A study on the effect of corporate governance and capital structure on firm value in Vietnam

The paper examines the impact of corporate governance (CG), capital structure (CS) on firm value

(FV) of firms in Vietnam. The study used different regression methods using the data collected at

enterprises listed on the stock market in Vietnam over the period 2008 - 2018, with 2937 observations.

The research results find that the size of the Board of Directors, the independence of the Board of

Directors, the percentage of women participating in the Board of Directors had a positive influence on

FV. Besides, in the case of the Chairman of the Board of Directors controlling the CEO, the frequency

of the Board meeting had a negative effect on FV. The study has determined that CS has nonlinear

influence on FV, in addition, the research results also prove that firm size had positive relationship to

FV. The empirical research results are a useful basis to help businesses improve FV, thereby helping

businesses need to consider the elements of the Board of Directors in each enterprise, determine the

appropriate capital structure.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

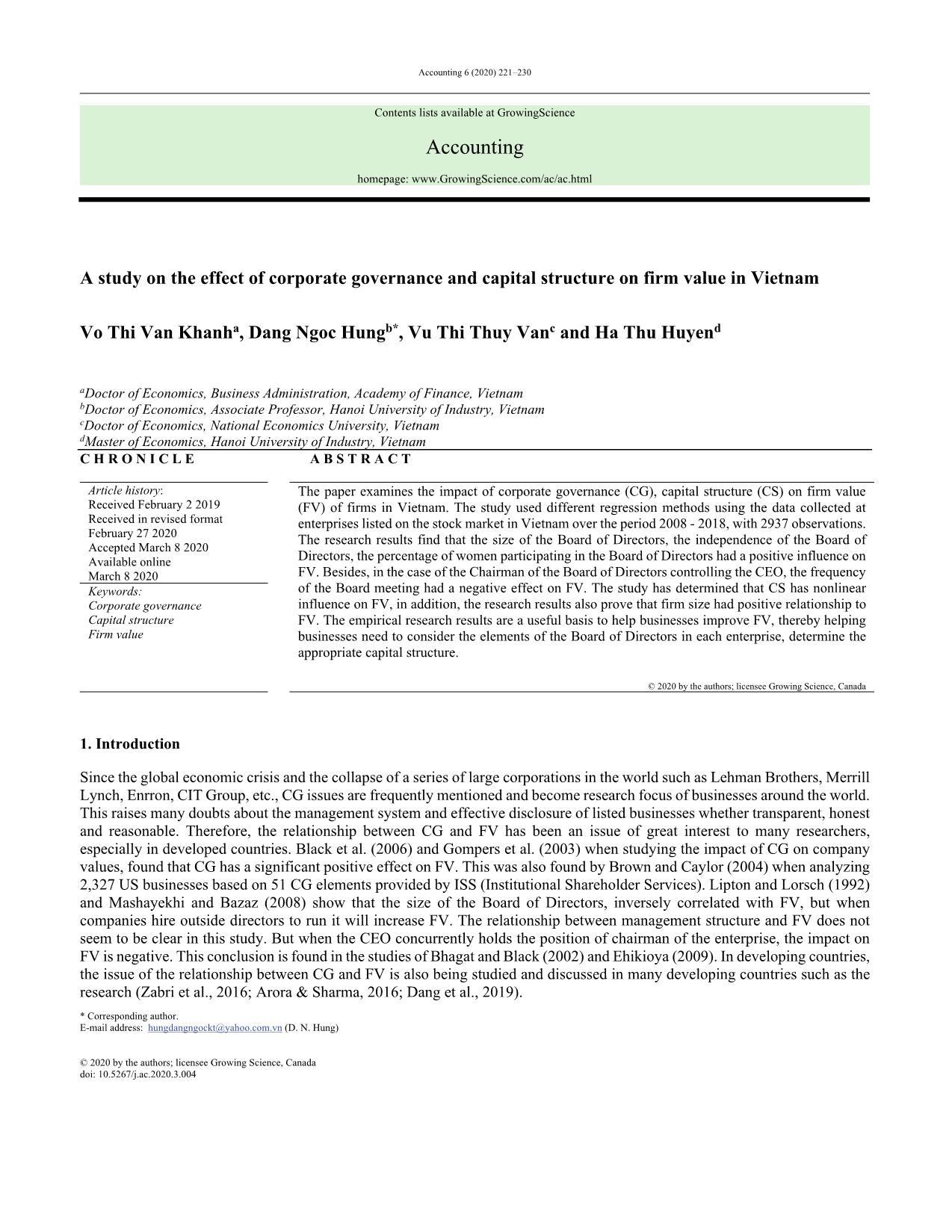

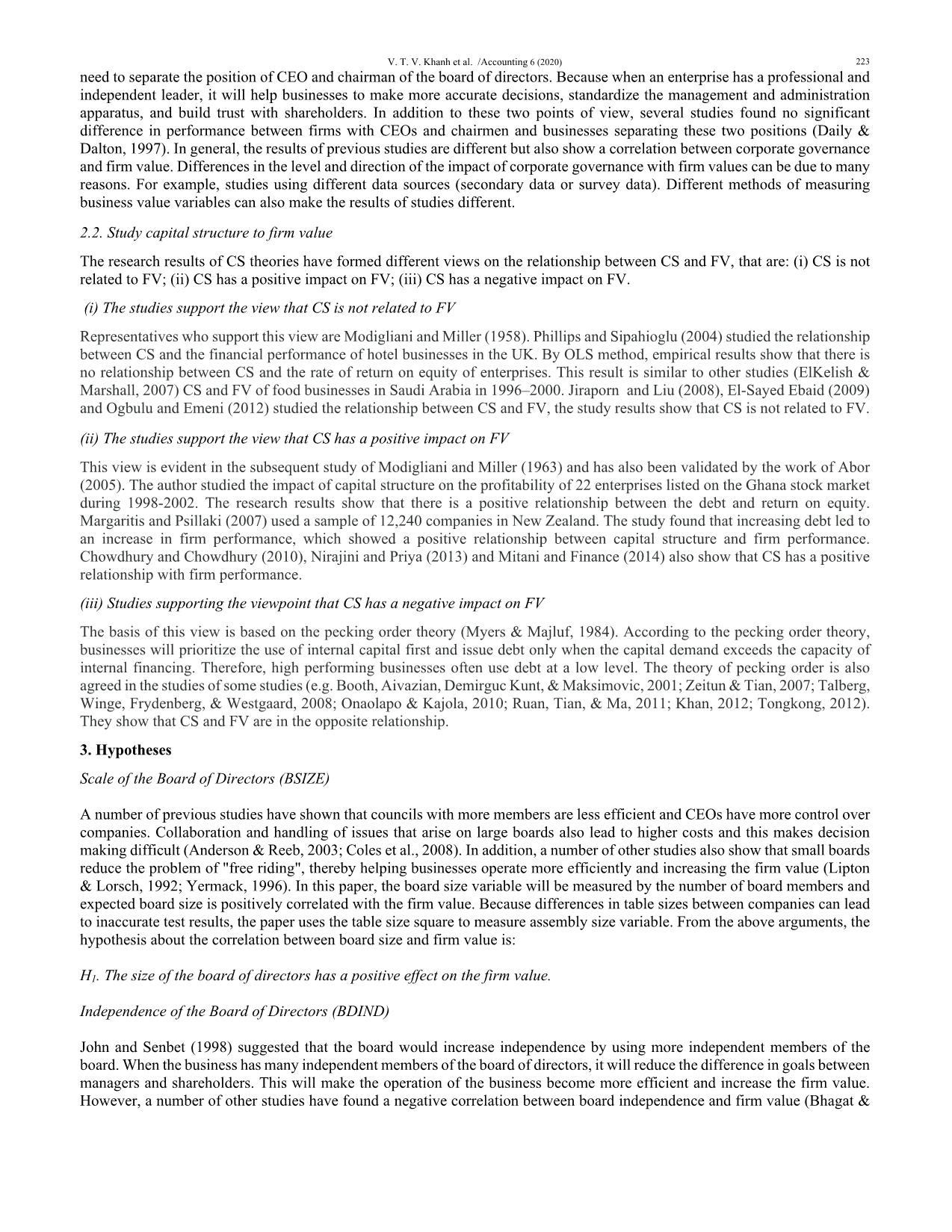

Tóm tắt nội dung tài liệu: A study on the effect of corporate governance and capital structure on firm value in Vietnam

