Auditor's perception in usage of audit information technology in Vietnam

Abstract

This study provides new evidence on the extent to which auditors are aware of the use and

importance of audit technology in an age of industrial revolution 4.0. This study explores

determinants that influence the use and importance of information technology audits;

examines the relationship between the use of awareness and the importance of specific tools

and features of audit firm. By using interviews and questionnaires of auditors at independent

audit firms in Vietnam, the resultsshow the high importance of using audit technology in

technical and administrative procedures, particularly for risk assessment. We also conclude

the use and importance of audit technology is highly valued. The results provide policymakers

with guidance on the opportunities and challenges of using information technology in the

audit process in both independent audit and internal audit

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Tóm tắt nội dung tài liệu: Auditor's perception in usage of audit information technology in Vietnam

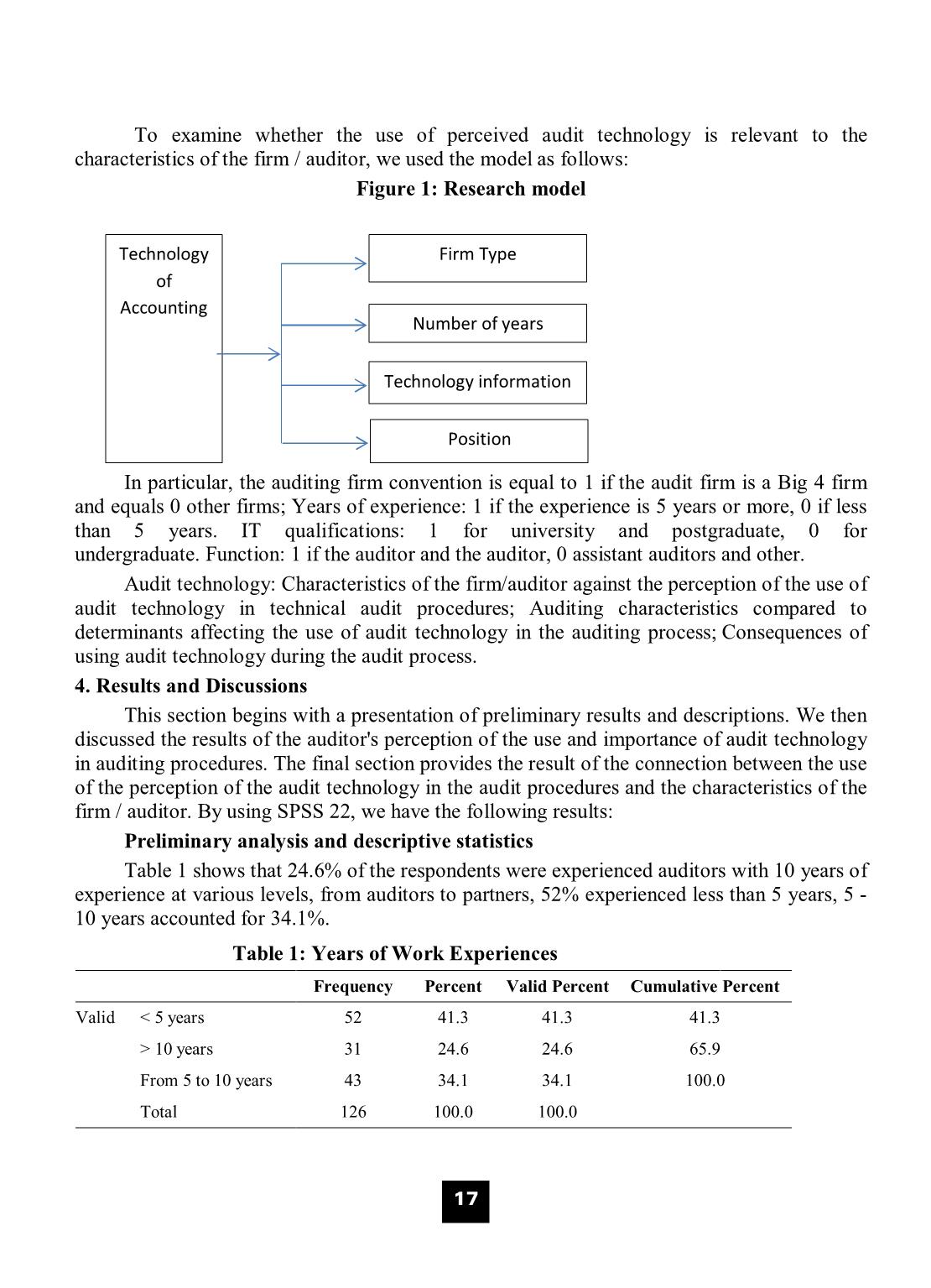

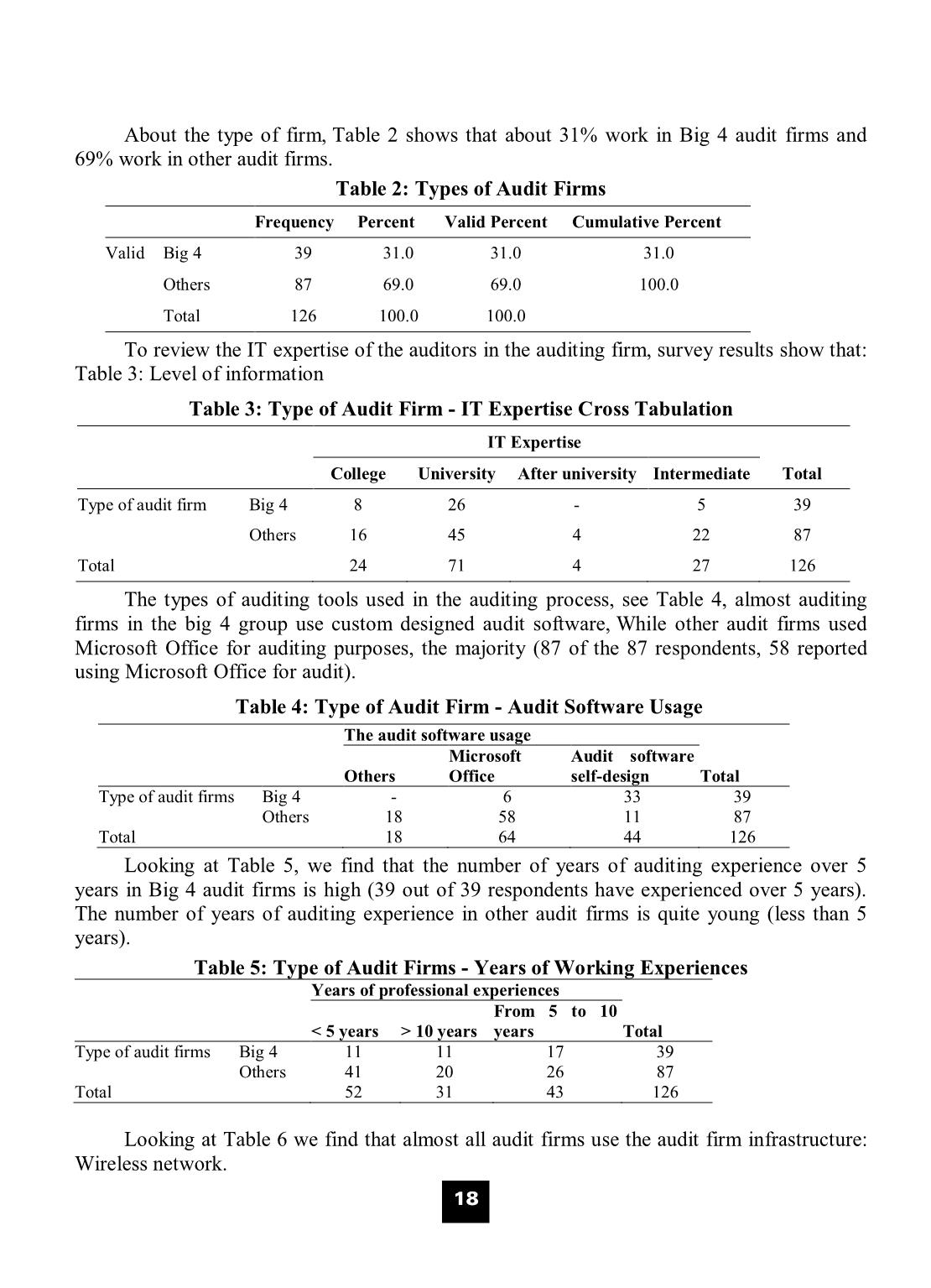

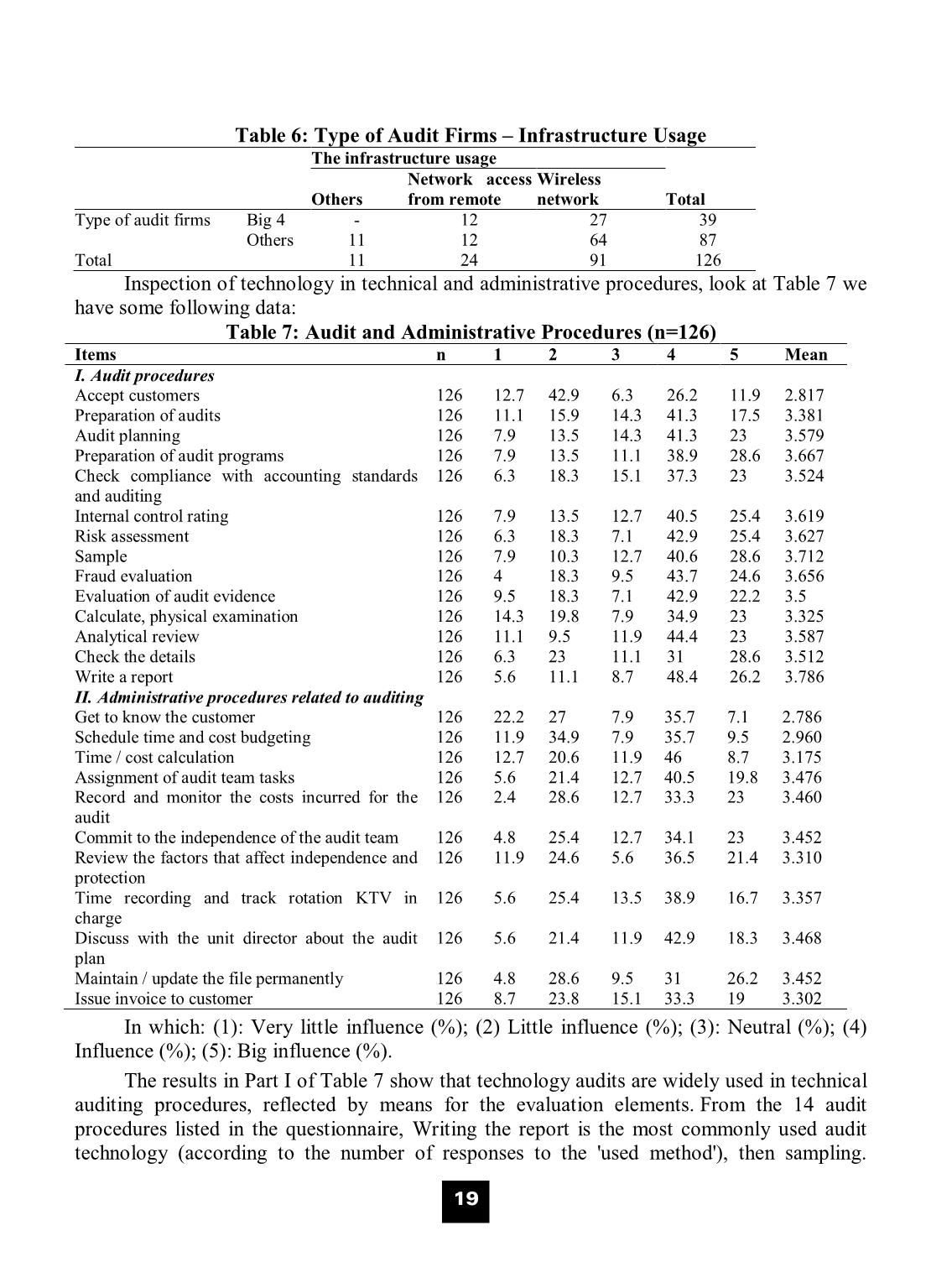

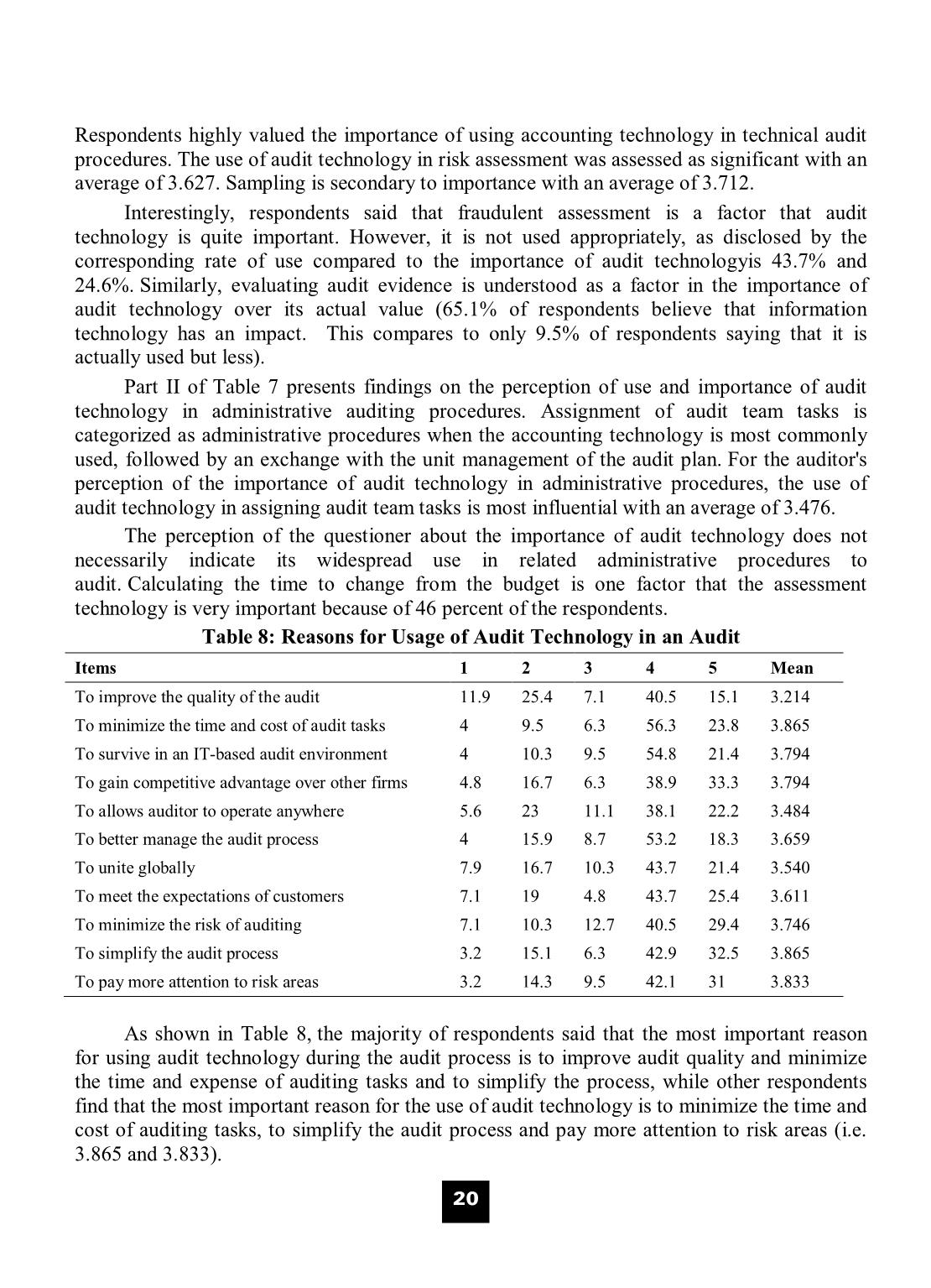

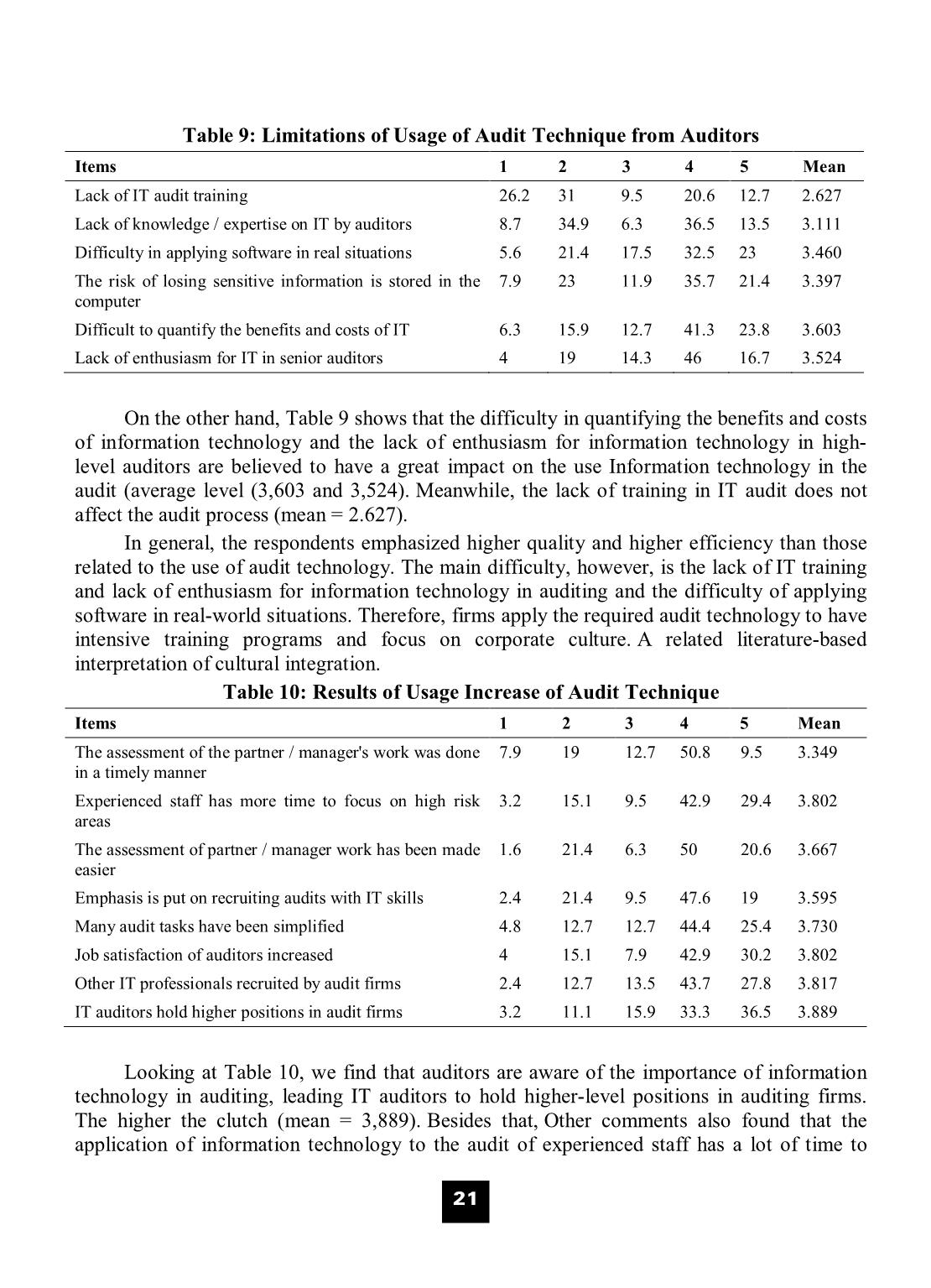

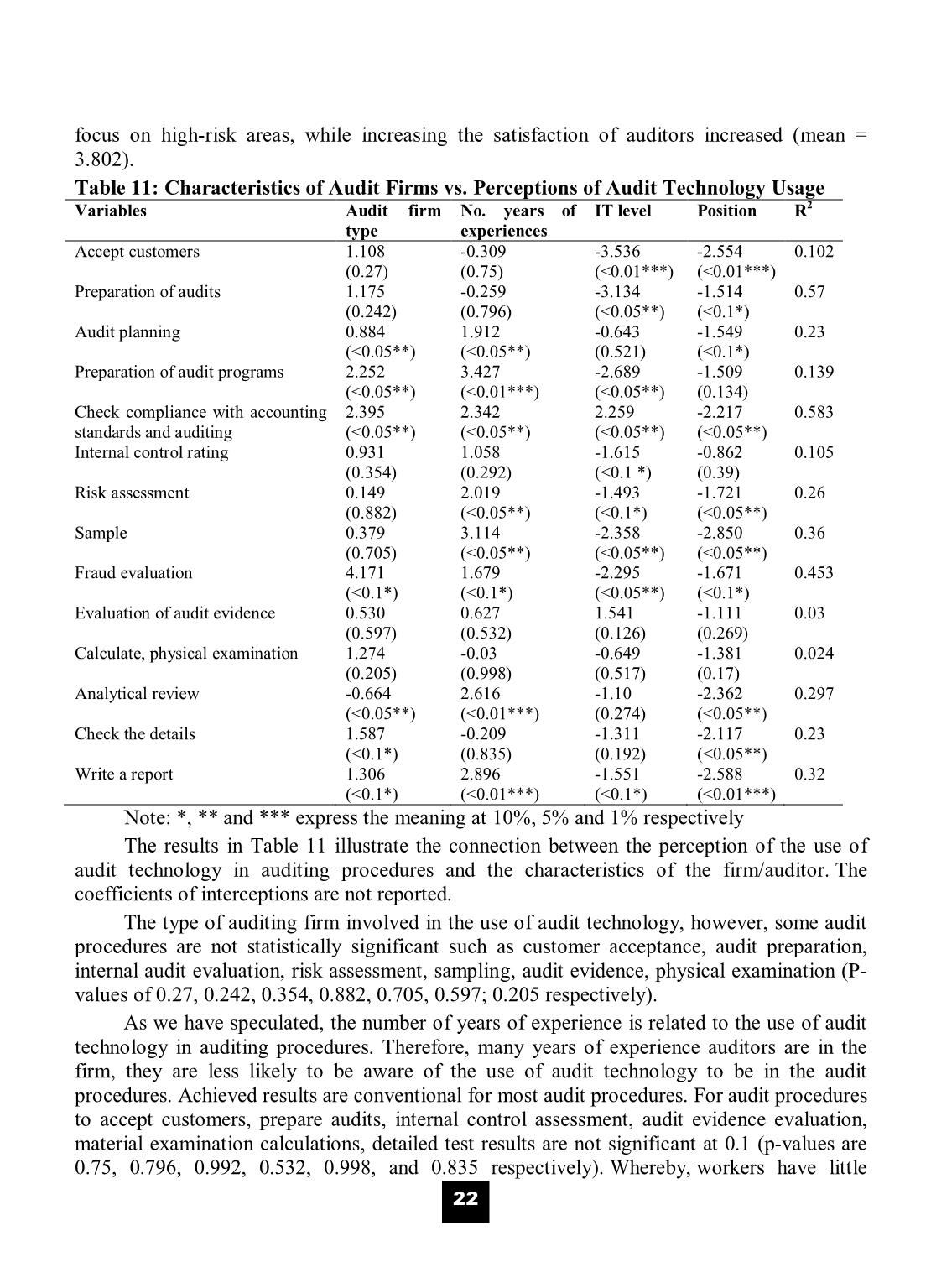

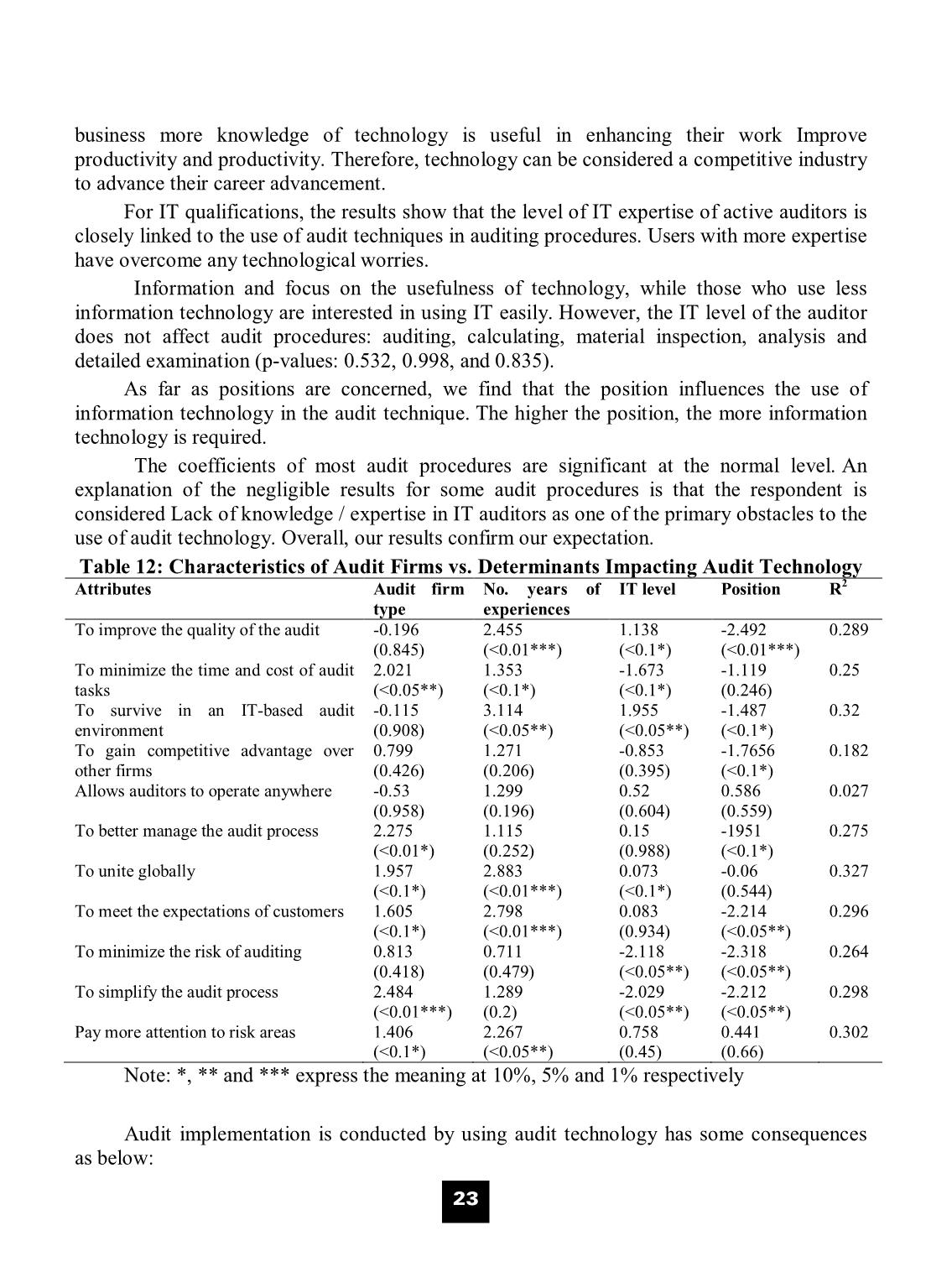

82) 2.019 (<0.05**) -1.493 (<0.1*) -1.721 (<0.05**) 0.26 Sample 0.379 (0.705) 3.114 (<0.05**) -2.358 (<0.05**) -2.850 (<0.05**) 0.36 Fraud evaluation 4.171 (<0.1*) 1.679 (<0.1*) -2.295 (<0.05**) -1.671 (<0.1*) 0.453 Evaluation of audit evidence 0.530 (0.597) 0.627 (0.532) 1.541 (0.126) -1.111 (0.269) 0.03 Calculate, physical examination 1.274 (0.205) -0.03 (0.998) -0.649 (0.517) -1.381 (0.17) 0.024 Analytical review -0.664 (<0.05**) 2.616 (<0.01***) -1.10 (0.274) -2.362 (<0.05**) 0.297 Check the details 1.587 (<0.1*) -0.209 (0.835) -1.311 (0.192) -2.117 (<0.05**) 0.23 Write a report 1.306 (<0.1*) 2.896 (<0.01***) -1.551 (<0.1*) -2.588 (<0.01***) 0.32 Note: *, ** and *** express the meaning at 10%, 5% and 1% respectively The results in Table 11 illustrate the connection between the perception of the use of audit technology in auditing procedures and the characteristics of the firm/auditor. The coefficients of interceptions are not reported. The type of auditing firm involved in the use of audit technology, however, some audit procedures are not statistically significant such as customer acceptance, audit preparation, internal audit evaluation, risk assessment, sampling, audit evidence, physical examination (P- values of 0.27, 0.242, 0.354, 0.882, 0.705, 0.597; 0.205 respectively). As we have speculated, the number of years of experience is related to the use of audit technology in auditing procedures. Therefore, many years of experience auditors are in the firm, they are less likely to be aware of the use of audit technology to be in the audit procedures. Achieved results are conventional for most audit procedures. For audit procedures to accept customers, prepare audits, internal control assessment, audit evidence evaluation, material examination calculations, detailed test results are not significant at 0.1 (p-values are 0.75, 0.796, 0.992, 0.532, 0.998, and 0.835 respectively). Whereby, workers have little n trÞ - Kinh nghiÖm quèc tÕ vµ thùc tr¹ng ë ViÖt Nam 23 business more knowledge of technology is useful in enhancing their work Improve productivity and productivity. Therefore, technology can be considered a competitive industry to advance their career advancement. For IT qualifications, the results show that the level of IT expertise of active auditors is closely linked to the use of audit techniques in auditing procedures. Users with more expertise have overcome any technological worries. Information and focus on the