The impact of income diversification on liquidity creation and financial performance of Vietnamese Commercial Banks

This research is conducted to investigate the impact of income diversification on bank liquidity

creation and the financial performance of Vietnamese commercial banks from 2007 to 2017. Data

were collected from 21 Vietnamese commercial banks. Panel OLS with fixed effects and GMM

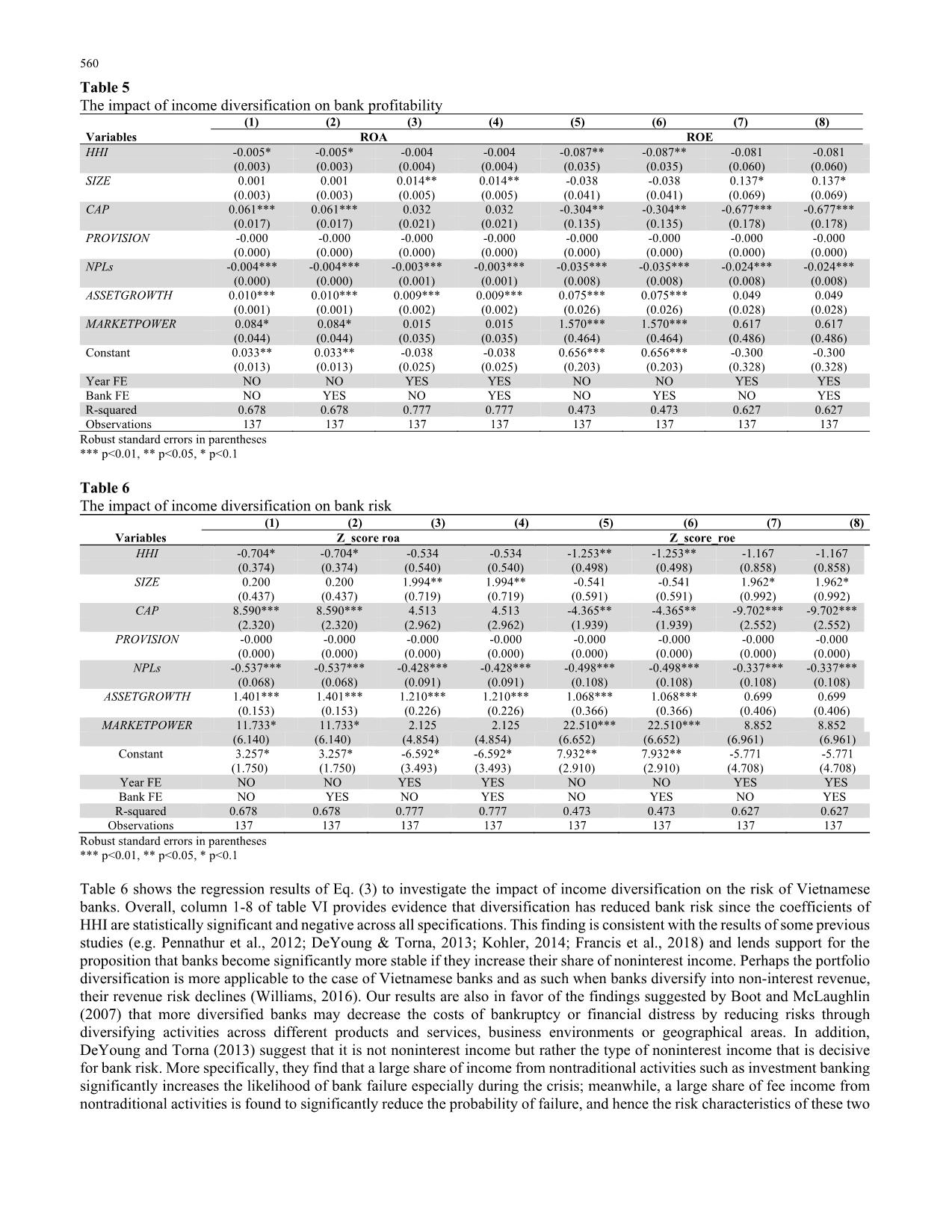

