Motivation for accounting human resources by material stimulation: The case of accounting service firms in Hanoi, Vietnam

This study is conducted for evaluating the motivation for accounting human resources by

material stimulation in the accounting service firms in Hanoi. Based on literature review and the

results of some interviews, dependent variable of the motivation for accounting human resources

by material stimulation includes seven attributes. The study has also performed some descriptive

analysis, Cronbach's Alpha, Independent T-test and ANOVA for measuring the motivation for

accounting human resources by material stimulation in the accounting service firms in Hanoi.

The results show that the motivation for accounting human resources by material stimulation

achieved an average of 3.74 and with Cronbach's Alpha coefficient greater than 0.6. The study

does not find any difference on evaluation of the motivation for accounting human resources by

material stimulation in terms of gender and job experience. Based on the findings, some

recommendations are given for improving the motivation for accounting human resources by

material stimulation in the accounting service firms in Hanoi.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tóm tắt nội dung tài liệu: Motivation for accounting human resources by material stimulation: The case of accounting service firms in Hanoi, Vietnam

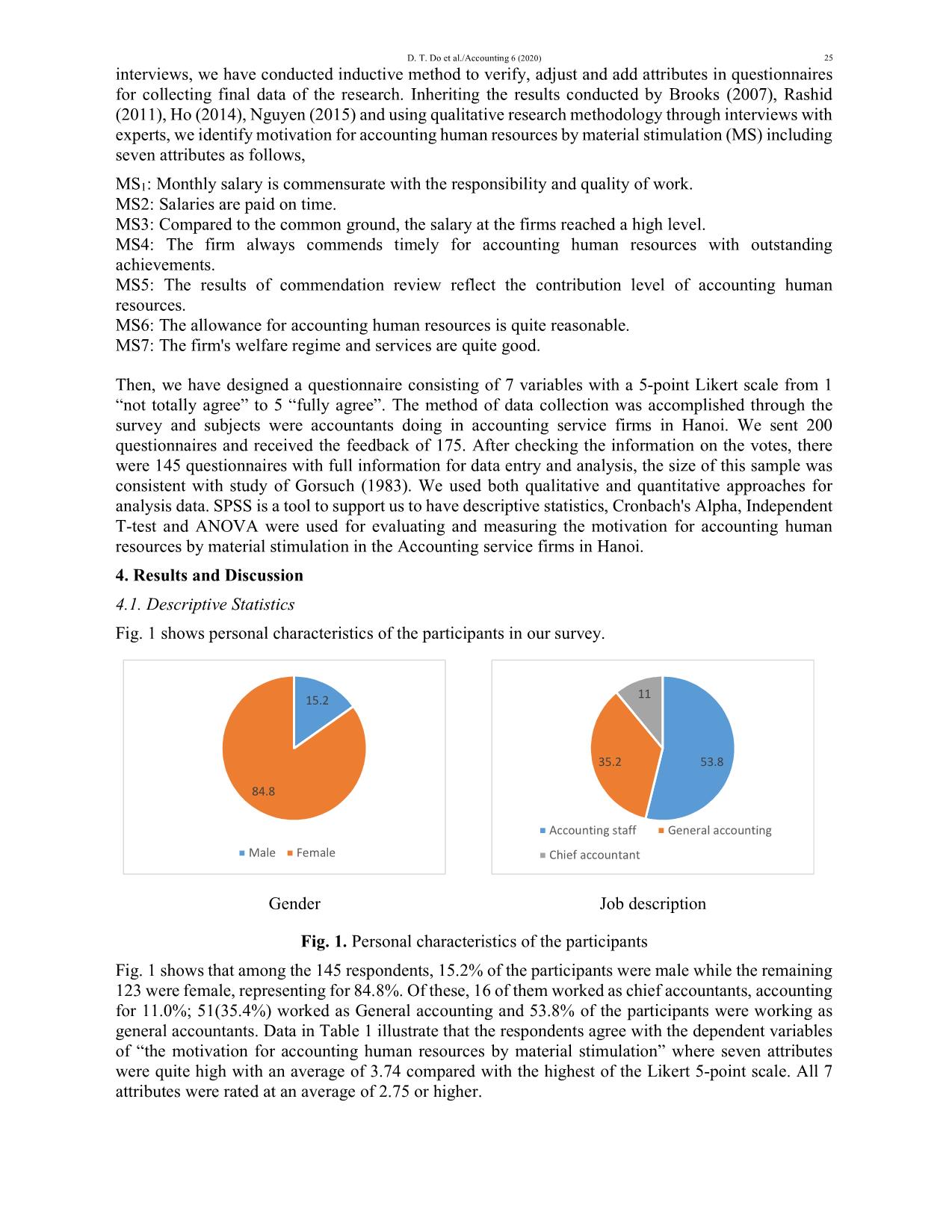

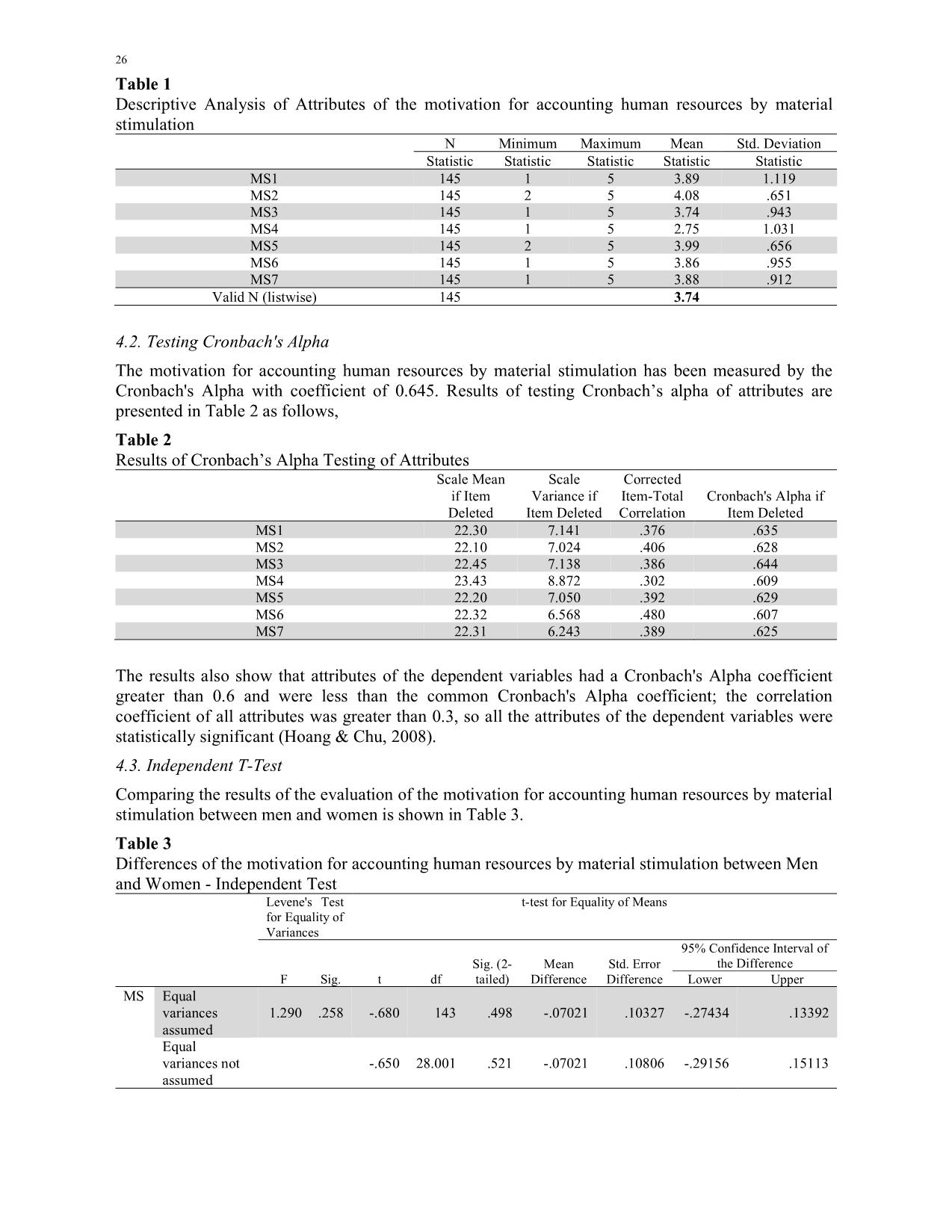

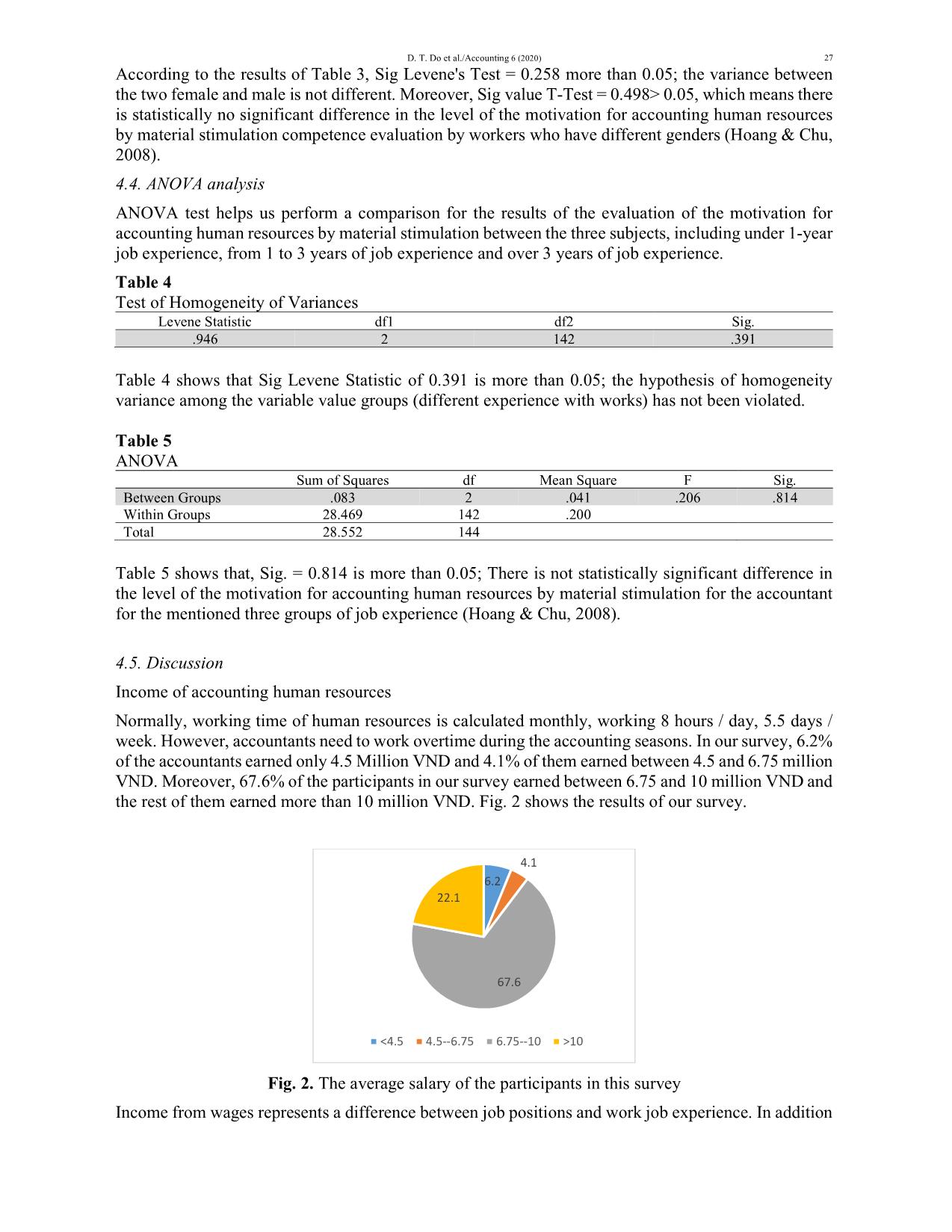

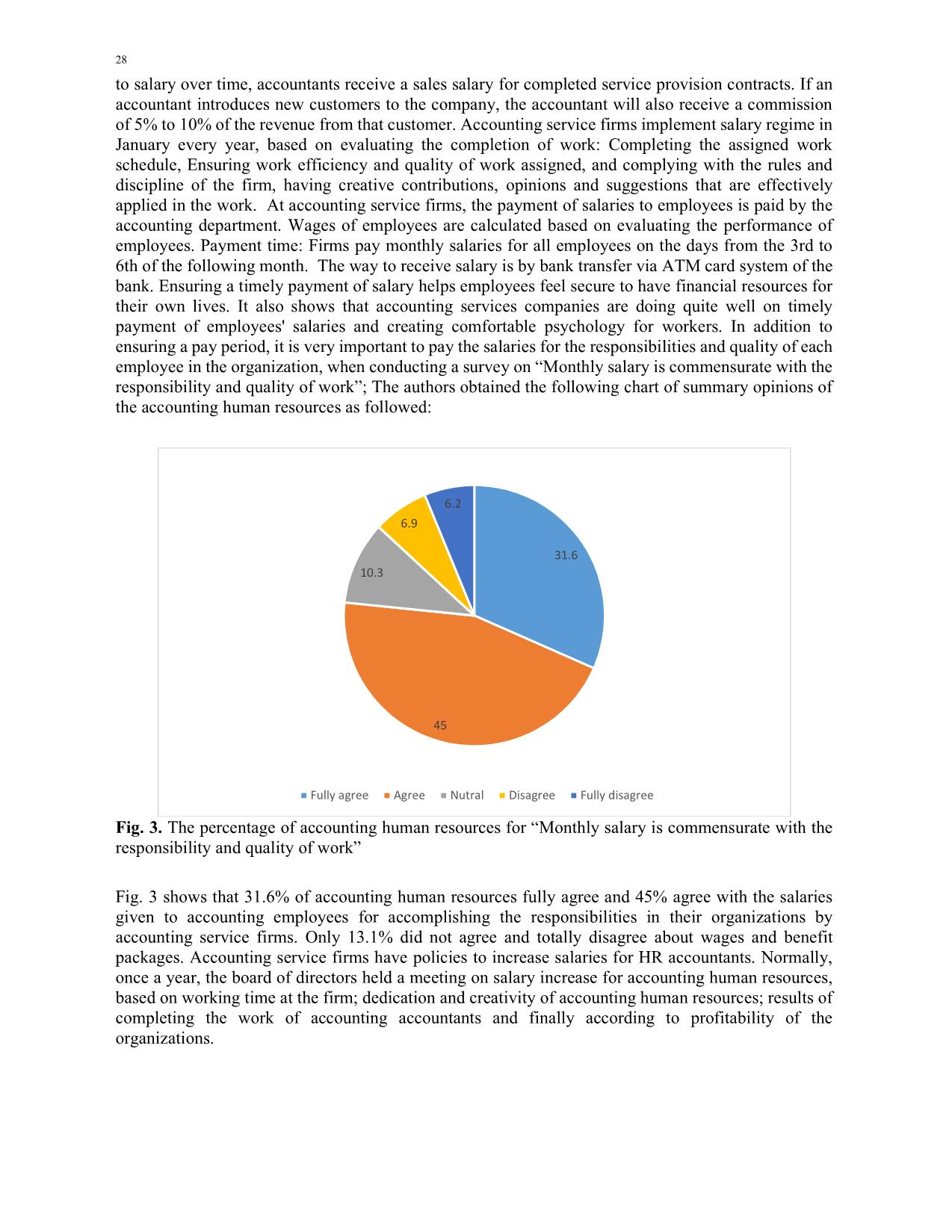

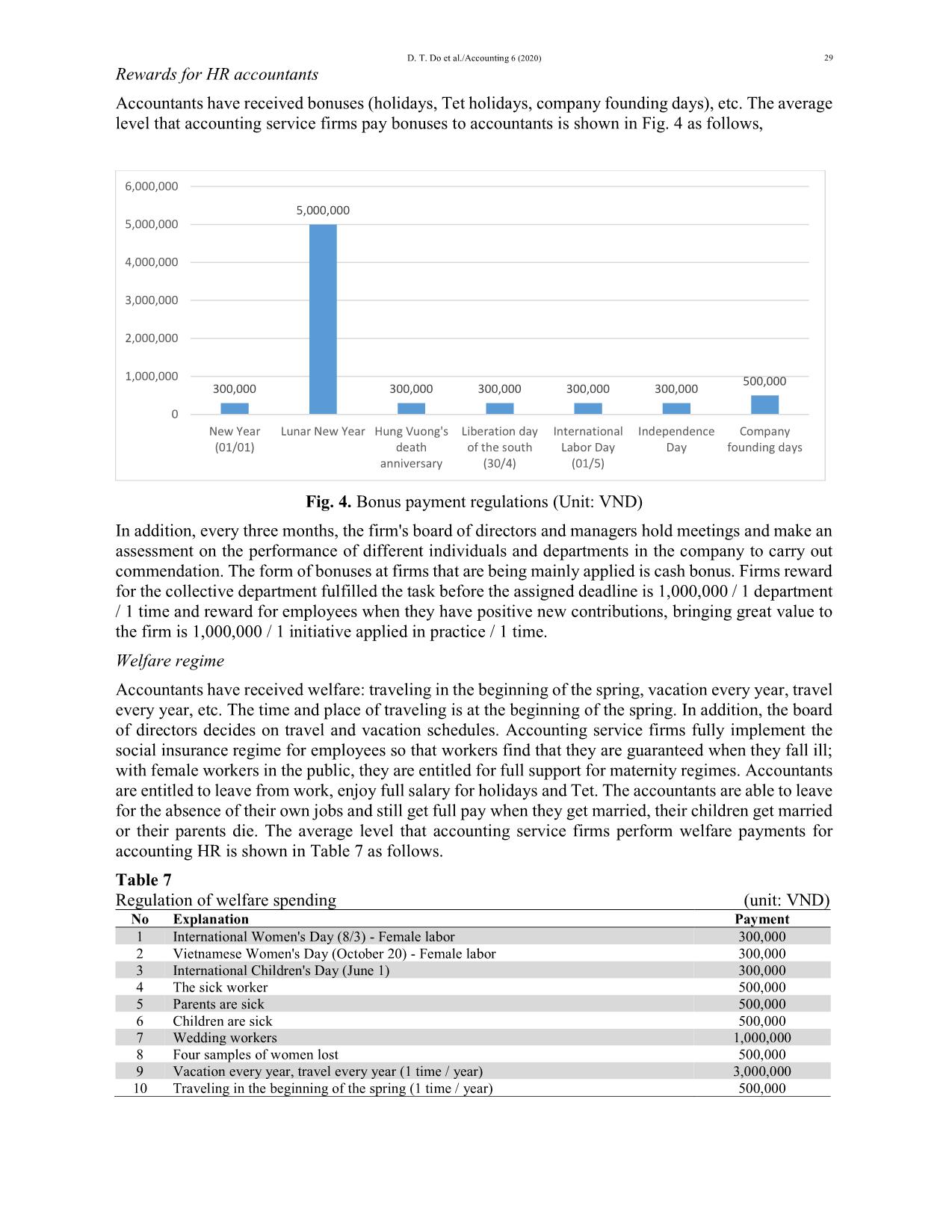

ny, the accountant will also receive a commission of 5% to 10% of the revenue from that customer. Accounting service firms implement salary regime in January every year, based on evaluating the completion of work: Completing the assigned work schedule, Ensuring work efficiency and quality of work assigned, and complying with the rules and discipline of the firm, having creative