The impact of interest rate channel on the monetary transmission mechanism in Vietnam

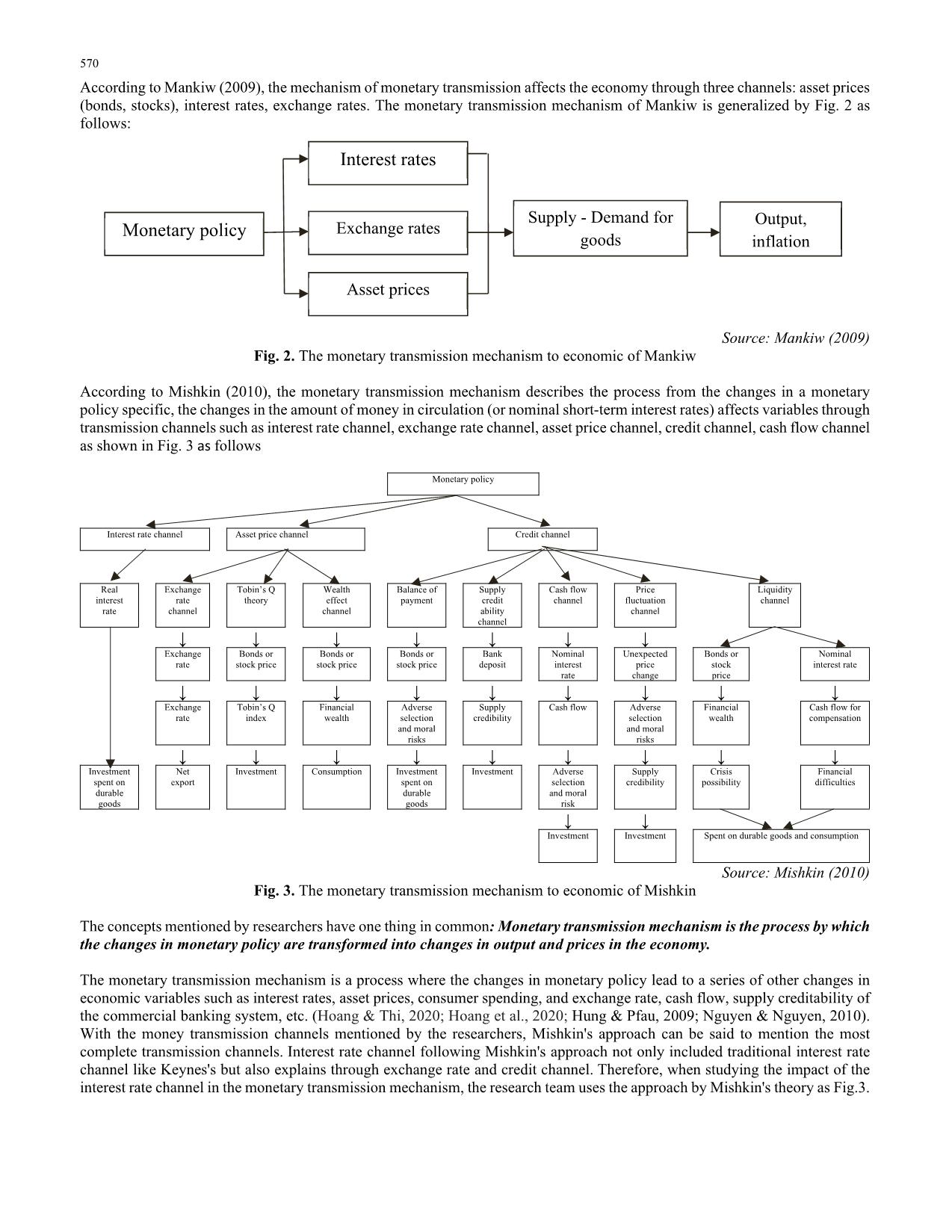

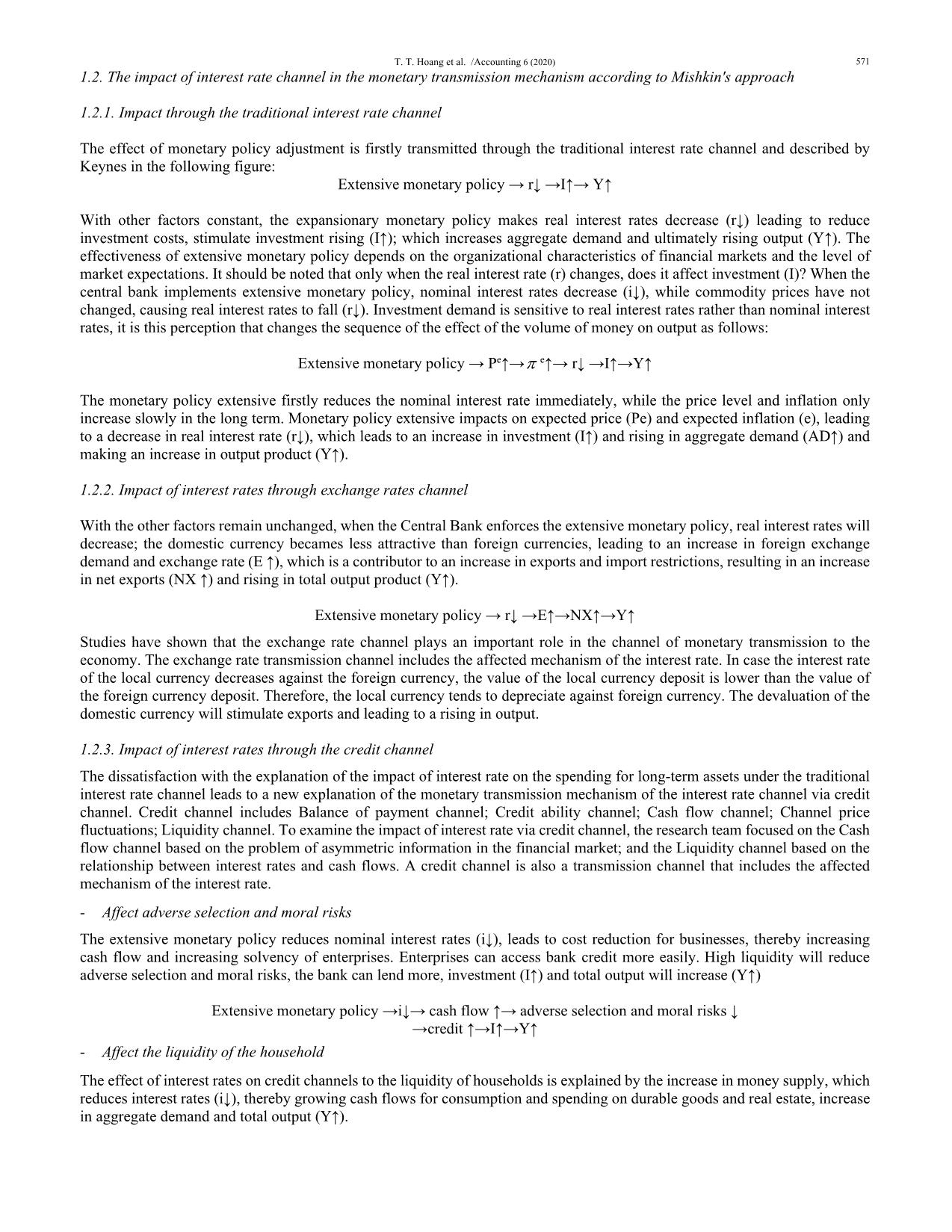

In this article, the research team systematized the theoretical basis of the monetary transmission

mechanism and the impact of interest rate channel in monetary transmission mechanism by Mishkin's

approach and used the vector error correction model (VECM) to test the impact of interest rate channel

in the monetary transmission mechanism in Vietnam in the period 2005 – 2019. There were 8

endogenous variables included in the VECM model; namely Consumer price index (CPI); Gross

domestic product (GDP) at constant 2010 prices (GDPR); Money supply (M2); Refinancing interest

rate (ISBV); Average lending interest rate in VND (ILR); Bilateral real exchange rate (ER); Credit to

the economy (CRE); VN-Index (VN-INDEX); and, 2 exogenous variables: world consumer price

index (PW) and US Federal Reserve interest rate (IFED). The results have shown that: money supply

had a clearer effect on average lending interest rate than refinancing rate; Interest rate channel was an

important channel to transfer the impact of monetary policy on inflation; Exchange rate and interest

rates channel influenced economic growth in Vietnam more strongly than credit and financial asset

prices channel did. Besides, the model results also confirm that in Vietnam, inflation in the past played

an important role in determining current inflation

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Tóm tắt nội dung tài liệu: The impact of interest rate channel on the monetary transmission mechanism in Vietnam