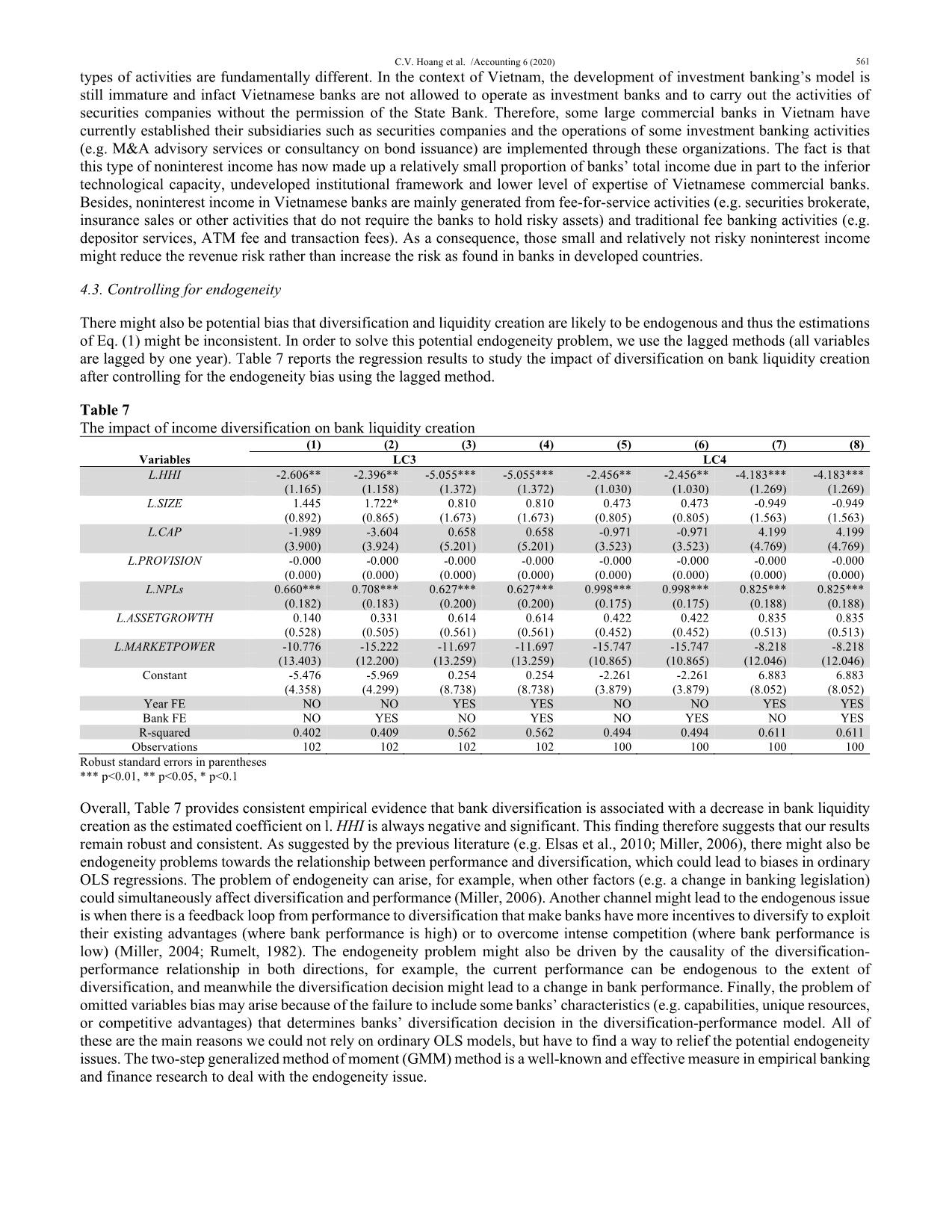

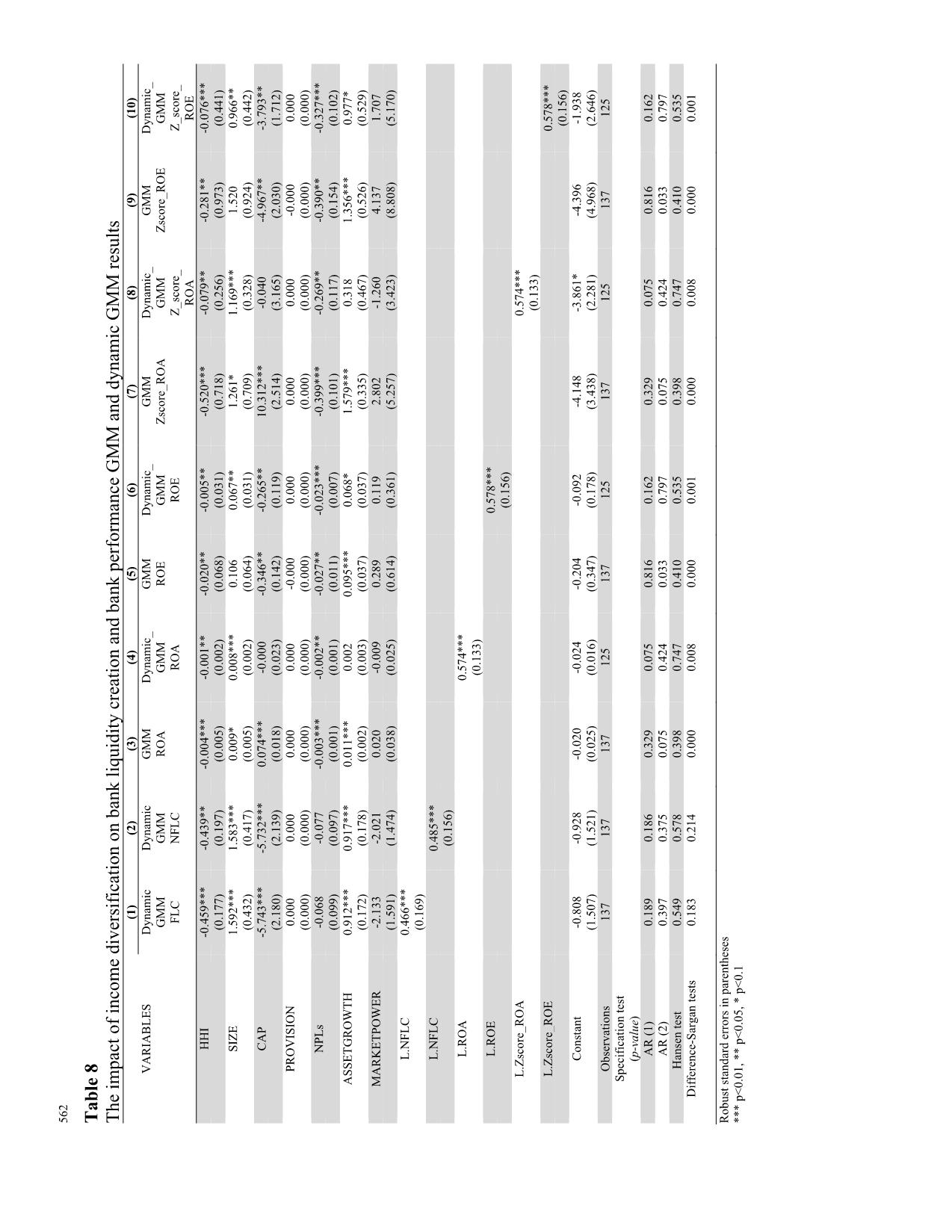

estimations were employed to process data. The results show that diversification had a negative impact

on both bank liquidity creation and bank profitability, and thus support the view that Vietnamese

commercial banks should remain focusing on their traditional lines of business rather than diversifying

towards nontraditional activities since this may lead to both a lower level of liquidity creation and

profitability. The findings of this study could draw broad inferences for researchers, policy makers,

and bank managers towards more focusing strategies to ensure the health of the banking system.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Tóm tắt nội dung tài liệu: The impact of income diversification on liquidity creation and financial performance of Vietnamese Commercial Banks

