Conceptualizing the effects of corporate tax rate differentials on transfer pricing activities of FDI enterprises in Vietnam

The purpose of this paper is to evaluate the differentials effects of the tax rate on transfer pricing

activities in foreign direct investment enterprises in Vietnam. The study then suggests further research

on the determinants over transfer pricing activities of these enterprises to have better solutions in

dealing with transfer mispricing in Vietnam. A quantitative research method involving selfadministered closed-ended questionnaires were extended to Managing Directors/Chief Executive

Officers, Tax Managers/ Directors, Chief Finance Officers or Heads of Finance from foreign direct

investment enterprises in Vietnam. Findings indicate a strong relationship between corporate tax rate

differentials and the transfer pricing activities in foreign direct investment enterprises in Vietnam. The

findings support Vietnamese policymakers, academic researchers, auditors, investors to have further

study on the effect of the tax rate on transfer pricing activities of the enterprises. Nevertheless, tax

officials and accounting representatives can have in-depth knowledge with regards to transfer pricing

activities which the outcome of this study aspires as guidance for better understanding the aspects of

transfer pricing while doing business in Vietnam.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tóm tắt nội dung tài liệu: Conceptualizing the effects of corporate tax rate differentials on transfer pricing activities of FDI enterprises in Vietnam

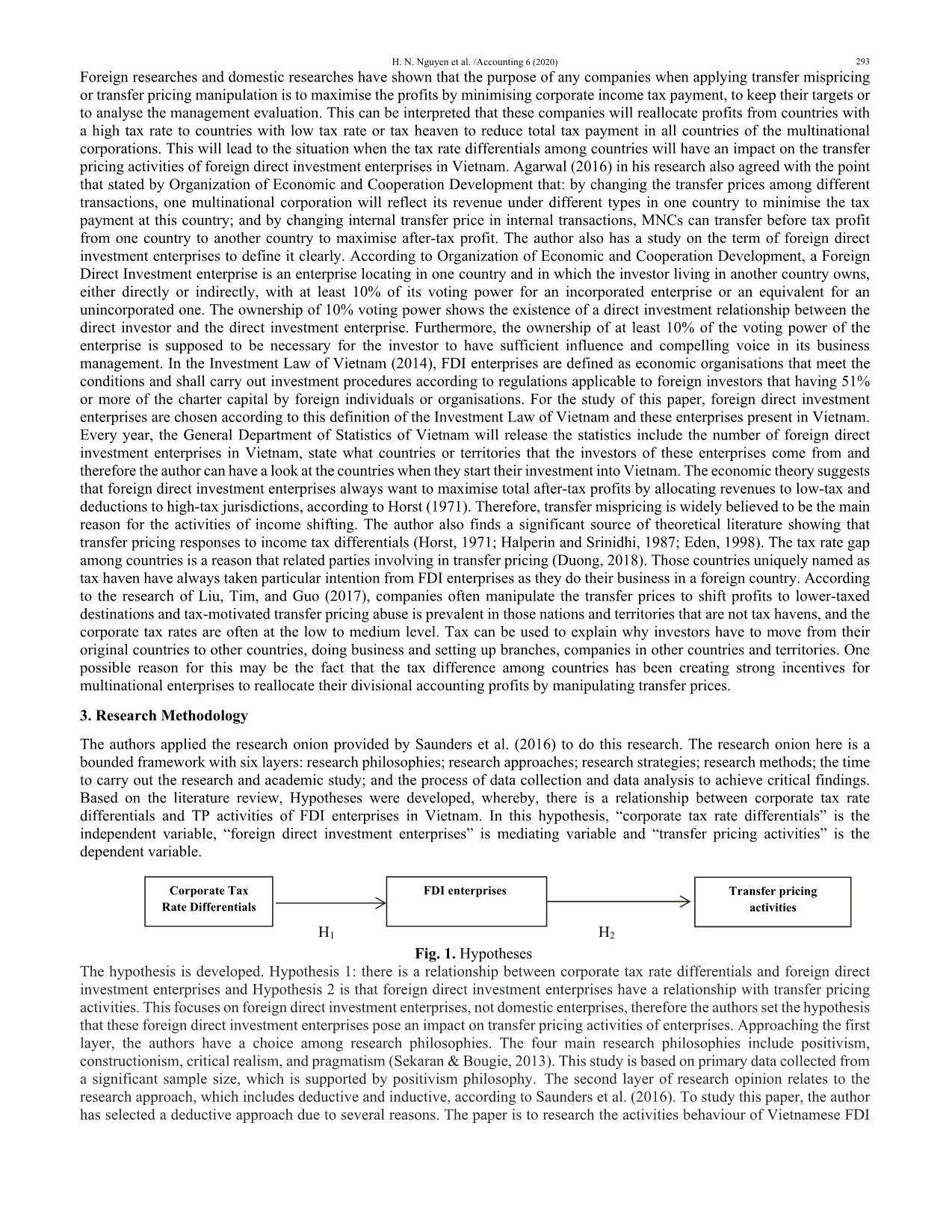

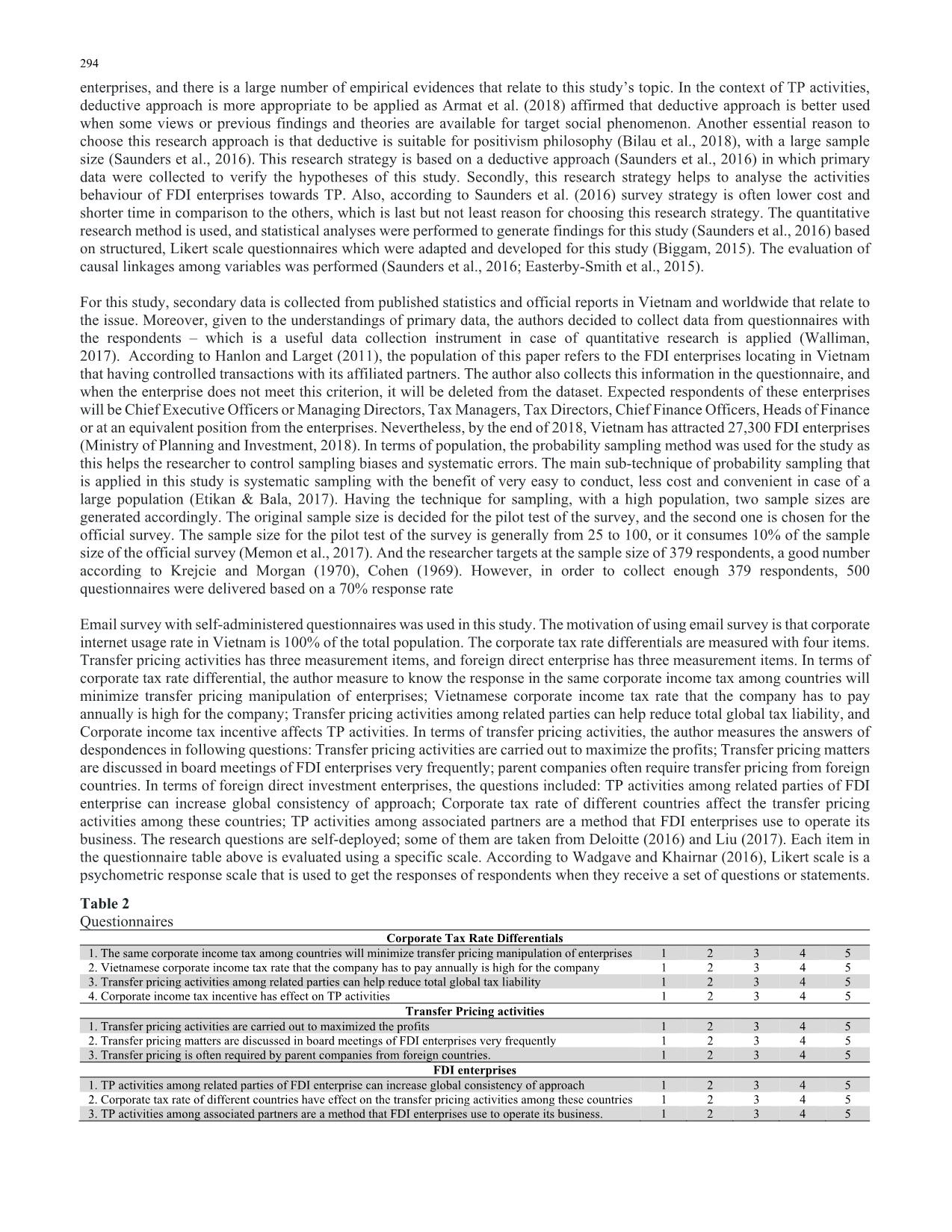

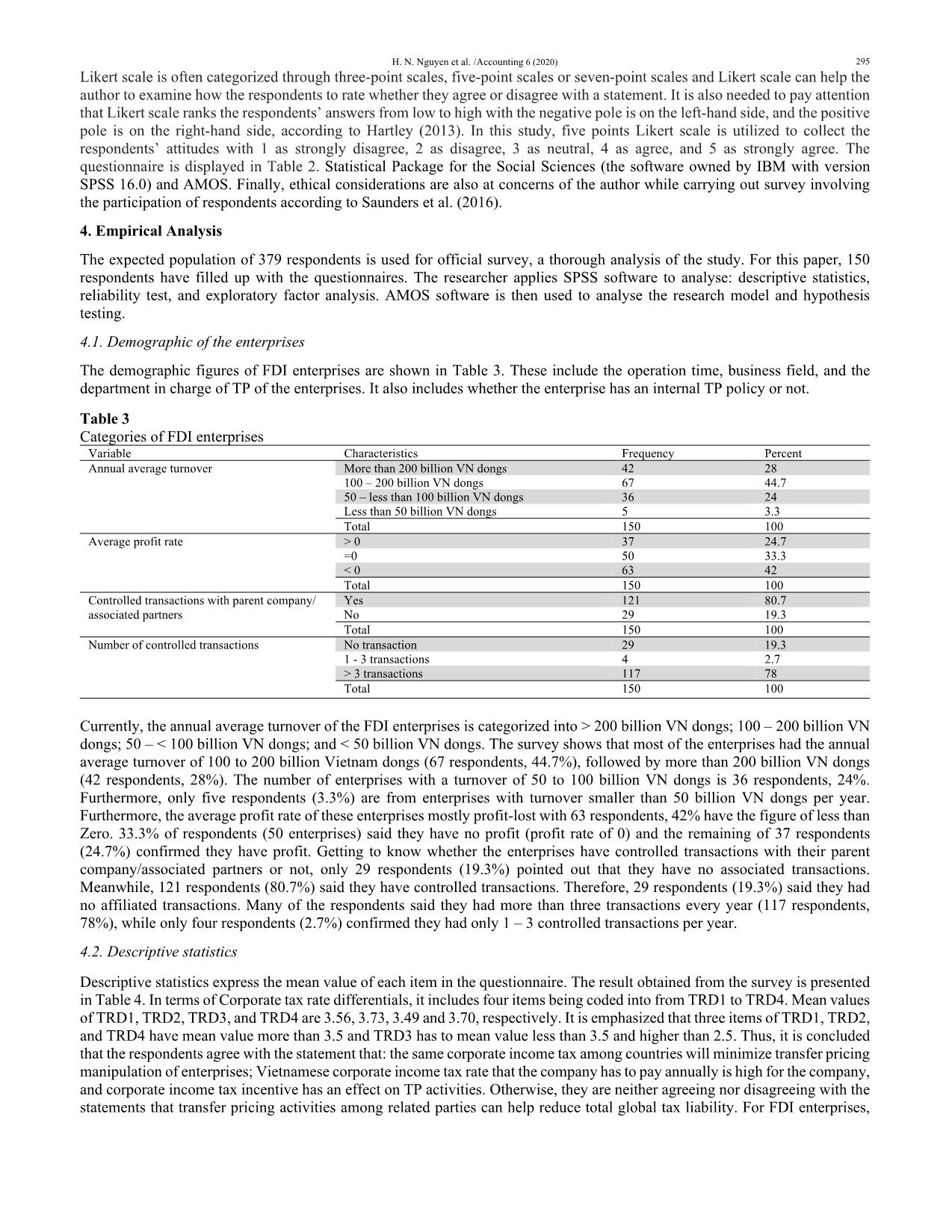

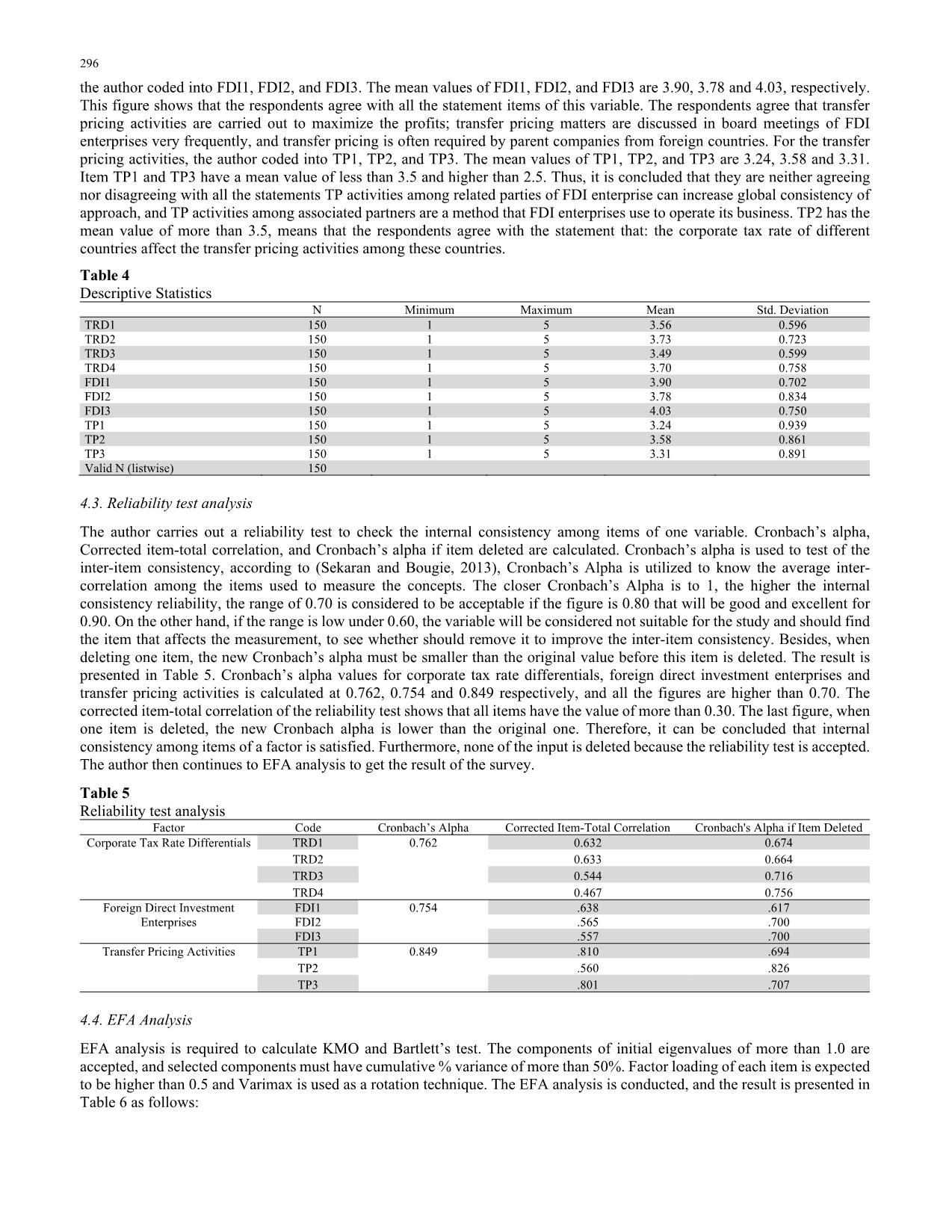

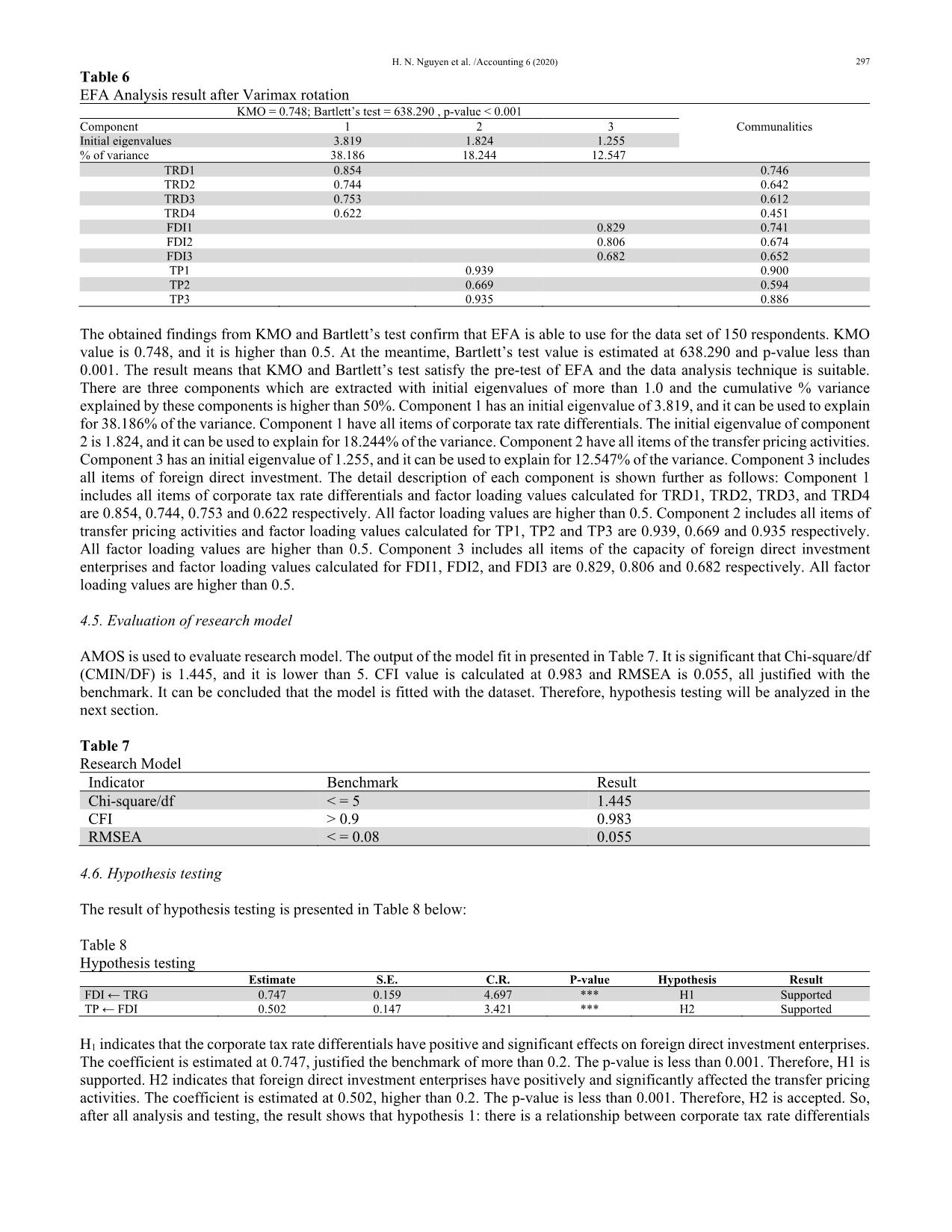

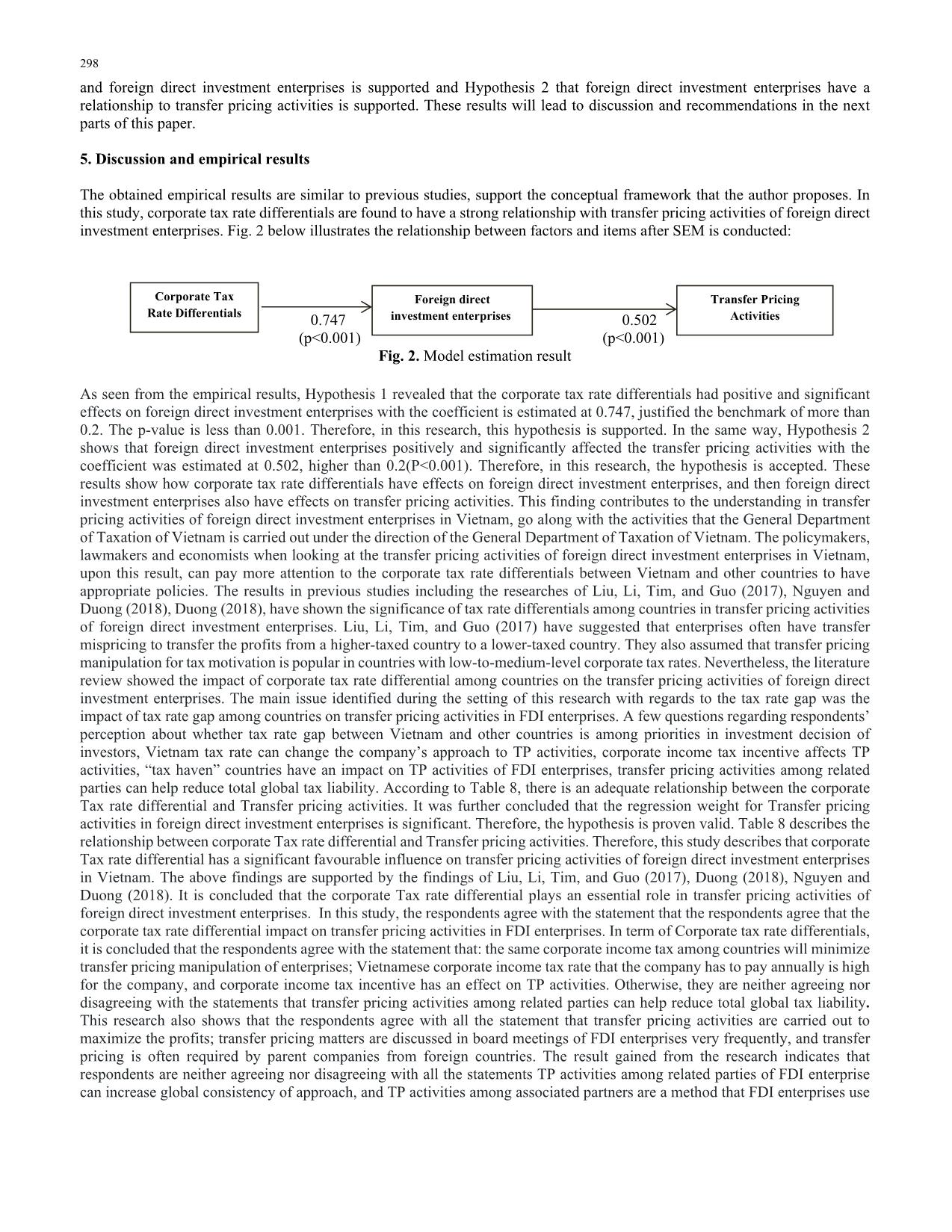

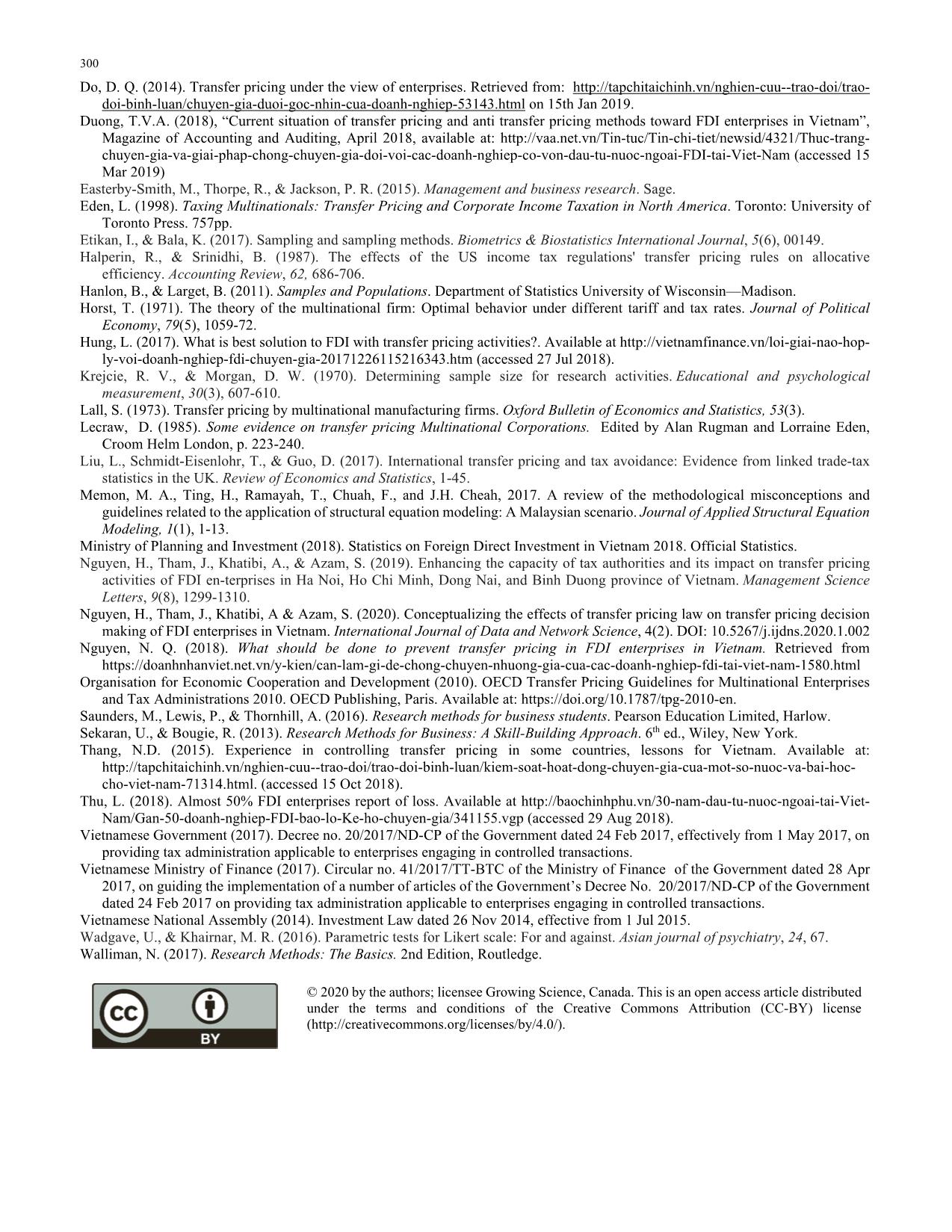

