Determinants influencing the profitability of listed food processing firms in Vietnam

This research is conducted to evaluate the determinants influencing the profitability of the foodprocessing firms in Vietnam. Data was collected from audited financial statements from the foodprocessing firms listed on the Vietnam Stock Exchange from 2012 to 2018 and panel regression model

was used in the research (PLS). We selected the methods of testing the model's defects. The testing

methods employed in this study were Pearson model, Hausman model, especially the relationship

between FEM and REM; Modified Wald Test, Wooldridge test (for autocorrelation in panel data), and

lastly Multicollinearity test based on VIF coefficient. The results indicate that Total-Debt-to TotalEquity and Long-term-Debt (TDTELT) had positive influence on profitability. However, Debt Ratio

(DR), Short-term Debt Ratio (SDR), Long-term Debt Ratio (LDR) had negative impacts. Fixed Assets

to Total Assets (FATA) and Firm size (SIZE) impact Return on Assets (ROA) without statistical

significance

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Tóm tắt nội dung tài liệu: Determinants influencing the profitability of listed food processing firms in Vietnam

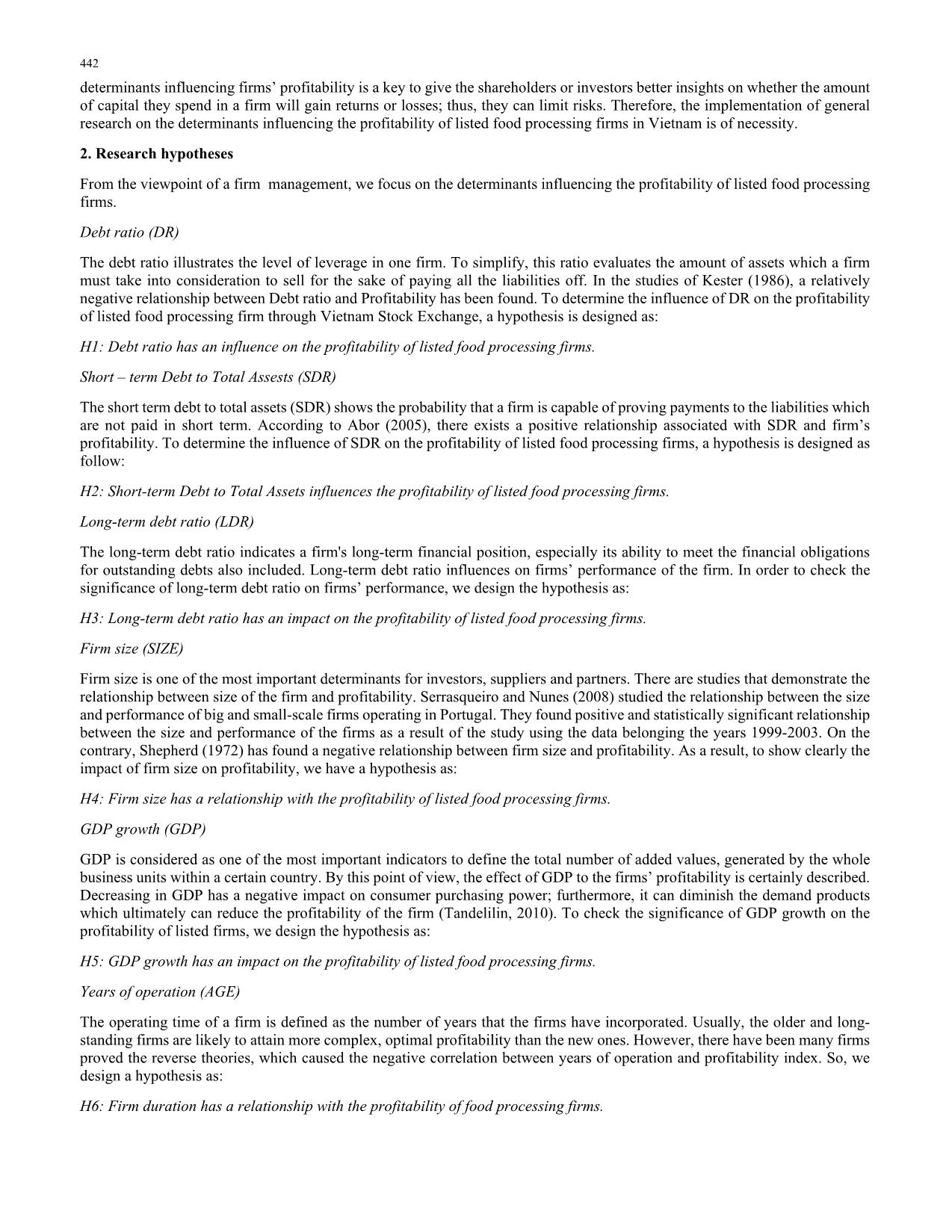

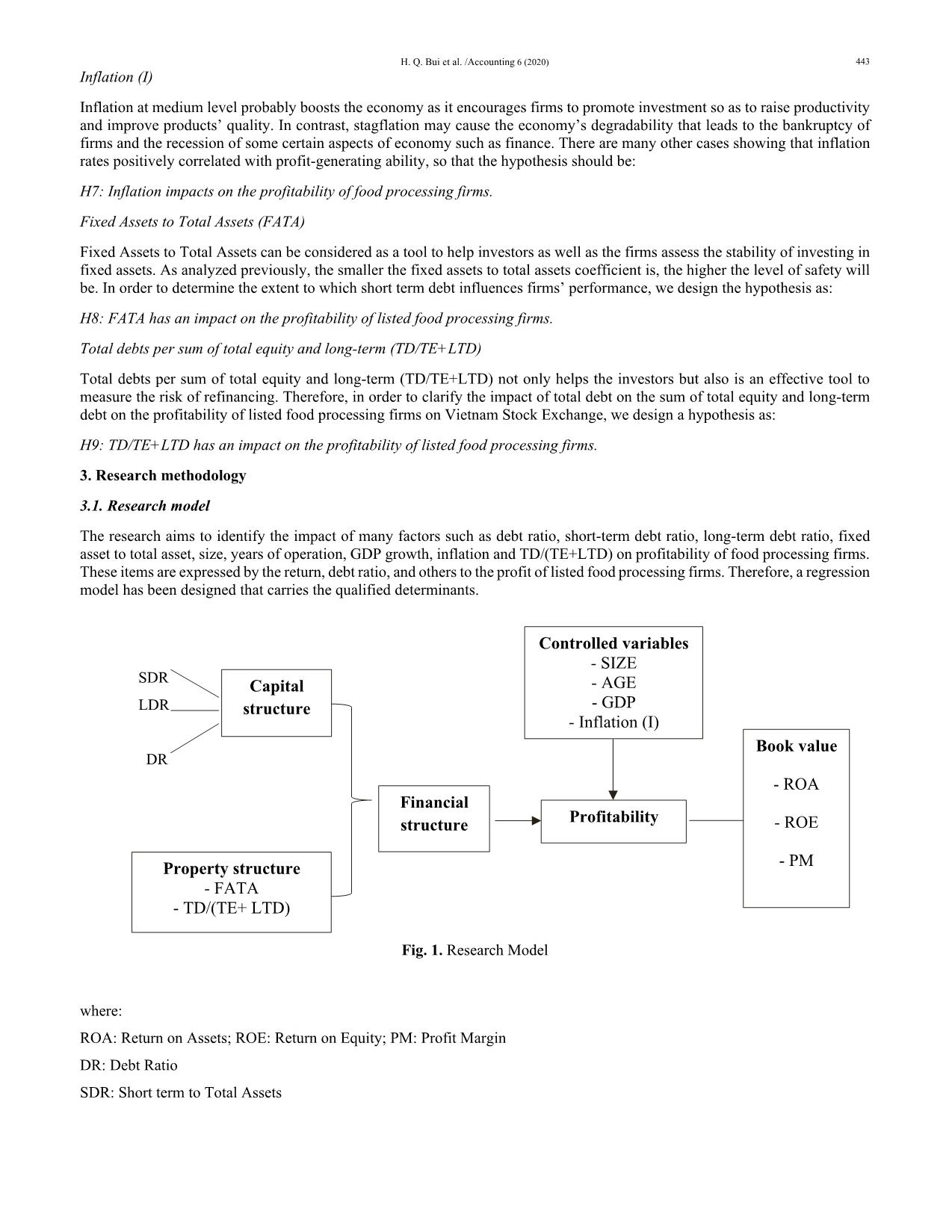

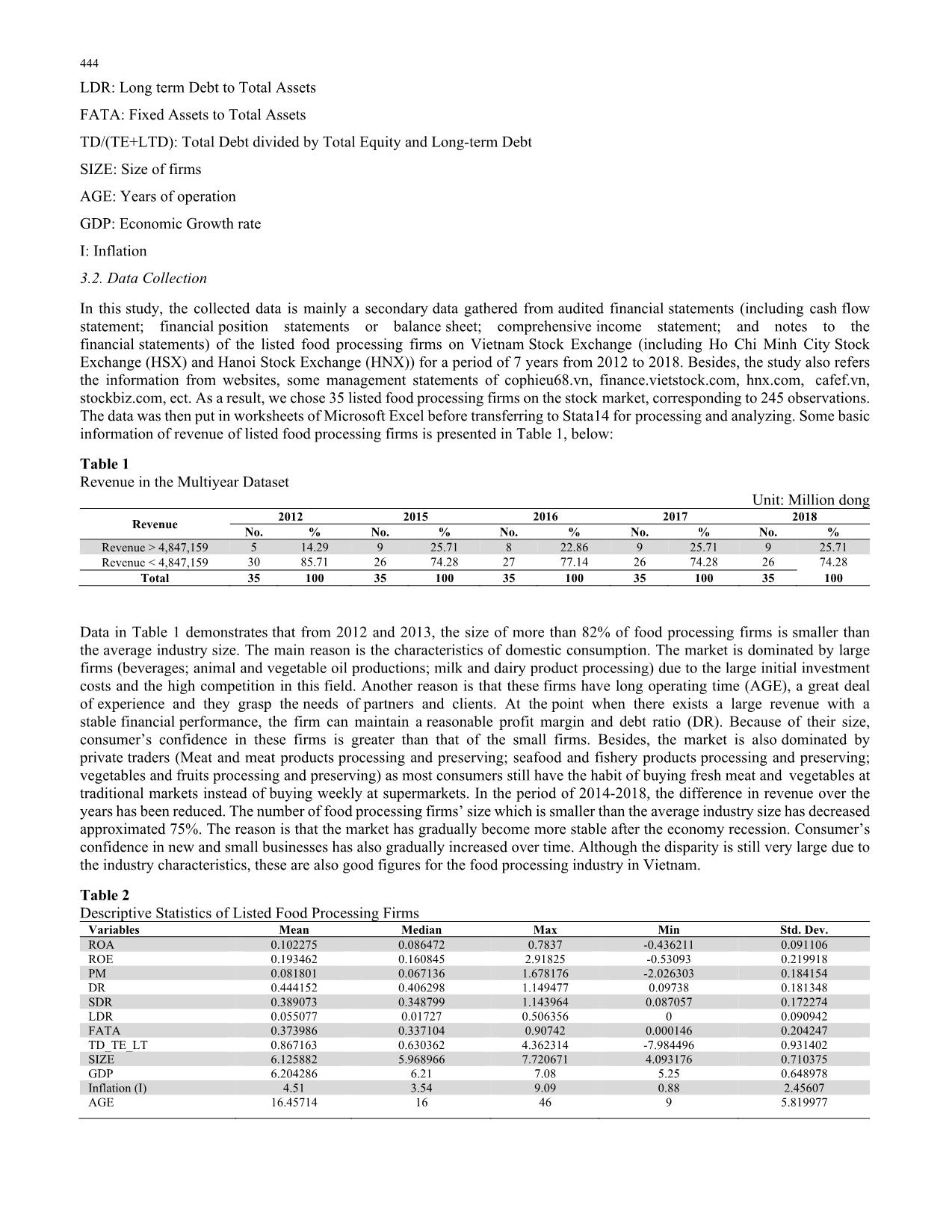

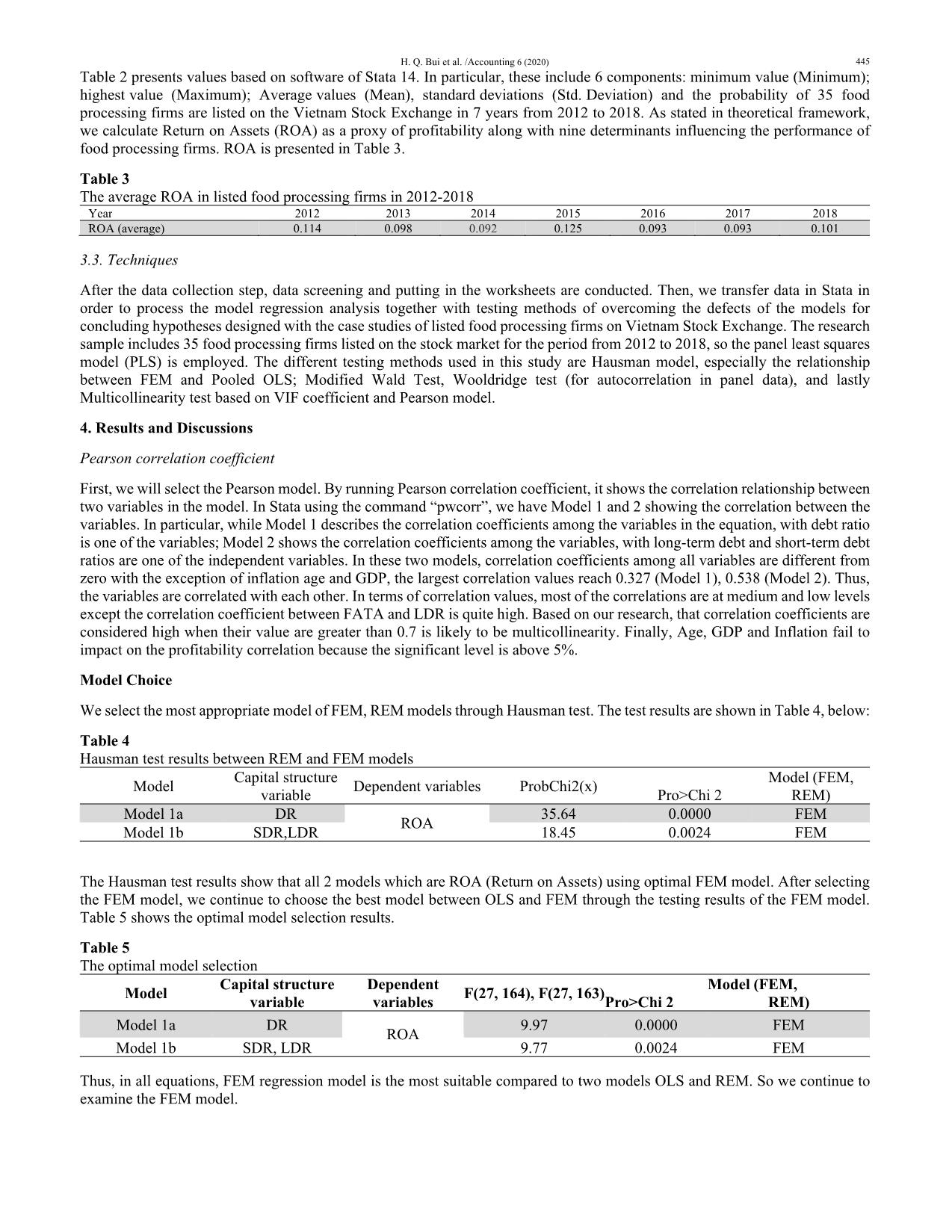

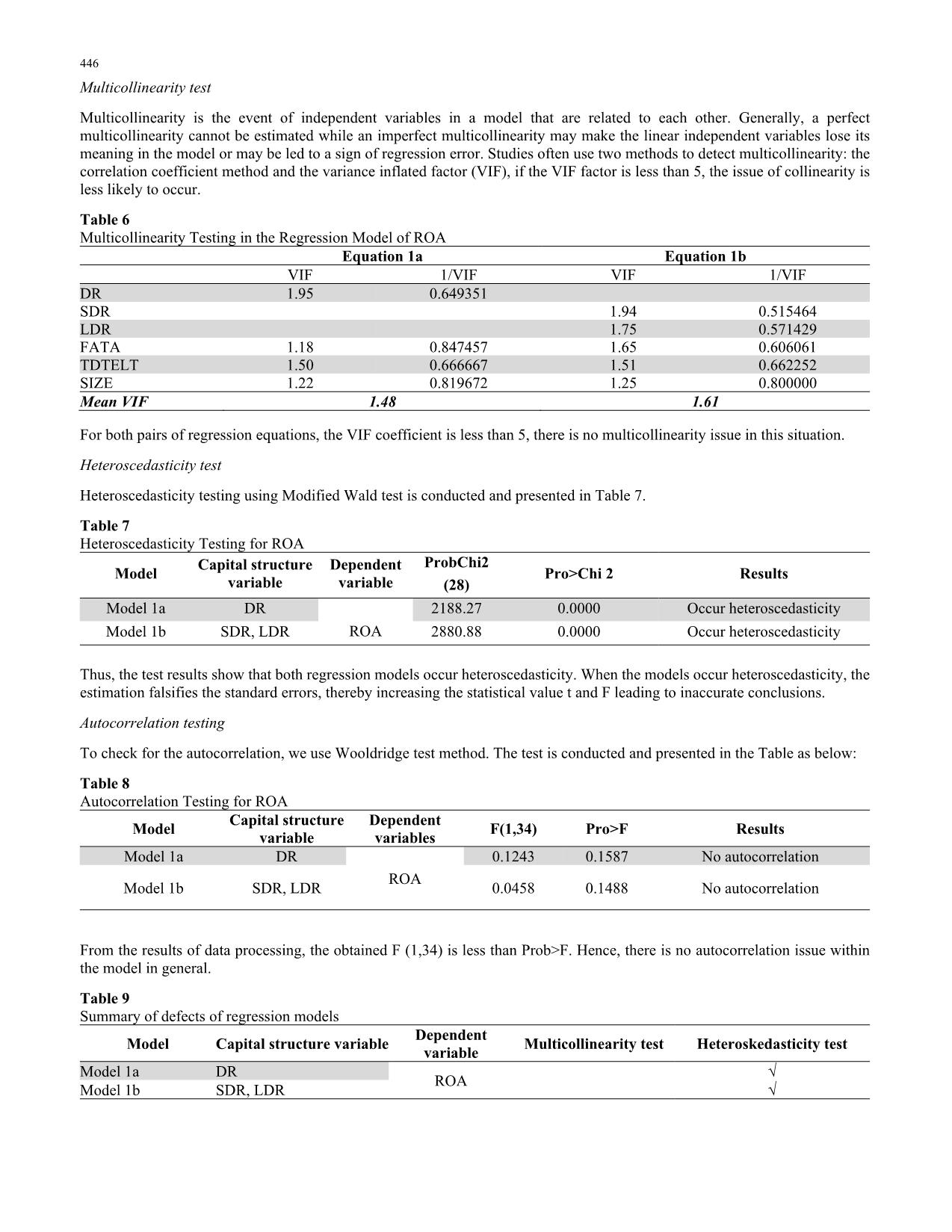

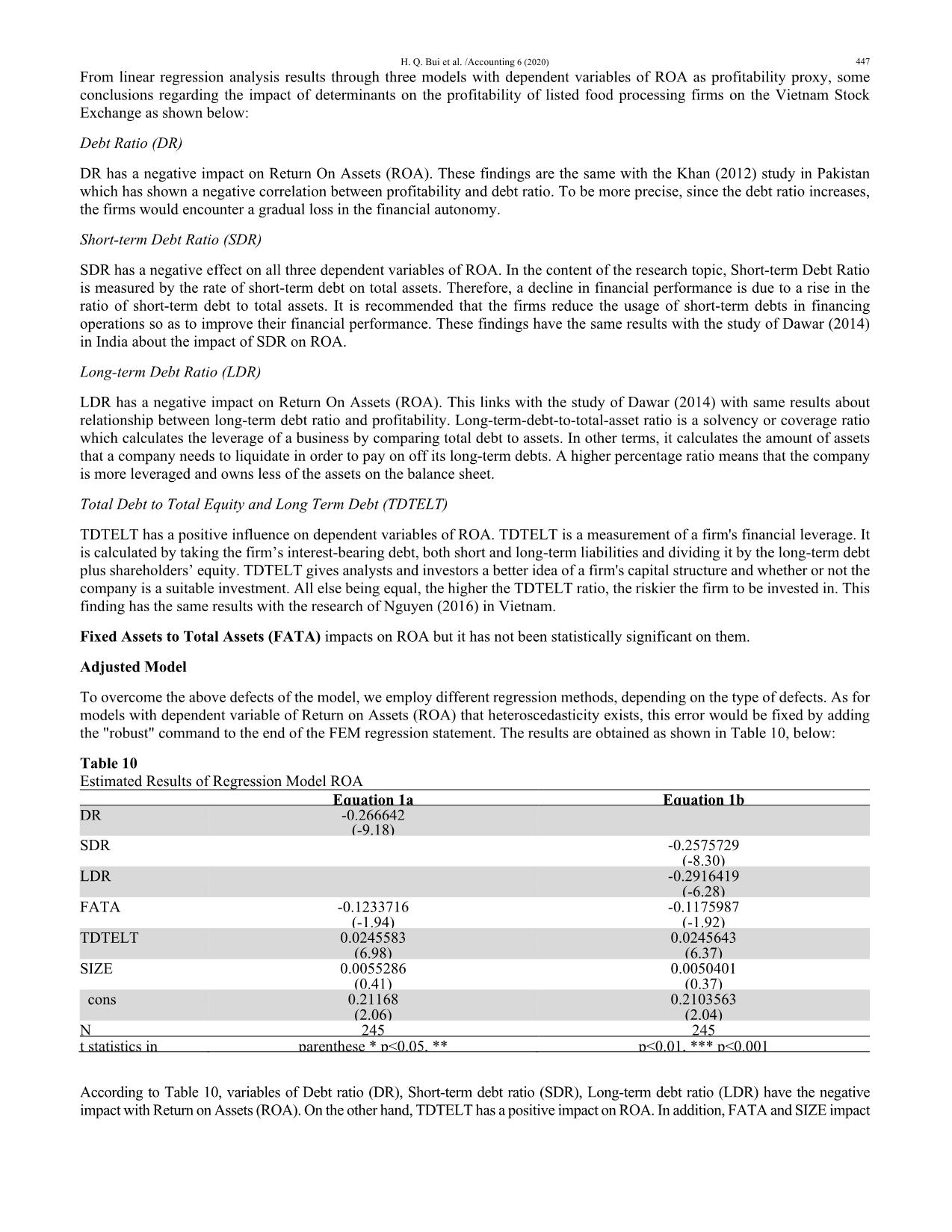

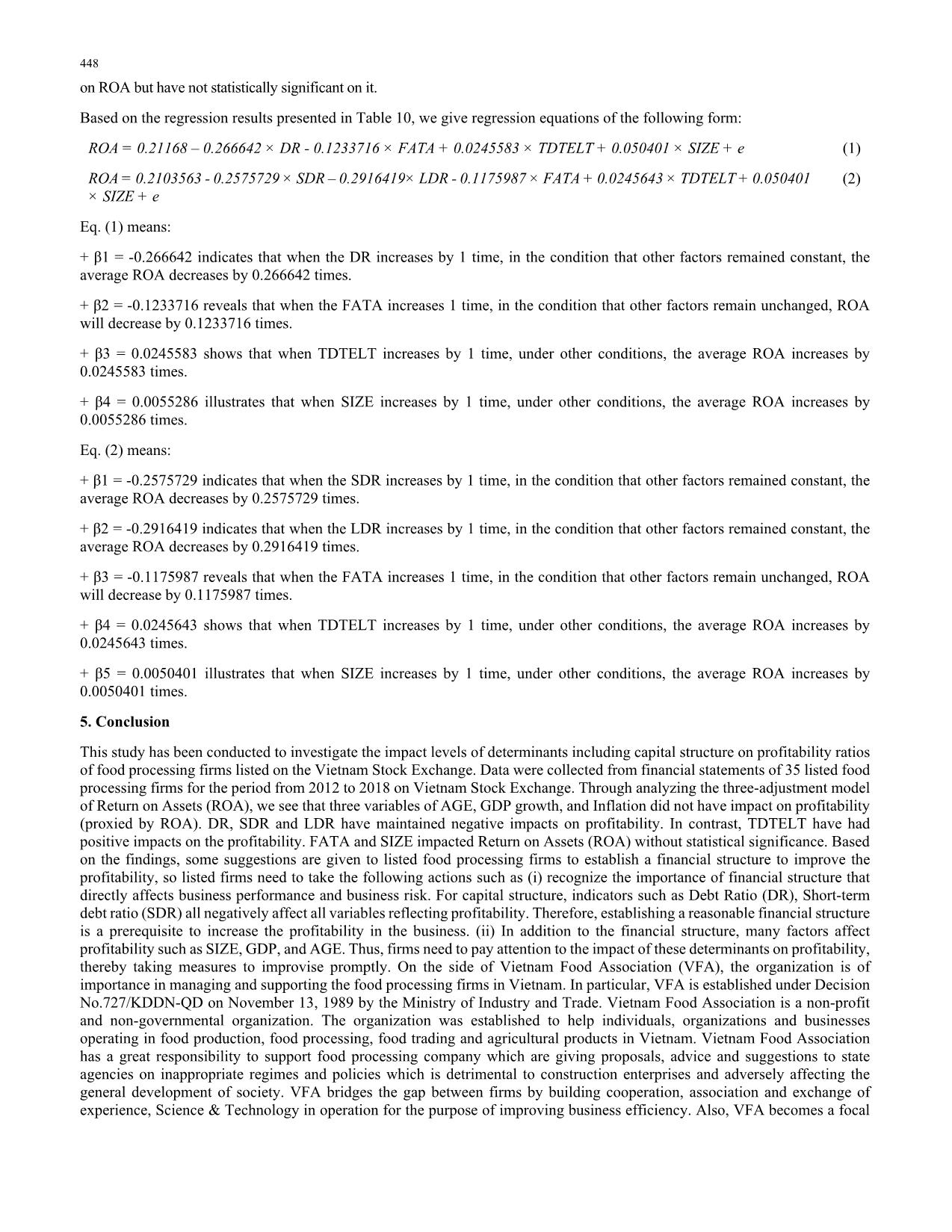

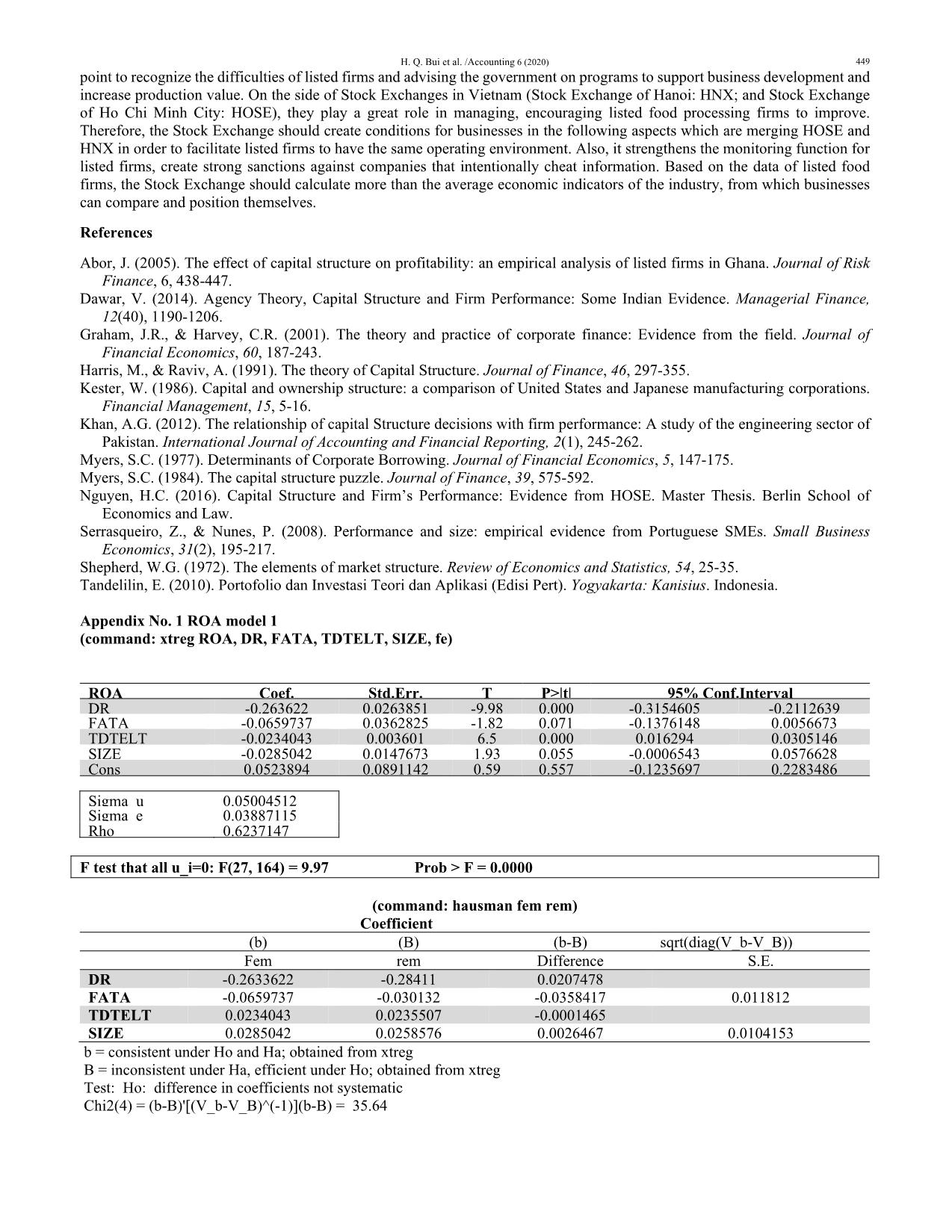

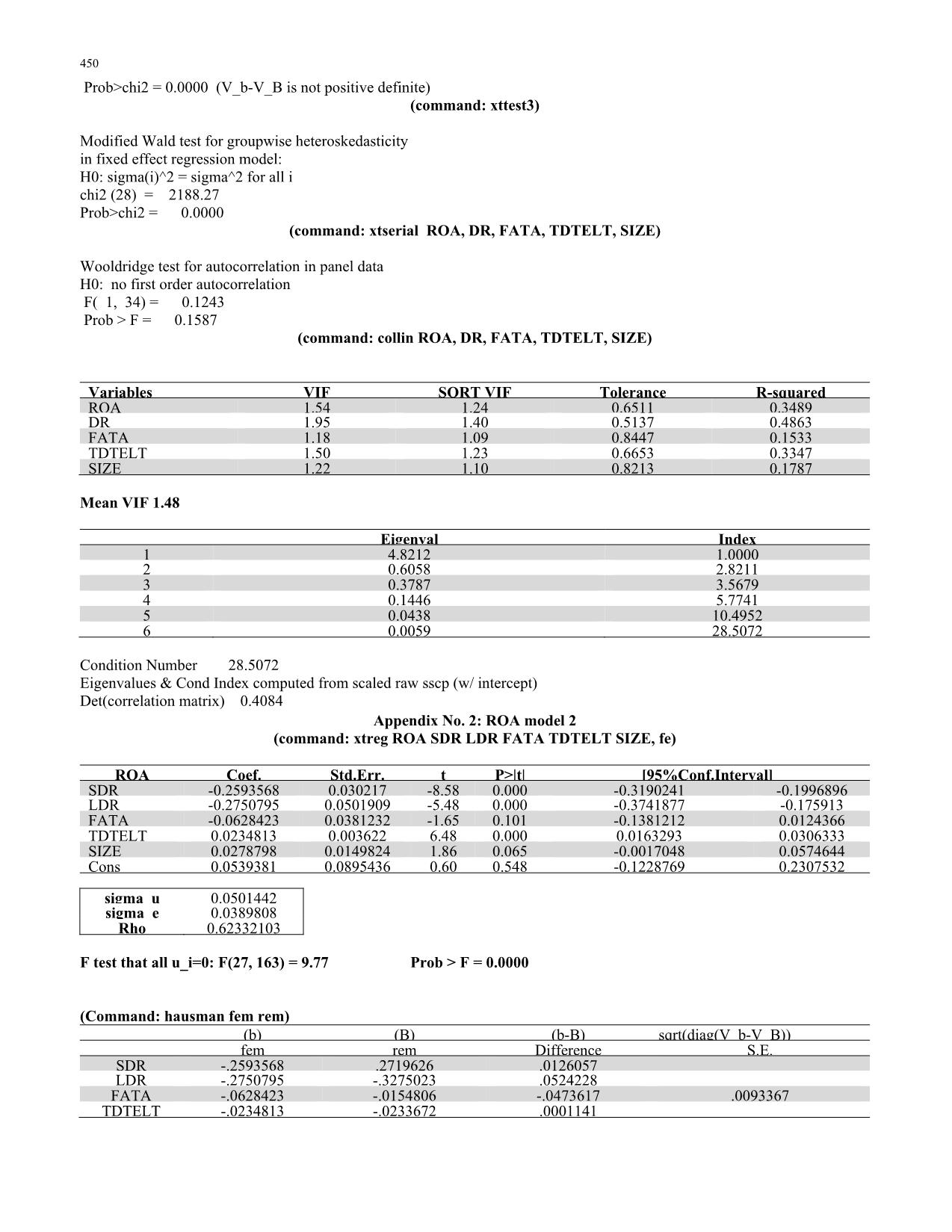

heet. Total Debt to Total Equity and Long Term Debt (TDTELT) TDTELT has a positive influence on dependent variables of ROA. TDTELT is a measurement of a firm's financial leverage. It is calculated by taking the firm’s interest-bearing debt, both short and long-term liabilities and dividing it by the long-term debt plus shareholders’ equity. TDTELT gives analysts and investors