Dividend policy and share price volatility: empirical evidence from Vietnam

This paper was conducted to examine the relationship between dividend policy and share price volatility of companies listed on Hochiminh Stock Exchange (HOSE) in Vietnam. Data set used in this research was compiled from financial statements of 260 listed firms on HOSE from 2009 to 2018. Three statistical approaches employed to address econometrics issues as well as to improve the accuracy of the regression coefficients like fixed effects model (FEM), random effects model (REM) and general method of movement (GMM). Based on the results from GMM, the association between share price volatility and dividend yield, dividend payout ratio has been explored. The findings show a positive relationship between dividend yield and stock price volatilities and a negative relationship between dividend payout ratio and stock price volatility. In addition, it is found that a firm’s growth rate, leverage and earnings volatility had positive influences on share price volatility while firm’s size had negative effect on share price volatility

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Tóm tắt nội dung tài liệu: Dividend policy and share price volatility: empirical evidence from Vietnam

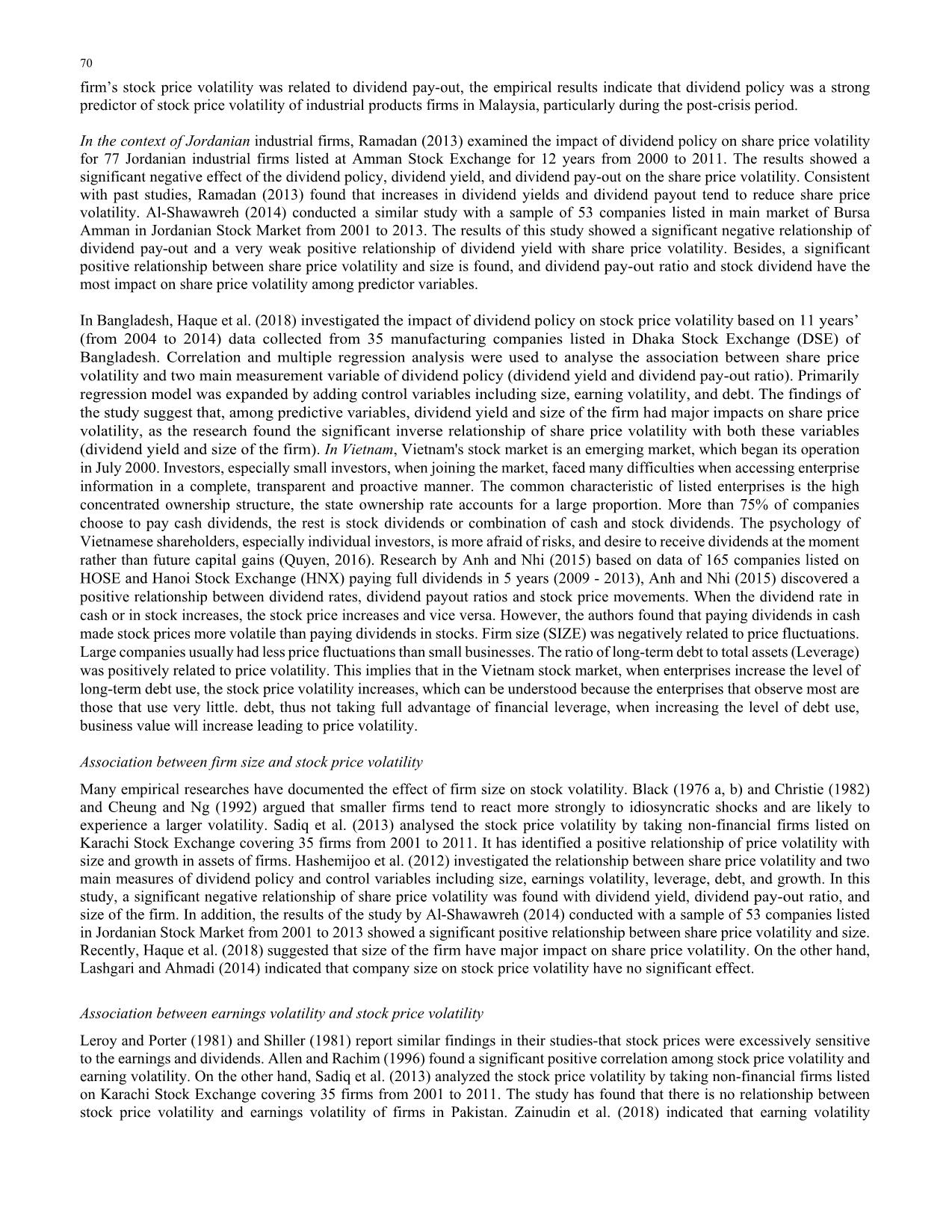

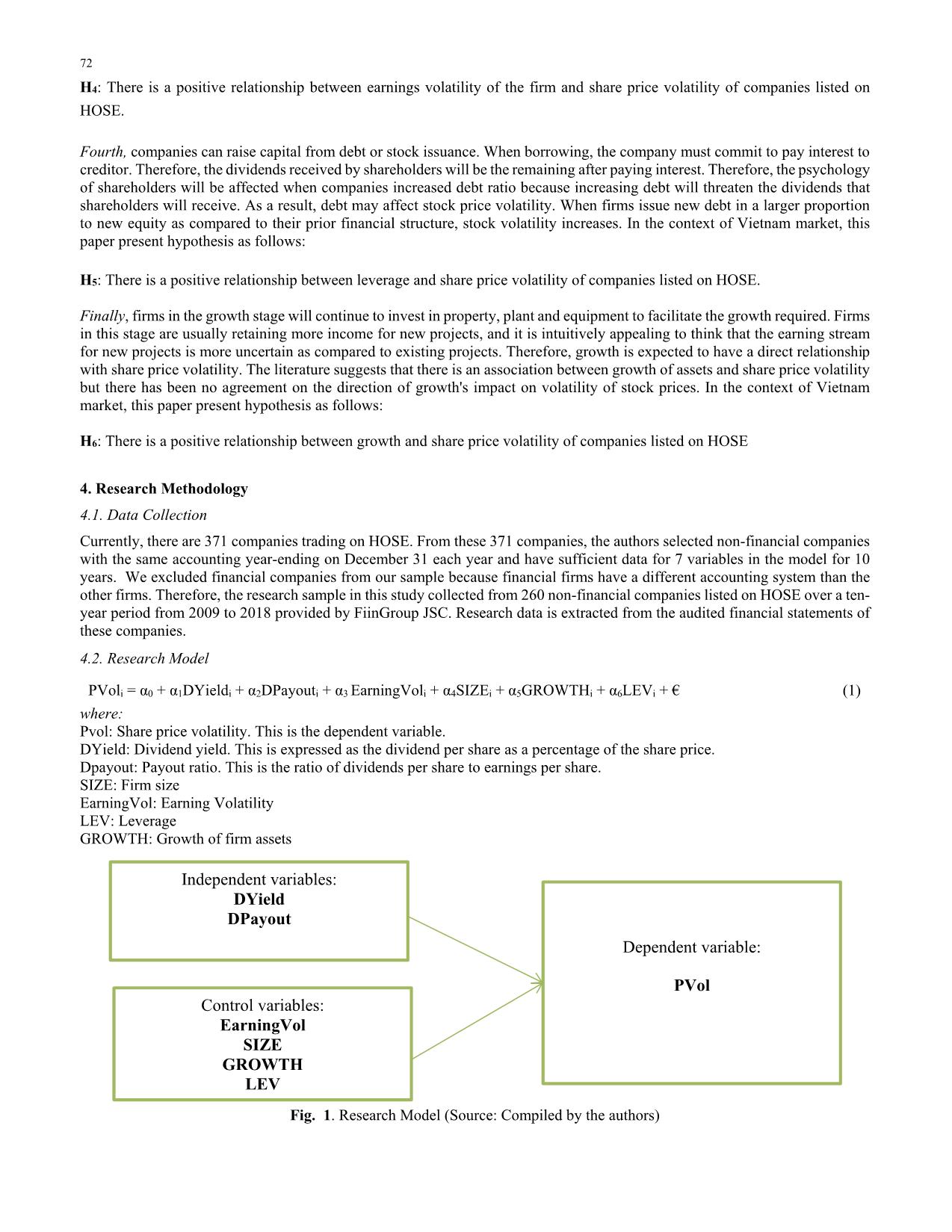

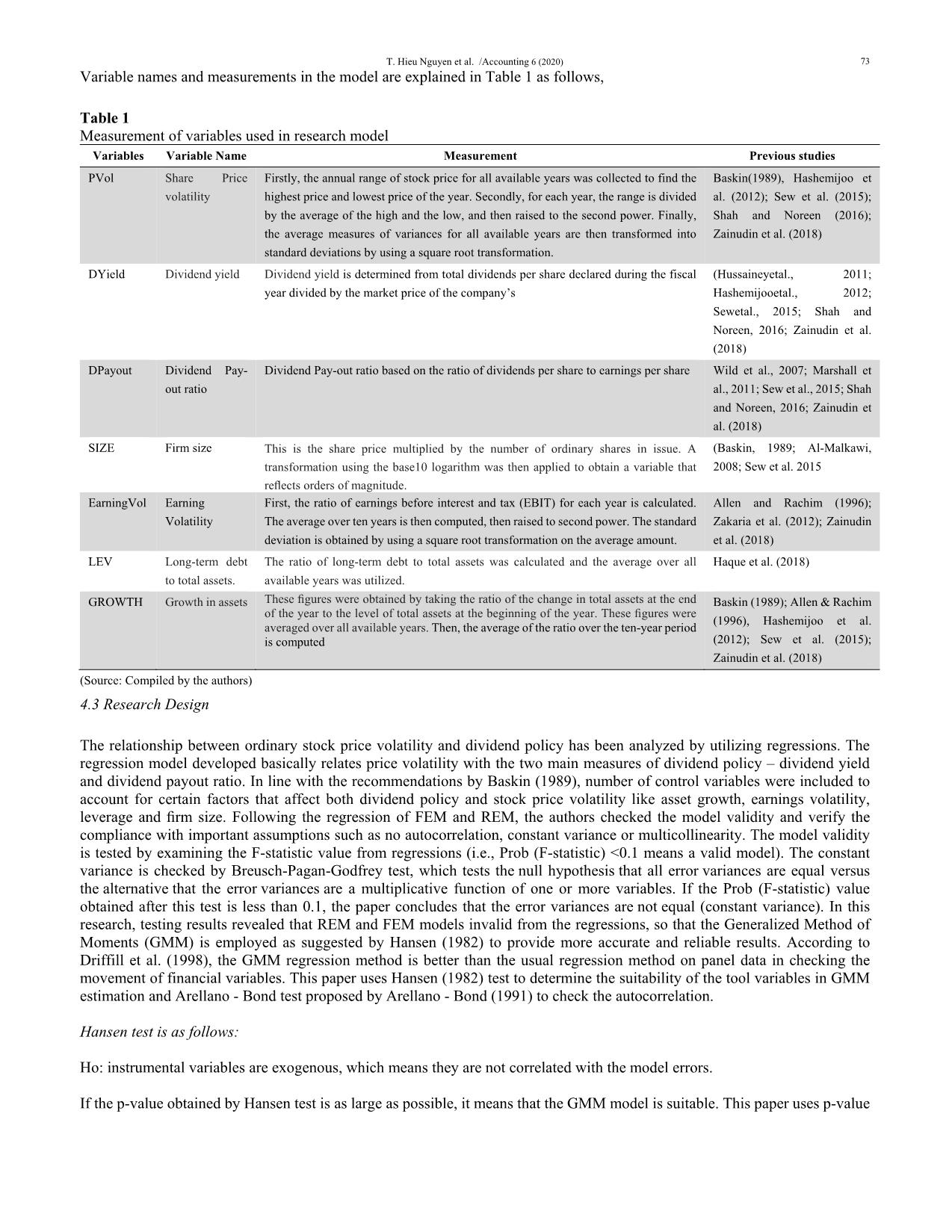

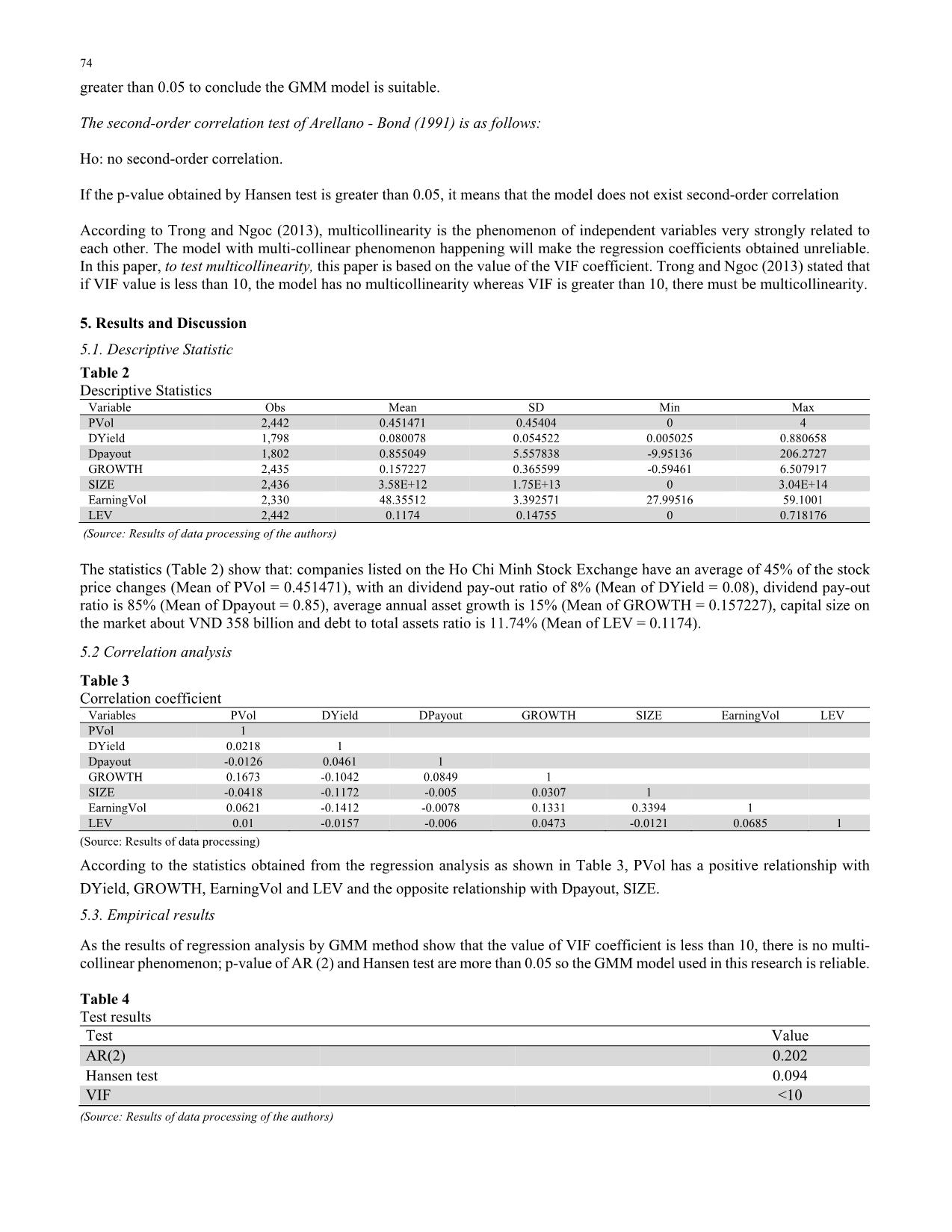

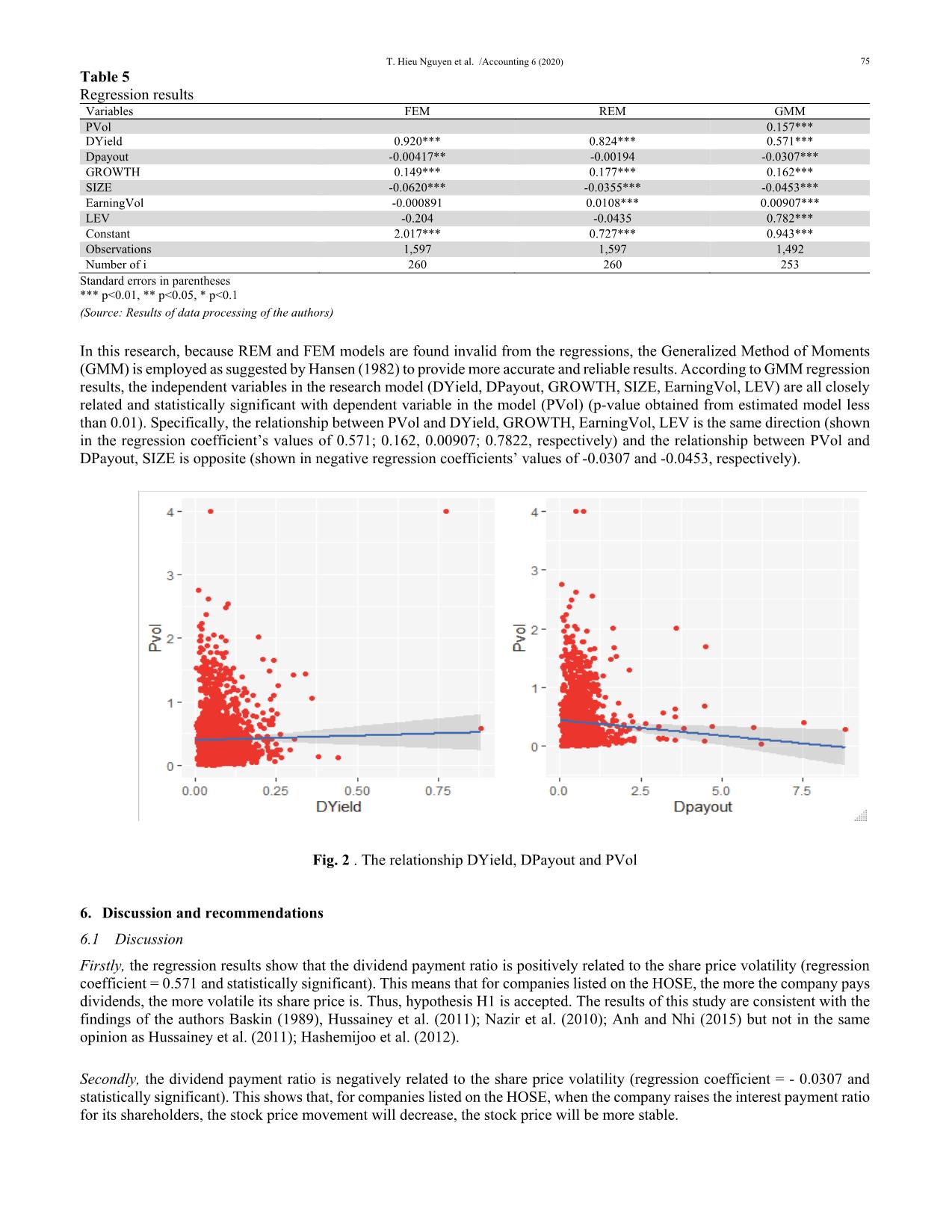

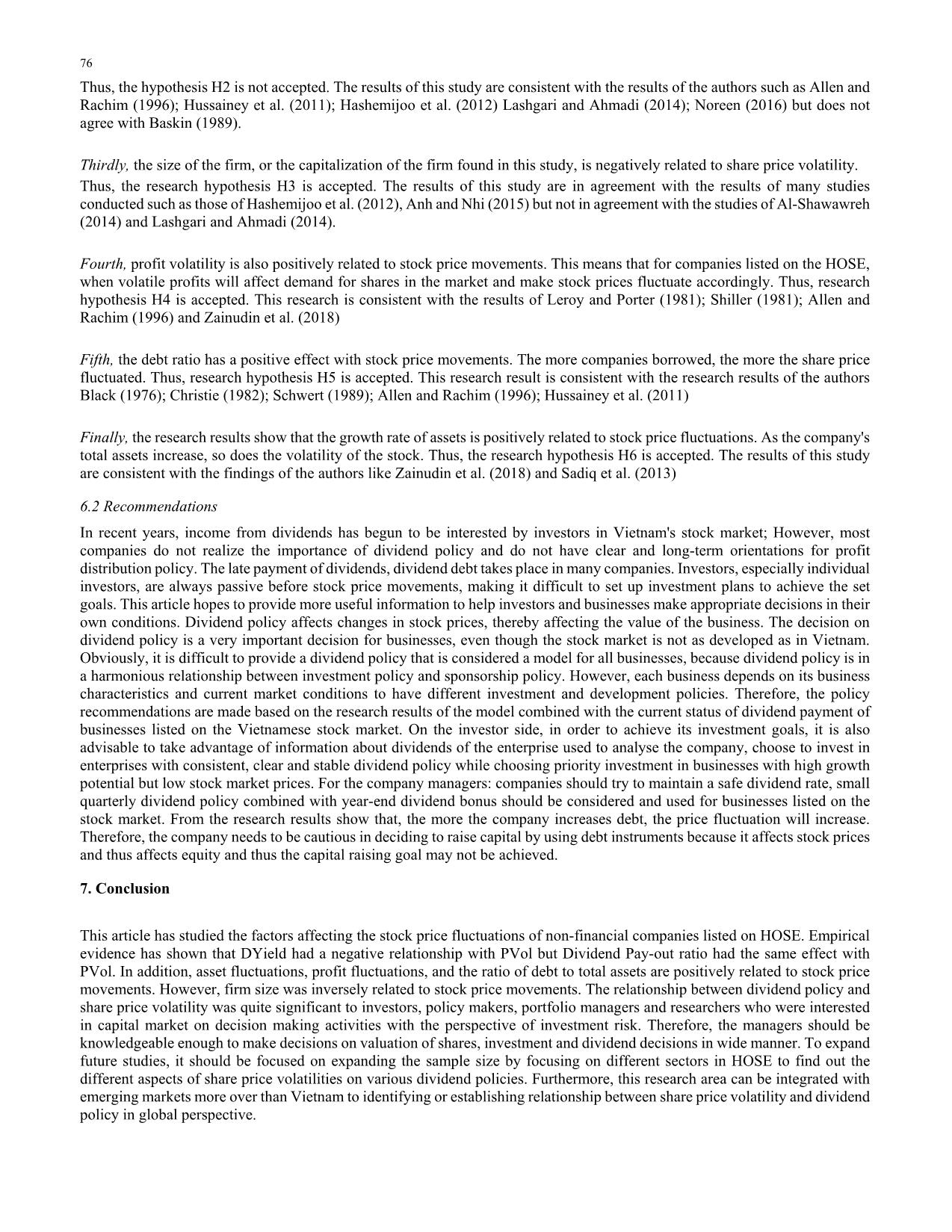

). Fig. 2 . The relationship DYield, DPayout and PVol 6. Discussion and recommendations 6.1 Discussion Firstly, the regression results show that the dividend payment ratio is positively related to the share price volatility (regression coefficient = 0.571 and statistically significant). This means that for companies listed on the HOSE, the more the company pays dividends, the more volatile its share price is. Thus, hypothesis H1 is accepted. The results of this study are consistent