The effects R&D expenditures on the market value in the telecommunication industry-evidence from North America

The linkage between R&D spending and

market value of firms has been continuously

debated from time to time. Many studies

have proved that there is a positive impact.

Meanwhile, other studies have proved that

it depends on which sectors in the economy,

some sectors have a strongly positive effect

but the others have a weak effect. This

paper estimates the relationship between

R&D expenditures and market price in the

telecommunication sector. First, by using the

COMPUSTAT annual industrials of North

America in period 1950-2005, we find a

strong evidence of the positive relationship.

Second, we implement another test to

investigate some particular characteristics

of the telecommunication sector during the

process of liberalization telecommunication

markets as well as the emerging internet

and developing Information Technology

era. Overall, our result is consistent with

some previous studies. Third, we expand

the model and find that price per share is

positively associated with other variables

including total assets per share and earning

per share

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Tóm tắt nội dung tài liệu: The effects R&D expenditures on the market value in the telecommunication industry-evidence from North America

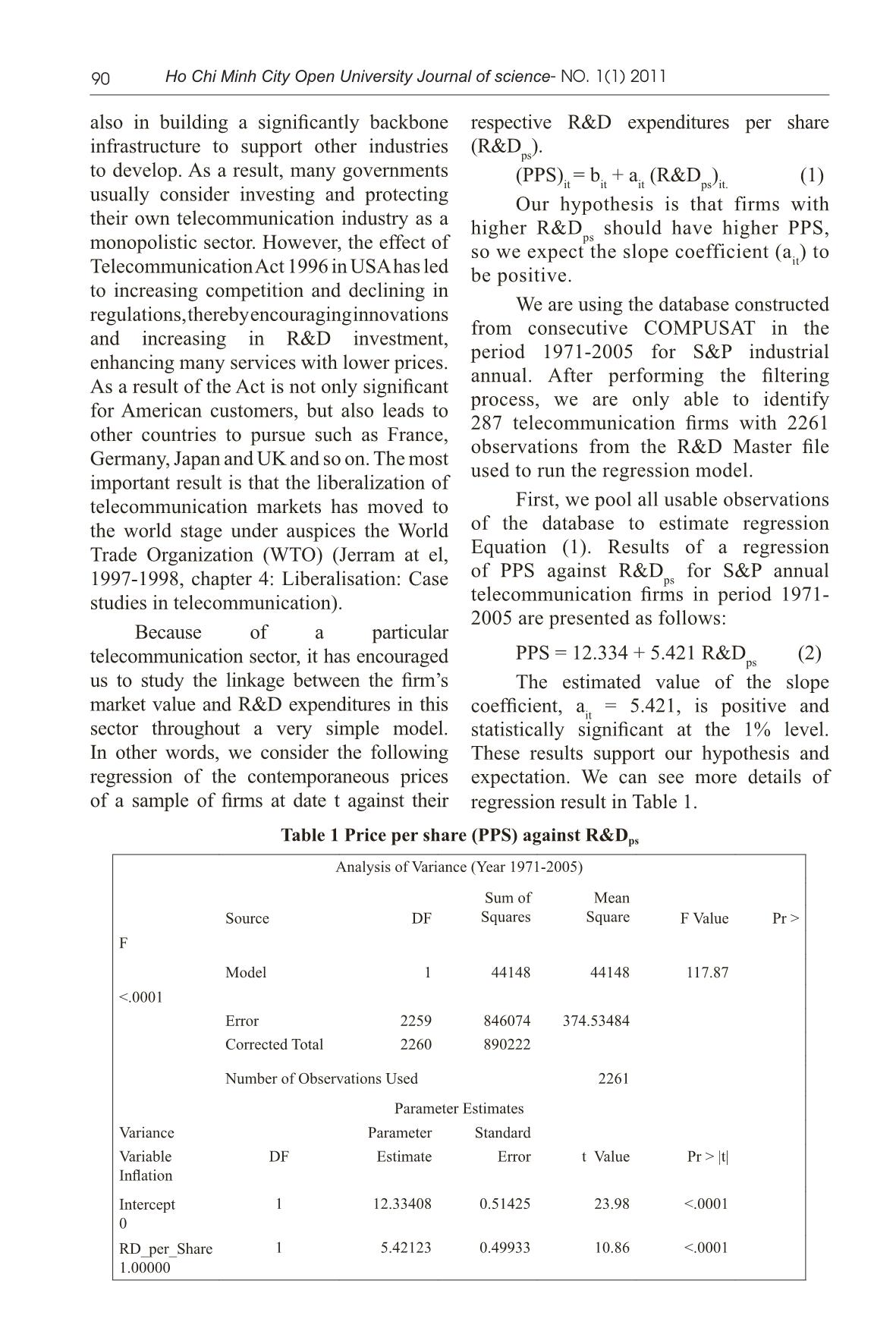

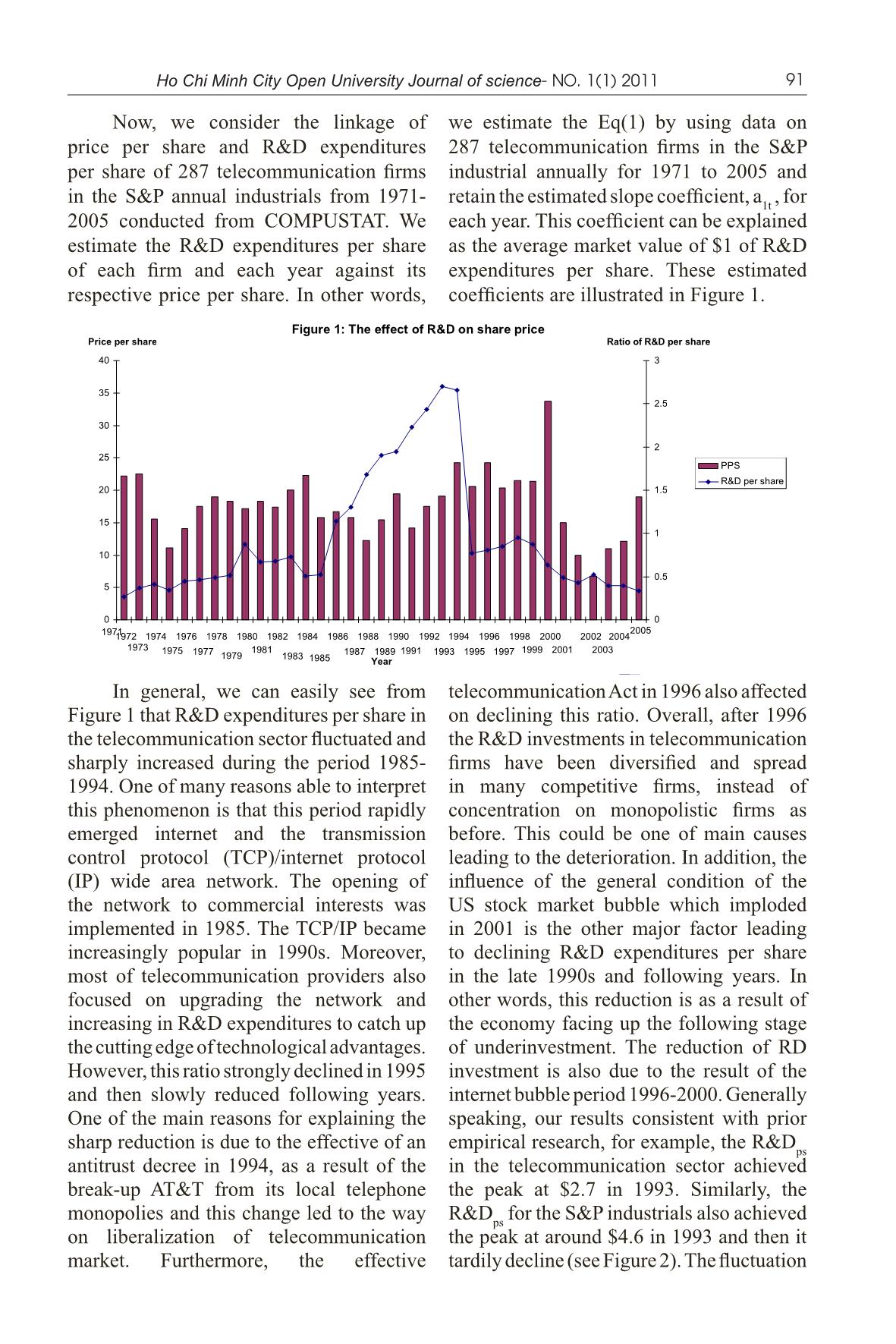

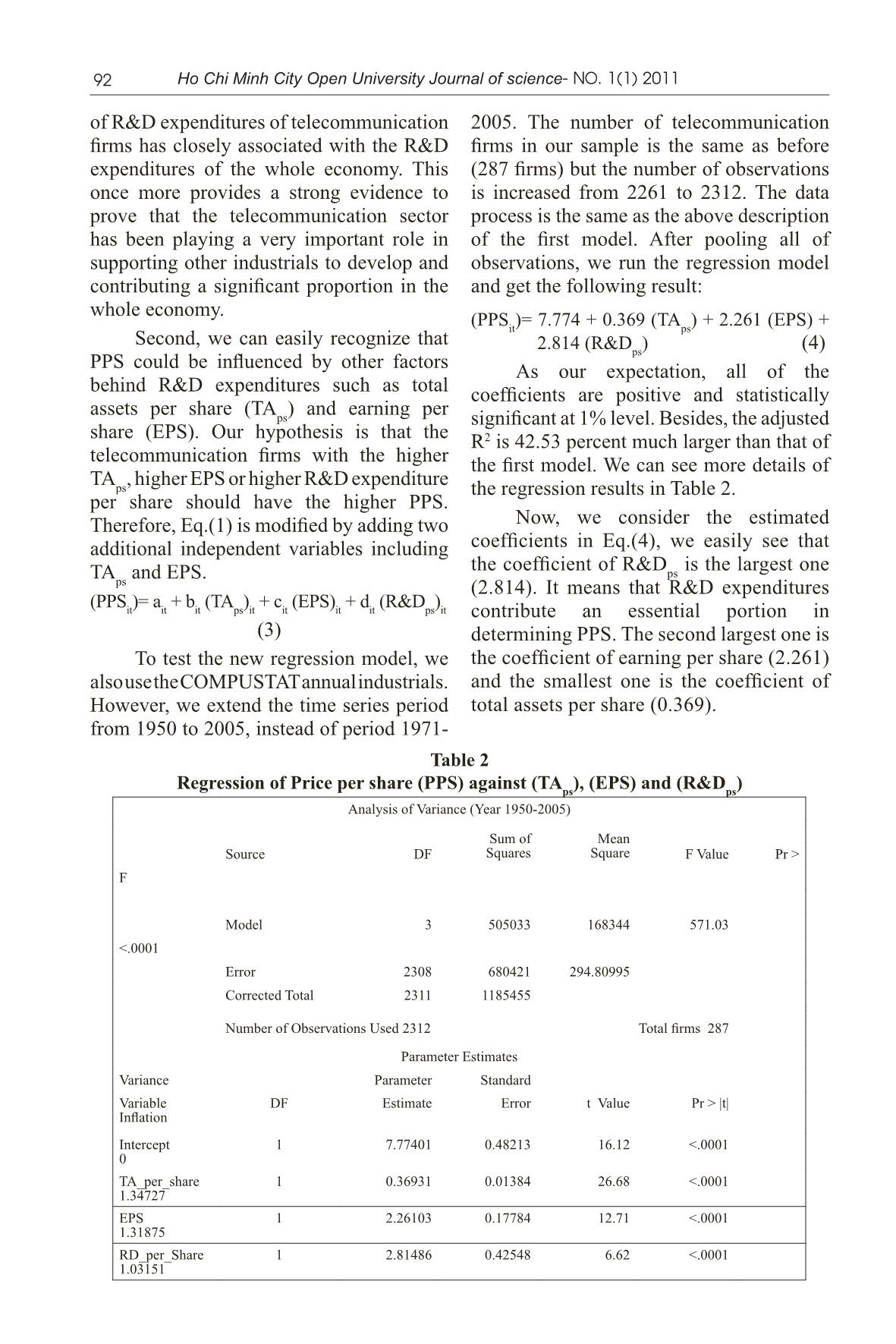

y relative to return volatility, after manufacturing firms. By empirical study of controlling for firm size, age and industry a 40 year period 1962-2001, Ho et al (2005) effects. By using a sample of around 1200 show that intensive investment in R&D companies’ expenditures on R&D, Lev and contributes positively to the one-year stock Sougiannis (1999) provide some evidences market performances of manufacturing (1) low market-to-book companies have a firms but not for non-manufacturing firms. large R&D capital and vice versa; (2) the In recent research, Sakakibara et al ratio of R&D capital to market value is (2006) have found that R&D expenditures closely relative to the book-to-market ratio; contribute to operating income for five years (3) the return premium is essentially higher on average for firms listed in Tokyo stock for risky R&D (basic research) than for exchange. Moreover, they also find R&D lower risk R&D (development). capital information is reflected in stock Throughout the empirical study, prices throughout analyzing relationship Sougiannis et al (2001) show that the market between R&D capital and subsequent stock is apparently