Firm size, business sector and quality of accounting information systems: Evidence from Vietnam

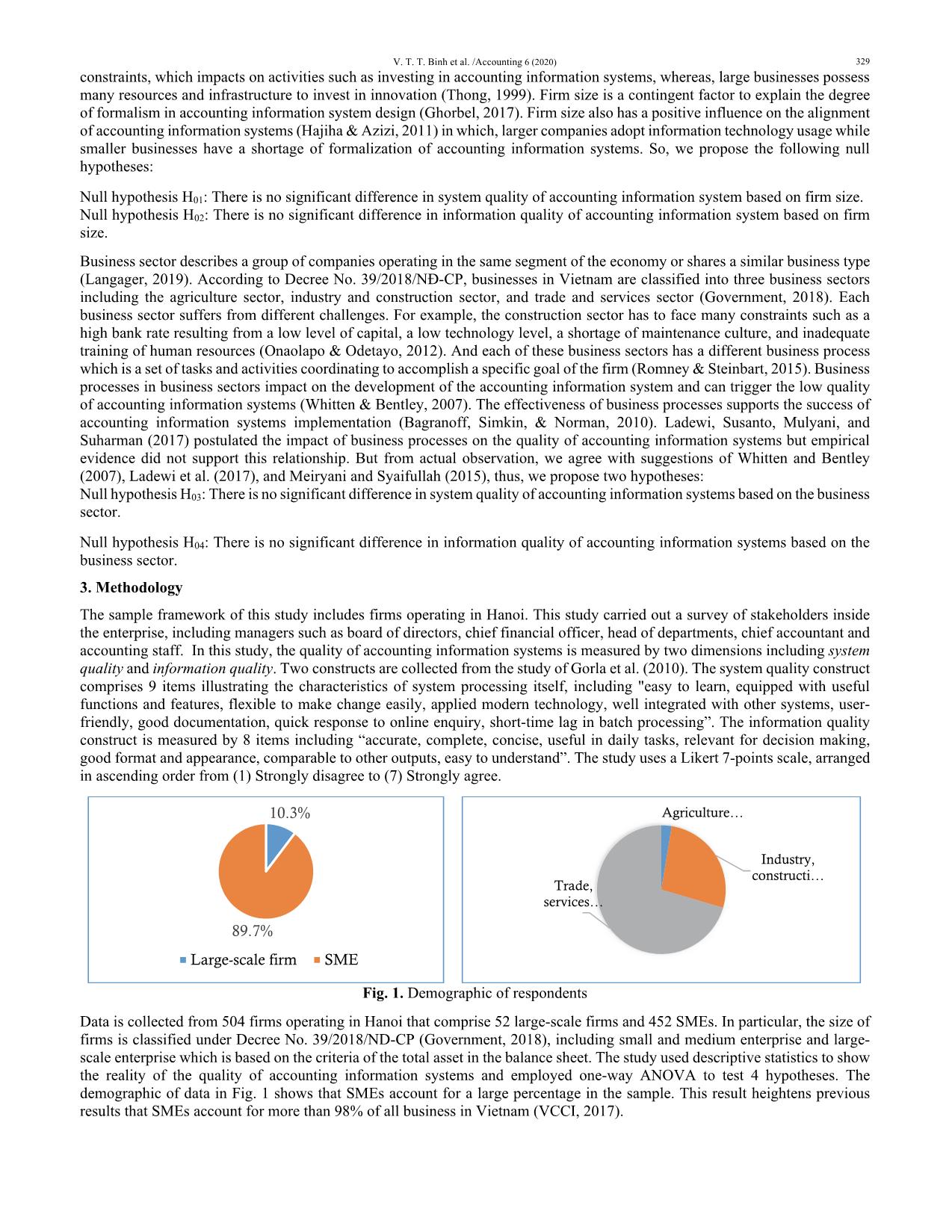

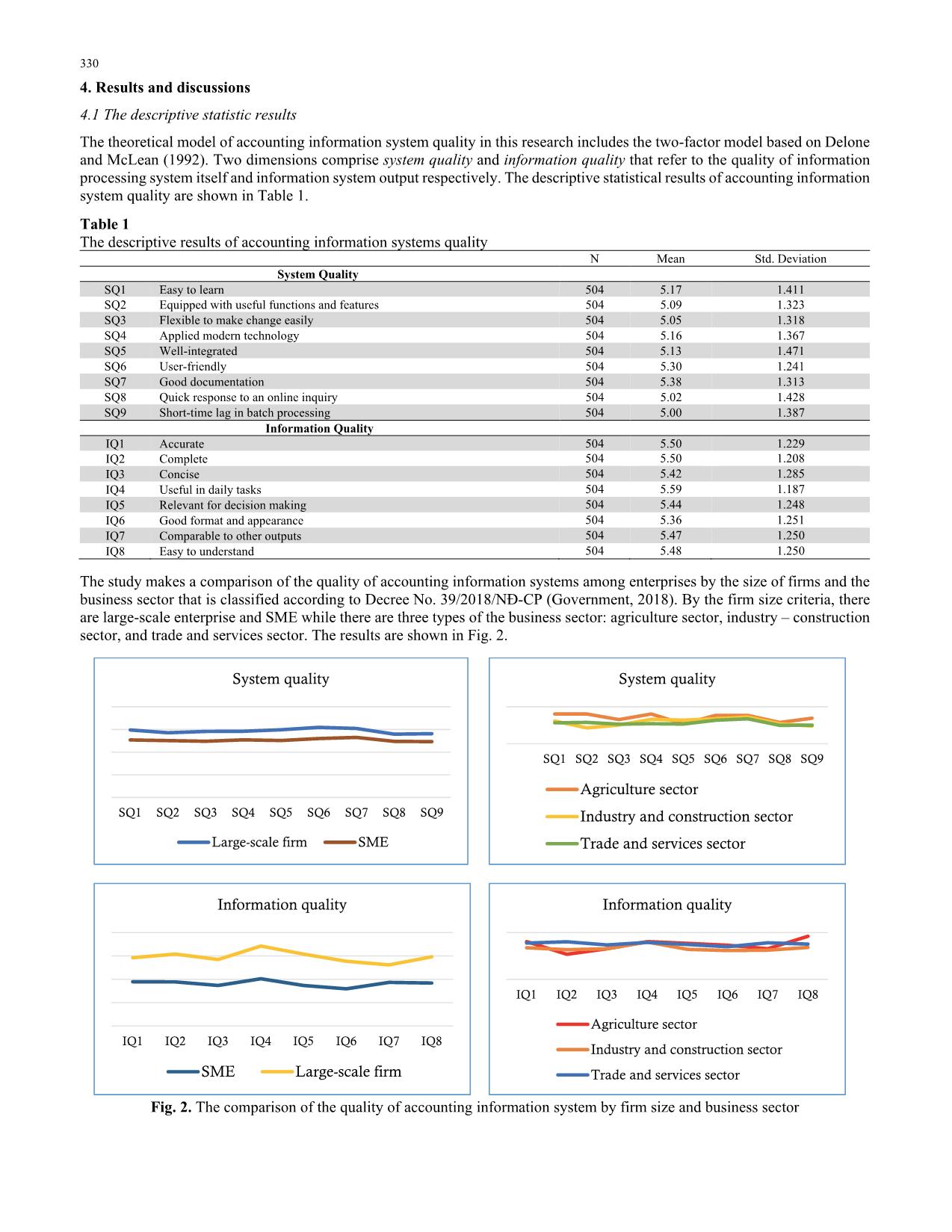

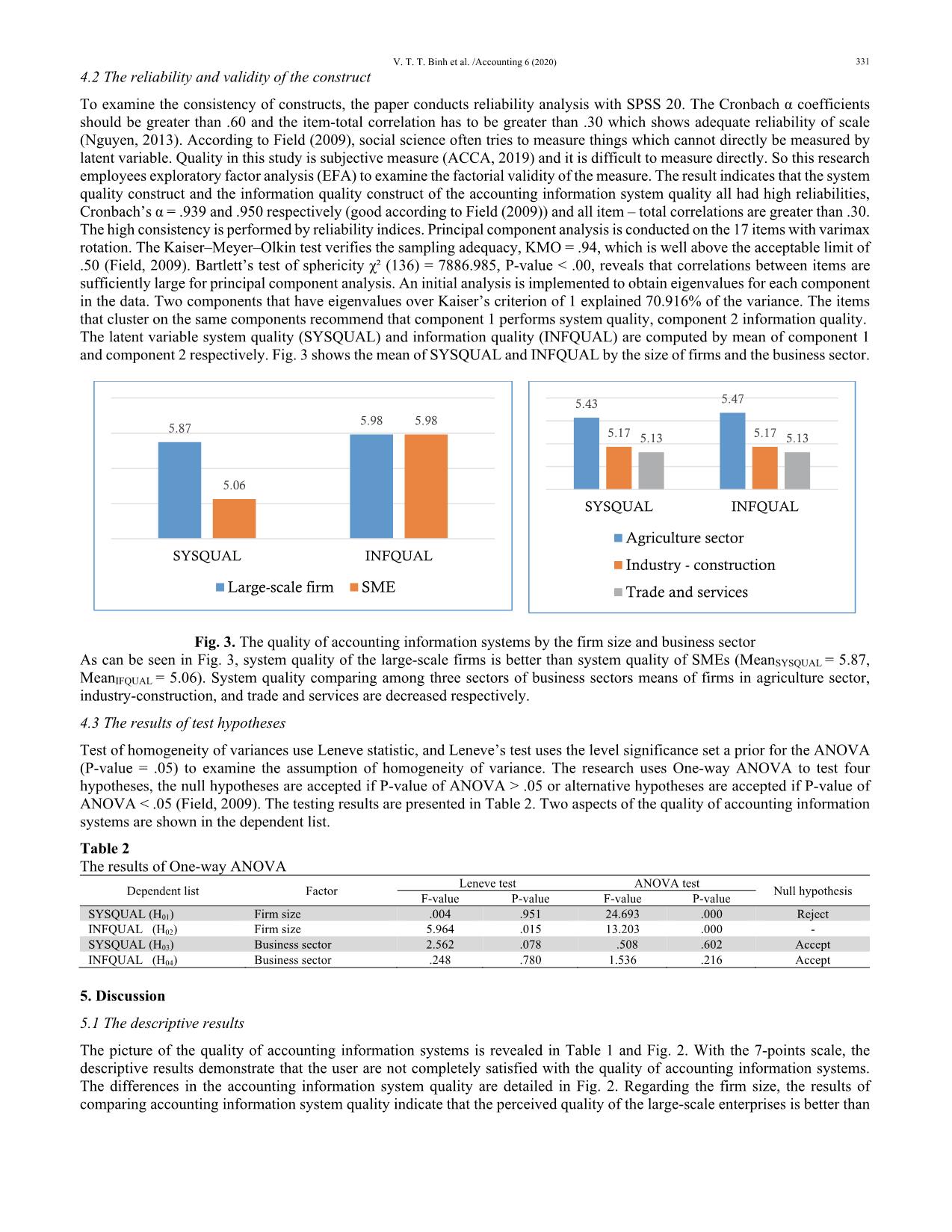

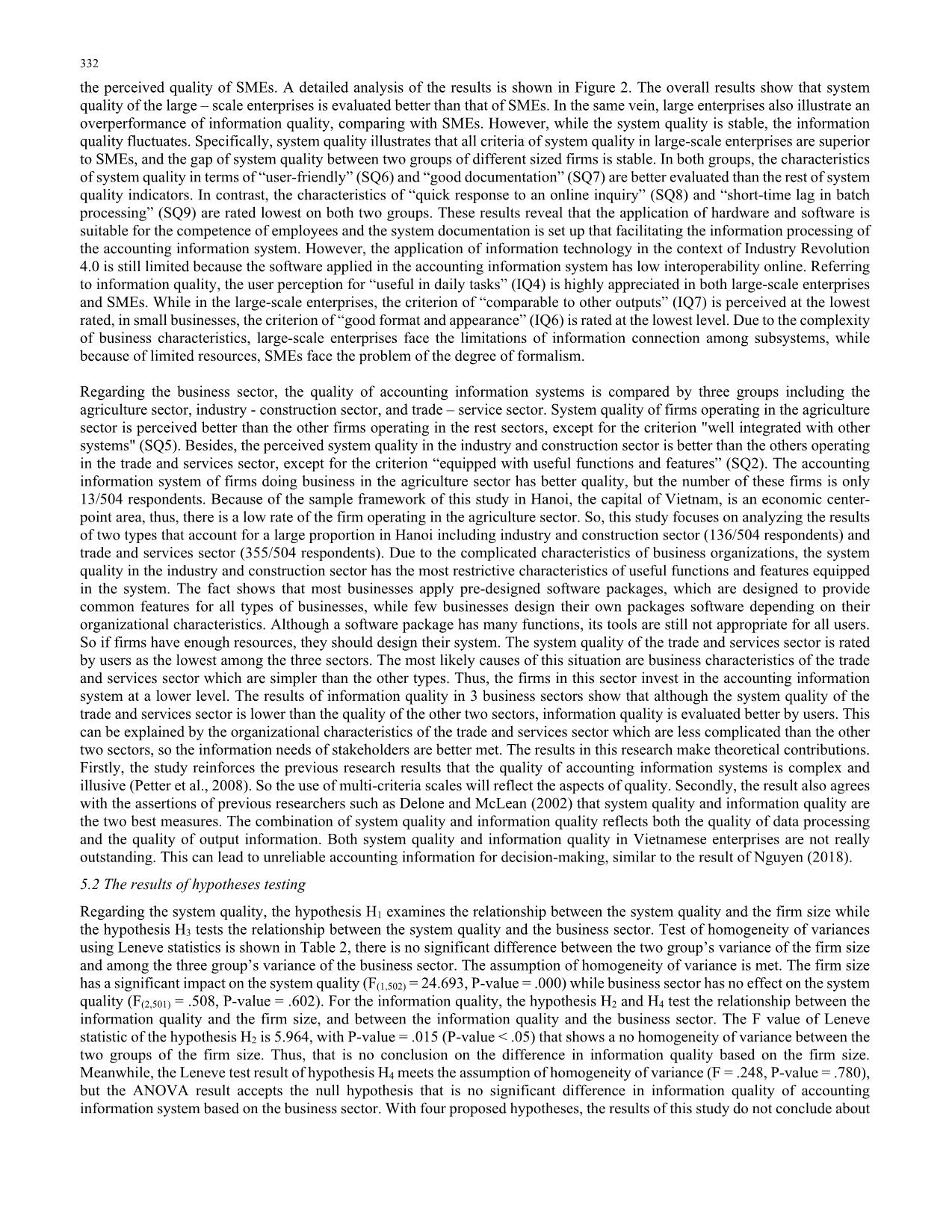

This paper increases the understanding of the quality of accounting information systems in emerging economies, using data from Vietnam as an example. The quality of accounting information systems is a measure combining system quality and information quality. It is important to figure out what aspects of this measure are critical for business to enhance firm performance. This research investigates the level of accounting information system quality and examines the relationships between system quality and firm size, information quality and firm size, system quality and business sector as well as information quality and business sector, respectively. We employed descriptive statistics to illustrate the quality of accounting information systems and One-Way ANOVA to test four hypotheses. The descriptive statistics results demonstrate the level of system quality and information quality, in general, is not excellent. And there are differences in system quality and information quality in each business sector groups and firm size groups. The test result highlights a relationship between system quality and firm size but there are no links between information quality and firm size, system quality and business sector, and information quality and business sector. In conclusion, the paper extends the literature of the quality of accounting information systems and assists state agencies and executives to have a framework to improve the business performance as well

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Tóm tắt nội dung tài liệu: Firm size, business sector and quality of accounting information systems: Evidence from Vietnam

are designed to provide common features for all types of businesses, while few businesses design their own packages software depending on their organizational characteristics. Although a software package has many functions, its tools are still not appropriate for all users. So if firms have enough resources, they should design their system. The system quality of the trade and services sector is rated by users as the lowest among the three sectors. The most