The impact of capital structure on the performance of construction companies: A study from Vietnam stock exchanges

This paper studies the impact of the factors reflecting the capital structure on the performance of construction companies listed on the Vietnam Stock Exchange by using a sample of 59 listed construction companies in three years (177 observations). This research is accomplished by applying a linear regression model and correlation analysis. The results show that: (1) factors such as number of years of operation, asset size, debt/equity do not affect return on assets (ROA) and return on equities (ROE); (2) the factor of total fixed assets / total assets yields a positive and significant impact on ROA and ROE; (3) the ratios of total debt / total equity and long term debt / total equity maintain negative impacts on ROA; and (4) debt / equity has a strong positive effect on ROE

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Tóm tắt nội dung tài liệu: The impact of capital structure on the performance of construction companies: A study from Vietnam stock exchanges

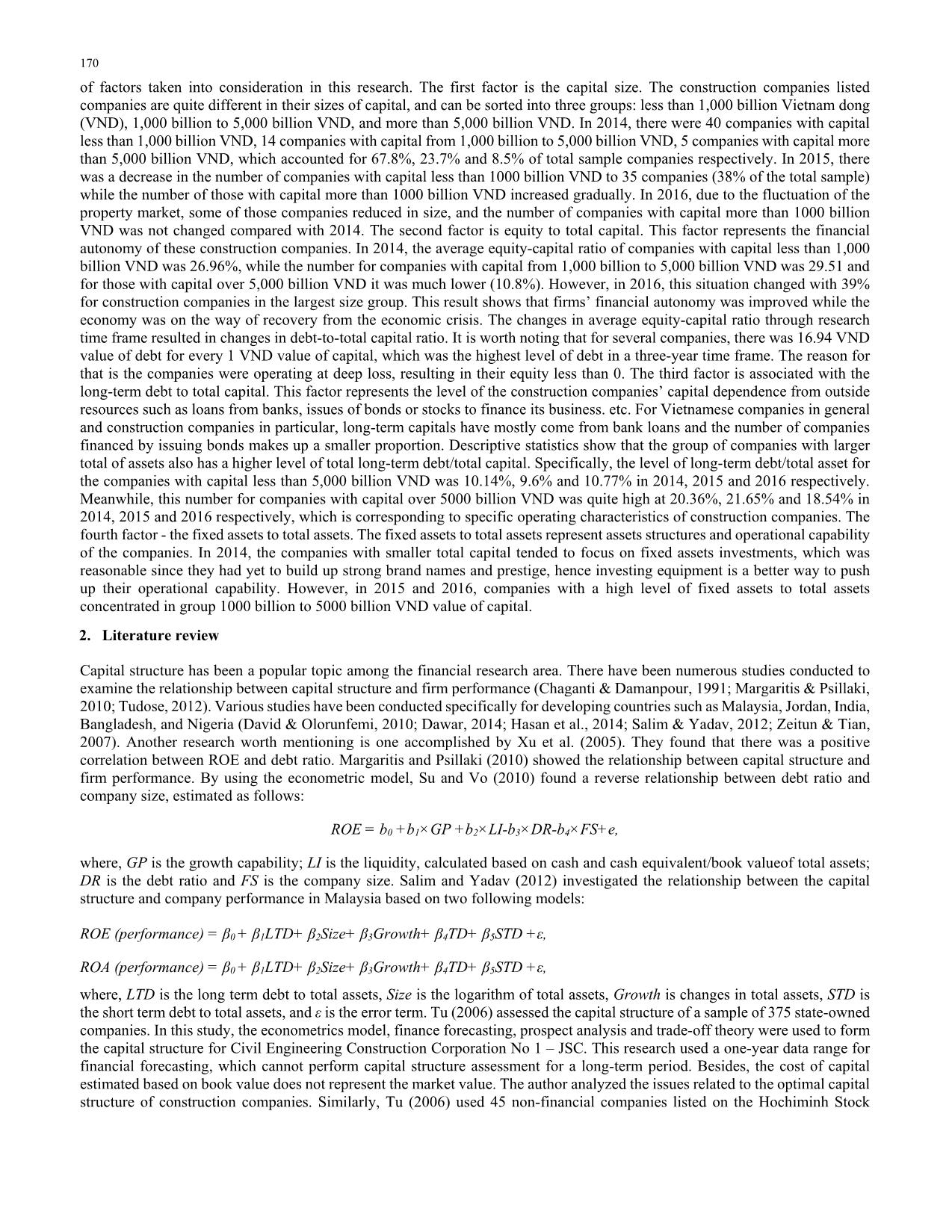

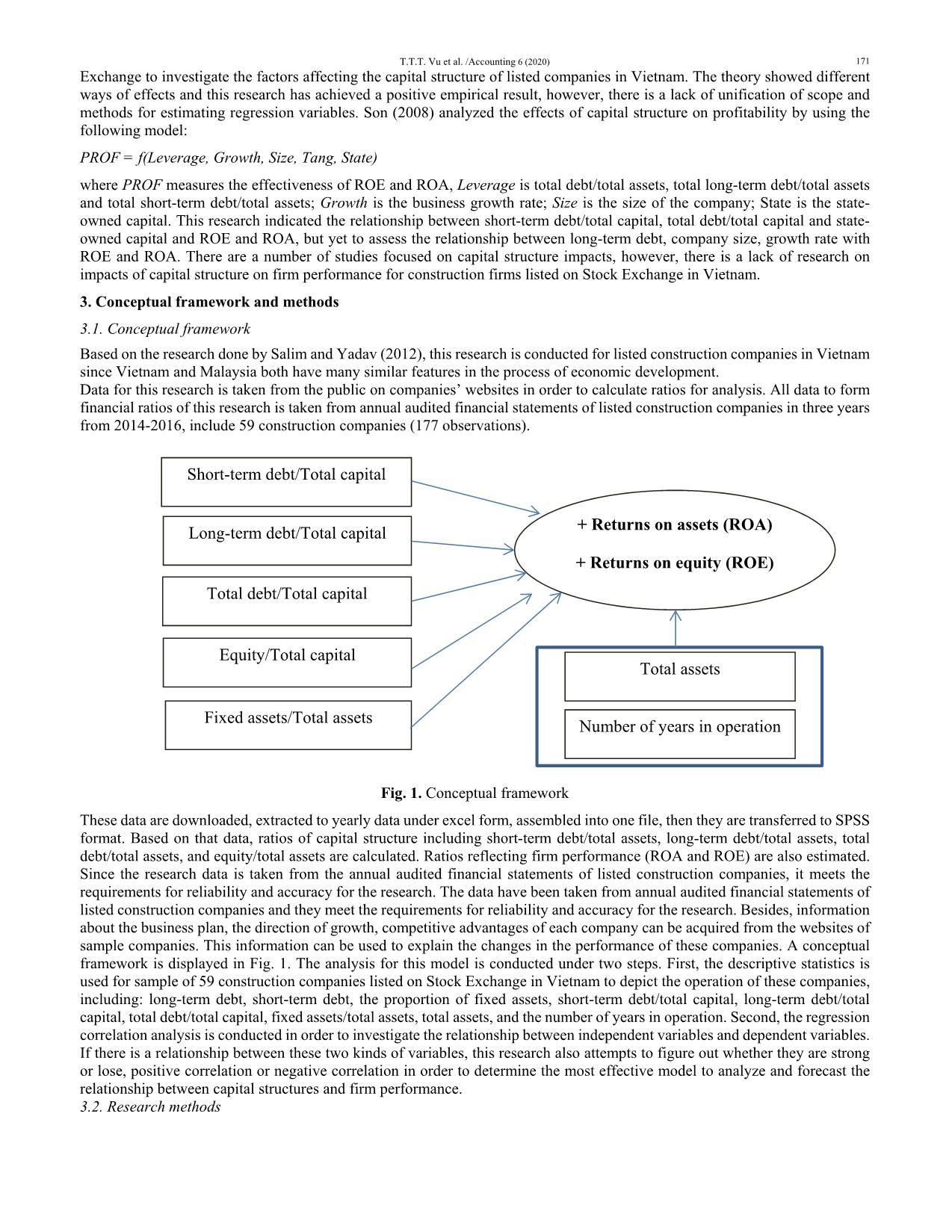

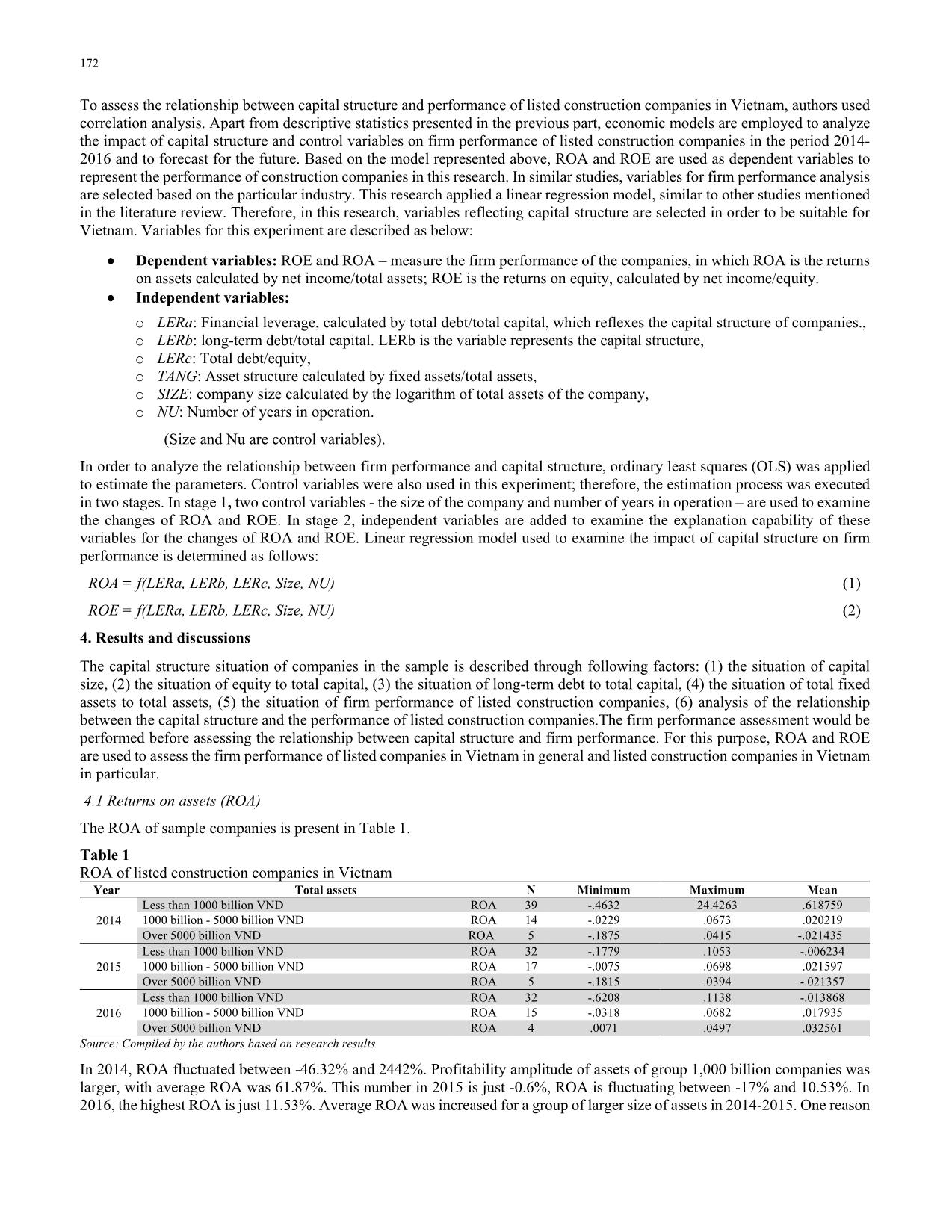

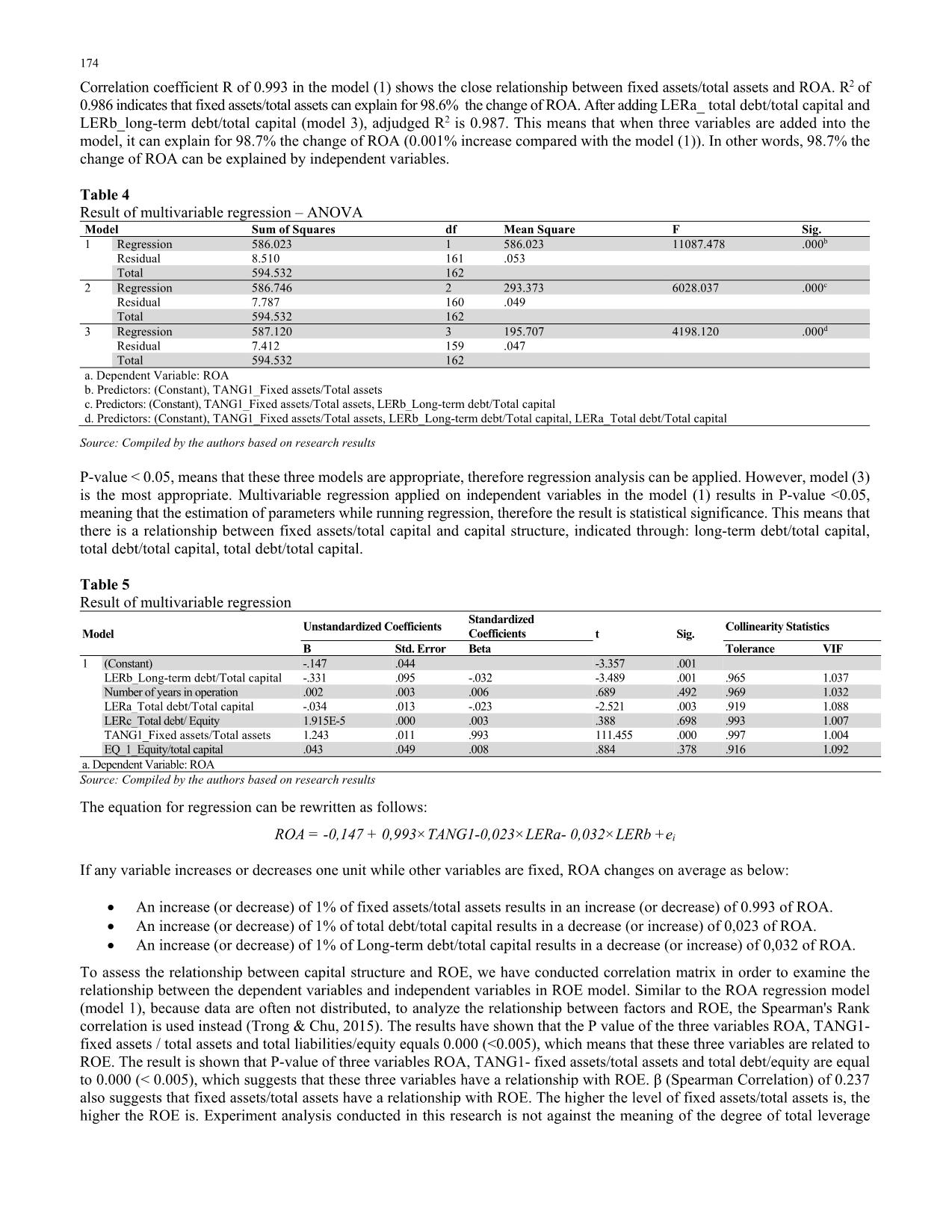

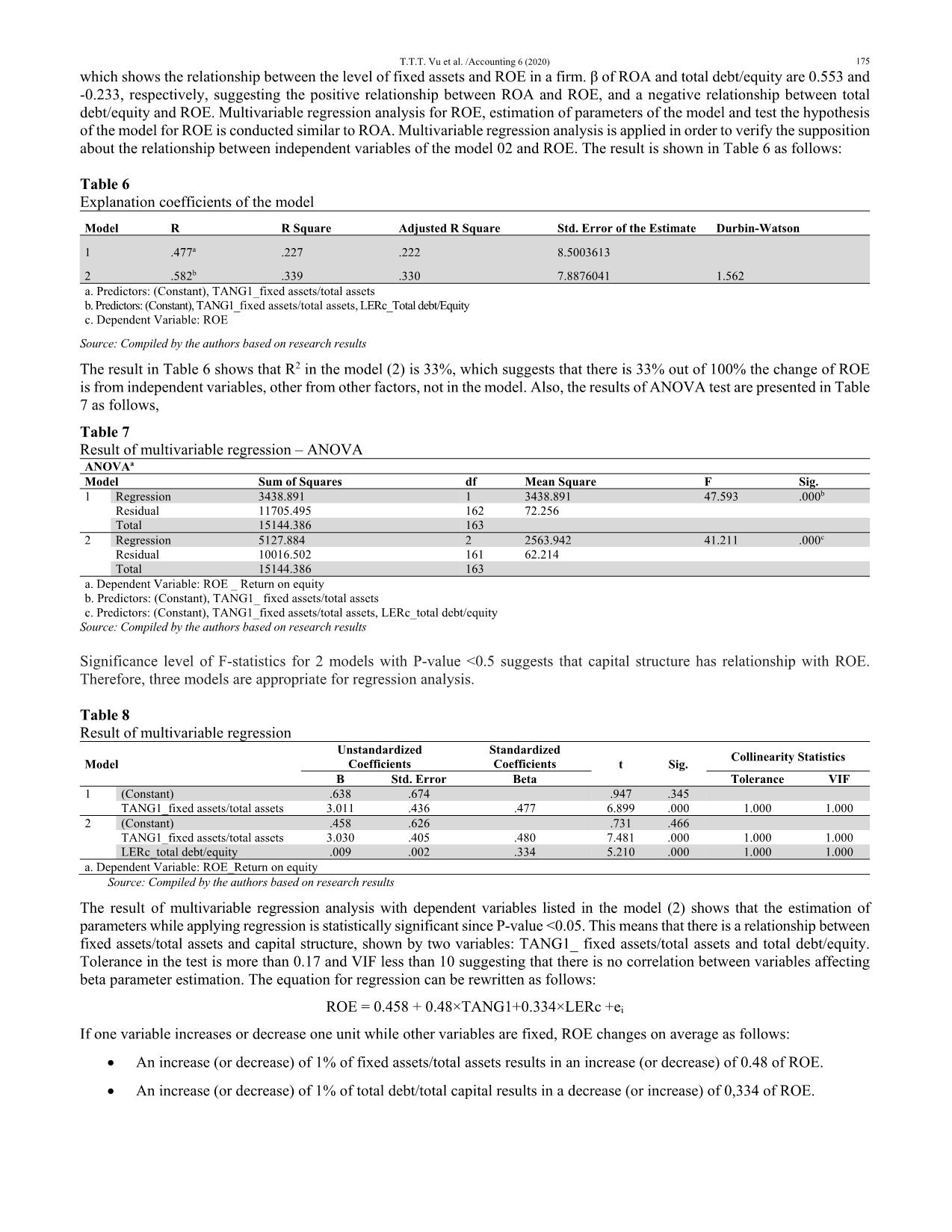

o examine the distribution of the data set, and the result showed that the data set was not normally distributed due to the secondary data set. For this reason, Spearman’s Rank correlation has been used instead to analyze the relationship between factors affecting ROA. The results show that: P-value of three variables: LERa (total debt/total capital), TANG1 (fixed assets/total asset) and EQ_1 (equity/total capital) are 0.000 which is less than 0.005. Therefore, there is a relationship between these three variables and ROA. Fixed assets to total assets had a positive relationship with ROA as indicated by β (Spearman Correlation) = 0,271. This experiment proves that in a