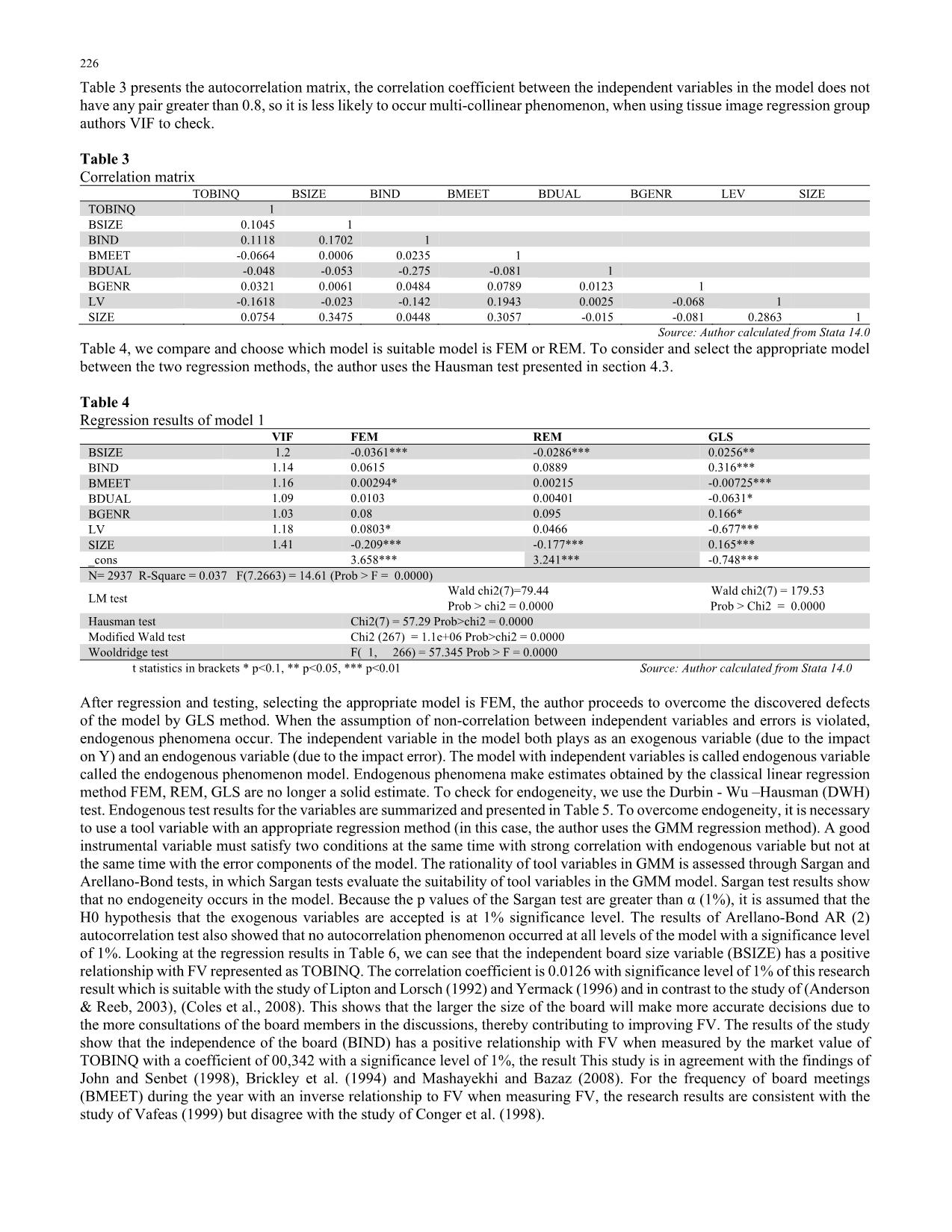

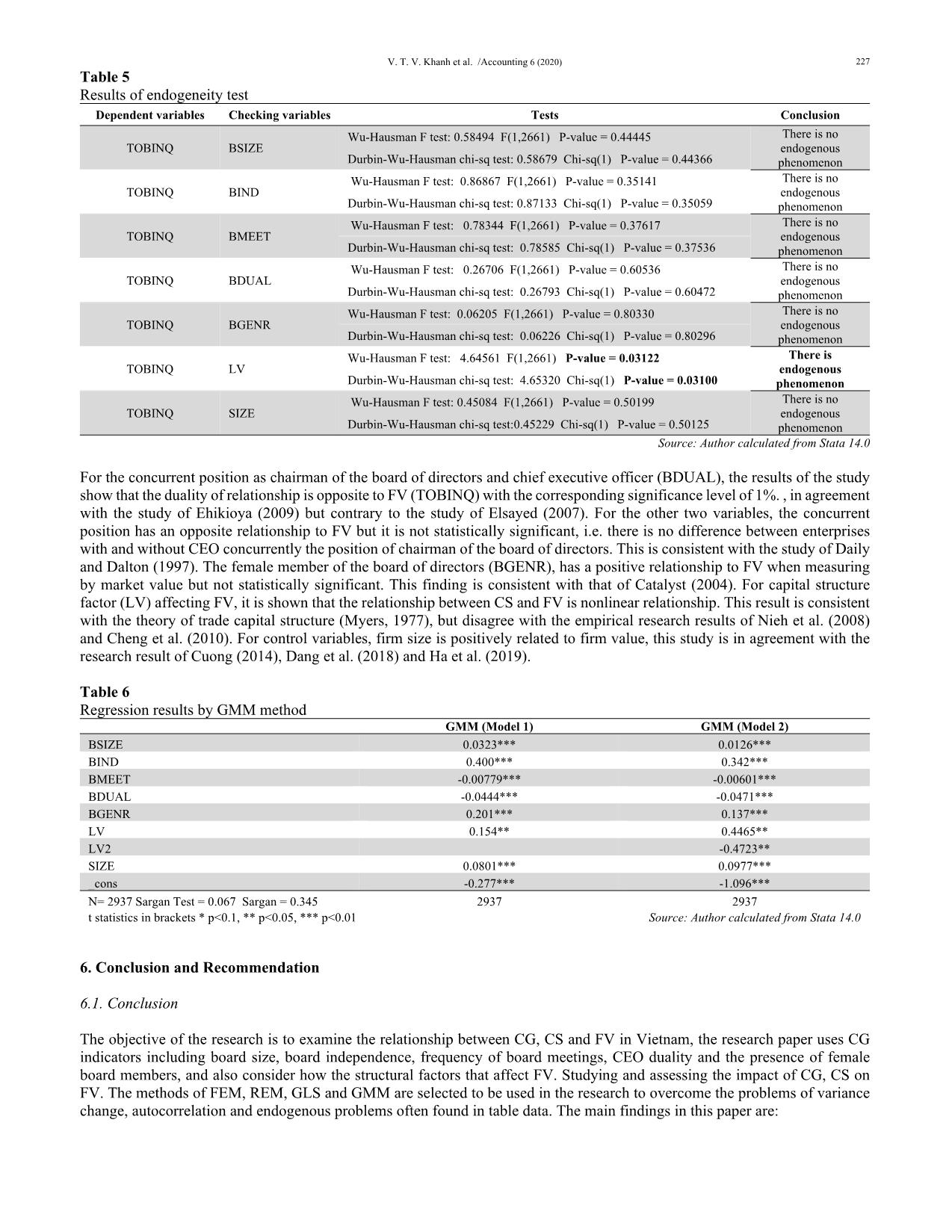

e of applying effective CG methods and identifying optimal CS for businesses in developing countries. development in general and in Vietnam in particular. The analysis results of the research show that when companies comply and implement CG well, they can make enterprises operate more effectively, reduce the agency cost of the business thereby increasing FV. Businesses in Vietnam are mostly small and medium-sized enterprises, so expanding the board of directors may result in administrative costs, difficulties in unifying and making decisions and can conflicts between members. Therefore, businesses need to build a board suitable to the size of the business. A reasonably sized board can make the coordination among the board members better, helping to supervise and manage more closely. However, as the business grows to a larger scale, operating in more areas, the CEO of the business needs to receive more advice from the members of the board of directors to come up with correct decisions help companies work more efficiently. Meanwhile, the expansion of the board size is an indispensable thing that businesses need to do. But to ensure that the expansion of the board size is effective for businesses, the board members must be competent, experienced and knowledgeable in the field of business operations. Besides, the positive relationship between the independence of the board and the firm value is consistent with the views in representation theory. There is always a conflict of interest between the directors and the shareholders. Directors make actions and decisions for personal gain and do not focus on the goal of maximizing shareholder value and can cause damage to shareholders. Therefore, the Board of Directors was created as a mechanism to oversee the activities of the directors in the company. The more independent the board of directors is, the more effective the monitoring mechanism is, the more effective the business operations will be and increase the enterprise value (according to the market value). Therefore, to strengthen the monitoring mechanism and improve the operational efficiency of the business, it is necessary to increase the independence of the board of directors in the enterprise. Regarding gender of the board, based on the above research results it can be concluded that diversification in the board is a good choice for businesses, but the election and appointment Board members should rely on competencies that will be better for business performance and value for the business. Therefore, increasing the percentage of female members on the board of directors can have an important impact on the business strategy, thereby raising the company's FV. Research results demonstrate that capital structure has a great influence on the price of listed businesses. Therefore, business executives