Banking development, economic growth and energy consumption in Vietnam

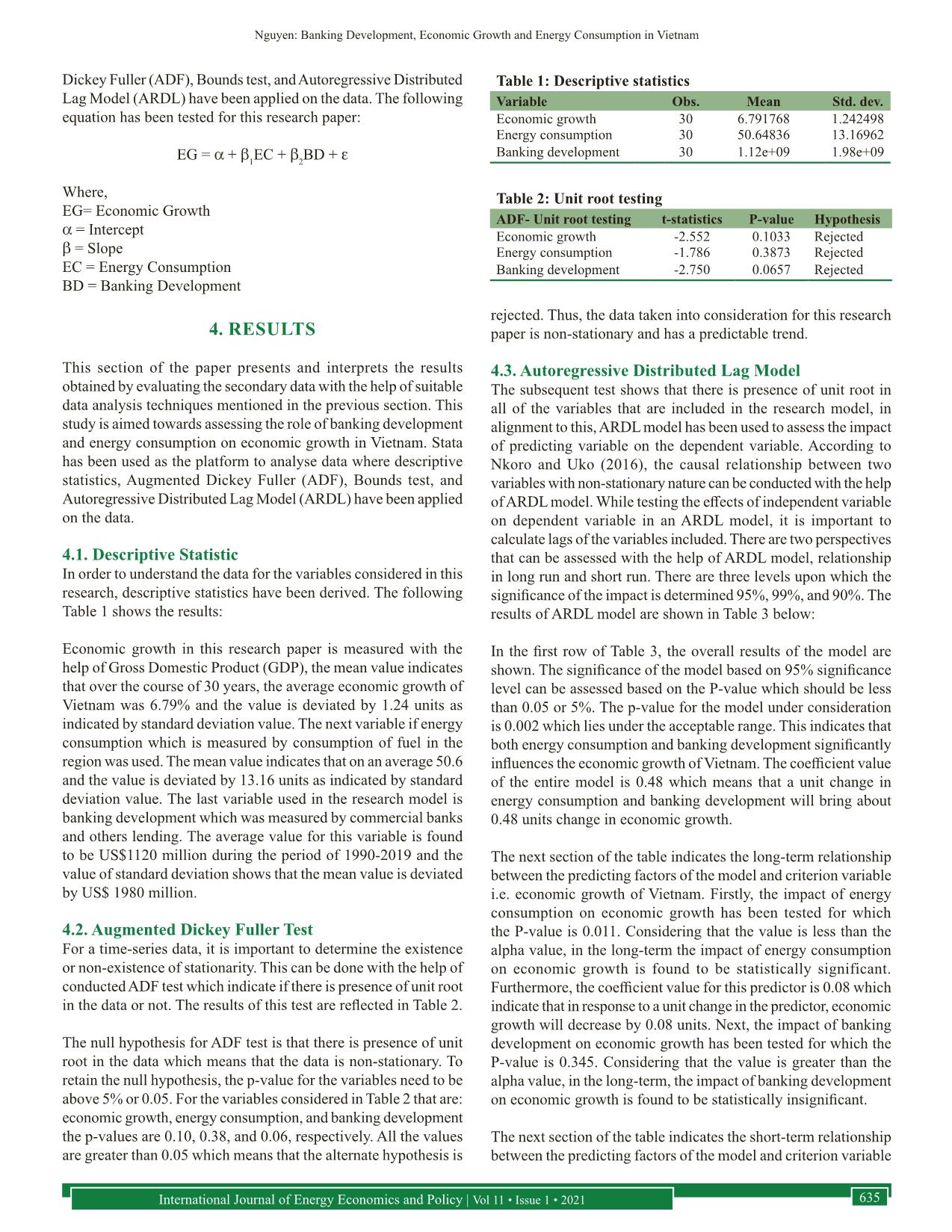

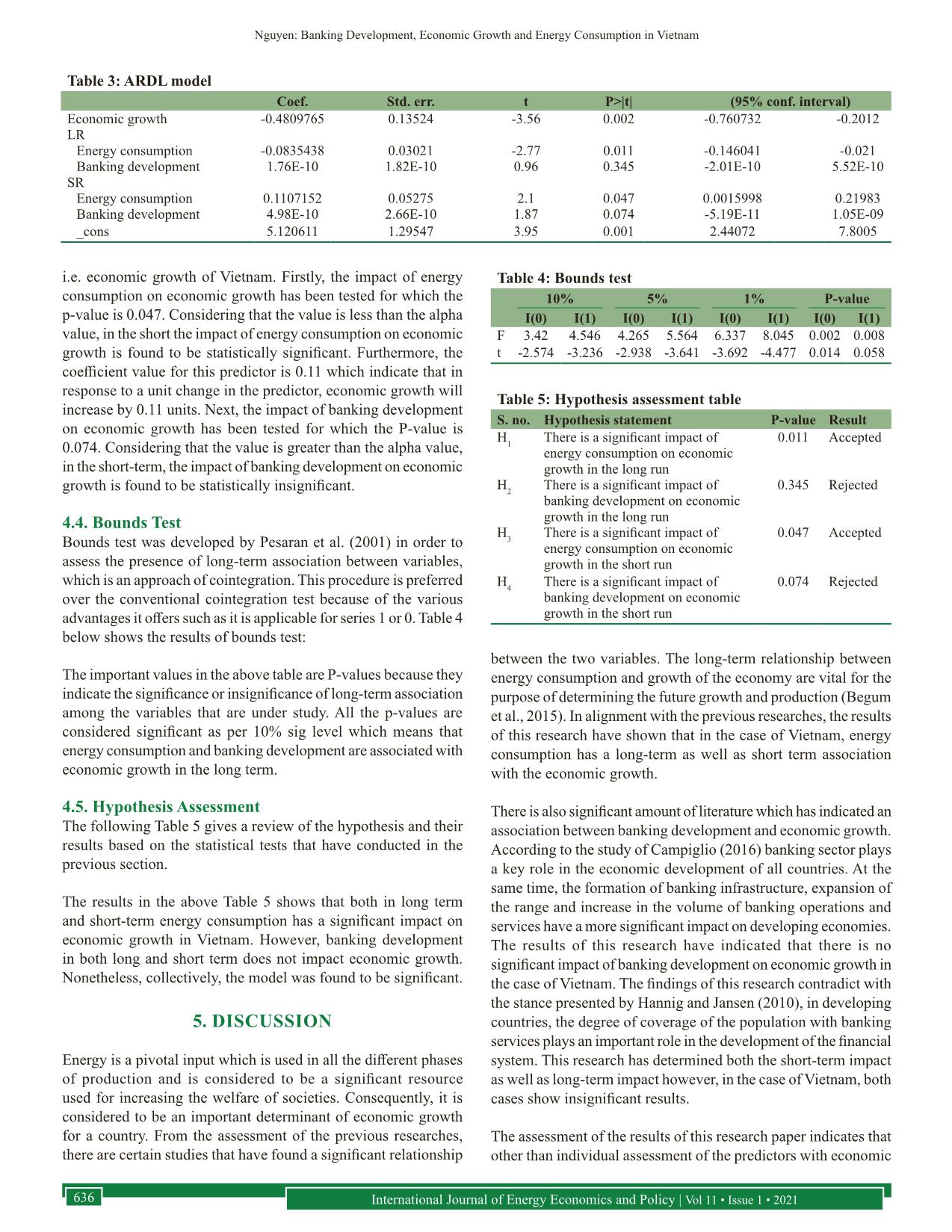

This study is aimed towards assessing the role of banking development and energy consumption on economic growth in Vietnam for the period ranging from 1990 to 2019. The researcher has collected data on the variables from 1990 to 2019 related with banking development, energy consumption and economic growth. On the data collected on the specified variables, certain tests have been conducted. This research has used Stata as the statistical platform to carry out data analysis where descriptive statistics, Augmented Dickey Fuller (ADF), Bounds test, and Autoregressive Distributed Lag Model (ARDL) have been applied on the data. The results indicated that the data was non-Stationary and had trend which can predict the future data. Based on this condition, ARDL test and Bounds test were applied. The results indicated that overall, the model was found to be significant. Individually, energy consumption had a significant impact in both short term and long term however, there was insignificant association among banking development and economic growth

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Tóm tắt nội dung tài liệu: Banking development, economic growth and energy consumption in Vietnam

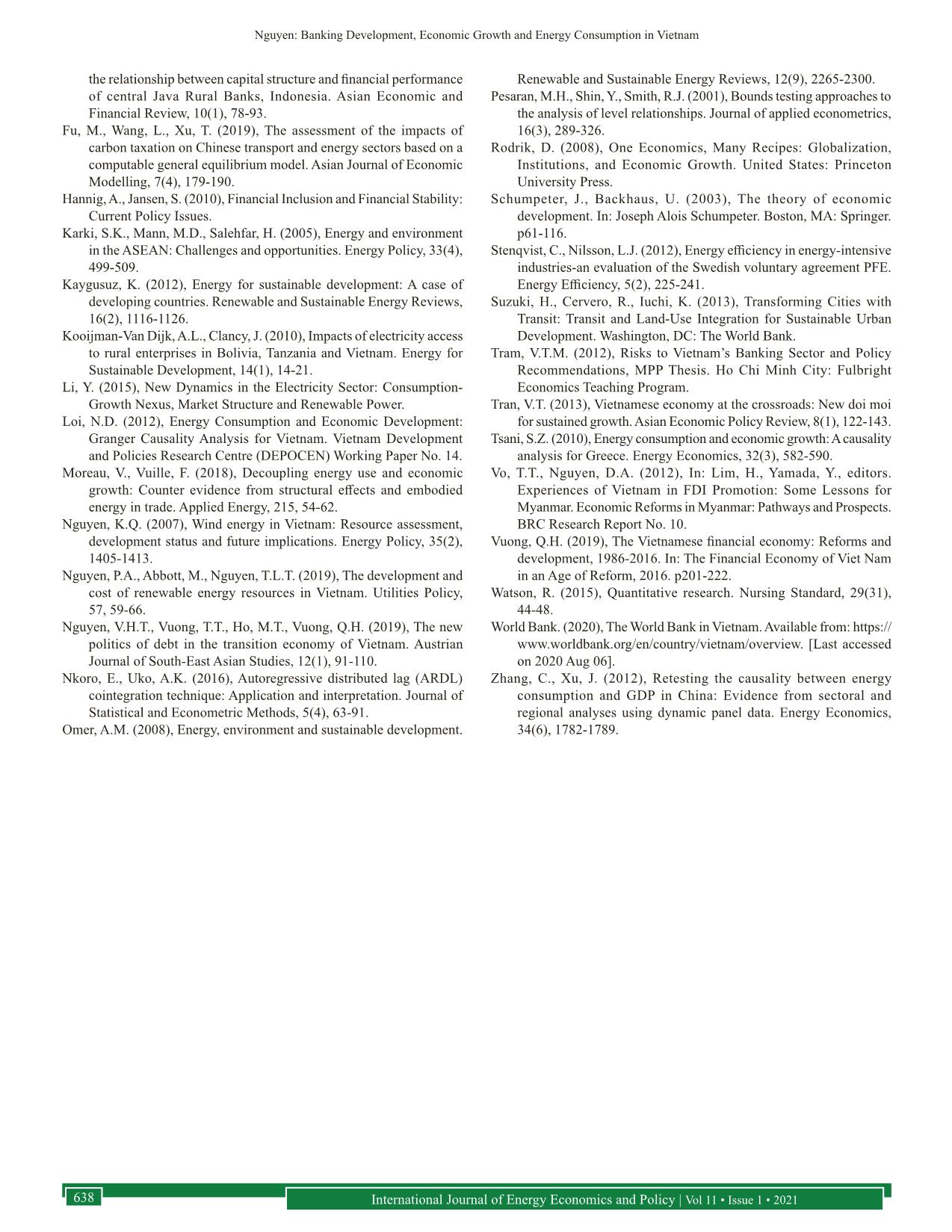

tical tests that have conducted in the previous section. The results in the above Table 5 shows that both in long term and short-term energy consumption has a significant impact on economic growth in Vietnam. However, banking development in both long and short term does not impact economic growth. Nonetheless, collectively, the model was found to be significant. 5. DISCUSSION Energy is a pivotal input which is used in all the different phases of production and is considered to be a significant resource used for increasing the welfare of societies. Consequently, it is considered to be an important determinant of economic growth for a country. From the assessment of the previous researches, there are certain studies that have found a significant relationship between the two variables. The long-term relationship between energy consumption and growth of the economy are vital for the purpose of determining the future growth and production (Begum et al., 2015). In alignment with the previous researches, the results of this research have shown that in the case of Vietnam, energy consumption has a long-term as well as short term association with the economic growth. There is also significant amount of literature which has indicated an association between