a better idea of a firm's capital structure and whether or not the company is a suitable investment. All else being equal, the higher the TDTELT ratio, the riskier the firm to be invested in. This finding has the same results with the research of Nguyen (2016) in Vietnam. Fixed Assets to Total Assets (FATA) impacts on ROA but it has not been statistically significant on them. Adjusted Model To overcome the above defects of the model, we employ different regression methods, depending on the type of defects. As for models with dependent variable of Return on Assets (ROA) that heteroscedasticity exists, this error would be fixed by adding the "robust" command to the end of the FEM regression statement. The results are obtained as shown in Table 10, below: Table 10 Estimated Results of Regression Model ROA Equation 1a Equation 1b DR -0.266642 (-9.18) SDR -0.2575729 (-8.30) LDR -0.2916419 (-6.28) FATA -0.1233716 -0.1175987 (-1.94) (-1.92) TDTELT 0.0245583 0.0245643 (6.98) (6.37) SIZE 0.0055286 0.0050401 (0.41) (0.37) cons 0.21168 0.2103563 (2.06) (2.04) N 245 245 t statistics in parenthese * p<0.05, ** p<0.01, *** p<0.001 According to Table 10, variables of Debt ratio (DR), Short-term debt ratio (SDR), Long-term debt ratio (LDR) have the negative impact with Return on Assets (ROA). On the other hand, TDTELT has a positive impact on ROA. In addition, FATA and SIZE impact 448 on ROA but have not statistically significant on it. Based on the regression results presented in Table 10, we give regression equations of the following form: ROA = 0.21168 – 0.266642 × DR - 0.1233716 × FATA + 0.0245583 × TDTELT + 0.050401 × SIZE + e (1) ROA = 0.2103563 - 0.2575729 × SDR – 0.2916419× LDR - 0.1175987 × FATA + 0.0245643 × TDTELT + 0.050401 × SIZE + e (2) Eq. (1) means: + β1 = -0.266642 indicates that when the DR increases by 1 time, in the condition that other factors remained constant, the average ROA decreases by 0.266642 times. + β2 = -0.1233716 reveals that when the FATA increases 