Examining the relationship between electricity consumption, financial development and economic growth in ASEAN countries: Evidence from a bayesian analysis

The literature has suggested that financial development and electricity consumption are key determinants of economic growth. However, existing studies usually was applied the frequentist inference, which is an outdated estimator. By applying the Bayesian approach via the Metropolis-Hasting and Gibbs samplers as the MCMC methods, the study aims to re-examine the impact of financial development and electricity consumption on economic growth in ASEAN+6 countries from 1980 to 2016. The obtained outcome shows that the impact of both financial development and electricity consumption is strong and positive on economic growth. There is a uni-directional causality running from economic growth to energy consumption, supported the Conversation hypothesis. Based on the empirical result, several policy implications are suggested for emerging countries, ASEAN+6 nations, in particular

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Tóm tắt nội dung tài liệu: Examining the relationship between electricity consumption, financial development and economic growth in ASEAN countries: Evidence from a bayesian analysis

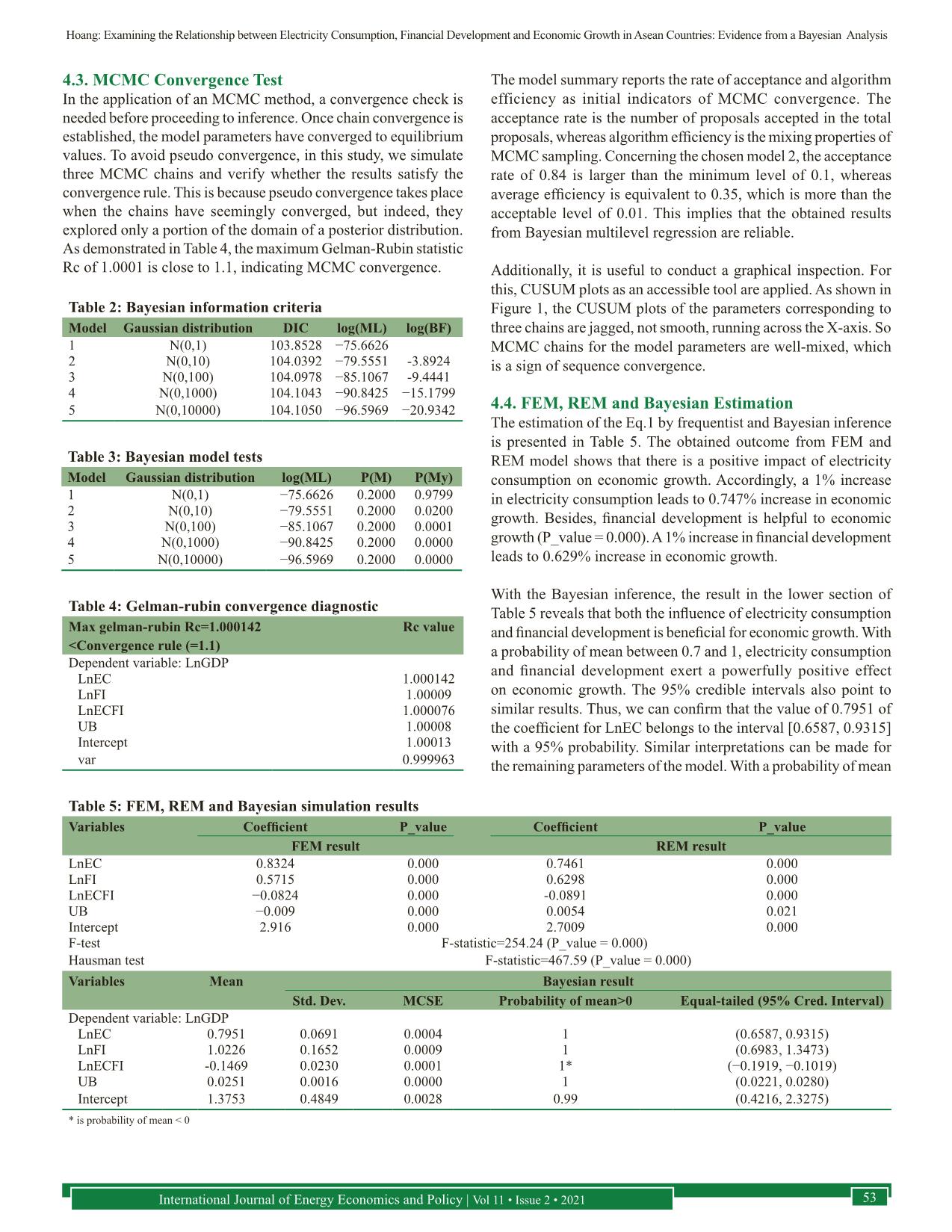

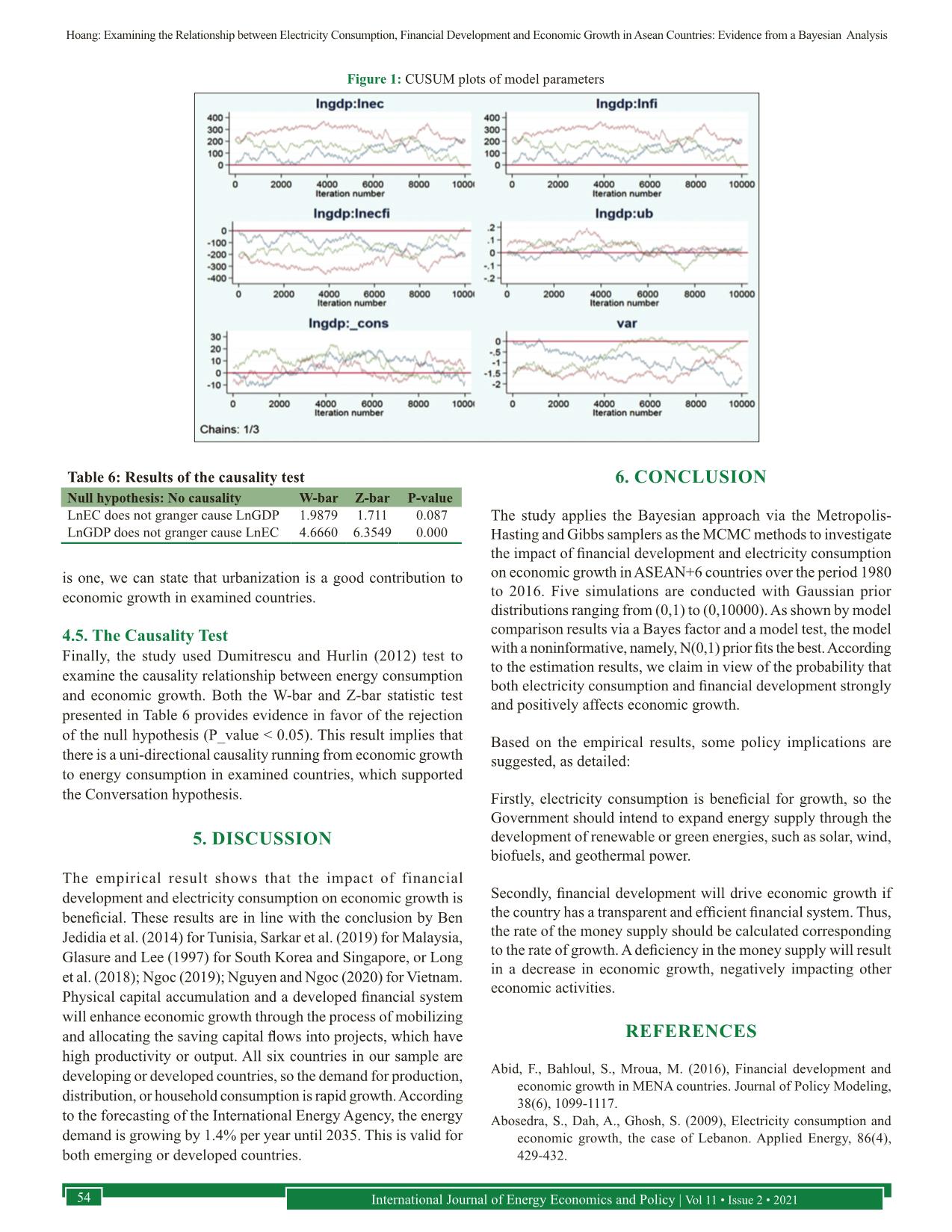

an between 0.7 and 1, electricity consumption and financial development exert a powerfully positive effect on economic growth. The 95% credible intervals also point to similar results. Thus, we can confirm that the value of 0.7951 of the coefficient for LnEC belongs to the interval [0.6587, 0.9315] with a 95% probability. Similar interpretations can be made for the remaining parameters of the model. With a probability of mean Table 2: Bayesian information criteria Model Gaussian distribution DIC log(ML) log(BF) 1 N(0,1) 103.8528 −75.6626 2 N(0,10) 104.0392 −79.5551 -3.8924 3 N(0,100) 104.0978 −85.1067 -9.4441 4 N(0,1000) 104.1043 −90.8425 −15.1799 5 N(0,10000) 104.1050 −96.5969 −20.9342 Table 3: Bayesian model tests Model Gaussian distribution log(ML) P(M) P(My) 1 N(0,1) −75.6626 0.2000 0.9799 2 N(0,10) −79.5551 0.2000 0.0200 3 N(0,100) −85.1067 0.2000 0.0001 4 N(0,1000) −90.8425 0.2000 0.0000 5 N(0,10000) −96.5969 0.2000 0.0000 Table 4: Gelman-rubin convergence diagnostic Max gelman-rubin Rc=1.000142 <Convergence rule (=1.1) Rc value Dependent variable: LnGDP LnEC 1.000142 LnFI 1.00009 LnECFI 1.000076 UB 1.00008 Intercept 1.00013 var 0.999963 Table 5: FEM, REM and Bayesian simulation results Variables Coefficient P_value Coefficient P_value FEM result REM result LnEC 0.8324 0.000 0.7461 0.000 