too pessimistic about beaten- return of manufacturing enterprises. down R&D intensive technology stocks’ III. Empirical Studies prospects. Firms with high R&D to equity Overall, the effects of R&D market value earn large excess returns. expenditures have been carefully studied Furthermore, Amir et al (2005) also consider by many scholars in theoretical aspects the effective R&D expenditures on the future as well as empirical studies. However, earnings. They build a model to estimate most previous studies focus on the whole the association between R&D investment economy or some particular sectors such as and capital expenditures (CAPEX) and the pharmaceutical industry, non-manufacturing variance of future earnings per share and and manufacturing firms. In recent time, operating income. They provide evidence many authors have concentrated on exploring that R&D investment lead to higher volatility the hot muddles of outsourcing R&D. Here, of future earnings than capital expenditures we focus on analyzing the linkage between only in R&D-intensive industries, where R&D expenditures and market value of industry R&D intensity is measured as the firms in the telecommunication industry. R&D-to-CAPEX ratio. Besides, they also A brief background of show that the stronger association of R&D telecommunication industry with uncertainty in future earnings is a Telecommunications is playing a very recent phenomenon. important not only in its own right, but 90 Ho Chi Minh City Open University Journal of science- No. 1(1) 2011 also in building a significantly backbone respective R&D expenditures per share infrastructure to support other industries (R&Dps). to develop. As a result, many governments (PPS)it = bit + ait (R&Dps)it. (1) usually consider investing and protecting Our hypothesis is that firms with their own telecommunication industry as a higher R&D should have higher PPS, monopolistic sector. However, the effect of ps so we expect the slope coefficient (ait) to Telecommunication Act 1996 in USA has led be positive. to increasing competition and declining in regulations, thereby encouraging innovations We are using the database constructed from consecutive COMPUSAT in the and increasing in R&D investment, period 1971-2005 for S&P industrial enhancing many services with lower prices. annual. After performing the filtering As a result of the Act is not only significant process, we are only able to identify for American customers, but also leads to 287 telecommunication firms with 2261 other countries to pursue such as France, observations from the R&D Master file Germany, Japan and UK and so on. The most used to run the regression