Bài giảng Macroeconomics - Chapter 3: Money and prices in the long-run - Nguyễn Thùy Dung

This section will help you:

▪ Define money and discuss its functions.

▪ Discuss the definition of the money supply.

▪ Explain how financial institutions create money.

▪ Understand tools of Monetary Control

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tải về để xem bản đầy đủ

Bạn đang xem 10 trang mẫu của tài liệu "Bài giảng Macroeconomics - Chapter 3: Money and prices in the long-run - Nguyễn Thùy Dung", để tải tài liệu gốc về máy hãy click vào nút Download ở trên

Tóm tắt nội dung tài liệu: Bài giảng Macroeconomics - Chapter 3: Money and prices in the long-run - Nguyễn Thùy Dung

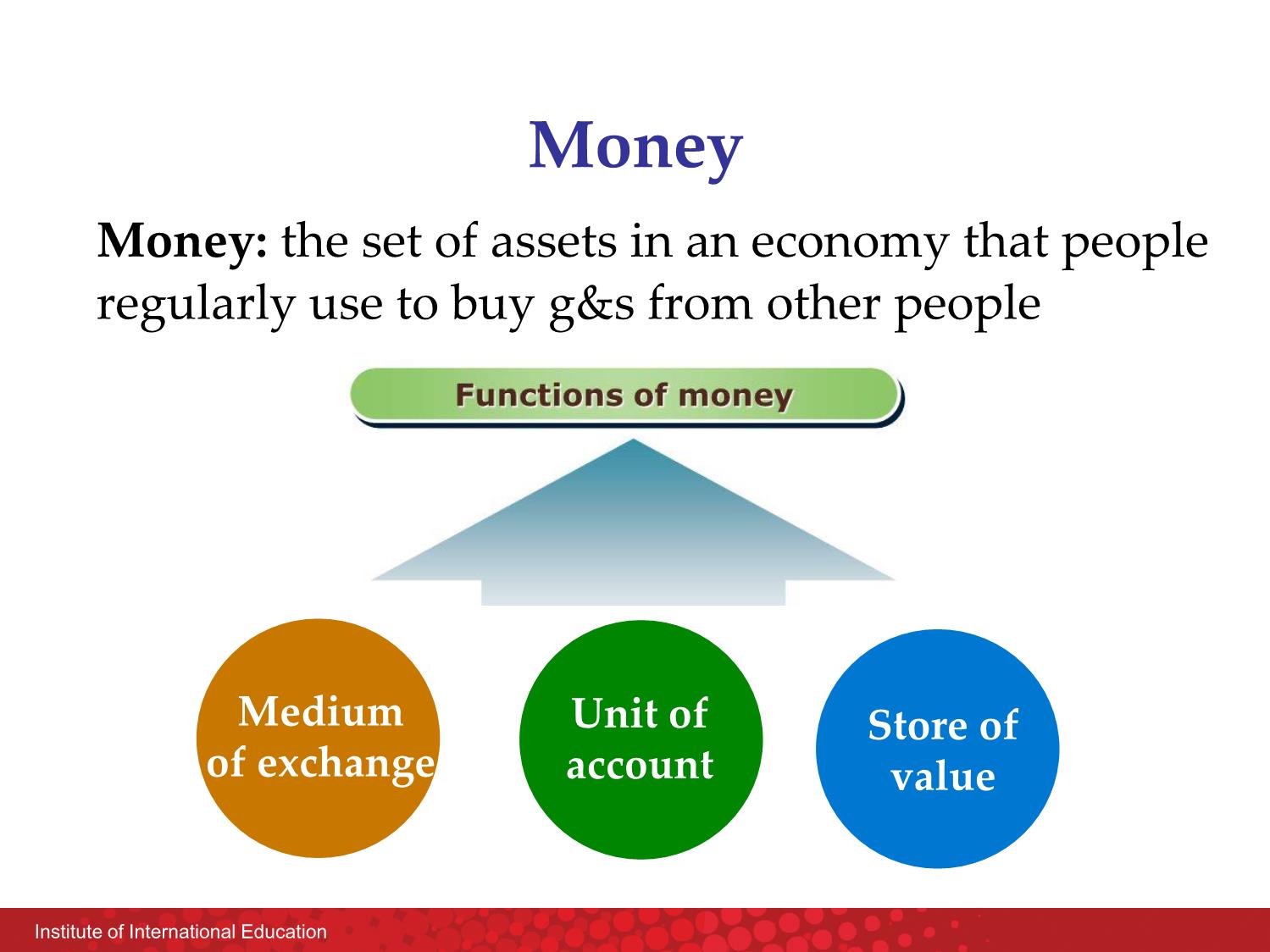

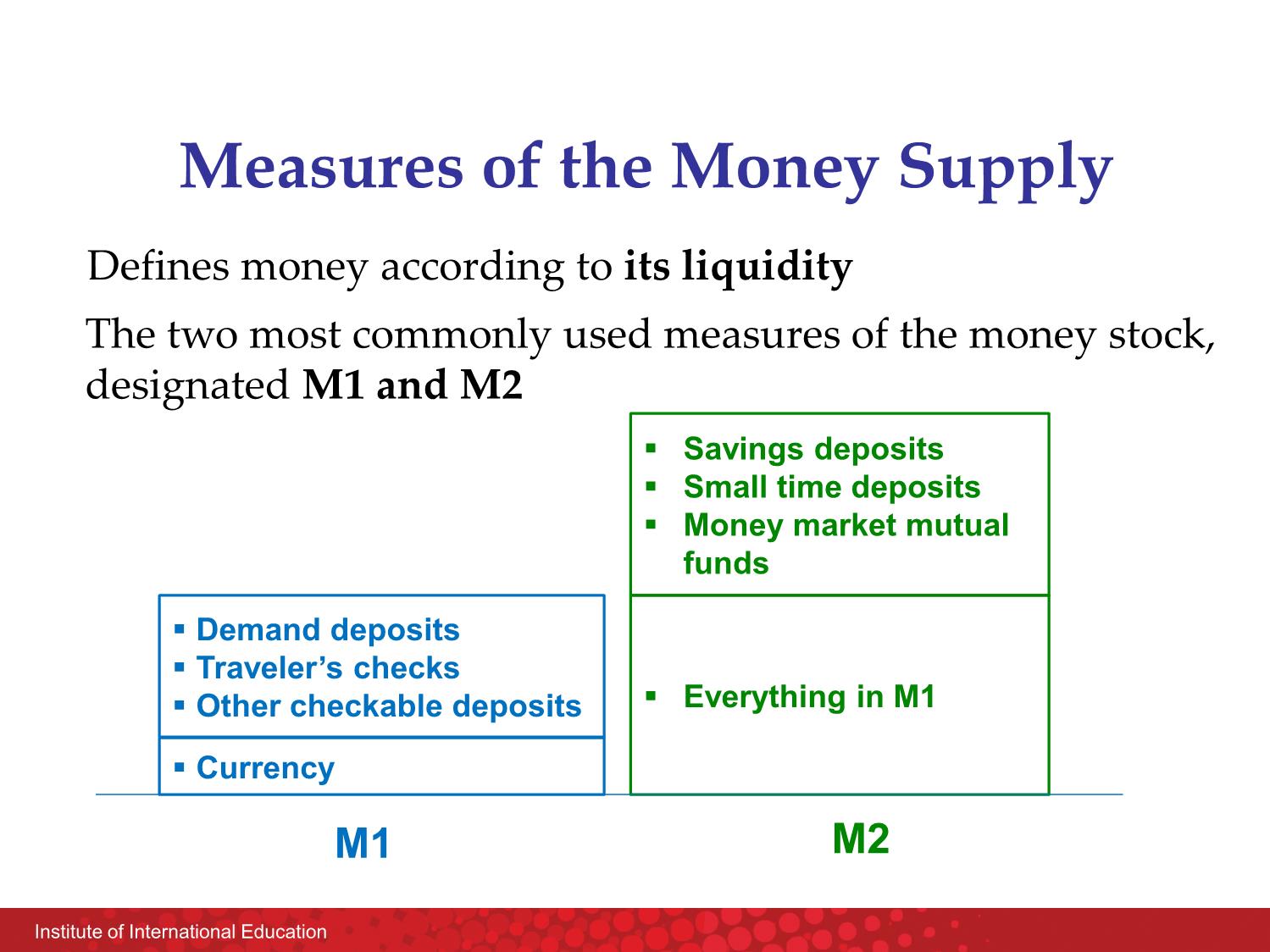

Institute of International Education TOPIC 3 MONEY AND PRICES IN THE LONG-RUN Institute of International Education This section will help you: ▪ Define money and discuss its functions. ▪ Discuss the definition of the money supply. ▪ Explain how financial institutions create money. ▪ Understand tools of Monetary Control 3.1 The monetary system Institute of International Education Trade without money ▪Most people have to spend time searching for others to trade with – a huge waste of resources. ▪ Trade without money is known as direct exchange, or barter ▪ Barter is inefficient because there must be a coincidence of wants. For trade to take place, each must want what the other person has, and must be willing to trade for it ▪ This searching is unnecessary with money, ▪ It facilitates production and trade: people accept money for their own products, and then use money to purchase other goods and services. Institute of International Education Indirect Trade Money makes trade much more efficient Institute of International Education Money: the set of assets in an economy that people regularly use to buy g&s from other people Money Medium of exchange Unit of account Store of value Institute of International Education The 3 Functions of Money ▪ Medium of exchange: an item buyers give to sellers when they want to purchase g&s. ✓Liquidity to describe the ease with which an asset can be converted into the economy’s medium of exchange ▪ Unit of account: is an agreed measure for stating the prices of g&s and record debts ▪ Store of value: an item people can use to transfer purchasing power from the present to the future one good to be compared with another. Institute of International Education The 2 Kinds of Money Commodity