How to improve financial performance of tourism and travel enterprises: The case of Vietnam

The objective of this paper is to study how to improve the financial performance of Vietnamese

tourism and travel enterprises through audit tools. The study was conducted on 228 tourism and travel

enterprises in Vietnam over a period of 1 year. The results show that quality of audit could improve

the financial performance of tourism and travel enterprises in Vietnam. This relationship, however,

was not a full mediate relationship, but audit quality still had a strong impact on capital access,

customer loyalty, employee satisfaction and corporate reputation. Nevertheless, the two mediate

factors that access capital and employee satisfaction did not have any statistically significant impact

on financial performance.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tóm tắt nội dung tài liệu: How to improve financial performance of tourism and travel enterprises: The case of Vietnam

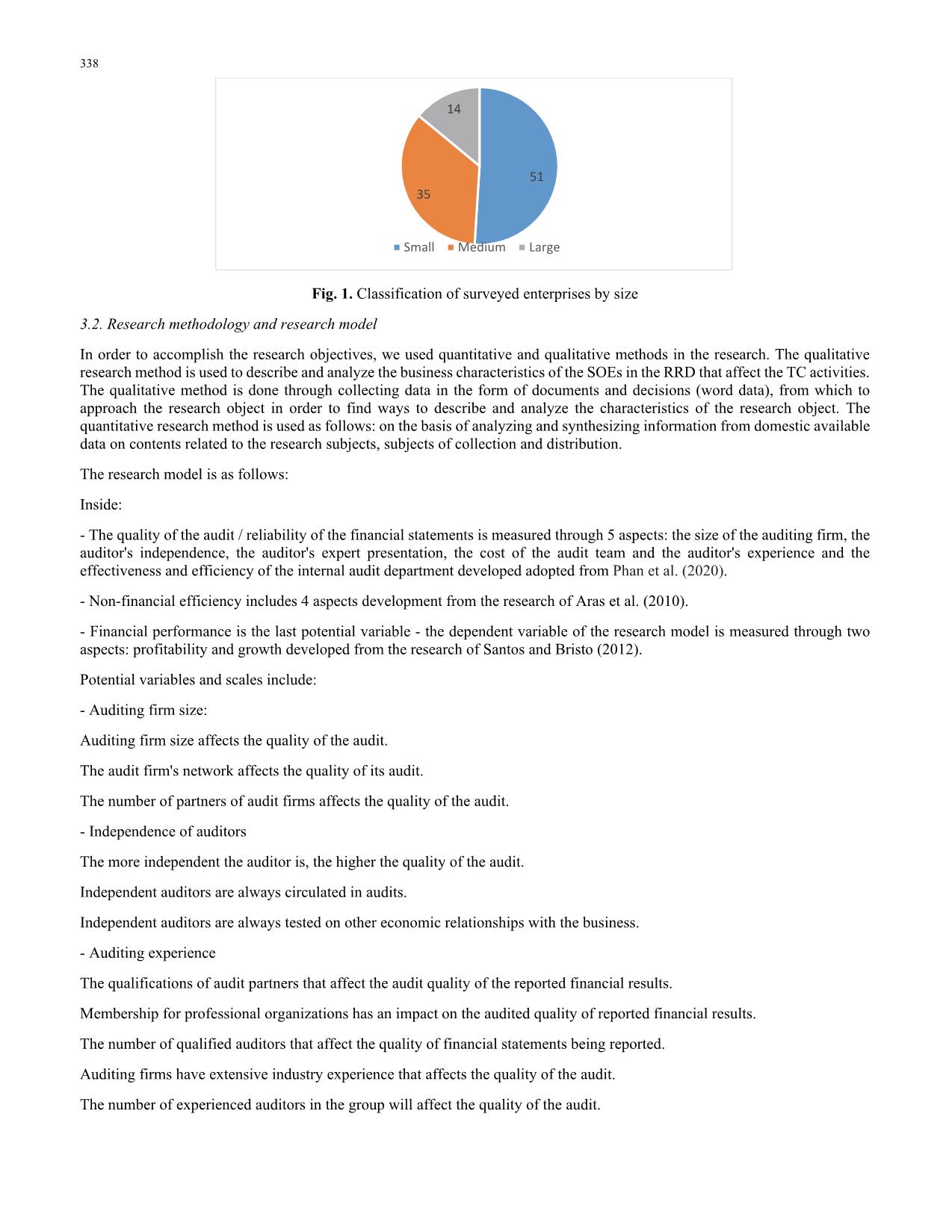

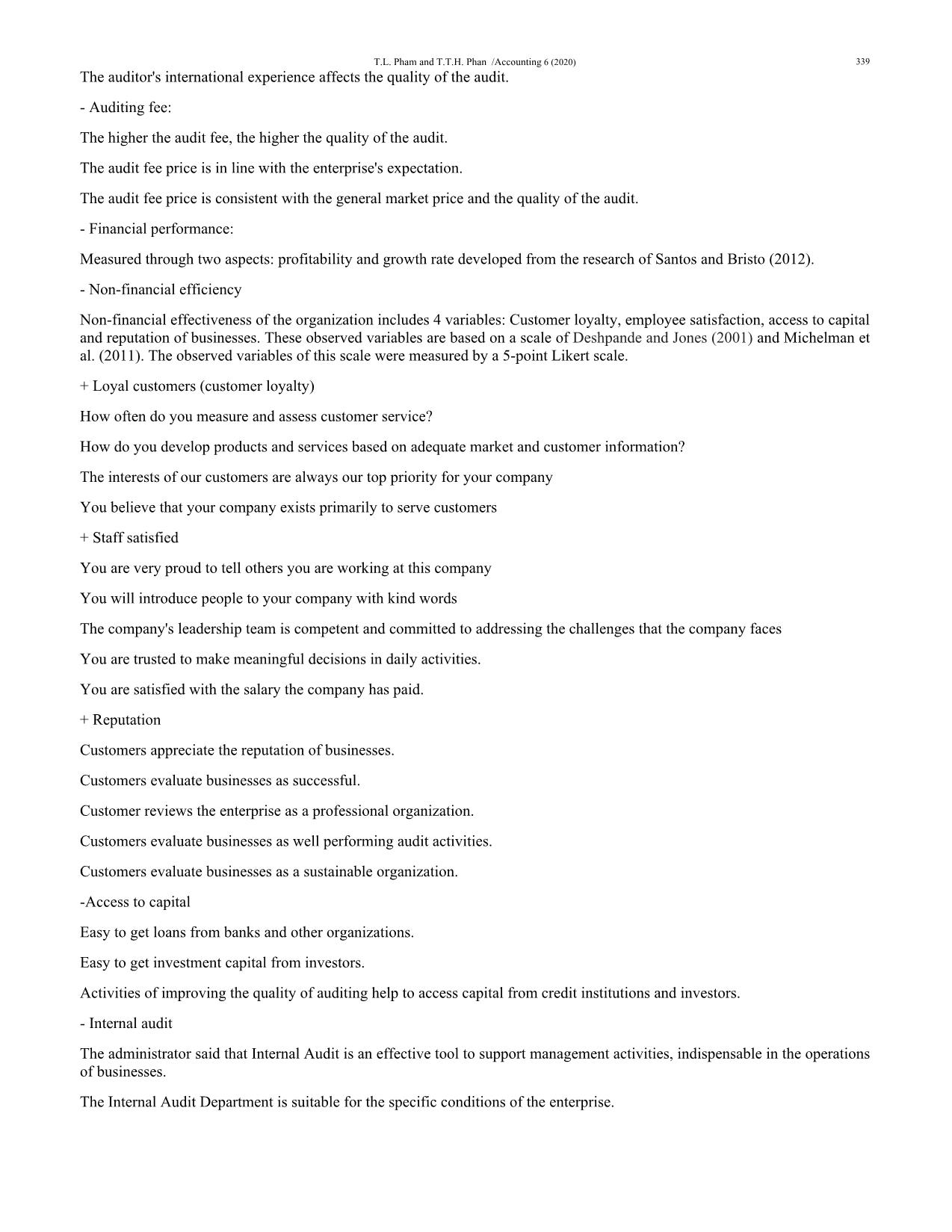

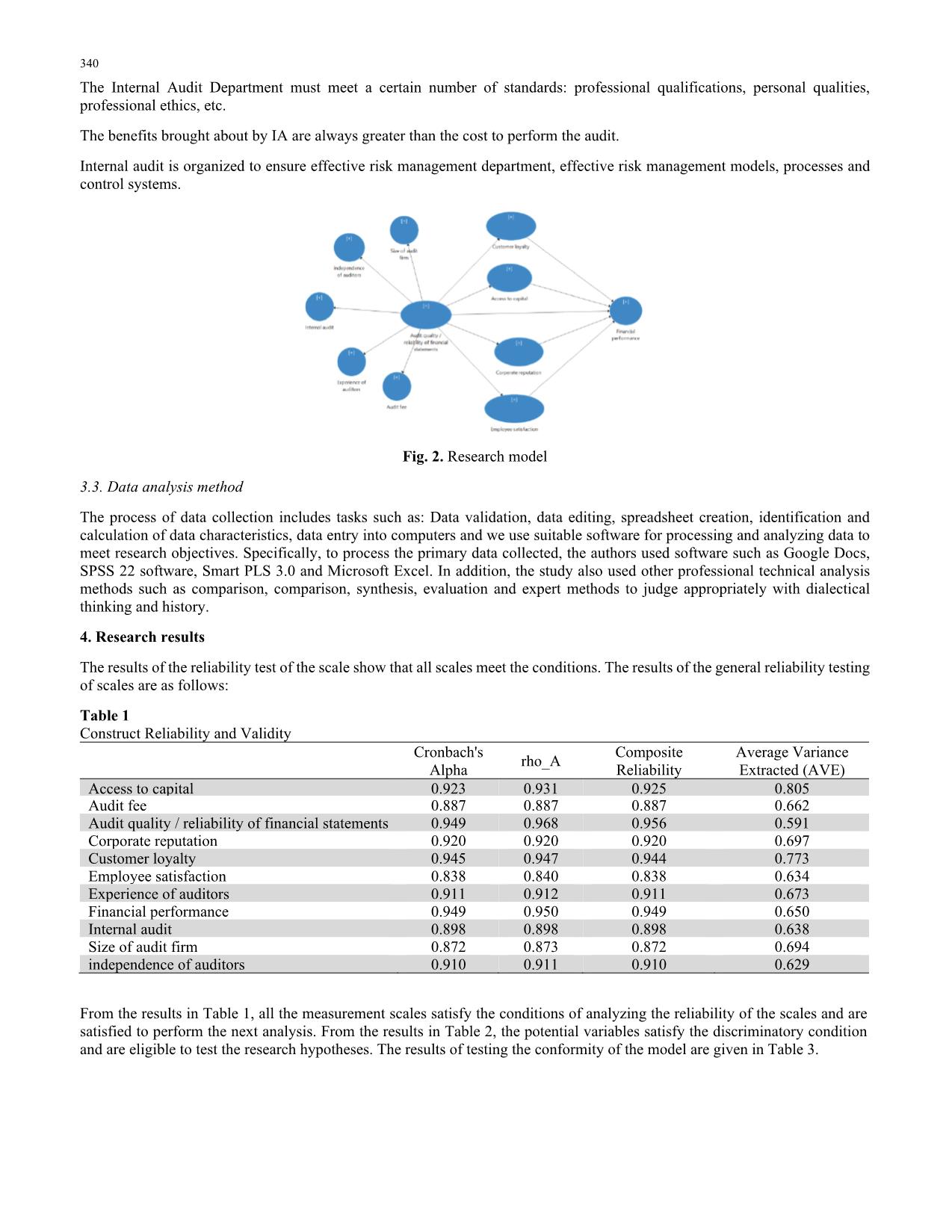

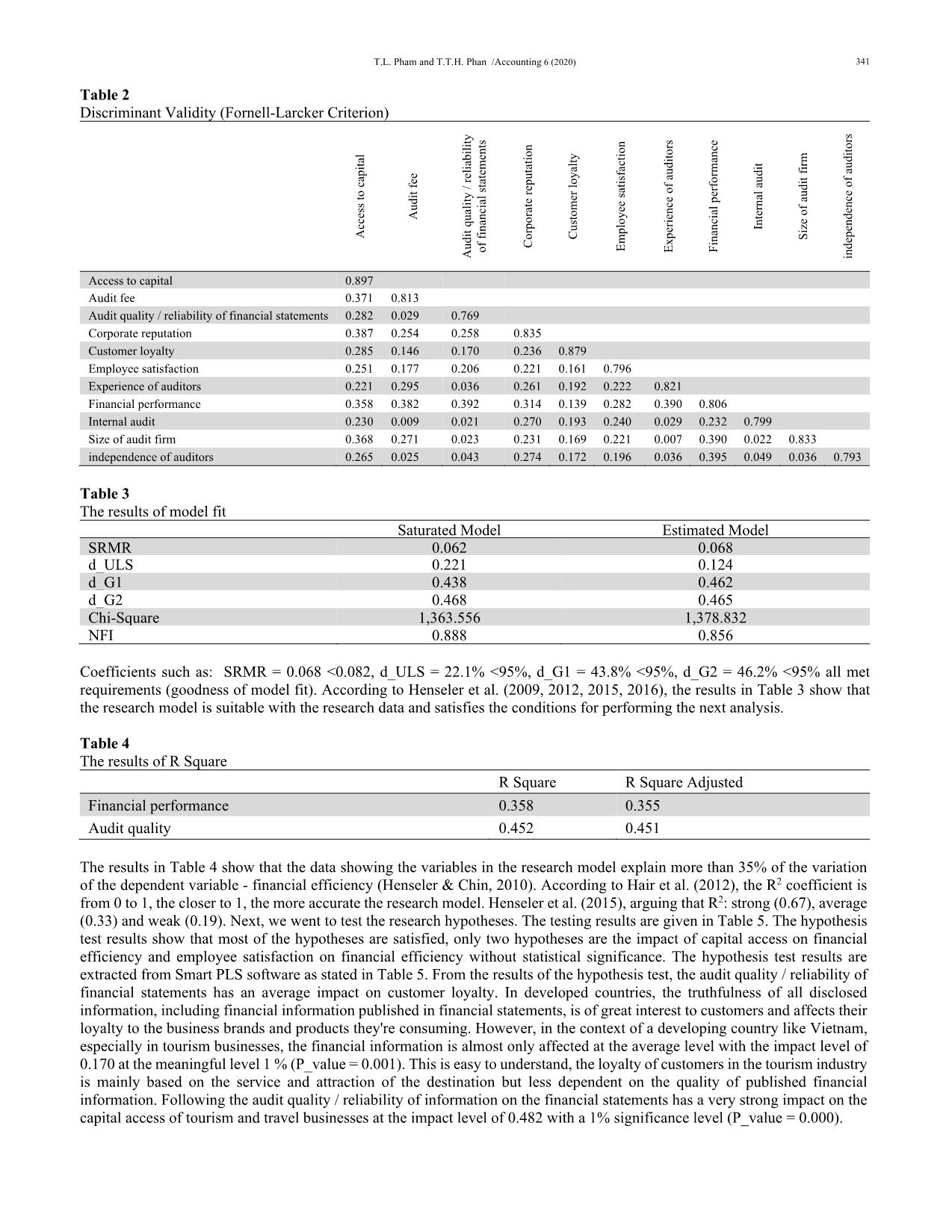

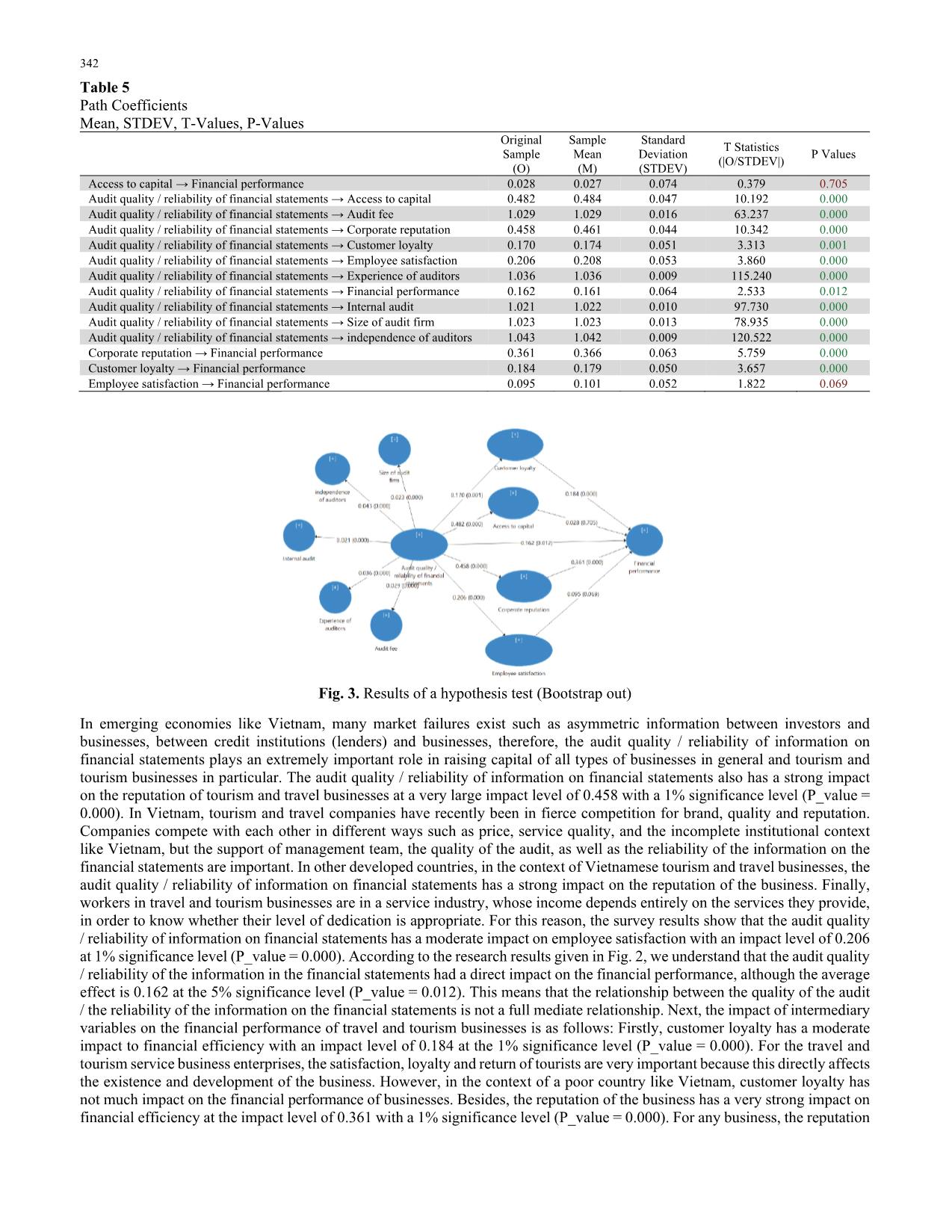

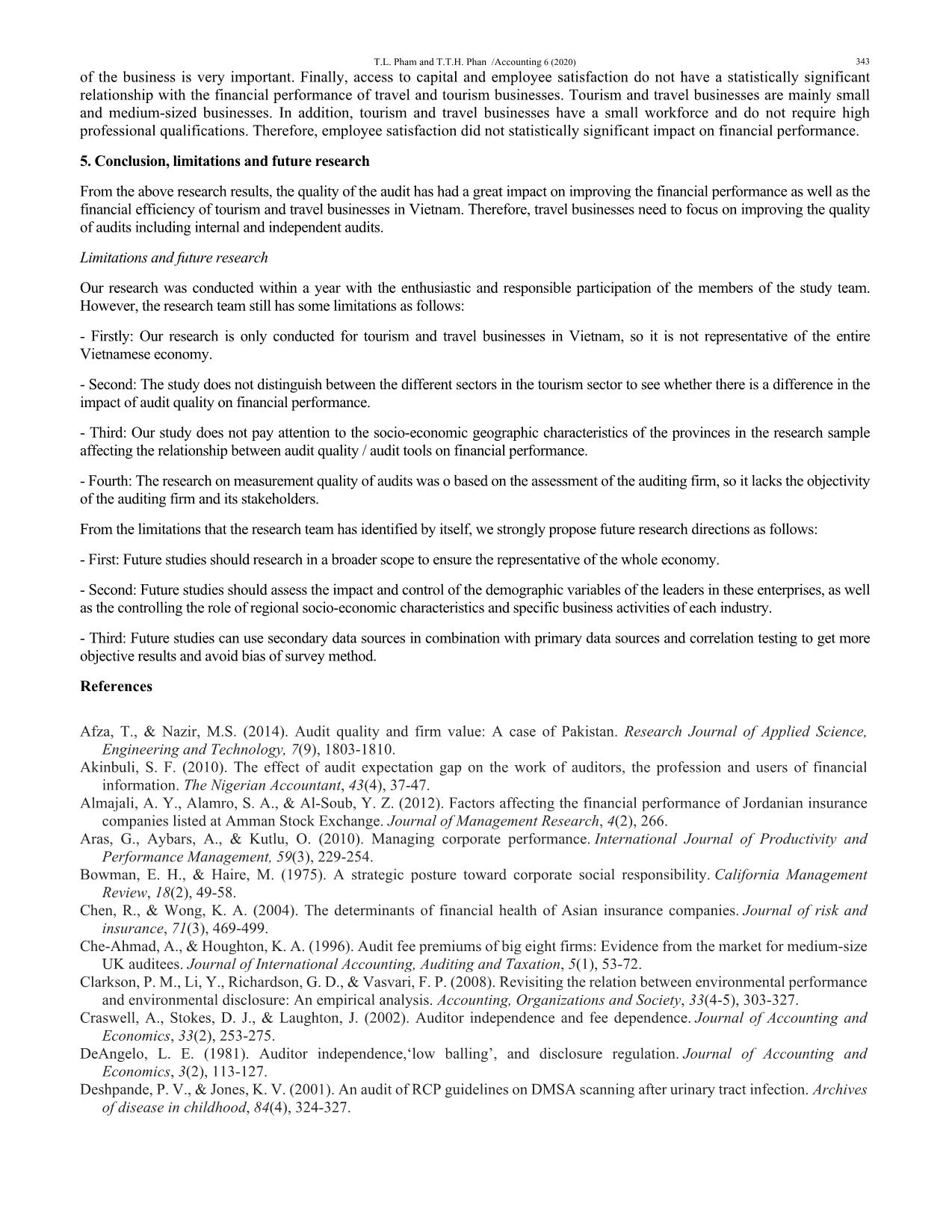

most of the hypotheses are satisfied, only two hypotheses are the impact of capital access on financial efficiency and employee satisfaction on financial efficiency without statistical significance. The hypothesis test results are extracted from Smart PLS software as stated in Table 5. From the results of the hypothesis test, the audit quality / reliability of financial statements has an average impact on customer loyalty. In developed countries, the truthfulness of all disclosed information, including financial information published in financial statements, is of great interest to customers and affects their loyalty to the business brands and products they're consuming. However, in the context of a developing country like