specific period of time, if a construction company invests more in fixed assets, it would end up with higher ROA. This result also confirms the effect of operating leverage, i.e. when a firm passes their breakeven point; investing more in fixed assets would result in higher EBIT and vice versa. On the other hand, β of LERa and EQ_1 are -0.54 and 0.53, respectively, meaning that total debt/total assets had a negative relationship with ROA. Therefore, if a firm relies more on debts to finance their assets would be in the downturn stage of the economy, ROA would decrease and vice versa. Thus, finance independence would help to improve ROA. Multi-variables regression analysis, estimate parameters and test the hypothesis of the model were conducted on the data set of 59 construction companies listed on the Stock Exchange in Vietnam in a three-year period (2014-2016) by using SPSS22. This analysis helps to assess whether there is any variable affected by another variable in the same model; and if there is a relationship like that, whether it is a positive or negative correlation. Multi-variables regression is used to examine the soundness of the hypothesis about independent variables in model 01. OLS is used to estimate the parameters and T-test is applied to verify the supposition for the model with the confidence interval of 95%. H0: there is a positive relationship between Xi and ROA H1: there is no positive relationship between Xi and ROA The result of multi-variables regression analysis is presented in the Table 3 as follows: Table 3 Explanation parameters of the model Model Summary Model R R Square_R2 Adjusted R Square Std. Error of the Estimate 1 .993a .986 .986 .2299010 2 .993b .987 .987 .2206084 3 .994c .988 .987 .2159114 a. Predictors: (Constant), TANG1_Fixed assets/Total assets b. Predictors: (Constant), TANG1_Fixed assets/Total assets, LERb_Long-term debt/Total capital c. Predictors: (Constant), TANG1_Fixed assets/Total assets, LERb_Long-term debt/Total