(1 .0 41 ) (1 .0 41 ) C AP 0. 06 0* ** 0. 06 0* ** 0. 03 2 0. 03 2 -0 .3 29 ** -0 .3 29 ** -0 .6 96 ** * -0 .6 96 ** * 8. 35 0* ** 8. 35 0* ** 4. 42 8 4. 42 8 -4 .7 11 ** -4 .7 11 ** -9 .9 73 ** * -9 .9 73 ** * (0 .0 17 ) (0 .0 17 ) (0 .0 22 ) (0 .0 22 ) (0 .1 40 ) (0 .1 40 ) (0 .1 77 ) (0 .1 77 ) (2 .3 34 ) (2 .3 34 ) (3 .1 11 ) (3 .1 11 ) (2 .0 11 ) (2 .0 11 ) (2 .5 34 ) (2 .5 34 ) PR O VI SI O N -0 .0 00 -0 .0 00 -0 .0 00 -0 .0 00 -0 .0 00 -0 .0 00 -0 .0 00 -0 .0 00 -0 .0 00 -0 .0 00 -0 .0 00 -0 .0 00 -0 .0 00 -0 .0 00 -0 .0 00 -0 .0 00 (0 .0 00 ) (0 .0 00 ) (0 .0 00 ) (0 .0 00 ) (0 .0 00 ) (0 .0 00 ) (0 .0 00 ) (0 .0 00 ) (0 .0 00 ) (0 .0 00 ) (0 .0 00 ) (0 .0 00 ) (0 .0 00 ) (0 .0 00 ) (0 .0 00 ) (0 .0 00 ) N PL s -0 .0 04 ** * -0 .0 04 ** * -0 .0 03 ** * -0 .0 03 ** * -0 .0 36 ** * -0 .0 36 ** * -0 .0 24 ** * -0 .0 24 ** * -0 .5 48 ** * -0 .5 48 ** * -0 .4 34 ** * -0 .4 34 ** * -0 .5 12 ** * -0 .5 12 ** * -0 .3 42 ** * -0 .3 42 ** * (0 .0 00 ) (0 .0 00 ) (0 .0 01 ) (0 .0 01 ) (0 .0 08 ) (0 .0 08 ) (0 .0 07 ) (0 .0 07 ) (0 .0 65 ) (0 .0 65 ) (0 .0 90 ) (0 .0 90 ) (0 .1 11 ) (0 .1 11 ) (0 .1 07 ) (0 .1 07 ) AS SE TG RO W TH 0. 00 9* ** 0. 00 9* ** 0. 00 8* ** 0. 00 8* ** 0. 06 6* * 0. 06 6* * 0. 04 1 0. 04 1 1. 32 4* ** 1. 32 4* ** 1. 16 1* ** 1. 16 1* ** 0. 94 9* * 0. 94 9* * 0. 58 8 0. 58 8 (0 .0 01 ) (0 .0 01 ) (0 .0 02 ) (0 .0 02 ) (0 .0 25 ) (0 .0 25 ) (0 .0 25 ) (0 .0 25 ) (0 .1 70 ) (0 .1 70 ) (0 .2 43 ) (0 .2 43 ) (0 .3 64 ) (0 .3 64 ) (0 .3 57 ) (0 .3 57 ) M AR K ET PO W ER 0. 08 7* 0. 08 7* 0. 01 1 0. 01 1 1. 62 1* ** 1. 62 1* ** 0. 53 3 0. 53 3 12 .1 11 * 12 .1 11 * 1. 55 0 1. 55 0 23 .2 44 ** * 23 .2 44 ** * 7. 63 4 7. 63 4 (0 .0 43 ) (0 .0 43 ) (0 .0 37 ) (0 .0 37 ) (0 .4 52 ) (0 .4 52 ) (0 .5 55 ) (0 .5 55 ) (6 .0 14 ) (6 .0 14 ) (5 .1 06 ) (5 .1 06 ) (6 .4 76 ) (6 .4 76 ) (7 .9 57 ) (7 .9 57 ) Co ns ta nt 0. 03 6* * 0. 03 6* * -0 .0 37 -0 .0 37 0. 71 4* ** 0. 71 4* ** -0 .2 96 -0 .2 96 3. 68 0* 3. 68 0* -6 .5 64 * -6 .5 64 * 8. 76 0* ** 8. 76 0* ** -5 .7 16 -5 .7 16 (0 .0 13 ) (0 .0 13 ) (0 .0 26 ) (0 .0 26 ) (0 .2 10 ) (0 .2 10 ) (0 .3 36 ) (0 .3 36 ) (1 .8 39 ) (1 .8 39 ) (3 .5 99 ) (3 .5 99 ) (3 .0 07 ) (3 .0 07 ) (4 .8 12 ) (4 .8 12 ) Y ea r F Es N O N O Y ES Y ES N O N O Y ES Y ES N O N O Y ES Y ES N O N O Y ES Y ES Ba nk F Es N O Y ES N O Y ES N O Y ES N O Y ES N O Y ES N O Y ES N O Y ES N O Y ES R- sq ua re d 0. 66 9 0. 66 9 0. 77 1 0. 77 1 0. 48 1 0. 48 1 0. 64 2 0. 64 2 0. 66 9 0. 66 9 0. 77 1 0. 77 1 0. 48 1 0. 48 1 0. 64 2 0. 64 2 O bs er va tio ns 13 4 13 4 13 4 13 4 13 4 13 4 13 4 13 4 13 4 13 4 13 4 13 4 13 4 13 4 13 4 13 4 Ro bu st sta nd ar d er ro rs in p ar en th es es ** * p< 0. 01 , * * p< 0. 05 , * p <0 .1 C.V. Hoang et al. /Accounting 6 (2020) 567 References Abedifar, P., Molyneux, P., & Tarazi, A. (2018). Non-interest income and bank lending. Journal of Banking & Finance, 87, 411–426. Abuzayed, B., Al-Fayoumi, N., & Molyneux, P. (2018). Diversification and bank stability in the GCC. Journal of International Financial Markets, Institutions and Money, 57, 17-43. ADB (2015). Financial soundness indicators for financial sector stability in Vietnam. available at: www.adb.org/sites/default/files/publication/173663/fsi-viet-nam.pdf. Allen, F., & Gale, D. (2004). Financial Intermediaries and Markets. Econometrica, 72, 1023– 1061. Allen, F., & Santomero, A.M. (1998). The theory of financial intermediation. Journal