with the findings of the authors Baskin (1989), Hussainey et al. (2011); Nazir et al. (2010); Anh and Nhi (2015) but not in the same opinion as Hussainey et al. (2011); Hashemijoo et al. (2012). Secondly, the dividend payment ratio is negatively related to the share price volatility (regression coefficient = - 0.0307 and statistically significant). This shows that, for companies listed on the HOSE, when the company raises the interest payment ratio for its shareholders, the stock price movement will decrease, the stock price will be more stable. 76 Thus, the hypothesis H2 is not accepted. The results of this study are consistent with the results of the authors such as Allen and Rachim (1996); Hussainey et al. (2011); Hashemijoo et al. (2012) Lashgari and Ahmadi (2014); Noreen (2016) but does not agree with Baskin (1989). Thirdly, the size of the firm, or the capitalization of the firm found in this study, is negatively related to share price volatility. Thus, the research hypothesis H3 is accepted. The results of this study are in agreement with the results of many studies conducted such as those of Hashemijoo et al. (2012), Anh and Nhi (2015) but not in agreement with the studies of Al-Shawawreh (2014) and Lashgari and Ahmadi (2014). Fourth, profit volatility is also positively related to stock price movements. This means that for companies listed on the HOSE, when volatile profits will affect demand for shares in the market and make stock prices fluctuate accordingly. Thus, research hypothesis H4 is accepted. This research is consistent with the results of Leroy and Porter (1981); Shiller (1981); Allen and Rachim (1996) and Zainudin et al. (2018) Fifth, the debt ratio has a positive effect with stock price movements. The more companies borrowed, the more the share price fluctuated. Thus, research hypothesis H5 is accepted. This research result is consistent with the research results of the authors Black (1976); Christie (1982); Schwert (1989); Allen and Rachim (1996); Hussainey