of foreign direct investment enterprises. Liu, Li, Tim, and Guo (2017) have suggested that enterprises often have transfer mispricing to transfer the profits from a higher-taxed country to a lower-taxed country. They also assumed that transfer pricing manipulation for tax motivation is popular in countries with low-to-medium-level corporate tax rates. Nevertheless, the literature review showed the impact of corporate tax rate differential among countries on the transfer pricing activities of foreign direct investment enterprises. The main issue identified during the setting of this research with regards to the tax rate gap was the impact of tax rate gap among countries on transfer pricing activities in FDI enterprises. A few questions regarding respondents’ perception about whether tax rate gap between Vietnam and other countries is among priorities in investment decision of investors, Vietnam tax rate can change the company’s approach to TP activities, corporate income tax incentive affects TP activities, “tax haven” countries have an impact on TP activities of FDI enterprises, transfer pricing activities among related parties can help reduce total global tax liability. According to Table 8, there is an adequate relationship between the corporate Tax rate differential and Transfer pricing activities. It was further concluded that the regression weight for Transfer pricing activities in foreign direct investment enterprises is significant. Therefore, the hypothesis is proven valid. Table 8 describes the relationship between corporate Tax rate differential and Transfer pricing activities. Therefore, this study describes that corporate Tax rate differential has a significant favourable influence on transfer pricing activities of foreign direct investment enterprises in Vietnam. The above findings are supported by the findings of Liu, Li, Tim, and Guo (2017), Duong (2018), Nguyen and Duong (2018). It is concluded that the corporate Tax rate differential plays an essential role in transfer pricing activities of foreign direct investment enterprises. In this study, the respondents agree with the statement that the respondents agree that the corporate tax rate differential impact on transfer pricing activities in