of Banking and Finance, 21, 1461–1485. Amidu, M., & Wolfe, S. (2013). Does bank competition and diversification lead to greater stability? Evidence from emerging markets. Review of Development Finance, 3(3), 152-166. Baele, L., De Jonghe, O., & Vander Vennet, R. (2007). Does the stock market value bank diversification?. Journal of Banking & Finance, 31(7), 1999-2023. Basuony, M.A., Mohamed, E.K.A. and Al-Baidhani, A.M. (2014). The effect of corporate governance on bank financial performance: evidence from the Arabian Peninsula. Corporate Ownership and Control, 11(2), 178-191. Berger, A.N., Demsetz, R.S., & Strahan, P.E. (1999). The consolidation of the financial services industry: causes, consequences, and implications for the future. Journal of Banking & Finance, 23(2), 135-194. Berger, A.N. & Bouwman, C.H. (2009). Bank Liquidity Creation. The Review of Financial Studies, 22(9), 3779-3837. Berger, A. N., Bouwman, C.H.S., Kick, T., & Schaeck, K. (2016). Bank liquidity creation following regulatory interventions and capital support. Journal of Financial Intermediation, 26, 115-141. Berger, A.N., Hasan, I., & Zhou, M. (2010). The effects of focus versus diversification on bank performance: evidence from Chinese banks. Journal of Banking & Finance, 34(7), 1417-1435. Berger, A.N., & Bouwman, C. (2015). Bank liquidity creation and financial crises. Academic Press. Berger, A.N., & Bouwman, C.H. (2017). Bank liquidity creation, monetary policy, and financial crises. Journal of Financial Stability, 30, 139-155. Bhattacharya, S., & Thakor, A.V. (1993). Contemporary Banking Theory. Journal of Financial Intermediation, 3, 2–50. Bliss, R.T., & Rosen, R.J. (2001). CEO compensation and bank mergers. Journal of Finance and Economics, 61, 107–138. Bouwman, C.H.S., & Malmendier, U. (2015). Does a bank’s history affect its risk-taking?. American Economic Review, 105(5), 321-325. Boyd, J.H., & Graham, S.L. (1986). Risk, regulation, and bank holding company expansion into nonbanking. Quarterly Review, 10(2), 2-17. Bryant, J. (1980). A Model of Reserves, Bank Runs, and Deposit Insurance. Journal of Banking and Finance, 4(4), 335–44. Chiorazzo, V., Milani, C., & Salvini, F. (2008). Income diversification and bank performance: evidence from Italian banks. Journal of Financial Services Research, 33, 181–203. Demsetz, R.S., & Strahan, P.E. (1997). Diversification, size and risk at bank holding companies. Journal of Money, Credit and Banking, 29, 300–313. DeYoung, R., & Roland, K.P. (2001). Product mix and earnings volatility at commercial banks: evidence from a degree of total leverage model. Journal of Financial Intermediation, 10(1), 54-84. DeYoung, R., & Torna, G. (2013). Nontraditional banking activities and bank failures during the financial crisis. Journal of Financial Intermediation, 22(3), 397-421. Diamond, D.W., & Philip, H.D. (1983). Bank runs, deposit insurance, and liquidity. Journal of Political Economy, 91, 401-419. Distinguin, I., Roulet, C., & Tarazi, A. (2013). Bank regulatory capital and liquidity: Evidence from US and European publicly traded banks. Journal of Banking & Finance, 37(9), 3295-3317. Do, T.K.H., Nguyen, T.M.N., & Le, H.T. (2017). Effects of the credit boom on the soundness of Vietnamese commercial banks. International Journal of Financial Research, 8(3), 57-73. Doan, A.T., Lin, K.L., & Doong, S.C. (2018). What drives