contributions, opinions and suggestions that are effectively applied in the work. At accounting service firms, the payment of salaries to employees is paid by the accounting department. Wages of employees are calculated based on evaluating the performance of employees. Payment time: Firms pay monthly salaries for all employees on the days from the 3rd to 6th of the following month. The way to receive salary is by bank transfer via ATM card system of the bank. Ensuring a timely payment of salary helps employees feel secure to have financial resources for their own lives. It also shows that accounting services companies are doing quite well on timely payment of employees' salaries and creating comfortable psychology for workers. In addition to ensuring a pay period, it is very important to pay the salaries for the responsibilities and quality of each employee in the organization, when conducting a survey on “Monthly salary is commensurate with the responsibility and quality of work”; The authors obtained the following chart of summary opinions of the accounting human resources as followed: Fig. 3. The percentage of accounting human resources for “Monthly salary is commensurate with the responsibility and quality of work” Fig. 3 shows that 31.6% of accounting human resources fully agree and 45% agree with the salaries given to accounting employees for accomplishing the responsibilities in their organizations by accounting service firms. Only 13.1% did not agree and totally disagree about wages and benefit packages. Accounting service firms have policies to increase salaries for HR accountants. Normally, once a year, the board of directors held a meeting on salary increase for accounting human resources, based on working time at the firm; dedication and creativity of accounting human resources; results of completing the work of accounting accountants and finally according to profitability of the organizations. 