The interactive relationship between credit growth and profitability of people's credit funds in Vietnam

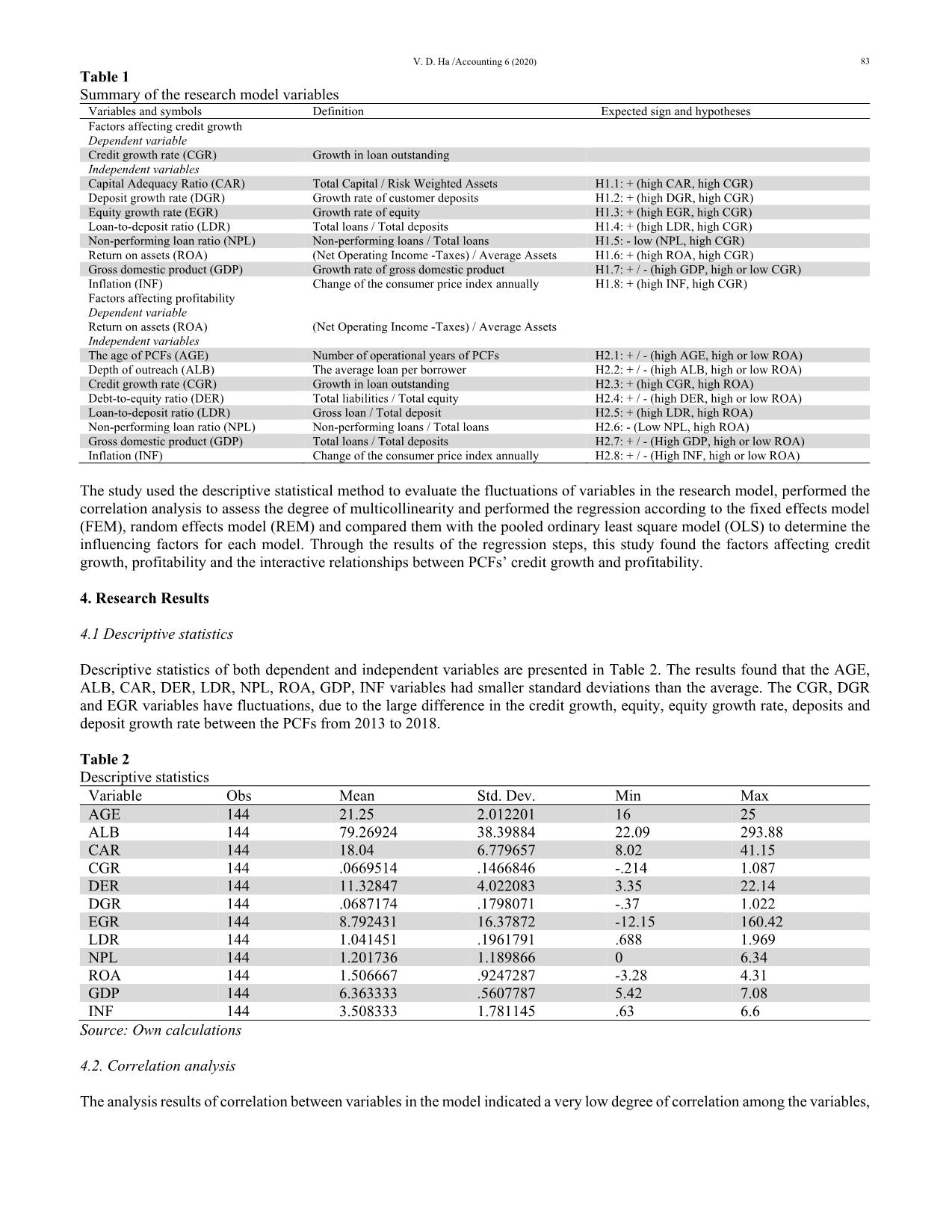

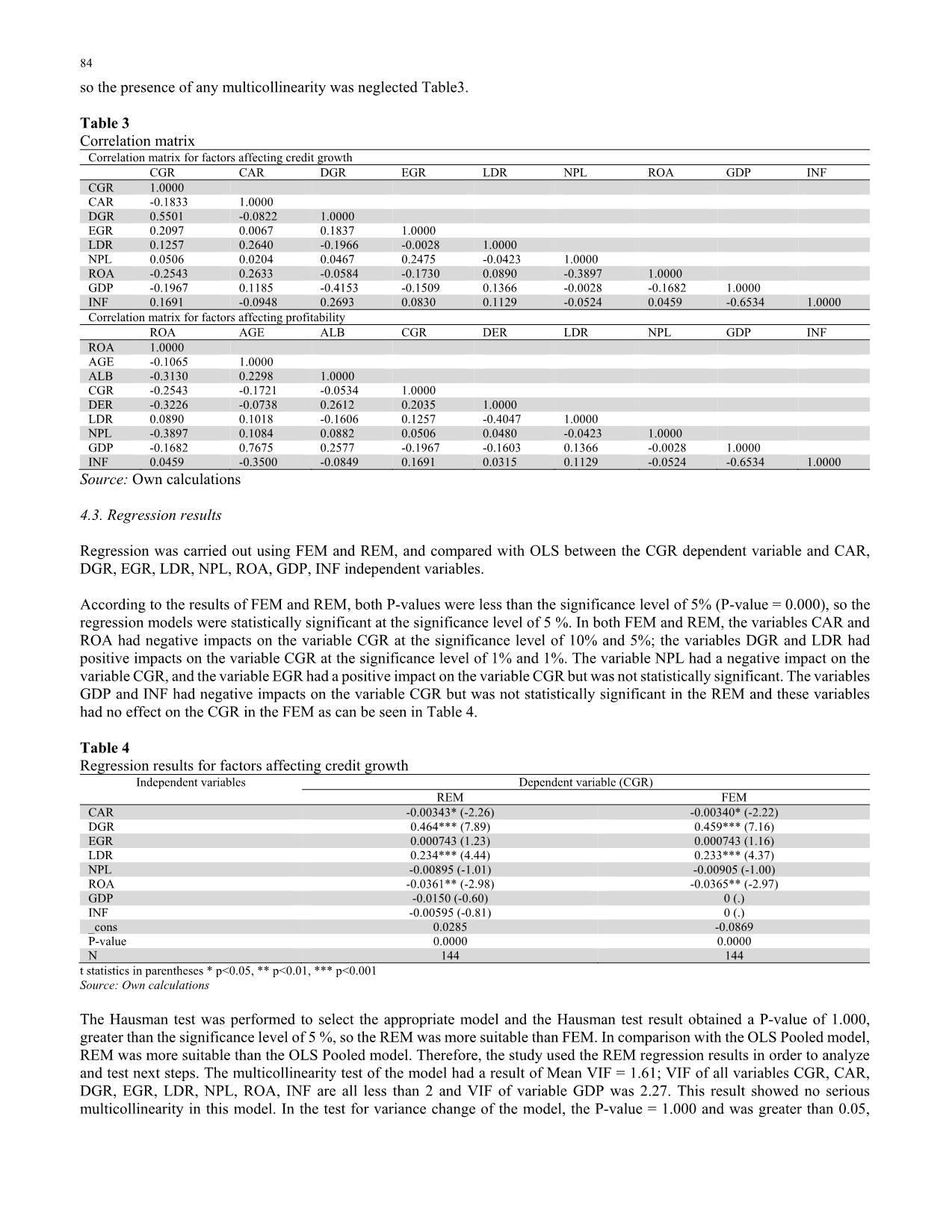

This study purposes to discover the interactive relationship between credit growth and profitability and to examine factors that affect the credit growth and profitability of people's credit funds (PCFs). After regression analysis on a set of panel data from 2013 to 2018 on 24 selected PCFs, it appeared that deposit growth and loan-To-deposit ratio had positive relationships with credit growth, and capital adequacy ratio and profitability had negative relationships with credit growth of PCFs. The age of PCFs has a positive relationship with profitability, while the credit growth, debt-to-equity ratio, non-performing loan ratio, economic growth and inflation have negative relationships with profitability of PCFs. The study found the credit growth and profitability have relationships with each other in a contrary trend. Based on the findings the study proposes policy measures that could be implemented by the managers to increase PCFs’ credit growth rate and profitability

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tóm tắt nội dung tài liệu: The interactive relationship between credit growth and profitability of people's credit funds in Vietnam

imed at profitability, at the same time, they ensured the credit growth. However, the credit growth of many PCFs leaded to an increase in the costs more than their income. The extra income was not commensurate with the rising the costs over the years. Therefore, there was a trade-off between PCFs’ profitability and credit growth in the past years. The variable DER had a negative impact on ROA with a coefficient of -0.0619 with the significance level of 1%, indicating that DER had a very strong impact on ROA. This result agreed with the analysis results of MicroRate (2014), but contrasted with the analysis results of Abdulai and Tewari (2017). The debt-to-equity ratio increased rapidly, it affected the level of safety in operations, and the rapid increase in debt financing put pressure on the profitability of many PCFs over the years. The variable NPL had a negative impact on ROA with a coefficient of -0.307 with the significance level of 1%, indicating that NPL had a very strong impact on ROA. This result agreed with the expected sign and hypotheses, and agreed with the analysis results of Baasi (2018) and Kingu et al. (2018). The financial inefficiencies in the PCFs arises due to high non-performing loan rate. Most of the PCFs had a low the non-performing loan rate, which helped the PCFs to ensure their operations were safety and profitability in the past years. Therefore, the increase in the non-performing loan ratio would be the risk in operational of the PCFs and the occurrence of non-performing loans was negatively associated with the level of profitability. The variable GDP had a negative impact on ROA with a coefficient of -0.986 with the significance level of 1%, indicating that GDP had a very strong impact on ROA. This result agreed with the analysis results of Yong and Christos (2012a), but contrasted with the