LnFI 0.5715 0.000 0.6298 0.000 LnECFI −0.0824 0.000 -0.0891 0.000 UB −0.009 0.000 0.0054 0.021 Intercept 2.916 0.000 2.7009 0.000 F-test F-statistic=254.24 (P_value = 0.000) Hausman test F-statistic=467.59 (P_value = 0.000) Variables Mean Bayesian result Std. Dev. MCSE Probability of mean>0 Equal-tailed (95% Cred. Interval) Dependent variable: LnGDP LnEC 0.7951 0.0691 0.0004 1 (0.6587, 0.9315) LnFI 1.0226 0.1652 0.0009 1 (0.6983, 1.3473) LnECFI -0.1469 0.0230 0.0001 1* (−0.1919, −0.1019) UB 0.0251 0.0016 0.0000 1 (0.0221, 0.0280) Intercept 1.3753 0.4849 0.0028 0.99 (0.4216, 2.3275) * is probability of mean < 0 Hoang: Examining the Relationship between Electricity Consumption, Financial Development and Economic Growth in Asean Countries: Evidence from a Bayesian Analysis International Journal of Energy Economics and Policy | Vol 11 • Issue 2 • 202154 is one, we can state that urbanization is a good contribution to economic growth in examined countries. 4.5. The Causality Test Finally, the study used Dumitrescu and Hurlin (2012) test to examine the causality relationship between energy consumption and economic growth. Both the W-bar and Z-bar statistic test presented in Table 6 provides evidence in favor of the rejection of the null hypothesis (P_value < 0.05). This result implies that there is a uni-directional causality running from economic growth to energy consumption in examined countries, which supported the Conversation hypothesis. 5. DISCUSSION The empirical result shows that the impact of financial development and electricity consumption on economic growth is beneficial. These results are in line with the conclusion by Ben Jedidia et al. (2014) for Tunisia, Sarkar et al. (2019) for Malaysia, Glasure and Lee (1997) for South Korea and Singapore, or Long et al. (2018); Ngoc (2019); Nguyen and Ngoc (2020) for Vietnam. Physical capital accumulation and a developed financial system will enhance economic growth through the process of mobilizing and allocating the saving capital flows into projects, which have high productivity or output. All six countries in our sample are developing or developed countries, so the demand for production, distribution, or household consumption is rapid growth. According to the forecasting of the International Energy Agency, the energy demand is growing by 1.4% per year until 2035. This is valid for both emerging or developed countries. 