Impact of working capital management on firm profitability: Empirical study in Vietnam

This article studies the impact of working capital management (WCM) on firm profitability (FP) in

Vietnam. The study uses the Generalized Least Squares (GLS) regression method using a sample of

5,295 firms (observations) listed on stock market in Vietnam from 2009 to 2018. First, the study found

that inventory turnover, average receivables (AR), average payment (AP), cash conversion cycle

(CCC) had negative impacts on the firm profitability (FP). However, when we continued using

quadratic function, we found that INV, AR, AP and CCC had a non-linear relationship (the U-curve)

with FP. These research results contribute managerial contributions for firms in efficiently using

capital when considering its investment policy.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Tóm tắt nội dung tài liệu: Impact of working capital management on firm profitability: Empirical study in Vietnam

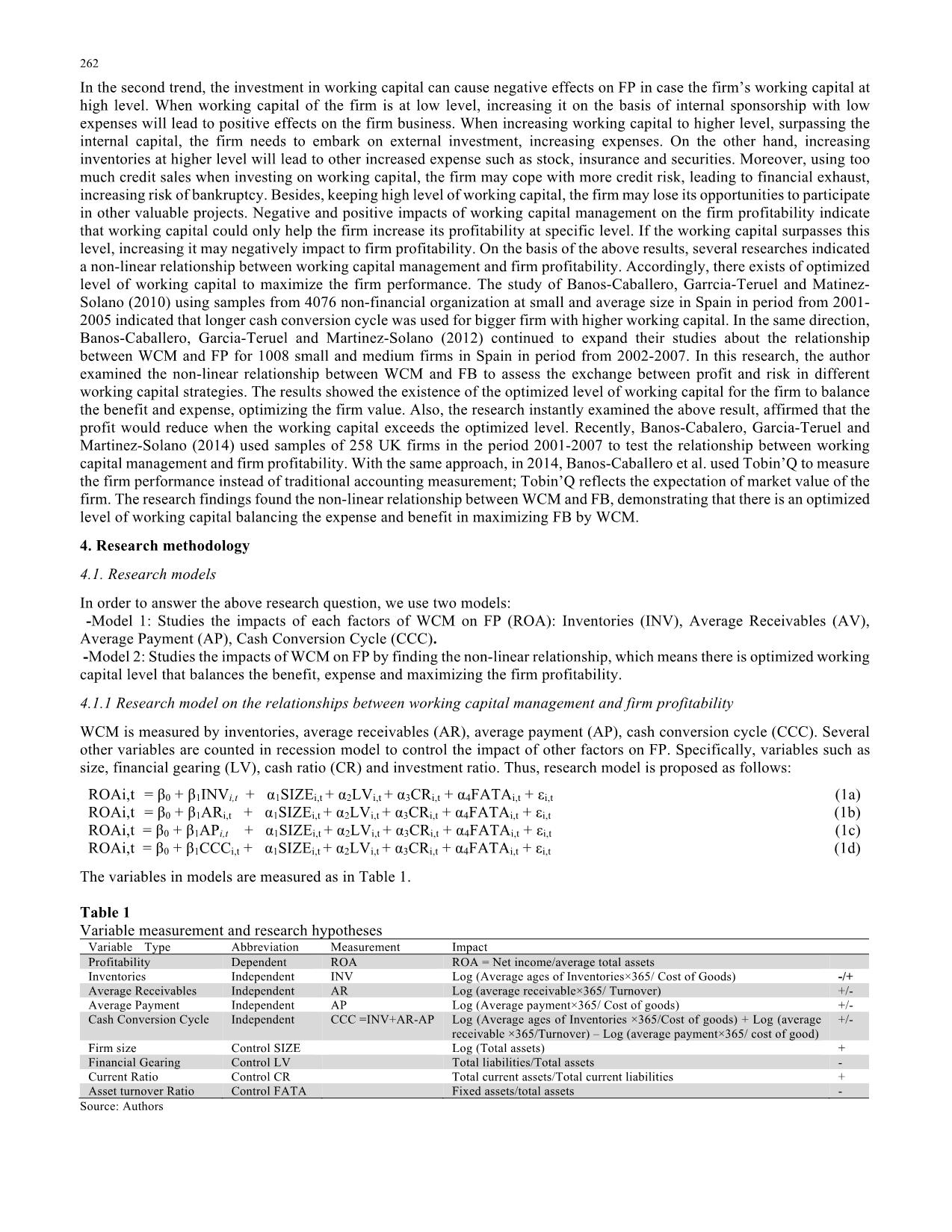

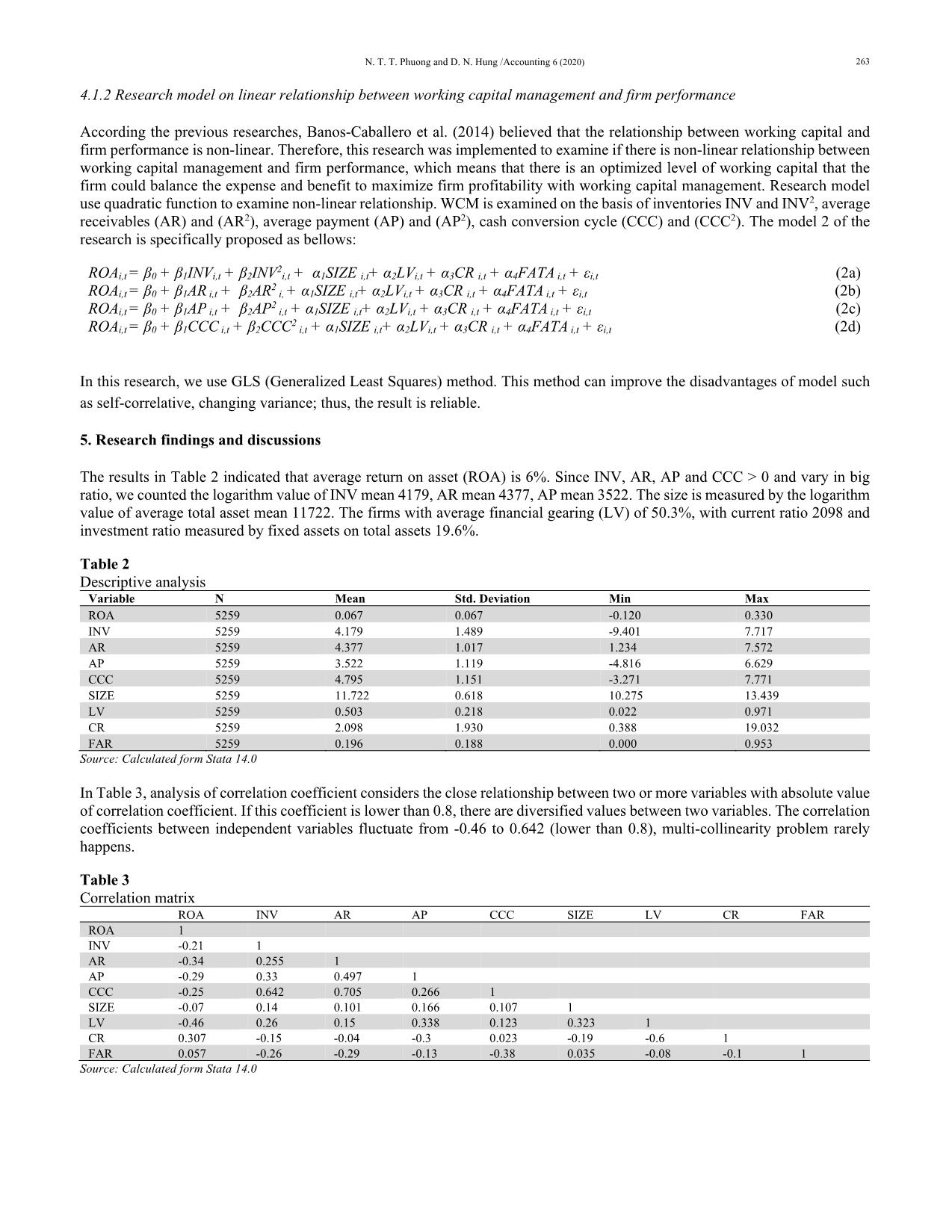

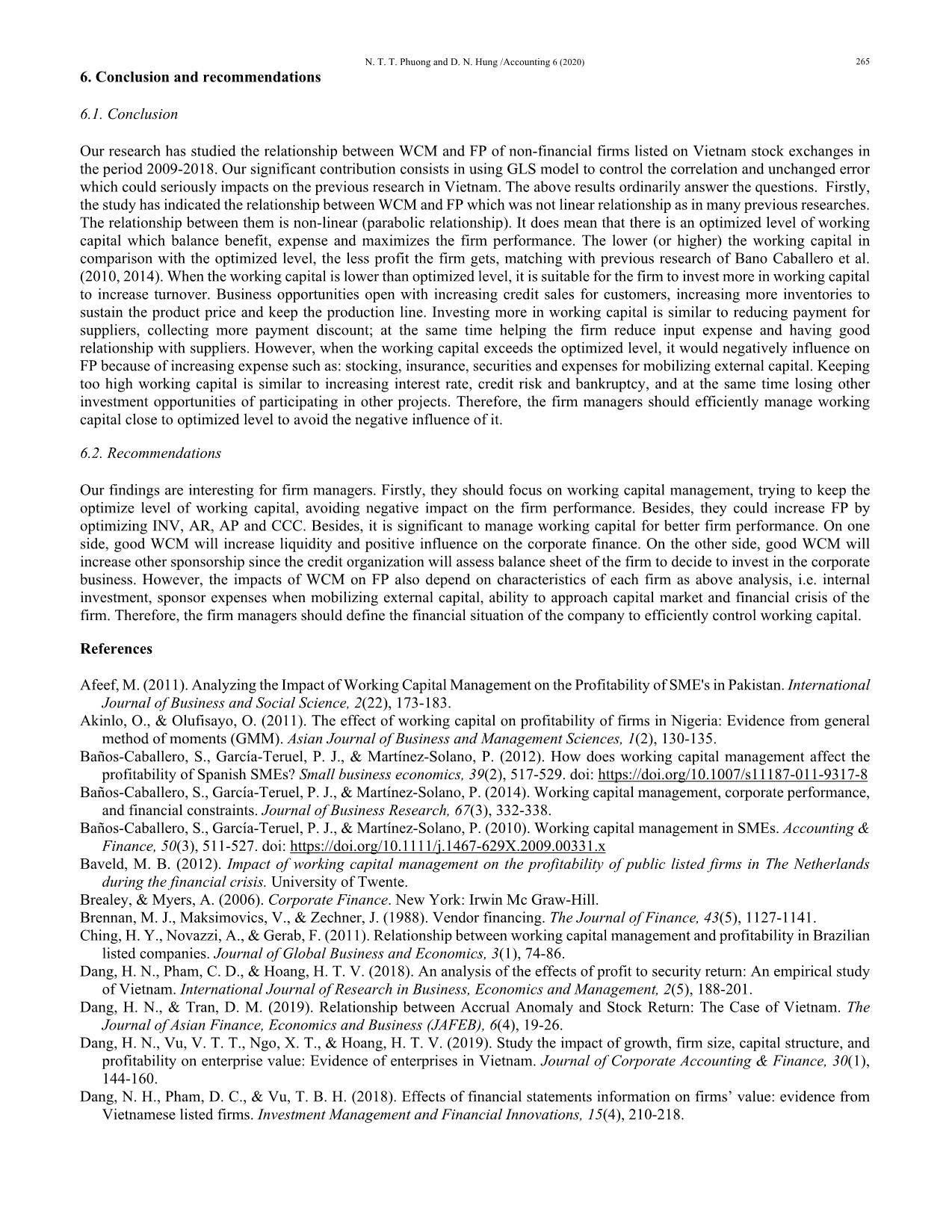

improve the disadvantages of model such as self-correlative, changing variance; thus, the result is reliable. 5. Research findings and discussions The results in Table 2 indicated that average return on asset (ROA) is 6%. Since INV, AR, AP and CCC > 0 and vary in big ratio, we counted the logarithm value of INV mean 4179, AR mean 4377, AP mean 3522. The size is measured by the logarithm value of average total asset mean 11722. The firms with average financial gearing (LV) of 50.3%, with current ratio 2098 and investment ratio measured by fixed assets on total assets 19.6%. Table 2 Descriptive analysis Variable N Mean Std. Deviation Min Max ROA 5259 0.067 0.067 -0.120 0.330 INV 5259 4.179 1.489 -9.401 7.717 AR 5259 4.377 1.017 1.234 7.572 AP 5259 3.522 1.119 -4.816 6.629 CCC 5259 4.795 1.151 -3.271 7.771 SIZE 5259 11.722 0.618 10.275 13.439 LV 5259 0.503 0.218 0.022 0.971 CR 5259 2.098 1.930 0.388 19.032 FAR 5259 0.196 0.188 0.000 0.953 Source: Calculated form Stata 14.0 In Table 3, analysis of correlation coefficient considers the close relationship between two or more variables with absolute value of correlation coefficient. If this coefficient is lower than 0.8, there are diversified values between two variables. The correlation coefficients between independent variables fluctuate from -0.46 to 0.642 (lower than 0.8), multi-collinearity problem rarely happens. Table 3 Correlation matrix ROA INV AR AP CCC SIZE LV CR FAR ROA 1 INV -0.21 1 AR -0.34 0.255 1 AP -0.29 0.33 0.497 