Factors affecting the revenue of the electric factory in immediate market and through contract for difference

ABSTRACT

This article investigates the factors affecting the revenue of the plant when paying through the

electricity market and contract for the difference such as the affection of power, contract price and the

factory’s offer price. The analysis has been applied to 14 network diagrams IEEE node, from which we can

see the impact and the role of contracting for differences in avoiding price risks in the electricity market.

Through the analysis process, the article also suggests the way to work properly so that the factory can

achieve the highest revenue.

Keywords: Contract for differences, electric power system, electricity market, location marginal

price, the profit in electricity market.

TÓM TẮT

Các yếu tố ảnh hưởng tới doanh thu của nhà máy điện

trong thị trường điện giao ngay và thông qua hợp đồng sai khác

Bài báo này nghiên cứu các yếu tố ảnh hưởng tới doanh thu của nhà máy khi thanh toán qua thị

trường điện giao ngay và qua hợp đồng sai khác như ảnh hưởng của công suất và giá hợp đồng, ảnh hưởng

của bảng giá chào của nhà máy. Các tính toán phân tích được áp dụng cho sơ đồ lưới IEEE 14 nút, từ đó

thấy được ảnh hưởng và vai trò của việc tham gia hợp đồng sai khác đối với việc tránh rủi ro giá cả trong

thị trường điện, và thông qua quá trình phân tích bài báo cũng đề xuất cách thức vận hành hợp lý để nhà

máy đạt doanh thu cao nhất.

Từ khóa: Hợp đồng sai khác, hệ thống điện, thị trường điện, giá biên nút, doanh thu trong thị

trường điện.

Trang 1

Trang 2

Trang 3

Trang 4

Trang 5

Trang 6

Trang 7

Trang 8

Trang 9

Trang 10

Tóm tắt nội dung tài liệu: Factors affecting the revenue of the electric factory in immediate market and through contract for difference

