Determinants influencing capital adequacy ratio of Vietnamese commercial banks

This study employs a panel data analysis to identify the factors that significantly affect the capital

adequacy ratio (CAR) of Vietnamese commercial banks for the period from 2011 to 2018. During this

period, the number of banks had decreased from 41 to 31 due to mergers and acquisitions. The variables

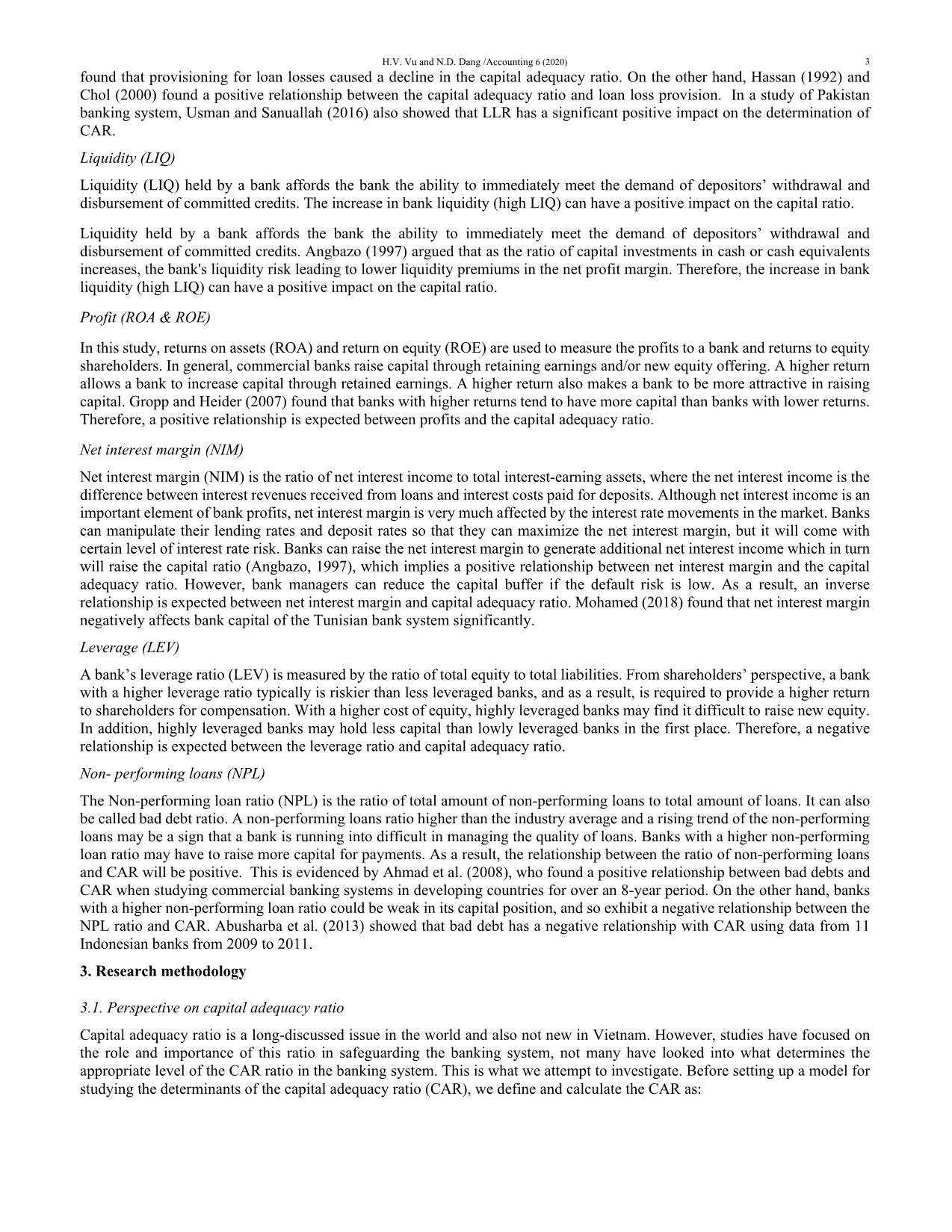

that are hypothesized to affect the capital adequacy ratio of commercial banks in Vietnam include bank

size (SIZE), deposit (DEP), loan (LOA), loan loss reserves (LLR), liquidity (LIQ), return on assets