1 CCC -0.25 0.642 0.705 0.266 1 SIZE -0.07 0.14 0.101 0.166 0.107 1 LV -0.46 0.26 0.15 0.338 0.123 0.323 1 CR 0.307 -0.15 -0.04 -0.3 0.023 -0.19 -0.6 1 FAR 0.057 -0.26 -0.29 -0.13 -0.38 0.035 -0.08 -0.1 1 Source: Calculated form Stata 14.0 264 The regression results have indicated that INV, AR, AP, CCC and WCM had negative impacts on FP at level 1%. CCC showed the period of time since the firm pays for the input resource until it receives money from customers. The shorter CCC, the higher FP. This research finding matches with the results of Jose et al. (1996), Shin and Soenen (1998), Wang (2002), Mansoori and Muhammad (2012), Tauringana and Adjapong Afrifa (2013), Dang & Tran (2019), Van Thuy Thi et al. (2019) and Dang et al. (2018). Table 4 Regression results of Model 1 Model 1a Model 1b Model 1c Model 1d INV -0.00468*** AR -0.0198*** AP -0.00913*** CCC -0.0135*** SIZE 0.00995*** 0.0115*** 0.0103*** 0.0115*** LV -0.135*** -0.131*** -0.132*** -0.134*** CR 0.00152*** 0.00187*** 0.000717 0.00220*** FAR -0.000969 -0.0212*** 0.000971 -0.0221*** _cons 0.0345** 0.0837*** 0.0432*** 0.0629*** N 5259 5259 5259 5259 t statistics in brackets * p<0.1, ** p<0.05, *** p<0.01 Source: Calculated form Stata 14.0 Table 5 Regression results of Model 2 Model 2a Model 2b Model 2c Model 2d INV 0.00113** INV2 -0.000689*** AR 0.0138*** AR2 -0.00391*** AP 0.00589*** AP2 -0.00258*** CCC 0.0118*** CCC2 -0.00292*** SIZE 0.0107*** 0.0119*** 0.0100*** 0.0131*** LV -0.134*** -0.133*** -0.127*** -0.133*** CR 0.00167*** 0.00188*** 0.00108** 0.00229*** FAR -0.00567 -0.0248*** -0.00176 -0.0262*** _cons 0.0239 0.0128 0.0257 -0.00496 N 5259 5259 5259 5259 t statistics in brackets * p<0.1, ** p<0.05, *** p<0.01 Source: Calculated form Stata 14.0 The results of GLS regression (Table 5), for model 2 have indicated that INV, AR, AP and CCC positively impact on FP. Specifically, if INV, AR, AP and CCC lengthen to one unit (count by logarithm value), FP will correspondingly increase 0.00113, 0.0238, 0.00589, 0.0118 with statistical significance of 1%. Meanwhile, variables INV2, AR2, AP2 and CCC2 negatively impacts on FP. The signs of coefficient β1 (β1>0) and β2 (β2<0) imply the relationship between INV, AR, AP and CCC with FP is reverse parabolic relationship. Max value of INV, AR, AP and CCC (curving point) valued at –β1/2β2. It does mean that when at first lengthening INV, AR, AP and CCC will increase FP, however, when exceeding the optimized level (at curving point), it will cause negative impacts on FP. When the working capital is lower than the value at curving point, increasing working capital contributes to