6. CONCLUSION The study applies the Bayesian approach via the Metropolis- Hasting and Gibbs samplers as the MCMC methods to investigate the impact of financial development and electricity consumption on economic growth in ASEAN+6 countries over the period 1980 to 2016. Five simulations are conducted with Gaussian prior distributions ranging from (0,1) to (0,10000). As shown by model comparison results via a Bayes factor and a model test, the model with a noninformative, namely, N(0,1) prior fits the best. According to the estimation results, we claim in view of the probability that both electricity consumption and financial development strongly and positively affects economic growth. Based on the empirical results, some policy implications are suggested, as detailed: Firstly, electricity consumption is beneficial for growth, so the Government should intend to expand energy supply through the development of renewable or green energies, such as solar, wind, biofuels, and geothermal power. Secondly, financial development will drive economic growth if the country has a transparent and efficient financial system. Thus, the rate of the money supply should be calculated corresponding to the rate of growth. A deficiency in the money supply will result in a decrease in economic growth, negatively impacting other economic activities. REFERENCES Abid, F., Bahloul, S., Mroua, M. (2016), Financial development and economic growth in MENA countries. Journal of Policy Modeling, 38(6), 1099-1117. Abosedra, S., Dah, A., Ghosh, S. (2009), Electricity consumption and economic growth, the case of Lebanon. Applied Energy, 86(4), 429-432. Figure 1: CUSUM plots of model parameters Table 6: Results of the causality test Null hypothesis: No causality W-bar Z-bar P-value LnEC does not granger cause LnGDP 1.9879 1.711 0.087 LnGDP does not granger cause LnEC 4.6660 6.3549 0.000 Hoang: Examining the Relationship between Electricity Consumption, Financial Development and Economic Growth in Asean Countries: Evidence from a Bayesian Analysis International Journal of Energy Economics and Policy | Vol 11 • Issue 2 • 2021 55 Acaravci, A. (2010), Structural breaks, electricity consumption and economic growth: Evidence from Turkey. Romanian Journal of Economic Forecasting, 2, 140-154. Alsamara, M., Mrabet, Z., Barkat, K., Elafif, M. (2018), The Impacts of trade and financial developments on economic growth in Turkey: ARDL approach with structural break. Emerging Markets Finance and Trade, 55(8), 1671-1680. Apergis, N., Payne, J.E. (2010), Energy consumption and growth in South America: Evidence from a panel error correction model. Energy Economics, 32(6), 1421-1426. Balcilar, M., Bekun, F.V., Uzuner, G. (2019), Revisiting the economic growth and electricity consumption nexus in Pakistan. Environmental Science and Pollution Research, 26(12), 12158-12170. Ben Jedidia, K., Boujelbène, T., Helali, K. (2014), Financial development and