analysis results of Yüksel et al. (2018). This relationship was explained by the low competitiveness of the PCFs in Vietnam. As the economy grows, incomes of the people were higher, capital demand, and banking services supply also increase. Meanwhile, the PCFs did not have enough financial and human resources to develop their services. The products, and services of the PCFs were not diversified, mainly loans in the period from 2013 to 2018. The variable INF had a negative impact on ROA with a coefficient of -0.124 with the significance level of 10%, indicating that GDP had an impact on ROA. This result is consistent with the analysis results of Scott and Ovuefeyen (2014) and Umar et al. (2014), but contrasted with the analysis results of Yong and Christos (2012b), Ishfaq and Khan (2015). Even though, the PCFs could be able to withstand the effects of inflation at its initial stages, since the PCFs system mostly operated with their lending. However, when the rate of inflation became stronger, the PCFs system could not absorb the shock. Therefore, that inflation had an adverse effect on PCFs’ profitability and its spillover effect was detrimental to the overall operations of PCFs. The results of this research were accurate according to the characteristics of PCFs and the development process of selected PCFs in Vietnam from 2013 to 2018. At the same time, this study did not find a statistically significant impact between the variables ALB and LDR. This was consistent with the fact that the PCFs mainly used the external the mobilized funds to provide loans under the conditions of low equity and the average loan per borrower was low in the past years. 6. Conclusions This paper has studied the interactive relationship between the credit growth and profitability of the selected PCFs in Vietnam. Multiple regression analysis was used in this study to find out the potential factors that affect PCFs’ credit growth and profitability. Based on prior research, two prominent models were identified and these research results were accurate according to the characteristics, and the development history PCFs in Vietnam from 2013 to 2018. The results of the study have shown that the two factors that had positive relationships with the credit growth were the deposit growth and the loan-to-deposit ratio. The capital adequacy ratio and the profitability had negative relationship with PCFs’ credit growth. On the other hand, the factors that had the highest impact were the deposit growth and loan-to-deposit ratio. This study also has shown that the one factors that had a positive relationship with profitability was the age of PCFs. The credit growth, debt-to-equity ratio, non- performing loan ratio, economic growth and inflation had negative relationships with PCFs’ profitability. On the other hand, the factors that had the highest impact were the debt-to-equity ratio, non-performing loan ratio, economic growth. The multiple V. D. Ha /Accounting 6 (2020) 87 regression analysis results of the two models for factors affecting credit growth and factors affecting profitability of selected PCFs in Vietnam, this study can conclude that two dependence variables of the two models were