increase FP. This could be explained since expanding credit sales will encourage business (Brennan et al., 1988; Peterson & Rajan, 1997), encourage customer to buy more goods or service at low demand period (Emery, 1984) and allow the buyer to assess the quality of the products or service before payment (Smith, 1987). However, that does not mean continually increase working capital will create continual increase FP, when the working capital exceeds optimize level (curving point), it will have negative impacts on FP. This could be explained since keep too much inventories will increase the expenses of stock, security and insurance (Kim & Chung, 1990). Besides, maintaining high working capital will lead to external capital expense, the firm needs to bear more interest rate (Kieschnick et al., 2013) and higher credit risks. Moreover, keeping high level of working capital means that the firm may lose many other projects for lack of money. From the regression results of Table 5, the research findings indicate that variables control impacts on FP. SIZE, CR positively influence on FP with statistical significance 1%, this also matched with researches by Dang et al. (2018) and Ha et al. (2019). Meanwhile, variables LV and FATA negatively influence on FP with statistical significance 1%, matching with research of Dang et al. (2019). N. T. T. Phuong and D. N. Hung /Accounting 6 (2020) 265 6. Conclusion and recommendations 6.1. Conclusion Our research has studied the relationship between WCM and FP of non-financial firms listed on Vietnam stock exchanges in the period 2009-2018. Our significant contribution consists in using GLS model to control the correlation and unchanged error which could seriously impacts on the previous research in Vietnam. The above results ordinarily answer the questions. Firstly, the study has indicated the relationship between WCM and FP which was not linear relationship as in many previous researches. The relationship between them is non-linear (parabolic relationship). It does mean that there is an optimized level of working capital which balance benefit, expense and maximizes the firm performance. The lower (or higher) the working capital in comparison with the optimized level, the less profit the firm gets, matching with previous research of Bano Caballero et al. (2010, 2014). When the working capital is lower than optimized level, it is suitable for the firm to invest more in working capital to increase turnover. Business opportunities open with increasing credit sales for customers, increasing more inventories to sustain the product price and keep