et al. (2011) Finally, the research results show that the growth rate of assets is positively related to stock price fluctuations. As the company's total assets increase, so does the volatility of the stock. Thus, the research hypothesis H6 is accepted. The results of this study are consistent with the findings of the authors like Zainudin et al. (2018) and Sadiq et al. (2013) 6.2 Recommendations In recent years, income from dividends has begun to be interested by investors in Vietnam's stock market; However, most companies do not realize the importance of dividend policy and do not have clear and long-term orientations for profit distribution policy. The late payment of dividends, dividend debt takes place in many companies. Investors, especially individual investors, are always passive before stock price movements, making it difficult to set up investment plans to achieve the set goals. This article hopes to provide more useful information to help investors and businesses make appropriate decisions in their own conditions. Dividend policy affects changes in stock prices, thereby affecting the value of the business. The decision on dividend policy is a very important decision for businesses, even though the stock market is not as developed as in Vietnam. Obviously, it is difficult to provide a dividend policy that is considered a model for all businesses, because dividend policy is in a harmonious relationship between investment policy and sponsorship policy. However, each business depends on its business characteristics and current market conditions to have different investment and development policies. Therefore, the policy recommendations are made based on the research results of the model combined with the current status of dividend payment of businesses listed on the Vietnamese stock market. On the investor side, in order to achieve its investment goals, it is also advisable to take advantage of information about dividends of the enterprise used to analyse the company, choose