capital, LERa_Total debt/Total capital Source: Compiled by the authors based on research results 174 Correlation coefficient R of 0.993 in the model (1) shows the close relationship between fixed assets/total assets and ROA. R2 of 0.986 indicates that fixed assets/total assets can explain for 98.6% the change of ROA. After adding LERa_ total debt/total capital and LERb_long-term debt/total capital (model 3), adjudged R2 is 0.987. This means that when three variables are added into the model, it can explain for 98.7% the change of ROA (0.001% increase compared with the model (1)). In other words, 98.7% the change of ROA can be explained by independent variables. Table 4 Result of multivariable regression – ANOVA Model Sum of Squares df Mean Square F Sig. 1 Regression 586.023 1 586.023 11087.478 .000b Residual 8.510 161 .053 Total 594.532 162 2 Regression 586.746 2 293.373 6028.037 .000c Residual 7.787 160 .049 Total 594.532 162 3 Regression 587.120 3 195.707 4198.120 .000d Residual 7.412 159 .047 Total 594.532 162 a. Dependent Variable: ROA b. Predictors: (Constant), TANG1_Fixed assets/Total assets c. Predictors: (Constant), TANG1_Fixed assets/Total assets, LERb_Long-term debt/Total capital d. Predictors: (Constant), TANG1_Fixed assets/Total assets, LERb_Long-term debt/Total capital, LERa_Total debt/Total capital Source: Compiled by the authors based on research results P-value < 0.05, means that these three models are appropriate, therefore regression analysis can be applied. However, model (3) is the most appropriate. Multivariable regression applied on independent variables in the model (1) results in P-value <0.05, meaning that the estimation of parameters while running regression, therefore the result is statistical significance. This means that there is a relationship between fixed assets/total capital and capital structure, indicated through: long-term debt/total capital, total debt/total capital, total debt/total capital. Table 5 Result of