statistically significant, and there was relationship between the credit growth and profitability. Particularly, this study has found bidirectional interactions between the credit growth and profitability of the selected PCFs in Vietnam in a contrary trend. Nowadays, the PCFs are having a significant investment prospects in many regions of the country. This study helps the researchers, and managers develop their expertise in the key determinants of the credit growth, profitability and the interactive relationships between PCFs’ credit growth and profitability. Base on the research results, the article recommends the following to improve PCFs’ profitability and credit growth rate in Vietnam. Firstly, PCFs are credit institutions that are allowed to mobilize the deposit to lend to its members. Therefore, to ensure the credit growth and profitability, the PCFs must follow the general principle of ensuring safety for banking operations. Secondly, PCFs focus on lending to its members and the poor for the credit growth, therefore, strict control over the credit growth quality and efficiency are necessary to ensure PCFs’ profitability. Thirdly, PCFs enhance the deposit mobilization to create the large capital for the credit growth. At the same time, PCFs should focus more on maintain and restrict non-performance loan ratio that contribute to promote the credit growth. Fourthly, PCFs enhance competitiveness and have enough financial and human resources to develop the diversified products and services. Thereby, the PCFs take advantage of economic growth to develop operations and increase PCFs’ profitability. Fifthly, PCFs need to balance sufficient resources to ensure their operational objectives. At the same time, strengthen solutions to limit the trade-off between PCFs’ credit growth and profitability. Sixthly, State bank of Vietnam should ensure a stable monetary policy in the economy. State bank of Vietnam should try to curtail and maintain the long run inflation rate at the low ebb which is one of the channels through which inflation volatility affect PCFs’ profitability. This study assesses the interaction relationships between the credit growth and profitability of selected PCFs in Vietnam. Subsequent researches can be extended to the credit institutions in Vietnam to investigate further other factors including macro and micro factors to achieve more comprehensive results on the interaction relationships between the credit growth and profitability. References Abdulai, A., & Tewari, D. (2017). Determinants of microfinance outreach in Sub-Saharan Africa. Acta Commercii - Independent Research Journal in the Management Sciences, 17(1), 1-10. Adusei, M. (2015). Bank profitability: Insights from the rural banking industry in Ghana. Cogent Economics & Finance, 3(1), 1078270-107. Alihodžić, A., & Ekşı̇, I. H. (2018). Credit growth and non-performing loans: evidence from Turkey and some Balkan countries. Eastern Journal of European Studies, 9(2), 229-249. Alnahedh, S., & Bhagat, S. (2017). Impact of Bank Equity Capital on Bank Cost of Capital, pp.3-4, University of Colorado Boulder, Leeds School of Business. Available at: Amin, W., Qin, F., Rauf, A., & Ahmad, F. (2017). Impact