to invest in enterprises with consistent, clear and stable dividend policy while choosing priority investment in businesses with high growth potential but low stock market prices. For the company managers: companies should try to maintain a safe dividend rate, small quarterly dividend policy combined with year-end dividend bonus should be considered and used for businesses listed on the stock market. From the research results show that, the more the company increases debt, the price fluctuation will increase. Therefore, the company needs to be cautious in deciding to raise capital by using debt instruments because it affects stock prices and thus affects equity and thus the capital raising goal may not be achieved. 7. Conclusion This article has studied the factors affecting the stock price fluctuations of non-financial companies listed on HOSE. Empirical evidence has shown that DYield had a negative relationship with PVol but Dividend Pay-out ratio had the same effect with PVol. In addition, asset fluctuations, profit fluctuations, and the ratio of debt to total assets are positively related to stock price movements. However, firm size was inversely related to stock price movements. The relationship between dividend policy and share price volatility was quite significant to investors, policy makers, portfolio managers and researchers who were interested in capital market on decision making activities with the perspective of investment risk. Therefore, the managers should be knowledgeable enough to make decisions on valuation of shares, investment and dividend decisions in wide manner. To expand future studies, it should be focused on expanding the sample size by focusing on different sectors in HOSE to find out the different aspects of share price volatilities on various dividend policies. Furthermore, this research area can be integrated with emerging markets more over than Vietnam to identifying or establishing relationship between share price volatility and dividend policy