(ROA), return on capital (ROE), net interest margin (NIM), non-performing loans (NPL) and leverage

(LEV). The results indicate that LEV, LLR, ROE had a negative impact, ROA had a positive impact,

and SIZE, DEP, LOA, LIQ, NIM, NPL did not significantly influence the CAR of Vietnamese

commercial banks.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Tóm tắt nội dung tài liệu: Determinants influencing capital adequacy ratio of Vietnamese commercial banks

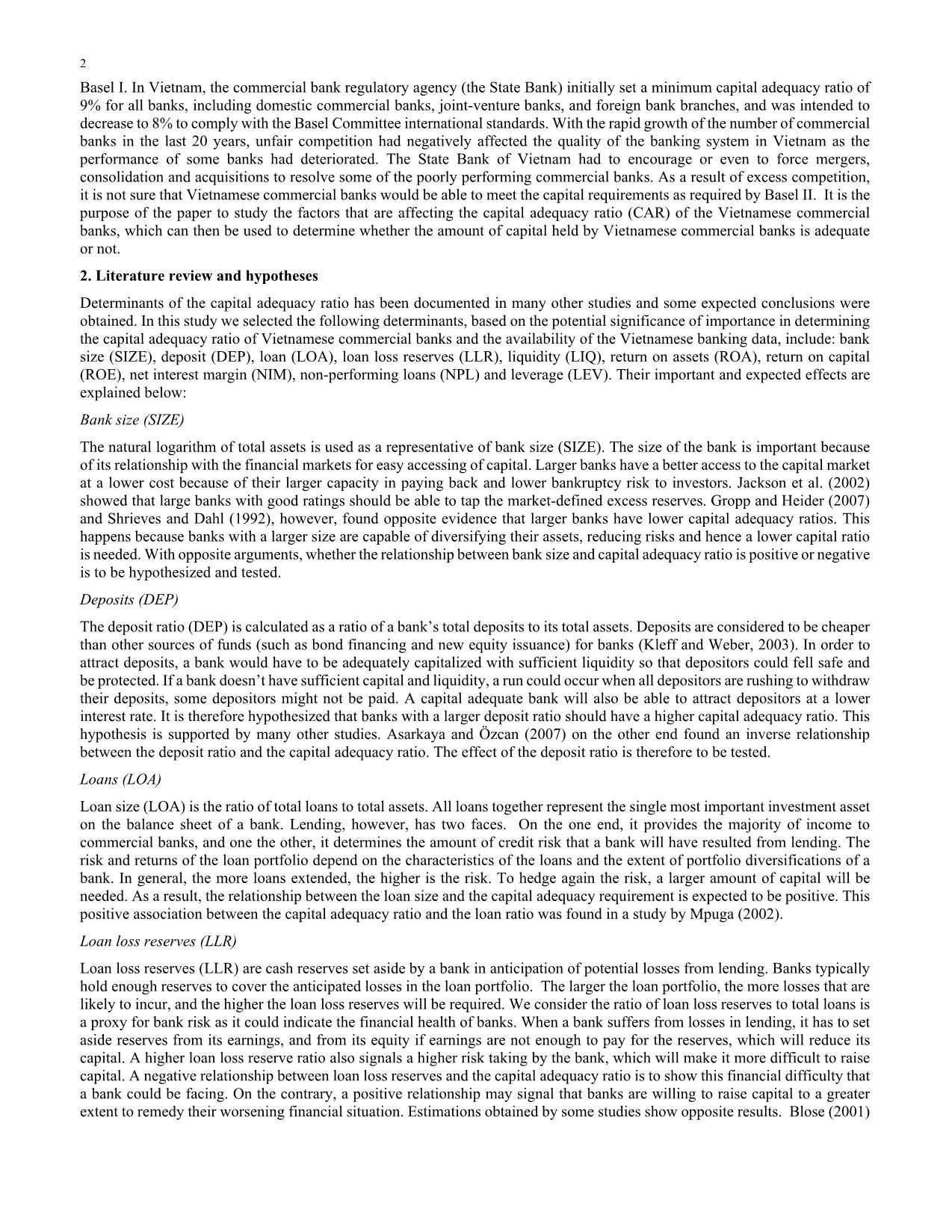

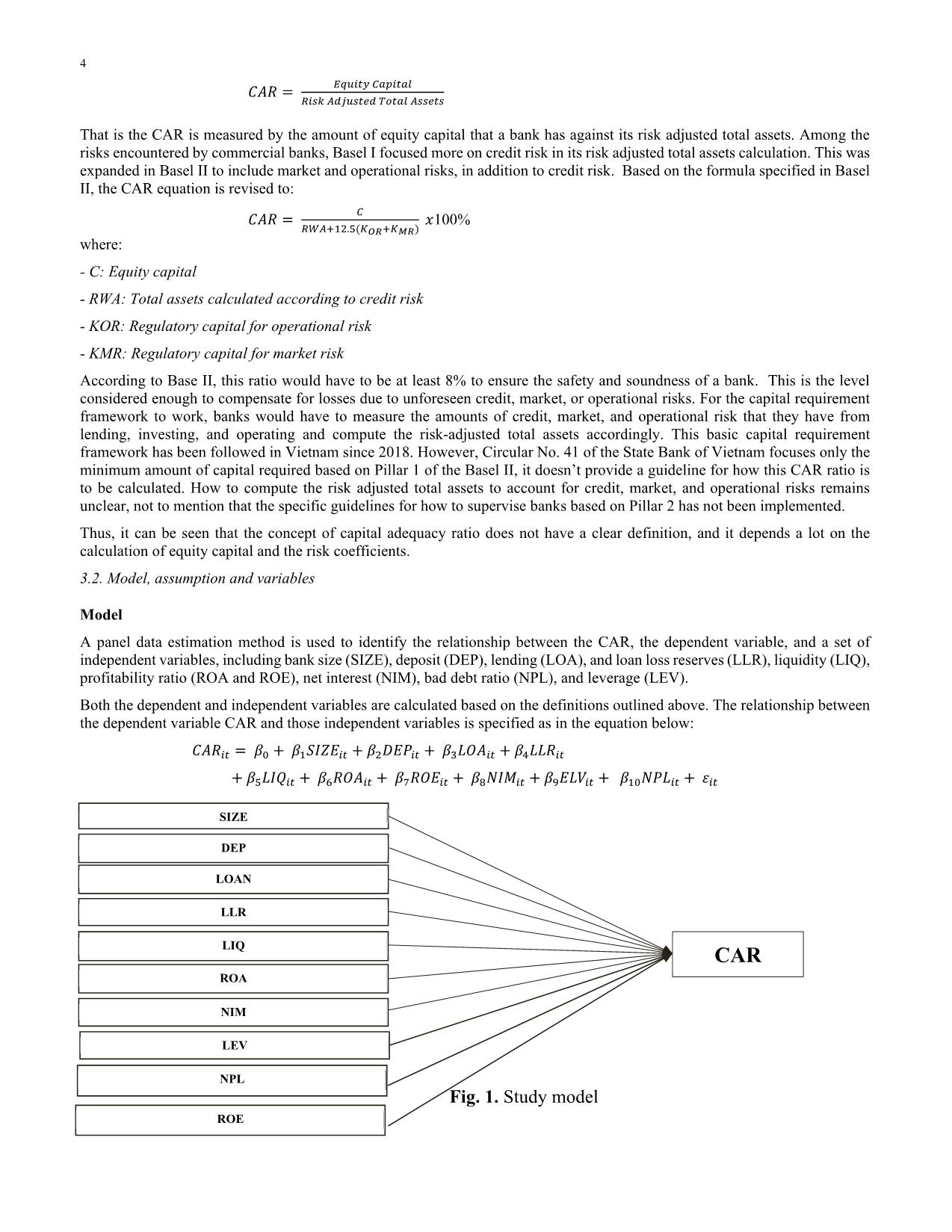

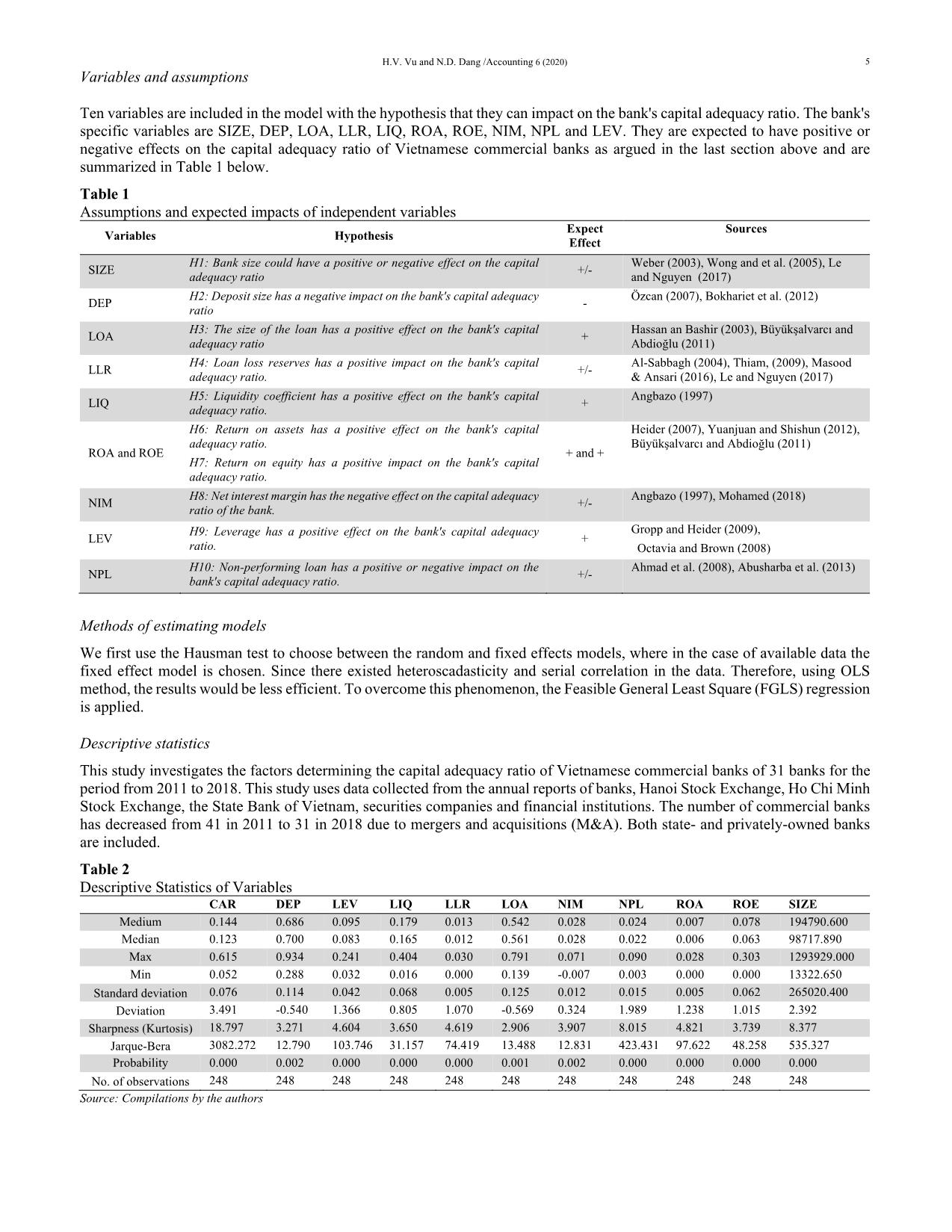

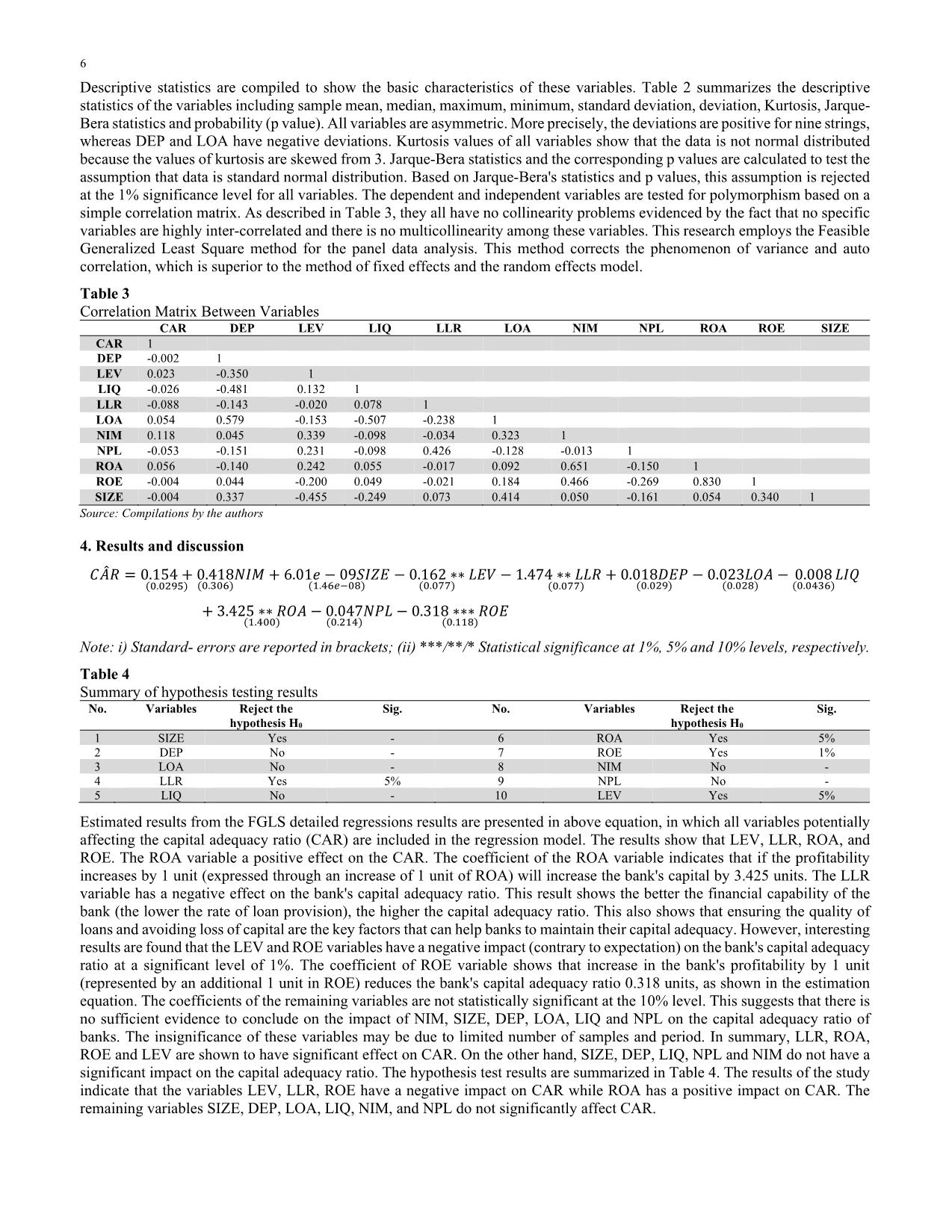

366 0.805 1.070 -0.569 0.324 1.989 1.238 1.015 2.392 Sharpness (Kurtosis) 18.797 3.271 4.604 3.650 4.619 2.906 3.907 8.015 4.821 3.739 8.377 Jarque-Bera 3082.272 12.790 103.746 31.157 74.419 13.488 12.831 423.431 97.622 48.258 535.327 Probability 0.000 0.002 0.000 0.000 0.000 0.001 0.002 0.000 0.000 0.000 0.000 No. of observations 248 248 248 248 248 248 248 248 248 248 248 Source: Compilations by the authors 6 Descriptive statistics are compiled to show the basic characteristics of these variables. Table 2 summarizes the descriptive statistics of the variables including sample mean, median, maximum, minimum, standard deviation, deviation, Kurtosis, Jarque- Bera statistics and probability (p value). All variables are asymmetric. More precisely, the deviations are positive for nine strings, whereas DEP and LOA have negative deviations. Kurtosis values of all variables show that the data is not normal distributed because the values of kurtosis are skewed from 3. Jarque-Bera statistics and the corresponding p values are calculated to test the assumption that data is standard normal distribution. Based on Jarque-Bera's statistics and p values, this assumption is rejected at the 1% significance level for all variables. The dependent and independent variables are tested for polymorphism based on a simple correlation matrix. As described in Table 3, they all have no collinearity problems evidenced by the fact that no specific variables are highly inter-correlated and there is no multicollinearity among these variables. This