multivariable regression Model Unstandardized Coefficients Standardized Coefficients t Sig. Collinearity Statistics B Std. Error Beta Tolerance VIF 1 (Constant) -.147 .044 -3.357 .001 LERb_Long-term debt/Total capital -.331 .095 -.032 -3.489 .001 .965 1.037 Number of years in operation .002 .003 .006 .689 .492 .969 1.032 LERa_Total debt/Total capital -.034 .013 -.023 -2.521 .003 .919 1.088 LERc_Total debt/ Equity 1.915E-5 .000 .003 .388 .698 .993 1.007 TANG1_Fixed assets/Total assets 1.243 .011 .993 111.455 .000 .997 1.004 EQ_1_Equity/total capital .043 .049 .008 .884 .378 .916 1.092 a. Dependent Variable: ROA Source: Compiled by the authors based on research results The equation for regression can be rewritten as follows: ROA = -0,147 + 0,993×TANG1-0,023×LERa- 0,032×LERb +ei If any variable increases or decreases one unit while other variables are fixed, ROA changes on average as below: An increase (or decrease) of 1% of fixed assets/total assets results in an increase (or decrease) of 0.993 of ROA. An increase (or decrease) of 1% of total debt/total capital results in a decrease (or increase) of 0,023 of ROA. An increase (or decrease) of 1% of Long-term debt/total capital results in a decrease (or increase) of 0,032 of ROA. To assess the relationship between capital structure and ROE, we have conducted correlation matrix in order to examine the relationship between the dependent variables and independent variables in ROE model. Similar to the ROA regression model (model 1), because data are often not distributed, to analyze the relationship between factors and ROE, the Spearman's Rank correlation is used instead (Trong & Chu, 2015). The results have shown that the P value of the three variables ROA, TANG1- fixed assets / total assets and total liabilities/equity equals 0.000 (<0.005), which means that these three variables are related to ROE. The result is shown that P-value of three variables ROA, TANG1- fixed assets/total assets and total debt/equity are