money: takes the form of a commodity with intrinsic value Examples: gold, silver, shell, cigarettes Fiat money: money without intrinsic value, is used as money because of government decree. Example: the U.S. dollar Institute of International Education The Money Supply ▪ The money supply (or money stock): the quantity of money available in the economy ▪ Assets should be considered as part of MS: ▪ Currency: the paper bills and coins in the hands of the public. ▪ Demand deposits: balances in bank accounts that depositors can access on demand by writing a check or swiping a debit card. Institute of International Education Measures of the Money Supply The two most commonly used measures of the money stock, designated M1 and M2 Defines money according to its liquidity ▪ Currency ▪ Demand deposits ▪ Traveler’s checks ▪ Other checkable deposits ▪ Everything in M1 ▪ Savings deposits ▪ Small time deposits ▪ Money market mutual funds M1 M2 Institute of International Education Central Banks & Monetary Policy ▪ Central bank: an institution that oversees the banking system and regulates the money supply ▪ Monetary policy: the setting of the money supply by policymakers in the central bank ▪ Federal Reserve (Fed): responsible for regulating the system - an example of central bank in U.S. Institute of International Education The Fed’s Organization Institute of International Education The Structure of the Fed The Federal Reserve System consists of: ▪ Board of Governors (7 members), located in Washington, DC ▪ 12 regional Fed banks, located around the U.S. ▪ Federal Open Market Committee (FOMC), includes the Board of Governors and Presidents of some of the regional Fed banks Institute of International Education US Dollar Institute of International Education ▪ The Fed’s functions – Regulate banks & ensure the health of the banking system – control the quantity of money that is made available in the economy, called the money supply ▪ At the Fed, monetary policy is made by the Federal Open Market Committee (FOMC). The Structure of the Fed ngân hàng của các ngân hàng. Fed Institute of International Education Federal Open Market Committee ▪ Fed’s primary tool: open-market operation • Purchase & sale of U.S. government bonds ➢ FOMC - increase the money supply • Open-market purchase (buy bonds) ➢ FOMC - decrease the money supply • Open-market sale (sell bonds) increase or decrease the number Institute of International Education Bank T-account ▪ T-account: a simplified accounting statement that