in global perspective. T. Hieu Nguyen et al. /Accounting 6 (2020) 77 References Allen, D.E., & Rachim, V.S. (1996). Dividend policy and stock price volatility: Australian evidence. Applied Financial Economics, 6(2), 175-188. DOI: 10.1080/096031096334402 Anh, Đ.T.Q., & Nhi, P.T.Y. (2016). The factors affect to the dividend policy of joint – stock companies listed on the Vietnam’s Stock Market. In Vietnamese: Impact of dividend policy on stock price movements of companies listed on Vietnam's stock market. Journal of Development and Integration, 26(36). Al-Shawawreh, F. K. (2014). The impact of dividend policy on share price volatility: Empirical evidence from Jordanian stock market. European Journal of Business and Management, 6(38), 133–143. Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies, 58, 277-297 Black, F. (1976a). Studies of stock price volatility changes. Proceedings of the 1976 Meetings of the American Statistical Association, Business and Economics Section, 3(1-2), 177-181. Black, F. (1976b). The dividend puzzle. The Journal of Portfolio Management, 2(2), 5-8. Baskin, J. (1989). Dividend policy and the volatility of common stocks. The Journal of Portfolio Management, 15, 19-25. Ball, R., Brown, P., Finn, F.J., & Officer, R.R. (1979). Dividends and the value of the firm: evidence from the Australian equity market. Australian Journal of Management, 4(1), 13-26. Bhattacharya, S. (1979). Imperfect information, dividend policy, and “The Bird in The Hand” fallacy. Bell Journal of Economics, 10, 259-270. Black, F., & Scholes, M. (1974). The effects of dividend yield and dividend policy on common stock prices and returns. Journal of Financial Economics, 1, 1-22. Brennan, M. (1971). A note on dividend irrelevance and the Gordon valuation model. The Journal of Finance, 26, 1115-1121. Christie, A.A. (1982). The stochastic behaviour of common stock variances: value, leverage and interest rate effects. Journal of Financial Economics, 10(4), 407-432. Cheung, Y.W. and