research employs the Feasible Generalized Least Square method for the panel data analysis. This method corrects the phenomenon of variance and auto correlation, which is superior to the method of fixed effects and the random effects model. Table 3 Correlation Matrix Between Variables Source: Compilations by the authors 4. Results and discussion 𝐶𝐴መ𝑅 = 0.154 +(.ଶଽହ) 0.418(.ଷ)𝑁𝐼𝑀 + 6.01𝑒 − 09𝑆𝐼𝑍𝐸(ଵ.ସି଼) − 0.162 ∗∗(.) 𝐿𝐸𝑉 − 1.474 ∗∗ 𝐿𝐿𝑅 +(.) 0.018𝐷𝐸𝑃(.ଶଽ) − 0.023𝐿𝑂𝐴(.ଶ଼) − 0.008(.ସଷ)𝐿𝐼𝑄+ 3.425 ∗∗ 𝑅𝑂𝐴(ଵ.ସ) − 0.047(.ଶଵସ)𝑁𝑃𝐿 − 0.318 ∗∗∗ 𝑅𝑂𝐸(.ଵଵ଼) Note: i) Standard- errors are reported in brackets; (ii) ***/**/* Statistical significance at 1%, 5% and 10% levels, respectively. Table 4 Summary of hypothesis testing results No. Variables Reject the hypothesis H0 Sig. No. Variables Reject the hypothesis H0 Sig. 1 SIZE Yes - 6 ROA Yes 5% 2 DEP No - 7 ROE Yes 1% 3 LOA No - 8 NIM No - 4 LLR Yes 5% 9 NPL No - 5 LIQ No - 10 LEV Yes 5% Estimated results from the FGLS detailed regressions results are presented in above equation, in which all variables potentially affecting the capital adequacy ratio (CAR) are included in the regression model. The results show that LEV, LLR, ROA, and ROE. The ROA variable a positive effect on the CAR. The coefficient of the ROA variable indicates that if the profitability increases by 1 unit (expressed through an increase of 1 unit of ROA) will increase the bank's capital by 3.425 units. The LLR variable has a negative effect on the bank's capital adequacy ratio. This result shows the better the financial capability of the bank (the lower the rate of loan provision), the higher the capital adequacy ratio. This also shows that ensuring the quality of loans and avoiding loss of capital are the key factors that can help banks to maintain their capital adequacy. However, interesting results are found that the LEV and ROE variables have a negative impact (contrary to expectation) on the bank's capital adequacy ratio at a significant level of 1%. The coefficient of ROE variable shows that increase in the bank's profitability by 1 unit (represented by an additional 1 unit in ROE) reduces the bank's capital adequacy ratio 0.318 