economic growth: New evidence from Tunisia. Journal of Policy Modeling, 36(5), 883-898. Bernardo, J.M., Smith, A.F.M. (1994), Bayesian Theory. Hoboken: John Wiley & Sons, Inc. Bretschger, L., Steger, T.M. (2004), The dynamics of economic integration: Theory and policy. International Economics and Economic Policy, 1(2-3), 119-134. Burakov, D., Freidin, M. (2017), Financial development, economic growth and renewable energy consumption in Russia: A vector error correction approach. International Journal of Energy Economics and Policy, 7(6), 39-47. Chandran, V.G.R., Sharma, S., Madhavan, K. (2010), Electricity consumption-growth nexus: The case of Malaysia. Energy Policy, 38(1), 606-612. Chen, S.T., Kuo, H.I., Chen, C.C. (2007), The relationship between GDP and electricity consumption in 10 Asian countries. Energy Policy, 35(4), 2611-2621. Demetriades, P.O., Hussein, K.A. (1996), Does financial development cause economic growth? Time-series evidence from 16 countries. Journal of Development Economics, 51(2), 387-411. Dumitrescu, E.I., Hurlin, C. (2012), Testing for Granger non-causality in heterogeneous panels. Economic Modelling, 29(4), 1450-1460. Edwards, S. (2001), Capital Mobility and Economic Performance: Are Emerging Economies Different? NBER Working Paper No. 8076. Available from: https://www.nber.org/papers/w8076. Ghosh, S. (2009), Electricity supply, employment and real GDP in India: Evidence from cointegration and Granger-causality tests. Energy Policy, 37(8), 2926-2929. Glasure, Y.U., Lee, A.R. (1997), Cointegration, error-correction, and the relationship between GDP and energy: The case of South Korea and Singapore. Resource and Energy Economics, 20, 17-25. Golam, A.M., Nazrul, I.A.K. (2011), Electricity consumption and economic growth nexus in Bangladesh: Revisited evidences. Energy Policy, 39(10), 6145-6150. Goldsmith, R.W. (1969), Financial Structure and Development. New Haven: Yale University Press. Greenwood, J., Jovanovic, B. (1990), Financial development, growth, and the distribution of income. Journal of Political Economy, 98(5), 1076-1107. Ha, N.M., Ngoc, B.H. (2020), Revisiting the relationship between energy consumption and economic growth nexus in Vietnam: New evidence by asymmetric ARDL cointegration. Applied Economics Letters, 2020, 1789543. Hamdi, H., Sbia, R., Shahbaz, M. (2014), The nexus between electricity consumption and economic growth in Bahrain. Economic Modelling, 38, 227-237. Ibrahiem, D.M. (2015), Renewable electricity consumption, foreign direct investment and economic growth in Egypt: An ARDL approach. Procedia Economics and Finance, 30, 313-323. Ibrahim, M., Alagidede, P. (2018), Effect of financial