bank efficiency? The interaction of bank income diversification and ownership. International Review of Economics & Finance, 55, 203-219. Drucker, S., & Puri, M. (2008). On loan sales, loan contracting, and lending relationships. The Review of Financial Studies, 22(7), 2835-2872. Elsas, R., Hackethal, A., & Holzhäuser, M. (2010). The anatomy of bank diversification. Journal of Banking & Finance, 34(6), 1274-1287. Francis, B.B., Hasan, I., Küllü, A.M., & Zhou, M. (2018). Should banks diversify or focus? Know thyself: The role of abilities. Economic Systems, 42(1), 106-118. Fu, X.M., Lin, Y.R., & Molyneux, P. (2016). Bank capital and liquidity creation in Asia Pacific. Economic Inquiry, 54(2), 966-993. Fungáčová, Z., & Weill, L. (2012). Bank liquidity creation in Russia. Eurasian Geography and Economics, 53(2), 285-299. Goddard, J., McK, D., & John, O.S.W. (2008). The diversification and financial performance of US credit unions. Journal of Banking & Finance, 32, 1836-1849. Harris, M., Kriebel, C.H., & Raviv, A. (1982). Asymmetric information, incentives and intrafirm resource allocation. Management Science, 28(6), 604-620. Horváth, R., Seidler, J., & Weill, L. (2014). Bank capital and liquidity creation: Granger-causality evidence. Journal of Financial Services Research, 45(3), 341-361. Horvath, R., Seidler, J., & Weill, L. (2016). How bank competition influences liquidity creation. Economic Modelling, 52, 155-161. Hou, X., Li, S., Li, W., & Wang, Q. (2018). Bank diversification and liquidity creation: Panel Granger-causality evidence from China. Economic Modelling, 71, 87-98. Kishan, R.P., & Opiela, T.P. (2000). Bank size, bank capital, and the bank lending channel. Journal of Money, Credit and Banking, 32(1), 121–141. Klein, P.G. and Saidenberg, M.R. (2000). Diversification, organization, and efficiency: evidence from bank holding companies. Performance of Financial Institution, 153-173. Köhler, M. (2014). Does non-interest income make banks more risky? Retail-versus investment-oriented. Review of Financial Economics, 568 23(4), 182-193. Laeven, L., & Levine, R. (2007). Is there a diversification discount in financial conglomerates?. Journal of Financial Economics, 85(2), 331- 367. Lepetit, L., Nys, E., Rous, P., & Tarazi, A. (2008). Bank income structure and risk: an empirical analysis of European banks. Journal of Banking & Finance, 32(8), 1452-1467. Le, T., (2019). The interrelationship between liquidity creation and bank capital in Vietnamese banking. Managerial Finance, 45(2), 331-347. Li, L., & Zhang, Y. (2013). Are there diversification benefits of increasing noninterest income in the Chinese banking industry?. Journal of Empirical Finance, 24, 151–165. Matz, L., & Neu, P. (2007). Liquidity Risk Measurement and Management: A Practitioner’s Guide to Global Best Practices. John Wiley & Sons, Singapore. Meyer, M., Milgrom, P., & Roberts, J. (1992). Organizational prospects, influence costs, and ownership changes. Journal of Economics & Management Strategy, 1(1), 9-35. Meslier, C., Tacneng, R., & Tarazi, A. (2014). Is bank income diversification beneficial? Evidence from an emerging economy. Journal of International Financial Markets, Institutions and Money, 31, 97-126. Milbourn, T.T., Boot, A.W., & Thakor, A.V. (1999). Megamergers and expanded scope: Theories of bank size and activity diversity. Journal of Banking & Finance, 23(2-4), 