1 time, in the condition that other factors remain unchanged, ROA will decrease by 0.1233716 times. + β3 = 0.0245583 shows that when TDTELT increases by 1 time, under other conditions, the average ROA increases by 0.0245583 times. + β4 = 0.0055286 illustrates that when SIZE increases by 1 time, under other conditions, the average ROA increases by 0.0055286 times. Eq. (2) means: + β1 = -0.2575729 indicates that when the SDR increases by 1 time, in the condition that other factors remained constant, the average ROA decreases by 0.2575729 times. + β2 = -0.2916419 indicates that when the LDR increases by 1 time, in the condition that other factors remained constant, the average ROA decreases by 0.2916419 times. + β3 = -0.1175987 reveals that when the FATA increases 1 time, in the condition that other factors remain unchanged, ROA will decrease by 0.1175987 times. + β4 = 0.0245643 shows that when TDTELT increases by 1 time, under other conditions, the average ROA increases by 0.0245643 times. + β5 = 0.0050401 illustrates that when SIZE increases by 1 time, under other conditions, the average ROA increases by 0.0050401 times. 5. Conclusion This study has been conducted to investigate the impact levels of determinants including capital structure on profitability ratios of food processing firms listed on the Vietnam Stock Exchange. Data were collected from financial statements of 35 listed food processing firms for the period from 2012 to 2018 on Vietnam Stock Exchange. Through analyzing the three-adjustment model of Return on Assets (ROA), we see that three variables of AGE, GDP growth, and Inflation did not have impact on profitability (proxied by ROA). DR, SDR and LDR have maintained negative impacts on profitability. In contrast, TDTELT have had positive impacts on the profitability. FATA and SIZE impacted Return on Assets (ROA) without statistical significance. Based on the findings, some suggestions are given to listed food processing firms to establish a financial