Bài giảng Macroeconomics - Chapter 4: Short-run economic fluctuation (Part 1) - Nguyễn Thùy Dung

Aggregate Demand and

Aggregate Supply

▪ Economic fluctuations and their characteristics

▪ The model of aggregate demand and

aggregate supply

▪ Shifts in the AD curve and AS curve.Institute of International Education

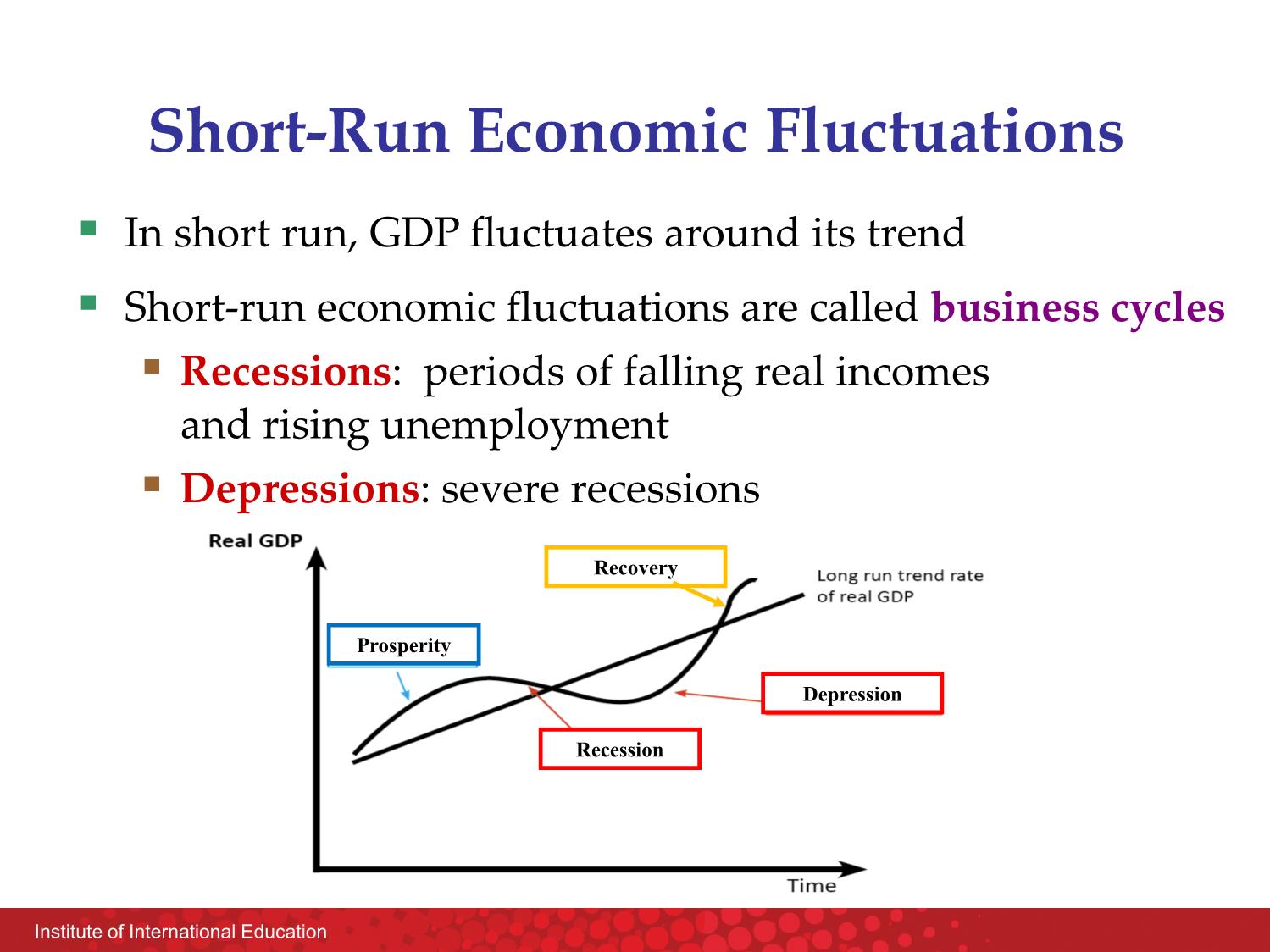

Short-Run Economic Fluctuations

▪ In short run, GDP fluctuates around its trend

▪ Short-run economic fluctuations are called business cycles

▪ Recessions: periods of falling real incomes

and rising unemployment

▪ Depressions: severe recessions

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Bạn đang xem 10 trang mẫu của tài liệu "Bài giảng Macroeconomics - Chapter 4: Short-run economic fluctuation (Part 1) - Nguyễn Thùy Dung", để tải tài liệu gốc về máy hãy click vào nút Download ở trên