banking development and economic growth. According to the study of Campiglio (2016) banking sector plays a key role in the economic development of all countries. At the same time, the formation of banking infrastructure, expansion of the range and increase in the volume of banking operations and services have a more significant impact on developing economies. The results of this research have indicated that there is no significant impact of banking development on economic growth in the case of Vietnam. The findings of this research contradict with the stance presented by Hannig and Jansen (2010), in developing countries, the degree of coverage of the population with banking services plays an important role in the development of the financial system. This research has determined both the short-term impact as well as long-term impact however, in the case of Vietnam, both cases show insignificant results. The assessment of the results of this research paper indicates that other than individual assessment of the predictors with economic Table 3: ARDL model Coef. Std. err. t P>|t| (95% conf. interval) Economic growth -0.4809765 0.13524 -3.56 0.002 -0.760732 -0.2012 LR Energy consumption -0.0835438 0.03021 -2.77 0.011 -0.146041 -0.021 Banking development 1.76E-10 1.82E-10 0.96 0.345 -2.01E-10 5.52E-10 SR Energy consumption 0.1107152 0.05275 2.1 0.047 0.0015998 0.21983 Banking development 4.98E-10 2.66E-10 1.87 0.074 -5.19E-11 1.05E-09 _cons 5.120611 1.29547 3.95 0.001 2.44072 7.8005 Table 4: Bounds test 10% 5% 1% P-value I(0) I(1) I(0) I(1) I(0) I(1) I(0) I(1) F 3.42 4.546 4.265 5.564 6.337 8.045 0.002 0.008 t -2.574 -3.236 -2.938 -3.641 -3.692 -4.477 0.014 0.058 Table 5: Hypothesis assessment table S. no. Hypothesis statement P-value Result H1 There is a significant impact of energy consumption on economic growth in the long run 0.011 Accepted H2 There is a significant impact of banking development on economic growth in the long run 0.345 Rejected H3 There is a significant impact of energy consumption on economic growth in the short run 0.047 Accepted H4 There is a significant impact of banking development on economic growth in the short run 0.074 Rejected Nguyen: Banking Development, Economic Growth and Energy Consumption in Vietnam International Journal of Energy Economics and Policy | Vol 11 • Issue 1 • 2021 637 growth, the overall model was found to be statistically viable. It can be inferred from the findings of this research as well as the previous studies that countries must be careful in terms of their energy consumption because its effect is directly translated as the economic growth. 