31.6 45 10.3 6.9 6.2 Fully agree Agree Nutral Disagree Fully disagree D. T. Do et al./Accounting 6 (2020) 29 Rewards for HR accountants Accountants have received bonuses (holidays, Tet holidays, company founding days), etc. The average level that accounting service firms pay bonuses to accountants is shown in Fig. 4 as follows, Fig. 4. Bonus payment regulations (Unit: VND) In addition, every three months, the firm's board of directors and managers hold meetings and make an assessment on the performance of different individuals and departments in the company to carry out commendation. The form of bonuses at firms that are being mainly applied is cash bonus. Firms reward for the collective department fulfilled the task before the assigned deadline is 1,000,000 / 1 department / 1 time and reward for employees when they have positive new contributions, bringing great value to the firm is 1,000,000 / 1 initiative applied in practice / 1 time. Welfare regime Accountants have received welfare: traveling in the beginning of the spring, vacation every year, travel every year, etc. The time and place of traveling is at the beginning of the spring. In addition, the board of directors decides on travel and vacation schedules. Accounting service firms fully implement the social insurance regime for employees so that workers find that they are guaranteed when they fall ill; with female workers in the public, they are entitled for full support for maternity regimes. Accountants are entitled to leave from work, enjoy full salary for holidays and Tet. The accountants are able to leave for the absence of their own jobs and still get full pay when they get married, their children get married or their parents die. The average level that accounting service firms perform welfare payments for accounting HR is shown in Table 7 as follows. Table 7 Regulation of welfare spending (unit: VND) No Explanation Payment 1 International Women's Day (8/3) - Female labor 300,000 2 Vietnamese Women's Day (October 20) - Female labor 300,000 3 International Children's Day (June 1) 300,000 4 The sick worker 