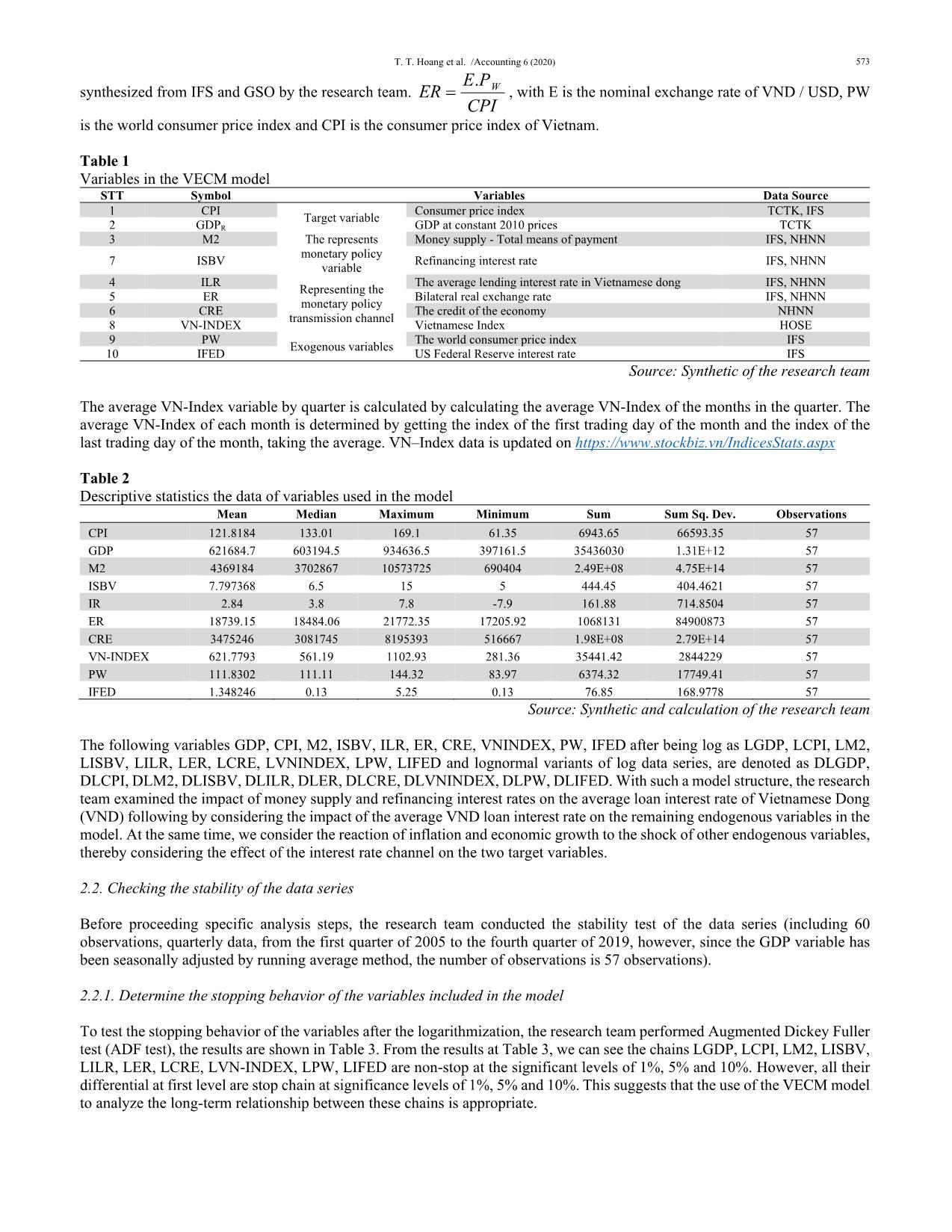

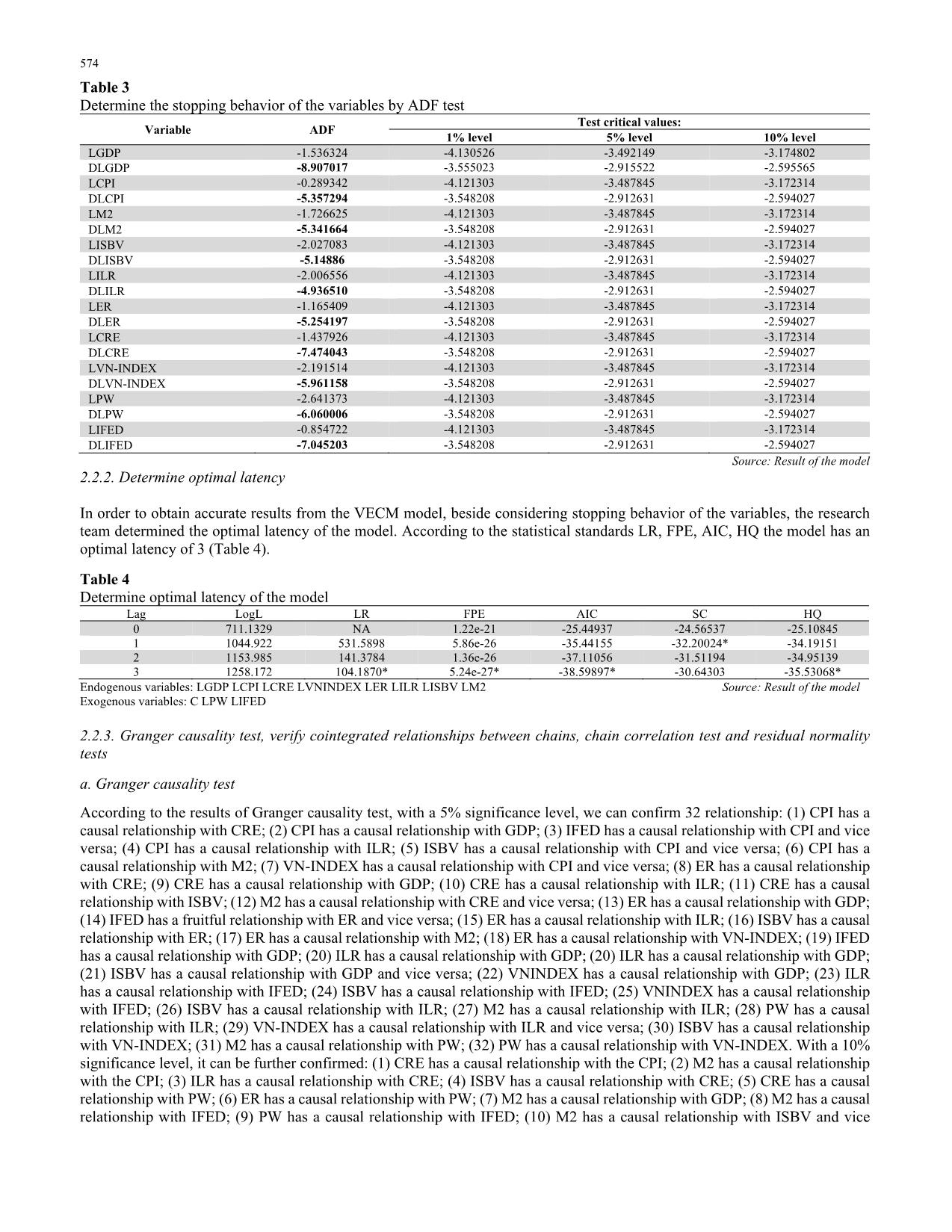

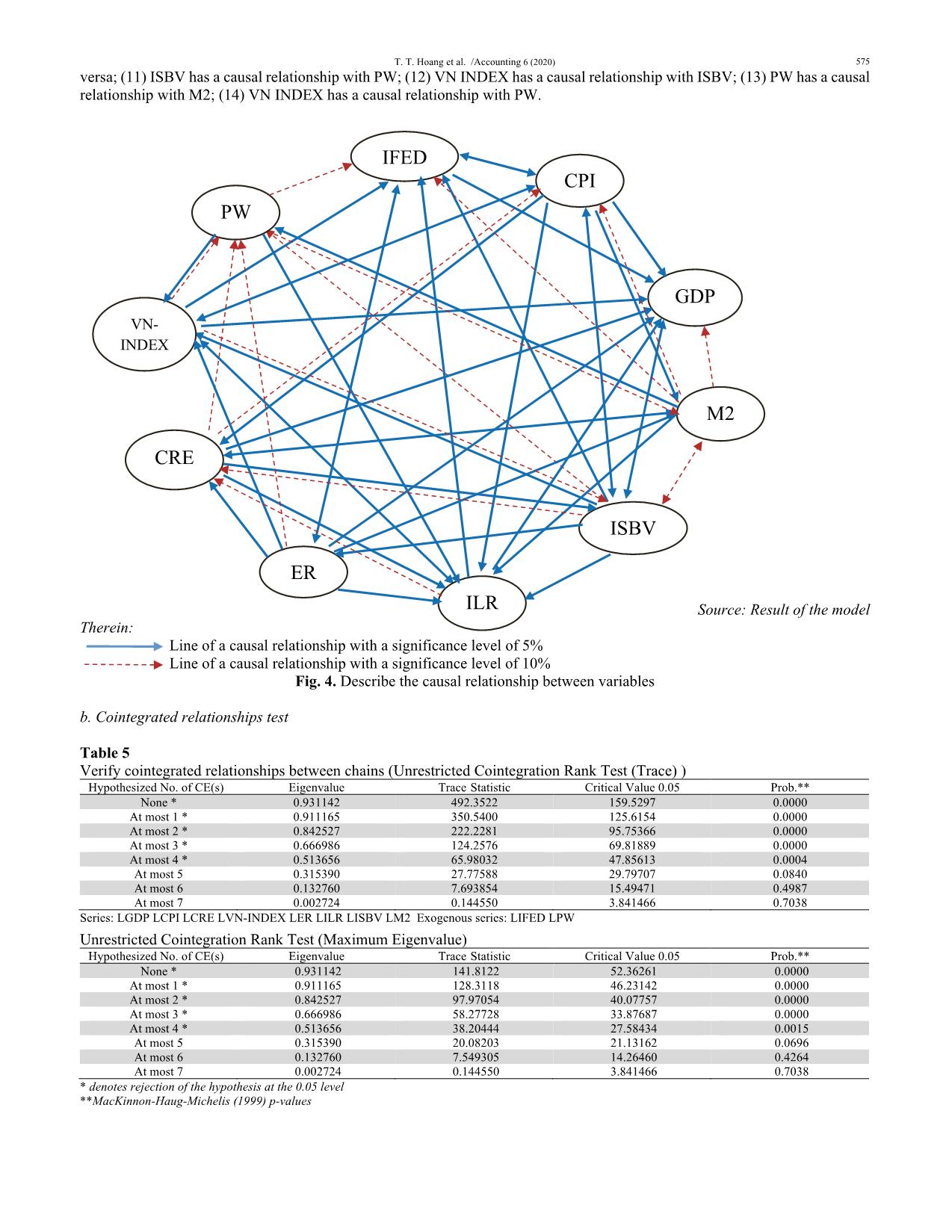

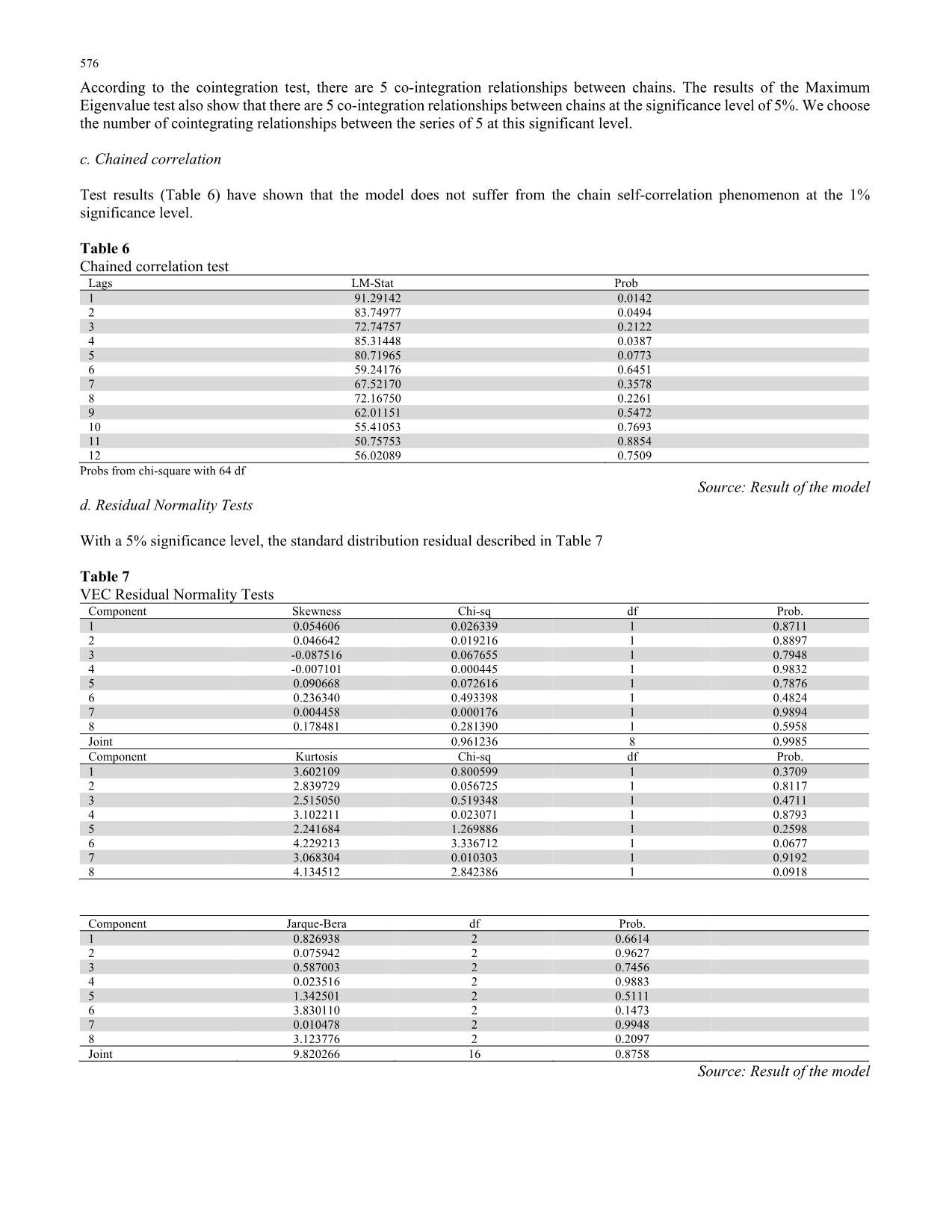

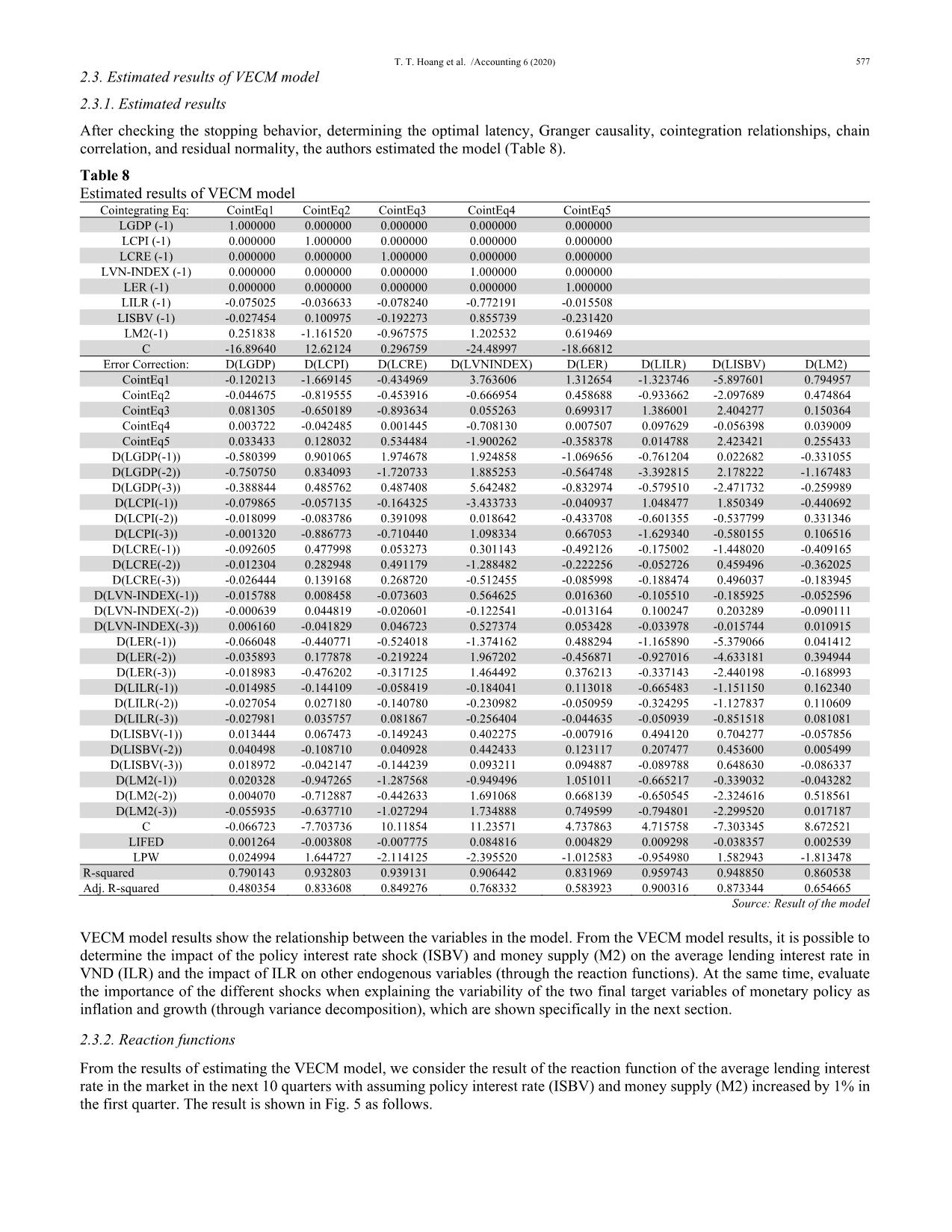

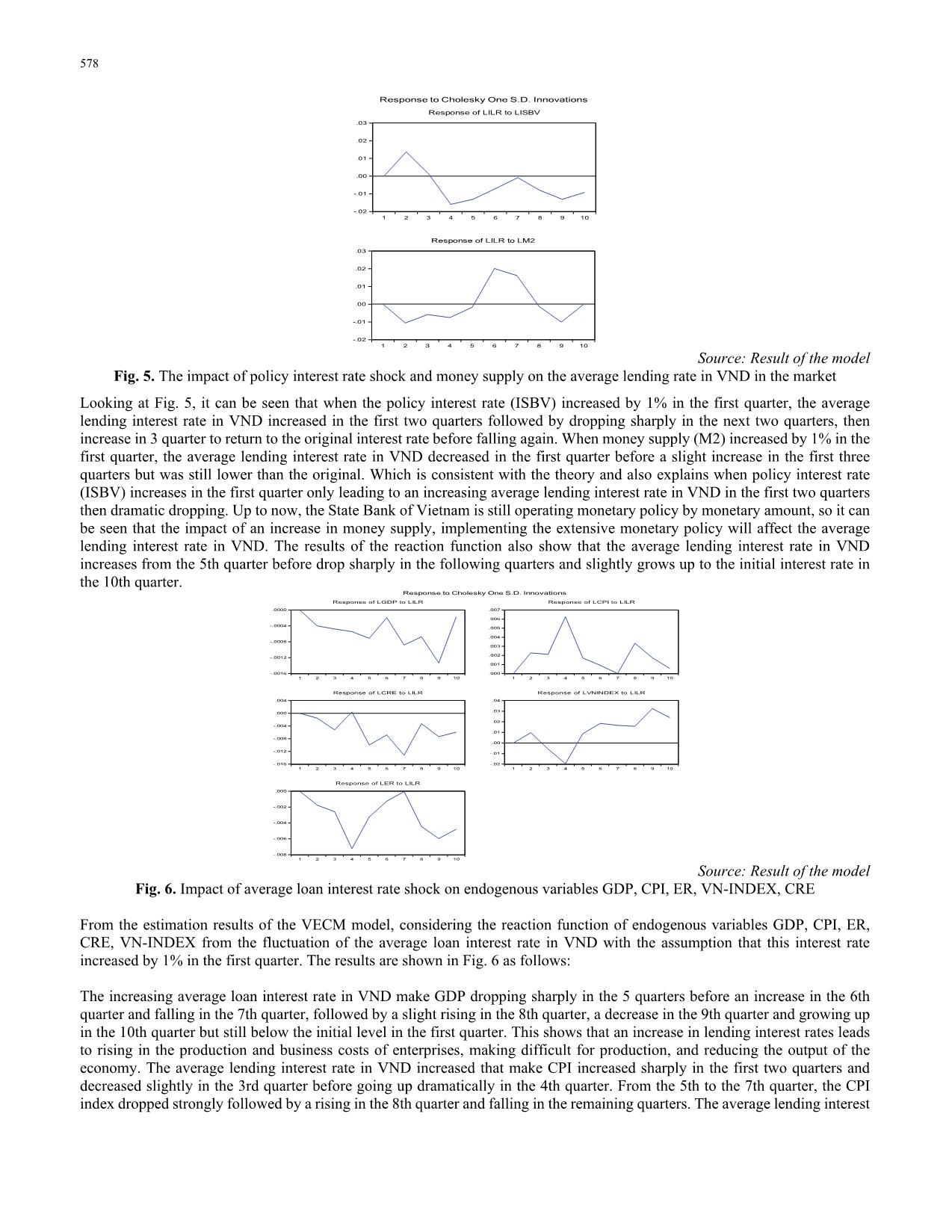

pact of the policy interest rate shock (ISBV) and money supply (M2) on the average lending interest rate in VND (ILR) and the impact of ILR on other endogenous variables (through the reaction functions). At the same time, evaluate the importance of the different shocks when explaining the variability of the two final target variables of monetary policy as inflation and growth (through variance decomposition), which are shown specifically in the next section. 2.3.2. Reaction functions From the results of estimating the VECM model, we consider the result of the reaction function of the average lending interest rate in the market in the next 10 quarters with assuming policy interest rate (ISBV) and money supply (M2) increased by 1% in the first quarter. The result is shown in Fig. 5 as follows. 578 -.02 -.01 .00 .01 .02 .03 1 2 3 4 5 6 7 8 9 10 Response of LILR to LISBV -.02 -.01 .00 .01 .02 .03 1 2 3 4 5 6 7 8 9 10 Response of LILR to LM2 Response to Cholesky One S.D. Innovations Source: Result of the model Fig. 5. The impact of policy interest rate shock and money supply on the average lending rate in VND in the market Looking at Fig. 5, it can be seen that when the policy interest rate (ISBV) increased by 1% in the first quarter, the average lending interest rate in VND increased in the first two quarters followed by dropping sharply in the next two quarters, then increase in 3 quarter to return to the original interest rate before falling again. When money supply (M2) increased by 1% in the first quarter, the average lending interest rate in VND decreased in the first quarter before a slight increase in the first three quarters but was still lower than the original. Which is consistent with the theory and also explains when policy interest rate (ISBV) increases in the first quarter only leading to an increasing average lending interest rate in VND in the first two quarters then dramatic dropping. Up to now, the State Bank of Vietnam is still operating monetary policy by monetary amount, so it can be seen that the impact of an increase in money supply, implementing the extensive monetary policy will affect the average lending interest rate in VND. The results of the reaction function also