6. CONCLUSION The primary objective of this study was to find out the impact of energy consumption and banking development on economic growth of Vietnam during the period ranging from 1990 to 2019. For the historic data, a range of statistical tests were applied on Stata to achieve the aim of the study. The results indicated that the data was non-stationary and had trend which can predict the future data. Based on this condition, ARDL test and Bounds test were applied. The results indicated that overall, the model was found to be significant. Individually, energy consumption had a significant impact in both short term and long term however, there was insignificant association among banking development and economic growth. Based on the findings of this study, it is recommended for the government of Vietnam and policy makers to pay close attention towards developing strategies that helps in attaining higher mobilisation of energy savings to gain confidence of Vietnam’s investors, and also to attract the foreign investments in Vietnam. However, the energy consumption should be done in such a manner that it contributes to the welfare of country and society. Irresponsible consumption of energy can cause increase in greenhouse emission which in turn are bad for the environment. Future researches can be carried out to study the role of CO2 emissions on economic growth. 6.1. Recommendations This following recommendation are proposed based on the overall research outcomes: • It is quite evident from the findings that financial developments and economic growth significantly increase the energy demand, thus consumption of energy is probably the most vital aspect for enhancing the country’s economic growth. Based on this, it has been recommended to the policy makers to pay close attention towards developing strategies that helps in attaining higher mobilisation of energy savings to gain confidence of Vietnam’s investors, and also to attract the foreign investments in Vietnam. • It has also been recommended to the policy makers of Vietnam to must emphasise on developing and exploring domestic resources of energy to safeguard the country from any adverse external energy blow. This has played a major role in reducing the dependence of Vietnam on energy imports and strengthen the country’s economic growth. • The government of Vietnam has also been advised to introduce some important measures and reforms for strengthening the banking development, as well crafted and designed strategy for financial sector tends to strategize many other reforms supported by private and public sector development and stakeholders’ partners. 