of MFIs Outreach on Profitability. The Case of Latin America. Public Finance Quarterly, 62(3), 348-36. Awdeh, A. (2017). The Determinants of Credit Growth in Lebanon. International Business Research, 10(2), 9-19. Bakker, B. B., & Gulde, A. M. (2010). The credit boom in the EU new member states: Bad luck or bad policies. IMF working paper, WP/10/130, pp.7-25. International Monetary Fund. Baasi, M., M. (2018). Effects of Non-Performing Loans on the Profitability of Commercial Banks - A Study of Some Selected Banks on the Ghana Stock Exchange. Global Journal of Management and Business Research: C Finance, 18(2), 39 - 47. Barajas, A., Chami, R., Espinoza, R., & Hesse, H. (2010). Recent Credit Stagnation in the MENA Region: What to Expect? What Can Be Done?. IMF Working Paper, WP/10/219, pp.13-14. International Monetary Fund. Barkley, D. L., Mellon, C., & Potts, G. T. (1984). Effects of Banking Structure on the Allocation of Credit to Nonmetropolitan Communities. Western Journal of Agricultural Economics, 9(2), 283-292. Bassem, B. S. (2012). Social and financial performance of microfinance institutions: Is there a trade-off? Journal of Economics and International Finance, 4(4), 92 -100. Berrospide, J. M., & Edge, R. M. (2010). The Effects of Bank Capital on Lending: What Do We Know, and What Does It Mean? International Journal of Central Banking, 6(4), 5-54. Bruett, T., Escalona, A., Norell, D., & Stephens, B. (2005). Measuring Performance of Microfinance Institutions: A Framework for Reporting, Analysis, and Monitoring. The SEEP Network, 1825 Connecticut Avenue NW, Washington, DC, USA. DiSalvo, J., & Johnston, R. (2017). Banking Trends: The Rise in Loan-to-Deposit Ratios: Is 80 the New 60?. Federal Reserve 88 Bank of Philadelphia, Research Department, Q3, pp.18-23. Growe, G., DeBruine, M., Lee, J. Y., & Maldonado, J. F. T. (2014). The Profitability and Performance Measurement of U.S. Regional Banks Using the Predictive Focus of the “Fundamental Analysis Research”. Advances in Management Accounting, 24, 189-237. Guo, K., & Stepanyan, V. (2011). Determinants of Bank Credit in Emerging Market Economies. IMF Working Paper, WP/11/51, pp.1-6, International Monetary Fund. Ishfaq, M. J., & Khan, N. U. (2015). Bank profitability, inflation and cost efficiency-a case of Pakistani banks. International Journal of Business and Management Review, 3(1), 41-53. Kingu, P. S., Macha, S., & Gwahula, R. (2018). Impact of non-performing loans on bank’s profitability: Empirical evidence from commercial banks in Tanzania. International Journal of Scientific Research and Management, 6(1), 71-78. Kipesha, E. F. (2013). Impact of size and age on firm performance: Evidences from microfinance institutions in Tanzania. Research Journal of Finance and Accounting, 4(5), 105-116. Kohlscheen, E., Murcia, A., & Contreras, J. (2018). Determinants of bank profitability in emerging markets. BIS Working Papers, 686, pp.3-10, Bank for International Settlements. Available at: https://www.bis.org/publ/work686.pdf Ledgerwood, J. (1999). Microfinance Handbook - A Financial Market System Perspective, pp.216-224, The World Bank, Washington, D.C. MicroRate (2014). Technical Guide: Performance and