usefulness of technology, while those who use less information technology are interested in using IT easily. However, the IT level of the auditor does not affect audit procedures: auditing, calculating, material inspection, analysis and detailed examination (p-values: 0.532, 0.998, and 0.835). As far as positions are concerned, we find that the position influences the use of information technology in the audit technique. The higher the position, the more information technology is required. The coefficients of most audit procedures are significant at the normal level. An explanation of the negligible results for some audit procedures is that the respondent is considered Lack of knowledge / expertise in IT auditors as one of the primary obstacles to the use of audit technology. Overall, our results confirm our expectation. Table 12: Characteristics of Audit Firms vs. Determinants Impacting Audit Technology Attributes Audit firm type No. years of experiences IT level Position R2 To improve the quality of the audit -0.196 (0.845) 2.455 (<0.01***) 1.138 (<0.1*) -2.492 (<0.01***) 0.289 To minimize the time and cost of audit tasks 2.021 (<0.05**) 1.353 (<0.1*) -1.673 (<0.1*) -1.119 (0.246) 0.25 To survive in an IT-based audit environment -0.115 (0.908) 3.114 (<0.05**) 1.955 (<0.05**) -1.487 (<0.1*) 0.32 To gain competitive advantage over other firms 0.799 (0.426) 1.271 (0.206) -0.853 (0.395) -1.7656 (<0.1*) 0.182 Allows auditors to operate anywhere -0.53 (0.958) 1.299 (0.196) 0.52 (0.604) 0.586 (0.559) 0.027 To better manage the audit process 2.275 (<0.01*) 1.115 (0.252) 0.15 (0.988) -1951 (<0.1*) 0.275 To unite globally 1.957 (<0.1*) 2.883 (<0.01***) 0.073 (<0.1*) -0.06 (0.544) 0.327 To meet the expectations of customers 1.605 (<0.1*) 2.798 (<0.01***) 0.083 (0.934) -2.214 (<0.05**) 0.296 To minimize the risk of auditing 0.813 (0.418) 0.711 (0.479) -2.118 (<0.05**) -2.318 (<0.05**) 0.264 To simplify the audit process 2.484 (<0.01***) 1.289 (0.2) -2.029 (<0.05**) -2.212 (<0.05**) 0.298 Pay more attention to risk areas 1.406 (<0.1*) 2.267 (<0.05**) 0.758 (0.45) 0.441 (0.66) 0.302 Note: *, ** and *** express the meaning at 10%, 5% and 1% respectively Audit implementation is conducted by using audit technology has some consequences as below: n trÞ - Kinh nghiÖm quèc tÕ vµ thùc tr¹ng ë ViÖt Nam 24 Table 13: Consequences of Audit Technology Usage in Audit Performance Attributes Audit firm type No. years of experiences IT level Position R2 The assessment of partner/manager's work was done in a timely manner -1.217 (0.226) 1.472 (<0.1*) 1.354 (<0.1*) -0.333 (0.74) 0.195 Experienced staff has more time to focus on high risk areas -0.331 (0.741) 3.183 (<0.01***) 1.508 (<0.1*) -0.440 (0.660) 0.306 The assessment of partner / manager work has been made easier 0.08 (0.936) 0.717 (0.475) -7.95 (0.428) -1.242 (0.217) 0.134 Emphasis is put on recruiting audits with IT skills -1.343 (<0.1*) 2.252 (<0.05**) 0.061 (0.952) -2.240 (<0.05**) 0.287 Many audit tasks have been simplified 0.913 (0.363) 1.508 (0.134) -0.3 (0.765) -1.217 (0.226) 0.167 Job satisfaction of auditors increased 0.847 (0.398) 2.049 (<0.05**) -0.824 (0.412) -0.588 (0.558) 0.125 Other IT professionals recruited by audit firms 1.827 (<0.1*) 1.43 (<0.1*) -5.4 (0.59) -1.787 (<0.1*) 0.223 IT auditors hold higher positions in audit firms 2.858 (<0.01***) 0.882 (0.380) -0.825 (0.411) -1.161 (0.248) 0.269 Note: *, ** and *** express the meaning at 10%, 5% and 1% respectively Looking at Table 12 shows the results of examining the relationship between cognitive reasoning using audit technology in the auditing process and demographic characteristics of the participants. Highly educated, postgraduate, and cognitive respondents improved audit quality, reduced audit time and costs, reduced audit risk, and simplified process Audit is the most important in the use of audit technology. On the other