structure to improve the profitability, so listed firms need to take the following actions such as (i) recognize the importance of financial structure that directly affects business performance and business risk. For capital structure, indicators such as Debt Ratio (DR), Short-term debt ratio (SDR) all negatively affect all variables reflecting profitability. Therefore, establishing a reasonable financial structure is a prerequisite to increase the profitability in the business. (ii) In addition to the financial structure, many factors affect profitability such as SIZE, GDP, and AGE. Thus, firms need to pay attention to the impact of these determinants on profitability, thereby taking measures to improvise promptly. On the side of Vietnam Food Association (VFA), the organization is of importance in managing and supporting the food processing firms in Vietnam. In particular, VFA is established under Decision No.727/KDDN-QD on November 13, 1989 by the Ministry of Industry and Trade. Vietnam Food Association is a non-profit and non-governmental organization. The organization was established to help individuals, organizations and businesses operating in food production, food processing, food trading and agricultural products in Vietnam. Vietnam Food Association has a great responsibility to support food processing company which are giving proposals, advice and suggestions to state agencies on inappropriate regimes and policies which is detrimental to construction enterprises and adversely affecting the general development of society. VFA bridges the gap between firms by building cooperation, association and exchange of experience, Science & Technology in operation for the purpose of improving business efficiency. Also, VFA becomes a focal H. Q. Bui et al. /Accounting 6 (2020) 449 point to recognize the difficulties of listed firms and advising the government on programs to support business development and increase production value. On the side of Stock Exchanges in