equal to 0.000 (< 0.005), which suggests that these three variables have a relationship with ROE. β (Spearman Correlation) of 0.237 also suggests that fixed assets/total assets have a relationship with ROE. The higher the level of fixed assets/total assets is, the higher the ROE is. Experiment analysis conducted in this research is not against the meaning of the degree of total leverage T.T.T. Vu et al. /Accounting 6 (2020) 175 which shows the relationship between the level of fixed assets and ROE in a firm. β of ROA and total debt/equity are 0.553 and -0.233, respectively, suggesting the positive relationship between ROA and ROE, and a negative relationship between total debt/equity and ROE. Multivariable regression analysis for ROE, estimation of parameters of the model and test the hypothesis of the model for ROE is conducted similar to ROA. Multivariable regression analysis is applied in order to verify the supposition about the relationship between independent variables of the model 02 and ROE. The result is shown in Table 6 as follows: Table 6 Explanation coefficients of the model Model R R Square Adjusted R Square Std. Error of the Estimate Durbin-Watson 1 .477a .227 .222 8.5003613 2 .582b .339 .330 7.8876041 1.562 a. Predictors: (Constant), TANG1_fixed assets/total assets b. Predictors: (Constant), TANG1_fixed assets/total assets, LERc_Total debt/Equity c. Dependent Variable: ROE Source: Compiled by the authors based on research results The result in Table 6 shows that R2 in the model (2) is 33%, which suggests that there is 33% out of 100% the change of ROE is from independent variables, other from other factors, not in the model. Also, the results of ANOVA test are presented in Table 7 as follows, Table 7 Result of multivariable regression – ANOVA ANOVAa Model Sum of Squares df Mean Square F Sig. 1 Regression 3438.891 1 3438.891 47.593 .000b Residual 11705.495 162 72.256 Total 15144.386 163 2 Regression 5127.884 2 2563.942 41.211 .000c Residual 