Vietnam, especially in tourism businesses, the financial information is almost only affected at the average level with the impact level of 0.170 at the meaningful level 1 % (P_value = 0.001). This is easy to understand, the loyalty of customers in the tourism industry is mainly based on the service and attraction of the destination but less dependent on the quality of published financial information. Following the audit quality / reliability of information on the financial statements has a very strong impact on the capital access of tourism and travel businesses at the impact level of 0.482 with a 1% significance level (P_value = 0.000). 342 Table 5 Path Coefficients Mean, STDEV, T-Values, P-Values Original Sample (O) Sample Mean (M) Standard Deviation (STDEV) T Statistics (|O/STDEV|) P Values Access to capital → Financial performance 0.028 0.027 0.074 0.379 0.705 Audit quality / reliability of financial statements → Access to capital 0.482 0.484 0.047 10.192 0.000 Audit quality / reliability of financial statements → Audit fee 1.029 1.029 0.016 63.237 0.000 Audit quality / reliability of financial statements → Corporate reputation 0.458 0.461 0.044 10.342 0.000 Audit quality / reliability of financial statements → Customer loyalty 0.170 0.174 0.051 3.313 0.001 Audit quality / reliability of financial statements → Employee satisfaction 0.206 0.208 0.053 3.860 0.000 Audit quality / reliability of financial statements → Experience of auditors 1.036 1.036 0.009 115.240 0.000 Audit quality / reliability of financial statements → Financial performance 0.162 0.161 0.064 2.533 0.012 Audit quality / reliability of financial statements → Internal audit 1.021 1.022 0.010 97.730 0.000 Audit quality / reliability of financial statements → Size of audit firm 1.023 1.023 0.013 78.935 0.000 Audit quality / reliability of financial statements → independence of auditors 1.043 1.042 0.009 120.522 0.000 Corporate reputation → Financial performance 0.361 0.366 0.063 