Ng, L.K. (1992). Stock price dynamics and firm size: an empirical investigation. The Journal of Finance, 47(5), 1985-1997. Driffill, J., Psaradakis, Z., & Sola, M. (1998). Testing the expectations hypothesis of the term structure using instrumental variables. International Journal of Finance and Economics, 3(4), 321-325. Gordon, M. J. (1959). Dividends, earnings & stock prices. Review of Economics and Statistics, 41(May), 99-105. Gordon, M.J. (1963). Optimal investment and financing policy. The Journal of Finance, 18(2), 264-272. Hansen, L.P. (1982). Large sample properties of generalized methods of moments estimators. Econometrica, 50, 1029-1054. Harkavy, O. (1953). The relation between retained earnings and common stock prices for large listed corporations. Journal of Finance, 8(3), 283-297. Trong, H., & Ngoc, C.N.M. (2013). Statistics applied in socio-economic research. Statistical Publishing House, Hanoi Hashemijoo, M., Ardekani, A. M., & Younesi, N. (2012). The impact of dividend policy on share price volatility in the Malaysian Stock Market. Journal of Business Studies Quarterly, 4(1), 111- 129. Hamid, K., Khurram, M.U., & Ghaffar, W. (2017), Juxtaposition of micro and macro dynamics of dividend policy on stock price volatility in financial sector of Pakistan: (comparative analysis through common, fixed, random and GMM effect. Journal of Accounting, Finance and Auditing Studies, 3(1), 64-79. Hunjra, A., Shahzad, M., Chani, M. I., Hassan, S., & Mustafa, U. (2014). Impact of dividend policy, earning per share, return on equity, profit after tax on stock prices. International Journal of Economics and Empirical Research, 2(3), 109-115. Haque, R., Jahiruddin, A. T. M., & Mishu, F. (2019). Dividend policy and share price volatility: A study on Dhaka Stock Exchange. Australian Academy of Accounting and Finance Review, 4(3), 89-99. Hussainey, K., Mgbame, C.O, & Chijoke Mgbame, A.M. (2011). Dividend policy and share price volatility: UK evidence. The Journal of Risk Finance, 12(1), 