development on economic growth in sub-Saharan Africa. Journal of Policy Modeling, 40(6), 1104-1125. Jeffreys, H. (1962), Theory of probability. Geophysical Journal International, 6(4), 555-558. Kahouli, B. (2017), The short and long run causality relationship among economic growth, energy consumption and financial development: Evidence from South Mediterranean countries (SMCs). Energy Economics, 68, 19-30. King, R.G., Levine, R. (1993), Finance, entrepreneurship and growth: Theory and evidence. Journal of Monetary Economics, 32(3), 513-542. Komal, R., Abbas, F. (2015), Linking financial development, economic growth and energy consumption in Pakistan. Renewable and Sustainable Energy Reviews, 44, 211-220. Kraft, J., Kraft, A. (1978), On the Relationship between energy and GNP. The Journal of Energy and Development, 3(2), 401-403. Law, S.H., Singh, N. (2014), Does too much finance harm economic growth? Journal of Banking and Finance, 41, 36-44. Liang, Q., Teng, J.Z. (2006), Financial development and economic growth: Evidence from China. China Economic Review, 17(4), 395-411. Long, P.D., Ngoc, B.H., My, D.T.H. (2018), The relationship between foreign direct investment, electricity consumption and economic growth in Vietnam. International Journal of Energy Economics and Policy, 8(3), 267-274. Mahi, M., Phoong, S.W., Ismail, I., Isa, C.R. (2019), Energy-finance- growth nexus in ASEAN-5 countries: An ARDL bounds test approach. Sustainability, 12(1), 1-16. Masten, A.B., Coricelli, F., Masten, I. (2008), Non-linear growth effects of financial development: Does financial integration matter? Journal of International Money and Finance, 27(2), 295-313. McKinnon, R.I. (1974), Money and capital in economic development. The Economic Journal, 84(334), 422-423. Ngoc, B.H. (2019), Energy consumption and economic growth nexus in Vietnam: An ARDL approach. In beyond traditional probabilistic methods in economics. In: Kreinovich, V., Thach, N., Trung, N., van Thanh, D., editors. Beyond Traditional Probabilistic Methods in Economics. ECONVN 2019. Studies in Computational Intelligence. Vol. 809. Cham: Springer. p311-322. Nguyen, H.M., Ngoc, B.H. (2020), Energy consumption-economic growth nexus in Vietnam: An ARDL approach with a structural break. The Journal of Asian Finance, Economics and Business, 7(1), 101-110. Okada, K. (2013), The interaction effects of financial openness and institutions on international capital flows. Journal of Macroeconomics, 35, 31-143. Omri, A. (2014), An international literature survey on energy-economic growth nexus: Evidence from country-specific studies. Renewable and Sustainable Energy Reviews, 38, 951-959. Ono, S. (2017), Financial