Tóm tắt nội dung tài liệu: Bài giảng Macroeconomics - Chapter 4: Short-run economic fluctuation (Part 1) - Nguyễn Thùy Dung

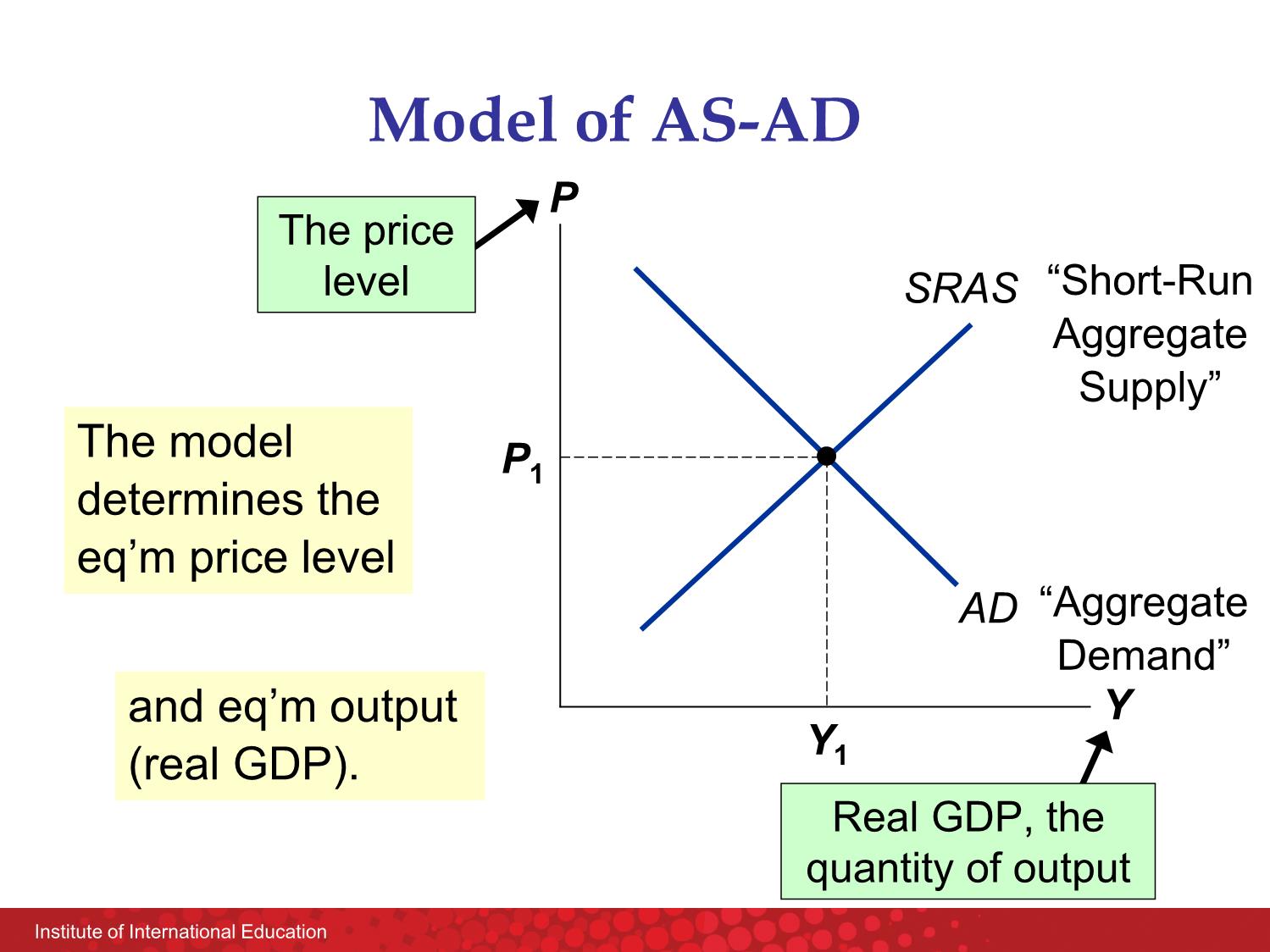

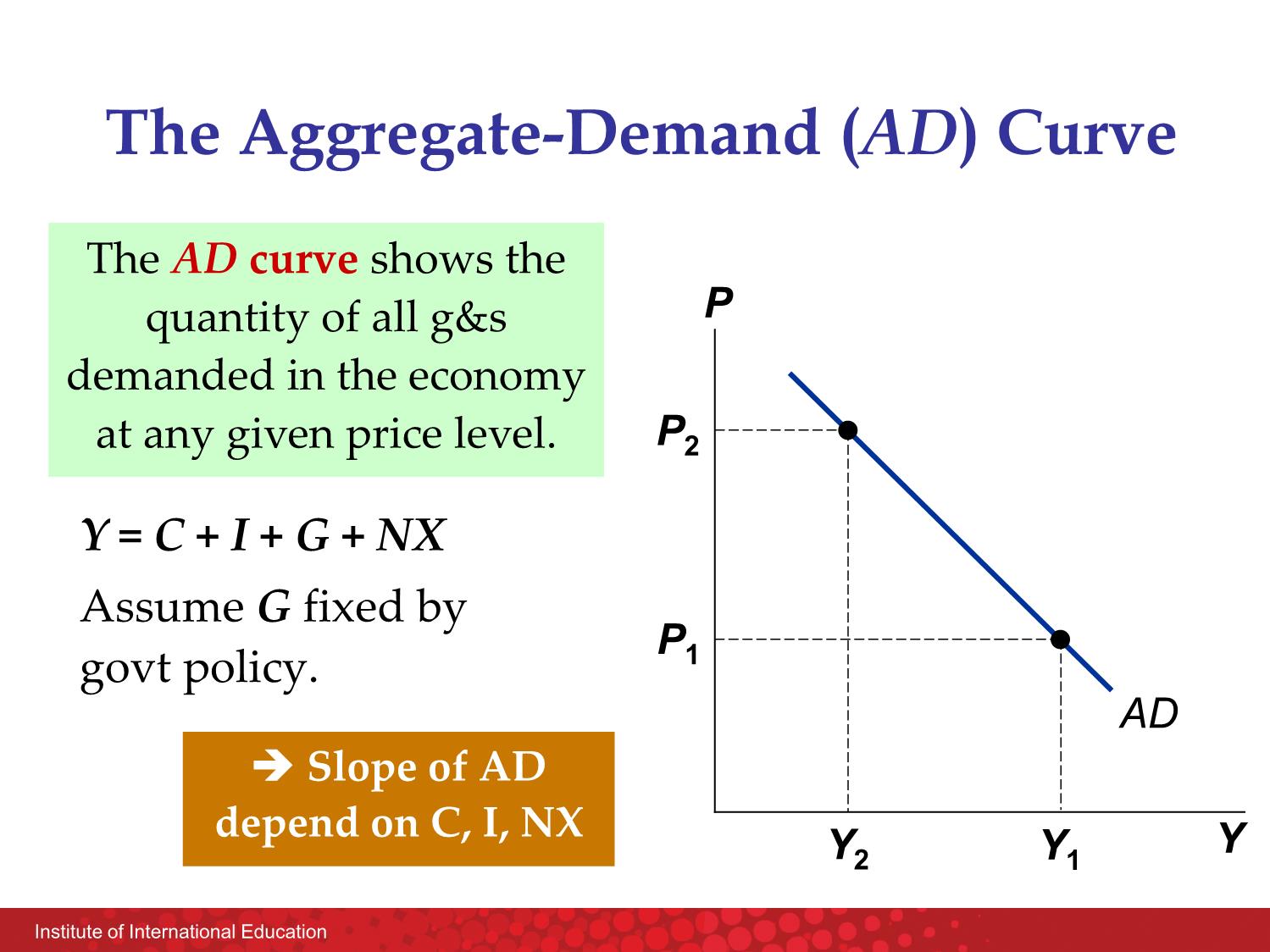

Institute of International Education SHORT-RUN ECONOMIC FLUCTUATION Institute of International Education 4.1 Aggregate Demand and Aggregate Supply ▪ Economic fluctuations and their characteristics ▪ The model of aggregate demand and aggregate supply ▪ Shifts in the AD curve and AS curve. Institute of International Education Short-Run Economic Fluctuations ▪ In short run, GDP fluctuates around its trend ▪ Short-run economic fluctuations are called business cycles ▪ Recessions: periods of falling real incomes and rising unemployment ▪ Depressions: severe recessions Recession Depression Prosperity Recovery and fall in production output of goods Recovery: That's when the economy is Institute of International Education 3 Facts About Economic Fluctuations Fact 1: Economic fluctuations are irregular & unpredictable. - Recessions are of different durations and do not occur with any regularity Fact 2: Most macroeconomic quantities fluctuate together. Fact 3: As output falls, unemployment rises. - Many variables fluctuate along with GDP: corporate profits, investment, consumption, stock prices - When firms cut back on production, they don’t need as many workers. Institute of International Education The Basic Model of Economic Fluctuations ▪ Most economists use the model of aggregate demand and aggregate supply to study fluctuations. ▪ The model focuses on the behavior of 2 variables: - The economy’s quantity of output, which can be measured by real GDP. - The economy’s price level, which can be measured by the CPI or the GDP deflator Institute of International Education Model of AS-AD P Y AD SRAS P1 Y1 The price level Real GDP, the quantity of output The model determines the eq’m price level and eq’m output (real GDP). “Aggregate Demand” “Short-Run Aggregate Supply” Institute of International Education The Aggregate-Demand (AD) Curve The AD curve shows the quantity of all g&s demanded in the economy at any given price level. P Y AD P1 Y1 P2 Y2 Y = C + I + G + NX Assume G fixed by govt policy. ➔ Slope of AD depend on C, I, NX Institute of International Education 1. The Wealth Effect (P and C) Suppose P rises and people’s real incomes are unchanged ▪ The dollars people hold buy fewer g&s, so consumers feel less wealthy. ▪ Consumer will spend less or C falls. ➔This decrease in consumer spending means smaller