units, as shown in the estimation equation. The coefficients of the remaining variables are not statistically significant at the 10% level. This suggests that there is no sufficient evidence to conclude on the impact of NIM, SIZE, DEP, LOA, LIQ and NPL on the capital adequacy ratio of banks. The insignificance of these variables may be due to limited number of samples and period. In summary, LLR, ROA, ROE and LEV are shown to have significant effect on CAR. On the other hand, SIZE, DEP, LIQ, NPL and NIM do not have a significant impact on the capital adequacy ratio. The hypothesis test results are summarized in Table 4. The results of the study indicate that the variables LEV, LLR, ROE have a negative impact on CAR while ROA has a positive impact on CAR. The remaining variables SIZE, DEP, LOA, LIQ, NIM, and NPL do not significantly affect CAR. CAR DEP LEV LIQ LLR LOA NIM NPL ROA ROE SIZE CAR 1 DEP -0.002 1 LEV 0.023 -0.350 1 LIQ -0.026 -0.481 0.132 1 LLR -0.088 -0.143 -0.020 0.078 1 LOA 0.054 0.579 -0.153 -0.507 -0.238 1 NIM 0.118 0.045 0.339 -0.098 -0.034 0.323 1 NPL -0.053 -0.151 0.231 -0.098 0.426 -0.128 -0.013 1 ROA 0.056 -0.140 0.242 0.055 -0.017 0.092 0.651 -0.150 1 ROE -0.004 0.044 -0.200 0.049 -0.021 0.184 0.466 -0.269 0.830 1 SIZE -0.004 0.337 -0.455 -0.249 0.073 0.414 0.050 -0.161 0.054 0.340 1 H.V. Vu and N.D. Dang /Accounting 6 (2020) 7 5. Policy implications 5.1. Vietnamese State Bank Credit Risk Continue to build and improve the bank information system: The State Bank needs to require commercial banks to build a system for information gathering and transmission safeguarded by a network security algorithm. The information collection, data transmission and links to networks for assessment are also to be improved to increase the autonomy and information sharing in the banking system. Need to develop a comprehensive Risk Management System for the Vietnamese commercial banking system, under a unified legal framework. Improve the banking inspection and supervision system, in a coordinated effort of inspection agencies, for the supervision of the financial markets and institutions in the economy, both domestically and