shows a bank’s assets & liabilities. ▪ Example: ▪ Banks’ liabilities include deposits, assets include loans & reserves. NATIONAL BANK Assets Liabilities Reserves $ 10 Loans $ 90 Deposits $100 Institute of International Education Banks the Money Supply: An Example Suppose $100 of currency is in circulation. To determine banks’ impact on money supply, we calculate the money supply in 3 different cases: 1. No banking system 2. 100% reserve banking system 3. Fractional reserve banking system Institute of International Education Banks and the Money Supply ▪ Reserves: Deposits that banks have received but have not loaned out ▪ The Fed establishes reserve requirements - the minimum amount of reserves that banks must hold against deposits. ▪ Banks may hold more than this minimum amount, called excess reserve ▪ The reserve ratio, R = total reserves as a percentage of total deposits Institute of International Education Banks and Money Supply: An Example CASE 1: No banking system Public holds the $100 as currency. ➔ Money supply = $100. Institute of International Education Banks and Money Supply: An Example CASE 2: 100% reserve banking system Public deposits $100 at First National Bank (FNB). FIRST NATIONAL BANK Assets Liabilities Reserves $100 Loans $ 0 Deposits $100 FNB holds 100% of deposit as reserves: ➔ Money supply = currency + deposits = $0 + $100 = $100 In a 100% reserve banking system, banks do not affect size of money supply. Institute of International Education Banks and Money Supply: An Example CASE 3: Fractional reserve banking system ➔ FNB creates an additional $90 of money. MS includes: Depositors have $100 in deposits, Borrowers have $90 in currency. Suppose R = 10%. FNB loans all but 10% of the deposit: FIRST NATIONAL BANK Assets Liabilities Reserves $ 10 Loans $ 90 Deposits $100 Institute of International Education Banks and Money Supply: An Example SECOND NATIONAL BANK Assets Liabilities Reserves $ 9 Loans $ 81 Deposits $ 90 Suppose borrower deposits $90 at Second National Bank (SNB). CASE 3: Fractional reserve banking system ➔ SNB creates an additional $81 of money. Institute of International Education CASE 3: Fractional reserve banking system THIRD NATIONAL BANK Assets Liabilities Reserves $ 8.1 Loans $ 72.9 Deposits $ 81 The borrower deposits $81 at Third National Bank (TNB). Banks and Money Supply: An Example Each time that money is deposited and a bank loan is made, more money is created. Institute of International Education CASE 3: Fractional reserve banking