quantities of g&s demanded. Institute of International Education 2. The Interest-Rate Effect (P and I) Suppose P rises. ▪ Real value of consumers’ money holdings falls ▪ People need more money to make their purchases → Demand for money → interest rates → Firms & household will borrow less or I falls. ➔ Decreases the quantity of g&s demanded. Institute of International Education 3. The Exchange-Rate Effect (P and NX) Suppose P rises. ▪ Interest rates rise → Foreign investors desire more domestic investments →Higher demand for $ US → $ US appreciates. ▪ Foreign goods become less expensive than domestic goods → imports become cheaper → NX falls. ➔ The decrease in NX spending means a smaller quantity of g&s demanded. Institute of International Education The Slope of the AD Curve: Summary An increase in P reduces the quantity of g&s demanded because: P Y AD P1 Y1 ▪ the wealth effect (C falls) P2 Y2 ▪ the interest-rate effect (I falls) ▪ the exchange-rate effect (NX falls) Institute of International Education Why the AD Curve Might Shift Any event that changes C, I, G, or NX – except a change in P, will shift the AD curve. Example: A stock market boom makes households feel wealthier, C rises and AD curve shifts right. P Y AD1 AD2 Y2 P1 Y1 If firms become more optimistic Institute of International Education What happens to the AD curve in each of the following scenarios? A. A ten-year-old investment tax credit expires. B. The U.S. exchange rate falls. C. A fall in prices D. State governments decrease their sales taxes A C T I V E L E A R N I N G 1 The Aggregate-Demand curve Institute of International Education A C T I V E L E A R N I N G 1 Answer A. A ten-year-old investment tax credit expires. I falls, AD curve shifts left. B. The U.S. exchange rate falls. NX rises, AD curve shifts right. C. A fall in prices Move down along AD curve D. State governments decrease their sales taxes C rises, AD shifts right. Institute of International Education The Aggregate-Supply (AS) Curves The AS curve shows the total quantity of g&s firms produce and sell at any given price level. P Y SRAS LRAS AS is: ▪ upward-sloping in short run ▪ vertical in long run Institute of International Education The Long-Run Aggregate-Supply Curve (LRAS) Human Capital (H) Natural Resources (N) Technological knowledge (A) Labor (L) Capital (K) Output in long-run Institute of International Education The Long-Run Aggregate-Supply Curve (LRAS) The natural rate of output (YN) is the amount of output the economy produces when unemployment is at its natural