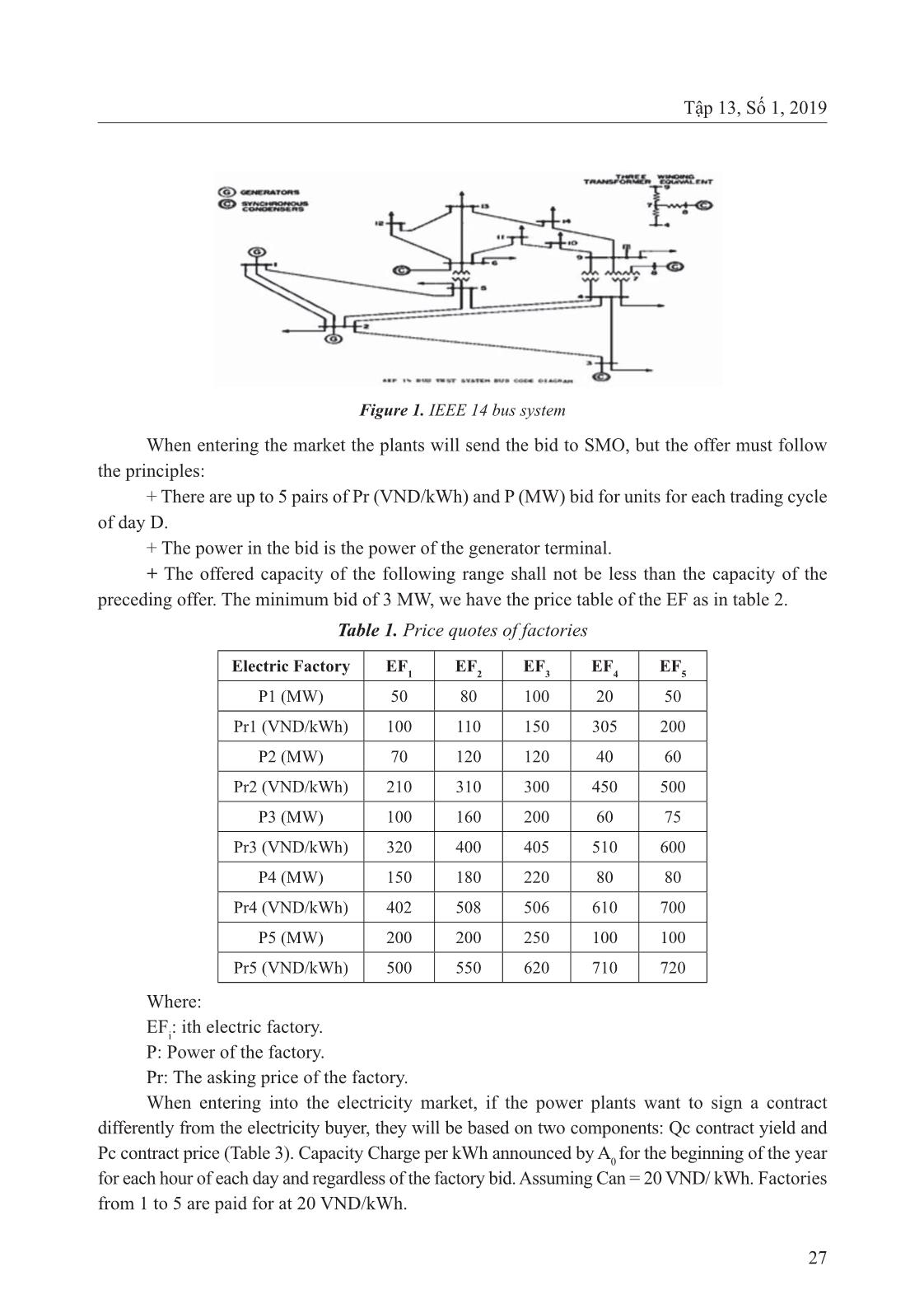

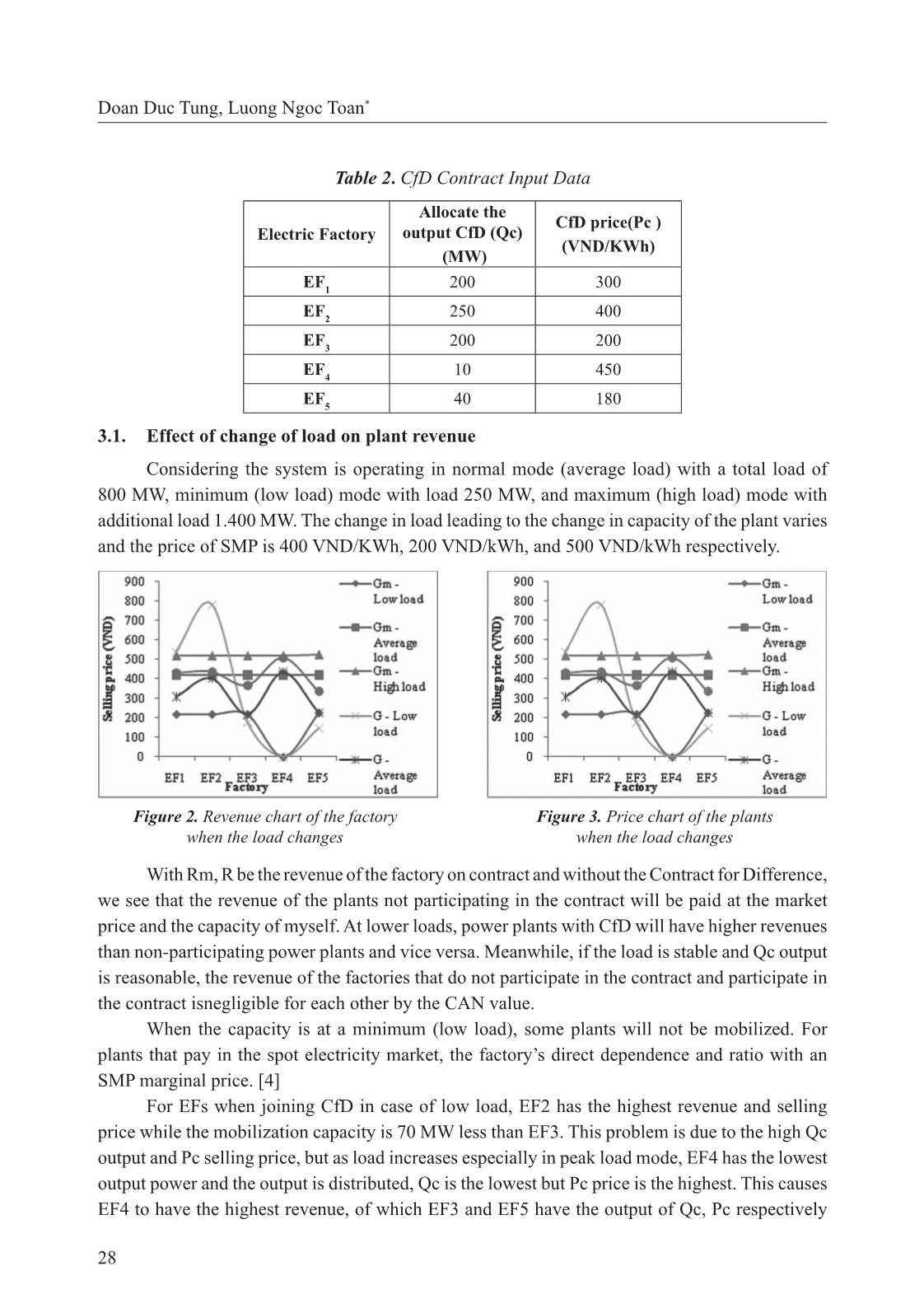

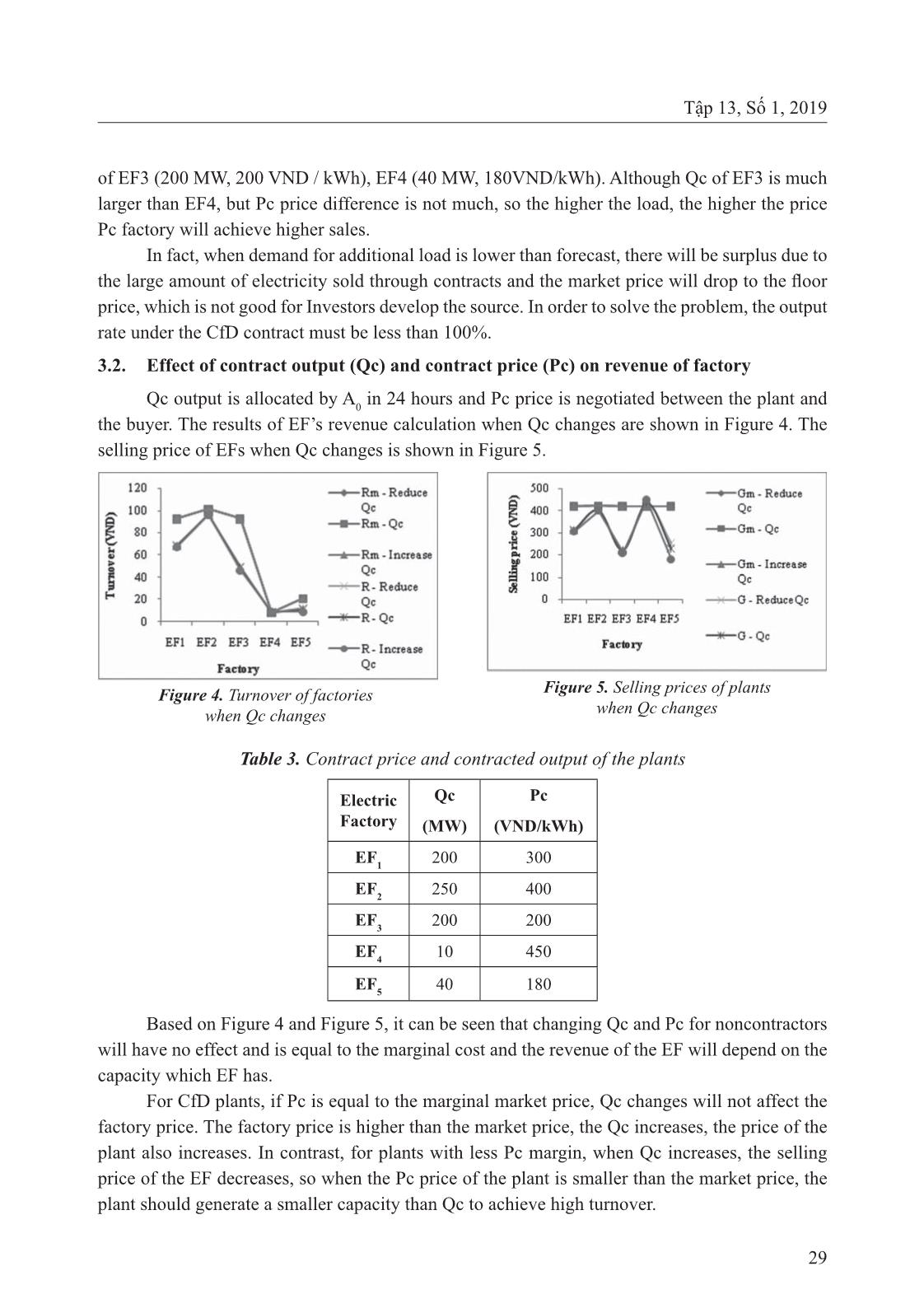

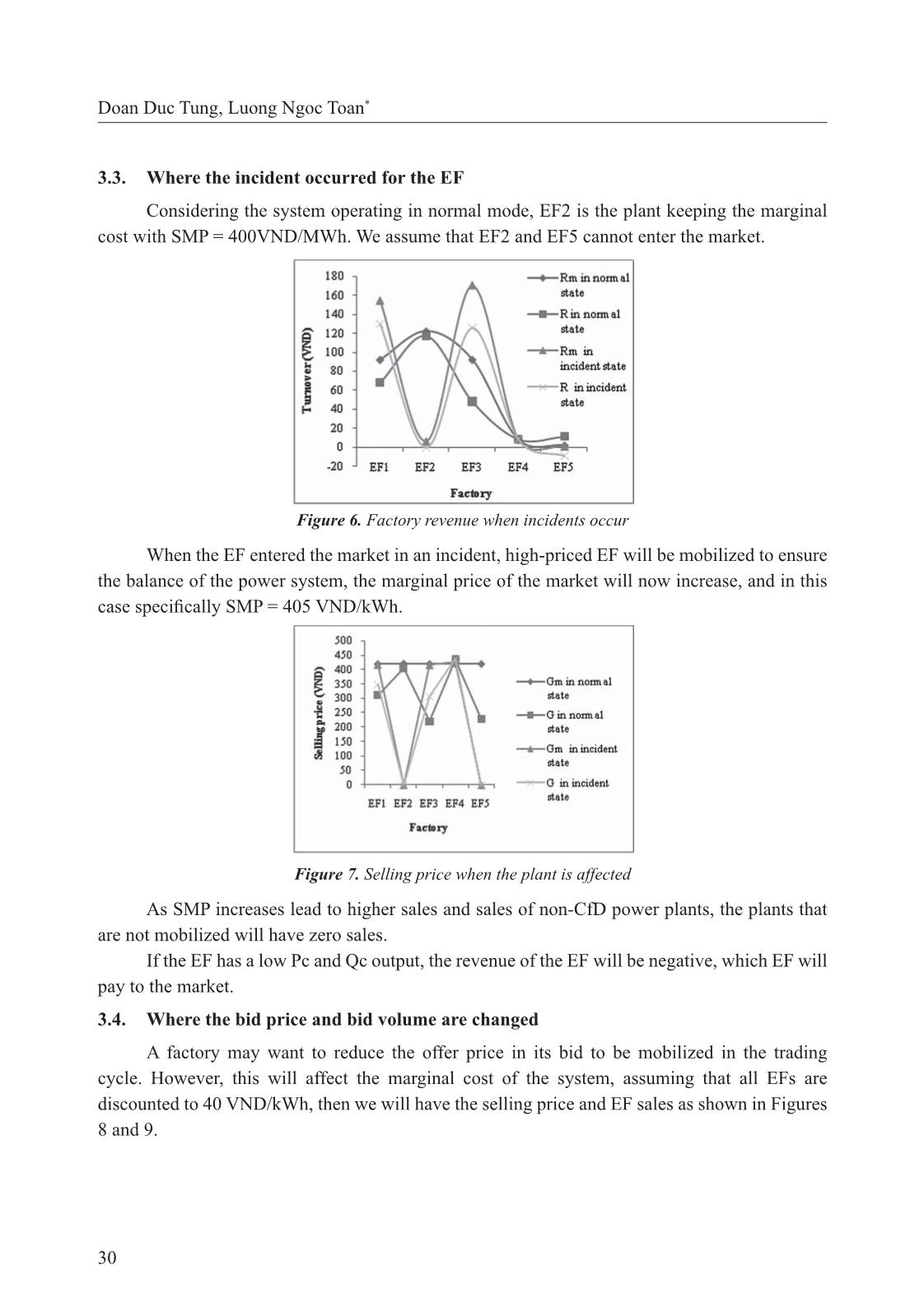

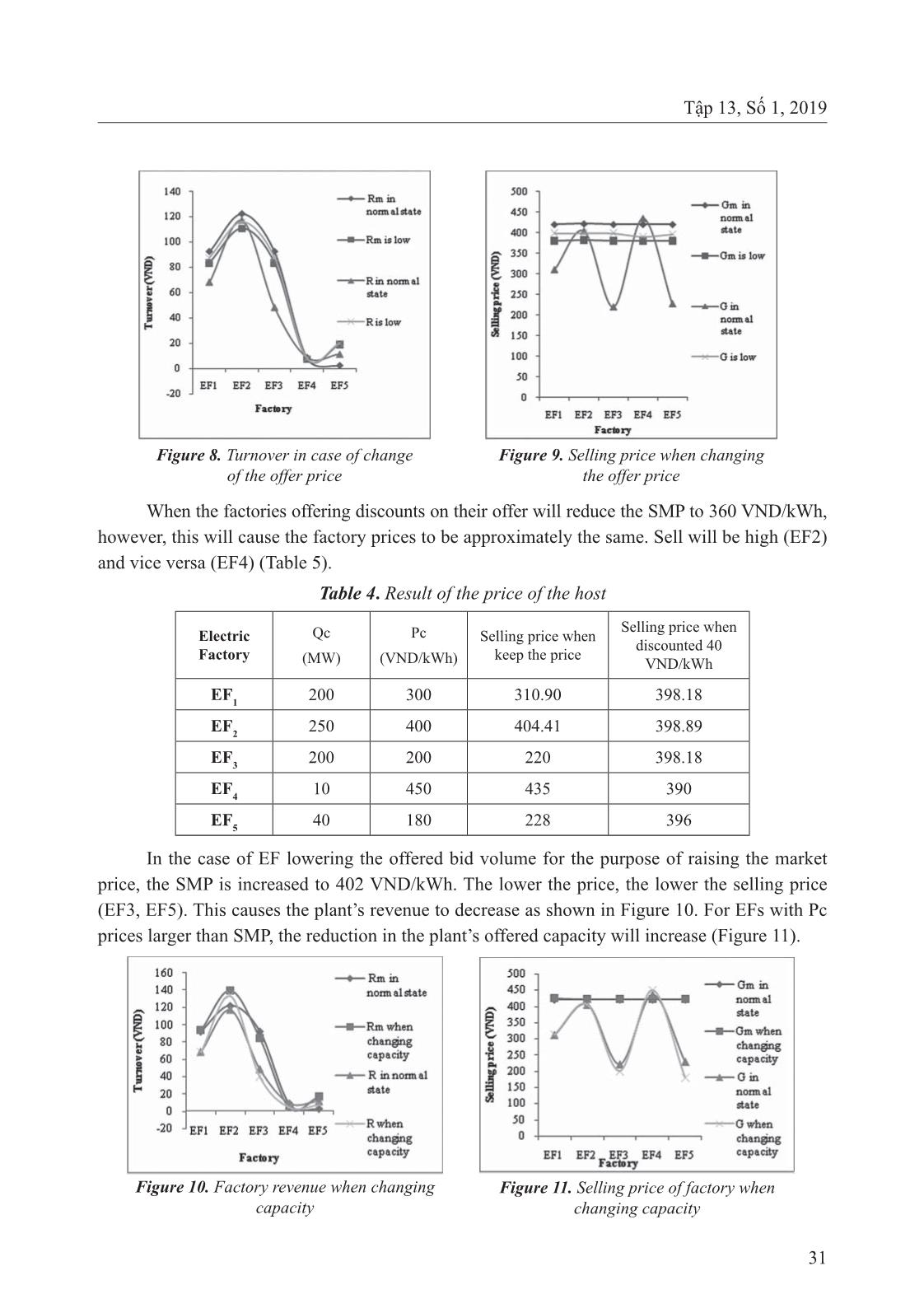

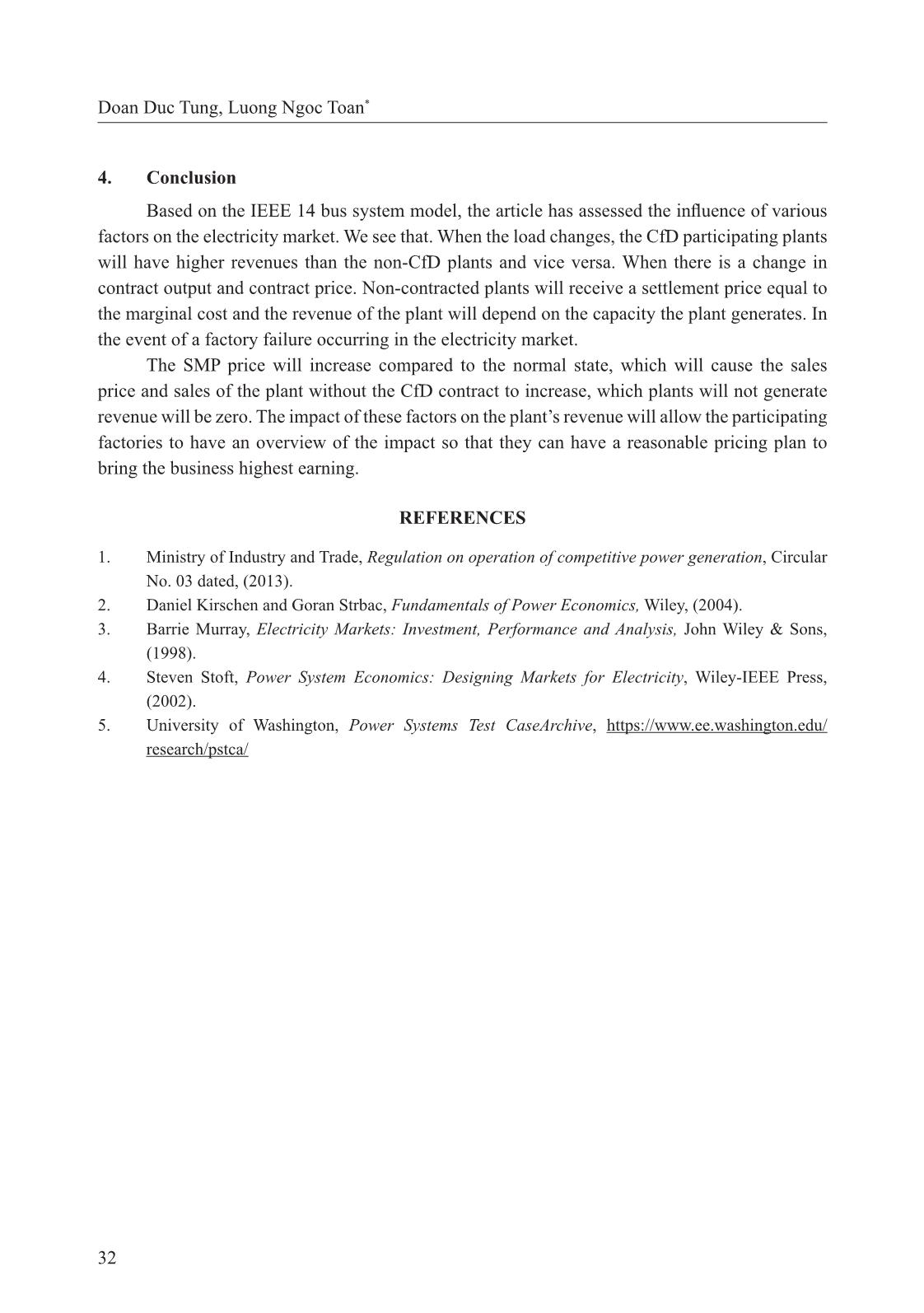

e annual variable price is adjusted to the base year variable price, effi ciency loss factor, base fuel price, fuel price at the time of payment.The monthly change price of the hydropower plants is adjusted based on the annual electricity price, base year price, environmental fee and royalty at the time of payment, total value of principal, foreign currency loans, the power output is many years at the factory’s power point. Here is a detailed calculation method of the relevant quantities: a. The annual contract output: The annual contract output is determined on the basis of the yearly output of the annual plan, average annual output and contract yield. They are determined through the following steps: + Plan the next year’s power grid system according to the binding scheduling method. + Calculate the annual output of the power plant according to the following formula [1]: AGO EGO= if (2) AGO a GO= × if EGO < a × GO (3) AGO b GO= × if (4) Where: AGO: Planned output of year N of power plant (kWh). a GO EGO b GO× ≤ ≤ × EGO b GO> × Doan Duc Tung, Luong Ngoc Toan* 25 Tập 13, Số 1, 2019 EGO: The estimated output in year N of the power plant (kWh), determined from the market simulation model in terms of the location of the measurement. GO: Power yield agreement to calculate contract price (kWh). a, b: Annual production adjustment coeffi cient shall be determined according to the regulations on methods of determining electricity generation prices. The order and procedures for the formulation and promulgation of power price brackets and the approval of power purchase contracts. Where a = 0.9; b = 1.1. + Calculate the annual output of the power plant [1]: (5) Where: Qc: Quantity contract of year N (kWh). AGO: Planned output of year N of power plant (kWh). α: The rate of output paid according to the contract price applied to year N (%). In the fi rst year operating