likely causes of this situation are business characteristics of the trade and services sector which are simpler than the other types. Thus, the firms in this sector invest in the accounting information system at a lower level. The results of information quality in 3 business sectors show that although the system quality of the trade and services sector is lower than the quality of the other two sectors, information quality is evaluated better by users. This can be explained by the organizational characteristics of the trade and services sector which are less complicated than the other two sectors, so the information needs of stakeholders are better met. The results in this research make theoretical contributions. Firstly, the study reinforces the previous research results that the quality of accounting information systems is complex and illusive (Petter et al., 2008). So the use of multi-criteria scales will reflect the aspects of quality. Secondly, the result also agrees with the assertions of previous researchers such as Delone and McLean (2002) that system quality and information quality are the two best measures. The combination of system quality and information quality reflects both the quality of data processing and the quality of output information. Both system quality and information quality in Vietnamese enterprises are not really outstanding. This can lead to unreliable accounting information for decision-making, similar to the result of Nguyen (2018). 5.2 The results of hypotheses testing Regarding the system quality, the hypothesis H1 examines the relationship between the system quality and the firm size while the hypothesis H3 tests the relationship between the system quality and the business sector. Test of homogeneity of variances using Leneve statistics is shown in Table 2, there is no significant difference between the two group’s variance of the firm size and among the three group’s variance of the business sector. The assumption of homogeneity of variance is met. The firm size has a significant impact on the system quality (F(1,502) = 24.693, P-value = .000) while business sector has no effect on the system quality (F(2,501) = .508, P-value = .602). For the information quality, the hypothesis H2 and H4 test the relationship between the information quality and the firm size, and between the information quality and