500,000 5 Parents are sick 500,000 6 Children are sick 500,000 7 Wedding workers 1,000,000 8 Four samples of women lost 500,000 9 Vacation every year, travel every year (1 time / year) 3,000,000 10 Traveling in the beginning of the spring (1 time / year) 500,000 300,000 5,000,000 300,000 300,000 300,000 300,000 500,000 0 1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 New Year (01/01) Lunar New Year Hung Vuong's death anniversary Liberation day of the south (30/4) International Labor Day (01/5) Independence Day Company founding days 30 Allowances: Accounting service firms in Hanoi have made allowances including: (i) Responsibility allowance, lunch allowance, gasoline allowance, phone allowance. Accounting HR receive these allowances at the same time of receiving monthly salaries. Accounting HR are entitled to an allowance at the rate of actual working days in the month. The average level that accounting service firms make allowances for accounting HR is shown in Fig. 5. Fig. 5. Regulation of allowances (Unit: VND) In addition to fixed allowances, accounting service firms also make payment for accounting human resources in terms of working expense. Support level includes eating and drinking, personal activities: If going back home in a day, the company supports 200,000 VND / day, if going from two days or more in neighboring provinces the firm gives 250,000 / day. The cost of train tickets, car tickets, motels, hotels, and accountants will be covered by vouchers of payment. When the income level that the accounting human resources receives is commensurate with the merit and work that makes them comfortable and effective, it will attract the dedication and wisdom of the people. Therefore, enterprises' managers of accounting services firms need to pay more attention, contributing to the use of effective accounting human resources, as a competitive factor in the process of sustainable development. Accounting human resources are educated and trained quite well in universities, colleges and accounting service firms. However, an accounting department of human resources has not received the expected level, so there is still a phenomenon of accounting human resources for job jumps. 