6.2. Limitations and Future Research There were certain limitations that have been associated with this study, which can be addressed in the future research to make an important contribution in the existing literature. The key limitation of this research has been linked with its limited scope, as researcher has conducted this study in the context of Vietnam, thus the findings and analysis presented in this study cannot viewed in another scenario or context. In this regard, future researchers are advised to widen the research scope by carrying out this study with the incorporation of more countries into the research investigation. This will help in providing a complete picture with more conclusive results about the research topic. On the other hand, the human perspective in the shape of qualitative data has also been missing from this study, as researcher has only followed quantitative research design to inquire about the association between the research variables. Hence, future researchers can consider conducting the same study with mixed research design to provide more conclusive results. REFERENCES Anwar, S., Nguyen, L.P. (2011), Financial development and economic growth in Vietnam. Journal of Economics and Finance, 35(3), 348-360. Bartleet, M., Gounder, R. (2010), Energy consumption and economic growth in New Zealand: Results of trivariate and multivariate models. Energy Policy, 38(7), 3508-3517. Beck, T., Demirgüç-Kunt, A., Levine, R. (2010), Financial institutions and markets across countries and over time: The updated financial development and structure database. The World Bank Economic Review, 24(1), 77-92. Begum, R.A., Sohag, K., Abdullah, S.M.S., Jaafar, M. (2015), CO2 emissions, energy consumption, economic and population growth in Malaysia. Renewable and Sustainable Energy Reviews, 41, 594-601. Bekhet, H.A., Matar, A., Yasmin, T. (2017), CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: Dynamic simultaneous equation models. Renewable and Sustainable Energy Reviews, 70, 117-132. Binh, P.T. (2011), Energy consumption and economic growth in Vietnam: Threshold cointegration and causality analysis. International Journal of Energy Economics and Policy, 1(1), 1. Busch, M. (2017), The Missing Middle: A Political Economy of Economic Restructuring in Vietnam. Sydney: Lowy Institute for International Policy. Campiglio, E. (2016), Beyond carbon pricing: The role of banking and monetary policy in financing the transition to a low-carbon economy. Ecological Economics, 121, 220-230. Canh, L.Q. (2011), Electricity Consumption and Economic Growth in Vietnam: A Cointegration and Causality Analysis. Vietnam: National Economics University. Caporale, G.M., Rault, C., Sova, A.D., Sova, R. (2015), Financial