the business sector. The F value of Leneve statistic of the hypothesis H2 is 5.964, with P-value = .015 (P-value < .05) that shows a no homogeneity of variance between the two groups of the firm size. Thus, that is no conclusion on the difference in information quality based on the firm size. Meanwhile, the Leneve test result of hypothesis H4 meets the assumption of homogeneity of variance (F = .248, P-value = .780), but the ANOVA result accepts the null hypothesis that is no significant difference in information quality of accounting information system based on the business sector. With four proposed hypotheses, the results of this study do not conclude about V. T. T. Binh et al. /Accounting 6 (2020) 333 the hypothesis H02 due to the heterogeneous variance between two groups. The null hypothesis H01 is rejected exposing a relationship between the size of firm and system quality. The descriptive result in Figure 3 demonstrates that large-companies have a higher system quality than SMEs. SMEs in Vietnam face many resource constraints and suffer from barries to investing in infrastructure of the accounting information system. The large-scale firms have more abundant resources to facilitate their information system. This result reinforces the study of Thong (1999) or Hajiha and Azizi (2011) on advantages of firm size to system quality. The acceptance of null hypotheses H03 and H04 show that there is no relationship between the business sector and the quality of accounting information systems. Each business sector has a different business process that leads to a difference in the accounting information system quality (Ladewi et al., 2017; Meiryani & Syaifullah, 2015). However, many other determinants affect the quality of accounting information systems such as top management support, manager participation in implementing accounting information systems, information technology, accounting staff, and so on. These determinants help eliminate disparity in the quality of accounting information systems among business sectors. 