model. important result is that the liberalization of telecommunication markets has moved to First, we pool all usable observations the world stage under auspices the World of the database to estimate regression Trade Organization (WTO) (Jerram at el, Equation (1). Results of a regression of PPS against R&D for S&P annual 1997-1998, chapter 4: Liberalisation: Case ps studies in telecommunication). telecommunication firms in period 1971- 2005 are presented as follows: Because of a particular telecommunication sector, it has encouraged PPS = 12.334 + 5.421 R&Dps (2) us to study the linkage between the firm’s The estimated value of the slope market value and R&D expenditures in this coefficient, ait = 5.421, is positive and sector throughout a very simple model. statistically significant at the 1% level. In other words, we consider the following These results support our hypothesis and regression of the contemporaneous prices expectation. We can see more details of of a sample of firms at date t against their regression result in Table 1. Table 1 Price per share (PPS) against R&Dps Analysis of Variance (Year 1971-2005) Sum of Mean Source DF Squares Square F Value Pr > F Model 1 44148 44148 117.87 <.0001 Error 2259 846074 374.53484 Corrected Total 2260 890222 Number of Observations Used 2261 Parameter Estimates Variance Parameter Standard Variable DF Estimate Error t Value Pr > |t| Inflation Intercept 1 12.33408 0.51425 23.98 <.0001 0 RD_per_Share 1 5.42123 0.49933 10.86 <.0001 1.00000 Ho Chi Minh City Open University Journal of science- No. 1(1) 2011 91 Now, we consider the linkage of we estimate the Eq(1) by using data on price per share and R&D expenditures 287 telecommunication firms in the S&P per share of 287 telecommunication firms industrial annually for 1971 to 2005 and in the S&P annual industrials from 1971- retain the estimated slope coefficient, 1ta , for 2005 conducted from COMPUSTAT. We each year. This coefficient can be explained estimate the R&D expenditures per share as the average market value of $1 of R&D of each firm and each year against its expenditures per share. These estimated respective price per share. In other words, coefficients are illustrated in Figure 1. Figure 1: The effect of R&D on share price Price per share Ratio of R&D per share 40 3 35 2.5 30 2 25 PPS R&D per share 20 1.5 15 1 10 0.5 5 0 0 1971 2005 1972 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 1973 1975 1977 1981 1987 1989 1991 1993 1995 1997 1999 2001 2003 1979 1983 1985 Year In general, we can easily see from telecommunication Act in 1996 also affected Figure 1 that R&D expenditures per share in on declining this ratio. Overall, after 