the electricity market α = 95%. b. Monthly contract output: Production contract month of thermal power plants and hydropower reservoirs to regulate over 1 weeks was determined in the process of planning next year’s operation were identifi ed: (6) Where: t cQ : Quantity contract of the t month of the power plant (kWh). Qc: Quantity contract of the year of the power plant (kWh). t dkQ : The Quantity in the month of the power plant t determined from market simulation models according scheduling method binding (kWh). - The electricity system operator and the electricity market are responsible for determining the contract output hours in the next month for power plants according to: (7) Where: i: Trading cycle i in month. I: Total number of cycles in the month. i cQ : Quantity contract yield of the power plant in transaction cycle i (kWh). t cQ : Quantity of the power plant in the transaction cycle iis determined from the market simulation model based on the binding scheduling method (kWh). t cQ : Quantity contract in monthly of the power plant (kWh). cQ AGOα= × t t dk c c 12 t dk t 1 Q Q Q Q = = × ∑ i i t E c c I i E i 1 Q Q Q Q = = × ∑ 26 2.2. Payment under the contract of sale and purchase of electricity in the contract for difference Based on the market electricity prices and market capacity announced by the operator of the electricity system and the electricity market, the electricity generating unit shall be responsible for calculating the payment under the different types of electricity purchase contracts in the billing cycle: + Revenue from electricity contract (8) Where: Rci: Difference payment in transaction cycle i (VND). Qci: Electricity output is settled according to the contract price in transaction cycle i (kWh). P c : The price of electricity trading contract is different (VND/kWh). For hydropower plants, this contract price does not include water resource tax and environmental fee. SMPi: Price of electricity in the trading cycle i (VND/kWh). CANi: Capacity price in transaction cycle i (VND/kWh). + The payment for the portion of electricity that is paid at the market electricity price (market power of electricity) of the power plant in the payment cycle is determined: (9) Where: Rsmp1: The payment for the output is paid at the market electricity price of the power plant in the cycle i in the payment cycle (VND); SMPi: Price of electricity market of the ith trading cycle in the payment cycle (VND/kWh); Qsmpi: Electricity output is paid according to the market electricity price of the ith trading cycle in the payment cycle (kWh). The operator of the electricity system and the electricity market shall be responsible for calculating the market capacity payment for the power plant in the payment cycle in accordance with the formula: (10) Where: Rcan: Payments for power plants in transaction cycle i (VND). g: Units of the power plant are paid according to capacity. G: The total number of units of the power plant is paid according to capacity. iCAN : Market capacity in transaction cycle i (VND/kWh). g iQcan : The amount of payment capacity of unit g in transaction cycle i (kW). 3. Evaluate the effect of different factors on the plant’s revenue in the power market using the 14-node IEEE model The analysis of net revenues in the electricity market is often the secret of the work of the plants themselves. In this section, we will analyze the different factors affecting the revenue of the EF based on the IEEE 14 bus system sample diagram as shown in Figure 1 with 5 plants in the system. [5] i i i iRc (Pc SMP CAN ) Qc= − − × i i iRsmp Qsmp SMP= × G g i i i g 1 Rcan CAN Qcan = = ×∑ Doan Duc Tung, Luong Ngoc Toan* 27 Tập 13, Số 1, 2019 Figure 1. IEEE 14 bus system When entering the market the plants will send the bid to SMO, but the offer must follow the principles: + There are up to 5 pairs of Pr (VND/kWh) and P (MW) bid for units for each trading cycle of day D. + The power in the bid is the power of the generator terminal. + The offered capacity of the following range shall not be less than the capacity of the preceding offer. The minimum bid of 3 MW, we have the price table of the EF as in table 2. Table 1. Price quotes of factories Electric Factory EF1 EF2 EF3 EF4 EF5 P1 (MW) 50 80 100 