FDI enterprises. In term of Corporate tax rate differentials, it is concluded that the respondents agree with the statement that: the same corporate income tax among countries will minimize transfer pricing manipulation of enterprises; Vietnamese corporate income tax rate that the company has to pay annually is high for the company, and corporate income tax incentive has an effect on TP activities. Otherwise, they are neither agreeing nor disagreeing with the statements that transfer pricing activities among related parties can help reduce total global tax liability. This research also shows that the respondents agree with all the statement that transfer pricing activities are carried out to maximize the profits; transfer pricing matters are discussed in board meetings of FDI enterprises very frequently, and transfer pricing is often required by parent companies from foreign countries. The result gained from the research indicates that respondents are neither agreeing nor disagreeing with all the statements TP activities among related parties of FDI enterprise can increase global consistency of approach, and TP activities among associated partners are a method that FDI enterprises use Corporate Tax Rate Differentials Foreign direct investment enterprises Transfer Pricing Activities H. N. Nguyen et al. /Accounting 6 (2020) 299 to operate its business. The respondents agree with the statement that: the corporate tax rate of different countries affect the transfer pricing activities among these countries. 6. Conclusions and Recommendations Transfer pricing has been getting its attention in many areas, especially in the field of tax and economics as enterprises expand their businesses across countries, where the gap in tax rates among these economies may arise. To partly contribute to a better understanding of TP, the research aims to identify the relationship between corporate tax rate differentials and TP activities of FDI enterprises in Vietnam. The theoretical and empirical review has been made related to the issues. From the literature