need to pay special attention to debt management accordingly. The results also indicate that there is no optimal capital structure that is applicable to all businesses. Depending on the characteristics of the business line and the characteristics of each company, the chief financial officer can devise a capital structure that maximizes business value. However, businesses also need to consider the burden of interest expenses, interest rate risks, liquidity risks to limit the cost of financial exhaustion that may arise when using a large proportion of liabilities. First of all, businesses should use internal capital by mobilizing from employees in the enterprise, from the unused capital of the business to pay off bank loans. At the same time, businesses need to focus on consolidating the business activities of the business activities to improve operational efficiency. Next, when the business efficiency is improved, the financial situation is better, the enterprise can increase its equity from retained earnings. As the position and competitiveness are gradually raised, businesses can gradually improve the debt usage within the thresholds to invest in business development, by seeking sources that do not require much talent. production assurance. Enterprises should expand the form of joint ventures and partners with both domestic and foreign partners to have more assets, especially fixed assets with modern technology. From there, businesses can take advantage of the management, assets and markets of the partners to enhance the firm value. Acknowledgements We gratefully acknowledge the financial support from the Vietnam National Foundation for Science and Technology Development (NAFOSTED) under Grant Number 502.02-2019.302 References Abor, J. (2005). The effect of capital structure on profitability: an empirical analysis of listed firms in Ghana. The Journal of Risk Finance, 6(5), 438-445. Anderson, R. C., & Reeb, D. M. (2003). Founding‐family ownership and firm performance: evidence from the S&P 500. The Journal of Finance, 58(3), 1301-1328. doi: https://doi.org/10.1111/1540-6261.00567 V. T. V. Khanh et al. /Accounting 6 (2020) 229 Arora, A., & Sharma, C. (2016). Corporate governance and firm performance in developing countries: evidence from India. Corporate Governance, 16(2), 420-436. doi: https://doi.org/10.1108/CG-01-2016-0018 Bhagat, S., & Black, B. (2002). The non-correlation between board independence and long-term firm performance. Journal of Corporation Law, 27(1), 231-273. Black, B. S., Jang, H., & Kim, W. (2006). Does corporate governance predict firms' market values? Evidence from Korea. The Journal of Law, Economics, and Organization, 22(2), 366-413. doi: https://doi.org/10.1093/jleo/ewj018 Booth, L., Aivazian, V., Demirguc‐Kunt, A., & Maksimovic, V. (2001). Capital structures in developing countries. The Journal of Finance, 56(1), 87-130. doi: https://doi.org/10.1111/0022-1082.00320 Boyd, B. K. (1995). CEO duality and firm performance: A contingency model. Strategic Management Journal, 16(4), 301-312. doi: https://doi.org/10.1002/smj.4250160404 Brickley, J. A., Coles, J. L., & Terry, R. L. (1994). Outside directors and the adoption of poison pills. Journal of Financial Economics, 35(3), 371-390. doi: https://doi.org/10.1016/0304-405X(94)90038-8 Brown, L. D., & Caylor, M. L. (2004). Corporate governance and firm performance. Available at SSRN 586423, 1-52. Catalyst. (2004). The bottom line: Connecting corporate performance and gender diversity: Catalyst. Coles, J. L., Daniel, N. D., & Naveen, L. (2008). Boards: Does one size fit all? Journal of financial economics, 87(2), 329-356. Conger, J. A., Finegold, D., & Lawler, E. E. (1998). Appraising boardroom performance. Harvard business review, 76, 136- 164. Core, J. E., Guay, W. R., & Rusticus, T. O. (2006). Does weak governance cause weak stock returns? An examination of firm operating performance and investors' expectations. The Journal of Finance, 61(2), 655-687. Cuong, N. T. (2014). Threshold effect of capital structure on firm value: Evidence from seafood processing enterprises in the South Central region of Vietnam. International Journal of Finance & Banking Studies, 3(3), 14-29. Cheng, Y.-S., Liu, Y.-P., & Chien, C.-Y. (2010). Capital structure and firm value in China: A panel threshold regression analysis. African Journal of Business Management, 4(12), 2500-2507. Chowdhury, A., & Chowdhury, S. P. (2010). Impact of capital structure on firm’s value: Evidence from Bangladesh. Business and Economic Horizons, 3(3), 111-122. Daily, C. M., & Dalton, D. R. (1997). CEO and board chair roles held jointly or separately: much ado about nothing? Academy of Management Perspectives, 11(3), 11-20. Dang, H. N., Vu, V. T. T., Ngo, X. T., & Hoang, H. T. V. (2019). Study the Impact of Growth, Firm Size, Capital Structure, and Profitability on Enterprise Value: Evidence of Enterprises in Vietnam. Journal of Corporate Accounting & Finance, 30(1), 144-160. Dang, N. H., Pham, D. C., & Vu, T. B. H. (2018). Effects of financial statements information on firms’ value: evidence from Vietnamese listed firms. Investment Management and Financial Innovations, 15(4), 210-218. Detthamrong, U., Chancharat, N., & Vithessonthi, C. (2017). Corporate governance, capital structure and firm performance: evidence from Thailand. Research in International Business and Finance, 42(1), 689-709. Durand, D. (1952). Costs of debt and equity funds for business: trends and problems of measurement. Paper presented at the Conference on research in business finance. Ehikioya, B. I. (2009). Corporate governance structure and firm performance in developing economies: evidence from Nigeria. Corporate Governance: The International Journal of Business in Society, 9(3), 231-243. El-Sayed Ebaid, I. (2009). The impact of capital-structure