hand, when respondents have more years of experience, they perceive that the reasons are not relevant weight. This end result may be due to years of experience with relatively low levels of participation in IT training, by reducing confidence in their ability to learn (Cleveland and Shore, 1992). The respondents had a large number of ICT specialists considering all the significant reasons, while respondents at management level, supervisory level, or partner level thought that the most important reasons for using the test technology The math is to minimize the time and expense of task audit, to minimize audit risk, and to pay more attention to the risk area. In general, the global coefficients are consistent and satisfying customer expectations are negligible at levels usually, common, normal. However, the significance of the determinants increases with the level of IT expertise of the auditor. Regarding the link between the cognitive consequences of using audit technology and the characteristics of the respondents, the results in Table 13 reveal that respondents have a graduate degree, With less experience, Knowledge of IT and management positions is n trÞ - Kinh nghiÖm quèc tÕ vµ thùc tr¹ng ë ViÖt Nam 25 recognized by the review of the work of the partners / managers and Emphasis on recruiting IT auditors is one of the most important consequences. Overall, these findings are consistent with previous results that respondents with postgraduate education and IT expertise are more affected by perceptive ease of use. 5. Conclusions and Recommendations Although auditing standards encourage the use of information technology in auditing, previous studies lacked the use of accounting technology in industrial revolution markets 4.0. The contribution of our article stems from its application to a revolutionary 4.0 technology environment, unlike previous studies that focused primarily on development markets. These results