10016.502 161 62.214 Total 15144.386 163 a. Dependent Variable: ROE _ Return on equity b. Predictors: (Constant), TANG1_ fixed assets/total assets c. Predictors: (Constant), TANG1_fixed assets/total assets, LERc_total debt/equity Source: Compiled by the authors based on research results Significance level of F-statistics for 2 models with P-value <0.5 suggests that capital structure has relationship with ROE. Therefore, three models are appropriate for regression analysis. Table 8 Result of multivariable regression Model Unstandardized Coefficients Standardized Coefficients t Sig. Collinearity Statistics B Std. Error Beta Tolerance VIF 1 (Constant) .638 .674 .947 .345 TANG1_fixed assets/total assets 3.011 .436 .477 6.899 .000 1.000 1.000 2 (Constant) .458 .626 .731 .466 TANG1_fixed assets/total assets 3.030 .405 .480 7.481 .000 1.000 1.000 LERc_total debt/equity .009 .002 .334 5.210 .000 1.000 1.000 a. Dependent Variable: ROE_Return on equity Source: Compiled by the authors based on research results The result of multivariable regression analysis with dependent variables listed in the model (2) shows that the estimation of parameters while applying regression is statistically significant since P-value <0.05. This means that there is a relationship between fixed assets/total assets and capital structure, shown by two variables: TANG1_ fixed assets/total assets and total debt/equity. Tolerance in the test is more than 0.17 and VIF less than 10 suggesting that there is no correlation between variables affecting beta parameter estimation. The equation for regression can be rewritten as follows: ROE = 0.458 + 0.48×TANG1+0.334×LERc +ei If one variable increases or decrease one unit while other variables are fixed, ROE changes on average as follows: An increase (or decrease) of 1% of fixed assets/total assets results in an increase (or decrease) of 0.48 of ROE. An increase (or decrease) of 1% of total debt/total capital results in a decrease (or increase) of 0,334 