show that the average lending interest rate in VND increases from the 5th quarter before drop sharply in the following quarters and slightly grows up to the initial interest rate in the 10th quarter. -.0016 -.0012 -.0008 -.0004 .0000 1 2 3 4 5 6 7 8 9 10 Response of LGDP to LILR .000 .001 .002 .003 .004 .005 .006 .007 1 2 3 4 5 6 7 8 9 10 Response of LCPI to LILR -.016 -.012 -.008 -.004 .000 .004 1 2 3 4 5 6 7 8 9 10 Response of LCRE to LILR -.02 -.01 .00 .01 .02 .03 .04 1 2 3 4 5 6 7 8 9 10 Response of LVNINDEX to LILR -.008 -.006 -.004 -.002 .000 1 2 3 4 5 6 7 8 9 10 Response of LER to LILR Response to Cholesky One S.D. Innovations Source: Result of the model Fig. 6. Impact of average loan interest rate shock on endogenous variables GDP, CPI, ER, VN-INDEX, CRE From the estimation results of the VECM model, considering the reaction function of endogenous variables GDP, CPI, ER, CRE, VN-INDEX from the fluctuation of the average loan interest rate in VND with the assumption that this interest rate increased by 1% in the first quarter. The results are shown in Fig. 6 as follows: The increasing average loan interest rate in VND make GDP dropping sharply in the 5 quarters before an increase in the 6th quarter and falling in the 7th quarter, followed by a slight rising in the 8th quarter, a decrease in the 9th quarter and growing up in the 10th quarter but still below the initial level in the first quarter. This shows that an increase in lending interest rates leads to rising in the production and business costs of enterprises, making difficult for production, and reducing the output of the economy. The average lending interest rate in VND increased that make CPI increased sharply in the first two quarters and decreased slightly in the 3rd quarter before going up dramatically in the 4th quarter. From the 5th to the 7th quarter, the CPI index dropped strongly followed by a rising in the 8th quarter and falling in the remaining quarters. The average lending interest T. T. Hoang et al. /Accounting 6 (2020) 579 rate in VND increased, credit to the economy decreased in the first three quarters before rising in the fourth quarter and then reverse continuously. In terms of trends, when interest rates increase, credit to the economy will decrease, this is in line with theory. The average lending interest rate in VND increased, VN-INDEX climbed slightly in the first quarter and plummeted in the next 3 quarters, this is appropriate because an increase in