internationally. Leverage, Return on Equity and Return on Asset in the Banks - mainly expressed in terms of operational risks The State Bank should improve a system of measuring, documenting, and regulating the operational risk management of banks. Build a database of operation risk throughout the banking system in order to detect and check on any operational risk events so that the new types of operational risks, their trends, and illegal behaviours can be identified, supervisory consultancy can be provided and information can be shared. Strengthen the role of the State Bank of Vietnam for supervising credit risk management activities of commercial banks Improve the effectiveness of inspection and supervision by the State Bank of Vietnam, as well as offering guidelines to commercial banks for compliances. 5.2. Commercial Banks Provisions for potential loan losses Provisions for bad debts should be based on the risk characteristics of credit activities (lending activities) that a bank practices, the higher the credit risk, the larger the provisions will be required. Provisions for bad debt are also to be related to the bank’s capital position, as any unused provisions will be returned to equity based on the GAPP accounting standards. Loan loss provisions allow banks to have resources to deal with arising bad debts without affecting the bank's profitability. It is important that commercial banks assess the potential losses from credit activities and keep adequate provisions to pay for the losses resulted from credit risks. Equity and leverage To ensure the safety and soundness of a banking system, it requires banks to minimize risk taking and to increase capital of banks at the end. The basic principle is that as the level of risk taking by a bank increases, it should have a greater amount of capital reserves for payments. That is, the ratio of total equity to total assets is should be positively correlated with risk. This indicates that increasing equity is a necessary solution to maintain the safety of a bank, along with a reduction in risky assets. Currently Vietnamese commercial banks have now reached the required capital adequacy ratio of 9% of risky assets (according to Circular No. 36). It will be converted into 8% by 2020 comply with the Basel II standard. 