5.759 0.000 Customer loyalty → Financial performance 0.184 0.179 0.050 3.657 0.000 Employee satisfaction → Financial performance 0.095 0.101 0.052 1.822 0.069 Fig. 3. Results of a hypothesis test (Bootstrap out) In emerging economies like Vietnam, many market failures exist such as asymmetric information between investors and businesses, between credit institutions (lenders) and businesses, therefore, the audit quality / reliability of information on financial statements plays an extremely important role in raising capital of all types of businesses in general and tourism and tourism businesses in particular. The audit quality / reliability of information on financial statements also has a strong impact on the reputation of tourism and travel businesses at a very large impact level of 0.458 with a 1% significance level (P_value = 0.000). In Vietnam, tourism and travel companies have recently been in fierce competition for brand, quality and reputation. Companies compete with each other in different ways such as price, service quality, and the incomplete institutional context like Vietnam, but the support of management team, the quality of the audit, as well as the reliability of the information on the financial statements are important. In other developed countries, in the context of Vietnamese tourism and travel businesses, the audit quality / reliability of information on financial statements has a strong impact on the reputation of the business. Finally, workers in travel and tourism businesses are in a service industry, whose income depends entirely on the services they provide, in order to know whether their level of dedication is appropriate. For this reason, the survey results show that the audit quality / reliability of information on financial statements has a moderate impact on employee satisfaction with an impact level of 0.206 at 1% significance level (P_value = 0.000). According to the research results given in Fig. 2, we understand that