choice on firm performance: empirical evidence from Egypt. The Journal of Risk Finance, 10(5), 477-487. ElKelish, W. W., & Marshall, A. P. (2007). Financial structure and firm value: empirical evidence from the emerging market of the United Arab Emirates. International Journal of Business Research, 7(1), 69-76. Elsayed, K. (2007). Does CEO duality really affect corporate performance? Corporate Governance: An International Review, 15(6), 1203-1214. Fosberg, R. H. (1989). Outside directors and managerial monitoring. Akron Business and Economic Review, 20(2), 24-32. Gompers, P., Ishii, J., & Metrick, A. (2003). Corporate governance and equity prices. The Quarterly Journal of Economics, 118(1), 107-156. Ha, T. V., Dang, N. H., Tran, M. D., Van Vu, T. T., & Trung, Q. (2019). Determinants Influencing Financial Performance of Listed Firms: Quantile Regression Approach. Asian Economic and Financial Review, 9(1), 78-90. Hoyt, R. E., & Liebenberg, A. P. (2011). The value of enterprise risk management. Journal of Risk and Insurance, 78(4), 795- 822. Hung, D. N., Pham, C. D., & Ha, V. T. B. (2018). Effects of Financial Statements Information on Firms’ Value: Evidence From Vietnamese Listed Firms. Investment Management and Financial Innovations, 15(4), 210-218. Jensen, M. C. (1993). The modern industrial revolution, exit, and the failure of internal control systems. The Journal of Finance, 48(3), 831-880. Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360. Jiraporn, P., & Liu, Y. (2008). Capital structure, staggered boards, and firm value. Financial Analysts Journal, 64(1), 49-60. 230 John, K., & Senbet, L. W. (1998). Corporate governance and board effectiveness. Journal of Banking & Finance, 22(4), 371- 403. Khan, A. G. (2012). The relationship of capital structure decisions with firm performance: A study of the engineering sector of Pakistan. International Journal of Accounting Financial Reporting, 2(1), 245-262. Lipton, M., & Lorsch, J. W. (1992). A modest proposal for improved corporate governance. The Business Lawyer, 48(1), 59- 77. Margaritis, D., & Psillaki, M. (2007). Capital structure and firm efficiency. Journal of Business Finance & Accounting, 34(9‐ 10), 1447-1469. Mashayekhi, B., & Bazaz, M. S. (2008). Corporate governance and firm performance in Iran. Journal of Contemporary Accounting & Economics, 4(2), 156-172. Mitani, H. J. I. R. o. E., & Finance. (2014). Capital structure and competitive position in product market. 29, 358-371. Modigliani, F., & Miller, M. H. (1958). The cost of capital, corporation finance and the theory of investment. The American Economic Review, 48(3), 261-297. Modigliani, F., & Miller, M. H. (1963). Corporate income taxes and the cost of capital: a correction. The American Economic Review, 433-443. Myers, S. C. (1977). Determinants of corporate borrowing. Journal of Financial Economics, 5(2), 147-175. Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187-221. Nieh, C.