review, the author has shown how transfer price and transfer pricing are defined in international and Vietnamese researches. The definition of foreign direct investment enterprises is also examined in the term of Organization for Economic and Cooperation Development and under the Investment Law of Vietnam. Also, from the literature review, the author sees that former researchers found the relationship between the corporate tax rate differentials among countries and the transfer pricing activities of the foreign direct investment enterprises. With the rising issue of transfer pricing in Vietnam, the author sees the need to continue study on TP, supplement and renew theory to catch up with globalization in the current context of TP management and control. The research methodology is examined in session three. Research onion is, and it requires the choices of research philosophy, research approach, research strategy, research method, time horizon, and data collection. After the discussions, the researcher applies positivism research philosophy and deductive research approach. Moreover, the survey is chosen as a research strategy and primary data, therefore, is collected from a self-administered questionnaire. The researcher relies on Survey Monkey, which is known as an online survey tool to implement the survey. Secondary data is also collected from published statistics and reports, and the role of this data is visible in literature. 150 respondents from FDI enterprises in Vietnam have given feedback on questionnaires. The empirical result shows that corporate tax rate differentials are found to have a strong relationship with transfer pricing activities of foreign direct investment enterprises. The author finds acceptable internal consistency reliability of the research, model testing, EFA analysis and hypothesis testing accepted with Hypothesis 1 and Hypothesis 2, which is similar to the literature review. Therefore, based on this result, the author suggests further research on the relationship between corporate tax rate differentials and