the audit quality / reliability of the information in the financial statements had a direct impact on the financial performance, although the average effect is 0.162 at the 5% significance level (P_value = 0.012). This means that the relationship between the quality of the audit / the reliability of the information on the financial statements is not a full mediate relationship. Next, the impact of intermediary variables on the financial performance of travel and tourism businesses is as follows: Firstly, customer loyalty has a moderate impact to financial efficiency with an impact level of 0.184 at the 1% significance level (P_value = 0.000). For the travel and tourism service business enterprises, the satisfaction, loyalty and return of tourists are very important because this directly affects the existence and development of the business. However, in the context of a poor country like Vietnam, customer loyalty has not much impact on the financial performance of businesses. Besides, the reputation of the business has a very strong impact on financial efficiency at the impact level of 0.361 with a 1% significance level (P_value = 0.000). For any business, the reputation T.L. Pham and T.T.H. Phan /Accounting 6 (2020) 343 of the business is very important. Finally, access to capital and employee satisfaction do not have a statistically significant relationship with the financial performance of travel and tourism businesses. Tourism and travel businesses are mainly small and medium-sized businesses. In addition, tourism and travel businesses have a small workforce and do not require high professional qualifications. Therefore, employee satisfaction did not statistically significant impact on financial performance. 5. Conclusion, limitations and future research From the above research results, the quality of the audit has had a great impact on improving the financial performance as well as the financial efficiency of tourism and travel businesses in Vietnam. Therefore, travel businesses need to focus on improving the quality of audits including internal and independent audits. Limitations and future research Our research was conducted within a year with the enthusiastic and responsible participation of the members of the study team. However, the research team still has some limitations as follows: - Firstly: Our research is only conducted for tourism and travel businesses in Vietnam, so it is not representative of the entire Vietnamese economy. - Second: The study does not distinguish between the different sectors in the tourism sector to see whether there is a difference in the impact of audit quality on financial performance. - Third: Our study does not pay attention to the socio-economic geographic characteristics of the provinces in the research sample affecting the relationship between audit quality / audit tools on financial performance. - Fourth: The research on measurement quality of audits was o based on the assessment of the auditing firm, so it lacks the objectivity of the auditing firm and its stakeholders. From the limitations that the research team has identified by itself, we strongly propose future research directions as follows: - First: Future studies should research in a broader scope to ensure the representative of the whole economy. - Second: Future studies should assess the impact and control of the demographic variables of the leaders in these enterprises, as well as the controlling the role of regional socio-economic characteristics and specific business activities of each industry. - Third: Future studies can use secondary data sources in combination with primary data sources and correlation testing to get more objective results and avoid bias of survey method. References Afza, T., & Nazir, M.S. (2014). Audit quality and firm value: A case of Pakistan. Research Journal of Applied Science, Engineering and Technology, 7(9), 1803-1810. Akinbuli, S. F. (2010). The effect of