57-68, https:// doi.org/10.1108/15265941111100076 Jensen, M.C., & Meckling, W.H. 2016). Theory of firm: Managerial behaviour, agency costs and ownership Structure. Journal of Financial Economics, 3, 305-350. Kinder, C. (2002). Estimating stock volatility. Available at: www.bryongaskin.net (accessed 2 December 2014). Lewellen, W. G., Stanley, K. L., Lease, R. C., & Schlarbaum, G. G. (1978). Some direct evidence on the dividend clientele phenomenon. The Journal of Finance, 33(5), 1385-1399. Lashgari, D., & Ahmadi, M. (2014). The impact of dividend policy on stock price volatility in the Tehran Stock Exchange. Kuwait Chapter of Arabian Journal of Business and Management Review, 3(10), 273-283. LeRoy, S.F., & Porter, R.D. (1981). The present-value relation: tests based on implied variance bounds. Econometrica: Journal of the Econometric Society, 49(3), 555-574. Lintner, J. (1956). Distribution of incomes of corporations among dividends, retained earnings, and taxes. The American Economic Review, 46, 97-113. Markowitz, H. (1952). Portfolio Selection. The Journal of Finance 7(1), 77-91. Miller, M.H., & Rock, K. (1985). Dividend policy under asymmetric information. The Journal of Finance, 40(4), 1031-1051. 78 Miller, M.H., Modigliani, F. (1961). Dividend policy, growth, and the valuation of shares. The Journal of Business, 34, 411- 433. Nazir, M.S., Nawaz, M.M., Anwar, W., & Ahmed, F. (2010). Determinants of stock price volatility in Karachi stock exchange: the mediating role of corporate dividend policy. International Research Journal of Finance and Economics, 55, 100-107. Nishat, M., & Irfan, C. M. (2004). Dividend policy and stock price volatility in Pakistan. Paper presented at the PIDE-19th Annual General Meeting and Conference, Islamabad. Pettit, R.R. (1972). Dividend announcements, security performance, and capital market efficiency. The Journal of Finance, 27(5), 993-1007. Quyen, N.T (2016). The factors affect to the dividend policy of joint – stock companies listed on the Vietnam’s