interest rate, the investors tend to deposit money in banks rather than investing in the stock market. From the 5th quarter, the VN-INDEX reversed and increased in the remaining quarters. This can be explained by the fluctuations of interest rates with GDP and CPI. From the 5th quarter the CPI drop and the GDP reverse in the upward trend. This shows that the growth of the economy drags on rising in the stock market. When the average lending interest rate in VND increased, the bilateral real exchange rate (ER) decreased in the first four quarters, combined with the increase in CPI as analyzed above, which made the bilateral exchange rate sharply decline. This will attract foreign investors leading to increased foreign investment into the country. From the 5th quarter, ER reversed and increased sharply again in 3 quarters and then went down in the next 2 quarters before slightly increasing in the last quarter. This can be considered reasonable as considering the fluctuations between interest rates and Vietnam's CPI, with the rising in average lending interest rate, ER and CPI have opposite reactions. 2.3.3. Decomposition of variance In addition to analyzing the reaction function, variance decomposition can be used to assess the importance of different shocks when explaining the variability of the last two target variables of interest rate policy as inflation and growth. Results of decomposition of variance at table 9 show: Table 9 Decomposition of variance Variance Decomposition of LCPI: Period S.E. LGDP LCPI LCRE LVN-INDEX LER LILR LISBV LM2 1 0.009084 0.041452 99.95855 0.000000 0.000000 0.000000 0.000000 0.000000 0.000000 2 0.013089 0.758330 83.72644 2.259088 3.142274 2.530492 3.043496 1.527125 3.012753 3 0.015752 7.403318 64.19484 1.698927 5.253266 5.343790 3.907573 6.810190 5.388096 4 0.017550 7.082764 51.71649 1.377759 5.584232 7.163620 15.89574 6.831039 4.348353 5 0.018583 7.276100 48.50787 1.966568 5.285067 6.823082 15.02898 8.188162 6.924178 6 0.020647 7.068218 43.25701 2.463828 8.608640 6.895215 12.36917 7.535022 11.80290 7 0.022175 7.353920 38.32475 2.889415 15.12435 6.293679 10.72253 8.266592 11.02476 8 0.023130 6.919050 35.23618 3.691673 16.17211 7.136021 11.96071 8.710367 10.17389 9 0.023672 6.822886 33.68814 4.291361 17.17422 7.228124 11.96701 9.110578 9.717681 10 0.024899 8.143873 31.13644 4.247706 19.69659 7.368412 10.86810 8.426546 10.11234 Variance Decomposition of LGDP: Period S.E. LGDP LCPI LCRE LVN-INDEX LER LILR LISBV