audit expectation gap on the work of auditors, the profession and users of financial information. The Nigerian Accountant, 43(4), 37-47. Almajali, A. Y., Alamro, S. A., & Al-Soub, Y. Z. (2012). Factors affecting the financial performance of Jordanian insurance companies listed at Amman Stock Exchange. Journal of Management Research, 4(2), 266. Aras, G., Aybars, A., & Kutlu, O. (2010). Managing corporate performance. International Journal of Productivity and Performance Management, 59(3), 229-254. Bowman, E. H., & Haire, M. (1975). A strategic posture toward corporate social responsibility. California Management Review, 18(2), 49-58. Chen, R., & Wong, K. A. (2004). The determinants of financial health of Asian insurance companies. Journal of risk and insurance, 71(3), 469-499. Che-Ahmad, A., & Houghton, K. A. (1996). Audit fee premiums of big eight firms: Evidence from the market for medium-size UK auditees. Journal of International Accounting, Auditing and Taxation, 5(1), 53-72. Clarkson, P. M., Li, Y., Richardson, G. D., & Vasvari, F. P. (2008). Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Accounting, Organizations and Society, 33(4-5), 303-327. Craswell, A., Stokes, D. J., & Laughton, J. (2002). Auditor independence and fee dependence. Journal of Accounting and Economics, 33(2), 253-275. DeAngelo, L. E. (1981). Auditor independence,‘low balling’, and disclosure regulation. Journal of Accounting and Economics, 3(2), 113-127. Deshpande, P. V., & Jones, K. V. (2001). An audit of RCP guidelines on DMSA scanning after urinary tract infection. Archives of disease in childhood, 84(4), 324-327. 344 Farouk, M. A., & Hassan, S. U. (2014). Impact of audit quality and financial performance of quoted cement firms in Nigeria. International Journal of Accounting and Taxation, 2(2), 1-22. Fooladi, M., & Shukor, Z. A. (2012, December). Board of directors, audit quality and firm performance: evidence from Malaysia. In National Research & Innovation Conference