Vietnam (Stock Exchange of Hanoi: HNX; and Stock Exchange of Ho Chi Minh City: HOSE), they play a great role in managing, encouraging listed food processing firms to improve. Therefore, the Stock Exchange should create conditions for businesses in the following aspects which are merging HOSE and HNX in order to facilitate listed firms to have the same operating environment. Also, it strengthens the monitoring function for listed firms, create strong sanctions against companies that intentionally cheat information. Based on the data of listed food firms, the Stock Exchange should calculate more than the average economic indicators of the industry, from which businesses can compare and position themselves. References Abor, J. (2005). The effect of capital structure on profitability: an empirical analysis of listed firms in Ghana. Journal of Risk Finance, 6, 438-447. Dawar, V. (2014). Agency Theory, Capital Structure and Firm Performance: Some Indian Evidence. Managerial Finance, 12(40), 1190-1206. Graham, J.R., & Harvey, C.R. (2001). The theory and practice of corporate finance: Evidence from the field. Journal of Financial Economics, 60, 187-243. Harris, M., & Raviv, A. (1991). The theory of Capital Structure. Journal of Finance, 46, 297-355. Kester, W. (1986). Capital and ownership structure: a comparison of United States and Japanese manufacturing corporations. Financial Management, 15, 5-16. Khan, A.G. (2012). The relationship of capital Structure decisions with firm performance: A study of the engineering sector of Pakistan. International Journal of Accounting and Financial Reporting, 2(1), 245-262. Myers, S.C. (1977). Determinants of Corporate Borrowing. Journal of Financial Economics, 5, 147-175. Myers, S.C. (1984). The capital structure puzzle. Journal of Finance, 39, 575-592. Nguyen, H.C. (2016). Capital Structure and Firm’s Performance: Evidence from HOSE. Master Thesis. Berlin School of Economics and Law. Serrasqueiro, Z., & Nunes, P. (2008). Performance