the production line. Investing more in working capital is similar to reducing payment for suppliers, collecting more payment discount; at the same time helping the firm reduce input expense and having good relationship with suppliers. However, when the working capital exceeds the optimized level, it would negatively influence on FP because of increasing expense such as: stocking, insurance, securities and expenses for mobilizing external capital. Keeping too high working capital is similar to increasing interest rate, credit risk and bankruptcy, and at the same time losing other investment opportunities of participating in other projects. Therefore, the firm managers should efficiently manage working capital close to optimized level to avoid the negative influence of it. 6.2. Recommendations Our findings are interesting for firm managers. Firstly, they should focus on working capital management, trying to keep the optimize level of working capital, avoiding negative impact on the firm performance. Besides, they could increase FP by optimizing INV, AR, AP and CCC. Besides, it is significant to manage working capital for better firm performance. On one side, good WCM will increase liquidity and positive influence on the corporate finance. On the other side, good WCM will increase other sponsorship since the credit organization will assess balance sheet of the firm to decide to invest in the corporate business. However, the impacts of WCM on FP also depend on characteristics of each firm as above analysis, i.e. internal investment, sponsor expenses when mobilizing external capital, ability to approach capital market and financial crisis of the firm. Therefore, the firm managers should define the financial situation of the company to efficiently control working capital. References Afeef, M. (2011). Analyzing the Impact of Working Capital Management on the Profitability of SME's in Pakistan. International Journal of Business and Social Science, 2(22), 173-183. Akinlo, O., & Olufisayo, O. (2011). The effect of working capital on profitability of firms in Nigeria: Evidence from general method of moments (GMM). Asian Journal of Business and Management Sciences, 1(2), 130-135. Baños-Caballero, S., García-Teruel, P. J., & Martínez-Solano, P. (2012). How does working capital management affect the profitability of Spanish SMEs? Small business economics, 39(2), 517-529. doi: https://doi.org/10.1007/s11187-011-9317-8 Baños-Caballero, S., García-Teruel, P. J., & Martínez-Solano, P. (2014). Working capital management, corporate performance, and financial constraints. Journal of Business