5.3. Other regulatory Ministries and industries need to take drastic measures in carrying out their functions and duties, to work out solutions to restructure the economy, to consolidate the banking system, and to develop and deepen the financial system further. Enhance the effectiveness of state supervision of commercial banks’ risk management activities for the purpose of minimizing risks in the course of business activities of commercial banks. Improve the quality of the stability analysis of the financial system and to develop an early warning system to prevent bankruptcies of commercial banks in the system. Ministry of Finance, Ministry of Justice, Ministry of Natural Resources and Environment, Ministry of Construction, Ministry of Planning and Investment, Ministry of Public Security, Supreme People's Procuracy, Court, Hanoi City People's Committee, Ho Chi Minh City and Vietnam Asset Management Company (VAMC) should coordinate to command the handling of rising bad debts situations and to resolve the large bad debt portfolio of the VAMC. Regulatory agencies should coordinate with the VAMC in handling and managing bad debts, these could include accelerating the process of completing legal documents, seizing and handling collateralized assets, improve the procedures for transferring collaterals and the tax requirements related to the transfer of collaterals. Recovery of bad debts can be done with different methods, such as urging debt recovery, seizing, selling collaterals, selling debt in accordance with the law through a public auction in a transparent manner. 8 References Abusharba, M., Triyuwono, I., Ismail, M. & Rahman, A. (2013). Determinants of Capital Adequacy Ratio (CAR) in Indonesian Islamic Commercial Banks. Global Review of Accounting & Finance, 4(1), 159 – 170. Ahmad, R., Ariff, M. & Skully, M. (2008). The Determinants of Bank Capital Ratios in a Developing Economy. Asia-Pacific Finance Markets, 15, 255–272. Angbazo, L. (1997). Commercial bank net interest margins, default risk, interest-rate risk, and off-balance