6. Conclusion This research has explored the quality of accounting information systems. The quality of accounting information systems is measured by a multidimensional scale. Whilst system quality refers to the quality of information processing, information quality performs the characteristics of output quality. System quality and information quality are two good measures to evaluate the quality of accounting information systems. The level of accounting information system quality of firms in Vietnam is not first- rate. This paper has compared system quality and information quality under a diversity of conditions and demonstrates some different characteristics in each group of business sector or firm size. The result has found support for hypothesis H01, which proposes a link between system quality and firm size. The results do not support the association between information quality and firm size. There is no link between system quality and business sector and no association between information quality and business sector as well. The results suggest that the size of firms (which based on the total capital) is a determinant impact on the quality of accounting information systems in the aspect of information processing. Based on the results, the study has implications for managers to improve business performance. Businesses in different size groups or businesses in different business sector groups need to overcome limitations on system quality and information quality. In the context of the IR4.0, many transactions are digitized such as transactions with e-tax system or e-banking system. Thus, firms need to invest to technology, because technologies impact accounting (Kruskopf et al., 2019), to increase the characteristics of information processing systems like “quick response to an inquiry” or “short-time lag in batch processing”. The results of this study are crucial because they highlight that state agencies should determine which policies issued for SMEs or which issued for large companies. Making support policies appropriate to each type of business to improve the effectiveness of these policies. References ACCA. (2019). Performance Management - Study text. London: BPP Learning Media Ltd. Aguilar-Fernández, M. E., & Otegi-Olaso, J. R. (2018). Firm size and the business model for sustainable innovation. Sustainability, 10(12), 4785. doi: https://doi.org/10.3390/su10124785 AICPA. (1966). Statement of Basic Accounting Theory. New York: AICPA Publication. Allahverdi, M. (2011, 12-14 Oct. 2011). A general model of accounting information systems. Paper presented at the Application of Information and Communication Technologies (AICT), 2011 5th International