Stock Market. The factors affect to the dividend policy of joint – stock companies listed on the Vietnam’s Stock Market. PhD thesis, National Economics University. Ramadan, I.Z. (2013). Dividend policy and price volatility: empirical evidence from Jordan. International Journal of Academic Research in Accounting, Finance and Management Sciences, 3(2), 15-22. Sadiq, M., Ahmad, S., Anjum, M.J., Suliman, M., Abrar, S.U. & Khan, S.U.R. (2013). Stock price volatility in relation to dividend policy; A case study of Karachi Stock Market. Middle-East Journal of Scientific Research, 13(3), 426-431. Shah, S.A., & Noreen, U. (2016). Stock price volatility and role of dividend policy: empirical evidence from Pakistan. International Journal of Economics and Financial Issues, 6(2), 461-472. Shiller, R.J. (1981). Do stock prices move too much to be justified by subsequent changes in dividends? The American Economic Review, 71(3), 421-436. Schwert, G.W. (1989). Why does stock market volatility change over time? The Journal of Finance, 44(5), 1115-1153. Sew, E.H., Albaity, M., & Ibrahimy, A.I. (2015). Dividend policy and share price volatility. Investment Management and Financial Innovations, 12(1), 226-234. Walter, J.E. (1963). Dividend policy: Its influence on the value of the enterprise. The Journal of Finance, 18, 280-291. Woolridge, J.R. (1983). Dividend changes and security prices. The Journal of Finance, 38(5), 1607-1615. Zakaria, Z., & Shamsuddin, S. (2012). Empirical evidence on the relationship between Stock Market Volatility and macroeconomics volatility in Malaysia. Journal of Business Studies Quarterly, 4(2), 61-71. Zainudin, R., Mahdzan, N., & Yet, C. (2018). Dividend policy and stock price volatility of industrial products firms in Malaysia. International Journal of Emerging Markets, 13(1), 203-217. © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

dividend_policy_and_share_price_volatility_empirical_evidenc.pdf

dividend_policy_and_share_price_volatility_empirical_evidenc.pdf