and size: empirical evidence from Portuguese SMEs. Small Business Economics, 31(2), 195-217. Shepherd, W.G. (1972). The elements of market structure. Review of Economics and Statistics, 54, 25-35. Tandelilin, E. (2010). Portofolio dan Investasi Teori dan Aplikasi (Edisi Pert). Yogyakarta: Kanisius. Indonesia. Appendix No. 1 ROA model 1 (command: xtreg ROA, DR, FATA, TDTELT, SIZE, fe) ROA Coef. Std.Err. T P>|t| 95% Conf.Interval DR -0.263622 0.0263851 -9.98 0.000 -0.3154605 -0.2112639 FATA -0.0659737 0.0362825 -1.82 0.071 -0.1376148 0.0056673 TDTELT -0.0234043 0.003601 6.5 0.000 0.016294 0.0305146 SIZE -0.0285042 0.0147673 1.93 0.055 -0.0006543 0.0576628 Cons 0.0523894 0.0891142 0.59 0.557 -0.1235697 0.2283486 Sigma u 0.05004512 Sigma e 0.03887115 Rho 0.6237147 F test that all u_i=0: F(27, 164) = 9.97 Prob > F = 0.0000 (command: hausman fem rem) Coefficient (b) (B) (b-B) sqrt(diag(V_b-V_B)) Fem rem Difference S.E. DR -0.2633622 -0.28411 0.0207478 FATA -0.0659737 -0.030132 -0.0358417 0.011812 TDTELT 0.0234043 0.0235507 -0.0001465 SIZE 0.0285042 0.0258576 0.0026467 0.0104153 b = consistent under Ho and Ha; obtained from xtreg B = inconsistent under Ha, efficient under Ho; obtained from xtreg Test: Ho: difference in coefficients not systematic Chi2(4) = (b-B)'[(V_b-V_B)^(-1)](b-B) = 35.64 450 Prob>chi2 = 0.0000 (V_b-V_B is not positive definite) (command: xttest3) Modified Wald test for groupwise heteroskedasticity in fixed effect regression model: H0: sigma(i)^2 = sigma^2 for all i chi2 (28) = 2188.27 Prob>chi2 = 0.0000 (command: xtserial ROA, DR, FATA, TDTELT, SIZE) Wooldridge test for autocorrelation in panel data H0: no first order autocorrelation F( 1, 34) = 0.1243 Prob > F = 0.1587 (command: collin ROA, DR, FATA, TDTELT, SIZE) Variables VIF SQRT VIF Tolerance R-squared ROA 1.54 1.24 0.6511 0.3489 DR 1.95 1.40 0.5137 0.4863 FATA 1.18 1.09 0.8447 0.1533 TDTELT 1.50 1.23 0.6653 0.3347 SIZE 1.22 1.10 0.8213 0.1787 Mean VIF 1.48 Eigenval Index 1 4.8212 1.0000 2 0.6058 