LM2 1 0.003908 100.0000 0.000000 0.000000 0.000000 0.000000 0.000000 0.000000 0.000000 2 0.004148 90.19690 7.188268 0.030850 1.217113 0.156222 0.923225 0.219034 0.068387 3 0.004536 75.44822 13.91362 1.790180 1.318334 4.330856 1.868808 0.984037 0.345948 4 0.004967 72.12958 12.64942 1.749351 1.500281 4.784338 2.756662 1.579299 2.851071 5 0.005867 71.62411 12.39930 3.257998 1.456107 3.628701 3.446496 1.877781 2.309502 6 0.006459 66.27528 19.51807 2.888462 1.268510 3.302878 2.932239 1.890350 1.924212 7 0.006916 58.91294 22.45472 3.709567 1.559914 5.511668 4.176953 1.649944 2.024291 8 0.007152 60.02359 21.43996 3.472598 1.462429 5.262938 4.787756 1.549351 2.001368 9 0.007923 62.07905 18.37546 3.712549 1.400235 4.380886 6.730227 1.475265 1.846329 10 0.008189 61.36379 19.63106 3.620747 1.476879 4.151335 6.347322 1.560361 1.848507 Cholesky Ordering: LGDP LCPI LCRE LVN-INDEX LER LILR LISBV LM2 Source: Result of the model The persistent nature of inflation explains most of the fluctuation in inflation in the first quarter. In the second quarter, the average lending interest rate in VND (ILR), money supply (M2) and VN-INDEX are three factors explaining over 3% of the variation of CPI. From the 3rd to the 5th quarter, the ILR was the second factor explaining the fluctuation of CPI after the CPI itself and also from the fourth quarter onwards, ILR is the factor that explains over 10% of the variation of CPI. Besides, the two variables M2 and ISBV represent the monetary policy from the third quarter onwards explain over 10% of the variation of CPI, in some quarters, that 2 variables can explain nearly 20% of the fluctuation of CPI. In the later quarters, The VN-INDEX explains more and more of the fluctuations of the CPI, from the 7th quarter onwards VN-INDEX explains over 15% of the variation in CPI. Especially, in the 10th quarter, VN-INDEX explains nearly 20% of the variation of CPI. It can be seen that the fluctuation of GDP is almost explained by itself factor in all quarters. Next is the CPI factor from the 3rd quarter that explains over 10% of the variation in GDP, especially from the 6th quarter, CPI can explain approximately 20% of the variation in GDP. The real bilateral exchange rate ER is a second factor that explains the variability of GDP after CPI, it can see a small open 580 economy like Vietnam, the exchange rate is an important factor affecting economic growth. The average lending interest rate in VND explains more and more of the