for Graduate Students in Social Sciences (pp. 7-9). Francis, J. R. (1984). The effect of audit firm size on audit prices: A study of the Australian market. Journal of Accounting and Economics, 6(2), 133-151. Francis, J. R., & Simon, D. T. (1987). A test of audit pricing in the small-client segment of the US audit market. Accounting Review, 145-157. Francis, J. R. (2004). What do we know about audit quality?. The British Accounting Review, 36(4), 345-368. Gul, F. A., Wu, D., & Yang, Z. (2013). Do individual auditors affect audit quality? Evidence from archival data. The Accounting Review, 88(6), 1993-2023. Hayes, R., Dassen Roger, Schilder, A., Wallage, P. (2005). Principles of Auditing. An Introduction to International Standards of Auditing. 2nd ed, Harlow: Pearson Prentice Hall. Jensen, M. C., & Meckling, W. (1976). Theory of the firm: managerial behavior, agency costs and ownership structure En: Journal of Finance Economics, 3. Jusoh, M. A., Ahmad, A., & Omar, B. (2013). Managerial ownership, audit quality and firm performance in Malaysian. International Journal of Arts and Commerce, 2(10), 45-58. Khurana, I. K., & Raman, K. K. (2004). Litigation risk and the financial reporting credibility of Big 4 versus non-Big 4 audits: Evidence from Anglo-American countries. The Accounting Review, 79(2), 473-495. Kinney, W. R., Martin, R. D., & Martin, R. (1994). Does auditing reduce bias in financial reporting? A review of audit-related adjustment studies. Auditing, 13(1), 149-156. Lily Marlina, A.M., & dan Takiah, M.I. (2003) Kualiti Pelaporan Maklumat Syarikatsyarikat di Bursa Saham Kuala Lumpur, Jurnal Pengurusan, 22, 27–45. McGuire, J. B., Sundgren, A., & Schneeweis, T. (1988). Corporate social responsibility and firm financial performance. Academy of Management Journal, 31(4), 854-872. Michelman, J. E., Gorman, V., & Trompeter, G. M. (2011). Accounting Fraud at CIT Computer Leasing Group, Inc. Issues in Accounting Education, 26(3), 