5. Recommendations Complete salary work associated with performance accountant The level of salaries for accountants must ensure satisfactory living, further learning, thus attract high- quality accountants to work for Accounting Services Firms. In most cases, salary is the most effective driving force that has been applied so far. Types of labor remuneration play a key role in motivating workers to work for and create value for the firm. Therefore, it is necessary: (i). to develop an effective performance assessment system to create the firm basis for the remuneration according to the level of work completion and the work performed; thus to maintain the current 5, 00 0, 00 0 4, 00 0, 00 0 3, 50 0, 00 0 3, 00 0, 00 0 68 0, 00 0 68 0, 00 0 68 0, 00 0 68 0, 00 0 68 0, 00 0 1, 00 0, 00 0 80 0, 00 0 70 0, 00 0 60 0, 00 0 50 0, 00 0 1, 00 0, 00 0 80 0, 00 0 70 0, 00 0 50 0, 00 0 30 0, 00 0 D I R E C T O R V I C E D I R E C T O R C H I E F A C C O U N T A N T M A N A G E R E M P L O Y E E S Responsibility Lunch Gasoline Phone D. T. Do et al./Accounting 6 (2020) 31 accounting human resources, as well as to attract and retain expert accountants, especially job placement. A high salary and recognition by the superiors can make accountants stick with Accounting Services Firms for a long period of time. (ii). The forms of payment and paying salaries need to be conducted in a detailed, specific, fair, and accurate way: The department in charge of payroll management is responsible for explaining the ideas of the accounting HR on their salaries when they have questions. (iii). Developing clear regulations on standards and conditions for wage increase, ensuring publicity and transparency. The division in charge of salary management needs to develop documents regulating specific standards. The conditions for