to the performance, an insignificant positive effect of a firm locating in the industrial park on firm performance has been found. Similarly, the construction firm is not likely to situate in the industrial park. Table 2 presents that only 0.86 percent of construction firms (or 4186 companies) operating in the industrial park. As shown by Zheng et al. (2015), the proximity to the industrial park may reduce the costs of moving goods, ideas and people, however, this advantage of construction industry has not happened. 5. Conclusion The study has estimated the impact of capital structure choice, human capital on firm performance in a developing country like Vietnam and using the dataset of 2016 Vietnamese Firm. Using a dataset of 48.673 observations and two accounting-based measures of firm performance; i.e. ROE and ROA. The empirical results present that a firm using more debt in capital structure can positively impact on firm performance but this effect is like an inverted U-shaped curve. Furthermore, a higher level of firm size as well as a higher level of human capital can increase the performance of the firm. The finding also indicated that a firm locating in the metropolitan of Ho Chi Minh had a significant positive impact on firm performance. In other words, a firm locating in the region of Hanoi may have significantly negative impact on firm performance. Finally, operating status and industrial park do not have any impact on the performance of the firm. References Adachi-Sato, M., & Vithessonthi, C. (2019). Corporate debt maturity and future firm performance volatility. International Review of Economics & Finance, 60, 216-237. Berger, A., & Bonaccora, E. (2006). Capital structure and firm performance: A new approach to testing agency theory and an application to the banking industry. Journal of Banking & Finance, 30(4), 1065-1102. Dollar, D. (2002). Reform, growth, and poverty in Vietnam. Policy, Research Working Paper. Washington DC: World Bank. Eesley, C.E., & Roberts, E.B. (2012). Are you experienced or are you talented?: When does innate talent vs. experience explain V. C. Nguyen /Accounting 6 (2020) 135 entrepreneurial performance?. Strategic Entrepreneurship Journal, 6(3), 207-219. Emin, A. (2016). Capital Structure and Firm Performance: An Application on Manufacturing Industry. Journal of Economics & Administrative Sciences, 38(1), 15-30. Gashi, P. (2014). Human capital and export decisions: The case of small and medium enterprises in Kosovo. Croatian Economic Survey, 16(2), 91-120. Iavorskyi, M. (2013). The Impact of Capital Structure on Firm Performance: Evidence from Ukraine. Kyiv School of Economics, Ukraine. Ibhagui, O.W., & Olokoyo, F.O. (2018). Leverage and firm performance: New evidence on the role of firm size. The North America Journal of Economics and Finance, 45, 58-72. Jensen, M. (1986). Agency cost of free cash flow, corporate finance, and takeovers: Corporate finance, and takeovers. American Economic Review, 76(2), 323-329. Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360. Khan, E.A., & Quaddus, M. (2017). Dimensions of human capital and firm performance: Micro-firm context. IIMB Management Review, 30(3), 229-241. Lehtimaki, J., & Lehtimaki, J. (2016). The impact of knowledge capital on performance of firms: A case of firms in Finland. Eurasian Journal of Business and Economics, 9(18), 41-59. McConnell, J.J., & Servaes, H. (1995). Equity ownership and the two faces of debt. Journal of Financial Economics, 39(1), 131-157. Modigliani, F., & Miller, M., (1963). Corporate income taxes and the cost of capital: A correction. The American Economic Review, 53(3), 433-443. Myers, S.C., & Majluf, N.S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187-221. Nguyen, A.N., & Nguyen, T. (2007). Foreign direct investment in Vietnam: An overview and analysis of the determinant of spatial distribution across provinces. Development and Policies Research Center, Working Paper, Hanoi. Nguyen, T và Nguyen, H.C. (2015). Capital structure and firms’ performance: Evidence from Vietnam’s stock exchange. International Journal of Economics and Finance, 7(12), 1-10. OECD (2002). Foreign direct investment for development: Maximum benefits and minimum costs. OECD Publications Service, Paris, France. Ployhart, R. E. and Moliterno, T. P. (2011). Emergence of the Human Capital Resource: A Multilevel Model. The Academy of Management Review, 36(1), 127-150. Ruíz, M. D. A., Gutiérrez, J. O., Martínez-Caro, E., & Cegarra-Navarro, J. G. (2017). Linking an unlearning context with firm performance through human capital. European Research on Management and Business Economics, 23(1), 16-22. Salim, M., & Yadav, R. (2012). Capital structure and firm performance: Evidence from Malaysian listed companies. Procedia - Social and Behavioral Sciences, 65, 156-166. Samagaio, A., & Rodrigues, R. (2016). Human capital and performance in young audit firms. Journal of Business Research, 69(11), 5354-5359. State Bank Vietnam (2012). Some solutions for the real estate market in Vietnam to develop sustainably under current conditions. Retrieved September 2, 2019, from https://www.sbv.gov.vn Vătavu, S. (2015). The impact of capital structure on financial performance in Romania listed companies. Procedia Economics and Finance, 32, 1314-1322. VCCI (2019). The summaries of Vietnam’s FTA to July 2019. Retrieved September 2, 2019, from Vietnamese National Productivity Institute (2018). Report of Productivity in Vietnam. Retrieved September 2, 2019, from Westerfield, R., Ross, S.A. & Jordan, B.D. (2011). Corporate Finance Essentials. Global Edition. Mc Graw-Hill Irwin (1803). Wignaraja, G. (2011). FDI, Size, and Innovation: Influences on Firm-Level Exports in East Asia. TMD Working Paper Series No.04. University of Oxford. Wignaraja, G. (2008). FDI and Innovation as Drivers of Export Behavior: Firm- Level Evidence from East Asia. UNU-MERIT Working Paper Series 061. Asian Development Bank. World Bank (2011). Vietnam Development Report 2012: Market Economy for a Middle Income Vietnam. Washington, D.C: World Bank. Zheng, S., Wu, W., & Kahn, M. (2015). The birth of edge cities in China: Measuring the effects in industrial parks policy. Journal of Urban Economics, 100(c), 80-103. 136 © 2019 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

human_capital_capital_structure_choice_and_firm_profitabilit.pdf

human_capital_capital_structure_choice_and_firm_profitabilit.pdf