Conference on, Baku, Azerbaijan. Bagranoff, N. A., Simkin, M. G., & Norman, C. S. (2010). Core concepts of accounting information systems (Eleventh ed.). Hoboken, NJ: Wiley. Becker, G. S., & Murphy, K. M. (1992). The division of labor, coordination costs, and knowledge. The Quarterly Journal of Economics, 107(4), 1137-1160. Binh, V. T. T. (2018). Nghiên cứu các yếu tố ảnh hưởng đến mức độ trang bị công nghệ thông tin của hệ thống thông tin kế toán doanh nghiệp [Research on factors affecting IT sophistication of accounting information system]. Paper presented at the Hội thảo khoa học quốc gia Nghiên cứu và đào tạo Kế toán, kiểm toán, Đại học Công nghiệp Hà Nội, Hà Nội. Chalu, H. (2012). Analysis of Stakeholder Factors Influencing the Effectiveness of Accounting Information Systems in Tanzania's Local Authorities. Business Management Review, 16(1), 1-32. Chúc, A. T. (2015). Thông tin kế toán hữu ích trong điều kiện ứng dụng CNTT [Useful accounting information in terms of IT application]. Tạp chí Tài Chính, Tháng 2. Delone, W. H., & McLean, E. R. (1992). Information Systems Success: The Quest for the Dependent Variable. Information Systems Research, 3(1), 60-95. doi: https://doi.org/10.1287/isre.3.1.60 Delone, W. H., & McLean, E. R. (2002). Information systems success revisited. Paper presented at the System Sciences, 2002. HICSS. Proceedings of the 35th Annual Hawaii International Conference on. Delone, W. H., & McLean, E. R. (2003). The DeLone and McLean Model of Information Systems Success: A Ten-Year Update. Journal of Management Information Systems, 19(4), 9-30. doi: 10.1080/07421222.2003.11045748 Field, A. (2009). Discovering statistics using SPSS (Sage ed.). Dubai: Oriental Press. Ghorbel, J. (2017). A Study of Contingency Factors of Accounting Information System Design in Tunisian SMIs. Journal of the Knowledge Economy, 1-30. doi: https://doi.org/10.1007/s13132-016-0439-8 334 Gorla, N., Somers, T. M., & Wong, B. (2010). Organizational impact of system quality, information quality, and service quality. Journal of Strategic Information Systems, 19, 207-228. doi: https://doi.org/10.1016/j.jsis.2010.05.001 Government. (2018). Nghị định 39/2018/NĐ-CP: Quy định chi tiết một số điều của Luật hỗ trợ doanh nghiệp nhỏ và vừa [Decree no. 39/2018/NĐ-CP: Detailed regulations on some articles of the Law to support small and medium