sheet banking. Journal of Banking & Finance, 21, 55-87. Al-Sabbagh, N. (2004). Determinants of Capital Adequacy Ratio in Jordanian Banks. Master thesis. Yarmouk University. Irbid, Jordan. Asarkaya, Y., & Özcan, S. (2007). Determinants of capital structure in financial institutions: The case of Turkey. Journal of BRSA Banking and Financial Markets, 1(1), 91-109. BIS (1999). Basel Committee on Banking Supervision: A new capital adequacy framework. [online]. Available from: https://www.bis.org/publ/bcbs50.pdf (Accessed 12 March 2017). [online]. Available from: https://www.bis.org/publ/bcbs50.pdf (Accessed 12 March 2019). BIS (2006). Basel II: International Convergence of Capital Measurement & Capital St&ards: A Revised Framework-Comprehensive Version. BIS (2011). Basel III: A global regulatory framework for more resilient banks & banking systems - revised version June 2011. Blose, L. (2001). Information asymmetry capital adequacy, and market reaction to loan loss provision announcements in the banking industry. Quarterly Review Economics Finance, 14(2), 239-258. Büyükşalvarcı, A. & Abdioğlu, H. (2011). Determinants of capital adequacy ratio in Turkish Banks: A panel data analysis. African Journal of Business Management, 5(27), 11199-11209 Casu, B., Molyneux, P. & Girardone, C. (2015). Introduction to Banking. 2nd ed. London: Prentice Hall Financial Times. Choi, G. (2000). The macroeconomic implications of regulatory capital adequacy requirements for Korean banks. Economic Notes, 29(1), 111-143. Gropp, R. & Heider, F. (2007). What can corporate finance say about banks’ capital structures? Working paper, .pdf. Hassan, K. (1992). An empirical analysis of bank standby letters of credit risk. Review of Financial Economics, 2(1), 31-44. Jackson, P., Perraudin, W. & Sapporta, V. (2002). Regulatory and economic solvency standards for internationally active banks. Journal of Banking Finance, 26, 953-976. Kleff, V. & Weber, M. (2003). How Do Banks Determine Capital? Evidence from Germany. German Economic Review, 9(3), 354- 372. Le, T.T. & Nguyen, D. L. (2017). Determinants of Banks’ Capital Adequacy ratio: Case Study from Vietnam. International Conference “Financing for Innovation, Entrepreneurship & Renewable Energy Development”, Hanoi, pp. 413-436. Masood, U. & Ansari, S. (2016.) Determinants of Capital Adequacy Ratio "A perspective from Pakistani banking sector". International Journal of Economics, Commerce & Management. 