Social Indicators for Microfinance Institutions. Industry research report. Lima, Peru. Monyi, J. N. (2017. Determinants of Financial Performance of Deposit Taking Microfinance Institutions in Kenya. A Thesis of Doctor of Philosophy, The Jomo Kenyatta University of Agriculture and Technology. National Assembly (2010). Law on credit institutions, No. 47/2010/QH12, June 16, 2010. Ha Noi, Vietnam. Available at: https://www.economica.vn/Portals/0/Documents/f6c24d103517f2a8c3ea307d119a2e0e.pdf Narwal, K. P., &Yadav, M. K. (2014). Impact of characteristics on outreach and profitability of microfinance institution in India. International Journal of Financial Management, 4(3), 50-57. Oliver, A. M., Ruano, S., & Fumás, V. S. (2012). Effect of equity capital on the interest rate and the demand for credit. Working Papers, Documentos de Trabajo, 1218, pp.10. Banco de España. Phi, N. T. M., Hoang, H. T. H., F. Taghizadeh-Hesary, F., &Yoshino, N. (2019). The Basel Capital Requirement, Lending Interest Rate, and Aggregate Economic Growth: An Empirical Study of Viet Nam. ADBI Working Paper 916, pp.6, Asian Development Bank Institute. Rabab’ah, M. (2015). Factors affecting the bank credit: An empirical study on the Jordanian commercial banks. International Journal of Economics and Finance, 7(5),166-178. Rossi, S., Borroni, M., Piva, M., & Lippi, A. (2019). Abnormal loan growth and bank profitability. Some evidences from the recent crisis. International Journal of Business and Management, 14(7), 36 – 53. Scott, A. O., & Ovuefeyen, E. J. (2014). Effects of economic openness and inflation on commercial banks’ profitability: Panel data evidence from Nigeria, PostBanking sector consolidation (2005-2012). European Journal of Business and Management, 6(30), 87-96. Tan, T. B. P. (2012). Determinants of Credit Growth and Interest Margins in the Philippines and Asia. IMF Working Paper, WP/12/123, pp.20-21, International Monetary Fund. Umar, M., Maijama’a, D., & Adamu, M. (2014). Conceptual exposition of the effect of inflation on bank performance’. Journal of World Economic Research, 3(5), 55-59 Vanroose, A., & D’Espallier, B. (2013). Do microfinance institutions accomplish their mission? Evidence from the relationship between traditional financial sector development and microfinance institutions’ outreach and performance. Applied Economics, 45(15), 1965 -1982. Wachukwu, I. P., Onyema, J.I., & Amadi, S.N. (2018). Microfinance banking and economic growth of Nigeria. Journal of Financial Market, 2(4), 6-20. Yong, T. A., & Christos, F. (2012a). Bank profitability and GDP growth in China: A note. Journal of Chinese Economic and Business Studies, 10(3), 267-273. Yong, T. A., & Christos, F. (2012b). Bank profitability and inflation: the case of China. Journal of Economic Studies, 39(6), 675¬696. Yüksel, S., Mukhtarov, S., Mammadov, E., & Özsarı, M. (2018). Determinants of Profitability in the Banking Sector: An Analysis of Post-Soviet Countries. Economies, 6(41). Available at: doi:10.3390/economies6030041 © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

the_interactive_relationship_between_credit_growth_and_profi.pdf

the_interactive_relationship_between_credit_growth_and_profi.pdf