195-214. Miller, D.J. (2004). Firms’ technological resources and the performance effects of diversification: a longitudinal study. Strategic Management Journal, 25(11), 1097-1119. Miller, D.J. (2006). Technological diversity, related diversification, and firm performance. Strategic Management Journal, 27(7), 601-619. Nguyen, P.A., & Simioni, M. (2015). Productivity and efficiency of Vietnamese banking system: new evidence using Färe-Primont index analysis. Applied Economics, 47(41), 4395-4407. Nguyen, M., Skully, M., & Perera, S. (2012). Market power, revenue diversification and bank stability: evidence from selected South Asian countries. Journal of International Financial Markets, Institutions and Money, 22(4), 897-912. Pennathur, A.K., Subrahmanyam, V., & Vishwasrao, S. (2012). Income diversification and risk: does ownership matter? An empirical examination of Indian banks. Journal of Banking & Finance, 36(8), 2203-2215. Rajan, R., Servaes, H., & Zingales, L. (2000). The cost of diversity: the diversification discount and inefficient investment. The Journal of Finance, 55(1), 35-80. Rumelt, R.P. (1982). Diversification strategy and profitability. Strategic Management Journal, 3(4), 359-369. Rauch, C., Steffen, S., Hackethal, A., & Tyrell, M. (2011). Determinants of Bank Liquidity Creation, Working Paper. Repullo, R. (2004). Capital requirements, market power and risk-taking in banking. Journal of Financial Intermediation, 13, 156–182. Santomero, A.M., & Eckles, D.L. (2000). The determinants of success in the new financial services environment: now that firms can do everything, what should they do and why should regulators care?. Economic Policy Review, 6(4), 22-29. Sanya, S., & Wolfe, S. (2011). Can banks in emerging economies benefit from revenue diversification?. Journal of Financial Services Research, 40(1&2), 79-101. Sissy, A.M., Amidu, M., & Abor, J.Y. (2017). The effects of revenue diversification and cross border banking on risk and return of banks in Africa. Research in International Business and Finance, 40, 1-18. Song, F., & Thakor, A.V. (2007). Relationship banking, fragility, and the asset-liability matching problem. The Review of Financial Studies, 20(6), 2129-2177. Stiroh, K. J. (2004). Diversification in banking: Is noninterest income the answer?. Journal of Money, Credit and Banking, 36(5), 853–882. Stiroh, K., & Rumble, A. (2006). The dark side of diversification: the case of US financial holding companies. Journal of Banking and Finance, 30, 2131–2161. Teece, D.J. (1982). Towards an economic theory of the multiproduct firm. Journal of Economic Behavior & Organization, 3(1), 39-63. Vodová, P. (2013). Determinants of commercial bank liquidity in Hungary. Finansowy Kwartalnik Internetowy e-Finanse, 9(3), 64-71. Williams, B. (2016). The impact of non-interest income on bank risk in Australia. Journal of Banking & Finance, 73, 16-37. Wheelock, D.C., & Wilson, P.W. (2000). Why do banks disappear? The determinants of US bank failures and acquisitions. Review of Economics and Statistics, 82(1), 127-138. Wong, W.P., & Deng, Q. (2016). Efficiency analysis of banks in ASEAN countries. Benchmarking: An International Journal, 23(7), 1798- 1817. © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

the_impact_of_income_diversification_on_liquidity_creation_a.pdf

the_impact_of_income_diversification_on_liquidity_creation_a.pdf