development and economic growth: Evidence from 10 new European Union members. International Journal of Finance and Economics, 20(1), 48-60. Cracknell, D. (2012), Policy Innovations to Improve Access to Financial Services in Developing Countries: Learning from Case Studies in Kenya. Washington, DC: Centre for Global Development. Demirgüç-Kunt, A., Klapper, L. (2013), Measuring financial inclusion: Explaining variation in use of financial services across and within countries. Brookings Papers on Economic Activity, 1, 279-340. Dufhues, T. (2003), Transformation of the financial system in Vietnam and its implications for the rural financial market-an update. Journal for Institutional Innovation, Development and Transition, 7, 29. Endang, P. (2020), Moderation effects of organisational environment on Nguyen: Banking Development, Economic Growth and Energy Consumption in Vietnam International Journal of Energy Economics and Policy | Vol 11 • Issue 1 • 2021638 the relationship between capital structure and financial performance of central Java Rural Banks, Indonesia. Asian Economic and Financial Review, 10(1), 78-93. Fu, M., Wang, L., Xu, T. (2019), The assessment of the impacts of carbon taxation on Chinese transport and energy sectors based on a computable general equilibrium model. Asian Journal of Economic Modelling, 7(4), 179-190. Hannig, A., Jansen, S. (2010), Financial Inclusion and Financial Stability: Current Policy Issues. Karki, S.K., Mann, M.D., Salehfar, H. (2005), Energy and environment in the ASEAN: Challenges and opportunities. Energy Policy, 33(4), 499-509. Kaygusuz, K. (2012), Energy for sustainable development: A case of developing countries. Renewable and Sustainable Energy Reviews, 16(2), 1116-1126. Kooijman-Van Dijk, A.L., Clancy, J. (2010), Impacts of electricity access to rural enterprises in Bolivia, Tanzania and Vietnam. Energy for Sustainable Development, 14(1), 14-21. Li, Y. (2015), New Dynamics in the Electricity Sector: Consumption- Growth Nexus, Market Structure and Renewable Power. Loi, N.D. (2012), Energy Consumption and Economic Development: Granger Causality Analysis for Vietnam. Vietnam Development and Policies Research Centre (DEPOCEN) Working Paper No. 14. Moreau, V., Vuille, F. (2018), Decoupling energy use and economic growth: Counter evidence from structural effects and embodied energy in trade. Applied Energy, 215, 54-62. Nguyen, K.Q. (2007), Wind energy in Vietnam: Resource assessment, development status and future implications. Energy Policy, 35(2), 1405-1413. Nguyen, P.A., Abbott, M., Nguyen, T.L.T. (2019), The development and cost of renewable energy resources in Vietnam. Utilities