salary increase and approval are approved by the Board of Directors of the company, with documents coming from the department, ensuring widespread dissemination to all employees and serious, public and transparent implementation. (iv). Developing specific criteria for each employee to pay salary for the right people in the right job, needing to add criteria for seniority working for employees who have been with the company for many years. (v). There is also a need to develop a job description suitable to the capacity and ability of accounting HR to meet the requirements of that job, thereby rationalizing the assignment and layout, choosing right person for the right job so that the accountant knows the specific job they have to do, accomplish it well and motivate themselves to work. (vi). Enhancing fostering and improving the professional level of the Ministry of salary operations. Construction appropriate reward and welfare regimes Have a reward system that is written in documents for each reward level, celebrate a recognition ceremony to show support and consensus among employees, thus encourage creativity. The reward decision should be made in a timely manner: The employee has a reward to be rewarded as soon as possible. If it is not possible to award immediately, there must be praise right away for the outstanding achievements gained by the employee. Implementation of seniority bonus regime: For the accountants who make accounting for long-term companies, at the end of the year, they can be rewarded according to a certain level to encourage them to stick with the company. Diversify types of benefits: Currently, accounting services firms only apply compulsory forms of benefits but firms need to diversify types of benefits such as: Organizing periodic health examination for employees, supporting bank loans for workers to stabilize their lives. Establishing a trade union organization: an organization representing workers to establish a healthy, stable and attracting environment to