569-591. Mohd-Mohid, R., & Takiah, M. I. (2004). Audit Fee Premiums from Brand Name. Industry Specialization and Industry Leadership: A Study of The Post Big, 6, 1-24. Pearce, N. J., Perkins, W. T., Westgate, J. A., Gorton, M. P., Jackson, S. E., Neal, C. R., & Chenery, S. P. (1997). A compilation of new and published major and trace element data for NIST SRM 610 and NIST SRM 612 glass reference materials. Geostandards newsletter, 21(1), 115-144. Phan, T., Lai, L., Le, T., & Tran, D. (2020). The impact of audit quality on performance of enterprises listed on Hanoi Stock Exchange. Management Science Letters, 10(1), 217-224. Ritchie, J. R. B., & Crouch, G. I. (2000, June). Are destination stars born or made: Must a competitive destination have star genes. In Lights, Camera, Action-31st Annual Conference Proceedings. Russo, M. V., & Fouts, P. A. (1997). A resource-based perspective on corporate environmental performance and profitability. Academy of Management Journal, 40(3), 534-559. Santos, J. B., & Brito, L. A. L. (2012). Toward a subjective measurement model for firm performance. BAR-Brazilian Administration Review, 9(SPE), 95-117. Stanwick, S. D., & Stanwick, P. A. (2000). The relationship between environmental disclosures and financial performance: an empirical study of US firms. Eco‐Management and Auditing: The Journal of Corporate Environmental Management, 7(4), 155-164. Teoh, H. Y. (1990). The Advertising of External Audit. Managerial Auditing Journal. Walker, M., & Tsalta, A. (2001). Corporate financial disclosure and analyst forecasting activity: preliminary evidence for the UK. Certified Accountants Educational Trust. Watts, R. L., & Zimmerman, J. L. (1983). Agency problems, auditing, and the theory of the firm: Some evidence. The Journal of Law and Economics, 26(3), 613-633. © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

how_to_improve_financial_performance_of_tourism_and_travel_e.pdf

how_to_improve_financial_performance_of_tourism_and_travel_e.pdf