rate. Any changes of determinants of YN will shift LRAS An increase in P does not affect any of these, so, does not affect YN. P Y LRAS1 YN LRAS2 YN’ to Institute of International Education 1. In the long-run, growth in technology shifts long-run AS... LRAS3LRAS2 Long-Run Growth and Inflation... Quantity of Output Price Level 0 P1 Y1 AD1 P3 P2 LRAS1 2. and growth in the money supply shifts AD... AD3 AD2 4. and ongoing inflation. Y2 Y3 3. leading to growth in output... Institute of International Education Quantity of Output Price Level 0 SRAS Y1 P1 Y2 2. reduces the quantity of goods and services supplied in the short run. P2 1. A decrease in the price level Short Run Aggregate Supply (SRAS) 3 theories for the upward slope of SRAS The SRAS curve is upward sloping. Change in price level affect output in the short run Institute of International Education 1. The Sticky-Wage Theory ▪ Nominal wages adjust slowly to changing economic conditions, or are “sticky” in the SR. ▪ Firms and workers set the nominal wage in advance based on PE - the expected price level ▪ If P > PE, production is more profitable, so firms increase output. ▪ Higher P causes higher Y, so the SRAS curve slopes upward. Wages do not adjust immediately Institute of International Education 2. The Sticky-Price Theory ▪ Many prices are sticky in the short run. ▪ Due to menu costs - the costs of adjusting prices. ▪ Examples: cost of printing new menus, the time required to change price tags ▪ Firms set sticky prices in advance based on PE. Institute of International Education ▪ Suppose money supply increase unexpectedly → P will rise. ▪ Firms with menu costs wait to raise prices. Meantime, their prices are relatively low, → increases demand for their products, so they increase output. ▪ Hence, higher P is associated with higher Y, so the SRAS curve slopes upward. 2. The Sticky-Price Theory Institute of International Education 3. The Misperceptions Theory ▪ Firms may confuse changes in P with changes in the relative price of the products they sell. ▪ If P > PE, a firm sees its price rise before realizing all prices are rising. The firm may believe its relative price is rising, and may increase output and employment. ▪ So, an increase in P can cause an increase in Y, making the SRAS curve upward-sloping. Institute of International Education Summing up All three theories suggest that Y deviates from YN when P deviates from PE. Y = YN + a (P – PE) Output Natural rate of output (long-run) a > 0, measures how much Y responds to unexpected changes in