transfer pricing activities of FDI enterprises in Vietnam to be conducted with the official survey of 379 respondents as suggested in Methodology. With the above empirical analysis, the author recognizes the limitation of the study as the findings may be correct only for the sample, not for the whole population. However, further research in terms of the effect that corporate tax rate differentials pose on TP activities of FDI enterprises can be carried out upon this conceptual study framework. These further researches can give recommendations for better tax rate in Vietnam and can help much in suggesting a better solution to TP abuse. To further study the tax rate gap among Vietnam and other countries to have better solutions with transfer pricing manipulation. This suggestion was supported as the results of the findings in the study of Liu, Li, Tim, and Guo (2017) as they discovered in their study that transfer mispricing with tax motivation is popular in countries that are not tax havens and have low-to-medium-level corporate tax rates. With the above-chosen research methodology components, the researcher recognizes several limitations of the study. Firstly, the paper findings are based on limited sample size. Even the sample size is acceptable for academic studies provided by previous researchers; the author is aware of expected findings may be correct for this sample only and may not be correct for the whole population. Secondly, the limitation may come from the chosen self-administered questionnaire as this kind of survey’s weakness is that the answers of the respondents are not verified, and the respondents may provide the feedback that does not reflect their real thinking. References Agarwal, S. (2016). Transfer Pricing Meaning Examples Risks Benefits. Available at: https://www.linkedin.com/pulse/transfer- pricing-meaning-examples-risks-benefits-shivangi-agarwal (accessed 10 Aug 2018) Akpojevwa, O. A. (2014). The effects of international transfer pricing on host nations: An overview of developing nations. SCSR Journal of Business