2.8211 3 0.3787 3.5679 4 0.1446 5.7741 5 0.0438 10.4952 6 0.0059 28.5072 Condition Number 28.5072 Eigenvalues & Cond Index computed from scaled raw sscp (w/ intercept) Det(correlation matrix) 0.4084 Appendix No. 2: ROA model 2 (command: xtreg ROA SDR LDR FATA TDTELT SIZE, fe) ROA Coef. Std.Err. t P>|t| [95%Conf.Interval] SDR -0.2593568 0.030217 -8.58 0.000 -0.3190241 -0.1996896 LDR -0.2750795 0.0501909 -5.48 0.000 -0.3741877 -0.175913 FATA -0.0628423 0.0381232 -1.65 0.101 -0.1381212 0.0124366 TDTELT 0.0234813 0.003622 6.48 0.000 0.0163293 0.0306333 SIZE 0.0278798 0.0149824 1.86 0.065 -0.0017048 0.0574644 Cons 0.0539381 0.0895436 0.60 0.548 -0.1228769 0.2307532 sigma u 0.0501442 sigma e 0.0389808 Rho 0.62332103 F test that all u_i=0: F(27, 163) = 9.77 Prob > F = 0.0000 (Command: hausman fem rem) (b) (B) (b-B) sqrt(diag(V b-V B)) fem rem Difference S.E. SDR -.2593568 .2719626 .0126057 LDR -.2750795 -.3275023 .0524228 FATA -.0628423 -.0154806 -.0473617 .0093367 TDTELT -.0234813 -.0233672 .0001141 H. Q. Bui et al. /Accounting 6 (2020) 451 SIZE .0278798 .0266708 .001209 .0108629 b = consistent under Ho and Ha; obtained from xtreg B = inconsistent under Ha, efficient under Ho; obtained from xtreg Test: Ho: difference in coefficients not systematic chi2(5) = (b-B)'[(V_b-V_B)^(-1)](b-B) = 18.45 Prob>chi2 = 0.0024 (command:xttest3) Modified Wald test for groupwise heteroskedasticity in fixed effect regression model: H0: sigma(i)^2 = sigma^2 for all i chi2 (28) = 2180.88; Prob>chi2 = 0.0000 (command: xtserial ROA SDR LDR FATA TDTELT SIZE) Wooldridge test for autocorrelation in panel data H0: no first order autocorrelation F( 1, 34) = 0.0458 Prob > F = 0.1587 (Command: collin ROA SDR LDR FATA TDTELT SIZE) Collinearity Diagnostics SQRT R- Variable VIF VIF Tolerance Squared ROA 1.57 1.25 0.6375 0.3625 SDR 1.94 1.39 0.5148 0.4852 LDR 1.75 1.32 0.5702 0.4298 FATA 1.65 1.28 0.6057 0.3943 TDTELT 1.51 1.23 0.6626 0.3374 SIZE 1.25 1.12 0.7970 0.2030 Mean VIF 1.61 Eigenval Index 1 