20 50 Pr1 (VND/kWh) 100 110 150 305 200 P2 (MW) 70 120 120 40 60 Pr2 (VND/kWh) 210 310 300 450 500 P3 (MW) 100 160 200 60 75 Pr3 (VND/kWh) 320 400 405 510 600 P4 (MW) 150 180 220 80 80 Pr4 (VND/kWh) 402 508 506 610 700 P5 (MW) 200 200 250 100 100 Pr5 (VND/kWh) 500 550 620 710 720 Where: EFi: ith electric factory. P: Power of the factory. Pr: The asking price of the factory. When entering into the electricity market, if the power plants want to sign a contract differently from the electricity buyer, they will be based on two components: Qc contract yield and Pc contract price (Table 3). Capacity Charge per kWh announced by A0 for the beginning of the year for each hour of each day and regardless of the factory bid. Assuming Can = 20 VND/ kWh. Factories from 1 to 5 are paid for at 20 VND/kWh. 28 Table 2. CfD Contract Input Data Electric Factory Allocate the output CfD (Qc) (MW) CfD price(Pc ) (VND/KWh) EF1 200 300 EF2 250 400 EF3 200 200 EF4 10 450 EF5 40 180 3.1. Effect of change of load on plant revenue Considering the system is operating in normal mode (average load) with a total load of 800 MW, minimum (low load) mode with load 250 MW, and maximum (high load) mode with additional load 1.400 MW. The change in load leading to the change in capacity of the plant varies and the price of SMP is 400 VND/KWh, 200 VND/kWh, and 500 VND/kWh respectively. With Rm, R be the revenue of the factory on contract and without the Contract for Difference, we see that the revenue of the plants not participating in the contract will be paid at the market price and the capacity of myself. At lower loads, power plants with CfD will have higher revenues than non-participating power plants and vice versa. Meanwhile, if the load is stable and Qc output is reasonable, the revenue of the factories that do not participate in the contract and participate in the contract isnegligible for each other by the CAN value. When the capacity is at a minimum (low load), some plants will not be mobilized. For plants that pay in the spot electricity market, the factory’s direct dependence and ratio with an SMP marginal price. [4] For EFs