system The process continues, and money is created with each new loan. Original deposit = SNB deposit = TNB deposit = FNB deposit = ... $ 100.00 $ 90.00 $ 81.00 $ 72.90 ... Total money supply = $ Banks and Money Supply: An Example Institute of International Education The Money Multiplier ▪ Money multiplier (or Deposit Expansion Multiplier): the amount of money the banking system generates with each dollar of reserves ▪ The money multiplier equals 1/R. ▪ In our example, R = 10%, money multiplier = 1/R = 10 Meaning bank holds a total of $100 in reserves, it can have only $1,000 in deposits Institute of International Education CASE 4: Excess reserves example Banks and Money Supply: An Example ➔Money supply = $160 Excess reserves reduce the money supply Suppose R = 10%. FNB loans all but 40% of the deposit: FIRST NATIONAL BANK Assets Liabilities Reserves $ 10 Excess reserves $ 30 Loans $ 60 Deposits $100 Institute of International Education A C T I V E L E A R N I N G 1 Banks and the money supply You deposit $50 in your checking account. The Fed’s reserve requirement is 20% of deposits. A. What is the maximum amount that the money supply could increase? B. What is the minimum amount that the money supply could increase? Institute of International Education If banks hold no excess reserves, then money multiplier = 1/R = 1/0.2 = 5 The maximum possible amount of deposits is 5 x $50 = $250 But currency falls by $50, then MS falls by $50 Hence, max increase in money supply = $200. You deposit $50 in your checking account. A. What is the maximum amount that the money supply could increase? A C T I V E L E A R N I N G 1 Answers Institute of International Education • Assets: – Besides reserves and loans, banks also hold securities. • Liabilities: – Besides deposits, banks also obtain funds from issuing debt and equity • Bank capital: – The resources a bank obtains by issuing equity to its owners A More Realistic Balance Sheet Institute of International Education A More Realistic Balance Sheet • Leverage ratio: ratio of assets to bank capital In this example, the leverage ratio = $1000/$50 = 20 Meaning for every $20 in assets, . Institute of International Education Leverage Amplifies Profits and Losses • Suppose value of bank assets increase by 5%, from $1000 to $1050. – increases bank capital from $50 to $100 • Instead, if value of bank assets decrease by 5%, – Bank capital falls from $50 to $0. • If value of bank assets decrease more than 5%, – Bank capital is negative and bank is