and Entrepreneurship (SCSR-JBE), 1(1), 34 – 41 Armat, M. R., Assarroudi, A., Rad, M., Sharifi, H., & Heydari, A. (2018). Inductive and deductive: Ambiguous labels in qualitative content analysis. The Qualitative Report, 23(1), 219-221. Biggam, J. (2015). Succeeding with your master's dissertation: a step-by-step handbook. McGraw-Hill Education (UK). Bilau, A. A., Witt, E., & Lill, I. (2015). A framework for managing post-disaster housing reconstruction. Procedia Economics and Finance, 21(15), 313-320. Borkowaki, S.C. (1997b). The transfer pricing concerns of developed and developing countries. International Journal of Accounting, 32(3), 321-36. Cohen, J. (1969). Statistical power analysis for the behavioral sciences. CA: Academic Press, San Diego. Deloitte, (2016). Trends in Transfer Pricing. Retrieved from https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Tax/dttl-tax-transfer-pricing-global-research-bulletin.pdf on 28th December 2018. Dillman, D. A., Smyth, J. D., & Christian, L. M. (2014). Internet, phone, mail, and mixed-mode surveys: the tailored design method. John Wiley & Sons. 300 Do, D. Q. (2014). Transfer pricing under the view of enterprises. Retrieved from: doi-binh-luan/chuyen-gia-duoi-goc-nhin-cua-doanh-nghiep-53143.html on 15th Jan 2019. Duong, T.V.A. (2018), “Current situation of transfer pricing and anti transfer pricing methods toward FDI enterprises in Vietnam”, Magazine of Accounting and Auditing, April 2018, available at: chuyen-gia-va-giai-phap-chong-chuyen-gia-doi-voi-cac-doanh-nghiep-co-von-dau-tu-nuoc-ngoai-FDI-tai-Viet-Nam (accessed 15 Mar 2019) Easterby-Smith, M., Thorpe, R., & Jackson, P. R. (2015). Management and business research. Sage. Eden, L. (1998). Taxing Multinationals: Transfer Pricing and Corporate Income Taxation in North America. Toronto: University of Toronto Press. 