when joining CfD in case of low load, EF2 has the highest revenue and selling price while the mobilization capacity is 70 MW less than EF3. This problem is due to the high Qc output and Pc selling price, but as load increases especially in peak load mode, EF4 has the lowest output power and the output is distributed, Qc is the lowest but Pc price is the highest. This causes EF4 to have the highest revenue, of which EF3 and EF5 have the output of Qc, Pc respectively Figure 2. Revenue chart of the factory when the load changes Figure 3. Price chart of the plants when the load changes Doan Duc Tung, Luong Ngoc Toan* 29 Tập 13, Số 1, 2019 of EF3 (200 MW, 200 VND / kWh), EF4 (40 MW, 180VND/kWh). Although Qc of EF3 is much larger than EF4, but Pc price difference is not much, so the higher the load, the higher the price Pc factory will achieve higher sales. In fact, when demand for additional load is lower than forecast, there will be surplus due to the large amount of electricity sold through contracts and the market price will drop to the fl oor price, which is not good for Investors develop the source. In order to solve the problem, the output rate under the CfD contract must be less than 100%. 3.2. Effect of contract output (Qc) and contract price (Pc) on revenue of factory Qc output is allocated by A0 in 24 hours and Pc price is negotiated between the plant and the buyer. The results of EF’s revenue calculation when Qc changes are shown in Figure 4. The selling price of EFs when Qc changes is shown in Figure 5. Table 3. Contract price and contracted output of the plants Electric Factory Qc (MW) Pc (VND/kWh) EF1 200 300 EF2 250 400 EF3 200 200 EF4 10 450 EF5 40 180 Based on Figure 4 and Figure 5, it can be seen that changing Qc and Pc for noncontractors will have no effect and is equal to the marginal cost and the revenue of the EF will depend on the capacity which EF has. For CfD plants, if Pc is equal to the marginal market price, Qc changes will not affect the factory price. The factory price is higher than the market price, the Qc increases, the price of the plant also increases. In contrast, for