P Actual price level Expected price level Institute of International Education Summing up P Y SRAS YN When P > PE Y > YN When P < PE Y < YN PE the expected price level Y = YN + a(P – PE) Institute of International Education Why the SRAS Curve Might Shift Everything that shifts LRAS shifts SRAS, too. Also, PE shifts SRAS: If PE rises, workers & firms set higher wages. At each P, production is less profitable, Y falls, SRAS shifts left. LRASP Y SRAS PE YN SRAS PE Institute of International Education The Long-Run Equilibrium In the long-run equilibrium, PE = P, Y = YN , and unemployment is at its natural rate. P Y AD SRAS PE LRAS YN Institute of International Education Economic Fluctuations ▪ Caused by events that shift the AD and/or AS curves. ▪ 4 steps to analyzing economic fluctuations: 1. Determine whether the event shifts AD or AS. 2. Determine whether curve shifts left or right. 3. Use AD-AS diagram to see how the shift changes Y and P in the short run. 4. Use AD-AS diagram to see how economy moves from new SR eq’m to new LR eq’m Institute of International Education LRAS YN The Effects of a Shift in AD Event: Stock market crash 1. Affects C, AD curve 2. C falls, so AD shifts left 3. SR eq’m at B. P and Y lower, unemployment higher 4. Over time, PE falls, SRAS shifts right, until LR eq’m at C. Y and unemployment back at initial levels. P Y AD1 SRAS1 AD2 SRAS2 P1 A P2 Y2 B P3 C unemployment Institute of International Education LRAS YN The Effects of a Shift in SRAS Event: Oil prices rise 1. Increases costs, shifts SRAS (assume LRAS constant) 2. SRAS shifts left 3. SR eq’m at point B. P higher, Y lower, unemployment higher From A to B, stagflation, a period of falling output and rising prices. P Y AD1 SRAS1 SRAS2 P1 A P2 Y2 B Institute of International Education LRAS YN Accommodating an Adverse Shift in SRAS If policymakers do nothing, Expected price level will also increase, causes wages to increase, SRAS shifts father left. At some point, this low level of output and employment will put downward pressure on wages → SRAS shifts right until LR eq’m back to point A P Y AD1 SRAS1 SRAS2 P1 A P2 Y2 B AD2 Institute of International Education LRAS YN Accommodating an Adverse Shift in SRAS P Y AD1 SRAS1 SRAS2 P2 Y2 B AD2 P3 C Or, policymakers could increase AD (from AD1 to AD2) and accommodate the AS shift until LR eq’m reach C Y back to YN, but P permanently higher

File đính kèm:

bai_giang_macroeconomics_chapter_4_short_run_economic_fluctu.pdf

bai_giang_macroeconomics_chapter_4_short_run_economic_fluctu.pdf