757pp. Etikan, I., & Bala, K. (2017). Sampling and sampling methods. Biometrics & Biostatistics International Journal, 5(6), 00149. Halperin, R., & Srinidhi, B. (1987). The effects of the US income tax regulations' transfer pricing rules on allocative efficiency. Accounting Review, 62, 686-706. Hanlon, B., & Larget, B. (2011). Samples and Populations. Department of Statistics University of Wisconsin—Madison. Horst, T. (1971). The theory of the multinational firm: Optimal behavior under different tariff and tax rates. Journal of Political Economy, 79(5), 1059-72. Hung, L. (2017). What is best solution to FDI with transfer pricing activities?. Available at ly-voi-doanh-nghiep-fdi-chuyen-gia-20171226115216343.htm (accessed 27 Jul 2018). Krejcie, R. V., & Morgan, D. W. (1970). Determining sample size for research activities. Educational and psychological measurement, 30(3), 607-610. Lall, S. (1973). Transfer pricing by multinational manufacturing firms. Oxford Bulletin of Economics and Statistics, 53(3). Lecraw, D. (1985). Some evidence on transfer pricing Multinational Corporations. Edited by Alan Rugman and Lorraine Eden, Croom Helm London, p. 223-240. Liu, L., Schmidt-Eisenlohr, T., & Guo, D. (2017). International transfer pricing and tax avoidance: Evidence from linked trade-tax statistics in the UK. Review of Economics and Statistics, 1-45. Memon, M. A., Ting, H., Ramayah, T., Chuah, F., and J.H. Cheah, 2017. A review of the methodological misconceptions and guidelines related to the application of structural equation modeling: A Malaysian scenario. Journal of Applied Structural Equation Modeling, 1(1), 1-13. Ministry of Planning and Investment (2018). Statistics on Foreign Direct Investment in Vietnam 2018. Official Statistics. Nguyen, H., Tham, J., Khatibi, A., & Azam, S. (2019). Enhancing the capacity of tax authorities and its impact on transfer pricing activities of FDI en-terprises in Ha Noi, Ho Chi Minh, Dong Nai, and Binh Duong province of Vietnam. Management Science Letters, 9(8), 1299-1310. Nguyen, H., Tham, J., Khatibi, A & Azam, S. (2020). Conceptualizing the effects of transfer pricing law on transfer pricing decision making of FDI enterprises in Vietnam. International Journal of Data and Network Science, 4(2). DOI: 10.5267/j.ijdns.2020.1.002 