are particularly relevant for auditors, managers, and the academic community on improving the quality of audits by using audit technology. Audit technology is widely used in both technical and administrative audits of Preparation of Working Documents and Sampling. Auditors generally consider audit technology to be most important in risk assessment and sampling. For the use and importance of audit technology in administrative auditing procedures, issue customer invoices and summarize the results to review the top-ranked list. The leading reason for using audit technology is that it is important to improve the quality of auditing. However, the lack of auditor training and Lack of knowledge / expertise in IT of auditors are considered as the main constraints to the use of audit technology. This reflects a general cultural trend that needs further investigation. The determinants are most likely to explain why the nature and extent of interaction differ between the Big 4 and the non-Big 4 firms including their training facilities, expertise, and administrative support. Such determinants can affect the degree of cultural integration and reflect appropriately the adoption of IT in Vietnamese audit firms. To investigate the impact, if any, of such determinants, requires an interview-based survey to assess the extent of the cultural integration process and its potential impact on IT levels. And / or respondents' perceptions of the use of IT in the audit process. Finally, regarding the relationship between the use of the recognized technology and the characteristics of the firm / auditor, our evidence suggests that the use of technology audits in auditing procedures The assessment is significant when the IT auditor level increases, and when the auditing firm is a large firm 4, while the use of audit technology in auditing procedures is reduced by the auditor's experience. More detailed analysis provides rich results on