1996 the telecommunication sector fluctuated and the R&D investments in telecommunication sharply increased during the period 1985- firms have been diversified and spread 1994. One of many reasons able to interpret in many competitive firms, instead of this phenomenon is that this period rapidly concentration on monopolistic firms as emerged internet and the transmission before. This could be one of main causes control protocol (TCP)/internet protocol leading to the deterioration. In addition, the (IP) wide area network. The opening of influence of the general condition of the the network to commercial interests was US stock market bubble which imploded implemented in 1985. The TCP/IP became in 2001 is the other major factor leading increasingly popular in 1990s. Moreover, to declining R&D expenditures per share most of telecommunication providers also in the late 1990s and following years. In focused on upgrading the network and other words, this reduction is as a result of increasing in R&D expenditures to catch up the economy facing up the following stage the cutting edge of technological advantages. of underinvestment. The reduction of RD However, this ratio strongly declined in 1995 investment is also due to the result of the and then slowly reduced following years. internet bubble period 1996-2000. Generally One of the main reasons for explaining the speaking, our results consistent with prior sharp reduction is due to the effective of an empirical research, for example, the R&Dps antitrust decree in 1994, as a result of the in the telecommunication sector achieved break-up AT&T from its local telephone the peak at $2.7 in 1993. Similarly, the monopolies and this change led to the way R&Dps for the S&P industrials also achieved on liberalization of telecommunication the peak at around $4.6 in 1993 and then it market. Furthermore, the effective tardily decline (see Figure 2). The fluctuation 92 Ho Chi Minh City Open University Journal of science- No. 1(1) 2011 of R&D expenditures of telecommunication 2005. The number of telecommunication firms has closely associated with the R&D firms in our sample is the same as before expenditures of the whole economy. This (287 firms) but the number of observations once more provides a strong evidence to is increased from 2261 to 2312. The data prove that the telecommunication sector process is the same as the above description has been playing a very important role in of the first model. After pooling all of supporting other industrials to develop and observations, we run the regression model contributing a significant proportion in the and get the following result: whole