of ROE. 176 5. Conclusion In summary, first, based on data set from 2014-2016, we have found no evidence for the relationship between the number of years in operation, total assets, long-term debt/total capital, total debt/total capital and ROA, ROE, although several other studies have found out this relationship. Secondly, the results have shown that there was a relationship between other factors and ROA, ROE and these factors can explain for 96.8% the change of ROA and 33% the change of ROE in listed construction companies on Stock Exchange in Vietnam. Third, regression result suggests the strongest positive relationship between fixed assets/total assets and ROA, ROE among factors taken into this research, which reveals the need of increasing the effectiveness of fixed assets in construction companies. Fourth, debt/equity has maintained a positive relationship with ROE, suggesting that the higher the level of debt/equity is, the higher the ROE is. Fifth, debt/total capital and long-term debt/total capital maintained a negative relationship with ROA and they both had similar effects on ROA, which implies that in the recession of the economy, with the slow speed of development of the market, high level of debt could have negative effect on the profitability of total assets However, in order to figure out if there are differences in the level of capital when examining the relationship between LERc and ROE, and to find out the persuasive basis for solutions, correlation analysis between LERc (debt/equity) and ROE is conducted by level of capital and by year. References Chaganti, R., & Damanpour, F. (1991). Institutional ownership, capital structure, and firm performance. Strategic management journal, 12(7), 479-491. David, D. F., & Olorunfemi, S. (2010) ‘Capital Structure and Corporate Performance in Nigeria Petroleum Industry : Panel Data Analysis’ Journal of Mathematics and Statistics, 6(2), 168 - 173. Dawar, V. (2014). Agency theory, capital structure