specific determinants that shape the perception of respondents about the importance of audit technology. This perception is significantly affected by the demographic characteristics of the auditor. These results have significant implications for the decision to apply audit technology in audit firms. There are some limitations to this study. First, the main limitation of this study is the relatively small number of responses. Although respondents may be the ones who are most concerned about the issues being investigated and therefore, as can be said, are also the most informed, their views may not represent those people are not respondents. Second, the sample was not balanced because respondents from other audit firms were over represented by Big 4's big firms. n trÞ - Kinh nghiÖm quèc tÕ vµ thùc tr¹ng ë ViÖt Nam 26 ----------------------------- References Abou-El-Sood,H., Kotb, A,Allam, A. (2015). “Exploring auditors’ perceptions of the usage and importance of audit information technology". International Journal of Auditing, 19(3), 252-266. AICPA (2002a). "Audit documentation. Statement of Auditing Standards." New York: American Institute of Certified Public Accountants. AICPA (2002b). "Consideration of fraud in financial statement audit. Statement of Auditing Standards." No. 99. New York: American Institute of Certified Public Accountants. AICPA (2002c). "Interim financial information. Statement of Auditing Standards" No. 100. New York: American Institute of Certified Public Accountants. AICPA ((2006)). "Risk assessment standards. Statement of Auditing Standards". No. 104–11. New York: American Institute of Certified Public Accountants. Bierstaker, J., Janvrin, D. & Love,D. (2014) "What factors influence auditors' use of computer-assisted audit techniques?" Advances in Accounting, 30(1), 67-74. Clarke, R. (1988). "Information technology and dataveillance".Communications of the ACM, 31(5), 498-512. Cleveland, J.N. and Shore, L.M. (1992). "Self-and supervisory perspectives on age and work attitudes and performance".Journal of applied Psychology, 77(4), 469. Craswell, A., Stokes, D.J.