enterprises]. Hajiha, Z., & Azizi, Z. A. P. (2011). Effective factors on Alignment of Accounting Information Systems in Manufacturing Companies: Evidence from Iran. Information Management and Business Review, 3(3), 158-170. Hartmann, M., Oriani, R., & Bateman, H. (2013). The performance effect of business model innovation: An empirical analysis of pension funds The 35th DRUID Celebration Conference Kieso, D. E., Weygandt, J. J., & Warfield, T. D. (2010). Intermediate accounting: IFRS edition (Vol. 2): John Wiley & Sons. Kruskopf, S., Lobbas, C., Meinander, H., Söderling, K., Martikainen, M., & Lehner, O. M. (2019). Digital accounting: opportunities, threats and the human factor. ACRN Oxford Journal of Finance and Risk Perspectives, 8(2019)(Special Issue Digital Accounting), 1-15. Ladewi, Y., Susanto, A., Mulyani, S., & Suharman, H. (2017). Critical Factors Accounting Information System Success Survey of State-Owned Enterprises (SOE) in Indonesia. International Journal, 10(1). Langager, C. (2019, Apr 12, 2019). Industry vs. sector: What's the difference? Retrieved Nov 11, 2019, from https://www.investopedia.com/ask/answers/05/industrysector.asp Meiryani. (2015). Influence Business Strategy on the Quality of Accounting Information System. International Journal of Scientific & technology research, 4(2), 80-86. Meiryani, & Syaifullah, M. (2015). Influence Business Process On The Quality Of Accounting Information System. International Journal of Scientific & technology research, 4(1), 323-328. Nguyen, B. N. (2018). Báo cáo tài chính của doanh nghiệp nhỏ và vừa - đối tượng sử dụng và chất lượng thông tin trên báo cáo tài chính [Finacial reporting of small and medium enterprises: users and information quality]. Tạp chí Khoa học & Đào tạo Ngân hàng, 192(tháng 5), 28-34. Nguyen, D. T. (2013). Giáo trình phương pháp nghiên cứu khoa học trong kinh doanh [Research method in business]. Trường Đại học Kinh tế TP. Hồ Chí Minh: Nhà xuất bản Tài chính. Nguyen, T. B. L. (2012). Xác định và kiểm soát các nhân tố ảnh hưởng chất lượng thông tin kế toán trong môi trường ứng dụng hệ thống hoạch định nguồn lực doanh nghiệp (ERP) tại các doanh nghiệp Việt Nam [Determine and control factors affecting information quality in ERP environment in Vietnamese enterprises]. (Thesis), Trường Đại học kinh tế thành phố Hồ Chí Minh. Onaolapo, A. A., & Odetayo, T. A. (2012). Effect of