Policy, 57, 59-66. Nguyen, V.H.T., Vuong, T.T., Ho, M.T., Vuong, Q.H. (2019), The new politics of debt in the transition economy of Vietnam. Austrian Journal of South-East Asian Studies, 12(1), 91-110. Nkoro, E., Uko, A.K. (2016), Autoregressive distributed lag (ARDL) cointegration technique: Application and interpretation. Journal of Statistical and Econometric Methods, 5(4), 63-91. Omer, A.M. (2008), Energy, environment and sustainable development. Renewable and Sustainable Energy Reviews, 12(9), 2265-2300. Pesaran, M.H., Shin, Y., Smith, R.J. (2001), Bounds testing approaches to the analysis of level relationships. Journal of applied econometrics, 16(3), 289-326. Rodrik, D. (2008), One Economics, Many Recipes: Globalization, Institutions, and Economic Growth. United States: Princeton University Press. Schumpeter, J., Backhaus, U. (2003), The theory of economic development. In: Joseph Alois Schumpeter. Boston, MA: Springer. p61-116. Stenqvist, C., Nilsson, L.J. (2012), Energy efficiency in energy-intensive industries-an evaluation of the Swedish voluntary agreement PFE. Energy Efficiency, 5(2), 225-241. Suzuki, H., Cervero, R., Iuchi, K. (2013), Transforming Cities with Transit: Transit and Land-Use Integration for Sustainable Urban Development. Washington, DC: The World Bank. Tram, V.T.M. (2012), Risks to Vietnam’s Banking Sector and Policy Recommendations, MPP Thesis. Ho Chi Minh City: Fulbright Economics Teaching Program. Tran, V.T. (2013), Vietnamese economy at the crossroads: New doi moi for sustained growth. Asian Economic Policy Review, 8(1), 122-143. Tsani, S.Z. (2010), Energy consumption and economic growth: A causality analysis for Greece. Energy Economics, 32(3), 582-590. Vo, T.T., Nguyen, D.A. (2012), In: Lim, H., Yamada, Y., editors. Experiences of Vietnam in FDI Promotion: Some Lessons for Myanmar. Economic Reforms in Myanmar: Pathways and Prospects. BRC Research Report No. 10. Vuong, Q.H. (2019), The Vietnamese financial economy: Reforms and development, 1986-2016. In: The Financial Economy of Viet Nam in an Age of Reform, 2016. p201-222. Watson, R. (2015), Quantitative research. Nursing Standard, 29(31), 44-48. World Bank. (2020), The World Bank in Vietnam. Available from: https:// www.worldbank.org/en/country/vietnam/overview. [Last accessed on 2020 Aug 06]. Zhang, C., Xu, J. (2012), Retesting the causality between energy consumption and GDP in China: Evidence from sectoral and regional analyses using dynamic panel data. Energy Economics, 34(6), 1782-1789.

File đính kèm:

banking_development_economic_growth_and_energy_consumption_i.pdf

banking_development_economic_growth_and_energy_consumption_i.pdf