&Laughton, J. (2002). "Auditor independence and fee dependence".Journal of Accounting and Economics, 33(2), 253-275. Elliott, R. K. and Jacobson, P.D. (1987). "Audit technology: A heritage and a promise",Journal of Accountancy, 163(5), 198-205. Hartono, J. (2012). "Adoption of information technology on small businesses: The role of environment, organizational and leader determinant." International Journal of Business, Humanities, and Technology, 2(4), 60-66. Ismail, N.A. and Abidin, A.Z. (2009). "Perception towards the importance and knowledge of information technology among auditors in Malaysia".Journal of Accounting and Taxation, 1(4),61-69. Janvrin, D., Bierstaker, J. &Love,D. (2008). "An examination of audit information technology use and perceived importance".Accounting Horizons, 22(1), 1-21. Manson,S., McCartney, S., Sherer, M.& Wallace, W.A. (1998). "Audit Automation in the UK and the US: A Comparative Study".International Journal of Auditing, 2(3), 233-246. Porter, C. E. and Donthu. N. (2006). "Using the technology acceptance model to explain how attitudes determine Internet usage: The role of perceived access barriers and demographics".Journal of business research, 59(9), 999-1007. Sundgren, S. and Svanström, T. (2010). "Auditor-In-Charge Characteristics and Going Concern Reporting Behavior: Does number of assignments, age and client fee dependence matter?".Contemporary Accounting Research, 31(2), 531-550. Venkatesh, V., Morris, M., Davis, G.&Davis, F. (2003). "User acceptance of information technology: Toward a unified view".MIS quarterly, 27(3),425-478. ----------------------------------

File đính kèm:

auditors_perception_in_usage_of_audit_information_technology.pdf

auditors_perception_in_usage_of_audit_information_technology.pdf