insolvent. ➔ Bank regulators require banks to hold a certain amount of capital, called Capital requirement. Institute of International Education The Fed’s 3 Tools of Monetary Control 1. Open-Market Operations (OMOs): the purchase and sale of U.S. government bonds by the Fed. ▪ To increase money supply, Fed buys govt bonds, paying with new dollars ▪ To reduce money supply, Fed sells govt bonds, taking dollars out of circulation, and the process works in reverse. Institute of International Education The Fed’s 3 Tools of Monetary Control 2. Reserve Requirements (RR): affect how much money banks can create by making loans. ▪ To increase money supply, Fed reduces RR. Banks make more loans which increases money multiplier and money supply. ▪ To reduce money supply, Fed raises RR. ▪ Fed rarely uses reserve requirements to control money supply Institute of International Education The Fed’s 3 Tools of Monetary Control 3. The Discount Rate: the interest rate on loans the Fed makes to banks ▪ When banks are running low on reserves they may borrow reserves from the Fed. ▪ To increase money supply, Fed can lower discount rate, which encourages banks to borrow more reserves from Fed. ▪ To reduce money supply, Fed can raise discount rate. Institute of International Education The Federal Funds Rate ▪ Banks with insufficient reserves can borrow from banks with excess reserves. → Federal funds rate: the interest rate at which banks make overnight loans to one another ▪ The FOMC uses OMOs to target the fed funds rate. ▪ Many interest rates are highly correlated, so changes in the fed funds rate cause changes in other rates and have a big impact in the economy. Institute of International Education Monetary Policy & the Fed Funds Rate To raise fed funds rate, Fed sells govt bonds (OMO). This removes reserves from the banking system, → reduces MS causes rf to rise. rf F D1 S2 3.75% F2 S1 F1 3.50% The Federal Funds market Institute of International Education Problems Controlling the Money Supply ▪ If households hold more of their money as currency, banks have fewer reserves, make fewer loans ➔ money supply falls. ▪ If banks hold more reserves than required, they make fewer loans ➔ money supply falls. ▪ Being aware of any changes in depositor or banker behavior Fed can respond to these changes and keep the money supply close to whatever level it chooses

File đính kèm:

bai_giang_macroeconomics_chapter_3_money_and_prices_in_the_l.pdf

bai_giang_macroeconomics_chapter_3_money_and_prices_in_the_l.pdf