development and economic growth nexus in Russia. Russian Journal of Economics, 3(3), 321-332. Payne, J.E. (2009), On the dynamics of energy consumption and output in the US. Applied Energy, 86(4), 575-577. Rafindadi, A.A., Ozturk, I. (2016), Effects of financial development, economic growth and trade on electricity consumption: Evidence from post-Fukushima Japan. Renewable and Sustainable Energy Reviews, 54, 1073-1084. Romer, P.M. (1990), Endogenous technological change. Journal of Political Economy, 95(5), 71-102. Rousseau, P.L., Vuthipadadorn, D. (2005), Finance, investment, and growth: Time series evidence from 10 Asian economies. Journal of Macroeconomics, 27(1), 87-106. Salahuddin, M., Gow, J. (2016), The effects of internet usage, financial Hoang: Examining the Relationship between Electricity Consumption, Financial Development and Economic Growth in Asean Countries: Evidence from a Bayesian Analysis International Journal of Energy Economics and Policy | Vol 11 • Issue 2 • 202156 development and trade openness on economic growth in South Africa: A time series analysis. Telematics and Informatics, 33(4), 1141-1154. Sarkar, M.S.K., Al-Amin, A.Q., Mustapa, S.I., Ahsan, M.R. (2019), Energy consumption, CO2 emission and economic growth: Empirical evidence for Malaysia. International Journal of Environment and Sustainable Development, 18(3), 318-334. Schumpeter, J.A. (1912), The Theory of Economic Development: Harvard Economic Studies. Shaw, E.S. (1974), Financial deepening in economic development. The Journal of Finance, 29(4), 1345-1348. Stern, D.I. (2000), A multivariate cointegration analysis of the role of energy in the US macroeconomy. Energy Economics, 22, 267-283. Stiglitz, J.E. (2000), Capital market liberalization, economic growth, and instability. World Development, 28(6), 1075-1086. Tang, C.F. (2009), Electricity consumption, income, foreign direct investment, and population in Malaysia. Journal of Economic Studies, 36(4), 371-382. Thompson, S.K. (2012), Sampling. 3rd ed. Hoboken, New Jersey: John Wiley & Sons. Inc. Tiba, S., Omri, A. (2017), Literature survey on the relationships between energy, environment and economic growth. Renewable and Sustainable Energy Reviews, 69, 1129-1146. Yoo, S.H. (2005), Electricity consumption and economic growth: Evidence from Korea. Energy Policy, 33(12), 1627-1632. Zhang, C., Zhou, K., Yang, S., Shao, Z. (2017), On electricity consumption and economic growth in China. Renewable and Sustainable Energy Reviews, 76, 353-368.

File đính kèm:

examining_the_relationship_between_electricity_consumption_f.pdf

examining_the_relationship_between_electricity_consumption_f.pdf