labors. Organizing counseling sessions on labor law so that employees can understand, trust and well implement the policies offered by the Company. Implementing the reward regime for children of public employees who have achieved outstanding achievements in studying. The content of service welfare programs should be contributed by accountants to create excitement for the programs. Because of the benefits for accounting human resources, it is necessary to survey the opinion of the accountant. 6. Conclusion Nowadays, motivation for accounting human resources is one of the necessary measures for accounting service firms because of accounting human resources are people who directly contribute to the development of firms. Accounting service firms to attach special important to motivate for accounting 32 human resources will urge accounting human resources engrossed work, strive to improve their skills to improve performance’s accountant, contribute to improving business performance of the firm and raise income of the accountants. Human motivation’s Accounting service firms are conformtable, satisfying the needs of accountants, accountants are assured of working and accountants have a strodependency to accounting service firms. This study was conducted for evaluating the motivation for accounting human resources by material stimulation in the accounting service firms in Hanoi via payroll, evaluating the work performance, bonus measures, welfare, etc. Some recommendations were also given for improving the motivation for accounting human resources by material stimulation in the accounting service firms in Hanoi. References Adams, J.C. (1961). Wage inequities in a clerical task. Unpublished study. General Electric Company, New York. Bui, T.X. (2018). Some solutions to perfect human motivation in small and medium enterprises. Journal of the Asia Pacific Economy, 4, 35-37. Do, D. T., & Nguyen, T.H. (2016). The impact of Vietnam accounting standard and tax law on completing work result of firm