economy. (PPSit)= 7.774 + 0.369 (TAps) + 2.261 (EPS) + Second, we can easily recognize that 2.814 (R&Dps) (4) PPS could be influenced by other factors As our expectation, all of the behind R&D expenditures such as total coefficients are positive and statistically assets per share (TA ) and earning per ps significant at 1% level. Besides, the adjusted share (EPS). Our hypothesis is that the R2 is 42.53 percent much larger than that of telecommunication firms with the higher the first model. We can see more details of TA , higher EPS or higher R&D expenditure ps the regression results in Table 2. per share should have the higher PPS. Therefore, Eq.(1) is modified by adding two Now, we consider the estimated additional independent variables including coefficients in Eq.(4), we easily see that the coefficient of R&D is the largest one TA and EPS. ps ps (2.814). It means that R&D expenditures (PPS )= a + b (TA ) + c (EPS) + d (R&D ) it it it ps it it it it ps it contribute an essential portion in (3) determining PPS. The second largest one is To test the new regression model, we the coefficient of earning per share (2.261) also use the COMPUSTAT annual industrials. and the smallest one is the coefficient of However, we extend the time series period total assets per share (0.369). from 1950 to 2005, instead of period 1971- Table 2 Regression of Price per share (PPS) against (TAps), (EPS) and (R&Dps) Analysis of Variance (Year 1950-2005) Sum of Mean Source DF Squares Square F Value Pr > F Model 3 505033 168344 571.03 <.0001 Error 2308 680421 294.80995 Corrected Total 2311 1185455 Number of Observations Used 2312 Total firms 287 Parameter Estimates Variance Parameter Standard Variable DF Estimate Error t Value Pr > |t| Inflation Intercept 1 7.77401 0.48213 16.12 <.0001 0 TA_per_share 1 0.36931 0.01384 26.68 <.0001 1.34727 EPS 1 2.26103 0.17784 12.71 <.0001 1.31875 RD_per_Share 1 2.81486 0.42548 6.62 <.0001 1.03151 Ho Chi Minh City Open University Journal of science- No. 1(1) 2011 93 IV. Conclusion Research.” Strategic Management The role of R&D expenditures Journal 15: 63-84. contributing to sustain and develop firms’ Joseph P. Ogden, Frank C. Jen and Philip business objectives has been explored in F. O’Connor (2002), “Advanced many various aspects. Our major findings Corporate Finance”, Prentice Hall, include: first, R&D expenditures per share 2002. are closely positive related to price per Louis K. C. Chan, Josef Lakonishok, and share in the telecommunication firms. Theodore Sougiannis (2001), “The This is also consistent with some previous Stock Market Valuation of Research studies such as Ogden at el (2002). Second, and Development