and firm performance: some Indian evidence. Managerial Finance, 40(12), 1190 - 1206. Hasan, M. B., Ahsan, A. F. M. M., Rahaman, M. A., & Alam, M. N. (2014). Influence of capital structure on firm performance: Evidence from Bangladesh. International Journal of Business and Management, 9(5), 184 - 194. Lan, T.T.P. (2013). Contruction and real estate companies, risks from the financial leverage. VNU Journal of Science, Economics and Business, 29(3), 68 – 74. Margaritis, D., & Psillaki, M. (2010). Capital structure, equity ownership and firm performance. Journal of Banking and Finance, 34(3), 621 - 632. Su, G. S., & Vo, H. T. (2010). The relationship between corporate strategy, capital structure and firm performance: An empirical study of the listed companies in Vietnam. International Research Journal of Finance and Economics, 50, 62-71. Salim, M., & Yadav, R. (2012). Capital structure and firm performance: Evidence from Malaysian listed companies. Procedia- Social and Behavioral Sciences, 65, 156-166. Son, T.H. (2008). Capital structure and firm performance. Banking Technology, 33, 31-35. Tu, T.T.T. (2006). The renovation of capital structure of state-owned enterprises. PhD thesis, National Economic University, Hanoi, Vietnam. Trong, H., & Chu, N. M. N. (2015). Analyzing research data with SPSS. 2nd ed, Hong Duc, Hanoi. Tudose, M. B. (2012). Capital Structure and Firm Performance. Economy Transdisciplinarity Cognition, 15(2), 76 - 82. Xu, W., Xu, X., & Zhang, S. ( 2005). An empirical study on relationship between corporation performance and capital structure. China – USA Business Review, 4(4), 49 – 53. Zeitun, R., & Tian, G. G. (2007). Capital structure and corporate performance : evidence from Jordan. Australasian Accounting Business and Finance Journal, 1(4), 40 - 61. © 2019 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

the_impact_of_capital_structure_on_the_performance_of_constr.pdf

the_impact_of_capital_structure_on_the_performance_of_constr.pdf