-C., Yau, H.-Y., & Liu, W.-C. (2008). Investigation of target capital structure for electronic listed firms in Taiwan. Emerging Markets Finance and Trade, 44(4), 75-87. Nirajini, A., & Priya, K. (2013). Impact of capital structure on financial performance of the listed trading companies in Sri Lanka. International Journal of Scientific Research Publications, 3(5), 1-9. Ogbulu, O. M., & Emeni, F. K. (2012). Capital structure and firm value: Empirical evidence from Nigeria. International Journal of Business and Social Science, 3(19), 252-261. Onaolapo, A. A., & Kajola, S. O. (2010). Capital structure and firm performance: Evidence from Nigeria. European Journal of Economics, Finance and Administrative Sciences, 25, 70-82. Phillips, P. A., & Sipahioglu, M. A. (2004). Performance implications of capital structure: evidence from quoted UK organisations with hotel interests. The Service Industries Journal, 24(5), 31-51. doi: Rechner, P. L., & Dalton, D. R. (1991). CEO duality and organizational performance: A longitudinal analysis. Strategic Management Journal, 12(2), 155-160. d Rose, C. (2007). Does female board representation influence firm performance? The Danish evidence. Corporate Governance: An International Review, 15(2), 404-413. Ruan, W., Tian, G., & Ma, S. (2011). Managerial ownership, capital structure and firm value: Evidence from China’s civilian- run firms. Australasian Accounting, Business Finance Journal, 5(3), 73-92. Shrader, C., Blackburn, V. B., & Iles, P. (1997). Women in management and firm financial performance: An exploratory study. Journal of Managerial Issues, 9(3), 355-373. Talberg, M., Winge, C., Frydenberg, S., & Westgaard, S. J. I. J. o. t. E. o. B. (2008). Capital structure across industries. International Journal of the Economics of Business, 15(2), 181-200. Tongkong, S. (2012). Key factors influencing capital structure decision and its speed of adjustment of Thai listed real estate companies. Procedia-Social Behavioral Sciences, 40, 716-720. Vafeas, N. (1999). Board meeting frequency and firm performance. Journal of financial economics, 53(1), 113-142. Yermack, D. (1996). Higher market valuation of companies with a small board of directors. Journal of Financial Economics, 40(2), 185-211. Zabri, S. M., Ahmad, K., & Wah, K. K. (2016). Corporate governance practices and firm performance: Evidence from top 100 public listed companies in Malaysia. Procedia Economics and Finance, 35(1), 287-296. Zeitun, R., & Tian, G. G. (2007). Capital structure and corporate performance: evidence from Jordan. Australasian Accounting, Business and Finance Journal, 1(4), 40-61. © 2020 by the authors; licensee Growing Science, Canada. This is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (

File đính kèm:

a_study_on_the_effect_of_corporate_governance_and_capital_st.pdf

a_study_on_the_effect_of_corporate_governance_and_capital_st.pdf