Expenditures”, the the estimated average of R&D expenditures Journal of finance, Dec/2001. per share for each year reflects some major characteristics of the telecommunication Louis K.C. Chan, Josef Lakonishok, sector during the process of liberalization Theodore Sougiannis (1999), “The of telecommunication market as well as Stock Market Valuation of Research the period of emerging IT and developing and Development Expenditures”, internet era and internet bubble period. Working Paper 7223, NBER, July Finally, we expand our basic model to 1999. test two additional independent variables Re-Jin Guo, Baruch Lev and Charles Shi including total assets per share and earning (2006), “Explaining the Short- and per share effect on price per share. As a Long-Term IPO Anomalies in the US result, we find that all of coefficients are by R&D”, Journal of Business Finance positive associated with price per share as & Accounting, 33(3) & (4), 550–579, our expectation. In addition, the result once April/May 2006. more affirms the significant role of R&D S. P. Kothari , Ted E. Laguerre, Andrew J. expenditures in the firms’ market value, Leone and William E. Simon (2002), especially in the telecommunication sector. “Capitalization versus Expensing: V. References Evidence on the Uncertainty of Future Baruch Lev and Theodore Sougiannis Earnings from Capital Expenditures (1999), “Penetrating the Book-to- versus R&D Outlays”, Review of Market Black Box: the R&D Effect”, Accounting Studies, 7, 355–382, Journal of Business Finance and 2002. Accounting, April/May 1999. Shigeki Sakakibara, Tadanori Yosano, Wesley M. Cohen, Daniel A. Levinthal, Euichul Jung and Hideo Kozumi 1990, Absorptive Capacity: A (2006), “Value Relevance of R&D New Perspective on Learning and Capital Information: Evidence from Innovation, Vol. 35, No. 1, 128-152. Tokyo Stock Exchange”, Discussion Eli Amir, Yanling Guan and Gilad Livne Paper Series, 2006. (2005), “The Association between Quinn, B.J. 2000. Outsourcing Innovation: the Uncertainty of Future Economic The New Engine of Growth. Sloan Benefits and Current R&D and Management Review 41(14):13-23. Capital Expenditures: Industry and Yew Kee Ho, Hean Tat Keh, and Jin Mei Intertemporal Analyses”, the seminar Ong (2005), “The Effects of R&D at Cardiff University. and Advertising on Firm Value: An Henderson, R., and I. M. Cockburn. 1994. Examination of Manufacturing and “Measuring Competence? Exploring Nonmanufacturing Firms”, IEEE, Vol. Firm Effects in Pharmaceutical 52, No.1, Feb/2005.

File đính kèm:

the_effects_rd_expenditures_on_the_market_value_in_the_telec.pdf

the_effects_rd_expenditures_on_the_market_value_in_the_telec.pdf