fluctuation of GDP, on average ILR explains nearly 5% meanwhile the remaining factors explain about 5% of the variation of GDP 3. Some exchanges and discussions The research team used the VECM model to assess the impact of interest rate channel in the monetary transmission mechanism in Vietnam. Quarterly data from the first quarter of 2005 to the fourth quarter of 2019 has been used for analysis. Granger test, co-integration test, reaction function, variance decomposition have shown that there was a certain impact of interest rate channel in the monetary transmission mechanism in Vietnam. The result of the reaction function has shown that the rising in refinancing interest rate only makes the average lending interest rate in VND increase in the first two quarters followed by a decrease in the remaining quarters. Meanwhile, the rising in money supply can make the average lending interest rate in VND decreasing in 5 quarters before growing up in the next 2nd quarters then falling in the remaining quarters. The increase in money supply has a clear impact on interest rates is entirely understandable, because, at present, the State Bank of Vietnam still manages monetary policy based on the monetary amount, not yet converted to operating by interest rates. The results of the variance decomposition have shown that the interest rate channel is one of the important channels to transmit the impact of monetary policy on inflation in Vietnam. From the fourth and fifth quarters, interest rate channel explains over 15%, the subsequent quarters also explain over 10% of the variation of the CPI. Besides, the model has pointed out that the exchange rate and interest rates are the channels that transmit monetary policy more strongly than credit and financial asset price channels to economic growth in Vietnam. Model results have also shown that interest rates are operated base on inflation movements in Vietnam. This can be explained in two stages: From 2005 to 2012, monetary policy in general and interest rate policy, in particular, proved to be awkward and passive especially in the period 2008 - 2012. During this period, Vietnam faced high inflation and interest rates were also high, even there were periods of interest rate racing. Interest rates were high to limit aggregate demand and curb inflation, but the results have shown that lending rates increase, inflation also increases, because the interest rate policy in this period is only adaptive and lack of