5.1170 1.0000 2 0.7993 2.5301 3 0.6167 2.8806 4 0.3077 4.0783 5 0.1090 6.8512 6 0.0447 10.6989 7 0.0056 30.2761 Condition Number 30.2761 Eigenvalues & Cond Index computed from scaled raw sscp (w/ intercept) Det(correlation matrix) 0.2476 (Command:. xtreg ROA DR FATA TDTELT SIZE, fe robust) Fixed-effects (within) regression Number of obs = 196 Group variable: firm1 Number of groups = 28 R-sq: Obs per group: within = 0.5681 min = 7 between = 0.5747 avg = 7.0 overall = 0.5659 max = 7 F(4,27) = 238.26 corr(u_i, Xb) = 0.1454 Prob > F = 0.0000 452 (Std. Err. adjusted for 28 clusters in firm1) ROA Coef. Robust Std. Err. t P>|t| [95% Conf. Interval] DR -.266642 .0290556 -9.18 0.000 -.3256901 -.2075939 FATA -.1233716 .0630774 -1.96 0.059 -.2515603 .004817 TDTELT .0245583 .0035209 6.98 0.000 .017403 .0317136 SIZE .0055286 .0135332 0.41 0.685 -.0219741 .0330314 _cons .21168 .1029421 2.06 0.047 .0024765 .4208836 sigma_u .06397261 sigma_e .05935437 rho .53739436 (fraction of variance due to u_i) (Command: xtreg ROA SDR LDR FATA TDTELT SIZE, fe robust) Fixed-effects (within) regression Number of obs = 196 Group variable: firm1 Number of groups = 28 R-sq: Obs per group within = 0.4683 min = 7 between = 0.4742 avg = 7.0 overall = 0.4651 max = 7 F(5,27) = 197.28 corr (u_i,Xb) = 0.1497 Prob > F = 0.0000 (Std. Err. adjusted for 28 clusters in firm1) ROA Coef. Robust Std. Err. t P>|t| [95% Conf. Interval] SDR -.2575729 .0310391 -8.30 0.000 -.320652 -.1944938 LDR -.2916491 .046469 -6.28 0.000 -.3860783 -.1972054 FATA -.1175987 .0612635 -1.92 0.063 -.2421011 .0069038 TDTELT .0245643 .0038555 6.37 0.000 .0167289 .0323997 SIZE .0050401 .0137663 0.37 0.717 -.0229365 .0330167 _cons .2103563 .1030976 2.04 0.049 .0008367 .4198758 sigma_u .06424692 sigma_e .05947044 rho .53855049 (fraction of variance due to u_i) © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

determinants_influencing_the_profitability_of_listed_food_pr.pdf

determinants_influencing_the_profitability_of_listed_food_pr.pdf