Research, 67(3), 332-338. Baños‐Caballero, S., García‐Teruel, P. J., & Martínez‐Solano, P. (2010). Working capital management in SMEs. Accounting & Finance, 50(3), 511-527. doi: https://doi.org/10.1111/j.1467-629X.2009.00331.x Baveld, M. B. (2012). Impact of working capital management on the profitability of public listed firms in The Netherlands during the financial crisis. University of Twente. Brealey, & Myers, A. (2006). Corporate Finance. New York: Irwin Mc Graw-Hill. Brennan, M. J., Maksimovics, V., & Zechner, J. (1988). Vendor financing. The Journal of Finance, 43(5), 1127-1141. Ching, H. Y., Novazzi, A., & Gerab, F. (2011). Relationship between working capital management and profitability in Brazilian listed companies. Journal of Global Business and Economics, 3(1), 74-86. Dang, H. N., Pham, C. D., & Hoang, H. T. V. (2018). An analysis of the effects of profit to security return: An empirical study of Vietnam. International Journal of Research in Business, Economics and Management, 2(5), 188-201. Dang, H. N., & Tran, D. M. (2019). Relationship between Accrual Anomaly and Stock Return: The Case of Vietnam. The Journal of Asian Finance, Economics and Business (JAFEB), 6(4), 19-26. Dang, H. N., Vu, V. T. T., Ngo, X. T., & Hoang, H. T. V. (2019). Study the impact of growth, firm size, capital structure, and profitability on enterprise value: Evidence of enterprises in Vietnam. Journal of Corporate Accounting & Finance, 30(1), 144-160. Dang, N. H., Pham, D. C., & Vu, T. B. H. (2018). Effects of financial statements information on firms’ value: evidence from Vietnamese listed firms. Investment Management and Financial Innovations, 15(4), 210-218. 266 Deloof, M. (2003). Does working capital management affect profitability of Belgian firms? Journal of Business Finance & Accounting, 30(3‐4), 573-588. Emery, G. W. (1984). A pure financial explanation for trade credit. Journal of Financial and Quantitative analysis, 19(3), 271- 285. Filbeck, G., & Krueger, T. M. (2005). An analysis of working capital management results across industries. American Journal of Business, 20(2), 11-20. Gill, A., Biger, N., & Mathur, N. (2010). The relationship between working capital management and profitability: Evidence from the United States. Business and Economics Journal, 10(1), 1-9. Ha, T. V., Dang, N. H., Tran, M. D., Van Vu, T. T., & Trung, Q. (2019). Determinants Influencing Financial Performance of Listed Firms: Quantile Regression Approach. Asian Economic and Financial Review, 9(1), 78-90. Jose, M. L., Lancaster, C., & Stevens, J. L. (1996). Corporate returns and cash conversion