initiative. From 2013 to 2019, the government has operated monetary policy and interest rate policy more smoothly and proactively intending to stabilize macroeconomy. Low-interest rates provided reasonable support for business and inflation being control stable were good signals in management of interest rates as well as monetary policy. Besides, based on CPI, the model results have also confirmed that in Vietnam, past inflation plays an important role in determining current inflation; The variability of GDP is almost explained by itself, followed by an inflation factor. This result implies that to combat inflation, the Government and the State Bank of Vietnam should first keep the inflation at a low rate for at least one quarter, thereby gaining public confidence about an environment in which prices are controlled and reduce expectations about future inflation. This also means that the Government and the State Bank of Vietnam need to persevere in the goal of controlling inflation thereby contributing to macroeconomic stability and supporting reasonable growth. References Hoang, T., & Thi, V. (2020). The impact of macroeconomic factors on the inflation in Vietnam. Management Science Letters, 10(2), 333-342. Hoang, T., Thi, V., & Minh, H. (2020). The impact of exchange rate on inflation and economic growth in Vietnam. Management Science Letters, 10(5), 1051-1060. Hung, L. V., & Pfau, W. D. (2009). VAR analysis of the monetary transmission mechanism in Vietnam. Applied Econometrics and International Development, 9(1), 165-179. Keynes, J.M. (1936), General Theory of Employment, Interest, and Currency, Published: Macmillan Cambridge University Press, for Royal Economic Society in 1936. Nguyen, T. H., & Nguyen, D.T. (2010), Macro Factors Influencing Vietnam's Inflation Period 2000-2010: Evidence and Discussion, Hanoi University of Economics - Vietnam National University. Mankiw, N. G. (2010). Macroeconomics. 7th Edition, Worth Publishers. Mishkin, F.S. (2010), The economics of money, banking and financial markets, 10th Edition by Frederic S. Mishkin State Bank of Vietnam, Annual Report, https://www.sbv.gov.vn/webcenter/portal/en/home/rm/public/nreport Vietnamese Index (2020), Market statistics, https://www.stockbiz.vn/IndicesStats.aspx [Accessed: 12/01/2020]. © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

the_impact_of_interest_rate_channel_on_the_monetary_transmis.pdf

the_impact_of_interest_rate_channel_on_the_monetary_transmis.pdf