plants with less Pc margin, when Qc increases, the selling price of the EF decreases, so when the Pc price of the plant is smaller than the market price, the plant should generate a smaller capacity than Qc to achieve high turnover. Figure 4. Turnover of factories when Qc changes Figure 5. Selling prices of plants when Qc changes 30 3.3. Where the incident occurred for the EF Considering the system operating in normal mode, EF2 is the plant keeping the marginal cost with SMP = 400VND/MWh. We assume that EF2 and EF5 cannot enter the market. Figure 6. Factory revenue when incidents occur When the EF entered the market in an incident, high-priced EF will be mobilized to ensure the balance of the power system, the marginal price of the market will now increase, and in this case specifi cally SMP = 405 VND/kWh. Figure 7. Selling price when the plant is affected As SMP increases lead to higher sales and sales of non-CfD power plants, the plants that are not mobilized will have zero sales. If the EF has a low Pc and Qc output, the revenue of the EF will be negative, which EF will pay to the market. 3.4. Where the bid price and bid volume are changed A factory may want to reduce the offer price in its bid to be mobilized in the trading cycle. However, this will affect the marginal cost of the system, assuming that all EFs are discounted to 40 VND/kWh, then we will have the selling price and EF sales as shown in Figures 8 and 9. Doan Duc Tung, Luong Ngoc Toan* 31 Tập 13, Số 1, 2019 When the factories offering discounts on their offer will reduce the SMP to 360 VND/kWh, however, this will cause the factory prices to be approximately the same. Sell will be high (EF2) and vice versa (EF4) (Table 5). Table 4. Result of the price of the host Electric Factory Qc (MW) Pc (VND/kWh) Selling price when keep the price Selling price when discounted 40 VND/kWh EF1 200 300 310.90 398.18 EF2 250 400 404.41 398.89 EF3 200 200 220 398.18 EF4 10 450 435 390 EF5 40 180 228 396 In the case of EF lowering the offered bid volume for the purpose of raising the market price, the SMP is increased to 402 VND/kWh. The lower the