Accounting Information System on Organizational Effectiveness: A case study of Selected Contruction Companies in Ibadan, Nigeria. American Journal of Business and Management, 1(4), 183- 189. Petter, S., Delone, W. H., & McLean, E. R. (2008). Measuring information systems success: models, dimensions, measures, and interrelationships. European journal of information systems, 17, 236-263. doi: https://doi.org/10.1057/ejis.2008.15 Romney, M. B., & Steinbart, P. J. (2015). Accounting information systems: Pearson Boston, MA. Sačer, I. M., & Oluić, A. (2013). Information Technology and Accouting Information Systems' Quality in Croatian Middle and Large Companies. Journal of Informatiion and Organizational Sciences, 37(2), 117-126. Sajady, H., Dastgir, M., & Nejad, H. H. (2008). Evaluation of the effectiveness of accounting information systems. International journal of information science and technology, 6(2), 49-59. Seddon, P. B. (1997). A respecification and extension of the DeLone and McLean model of IS success. Information Systems Research, 8(3), 240-253. doi: https://doi.org/10.1287/isre.8.3.240 Seddon, P. B., & Kiew, M. Y. (1996). A Partial Test and Development of Delone and McLean's Model of IS Success. Australian Journal of Information Systems, 4(1), 90-109. doi: Smith, A. (1776). An inquiry into the nature and causes ofthe wealth ofnations. London: George Routledge and Sons. Thong, J. Y. L. (1999). An integrated model of information systems adoption in small businesses. Journal of Management Information Systems, 15(4), 187-214. doi: https://doi.org/10.1080/07421222.1999.11518227 VCCI. (2017). Báo cáo thường niên doanh nghiệp Việt Nam 2016 [Annual reporting: Vietnameses Enterprises in 2016]. Weill, P., & Olson, M. H. (1989). An Assessment of the Contingency Theory of Management Information Systems. Journal of Management Information Systems, 6(1), 59-86. doi: DOI: 10.1080/07421222.1989.11517849 Whitten, J. L., & Bentley, L. D. (2007). Systems analysis and design. London: McGraw-Hill. Yap, C. S., Soh, C. P., & Raman, K. S. (1992). Information Systems Success Factors in Small Business. OMEGA International Journal of Management Science, 20(5/6), 597-609. © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

firm_size_business_sector_and_quality_of_accounting_informat.pdf

firm_size_business_sector_and_quality_of_accounting_informat.pdf