4(17), 247-273. Mohamed, A. B. M. (2018). Determinants of bank capital: Case of Tunisia. Journal of Applied Finance & Banking, 8(2), 1-15. Mpuga, P. (2002). The 1998-99 banking crisis in Uganda: What was the role of the new capital requirements? Journal of Finance Regulation and Compliance, 10(3), 224- 242. Octavia, M. & Brown, R. (2010). Determinants of bank capital structure in developing countries: Regulatory capital requirement versus the standard determinants of capital structure, Journal of Emerging Market, 15, 50-62. Shrieves, R. & Dahl, D. (1992). The relationship between risk and capital in commercial banks. Journal of Banking & Finance, 16, 439-457. The State Bank of Vietnam (2014). Circular No. 36/2014/TT-NHNN dated November 20, 2014 on stipulating minimum safety limits & ratios for transactions performed by credit institutions & branches of foreign banks [online]. Available from: (Accessed 1 March 2017). The State Bank of Vietnam (2016). Circular No. 41/2016 /TT-NHNN dated December 30, 2016 on stipulating the capital adequacy ratio for foreign-owned banks & branches of foreign-owned banks. [online]. Available from: (Accessed 1 March 2017). Usman, M. & Sanaullah, A. (2016). Determinants of capital adequacy ratio: a perspective from Pakistan banking sector, International Journal of Economics, Commerce and Management, 4(7), 247-273. Wong, J., Fong, T. & Choi, K. (2005). Determinants of the capital level of banks in Hong Kong. SSRN Electronic Journal. Yuanjuan, L. & Shishun, X. (2012). Effectiveness of China's Commercial Banks' Capital Adequacy Ratio Regulation A Case Study of The Listed Banks. Inter Disciplinary Journal of Contemporary Research in Business, 4(1), 58-68. © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

determinants_influencing_capital_adequacy_ratio_of_vietnames.pdf

determinants_influencing_capital_adequacy_ratio_of_vietnames.pdf