cycles. Journal of Economics and finance, 20(1), 33-46. Juan García-Teruel, P., & Martinez-Solano, P. (2007). Effects of working capital management on SME profitability. International Journal of Managerial Finance, 3(2), 164-177. Kieschnick, R., Laplante, M., & Moussawi, R. (2013). Working capital management and shareholders’ wealth. Review of Finance, 17(5), 1827-1852. Kim, Y. H., & Chung, K. H. (1990). An integrated evaluation of investment in inventory and credit: a cash flow approach. Journal of Business Finance & Accounting, 17(3), 381-389. Lazaridis, I., & Tryfonidis, D. (2006). Relationship between working capital management and profitability of listed companies in the Athens stock exchange. Journal of Financial Management and Analysis, 19(1), 1-12. Mansoori, D. E., & Muhammad, D. (2012). The effect of working capital management on firm’s profitability: evidence from Singapore. Interdisciplinary Journal of Contemporary Research in Business, 4(5), 472-486. Mathuva, D. (2010). The Influence of working capital management components on corporate profitability. Research Journal of Business Management, 4(1), 1-11. Nobanee, H., Abdullatif, M., & AlHajjar, M. (2011). Cash conversion cycle and firm's performance of Japanese firms. Asian Review of Accounting, 19(2), 147-156. Petersen, M. A., & Rajan, R. G. (1997). Trade credit: theories and evidence. The review of financial studies, 10(3), 661-691. Sharma, A., & Kumar, S. (2011). Effect of working capital management on firm profitability: Empirical evidence from India. Global Business Review, 12(1), 159-173. Shin, H.-H., & Soenen, L. (1998). Efficiency of working capital management and corporate profitability. Financial Practice and education, 8(1), 37-45. Smith, J. K. (1987). Trade credit and informational asymmetry. The journal of finance, 42(4), 863-872. Tauringana, V., & Adjapong Afrifa, G. (2013). The relative importance of working capital management and its components to SMEs' profitability. Journal of Small Business and Enterprise Development, 20(3), 453-469. Van Thuy Thi, V., Nhung Hong, D., & Hung Ngoc, D. (2019). Profitability and the Distance to Default: Evidence from Vietnam Securities Market. The Journal of Asian Finance, Economics and Business, 6(4), 53-63. Wang, Y.-J. (2002). Liquidity management, operating performance, and corporate value: evidence from Japan and Taiwan. Journal of Multinational Financial Management, 12(2), 159-169. © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

impact_of_working_capital_management_on_firm_profitability_e.pdf

impact_of_working_capital_management_on_firm_profitability_e.pdf