Nguyen, N. Q. (2018). What should be done to prevent transfer pricing in FDI enterprises in Vietnam. Retrieved from https://doanhnhanviet.net.vn/y-kien/can-lam-gi-de-chong-chuyen-nhuong-gia-cua-cac-doanh-nghiep-fdi-tai-viet-nam-1580.html Organisation for Economic Cooperation and Development (2010). OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations 2010. OECD Publishing, Paris. Available at: https://doi.org/10.1787/tpg-2010-en. Saunders, M., Lewis, P., & Thornhill, A. (2016). Research methods for business students. Pearson Education Limited, Harlow. Sekaran, U., & Bougie, R. (2013). Research Methods for Business: A Skill-Building Approach. 6th ed., Wiley, New York. Thang, N.D. (2015). Experience in controlling transfer pricing in some countries, lessons for Vietnam. Available at: cho-viet-nam-71314.html. (accessed 15 Oct 2018). Thu, L. (2018). Almost 50% FDI enterprises report of loss. Available at Nam/Gan-50-doanh-nghiep-FDI-bao-lo-Ke-ho-chuyen-gia/341155.vgp (accessed 29 Aug 2018). Vietnamese Government (2017). Decree no. 20/2017/ND-CP of the Government dated 24 Feb 2017, effectively from 1 May 2017, on providing tax administration applicable to enterprises engaging in controlled transactions. Vietnamese Ministry of Finance (2017). Circular no. 41/2017/TT-BTC of the Ministry of Finance of the Government dated 28 Apr 2017, on guiding the implementation of a number of articles of the Government’s Decree No. 20/2017/ND-CP of the Government dated 24 Feb 2017 on providing tax administration applicable to enterprises engaging in controlled transactions. Vietnamese National Assembly (2014). Investment Law dated 26 Nov 2014, effective from 1 Jul 2015. Wadgave, U., & Khairnar, M. R. (2016). Parametric tests for Likert scale: For and against. Asian journal of psychiatry, 24, 67. Walliman, N. (2017). Research Methods: The Basics. 2nd Edition, Routledge. © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

conceptualizing_the_effects_of_corporate_tax_rate_differenti.pdf

conceptualizing_the_effects_of_corporate_tax_rate_differenti.pdf