price, the lower the selling price (EF3, EF5). This causes the plant’s revenue to decrease as shown in Figure 10. For EFs with Pc prices larger than SMP, the reduction in the plant’s offered capacity will increase (Figure 11). Figure 8. Turnover in case of change of the offer price Figure 9. Selling price when changing the offer price Figure 10. Factory revenue when changing capacity Figure 11. Selling price of factory when changing capacity 32 4. Conclusion Based on the IEEE 14 bus system model, the article has assessed the infl uence of various factors on the electricity market. We see that. When the load changes, the CfD participating plants will have higher revenues than the non-CfD plants and vice versa. When there is a change in contract output and contract price. Non-contracted plants will receive a settlement price equal to the marginal cost and the revenue of the plant will depend on the capacity the plant generates. In the event of a factory failure occurring in the electricity market. The SMP price will increase compared to the normal state, which will cause the sales price and sales of the plant without the CfD contract to increase, which plants will not generate revenue will be zero. The impact of these factors on the plant’s revenue will allow the participating factories to have an overview of the impact so that they can have a reasonable pricing plan to bring the business highest earning. REFERENCES 1. Ministry of Industry and Trade, Regulation on operation of competitive power generation, Circular No. 03 dated, (2013) . 2. Daniel Kirschen and Goran Strbac, Fundamentals of Power Economics, Wiley, (2004). 3. Barrie Murray, Electricity Markets: Investment, Performance and Analysis, John Wiley & Sons, (1998). 4. Steven Stoft, Power System Economics: Designing Markets for Electricity, Wiley-IEEE Press, (2002). 5. University of Washington, Power Systems Test CaseArchive, https://www.ee.washington.edu/ research/pstca/ Doan Duc Tung, Luong Ngoc Toan*

File đính kèm:

factors_affecting_the_revenue_of_the_electric_factory_in_imm.pdf

factors_affecting_the_revenue_of_the_electric_factory_in_imm.pdf