accountants in Vietnam. Proceedings of Accounting Integration. National Economics University, Part 1, 319-231. Do, D.T., Truong, D.D., Tran, M.D. & Nguyen, T.N.L. (2018). Determinants influencing performance of accountants: The case of Vietnam. International Journal of Economics and Finance, 10(7), 1-9. Gorsuch, R. L. (1983). Factor Analysis. 2nd ed., Hillsdale, NJ: Erlbaum. Hoang, T., & Chu, N.M.N (2008). Analysis of research data with SPSS. Hong Duc Publishing House. Ho, D. V. (2014). Some solutions to perfect human motivation in VINAINCON. Industry and trade journal, 8-9, 88-89. Maslow, A. (1943). A theory of human motivation. Psychological Review, 50(4), Jul 1943, 370-396. Nguyen, T. H. N. (2014). The cooperation strengthening between universities and firms in order to increase the quality of accounting human resources training in the direction of integration. Science and Technology Journal, 23, 3-7. Nguyen, T. M. A. (2015). Human motivation in the business transformation process of Vietnam post office. Asian economy in the Pacific journal, 8, 31-33. Shiraz, N., Rashid, M., & Riaz, A. (2011). The impact of reward and recognition programs on employee's motivation and satisfaction. Interdisciplinary Journal of Contemporary Research in Business, 3(3), 1428-1434. Tran, M.D. & Do, D.T. (2019). Quality of personnel via accountants’ physical and mental strengths in multinational firms in Vietnam. The 15th Conference of International Federation of East Asian Management Associations, Innovation Management for the Sustainable and Inclusive Development in a Transforming Asia, Kyoto, Japan, 2019. Truong, D.D., Do, D.T., &Tran, M.D. (2018), Evaluation of Accountants’ Performance: The Case of Vietnam. Research Journal of Finance and Accounting, 9(12), 39-46. Vroom, V.H. (1964). Work and motivation. New York: Wiley. © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

motivation_for_accounting_human_resources_by_material_stimul.pdf

motivation_for_accounting_human_resources_by_material_stimul.pdf